27 January 2023 Global Credit Wrap

Mixed US economic signals, Canada pause, European data improving, inflation surprises in OZ, Xover at 405bps, Euro HY & lev fin markets are alive, some useful earnings call snippets

*TLDR*

MOVES

Bond ETFs over 5d - Strength in TIPS, long dated bonds, Asian HY, Hybrids, AT1

Credit spreads over 5d - Tightening across the board in CDS and Cash bonds.

5 year Xover now at +405bps vs last yr peak of +670bps

Rate vol has collapsed after spiking at end of last year - MOVE Index

US 2 yr yields drop below Fed Funds rate

MACRO

US Data summary: GDP stronger than expected, weak PMIs, jobless claims remain low, wages remain high

Fed meeting next week, J Powell & Fed unlikely to waver on commitment to bringing inflation below target

Jobs - BofA opine that layoffs in tech outweighed by labor hoarding in other industries

US full-time workers real wage growth has turned positive

Visa and Mastercard earnings reveal no obvious signs of a weaker consumer

However, subprime Auto loan borrowers are falling behind on car payments at higher rate than 2009

Canada pauses rate hikes

European Data: Improving PMIs, inflation coming down

Could inflow of Japanese funds be behind the recent risk rally?

Germany & France looking to counter effects of US I.R.A

UK 30-year bond sale draws strongest demand in over a year

UK business confidence drops to lowest since financial crisis but may have bottomed: ICAEW

INFLATION

Higher than expected inflation prints in Australia, New Zealand, Tokyo, Brazil and Mexico. Reminder that inflation unlikely to fall in a straight line

COMMODITIES

Divergent moves: Copper has risen 36% since last July while oil has fallen 22%

Trafigura ends oil export deal with Govt of Kurdistan - BBG

IG

Earnings - Overall, 29% of the companies in the S&P 500 have reported actual results for Q4 2022 to date. Of these companies, 69% have reported actual EPS above estimates, below the 5 year average of of 77%. Factset

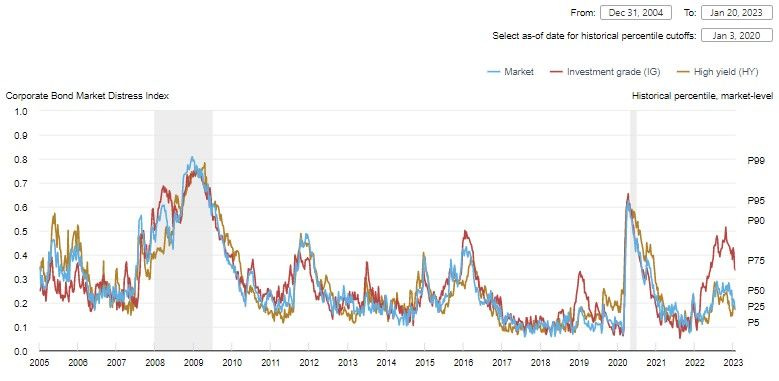

NY Fed Corporate bond market distress monitor retreating from 2022 highs

IG Corp new issues - Back to the old habits of zero concessions (in certain places) and greater demand for longer duration

First Real Estate bond issuer of the year suggests slight easing of concerns over best players in the sector

Corporate Hybrids - Strong demand for Red Electrica bond, Telefonica's new bond paid no new issue premium.

European Airlines- Strong updates from Easyjet and Wizz Air

Tesla gets $5bn credit line

HY/Lev Loans

US HY New issue total goes to $15bn, returns YTD are best since 2009

$5.9bn in lev loan issuance in the US including a $1.2bn LBO

SRLN Senior Loan ETF technically overbought

EUR HY market sees large inflows and issuance gathering pace

Looser financial conditions enable Banks to offload some of the hung LBO debt on their balance sheets

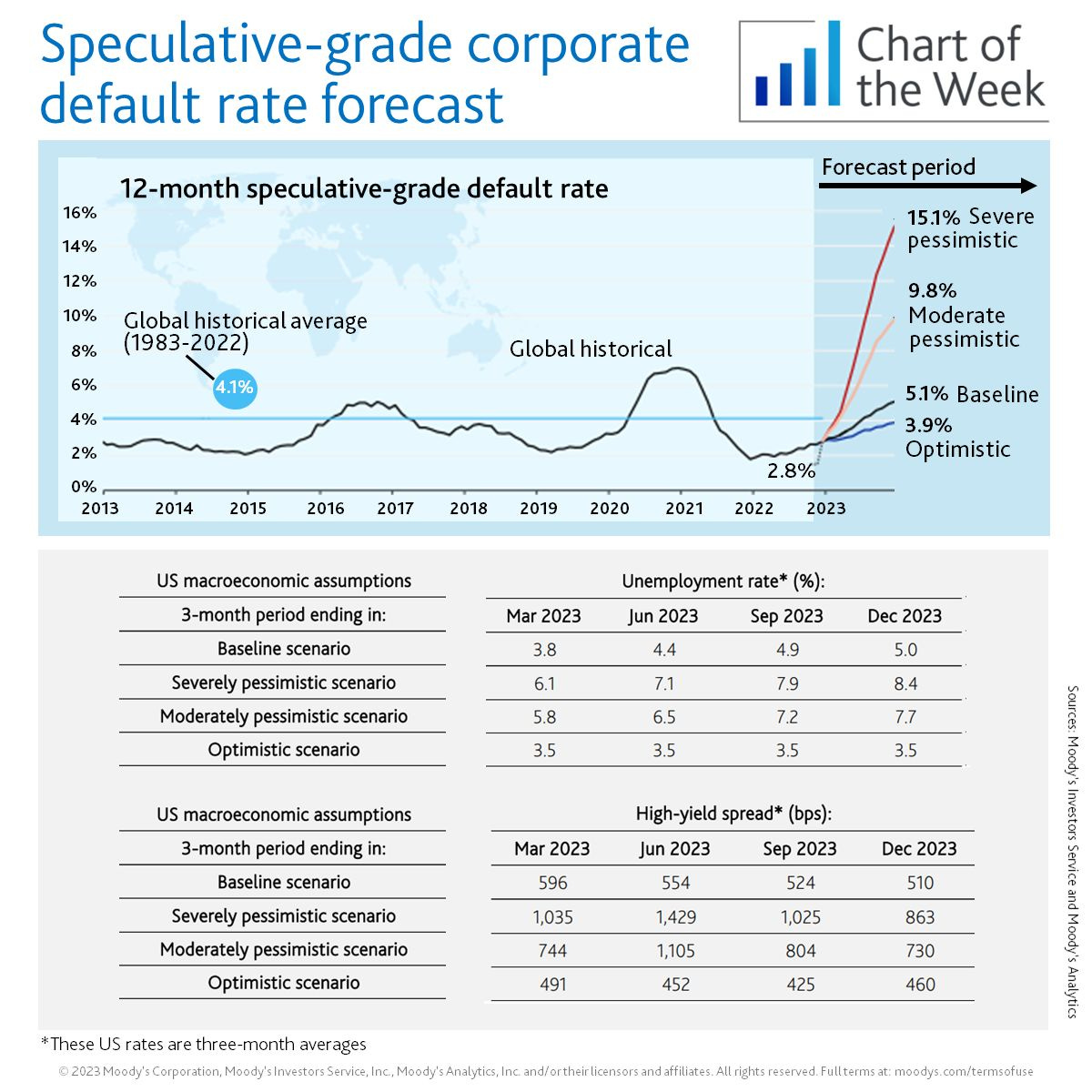

Fitch and Moody's up default forecasts for 2023

AMC CEO Adam Aron touts 'vote of confidence' in the company by its bank lenders

Permira invests in Outsourced Credit Research firm Acuity after investing in Re-Org Research

