17 Feb 2023 Global Credit Wrap

Hawkish CBs, better data + sticky inflation pushing gov bond yields higher. Bumper IG flows + issuance. HY issuance slowed but new converts print. News on REITS. Bankruptcies continue march higher....

*TLDR*

NORTH AMERICA MACRO

US Treasury Risks July Payment Default If Lawmakers Fail to Raise Debt Limit: CBO

Hot US Retail sales data corroborates with BofA/Citi card data for January

Fedspeak seemed to get more hawkish as the week went on

Proportion of firms mentioning “recession” in quarterly earnings drops – GS chart

Fund flows:

Weekly flows - US IG saw inflows whereas loans and HY saw outflows

FT reports $19bn inflow into IG funds globally in 2023

Hot US Retail sales data corroborates with BofA/Citi card data for January

Notable data/events in week beginning 20 Feb (SRC: Cityindex)

Tue: Flash PMIs

Wed: Fed minutes

Thur: Initial jobless claims, US Q4 GDP Revision

Fri: New BOJ Governor Ueda Speech, US Core PCE

OTHER DM MACRO

Australian job market remains tight, inflation still hot - RBA’s Lowe

ECB Schnabel ends the week with hawkish BBG Interview – ECB

Markets ride $1 trillion global liquidity wave (originating in Japan/China) - Reuters

Japan and Singapore missed GDP expectations

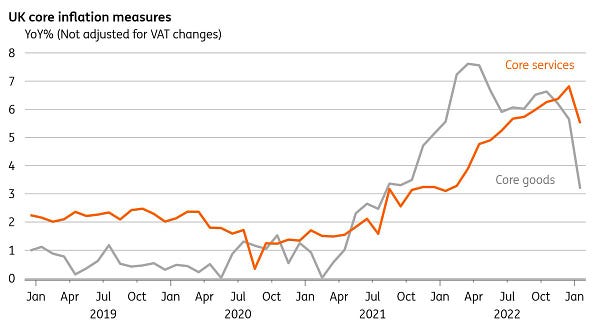

UK retail sales beat, UK wages data better than expected, weaker than expected CPI print, but RPI higher

PM Sunak working on post Brexit-deal with Northern Ireland

INFLATION

US producer prices rebounded in January by the most since June

BofA expects CPI inflation to moderate in line with Fed target by end of 2024

Australia MI Feb. Inflation Expectations Ease to 5.1%

Most countries seeing hotter than expected inflation:

Israel CPI rose 5.4% last month vs 5.3% in Dec & forecast of 5.2%

Philippines inflation forecast boosted from 4.5% to 6.1%

However, Romania CPI came in lower than expected in January

Corporate inflation snippets:

Motor Insurance: Allstate Insurance raised auto insurance rates by 9.9% across 13 locations

US - Manheim used car index reported another increase

VW said to raise price of combustion engine vehicles by 4.4% due to rising costs

Luxury Cars - The average price of a Mercedes costs +43% more vs 2019 levels

U.S. pilot shortage drives up airfares - FT

Mining cost inflation reported by Barrick and Vale

UK Breakfast index +22% according to BBG

COMMODITIES

Deere stock +7.5% on Friday after raising forecasts on strong Farming demand for its products

US Oil SPR levels now at levels last seen in Summer of 1983

Oil Tanker rates have rocketed

China's state-owned refiners resume Russian Urals crude imports

European nat. gas futures below €50 a MWh for 1st time in 17 months

IG

Issuance topped $54bn in the US in the week ended 17 Feb 2023

Amgen raised 9th largest ever US IG corp bond issuance, $90bn books

US Builder Toll Brothers enters into 5 yr $1.9bn sr unsec RCF

Brief look at Glencore and Marriott earnings

EDF – Would like to retain S&P BBB rating

Marriott and Airbnb report strong figs

Kraft Heinz Upgraded to BBB by S&P, Outlook Stable

HY / CONVERTS

Rare Convertible bonds issuance – Delivery Hero/Balder

Reasonable amount of HY debt being tendered / called

B minus rated companies are getting issuance completed this year: S&P LCD

Man Utd gets multiple bid approaches, including one proposal without any debt

A look at updates from some HY issuers across a range of sectors: EnQuest, Centrica, Avis and Danaos

REITs round up - Castellum Hybrids rally strongly, Balder new convertible, Segro shares rally despite big drop in NAV, Brookfield defaults on two office properties in downtown LA and a loan linked to a NY Mall enters “special servicing.” A small UK Housebuilder re-negotiated its bank covenants.

