10 March 2023 Global Credit Wrap

$SIVB, massive rally in front end UST, sentiment returns to "Extreme Fear", credit widening lead by US, corporate distress rising, eventful week in LATAM

*TLDR*

MOVES

Govvies - Big move in US 2yr bond; 42bps tighter to 4.59% after touching 5%, curves remain inverted

Credit spreads: US credit indicators widening more than European. Bank CoCo spreads +40bps. Major US Bank CDS spreads widening between 15 and 30bps

Bond ETFs:

Duration and Government bond ETFs were broad winners. Prefs, Converts, Bank capital and US HY/Lev fin are biggest fallers over 5 days.

Short interest in HYG and EMB nearing highs

Investors pull near record sums from corporate bond ETFs in Feb ‘23 - FT

EM - Egypt 5 year CDS nearly 500bps wider vs Feb 2023 lows, accelerated by hot inflation print

Stocks & Commodities:

Gold price hits one month high on safety bid

Big moves in US financials (Regional Banks, Bank Majors, Insurers)

Schwab Has Worst Drop in Years After SVB, Block Trade - BBG

US Office REITs - Some names trading below pandemic lows now

MACRO

Fear & Greed index hits “Extreme Fear”

A handful of global central banks paused hikes in the week

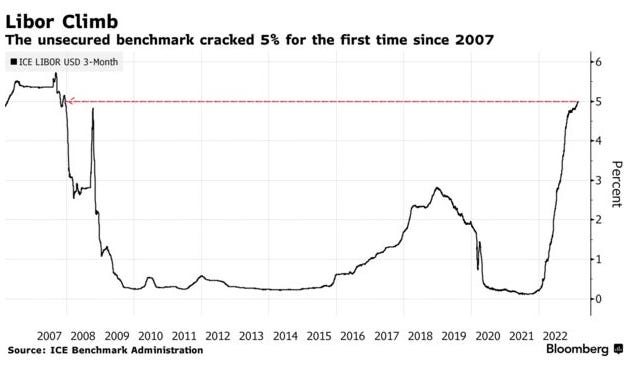

Earlier in week libor went through 5% for First Time Since ‘07

UK Housing - Halifax reports price increase in Feb but updates from UK Housebuilders less cheery

Australia’s Biggest Firms Flash Warning Signals on Recession

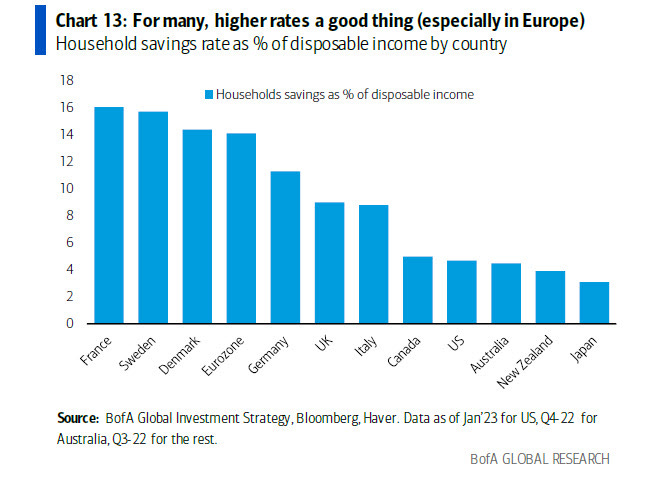

European Households should do well from higher rates - BofA

INFLATION

China CPI and PPI slows

ECB Says Consumer Inflation Expectations Fall Significantly

Switzerland / Sweden dealing with higher inflation

S.Korea's slowest inflation in 10 months, time for pause?

Dubai rents and sale prices rise double digits in Feb YoY

Tesla Cuts Prices in US for Second Time This Year

US Manheim used-car prices rose 4.3% sequentially in February

COMMODITIES

Russian Oil Gets More Pricey as Pool of Asian Buyers Expands

IG

EUR IG new issues pass half a trillion two weeks faster than record set in 2020

Higher quality issuers raise money successfully: Rio Tinto, Anglo American, Heineken, Nestle

Total LMEs for Corporate Hybrids ytd is €3.5bn

Possible tie up between Vodafone and Three in the UK

Mega caps with large cash piles are getting richer thanks to interest rates

FINANCIALS

New bond issues - Santander UK tender offer for legacy opco securities, Lloyds new $ AT1 at 8.0%

Silicon Valley Bank:

Problem is the huge proportion of uninsured deposits

Inability to access cash has serious real world implications (e.g. meeting payroll for end of month)

Help looks like it may be underway from California lawmakers, FDIC and the Fed, but level of recovery is key

If the above help is not executed well, could speed up time to a US recession

SIVB Bonds - TRACE showed 2.5bn trading volume on Friday, seniors closing at around 40c, perps closing around 5-6cents.

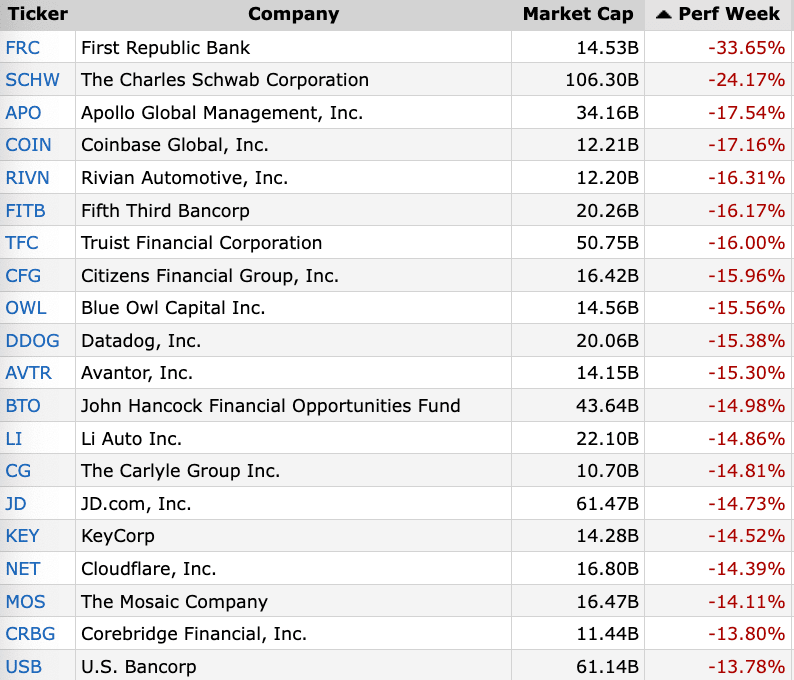

Regional Banks and Alternative Asset Managers were some of the biggest fallers in the US equity market last week