FINANCIALS

European Financials have issued a €82.8bn of bonds YTD, highest monthly total in past 5 yrs

US regional banks have issued more bonds than US Money Centre banks YTD

European bank earnings season began very strongly with Sabadell and SEB

SocGen called a low reset T2 bond

EBA opine that DNB discos cant count fully as eligible T2

Auto Insurers in the US are raising premiums to fight claims inflation

CEO departure at Direct Line, UK General/Motor Insurer

UK Buy to Let - No major weakness noted yet by Paragon Group

Crypto Bank Silvergate Suspends Preferred Stock Dividend to Preserve Funds

EM

Strong flows into EM debt and equity continue

More big coupon EM issuance this week

Philippines' GDP growth accelerated to 7.6% in 2022

Two of UAE’s biggest banks beat estimates as economy boosts earnings

Tullow Oil - Positive trading update re cashflow/balance sheet position

Apollo and former Softbank exec in talks to acquire Millicom for $10bn

RATINGS

Egypt Affirmed at B by S&P

S&PGR Upgrades Travelodge To 'B-'; Outlook Stable

Moody's downgrades Rackspace's CFR to Caa1; outlook changed to negative

BUYSIDE/PRIVATE CREDIT/TRADING

Blackstone Earnings call highlights

Some Credit Hedge Funds Bounce Back After Credit Turmoil in 2022

MarketAxess posts FY figures, sees increasing Bond ETF participation

*MOVES OVER 5D*

Bond ETFs

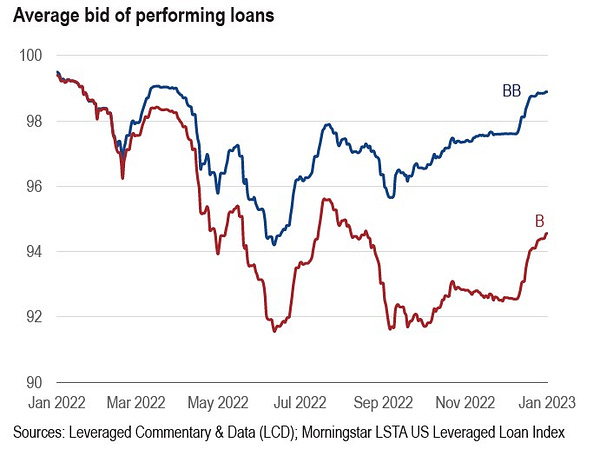

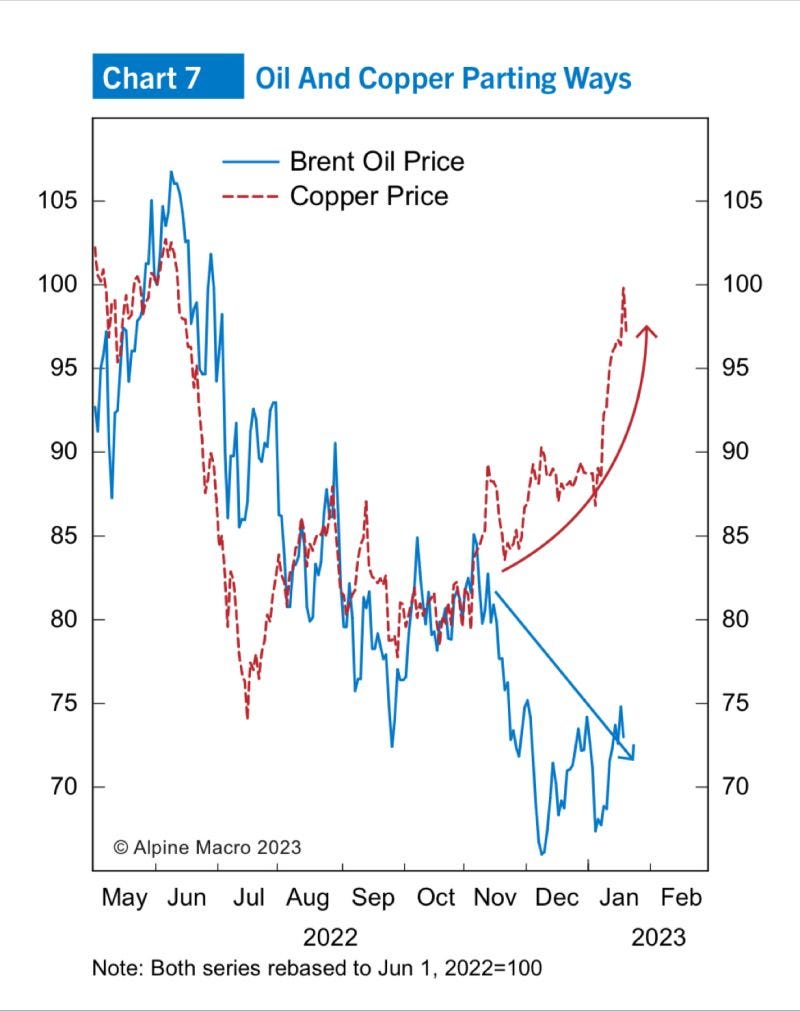

Strength in TIPS (LTPZ+1.9%), Long dated bonds (EDV+1.7%), Asian HY (AHYG+1.6%), Corporate Hybrids (EHYB+0.9%), AT1s (AT1+0.7%), Inflation linked Gilts (INXG+0.8%). Looking at MTD, there have been some monster moves in certain Bond ETFs:

Data to 27 Jan 2023, SRC:BBG

Weakness over 5 days has been mainly in inverse long bond ETFs (TTT -2.8%)

CDS Credit spreads

Tightening most evident in Xover (-24bps), CDX HY (-14bps), Sub Fins (-10bps), EM (-9bps). No widening to be seen in the major CDS indices.

Cash credit spreads

All major cash credit spread benchmarks I track tightened led by CoCos (-17bps), US HY (-11bps) and EM HY (-9bps).

Rate vol has collapsed after a spike at the end of 2022

US 2 year yields drop below Fed Funds rate

*NORTH AMERICA MACRO*

Recession watch - Watch what they do, not what they say…

I thought the this tweet summed up the current situation quite well.

Canada pause

The US Money Supply has fallen 1.3% over the last 12 months

US Job market - More to it than the current mass layoffs in Tech..