UK’s Morrison Supermarkets debt sold at 85 cents on Euro

Boaz Weinstein highlighting asymmetry of HY spreads again..

DISTRESSED

Debt advisors are seeing huge uptick in companies looking to do LMEs

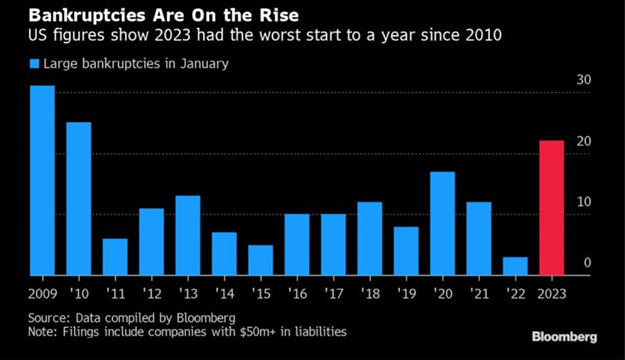

Large bankruptcies in US have biggest January total since 2010 - BBG

EU bankruptcy filings reach highest level since records began - Eurostat

S&P LCD: US HY default rate at end of 2023 expected to double vs 2022

Cloud communication co Avaya files for bankruptcy (original debt o/s of $3.4bn)

Trailing 12-mth US HY default rate of 1.5% is highest since June 2020 - Fitch

Vue Int’l lines up backing from shareholders for a bid for Cineworld – Sky

FINANCIALS

Quiet week for issuance with only Swedbank AT1 the only interesting deal.

Credit Suisse Senior tap issue placed with one investor

Bank earnings – No major upside surprises at Barc and Natwest but Commerz and Stanchart shares sent higher

Barclays - Improving credit rating is a "key strategic priority" for them

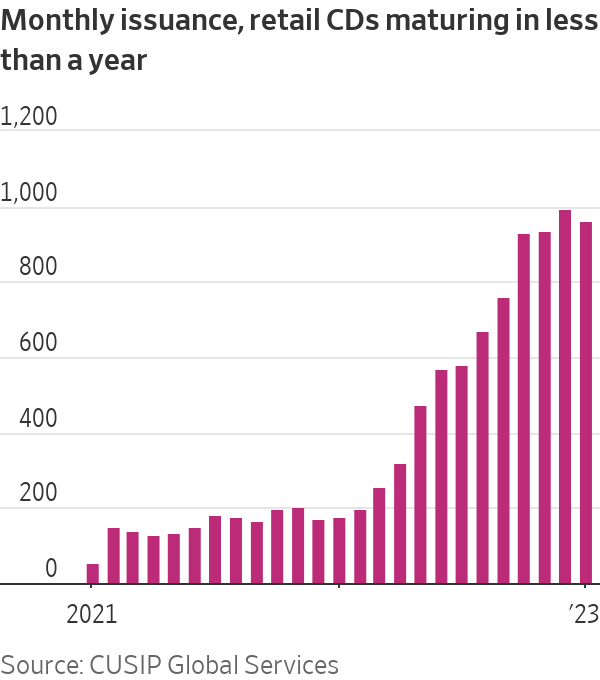

Demand for short term CDs have jumped to highest since ’08 - WSJ

Lenders to PE owned Italian Life Insurer EuroVita write down $300m loan

Net interest income formed over 35% of Hargreaves’ Lansdown’s total revenue vs only 4% last year…

CHINA

China Bolsters Liquidity Support to Meet Loan Demand Surge

China's dollar-bond default rate has dropped for five consecutive months - BBG Intelligence