Silvergate Bank wound down operations last week, but much smaller than SVB

LGIM assets dropped after LDI crisis

Banco BPM Gets ‘Financial Conglomerate’ Status From ECB

HY

Quiet issuance week for HY, convert issuance running ahead of 2022 levels

$5bn in lev loans were issued in the week dominated by Single Bs

New snippets Aston Martin, Dish, First Quantum, Weight Watchers and Theatres

Loan Investors Shed Tech Company Debt as Earnings Fears Spread

HY Energy Co earnings -Tullow, Harbour Energy, Neptune Energy

Real Estate news round up:

Almost $92 bn of nonbank office sector debt is maturing this year

Distress in US office sector including comment from SVP’s Khosla

WeWork said to be in talks to raise cash, bonds dropped 10pts vs Feb highs

German propco Leg Immobilien suspended FY22 dividend, changing CFO

Aroundtown and Vonovia report in the next two weeks

EM

New issues: Cemex, Macedonia & Turkey. Cemex comes with 9.125 coupon perp..

Egypt inflation soars to 5-1/2-year high, core inflation at record, bonds drop

Argentina swaps $21.7 bn in domestic debt to reduce default risk

Bolivia bonds trade lot lower on falling Dollar reserves

Brazilian Airlines see huge moves higher after debt agreements

Mexican firm Totalplay’s bonds sink further into distressed territory

China sets GDP growth target at around 5% for 2023

Adani Repays $500m Bridge Loan to International Banks

Fitch Rtgs: Sri Lanka’s Probable IMF Support Deal Positive for Debt Negotiations

BUYSIDE/PRIVATE CREDIT

JPMorgan Plays Both Sides in Battle Over Cotiviti Buyout Loan

Goldman launches community muni bond ETF

Apollo CEO: Most of the pain will be borne by equity holders

DISTRESSED

S&P Adds 11 Companies to Default, Selective Default in February

US leveraged loan default rate climbs to 20-month high in February | PitchBook

TRADING

Stock ETFs Blamed for Liquidity Shocks in Short-Term Treasuries

Record volumes in SOFR futures this week

Bond trading platform Trumid Reports February Performance

RATINGS

Barclays Upgraded to Baa1 by Moody's, Outlook Stable

Occidental Raised to Investment Grade by Moody's

SVB Financial - S&P and Moody's withdraw ratings

S&P cuts Nissan to BB+

Surprise outlook change on South Africa from Positive to Stable by S&P

Moody’s Cuts Vedanta Resources’ CFR to Caa1; Outlook Negative

*MOVES*

Treasuries

Epic rally between Tuesday’s close (7th Mar) when yields peaked and Friday’s close. Most of the biggest moves took place at the front end as skepticism grew from market participants re a 50bps hike at the next Fed meeting. Rally in short end bonds may have also been driven by cash going out of other assets and into short dated treasuries in light of the risk off bid.

2 yr yields -42bps to 4.59% after touching 5%

5 yr yields -34bps to 3.97%

10 yr yields -26bps to 3.70%

30 yr yields -16bps to 3.71%

Credit spreads over 5 days

Moves in US more pronounced than anywhere else.

Credit Indices: CDX HY+65bps to 498bps, Xover +29bps to 426bps, Sub Fins +17bps, CDX EM +15bps, NA IG +12bps, ITRX Europe +6bps

Bank CDS: Across major banks, seeing some widening in MS +28bps, BofA+17bps, Citi +17bps, JPM +15bps, GS+14bps. For context, taking BofA’s CDS which closed around 86.5 compares to wides in 2022 of 117.5bps. Other notable CDS movers in US Financials: OneMain Finance Corp +44bps, First Citizens Bank & Trust +37bps, Ally Financial +37bps, CitiBank NA +30bps

Cash credit: US HY +53bps to 450bps, Global CoCos +40bps to 452bps, EM HY +28bps to 705, US IG+16bps to 136 whereas EUR IG only widened 4bps

Bond ETFs over 5 days

Bond ETF winners: Duration, UK IL Gilts, JGBs, UK Gilts. Ticker: EDV +5.6%, TLT+4.4%, INXG+2.9%, XJSE+2.5%, IGLT+1.7%

Bond ETF losers: Preferreds, Convertible bonds, Bank Capital US HY and loans were the biggest fallers over 5 days. Tickers: PGX -4.4%, PFF -4.2% CWB -2.9%, AT1 -2.1%, JNK -1.8%, HYLB -1.8%, HYG -1.7%, BKLN -0.8%, IHYG-0.7%

EM

Brazilian Airline stocks rallied hard, Azul +74% and Gol +34% in the week

Stocks

Friday: Vix climbed to 27.60, highest since October 25th

Epic moves in the Financials space:

XLF - Financial Select Sector ETF down 8.8% on the week

KRE - US Regional Bank ETF down 16% on the week

KIE- Insurers down heavily, with this ETF closing down 7.99% on the week

Office REITs:

Vornado Realty Trust hits 1997 levels, SL Green Realty & Boston Properties are trading below 2020 lows

Source for all movers above were Bloomberg.

*MACRO*

CNN F&G Index pointing to “Extreme Fear” for first time in nearly 6 months

Short interest in higher beta ETFs (HYG/EMB) tick higher

These were from last week, before the whole SIVB fall-out, so I can’t imagine short interest would have declined since then.

Few CBs Pausing:

Bank of Canada Holds Key Interest Rate at 4.5%

Peru Central bank left its benchmark rate at 7.75% as expected.