The reason why McDonalds and Burger King are no longer cheap eats…

While the headlines have been caught up with tech layoffs, other parts of the labour market are much hotter. Walmart, the huge US Retailer also announced it is raising wages for its U.S. hourly workers to $14 an hour starting next month, from $12 currently. Its rivals, including Amazon, Target and Costco, all still pay more (Source: @lisaabramowicz1 / WSJ)

Full-time workers real wage growth has turned positive

Counter argument to continuously higher wages

Americans Fall Behind on Car Payments at Higher Rate Than in 2009 - BBG

BBG chronicles the story of one person called Kobe Hatch who had his car repossessed in the US to demonstrate some of the devastating second order effects of higher interest rates on certain consumers. The problems seem to be concentrated in the subprime group of customers.

Hatch is part of a growing cohort of Americans facing auto repossessions, an ominous sign for the US economy. During the pandemic, a surge in used car prices forced buyers to take out bigger loans for their vehicles. The monthly payments seemed doable in an era of stimulus checks, a tight labor market and surging stocks, but that’s changed for many people as inflation eats into their budgets and the job market cools.

Now, more Americans are falling behind on their car payments than during the financial crisis. In December, the percentage of subprime auto borrowers who were at least 60 days late on their bills rose to 5.67%, up from a seven-year low of 2.58% in April 2021, according to Fitch Ratings. That compares to 5.04% in January 2009, the peak during the Great Recession.

Higher interest rates are making it even more difficult to make the monthly payments. The average new auto loan rate was 8.02% in December, up from 5.15% a year earlier, according to Cox Automotive. The rate can be much higher for subprime borrowers.

*OTHER DM MACRO*

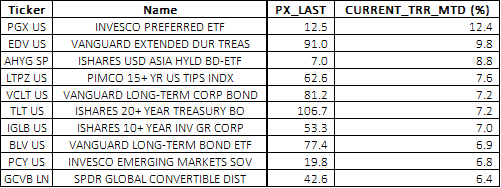

One theory for the current rally in risk assets is the infusion of Japanese money

Nicely summarised by Syz Group’s CIO: As highlighted by BofA, there is a tsunami of liquidity coming from #japan. Indeed, as the YCC (yield curve control) ceiling was raised last month, the #BoJ has been buying enormous amounts of JGBs via “unscheduled” bond-buying operations to defend the YCC. Reports show that the BoJ has bought $550 billion of bonds in the past seven months, roughly equal to 14% of the Japanese GDP. Estimates suggest that around $300 billion will be pumped by BoJ in January alone! As highlighted by Sagar Sing Sethia, this unprecedented liquidity is now flowing into the global financial system and has started to affect even the US financial conditions, which have now eased to the levels when Fed began to raise rates in March 2022.

Germany and France express joint support for a EU effort to push against tax breaks in the US I.R.A - WSJ

Something to monitor as we come out of 2022…

Extract - Germany and France expressed joint support for a European Union effort to push back against tax breaks in the U.S. Inflation Reduction Act, increasing the likelihood that the bloc can agree on simpler European subsidy rules and additional aid for specific sectors next month. At a meeting in the French capital on Sunday, German Chancellor Olaf Scholz and French President Emmanuel Macron said they had aligned their positions ahead of an expected plan by the bloc’s executive body to counter what it sees see as the unfair advantage the U.S.’s legislation gives American companies. The EU has lobbied the U.S. to rewrite its rules so that European companies can benefit from the tax breaks. If that fails, the bloc’s response could range from making it easier for European governments to subsidize their own companies to earmarking EU funding for such investments.

European PMIs improving

UK’s private sector faced the strongest downturn in 2-years - S&P Global

UK 30-year bond sale draws strongest demand in over a year | RTRS

Extract - Britain received the highest demand in more than a year at a sale of 30-year government bonds on Tuesday, attracting some 68.4 billion pounds ($84.3 billion) of orders for a new gilt which matures in October 2053. The strong demand - which comes after severe bond market turmoil in late September and October - will be welcomed by the government which is likely to need to issue around 300 billion pounds of debt in the upcoming 2023/24 financial year.

UK business confidence drops to lowest since financial crisis but may have bottomed…says ICAEW

Extract - Institute of Chartered Accountants in England and Wales Business Confidence Monitor finds a weakened economy and depleting customer demand have caused confidence to plunge to 2009 global financial crisis levels.

Extract - Confidence has again fallen sharply to a very low level by past standards, but it may have bottomed out, possibly as a result of less anxiety over economic policy, and indications of inflationary pressures easing a little. Among sectors, Construction, Property, Retail and Manufacturing are the least confident.

However, domestic sales growth has stabilised after a period of recovery. Export sales growth is stronger than a year ago, helped by a weaker sterling. Both are expected to continue growing.

Input prices and selling prices also continue to rise sharply, but expectations for the year ahead have softened. However, salary growth continues to accelerate, as expected.

While labour market challenges have eased, financial challenges have risen and a marked slowdown in investment growth is anticipated.

Access to capital is a prominent issue for Property and Construction companies; both sectors face severe difficulties with bank charges. Input price issues are worst for Retail and Construction companies, while IT companies face strong market competition, which seems to be impacting their expectations for selling price increases over the coming year.

All regions and types of companies show broadly similar trends, although UK-listed companies are a little less confident than non-UK listed and those that are privately owned.

*INFLATION*

Australian CPI surprised to the upside - Official release

Latest Australian CPI stats showing that inflation can remain very sticky. The higher than expected figure was driven by large price hikes in domestic holiday travel and accommodation during the Christmas season, probably a time when lot of Australians from abroad come back to OZ and bid up local hotel / b&b rates. I also wonder how much impact the China re-opening will have an impact on Australia as more Chinese visit the country for business / pleasure / education and visiting family.

Extracts: The annual CPI movement of 7.8 per cent is the highest since 1990. The past four quarters have seen strong quarterly rises off the back of higher prices for food, automotive fuel and new dwelling construction. Trimmed mean annual inflation, which excludes large price rises and falls, increased to 6.9 per cent, the highest since the ABS first published the series in 2003.

The most significant price rises were Domestic holiday travel and accommodation (+13.3%), Electricity (+8.6%), International holiday travel and accommodation (+7.6%) and New dwelling purchase by owner occupiers (+1.7%).

The services component of the CPI recorded its largest annual rise since 2008, driven by holiday travel and meals out and takeaway food. Annual inflation for goods saw little change from the previous quarter.

Brazilian inflation slightly higher than forecast in early January - RTRS

Extract - The Brazilian IPCA-15 consumer price index rose 5.87% in the 12 months to mid-January, slightly exceeding the 5.83% median forecast by Reuters though slowing from the 5.9% seen in the previous month. That came on the back of a 0.55% monthly increase, IBGE said, boosted by higher health and personal care and food and beverage costs. Economists had expected a 0.52% rise in the month.