EM

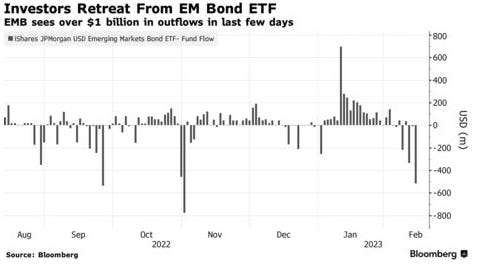

EMB Bond ETF saw $1bn outflow over past week | BBG

Adani bonds rally strongly to end the week, moving out of distress

BUYSIDE

Fixed income ETFs see record inflows in January – ETF Stream

Steve Eisman (of big short fame) is buying bonds after 15 years…

Soros Fund Mgmt bought LQD in Q4 2022 according to 13F Filing | BBG

Apollo, Goldman Plan Private Credit Funds for Rich Europeans – BBG

Private Credit defaults seem to be rising

TRADING

JPMorgan Trading Head Troy Rohrbaugh Says ‘Fixed Income Is In’

Barclays FICC Trading insights

Natwest Markets Macro Traders got paid - EfinancialCareers

Citi pulling out of Australian Credit Trading

CS is exiting distressed debt + special sits trading

A new academic paper about Bond ETFs & bond Liquidity published

*MOVES OVER 5D*

Gov Bonds

Six-Month Treasury Yield Surpasses 5% for First Time Since 2007 - picture from

US 2yr yields rose to the highest since November after strong retail sales/inflation prints which pushed up the terminal Fed Funds rate expectation. The 2yr, which is particularly sensitive to FOMC interest rates has gained ~50bps since the start of February 2023.

2, 3 and 5 year UST now trade above 4.0%, 7yr trading at 3.9%. Meanwhile 10yr yield rose to 3.84%, highest in 2023.

German Bunds 2yr yield hit its highest in nearly 15 years, closed week at 2.87%.

10 year breakeven inflation rates in US, Canada and South Africa have hit 10, 14 and 6 week highs respectively according to BBG.

Credit spreads

CDS - Widening in CDX HY (+13bps to 444), CDX EM (+6bps to 238), Xover (+4bps to 405). European fins CDS seem to be the most well supported as they were largely flat on the week.

Cash credit spreads - In contrast to CDS indices the widening was led here by CoCo spreads which were 26bps wider to 409. EMHY +17bps to 683, US HY +12bps to 426. Other indices were wider by low-mid single digits.

Bond ETFs

Bond ETF winners - Inverse TSY ETFs, short dated strategies, US TIPS, floating rate did well. TTT+6.0%, IBTS +1.0%, ITPS +0.6%, IBGE +0.6%, SE15 +0.5%, VRIG +0.3% FLOT +0.3%,

Bond ETF losers - Long duration bonds/credit, ££ inflation linked, Munis and even Asian bonds sold off in the week. Examples: INXG -2.6%, EDV -2.5%, IDTL -2.3%, TLT-1.8%, EUNR -1.6%, VCLT -1.6%, HYD-1.5%, 2821 HK -1.5%, LQDE -1.4%.

*NORTH AMERICAN MACRO*

Treasury Risks July Payment Default If Lawmakers Fail to Raise Debt Limit: CBO

A non-negligible risk and part of the reason for the spike in yields in US T-bills.

Extract of BBG article:

The nonpartisan Congressional Budget Office warned that the federal government would be at risk of a payment default as soon as July if lawmakers fail to raise the debt limit. The Treasury Department is currently using accounting maneuvers to keep making good on federal obligations, after hitting the statutory debt ceiling last month. While Treasury Secretary Janet Yellen signaled at the time those measures would last at least until early June, Wednesday’s CBO estimates offer an updated timeline. “If the debt limit remains unchanged, the government’s ability to borrow using extraordinary measures will be exhausted between July and September 2023,” the CBO estimated.

US Retail sales came in hotter than expected - RTRS/ FinTwit takes

RTRS - U.S. retail sales increased by the most in nearly two years in January after two straight monthly declines as Americans boosted purchases of motor vehicles and other goods, pointing to the economy's continued resilience despite higher borrowing costs.

Last month's broad increase in retail sales was led by motor vehicle purchases, with receipts at auto dealers accelerating 5.9%. Sales at service stations were unchanged, despite rising gasoline prices. Online retail sales rebounded 1.3%.

Furniture stores sales jumped 4.4%. Receipts at food services and drinking places, the only services category in the retail sales report, soared 7.2%. Electronics and appliance store sales shot up 3.5%.