Polish Central Bank Leaves Main Rate at 6.75%; Est. 6.75%

Malaysia leaves overnight policy rate at 2.75% as expected

For more detailed macro commentary, pls refer to the excellent Substack from FXMacro:

Libor Cracks 5% for First Time Since ‘07, Spurred by Fed Outlook | BBG

This happened on Monday 6th March before the SVB news came out.

The three-month London interbank offered rate for dollars, a major global lending benchmark, surpassed 5% for the first time in more than 15 years on Monday. The benchmark rate for lending between banks rose 2.4 basis points to 5.008%, the highest since December 2007. The spread of Libor over overnight index swaps — a barometer of funding pressure — widened to 3.2 basis points on Monday from 1.7 basis points the prior session.

UK Housing Roundup

The UK housebuilders reporting a slowing in home sales vs prior year which may lead to job cuts.

UK house prices slide further but market pessimism eases: RICS | RTRS

Halifax BS sees avg monthly increase in house prices of 1.1% to £285,476 in February, after falls in previous two months | Guardian

Goldman Sachs Sells Bundle of Affordable UK Homes to PGIM | BBG

UK housebuilders Vistry & Persimmon may need to cut jobs | BBG

Persimonn has warned its new home sales could fall by upto 40% this year | FT

Australia’s Biggest Firms Flash Warning Signals on Recession - BBG

Extracts - BHP Group Ltd. said mounting energy and labor costs crimped its results, while Commonwealth Bank of Australia set aside more capital cushions as consumers feel the pinch from price pressures. Food producers were also hurt by higher expenses. Domino’s Pizza Enterprises Ltd. plummeted the most on record after the pizza chain operator’s earnings dropped as customers spurned price increases. Meanwhile, poultry processor Inghams Group Ltd. said elevated labor, packaging and fuel costs would persist after its profit dampened.

However, its not all doom and gloom for Aussie businesses as Travel firms have been doing well (e.g. Qantas shares hit a new 52w high this week).

Investors pull near record sums from corporate bond ETFs - FT

Extracts - Investors pulled near-record sums from corporate bond exchange traded funds in February as robust US economic and inflation data fuelled expectations for further rate hikes.

Investment-grade and high-yield corporate bond ETFs suffered a combined net outflow of $8.3bn in February, according to data from BlackRock, the second-largest exodus on record, exceeded only by an isolated spike in June last year, when $9.7bn was pulled from the sector.

February’s selling was not far off the combined $10.2bn pulled from corporate bond ETFs in February and March 2020, when markets were pummelled by the onset of the Covid crisis.

Investors instead sought refuge in government bond ETFs — largely US Treasury funds — which sucked in a net $10.9bn.

Individual savers should also do better from higher rates

BofA’s Hartnett on savings: "higher rates are actually a good thing for some – they benefit big savers (and punish big debt-funded spenders) and with a Eurozone household savings rate (14%), UK (9%) way higher than 4% in US, that's one reason Europe's macro has been doing so well".

*INFLATION*

Sovereign inflation snippets:

ECB Says Consumer Inflation Expectations Fall Significantly - BBG

Swiss Inflation Unexpectedly Accelerates on Airfares, Rents - BBG

Riksbank to Do ‘Whatever It Takes’ on Inflation, Bunge Says - BBG

China CPI and PPI slows:

China consumer inflation slowest in a year, leaves room for more stimulus - RTRS

China PPI in February was down 1.4% on a year earlier, largely driven by softer commodity costs

S.Korea's slowest inflation in 10 months bolsters views for no more hikes - RTRS

Egypt Feb. Consumer Prices Rise 31.9% Y/y; Rise 6.5% M/m, Egypt Feb. Core CPI Rises 40.262% Y/y (see comment later on in EM section).

Dubai average annual rent for a villa jumped 26% in the year through to February and average sale price for villas rose 14% - BBG

Corporate inflation snippets

Tesla Cuts Prices of Model S, X in US for Second Time This Year

US Manheim used-car prices rose 4.3% sequentially in February - CoxAuto

Business leaders call for UK version of US Inflation Reduction Act - Yahoo

UK Motor Insurer Admiral says seeing high level of claims inflation | PRNews

Shipping costs have fallen back to 2018 levels - Lombard Odier

*COMMODITIES*

Russian Oil Gets More Pricey as Pool of Asian Buyers Expands - Yahoo Finance

Extract - The price of Russian crude and fuel is rising for buyers in Asia as a pool of bigger customers from China and India expands, putting pressure on smaller refiners that have eagerly consumed the cheap oil. Offer levels for Russia’s Urals and ESPO crude, as well as fuel oil, surged over the past weeks, according to traders with knowledge of the matter. Increased interest from Chinese state-owned and large private refiners such as Sinopec, PetroChina Co. and Hengli Petrochemical Co., in addition to a jump in Indian demand, led cargoes to be snapped up at higher prices, they said.

*IG*

IG New issues comment

Nothing remarkable to comment on in the new $ issue IG markets. High quality issuers returned to the market, e.g. Rio Tinto and HSBC. Rio is a rare issuer and issued $1.75bn across a 10 year and a 30 year. In an interesting twist, Air Lease, the large Aircraft Leasing firm raised money via the Sukuk market (Air Lease $600m 5Y Sukuk at T+185). Regarding SVB and Regional US Banks more broadly, there were some subtle signs of problems in the sector as Regional Banks were large issuers of paper to counteract falling deposits.

EUR IG New issues pass half a trillion two weeks faster than record set in 2020

The European IG market continues to power along and pasted the €500bn mark this week. A selection of higher quality companies came to market, e.g. Anglo American, Heineken and Land Securities. The weekly total went north of €54bn. There was new hybrid issuance for Elia Group which used the proceeds to buy back some of its existing hybrids before the first call date. BBG commented that total of LMEs for Hybrids ytd is €3.5bn or more than 15% of all hybrids callable from start of 2023 to end of March 2024.

IG Corporates News roundup

Vodafone / Three Tie up - ISP review

Extract - Sources close to the proposed merger talks between mobile network operators Vodafone and Three UK (CK Hutchison), which could value the combined business at around £15bn, have reportedly indicated that a deal may be announced as soon as before the end of March 2023. Sidenote: Vodafone Weighs Cutting Almost 20% of Italy Staff, Union Says (src: BBG).