Mexico early-January prices exceed market forecasts - RTRS

Extract - Annual headline inflation in the first half of the month reached 7.94%, beating both the 7.77% recorded in the month of December and economists' forecasts of 7.86%, though still below the two-decade high of 8.70% registered in August and September. Meanwhile the core index, which strips out some volatile food and energy prices, hit 8.45% on an annual basis, back on the rise after showing some relief in December. It also exceeded forecasts of 8.34%. That means annual inflation remains far above the target rate of 3%, plus or minus one percentage point set by Banxico, as the Bank of Mexico is known. Banxico bank board member Jonathan Heath said on Twitter the consumer price data pointed to "domestic pressure, possibly from increases in labor costs." Heath underscored that Mexico still has "a lot to worry about" in terms of inflation.

Consumer inflation in Tokyo hits near 42-year high - RTRS

Extract - Core consumer prices in Japan's capital, a leading indicator of nationwide trends, rose 4.3% in January from a year earlier, marking the fastest annual gain in nearly 42 years and keeping the central bank under pressure to phase out economic stimulus. While the government's energy subsidies starting next month will likely moderate price gains from February, the data heightens the chance that inflation will stay well above the Bank of Japan's 2% target in coming months as companies continue to steadily pass on higher costs to households. The rise in the Tokyo core consumer price index (CPI), which excludes fresh food but includes fuel, exceeded a median market forecast for a 4.2% gain and marked the fastest year-on-year increase since May 1981.

UK newspapers making a bigger deal of the cost of inflation crisis

I noticed this week that the Mail and Telegraph have highlighted surging inflation in items such as Baked Beans and Broadband contracts. Extracts below:

Telegraph extract - BT broadband customers are paying the highest exit fees to escape double-digit price rises due to kick in from April. Home internet users are facing bill increases of as much as 14pc, amounting to more than £50 a year on average.

*COMMODITIES*

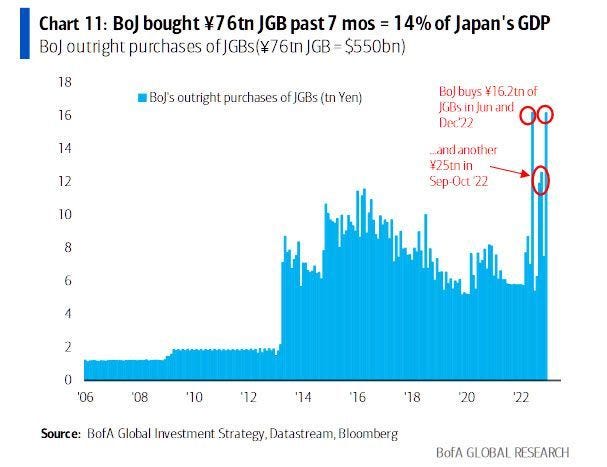

Alpine Macro highlight rare divergence between Oil and Copper prices

Alpine Macro - Copper has risen 36% since last July while oil has fallen 22%. The divergence between the two markets is very rare in history.

The difference is likely the much tighter physical market in Copper compared to oil driven by the multi-decade need for Copper in EVs and the green transition.

Trafigura ends oil export deal with Govt of Kurdistan - BBG

Seems like Govt of Kurdistan are not willing to strike up a contract when the price of Kurdish oil is at subdued levels. Kurdish Oil maybe suffering from the price discount offered by cheap Russian barrels in the market.

Extract from Jack Farchy (BBG) - Commodities trading giant Trafigura Group is ending a relationship with the government of Kurdistan in northern Iraq, a fresh blow to the region’s ability to sell its oil independently. The parting of ways comes after Trafigura failed to renegotiate the terms of its contract with the Kurdistan Regional Government following a drop in the price of Kurdish oil, according to a person familiar with the matter. After the Kurdistan government refused to renegotiate, Trafigura pinned its hopes on talks with Prime Minister Masrour Barzani in Davos, but a planned meeting last week was canceled by the Kurdish leader at the last minute without explanation, the person said, asking not to be named as the matter wasn’t public. Trafigura was one of several trading houses that, starting in 2014-15, lent billions of dollars to the cash-strapped government of Kurdistan in exchange for future oil sales, in the process helping to finance its bid for independence. Oil is the lifeblood of Kurdistan’s economy, accounting for more than half the government’s revenues, and the exports through Turkey have underpinned its autonomy from Baghdad. For the traders, the deals with cash-strapped Kurdistan represented a potentially lucrative opportunity to secure new flows of oil.

*IG*

S&P 500 earnings update 27 Jan 2023 - Factset

Extract - Overall, 29% of the companies in the S&P 500 have reported actual results for Q4 2022 to date. Of these companies, 69% have reported actual EPS above estimates, which is above the percentage of 67% at the end of last week, but below the 5-year average of 77% and below the 10-year average of 73%.

Corporate bond market distress retreating from 2022 highs - NY Fed

This data does not yet include the huge rally we have seen since the 3rd of January…

Really tight IG credit deals + duration are back in vogue…

The start of the week began very strong for US IG Corporates, this was some of the colour from the BBG new issues team:

Borrowers paid less than one basis point in new issue concessions on deals that were nearly five times oversubscribed

Proctor & Gamble brought a new 3y at +23, just 8bps off the all time 3y record of +15bps. The same article

After moving in favour of investors for much of 2022, it seems the pendulum is swinging back to IG Corporates. One of the only saving graces is the relatively high yield on the 2 year treasury which makes all in yields look adequate on short dated IG Corps.

This week also saw the first European Real Estate bond issue since August 2nd 2022. Prologis, the $117bn market cap listed US logistics warehouse firm re-opened the market with a dual tranche totaling over €1.2bn.

Corporate Hybrid corner

There was strong demand for Hybrid paper in Europe, demonstrated by the new deal for Red Electrica, the Spanish utility which saw over 9x book coverage on its new €500m PerpNC5.5 Green Hybrids Yielding 4.7%. Besides this, Telefonica came with yet another new issue and tendered for two of its hybrids.

The results of the tender of Enel’s $ corporate hybrid showed that $411m of its $1.2bn hybrid issue will be tendered tendered. Tenders are bringing reinvestment flows back into both the Corporate Hybrid market and credit more generally.

European Airlines (Wizz Air/Easyjet/Jet2) mirror booking strength seen at US Airlines

The strength of bookings for Airlines suggests that consumers are happy to spend on experiences abroad / visit family while cutting back on other areas. Wizz Air, Jet2 and Easyjet all reported strong figures. On the day of the results, Easyjet’s shares rose 9.7% whereas Wizz’s traded down 7% after a strong run into figures.

Earnings highlights from AT&T and Verizon - cashflow and debt focus

Tesla Gets $5bn Credit Line in Sign It’s Nearing IG Status - BBG

Makes sense that Elon is looking to boost Tesla’s financing options when financial conditions are so loose.