There were also hefty increases in clothing stores sales as well as receipts at general merchandise and health and personal care stores. Sporting goods, hobby and musical instrument stores eked out a 0.2% gain, while building material and garden equipment supplier receipts climbed 0.3%.

The Bank of America Institute last week reported a surge in spending in January based on an analysis of Bank of America credit and debit card data. It said this suggested "that while lower-income consumers are pressured, they still have solid cash buffers and borrowing capacity," noting "even for the lowest- income cohorts this should provide support for some time yet." Citi card data also showed gains in services spending.

Fed speaker roundup for the week

Fedspeak seemed to get more hawkish as the week went on tempered by Richmond Fed’s Barkin who is looking to stick to 25bps increases.

Fed Governor Michelle Bowman: "I think there's a long way to go before we reach our 2% inflation objective and I think we'll have to continue to raise the federal funds rate until we see a lot more progress on that"

St. Louis Fed chief James Bullard (non-voter) said he wouldn't rule out supporting a half-percentage-point rate hike.

Loretta Mester (non-voter) saw a compelling case for 50bps hike at last FOMC meeting

Meanwhile, Richmond Fed’s Barkin told reporters on Friday that “I like the 25 basis-point path.” Barkin did a good interview with Jonathan Ferro earlier on in the week on BBG which is worth watching - Youtube.

Proportion of firms mentioning “recession” in quarterly earnings - GS chart

Weekly fund flows - US IG took in money but loans & HY saw outflows

*US HIGH-YIELD FUNDS SEE $2.82B OUTFLOW IN WEEK: LIPPER

*US LOAN FUNDS SEE $529M OUTFLOW IN WEEK: LIPPER

*US INVESTMENT-GRADE FUNDS SEE $1.19B INFLOW: LIPPER

FT also remarked that $19bn has gone into IG funds so far in 2023:

*OTHER DM MACRO*

Australian job market remains tight, inflation still hot - RBA’s Lowe | Yahoo Finance

Extracts - Australia’s labor market is “still very tight” and price pressures remain surprisingly strong, Reserve Bank Governor Philip Lowe said, making the case for further interest-rate increases.

“Given there is a significant demand element to inflation, we need to respond to that with further monetary policy,” Lowe told a parliamentary panel Friday in his second session of testimony this week. “We need to make that clear to the community that we were not done yet.”

ECB Schnabel ends the week with hawkish BBG Interview - ECB

Extracts from a very useful interview, a full read is worthwhile:

ECB QT could be sped up after June 2023.

Given the current level of policy rates and the level and persistence of underlying inflation, a rate hike by 50 basis points is necessary under virtually all plausible scenarios in order to bring inflation back to 2%.

Markets are priced for perfection. They assume inflation is going to come down very quickly toward 2% and it is going to stay there, while the economy will do just fine. That would be a very good outcome, but there is a risk that inflation proves to be more persistent than is currently priced by financial markets.

If we look at our wage trackers, we are seeing that wage growth has picked up substantially. It is expected to be around 4 to 5% in the years to come, which is too high to be consistent with our 2% inflation target even when taking productivity growth into account.

Column: Markets ride $1 trillion global liquidity wave | Reuters

This long read pinpoints how liquidity from China and Japan might be powering the current rally despite the Fed’s QT, as summarised in @Credit_Junk’s tweet.

Japan and Singapore missed GDP expectations

Singapore 4Q GDP QoQ came in 0.1% vs 0.3% expectation

Japan 4Q GDP QoQ came in at 0.6% vs 2.0% expectation

UK Macro roundup

UK retail sales beat expectations (Monthly sales volume +0.5% in January vs Rtrs poll -0.3%), meanwhile sales volumes in Christmas month of December fell more deeply than previously reported, dropping by 1.2% from November, rather than the original estimate of a 1.0% decline - RTRS has more.

UK wage data was stronger than expected in December which sent Gilt yields higher on Monday. The growth seemed to be driven by pay awards in the public sector according to ITV’s Joel Hills.

The jobs data was then followed by a weaker than expected UK CPI print which saw Gilt yields come off.

Interesting though that RPI came in hotter than CPI, important since many UK inflation instruments go off RPI.