Apple, Berkshire, Alphabet, and Microsoft Are Getting Richer, Thanks to Interest Rates - Barrons

While we hear of many companies that are falling into distress due to higher rates, companies that have large cash piles are benefitting. I wrote about this phenomenon with regards to the UK’s largest stockbroker Hargreaves Lansdown which made a huge amount on net interest income. Extract of Barrons:

Apple, Alphabet, Berkshire Hathaway, and Microsoft have the largest cash positions among American companies, and they are garnering much higher interest income as short-term rates have risen above 4% from near zero at the start of 2022. The situation should continue to get better this year with short rates already up a quarter percentage point and the Federal Reserve expected to push the federal-funds rate above 5% from the current target of 4.5% to 4.75%.

*FINANCIALS*

New issues/tenders

Quietish week with the only issuer of note really Lloyds Bank who came with its second AT1 of the year. Lloyds decided to issue a PNC7 AT1 at 8%.

As we closed the week out there was some softness in recently issued AT1s, e.g. this new Lloyds traded down ~1.5pts to close the week, on the wider SVB fears.

Santander UK launched tender offer for some of its legacy Opco sub bonds - Link and later on in the week announced the pricing.

Silicon Valley Bank…the main story of the week

This situation is moving fast and looks like FDIC and Californian lawmakers are going to announce something later today (Sunday 12th March) with respect to SVB. Also the Fed and FDIC are weighing new measures:

[Updated on 12 March 2023 at 02:52 GMT] The Federal Deposit Insurance Corp. and the Federal Reserve are weighing creating a fund that would allow regulators to backstop more deposits at banks that run into trouble following Silicon Valley Bank’s collapse.

FDIC is also looking to return some uninsured SVB deposits Monday according to BBG.

The core of SVB’s problem was an asset / liability mismatch exposed by rapid deposit outflows. During the bull market, deposits had grown quickly, but they also left quickly when key stakeholders sensed trouble. Deposits which are short term in nature were invested in long duration bonds and MBS securities during 2021 / 2022 at low yields. As the Fed hiked rates, the capital value of these securities fell materially. This wouldn’t have caused a problem if they were held to maturity as the bonds are generally high quality, but being a forced seller meant it needed to realise large losses which is why they needed to do a capital raise last week.

This week has seen some incredible posting by folks on Social Media, I set out below some of the best takes.

A newsletter writer (Byrne Hobart) had highlighted issues at SVB back in February, which key stakeholders of SVB like Peter Thiel read and acted on. Question is, why did a Newsletter writer spot SVB’s issues instead of the number of other key stakeholders such as Ratings Agencies, FDIC, Credit Analysts, Risk Managers at SVB!

BBG’s Tracy Alloway’s summary is the the most concise summary I’ve read on SVB:

←-Key Figures—>

This is what SVB disclose on its “about” section on its website; large exposure to US VC backed Tech and Life Science companies, material amounts of assets and client funds.

SVB’s total assets compared to previous failed US Banks is meaningful. It is the second largest FDIC Insured Bank Failure in US History.

The biggest issue for customers of the bank is the level of uninsured deposits:

Seems clear now that SVB was running a more riskier operation than other Banks

←-Contagion / Knock on effects—>

SVB UK is also a key player in the startup ecosystem in the UK

A number of startups cannot meet their payroll requirements. Garry Tan, the founder of Y Combinator said that SVB cannot make payroll for 30% of YC companies. These are the sort of things that can speed up recessions, where gainfully employed people do not get paid!

Circle’s USDC, the second largest stablecoin with $43 bn market cap had $3.3bn in cash reserves with SVB according to a release from Circle.

←-SVB Bonds—>

Looking at FINRA’s TRACE system, estimated trading volume in SIVB bonds was around 2.5bn on Friday alone in SIVB paper with the most traded security being the SIVB senior 1.8% 2031. Rough closing indications in SIVB paper looked like around 40 cents on the Dollar and the perps around 5 cents on the Dollar.

Market participants are likely to be on high alert for other firms who could suffer from a similar mismatch of assets/liabilities. The risk of large deposit / fund outflows is more credible since “risk free” short dated government bond yields are higher than they have been for a long time.

So far CDS on large US Banks seem contained - WSJ

There is a narrative and evidence building online of a whole raft of SVB customers trying to switch to the likes of JPM Chase (note JPM stock closed up on the day on Friday).

The largest US equity movers in the week were financials

Handy list from @BullishRippers. Besides Regional Banks, stockbrokers and alternative asset managers were also sold off e.g Schwab, Apollo and Carlyle. Certain FinTwit gurus like @eliant_capital were well ahead of the market with respect to the eventual falls of Silvergate, US Regional Banks and SVB share prices.

Silvergate collapse - comment

SVB stole all the headlines at the end of the week, but only a few days earlier another Bank actually had to wind down its operations - Silvergate.

Silvergate, a Bank which specialised in services for crypto clients like FTX plans to wind down its bank operations and liquidate. This is what the company had to say this week:

“In light of recent industry and regulatory developments, Silvergate believes that an orderly wind down of bank operations and a voluntary liquidation of the bank is the best path forward,…The bank’s wind-down and liquidation plan includes full repayment of all deposits.”

At its peak, Silvergate’s market cap reached nearly $6bn (November 2021) compared to its market cap on Thursday 9th March of $121m. This extract from the SF Examiner provided a good summary:

Silvergate’s collapse is significant because it represents the fall of what was essentially a traditional financial institution that catered to the crypto market. The bank facilitated the movement of dollars in and out of crypto trading platforms, which became a lucrative business when cryptocurrencies were a hot market.

But the collapse of the industry and the sudden spike in interest rates created serious liquidity problems for Silvergate. The bank has promised that its liquidation plan “includes full repayment of all deposits.”

Todd Baker, a senior fellow with the Richman Center for Business, Law and Public Policy, told The Examiner that Silvergate ran into serious trouble after “crypto trading started being less attractive as opposed to other types of activities and so the amounts on deposit started to decline because crypto trading was going into a recession.”