Extract - Tesla Inc. has secured a new $5 billion revolving credit facility, another sign that the company is nearing investment-grade status. The electric-vehicle maker may increase the facility by up to $2 billion, according to a filing…Tesla has cut about $9.5 billion in debt since its short- and long-term obligations peaked at $15.3 billion in late June 2020, Bloomberg Intelligence analyst Joel Levington wrote in a Jan. 12 note. It has also improved its cash generation and built out its capital reserves, Levington said.

*HY*

US HY New issue total goes to $15bn, returns YTD are best since 2009 - BBG

17 issuers have come to market to raise $14.9bn as at end of Thursday 26th January. In terms of performance, BBG states that the HY sector has gained 3.7% with CCCs returning 5.3% (best in almost two decades). Highlighted transactions:

Crescent Energy - Issued $400m of 5NC2 bonds at par to yield 9.25%

Savers - Savers $550m 5NC2 Sr Sec at 97.986, Yield 10.25%

Despite aggregate spreads being tight in HY, the deals that are being priced are coming with reasonably high coupons which is why most deals are trading up in the secondary market. Issuance in the HY market is helping adjacent markets like the Nordic USD bond market. This week; Borr Drilling, a $1.2bn market cap Drilling firm that owns and operates jack-up rigs raised a total of $400m across a secured 1st lien bond (9.5% maturing in 2026) and a convertible bond (BDRILL 5% 2028), the latter which has quickly risen to a price of 107 after being issued at par.

The strength in the US HY market seems to be also reflected in the related CLO market where yields on BB rated tranches have fallen to 13% from 15% in October 2022 according to BBG. This has helped Managers raise new CLOs, e.g. the risk premium on the AAA portion of a CLO sold last week from Blackrock Financial Management was +187bps compared to just two weeks ago when CLOs were selling at spreads closer to +210bps.

Lev Loan issuance totaled $5.9bn in the week including a $1.2bn LBO

Euro HY / Lev loan market

Some positive developments here too for issuers and for investors in the week.

Fund flows into the European HY sector have been robust with one US Bank highlighting around $1.2bn of inflow YTD with a large $600m inflow just in the past week.

The week saw a diverse roster of issuers hit the market and roadshows are happening in person with some issuers even offering gift bags, the good times are back! Most of the issuance seems to be for refinancing and marks a change from the days when we used to see lots of debut issuers.

Vehicle breakdown company AA Bond Co had tendered for part of its 2024 issue, so some existing investors would have rolled into the new issue.

Italmatch owned by Bain Capital tightened up pricing on its new fixed rate bond from IPT of 10.5% (and whisper of 11%) to 10.0%.

Telefonica’s latest hybrid appeared to offer no new issue concession which is probably why it has underperformed…and is indicative of the strength of investor demand. It did lift the hybrid sector modestly as it gave the idea that Corporate Hybrid market is functioning.

Improved risk sentiment and increasing CLO issuance is also helping lev loan new issuance. Nord Anglia Education raised €2bn this week across two loans maturing in 2028. The € tranche is said to pay +475bps while the $ loan pays +450bps above the US money market rate. The news could be interesting to other private school operator Alpha Plus Schools which has a bond maturing in March 2024.

Equity financing markets seem to be thawing too which will help HY issuers further, demonstrated by Tui that is said to be looking to execute a rights offering to payback Govt bailout debt. I’m pretty sure this is not the first time Tui has executed a rights offering to reduce debt in the past few years.

Banks Offload Millions in Hung Debt as Sale Restrictions Expire - BBG

The looser financial conditions in the credit markets generally are seeing some thawing in the loans that are sitting on banks balance sheets for most of 2022…

Extracts - Goldman Sachs sells about £25 million of its Morrisons debt. Banks stuck with about $40 billion of debt on balance sheets. With the restrictions lifted, and global credit markets rallying, some banks are managing to offload some of the debt, but at steep discounts. Goldman offloaded its Morrison debt to a credit hedge fund at a discount, at around the mid-80s pence on the pound, the people said. Other banks holding an outstanding £300 million of the sterling-denominated term-loan B are also in discussions with credit hedge funds about selling, they said.

Increase in high yield and leveraged loan default forecasts: Fitch | P&I

Fitch Ratings forecasts that this year's high-yield default rate will increase to 3% to 3.5% compared with September's 2.5% to 3.5% rate. The ratings agency cited macroeconomic factors, including sluggish GDP growth and its prediction of a U.S. recession starting midyear. Last year, the default rate was 1.3%.

Moodys: Global speculative-grade corporate default rate will rise to 5.1% at end of 2023

Extract - The global speculative-grade corporate default rate will rise to 5.1% by the end of 2023 from 2.8% at the end of 2022, under the baseline scenario of Moody's Credit Transition Model, as slower macroeconomic growth and weaker financing conditions will erode corporate earnings and cash flow.

AMC CEO Adam Aron touts 'vote of confidence' in the company by its bank lenders

Adam Aron tweeted that AMC’s bank lenders have extended a covenant waiver till March 31 2024. This buys some time for the company to generate ticket revenues from blockbusters this year.

BlackRock, Apollo Among Bondholders of Bankrupt Crypto Miner - BBG

The fallout from the implosion of Crypto exchanges continues..

Extract - BlackRock Inc. and Apollo Global Management Inc. are among a group of creditors that lent around $500 million to bankrupt Bitcoin miner Core Scientific Inc. by purchasing its secured convertible notes, according to a court filing. The disclosure reveals how traditional finance firms helped to bankroll the crypto-mining industry during its boom, when such companies raised billions of dollars by issuing debt. But a plunge in the price of Bitcoin, the largest cryptocurrency, and high electricity costs have slashed the profit margins of the so-called miners that process transactions, threatening the companies with insolvency.

Medical Properties Trust - Bonds drop on short seller allegations

‘Tis the week for short sellers, with Adani first and then Medical Properties Trust (MPW).

Viceroy Research’s core thesis around MPW seems to be around an overstatement of its assets due to “uncommercial transactions with its tenants”, whom Viceroy state appear to be in distress.

While I haven’t followed the name closely, people appear to be taking note as Viceroy were also behind short seller reports for Wirecard, Adler and Home REIT.

Even this rally in CCCs and HY couldn’t save Bed, Bath and Beyond

Permira invests in Outsourced Credit Research firm Acuity

Permira, which also made an investment in distressed debt research firm Re-Org has now just acquired a majority stake in Outsourced Credit Research firm Acuity. The Credit research area has been a hive of activity in the past few years with Fitch acquiring Creditsights in 2021.

*FINANCIALS*

European Financials have issued a record €82.8bn which is the highest monthly total for past 5 yrs - Citi

We are not even at month end yet!

European Banks earnings season began well with Sabadell and SEB

Sabadell and SEB beat on quarterly earnings. Worries around SEB’s exposure to commercial Real Estate have been largely brushed aside for now due to the benefit it is getting from a higher rate environment. Sabadell shares rose as much as 10% after it reported earnings showing just how much the market underestimates certain banks. Note that several European bank shares are hitting new 52w highs currently including Sabadell, AIB, Bank of Ireland, HSBC and Natwest.