PM Sunak has been busy trying to sort out a deal on post-Brexit trade in Northern Ireland that satisfies leaders there and in Europe as well as hardliners in his own party. He met with Northern Irish parties this week according to the BBC.

*INFLATION*

US producer prices rebounded in January by the most since June

BofA expects CPI inflation to moderate in line with Fed target by end of 2024

Australian Inflation expectations continue to moderate: Melbourne Institute

Extract - The expected inflation rate (30-per-cent trimmed mean measure) fell by 0.5 percentage points in February to 5.1 per cent. Total pay (30-per-cent trimmed mean) is expected to grow by 1.0 per cent over the next 12 months. The data show a general moderation in inflation expectations in recent months, with trimmed mean expectations falling from 6.0 per cent in November to 5.1 per cent in February.

Israel CPI rose 5.4% last month vs 5.3% in Dec & forecast of 5.2%

Philippines inflation forecast boosted from 4.5% to 6.1%

The central bank boosted its inflation forecast for 2023 to 6.1%, up from 4.5% at its December meeting. That’s further above the 2%-4% target range, and above last year’s average of 5.8%. It expects inflation to fall to 3.1% next year.

Romania inflation comes in lower than expected in January

Romania CPI index advanced 15.1% last month from a year earlier, compared with 16.4% in December, the Statistics Office said Tuesday. That was below the 15.8% estimate in a Bloomberg survey. Prices rose 0.3% compared with the previous month. (BBG)

Corporate inflation snippets:

Motor Insurance: Allstate Insurance raised auto insurance rates by 9.9% across 13 locations

US - Manheim used car index reported another increase:

VW is said to raise the price of combustion engine vehicles by 4.4% due to rising costs - RTRS

Luxury Cars - The average price of a Mercedes reached some €72,900 ($76,590) last year — a 43% increase over 2019 levels. Combine that with higher rates and the possibility of a recession at some point and it doesn’t look great…we want cheaper cars!

U.S. pilot shortage drives up airfares (FT)

Mining - Barrick CEO Says Inflation Not Over as Costs Weigh on Results - BBG, meanwhile Vale reported a rise in COGS of 12% YoY in the results it reported this week.

UK Breakfast inflation:

*COMMODITIES*

Deere stock was up 7.5% on Friday after raising its forecasts for the year

Net income of $1.9bn for Q1 2023, beating estimates and rising 117% from Q1 2022.

Worldwide net sales and revenues increased 32% yoy to $12.6bn, driven by higher shipment volumes and price realization.

Deere raised its profit forecast for the year after its quarterly income more than doubled from a year earlier, and sales increased by more than one-third.

Raised its full-year 2023 forecast for net income to $8.5-$9bn, up from $8-$8.5bn previously, reflecting strong demand for its products across all segments.

WSJ contextualised some of the reasons for Deere’s strong Q1 and outlook:

”Deere said it expects demand for its farm equipment to remain strong as farmers convert their rising incomes into purchases of tractors, crop harvesters and other machinery.

Deere executives said the company is benefiting from a strong farm economy, while operations improve at its factories because of diminished supply-chain disruption and some lower costs for production. “It was a good quarter. A strong start to the year,” said Josh Jepsen, Deere’s chief financial officer, during a conference call with analysts.

“The supply chain is showing early signs of improvement but remains fragile.” Deere, the world’s largest seller of farm equipment, said its costs for raw materials and freight shipping have declined, though expenses for components, labor and energy remain elevated. Deere has aggressively raised its prices to counter the elevated expenses. The company said it expects price increases to lessen later in the year as its costs continue to decline. “

US SPR now at levels last seen in Summer of 1983

European nat gas futures below €50 a MWh for 1st time in 17 months | BBG

Extracts:

Prices have plunged by more than 80% from their August peak

Prices are still about double usual levels for time of year

The continent is seeing a sharp turnaround as relatively mild weather, efforts to reduce energy consumption and strong inflows of liquefied natural gas from the US to Qatar take the edge off.

China's state-owned refiners resume Russian Urals crude imports | RTRS

Extract - China's top refiners PetroChina and Sinopec are resuming purchases of discounted Russian crude after a brief pause in late 2022, just before the European Union embargo on Russian oil started, industry sources said. Russian Urals crude, typically consumed in Europe, is now heading to India and China at depressed prices following an EU ban on Russian crude because of the Ukraine war.