LGIM Assets Drop After LDI Crisis Caused Collateral Calls - PiOnline

Legal & General Investment Management quantified the impact of the significant rise in Gilt yields in September 2022 and how its clients had to sell high fee generating investments to meet margin calls.

Legal & General Investment Management recorded a 15.9% drop in assets under management in 2022 to £1.2 trillion ($1.45 trillion), as the money manager felt the impact of the market downturn and U.K. liability-driven investment crisis.

Market impacts resulted in a total £271.5 billion loss for the year, vs. a £109 billion gain in 2021.

Assets under management in LGIM's largest business — solutions — fell 19.7% to £485.9 billion, impacted by market movements, which amounted to a £173.9 billion loss. However, the market-related loss was partially offset by total net inflows to the solutions business of £55.6 billion, up from £18.4 billion at the end of Dec. 31.

LGIM said in a financial update Wednesday that the sharp rise in gilt yields in September, following the announcement of the then-government's unfunded tax cuts, forced its clients to post increased collateral on derivative positions associated with LDI strategies, resulting in net outflows from active strategies of £8.3 billion.

"Over the course of 2022, we experienced positive flows into LDI but the firm's overall defined benefit revenue decreased as interest-rate rises caused assets under management to reduce and as clients sold higher fee-generating investments to meet collateral requests," the update said.

Banco BPM Gets ‘Financial Conglomerate’ Status From ECB - RTRS

Extract - Banco BPM said it had been recognised as a financial conglomerate by the European Central Bank (ECB), a prerequisite that will allow it to access a more favourable way of calculating consolidated capital ratios. The ECB granted Banco BPM the status of financial conglomerate after the Italian bank gained full control of its Banco BPM Vita and Banco BPM Assicurazioni insurance joint-ventures in July 2022, by buying out French partner Covea.

*HY*

HY New issuance

Largely nothing to see here due to a volatile week and the J Powell speech during mid week. In the Nordic market, there were two transactions: Floatel International raised $100m of 3yr bonds at 11.25% and KKR owned Ocean Yield came to market with a NOK 750m 4NC2 bond at 3mN+395bps. Floatel specialises in Offshore Floatels and Ocean Yield is a ship leasing company

Convertibles issuance in 2023 outpacing 2023 so far

BBG reports that 2023 issuance is outpacing 2022 issuance for the same time period. So far there has been around $4.3bn of issuance compared to $1.5bn in Q1 2022. Issuers that have come to market hsi year include Delivery Hero, Borr Drilling and L’Oreal. Some of the commentary in the article suggested that investors are looking for instruments that are less sensitive to interest rates. Notable converts issuance in the week included that for Rivian ($1.5bn Green Convertible Bond RIVN 4.625% 2029).

$5bn in lev loans were issued with most of it in the B rated sector according to LCD.

HY News snippets

Weightwatchers shares closed up 79% on Tuesday following Sequence deal: CNBC

Shares of WW International, also known as WeightWatchers, skyrocketed Tuesday after the company said it planned to buy Sequence, a telehealth platform that provides treatment for obesity. The stock closed 79% higher on Tuesday. Its market value stood at more than $488 million. “It is our responsibility, as the trusted leader in weight management, to support those interested in exploring if medications are right for them,” WW CEO Sima Sistani said in a Monday announcement.

WW 4.5% 2029 1st lien bonds traded up 10 points on the news too.

Aston Martin shares Jumped 25% intra day due to Alonso win + short squeeze

Aston’s shares rose only 2.3% overall in the week to 10th March, but last week they rose 23.7%. Extract of BBG article:

About 11% of Aston’s shares have been loaned out for short selling. Analysts also speculated that Fernando Alonso’s surprise third-place finish for the Aston Martin Racing team at the Bahrain Grand Prix this weekend may also be benefiting the stock.

Shares of the luxury car maker have been spiking higher for the past few days. The rally, which accelerated on Monday, kicked off last week after the company reported strong results and predicted it’ll be able to ramp up deliveries in the second half as supply chain shortages ease.

“Could be some shorts covering or generally improved perception on the back of reassuring FY22 results,” said Anthony Dick, an auto analyst at Oddo BHF. “It’s also possible the F1 performance could have something to do with it.”

Aston’s 10.5% 2025 bonds have moved up from around 94 at the end of 2022 to par currently although this was a more gradual move compared to what happened in the stock this week.

US blocks Jet Blue Airways $3.8bn acquisition of Spirit Airlines - TravelWeekly

Extracts - JetBlue faces an antitrust lawsuit in an attempt by the US Justice Department to block the $3.8 bn takeover of budget rival Spirit Airlines.

The complaint claims that fares will rise and reduce choice on hundreds of routes where both airlines currently “compete fiercely”, harming cost-conscious fliers most acutely.

This is particularly the case on more than 40 direct routes where the two carriers’ combined market shares are so high that the deal is “presumptively anti-competitive”.

The acquisition would also make it easier for the remaining airlines to co-ordinate to charge travellers higher fares or limit capacity.

It alleges that JetBlue’s acquisition of Spirit would eliminate the ‘Spirit Effect’, where Spirit’s presence in a market forces other air carriers, including JetBlue, to lower their fares. The deal also would eliminate half of the ultra-low-cost capacity in the US, leading to higher fares and fewer seats, “harming millions of consumers on hundreds of routes”.

Panama gives Canada's First Quantum go-ahead to operate port terminal - RTRS

Panama's Maritime Authority has lifted a suspension on First Quantum Minerals' operations at the port of Punta Rincon, which the Canadian company uses to export copper concentrate from its key Cobre Panama mine, company sources said late on Friday.

Two spokespersons for Minera Panama, First Quantum's Panama unit, told Reuters the suspension dated Jan. 26 had been ended, which was confirmed by a source at the Maritime Authority.

The company, which spent weeks at loggerheads with Panama over Cobre Panama, had said that once the suspension ended, it would be able to resume activity at the port quickly.

The Panamanian government and First Quantum said on Wednesday they had agreed on the final text for a new contract on the operations of Cobre Panama, which accounts for about 3.5% of the country's gross domestic product.