US Regional Banks have been active issuers YTD- IFR

Just like European Banks have been issuing due to the gradual withdrawal of one of their funding sources (European TLTROs), US Regional Banks seem to be issuing to reduce reliance on customer deposits.

Extract - Truist and Capital One doused the bond market with fresh deals this week. Many of these lenders are stepping up debt issuance as a way of dealing with falling deposits and expectations that regulators may require them to keep more capital on their balance sheets. Capital One, M&T Bank, KeyBank, US Bancorp and Truist issued nearly US$14bn this week. That overshadowed the US$9bn of bonds issued so far this year by US-headquartered global banks like Goldman Sachs. For some of the smaller consumer-facing banks, the Fed's interest rate hikes may be pushing their depositors to shift cash into higher interest-bearing assets. “Are you going to keep money in your checking account when you have CDs [certificate of deposit] and money markets offering over 4% yields?” said one banker. “People are taking money out of traditional banks.”

Soc Gen called a low reset € T2 bond

Soc Gen called its SOCGEN 1 ⅜ 02/23/28 T2 bond which has a call date of 23 Feb 2023. The reset on the bond is 5 year European swaps + 90bps. Based on the size of the reset, it seems more than economics were at play when it came to calling this bond issue.

EBA - Opine that DNB discos cant count fully as eligible T2 - EBA

Extract - The EBA responds to law firm on the prudential treatment of legacy instruments held by DNB Bank ASA 26 January 2023 The European Banking Authority (EBA) published today a response to the letters received from a law firm on 23 June and 3 October 2022, regarding the case of the prudential classification as Tier 2 instruments of legacy perpetual bonds (so-called ‘Discos’) of an institution established in Norway (DNB Bank ASA). After careful consideration of the concerns raised, and a scrutiny of the detailed terms and conditions of the Discos, the EBA assessed that the Discos cannot count as fully eligible Tier 2 instruments of DNB Bank ASA. The EBA shared with the relevant competent authority this assessment for its own consideration, as well as to be informed of the next steps it intends to take, in particular with regard to the EBA Opinion on legacy instruments and the cascading options it contains to address the so-called infection risk. The EBA will continue monitoring the residual limited stock of legacy instruments in coordination with the concerned competent authorities.

Visa earnings call - No obvious signs of slowdown here - Transcript

Extracts of comments from mgmt:

on the last call for the full year, and we told you we had assumed no recession. As you can see, business trends have been remarkably stable. The spend levels just around the world, they've indexed in the mid-140s for almost four quarters right now, and there's no evidence of a change in trend. That's reflected in our second-quarter outlook.

….We're not changing any of our views in the second half. I mean, they are planning assumptions. And if there is a slowdown, then we will react accordingly.

In total spend, it's remarkable stability. What's happening is as goods spending slowed down a bit, services spending really took up all the slack. And so, consumers have just shifted their spending but they're spending the same amount, and that's why debit has stayed resilient.

But as you've seen, debit has stayed resilient even as credit has recovered, which has kept our overall payment volumes very stable.

And other revenue was helped by mostly marketing services and consulting revenue, a fair amount of that linked to the FIFA World Cup. There was a lot of client-related marketing and spending related to the World Cup.

We're going to see the travel outbound from China to Southeast Asia. I think it's going to be still a bit of time before we're going to see a Chinese traveler back in Europe at the level of pre pandemic or back in the United States at the level of pre pandemic.

My personal expectation is that we'll see probably a spread of three to five quarters before, starting in the second half before China gets back to a level of pre pandemic or 2019.

Mastercard CEO remarks on “resilient” consumer despite macro uncertainty - IR

“As we look at the broader economy, we see the continued recovery of cross-border travel, with volumes up 59%1 versus a year ago and we’re encouraged by Asia opening up further. While macroeconomic and geopolitical uncertainty persists, consumer spending has been remarkably resilient. We are well prepared to adjust our investment profile quickly if needed.”

Auto Insurers in the US are raising premiums to fight claims inflation - WSJ

Extract - Travelers (TRV) is pushing to make up for inflated claims costs on personal auto policies. Auto insurers are racing to catch up with higher costs to cover claims. Investors should buckle up. Loss trends in auto insurance, propelled by higher costs to cover accidents, continue to be ugly. Travelers reported an underlying combined ratio in its personal auto business of 110.5% for the fourth quarter, meaning payouts and expenses were more than premiums earned, excluding catastrophe-related losses and adjustments in reserves for past years. That was a nearly 7 percentage point jump from a year earlier. Like other auto insurers, Travelers has been pushing through premium increases to try to cover rising loss ratios. This is a slow process that involves getting approval from state authorities in addition to waiting for policies to come up for renewal.

This is an issue that has impacted not only US Auto insurers but also the likes of UK’s Direct Line which suffered a 25% one day hit to its share price after a recent trading update, and has subsequently announce its CEO is departing. The issue around claims inflation in the UK seems to do with a lack of third party garages which means the existing garages can dictate prices to Insurers and their customers…dreaded inflation again.

Paragon - UK Buy to Let Lender grew loan volumes and upgrades NIM forecast

Paragon, the FTSE 250 buy to let lender reported an upbeat trading update for the period covering 1st October to 31st December 2022, which was during the time of the huge vol event in UK markets caused by Liz Truss/Kwasi Kwarteng. Key highlights:

The loan book grew by 5.4% to £14.4 billion in the twelve months to 31 December 2022 and net interest margins ran at levels above expectations over the first quarter.

Strong conversions from the new lending pipeline resulted in total new lending for the quarter to 31 December 2022 increasing by 21.7% to £861.7 million from £708.0 million in Q1 2022

After accruing for half of the assumed interim dividend, but excluding the remaining element of the announced 2023 share buy-back, the Group's unverified CET1 and total capital ratios remained strong at 16.1% and 18.1% respectively (15.6% and 17.7% on a fully loaded basis) at 31 December 2022. Source: Paragon IR

Paragon’s shares along with peer OneSavings Bank look like they are breaking out and have outperformed other larger domestic peers in the UK over the past 5 years.

Smaller UK property developers showing signs of strain - Inland Homes / Watkins Jones - ThisisMoney

Extracts - British property developers Watkin Jones and Inland Homes have revealed significant slumps in earnings amid soaring costs and weaker sales volumes. Student accommodation builder Watkin Jones saw pre-tax profits plunge by 64 per cent to £18.4million for the year ending September 2022. Though the group achieved record forward sales totalling £900million, while revenue was only moderately down on the prior 12 months, trading was badly affected by heightened market volatility towards the end of the period. Meanwhile, Inland Homes shares plummeted by a third after the Beaconsfield-based company admitted to breaching covenants with two lenders. The AIM-listed group has more than doubled expected annual pre-tax losses for the last fiscal year from £37.1million to around £91million. It partly blamed the performance on higher costs and prolonged construction projects resulting from staff shortages and supply chain issues delaying the delivery of certain materials.