Oil Tanker rates have rocketed recently..

The strength seems to be led by MR Tankers. I’m no tanker expert but it seems to be the redirection of flows from Europe to Asia which is driving rates higher according to this Oilprice.com article:

Sanctions have redirected Russian energy flows from Europe to Asia. The rejiggering of supply chains means Russia has to rely more on tankers. According to Bloomberg, this has led to a 400% surge in the daily rates for clean product tankers. The latest data from the Baltic Exchange in London shows clean product tankers rates have reached $55,857 per day, surging 58% just last Thursday.

Comments from Scorpio Tankers’ President corroborated some of the developments related to the strength in tanker rates:

Robert Bugbee, President: “We believe that the tanker market is entering a new phase of recovery, supported by several factors. First, we see a robust growth in oil demand, especially from Asia and Europe, as economies reopen and recover from the pandemic. Second, we see a limited supply of new vessels entering the market, as shipyards are facing delays and higher costs due to COVID-19 disruptions. Third, we see an increasing regulatory pressure on older vessels to comply with environmental standards, which will accelerate scrapping activity and reduce fleet availability.”

The full earnings call is really worth a listen if you are interested in the sector (Seekingalpha). STNG stock is up 15% ytd.

*HY / CONVERTS*

HY Summary - Issuance/tenders/trends

The week saw a $2.8bn outflow from the US HY market. The market has been pressured by higher front end Treasury yields, which makes HY less compelling and could have been behind the second successive week of losses for the US HY market. There was issuance in adjacent markets, e.g. the Convertible bond market which saw Delivery Hero print €1bn Convertible bond and Balder issue €0.5bn of convertible bonds. While benchmark HY issuance took a pause there was a new deal for North Sea issuer Waldorf Energy Finance. It issued $150m of 12% coupon secured bonds at 96.0 to yield nearly 14.5%. Bond coupons are paid quarterly and start to amortise in June 2024.

Existing HY bonds continue to get tendered / called especially by issuers that have come to market recently or have decent liquidity, examples include: Co-Op Group, Transocean, First Quantum, AMC Networks, Nokia, Car Inc, Finnair.

Delivery Hero Convertible Bond issue priced at 3.25% with conversion premium of 40%

Delivery Hero priced debt at a coupon of 3.25% and a conversion premium of 40%. Proceeds from this bond are said to be to buy back securities maturing in 2024 and 2025. The largest players in the Food delivery sector seem to be doing better than many would have thought. E.g. DoorDash ($23bn market cap) stock rallied 10.7% on the day of its earnings but gave most of it back in the following two days.

B minus rated companies are getting issuance completed this year - LCD

Man Utd gets several bid approaches including one without any debt

It is a sign of the times, an acquirer (a Qatar UHNWI) is willing to finance a deal for the club without using debt. The Man-U fans are likely to prefer an approach that does not lead to a repeat of what the Glazers’s did to Man-U’s cap structure.

In Man Utd’s last quarterly filing this is what was stated regarding its debt position:

Our USD non-current borrowings as of 30 September 2022 were $650m, which was unchanged from 30 September 2021. As a result of the year-on-year change in the USD/GBP exchange rate from 1.3506 at 30 September 2021 to 1.1173 at 30 September 2022, our non-current borrowings when converted to GBP were £577.4m, compared to £476.2m at the prior year quarter. In addition to non-current borrowings, the Group maintains a revolving credit facility which varies based on seasonal flow of funds. Current borrowings at 30 September 2022 were £102.9m compared to £62.2m at 30 September 2021. As of 30 September 2022, cash and cash equivalents were £24.3m compared to £98.7m at the prior year quarter, primarily due to investment in the first team playing squad.

Meanwhile, Jim Ratcliffe, the Billionaire owner of Ineos has prepared a competing bid. Separately, Elliott Investment Management has offered to structure the financing according to BBG after being involved in a similar way with AC Milan…

Enquest (North Sea Oilco) Trading Update | IR

EnQuest stock traded down on a weak day for Energy shares plus a disappointment on the lower forecast production in 2023. Bonds were touch softer although the de-leveraging appears to be on track.