Dish CEO buys $15m of shares in company

Co-founder Jim DeFranco had bought nearly $16 m worth of the company's stock a few days before it closed at a 14-year low. DeFranco bought 1.45 m Dish shares on March 2 at a price of $10.84, for a value of $15.72 m. Dish's stock has dropped 20.4% over the past three months and tumbled 61% over the past 12 months. SRC: BBG

Good opening for Creed III in the Cinemas

The film was created by Amazon studios.

Loan Investors Shed Tech Company Debt as Earnings Fears Spread - BBG Law

Extract:

Rising rates boost interest expense and can weigh on sales

Tech loans were “way too levered,” a money manager says

(Bloomberg) -- Investors’ fears about the technology industry have spread from equity markets to leveraged loans as money managers grow more concerned about interest rates rising more than previously expected. Loans for junk-rated tech companies have been performing worse than the broader loan market since September. Prices for those loans averaged about 93 cents on the dollar in February, compared with 94.6 cents for leveraged loans as a whole, according to Bank of America Corp. In August, both prices were similar.

Price movements for loans tend to be muted compared with equities, where hardware and equipment companies saw their shares drop about 26% last year. But in both cases, the weakness stems from similar sources, said Michael Pang, a portfolio manager at Tetragon Capital Partners. As the Federal Reserve tightens rates and potentially slows the economy, investors are growing less hopeful about the potential for future revenue growth.

HY Energy Co round up

Good set of results from Independent Energy Cos this week. However firms with operations in the North Sea warned on the economic challenges of operating under the UK’s Energy Profits Levy that may impact new projects and jobs in the region.

Neptune Energy doubles annual profits amid production boost- EnergyVoice

Extract - But the company says the imposition of windfall taxes makes new projects “economically challenging”, meaning they will require “higher rates of return” to receive sign off. The warning comes on the same day that Harbour Energy said its returns for 2022 were all but “wiped out” by the UK’s energy profits levy (EPL). Last year’s profits are more than double the $1.4bn that Neptune reported in 2021, when the oil and gas industry was still recovering from the latest downturn. After accounting for levies, including the UK windfall tax, the company’s profits for the year stand at $924m, compared to $387m in 2021.

Harbour Energy (North Sea firm) FY results - IR

Increased EBITDAX of $4.0bn (2021: $2.4bn) and PBT of $2.5bn (2021: $0.3bn)

PAT of $8m (2021: $101m) impacted by a $1.5bn one off non-cash deferred tax charge associated with the EPL

FCF of $2.1bn (2021: $0.7bn) after total capex of $0.9bn (2021: $0.9bn) and $551m of tax payments (2021: $280m)

Approved $600m of shareholder distributions: $553m made in 2022; $41m in 2023

Net debt (excluding unamortised fees) and leverage reduced to $0.8bn (2021: $2.3bn) and 0.2x (2021: 0.9x), respectively

Tullow Oil FY 2022 - Financial highlights

The tone of the earnings call seemed to be one of reducing the debt in Tullow to improve the firm’s perception with both debt and equity investors alike. On the debt side, Tullow’s unsecured 2025 bonds trade at a yield of 30% (cash price of 67) compared to Kosmos Energy’s 2026 bonds at 10.8% (cash price of 90). So clearly there is some work to do to address that difference.

FY22 highlights:

EBITDA $1.47bn (+53% y/y, same as guidance)

Liquidity: $1.1bn includes $636m cash

Net leverage 1.3x (vs 2.2x in PY)

FY23 outlook highlights:

FCF $200mn

Net leverage (~1x by FY23)

Hedges – 54% of 2023 production is hedged

Earnings call highlights:

Financial Controller: Our next maturity is not until March 2025 and ahead of this as you can see from the graph, we're going to deliver material-free cash flow. And at which point, we'll also be 1x geared. Therefore, our conclusion is we have time. We have an ever-improving financial position and a number of options to address our debt maturities on an opportunistic basis.

CEO: Now, as you look at the hedges rolling off that Richard talked about, we've got some very significant oil price upside. So, when you look at the strong balance sheet, you got visible and accelerated deleveraging, our conviction is this is the year people stop worrying about the debt at Tullow and I think that's going to be a major game changer from a value perspective.

Richard Miller: [In response to an analyst question about whether they would buy back debt in the open market]: “It's one of the many options that we've got available to us.”

Real Estate / REIT news round up

Excellent article from BBG summarises goings on in the Office Property Market

Key extracts:

Analysts and investors liken struggling office buildings to dying malls; just as e-commerce hastened the demise of older suburban shopping centers, remote work will decimate business districts.

One brokerage estimates there will be about 330 million square feet of excess office space by the end of the decade.

Average office usage is about 50% of pre-pandemic levels—which could be the new norm

Stock of New York’s largest office real estate investment trust, Vornado Realty Trust, has dropped to 1997 levels; those of SL Green Realty and Boston Properties are below 2020 lows.

Almost $92 bn of nonbank office debt is maturing this year, and it needs refinancing, according to the Mortgage Bankers Association

Bruce Richards’s Marathon Asset Management and Dan McNamara’s Polpo Capital Management LLC, are using credit-default swap indexes known as CMBX to wager against bonds tied to office buildings

Cascade of Restructuring Coming for Offices, SVP’s Khosla Says - BBG Video

WeWork 2025 bonds trade down 10pts, said to be in talks re debt

WeWork 7.875% 2025 Bonds trade at around 45 vs 58 in February. WeWork is said to be in talks with investors to restructure its debt load.

Germany propco Leg Immobilien suspended its FY22 dividend, changing CFO…

but increases AFFO guidance. Key comment from statement: “Against the background of the current market situation which is affected by high interest rates as well as ongoing uncertainty on the valuation of the real estate portfolio, the liquidity will be used to strengthen the balance sheet instead of paying a dividend.” Shares closed the week 17.3% lower. Next week we hear from Vonovia and Aroundtown the week after.

*EM*

EM New issues

Some interesting new issues this week:

Cemex 9.125% subordinated perp (B+/BB-) with a call date of 2028.

Macedonia (BB+) 4y EUR 500m bond at a yield of 7.25%

Turkey $2.25b 6Y at 99.438 to Yield 9.5%

Cemex’s bond was priced on the 9th of Marchwhilst the SVB news was doing the rounds, so seems like EM is sentiment is not too fazed by events in the US Banking sector.