Silvergate Suspends Preferred-Stock Dividend to Preserve Funds - Coin Desk

Extract - Crypto-focused bank Silvergate Capital (SI) suspended dividend payments on its preferred stock as it seeks to preserve capital. The suspension affects its 5.375% Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series A, Silvergate said Friday. In response, its preferred stock (SI.PRA) is down over 26% on the day at $8.43. Meanwhile, common shares of the La Jolla, California-based bank are down around 6% at $13.26. The bank said the decision reflects its "focus on maintaining a highly liquid balance sheet with a strong capital position as it navigates recent volatility in the digital asset industry."

*EM*

EM flows continue to be surge

EM - More new big coupon issuance

Notable issuance this week:

$1.8bn Colombia 11 year at 7.6%

$500m Turkey Exim Bank 3yr at 9.6%

$500m Ziraat Bankasi 3yr at 9.75%

Pemex said it may issue $2bn of bonds this year.

Philippines' GDP growth accelerated to 7.6% in 2022 - Nikkei Asia

Impressive from Philippines, wonder if other Asian nations will follow.

Extract - The Philippine economy expanded 7.6% last year, surpassing the government's target as domestic consumption remained resilient despite soaring inflation. Government data released Thursday showed gross domestic product growth was faster than the 5.7% recorded in 2021 and narrowly exceeded the government's projection of 6.5% to 7.5%. The Philippines' performance is among the strongest in the region and comes as President Ferdinand Marcos Jr. bids to attract foreign investors. "The growth in domestic demand was met by expansion in the services and industry sectors, with production in most subsectors back to their pre-pandemic levels," National Economic and Development Authority Secretary Arsenio Balisacan told reporters in Manila. Accommodation and food services logged the fastest growth of 31.8%, after the government fully reopened the economy and lifted pandemic-era restrictions. In the fourth quarter, GDP grew 7.2%, slower than the 7.8% in the same period in 2021 but still faster than the median forecast of 6.5% by 15 analysts polled by Reuters. The seasonally adjusted quarterly expansion stood at 2.4%. "The improvements in labor market conditions, increased tourism, 'revenge' and holiday spending, and resumption of face-to-face classes supported growth in the quarter," Balisacan said.

Two of UAE’s biggest banks beat estimates as economy boosts earnings - Al Arabiya

Extract - Profit at First Abu Dhabi Bank PJSC rose 7% to 13.4 bn dirhams ($3.6 bn) after the lender’s “core businesses sustained positive momentum, resulting in double-digit growth in loans and deposits….” Income rose 10 percent, boosted by a 23 percent growth in net interest income and gain on the sale of majority stake in payments business Magnati.

Meanwhile, profit at Emirates NBD PJSC surged 40% to Dh13 bn, while impairment charges fell 12% to Dh.5.2 bn dirhams. Dubai’s biggest bank “maintained strong income growth momentum, kept a firm control of costs, and benefited from writebacks and recoveries, reflecting a healthy regional economy.”

Moody’s labels Argentina’s debt buyback “a default” - BA Times

Extract - Credit ratings agency Moody’s reported that Argentina’s US$1 bn sovereign debt buyback announced last week constitutes “a default under our definition”. The agency called the buyback, which mainly involves two dollar-denominated bonds that mature in 2029 and 2030, a “distressed exchange,” which qualifies as a default according to their criteria. As per Moody’s definition, a “distressed exchange” happens when a debt issuer makes a new offer to creditors that amounts to a diminished value compared with the original promise, with the effect of allowing the issuer “to avoid a likely default.” Argentina’s maneuver, which Moody’s said consisted of retiring debt “at a discount before it begins to amortize at par,” would meet that description. According to Moody’s, the operation, which started last Wednesday with a US$300 million purchase, is unlikely to boost investor sentiment as the government intended.

Hindenburg Research note on Adani, estimated impact on bonds so far..

Adani’s corporate family bonds are not something I’m familiar with and I have not read the Hindenburg short-seller note (on my list). Adani’s firm appears to issue bonds across several different entities. From what I can glean, it looks like biggest movers have been Adani Ports, Adani Green and Adani Electricity with total returns MTD ranging from minus 6% to minus 15% across those complexes. Forced selling from holders likely resulted in gapping of prices, although I did see some messages in my inbox with two-way interest.

Tullow Oil Trading - Positing trading update

Tullow announced underlying operating cash flow of c.$1.0 billion and free cash flow of c.$267 million, which was ahead of guidance.

Year-end net debt reduced to c.$1.9 billion (2021: $2.1 billion), with expected cash gearing of net debt to EBITDAX of 1.3x and liquidity headroom of c.$1.1 billion.

No payment issues were mentioned with respect to the Ghana Sovereign although Tullow did highlight that “Tullow has received both revised and new tax assessments from the Ghana Revenue Authority throughout 2022” and these are being negotiated with the Ghanaian government. These assessments not resulting in an increase to the overall exposure previously disclosed. Tullow’s unsecured 2025 bonds have risen 12pts from the start of the year, also helped by the much improved sentiment in EM Debt.

Apollo and former Softbank exec in talks to acquire Millicom for $10bn | BBG

Interesting transaction that I felt was bit under the radar in terms of news coverage. $10bn is not small and I’m not entirely sure what the rationale is (feel free to post in comments section). However it seems other are also interesting in Tigo as serial Telco entrepreneur Xavier Niel took a stake in the biz earlier this year.

Apollo Global Management Inc. and former SoftBank Group Corp. executive Marcelo Claure are in talks to acquire Millicom International Cellular SA, the Latin American telecommunications firm said in a statement Wednesday. “There is no certainty that a transaction will materialize nor as to the terms, timing or form of any potential transaction,” Millicom said. The potential deal could value the company at almost $10 billion, including debt, according to a person familiar with the matter. Apollo and Claure are trying to structure an offer to avoid repaying or refinancing about $6.9 billion in Millicom debt because of the rockiness of financial markets, said the person, who asked to not be identified because the details aren’t public…Millicom, which operates under the brand Tigo and offers service in countries including Colombia, Panama and El Salvador. French billionaire Xavier Niel took a stake in the company

*RATINGS*

Egypt Affirmed at B by S&P

S&PGR Upgrades Travelodge To 'B-'; Outlook Stable

Moody's downgrades Rackspace's CFR to Caa1; outlook changed to negative

*BUYSIDE / PRIVATE CREDIT*

Blackstone Earnings call highlights

General tone from Blackstone seems to be that private credit is more in favour than its real estate product, which is not surprising. Blackstone are committed to the growth of the alternatives space which is different from what we heard from Goldman last week which said that will “significantly reduce the $59 billion of alternative investments that weighed on the bank's earnings.”

Highlights from the BX call:

In credit (in the 4th quarter), the private credit strategies appreciated 2.4% and the liquid strategies appreciated 3%, reflective of a resilient portfolio generating strong current income against a stable backdrop for credit generally in the quarter

Blackstone's second largest product in this area (private wealth), BCRED, has achieved 8% net returns annually, significantly outperforming the relevant credit indices, and is yielding over 10% today, exclusively in floating rate debts. The response to our performance has been extremely positive. In 2022, our sales in the private wealth channel totaled a remarkable $48 billion, not exactly what you're hearing in the media.