MENA

Egypt inflation soars to 5-1/2-year high, core inflation at record - RTRS

Extract - Egypt's official annual headline inflation rate leapt in February to a higher-than-expected 31.9%, its highest in five and a half years, while core inflation skyrocketed to a record 40.26%, according to official data published on Thursday. The soaring inflation follows a series of currency devaluations starting in March 2022, a prolonged shortage of foreign currency and a continuing backlog of getting imports out of ports.

Egypt Dollar bonds traded down further and Egypt 5 year CDS has gone from 763bps to 1237bps between early Feb and March 10th.

LATAM corner (Argentina/Bolivia/Gol/Azul,Totalplay)

Argentina swaps $21.7 bn in domestic debt, reducing default risk - RTRS

Extract - Argentina has swapped 4.34tn pesos ($21.66bn) in domestic debt, amounting to around 64% of loans due to mature through June and helping to ease near-term fears of a debt default as the economy falters under pressure from a devastating drought. The swap exchanges old debt for new bonds maturing in 2024 and 2025, according to an economy ministry statement Thursday.

Bolivia bonds trade lot lower on falling Dollar reserves - BBG

Extracts: Bolivia’s central bank moved to reassure anxious savers who have been lining up for days outside the bank’s headquarters in a rush for dollars that has spooked global investors, sinking the nation’s bonds.

The bank began selling dollars directly to the public this week, and across the country via state-controlled Banco Union, to meet a surge in demand.

Outside the building, people were queuing in a line stretching three blocks to buy dollars at the bank’s counters. The scramble was stoked by growing fears the nation’s dwindling cash reserves will force a devaluation of the boliviano currency, which has been held at around seven per dollar since 2008.

The finance ministry’s call on the population last week to cut their demand for dollars further fanned concerns. The monetary authority began selling dollars directly to the public this week, and across the country via state-controlled Banco Union.

The country’s sovereign bonds due in 2028 and 2030 are trading at record lows as concern about the South American nation spreads.

Bolivia’s 4.5% 2028 USD bonds are trading in the mid 60s after starting the year above 80.0 cash price.

Brazilian Airlines see huge moves higher after debt agreements

Brazilian Airline firms Gol and Azul see their bonds and equity rocket as they separately announced credit positive developments. Gol’s shares were up 34% and Azul’s up 74% in the week ended 10th March 2023. The broader market appeared to under-estimate the ability of these two firms to get through their current debt issues. Gol had been through a “near death” type experience only a few years ago, which probably prepared the management team for its latest battle. The comprehensive refinancing exercise at Gol would form a great business school case study due to its complexity and innovation.

Extract of BBG article below:

Azul SA’s American depositary receipts closed 41% higher at $5.85 in New York, the most on record, and bonds due in 2026 climbed 16 cents to 67.5 cents on the dollar. The moves follow an agreement the company struck with most lessors allowing it to reduce its payments in exchange for a mix of stocks and bonds, according to a filing published Sunday.

The deal “seems to be a powerful vote of confidence in the carrier’s long-term staying power and cash-generating ability,” Citigroup Inc. analyst Stephen Trent wrote.

On Friday, Gol announced a debt restructuring with Abra Group Ltd., a holding company that will control operations of Gol and Avianca Group International Ltd., and a group of creditors. The transaction provides the company with $451 million in cash, lengthens its debt profile and should ease negotiations with lessors, Bradesco BBI analyst Victor Mizusaki wrote in a note dated March 5.

Mexican firm Totalplay’s bonds sink further into distressed territory - BBG

HY / EM firms owned by individual billionaires individuals are viewed with a healthy level of scepticism to begin with, but if bond investors do not like the direction that individual is taking the company in then bonds tend to sell off heavily. This is exactly what has happened with Total Play as per BBG:

Bonds of Total Play Telecomunicaciones have fallen to distressed territory as investors weigh whether the cable provider owned by Mexicanbnaire Ricardo Salinas is spending too much to expand as debt payments approach.

The yield on notes due in 2025 rose above 22% Wednesday after nine-straight days of selling pushed the price down 20 cents to 71.5 cents on the dollar, according to Trace data. Bonds due in 2028 trade for around 69 cents on the dollar, as of Tuesday.

The selloff — which has saddled investors with losses of more than 19% since it began on Feb. 24, the worst performance in Latin America — adds to mounting concerns about Salinas’s companies. His broadcaster, TV Azteca, defaulted on $400m worth of dollar bonds in 2021, though it continued to pay on its local debt.

The bond rout began after Total Play announced fourth-quarter earnings on Feb. 23. While the company delivered strong revenue and margins, analysts noted that it blew past the 2022 and 2023 capital expenditure estimates it had set the previous quarter and failed to meet its own cash burn guidance.

It announced it would increase capex to a range of 15bn to 17bn pesos ($830m to $940m) this year from a previous target of around $550m. The company has set a goal of adding 1m net subscribers to its current base of 4.3m as it competes with rivals Grupo Televisa and Megacable Holdings.

Asia

China sets GDP growth target at around 5% for 2023: Global Times

Extracts - China set its GDP growth target at about 5 percent for 2023, reflecting the country’s confidence in a nationwide economic recovery after claiming a decisive victory against the COVID-19 epidemic, while also balancing against global economic volatility and geopolitical uncertainty.

The growth target means China will once again become one of the world’s fastest-growing major economies, as the global economy is widely expected to slow down sharply this year and major economies such as the US and the eurozone are grappling with risks of recession.

The growth target is significantly higher than China’s GDP growth rate of 3 percent in 2022 amid severe impact from the epidemic and major disruptions in global supply chains.

Adani Repays $500 Million Bridge Loan to International Banks | BBG

Extracts: The money was released to lenders on Tuesday, reported Bloomberg quoting sources. The Gautam Adani-led conglomerate has pre-paid about $2bn of share-backed loans, made bond repayments on time and won another $1.9bn investment from star investor Rajiv Jain of GQG Partners.

"Global banks had lent Adani $4.5bn to finance the purchase of Holcim Ltd. cement assets last year, and a portion of this was due March 9. The next tranche of the loan comes due in 2024," the Bloomberg report said.

In a $10.5-billion deal, Adani Group picked up Holcim Group’s entire stake in two Indian firms — Ambuja Cements and ACC. This is also the largest-ever acquisition by Adani, and India’s largest-ever M&A transaction in the infrastructure and materials space. Holcim sold its 63.19% stake in Ambuja Cements Ltd and 54.53% in ACC (of which 50.05% is held through Ambuja Cements) to Adani Group.

Fitch Rtgs: Sri Lanka’s Probable IMF Support Deal Positive for Debt Negotiations

Some positive developments with respect to Sri Lanka’s debt situation, extracts:

Fitch Ratings believes Sri Lanka is likely to secure financing support from the IMF after the fund’s Executive Board set a date of 20 March to review the USD2.9 billion staff-level agreement that the country signed with the IMF in September 2022. IMF funding should improve Sri Lanka’s external liquidity, but the timing of any debt restructuring agreement with official and private creditors remains uncertain.

We view the announcement of a date for the Executive Board review as an indication that the IMF regards the financing assurances it has received from key official creditors as sufficiently credible to move forward. Sri Lanka’s president on 7 March indicated that China had provided its support, following earlier assurances from India and Paris Club official creditors. The president also indicated that Sri Lanka had completed all prior actions required under the IMF programme, although the IMF Board will make its own assessment on this in deciding whether to approve the package.

Board approval of the programme would release IMF funding and should unlock additional financing from multilateral creditors. This would bolster official foreign-exchange reserves, which have already risen 30% from their trough in October 2022. Nonetheless, reserves remain very low, at USD2.2 billion in February, equivalent to around one month of imports.

*BUYSIDE + PRIVATE CREDIT*

JPMorgan Plays Both Sides in Battle Over Cotiviti Buyout Loan | BBG

Seems that JPM is looking to provide a “traditional” syndicated debt deal but also be part of a group that has offered to take a small piece of a $5.5bn loan that private credit firms have proposed to arrange instead.

Goldman launches community muni bond ETF - ETFDB

Apollo Sees Private Credit ‘Best Entry Point’ on Low Liquidity

*DISTRESSED*

S&P Adds 11 Companies to Default, Selective Default in February

…According to BBG Intelligence Research, issuers include AMC Entertainment, Cooper Standard Holdings and Bed Bath and Beyond.

US leveraged loan default rate climbs to 20-month high in February | PitchBook

Extract - Three defaults in February propelled the U.S. leveraged loan default rate above 1%, the first time this metric has reached that level in 20 months, according to the Morningstar/LSTA Leveraged Loan Index. At 1.02% by amount, and 1.10% by issuer count, this is the highest ratio for the Index since June 2021, when the 2020 wave of covid-related defaults began rolling off the 12-month calculation.

*TRADING*

Stock ETFs Blamed for Liquidity Shocks in Short-Term Treasuries - BBG

Extract of paper titled “ETF Dividend Cycles”, where academics attempt to make the link between stock ETFs and liquidity shocks in short dated USTs:

New academic research claims that equity exchange-traded funds are even creating distortions in the world’s largest debt market.

By gradually funneling their dividend income into money-market funds — which typically hold short-term Treasuries — equity ETFs are then seen adding upward pressure to US yields when they divest these holdings in one swoop to make their own distributions to shareholders.

The paper penned by a trio of academics suggests that a slew of stock products are indirectly hitting prices in the short-term Treasury market, thanks to their big liquidations in the world of mutual funds.

ETFs now control about $6.8 trillion in the US alone, according to data compiled by Bloomberg, with about $5.3 trillion in equity-focused funds. The paper estimates that they collected about 7% of all American share dividends as of 2021.

SOFR futures were active this week

Trumid Reports February Performance (prweb.com)

Extracts-

Reported average daily volume (ADV) more than doubled year-over-year to a record $3.7B, with record overall market share, up 81% versus February 2022.

Momentum from January continued into February with over 1,000 users trading on the platform for the second month in a row. Strong engagement across Trumid’s growing client network resulted in a record number of users executing a trade each day in February, up 48% year-over-year.

*RATINGS*

←Sovereign→

Cyprus Upgraded to BBB by Fitch

Portugal Affirmed at BBB+ by S&P

Greece is on the cusp of regaining its investment-grade credit rating: FT

←FINS→

S&P Revises abrdn PLC Outlook To Negative; Affirms 'A-' Rtg

Allianz Affirmed at AA by S&P

Barclays Upgraded to Baa1 by Moody's, Outlook Stable

Moody’s Downgrades SVB Financial Group, Will Withdraw Ratings

S&P Withdraws SVB Rating, Expects SVB Finl to Enter Bankruptcy

←IG→

Freeport Outlook to Positive by Fitch; L-T IDR Rating Affirmed

Occidental Raised to Investment Grade by Moody's

←HY→

S&P Upgrades Caesars Entertainment To 'B+'; Outlook Stable

EnQuest Outlook to Negative by Moody's

X-S&PGR Downgrades Medical Properties Trust To 'BB'; Otlk Stable

S&P CUTS NISSAN RATING TO BB+

Eaton Corp Upgraded to A- by Fitch

Fitch Affirms Delta Air Lines at 'BB+'; Revises Outlook to Stable

IAG Outlook to Stable by Moody's; L-T CFR Rating Affirmed

Moody's changes outlook on Danaos' ratings to pos from stable; Ba3 rating affirmed

Rolls-Royce Outlook to Positive by Moody’s

←EM→

Argentina Affirmed at CCC- by Fitch

Argentina Downgraded to SD by S&P

S&PGR Revises South Africa Outlook To Stable; ‘BB-/B’ Affirmed

Moody’s Cuts Vedanta Resources’ CFR to Caa1; Outlook Negative

Fitch Rtgs: Sri Lanka’s Probable IMF Support Deal Positive for Debt Negotiations

*LINKS / CHARTS*

Good chart from Charlie Bilello about the sheer move in Treasury yields since 2021..

A key reason for failings at SVB and likely other institutions out there.

Thank you for doing this. An excellent summary of the most important events in the credit markets.

I love it!

Thank you for putting this together every week, it’s highly valuable!