We're seeing the greatest demand today for private credit strategies, including from insurance clients and for infrastructure. In credit, the current environment is favorable for deployment, given the significant increases in base rates and wider spreads.

I think private credit is considered more attractive today (vs Real Estate).

So I think there is still enormous opportunity in the alternative space. When you look at it aggregately, it's roughly $10 trillion industry, we're about 10% of the industry. That compares to stocks and bonds over $200 trillion. If you throw in commercial real estate, residential real estate, other things, you can get up to $300 trillion. So I think there's a lot of room to grow, Mike.

Hedge Funds Arini, Selwood Bounce Back After Credit Turmoil - BBG

Extract - Hamza Lemssouguer and Sofiane Gharred, two of the most closely-followed credit traders in Europe, guided their hedge funds to gains in 2022 after recovering from double-digit declines earlier in the year. The Arini Credit Master Fund, run by former Credit Suisse Group AG trader Lemssouguer, ended the year up 5.7%, according to people with knowledge of the matter. Gharred’s flagship credit strategy at Selwood Asset Management made 0.14%, one of the people said, asking not to be identified because the details are private. The gains represent a turnaround for both funds in the closing stages of the year, aided by a calmer spell in the credit markets. Arini was down as much as 16% through September, while Selwood’s flagship fund declined 15% during the first half as short-term credit spreads jumped, Bloomberg reported earlier. The average credit hedge fund lost 5% last year, according to data compiled by Bloomberg.

My guess is that these types of HFs bought the dip heavily in October during the “Liz Truss/LDI crash” and benefitted from the snap-back in money good instruments which had become oversold by accounts forced to generate liquidity. Pretty much every recent spread widening event has seen a liquidity shortage of some sort which results in asset prices being extremely oversold.

The article goes on to highlight that Lemssouguer made better returns in its structured credit strategies and that it is said to plan a launch a platform for CLOs. Other firms such as Pimco are also looking to issue CLOs in Europe for the 1st time in a decade.

Canadian HF that returned 8.5% in 2022 says credit is still too expensive - BBG

Extract - Risk premiums are about 50% wider than late 2021, before monetary policy makers including the Bank of Canada, began a series of rate hikes. Still, spreads need to widen more to become attractive, said Andrew Labbad, who manages Amplus Credit Income Fund, one of the investment vehicles of Toronto-based Wealhouse Capital Management.

The article highlights how the fund generated its stellar return in 2022, by hedging out interest rate risk and investing in Energy sector corporate bonds.

*TRADING*

MarketAxess posts FY figures, sees increasing Bond ETF participation

MarketAxess’s results corroborate what was said by some of the large US Banks like BofA which reported a robust 4Q in FICC trading. Also, judging by comments made by management, the presence of Bond ETFs and systematic credit funds in Global Credit Markets are increasing meaningfully, suggesting an evolution of the playing field for credit market participants.

Selected highlights from investor presentation:

24% growth in total credit ADV to $12 billion, third highest quarter of total credit ADV delivered during seasonally slower fourth quarter period.

Record 38% of total credit trading volume executed via Open Trading

Record total Portfolio Trading volume of $31 billion, increase of 135%

1 out of 4 high grade trades were automated according to MarketAxess

Credit - Increase in distribution fees principally due to new dealers on fixed fee plans, upgrades in existing fixed fee plans and higher unused monthly minimum commitment fees

Growth in total credit commission revenue was driven by record increases in estimated market share and healthy increases in our trading volume, but was partially offset by lower fee capture across U.S. high grade.

Extracts from earnings call:

We do think, the demand for fixed income ETFs by our institutional clients is climbing. It's a wonderful vehicle for dealing with capital flows to get exposure to the overall credit market quickly and through a liquid instruments

…think with high yield in particular the liquidity challenges in the U.S. credit markets were most pronounced in high yield and that plays right to our favor, and what I think is showing you is that when liquidity is challenging Open Trading is significantly differentiated from any other way of conducting trades in the high yield market or elsewhere

Significant increases in market participants both in market makers, as well as systematic credit funds. So all of this points to the fact that fixed income is a better, investing and trading environment now that it was four years due to quantitative easing, that's one of the reasons that we're excited about 2023.

some of the largest ETF market makers are our very strong clients of MarketAxess and in particular, play a major role in our Open Trading offering.

The market seemed to like the Q4 earnings update, as the stock was up 10% on the day, what’s more impressive is that the stock is up nearly 70% from the lows seen in September 2022!

BNY Mellon Expands Outsourced Trading to Buy-Side Clients - Statement

As firms look to save costs, we are going to hear more and more of this sort of thing (outsourced trading). BNY’s provision is said to include fixed income products too.

Extract - BNY Mellon (NYSE: BK) announced today a new outsourced trading offering for buy-side institutions globally, including asset managers and asset owners. The offering by BNY Mellon Capital Markets, LLC will be powered by xBK, the buy-side trading division that executes more than $1 trillion in volumes on average annually for the company's Investment Management franchise (one of the world's largest asset managers1)

*LINKS*

Oaktree’s performing Credit Quarterly 4Q2022 - Oaktree

Solid read from the team at Oaktree on different sectors within Credit.

Current Emerging Markets Sovereign Opportunity Set - Gramercy

Summary: Gramercy’s Chair, Mohamed El-Erian, Chief Investment Officer, Robert Koenigsberger, and Head of Public Credit, Matthew Maloney, discussed the sovereign opportunity set unfolding amid the second largest drawdown of the last two decades.

Reuters longer read - some Credit Managers feel rally has gone too far

A New Year rally in U.S. corporate bonds has started to lose some momentum, as some investors become skeptical of recent optimism about a 'Goldilocks' economic scenario of slowing inflation against a backdrop of moderate growth. Credit spreads for both investment-grade and high-yield bonds have been tightening in recent months, and more so this month, as lower inflation prints raised hopes of a pivot in the Federal Reserve's current hawkish policy.

Private Credit guys feeling bullish about 2023 according to EFC

Extract - Charlotte Muellers, co-head of North America credit investments at PSP Investments, the large Canadian pension fund manager, said that in normal times, "the private equity person’s glass is half full and the credit person’s glass is half empty." But in 2023 the tables have turned. This is a "once in a lifetime opportunity from a credit perspective," Muellers declared. What makes this moment so especially exciting for Muellers is the huge "$35bn in hung commitments" at investment banks. This so-called 'hung debt' is debt that banks took on to finance M&A deals and leveraged buyouts. They expected to sell-on to investors, but have been unable to do so at a desirable price. As banks start to panic and sell the debt at lower prices, private credit investors waiting in the wings and are able to be "really picky," she enthused.

Thanks for the comprehensive summary! Are you EU based too?

$PGX , the top mover, is my favorite instrument for hedging at the moment. My portfolio is hoping for some mean reversion in credit :)