Key extracts:

Enquest said 2023 output would be between 42-46,000 barrels daily in the current twelve months, compared to an average 47,259 in 2022

The Group's average realised oil price was around $103/bbl pre-hedging and around $89/bbl, including the impacts of hedging vs unit opex for 2022 is expected to be c.$23/Boe.

Record free cash flows of over $500 million in 2022

At 31 December 2022, the Group's net debt position was c.$717m, down c.$505 m versus 31 December 2021, with cash and available facilities of c.$349 m. As at 31 January 2023, the Group's net debt position was further reduced to c.$698 million.

Capital structure reset with debt maturities extended by five years following the successful refinancing of its facilities

At 31 December 2022, cash drawings under the RBL were $400 million against a commitment of $500 million

Reduced its UK emissions by c.40% from the 2018 benchmark, significantly ahead of the UK's North Sea Transition Deal targets

"Looking ahead, changes to the UK Energy Profits Levy will impact cash flow generation and have implications for our capital allocation strategy and our UK production growth ambitions. However, given the strong performance towards our leverage target, returns to shareholders are becoming an increasingly important consideration for our capital allocation decisions. In the immediate future, we remain focused on deleveraging and intend to prioritise organic investments with quick pay backs and accretive M&A opportunities that allow us to leverage our operating capability and tax loss position."

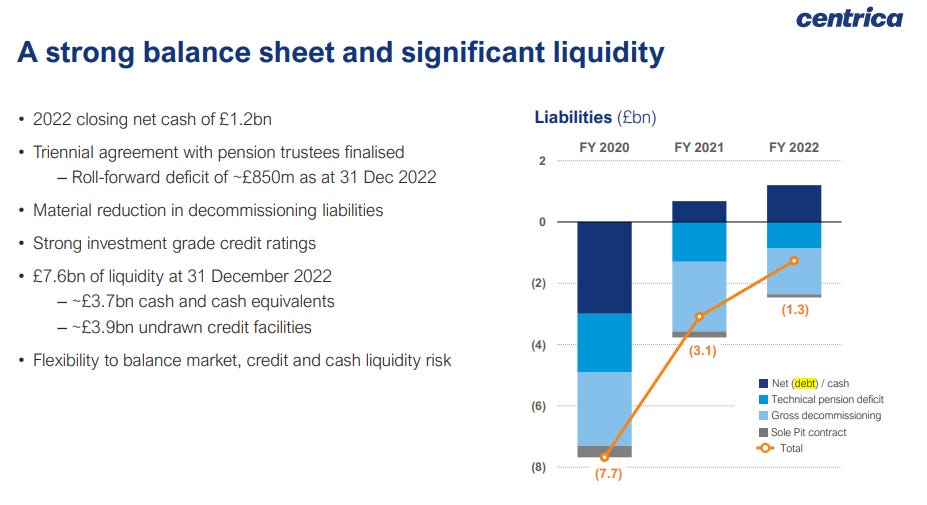

Centrica reported strong figures and a strong net cash position - IR

Corporate Hybrid issuer Centrica reported strong figures. The strength appeared to be driven by Energy Marketing & Trading and the Nuclear divisions.

Centrica closed 2022 with a net cash position of £1.2bn:

Centrica’s Hybrids have risen 15pts since the October 2022 lows (“Trussmageddon” event).

Avis Budget continues theme of strength in travel and leisure businesses

Extracts of earnings call and release.

On demand:

The quarter showed strong commercial demand. In fact, it was the highest amount of commercial volume we have seen during the fourth quarter in company history and well above levels we achieved in 2019. It's apparent that the commercial customer is traveling and using our brands at an elevated level. Our commercial re-signings for the year are approximately a 100% and on average coming in at an increased price.

Overall, the Americas had a great quarter and a terrific year, and we see positive trends going into January and February. Demand is strong and forward-looking reservations show this and our price discipline we saw in the fourth quarter is continuing into the first. Lastly, there's improved demand for our car sales and the prices have shown improvement, which is encouraging.

Key financials:

Reported strongest FY revenue in company’s history ($12bn)

Record net cash from operating activities in the quarter of $943m and double PY

$1.1bn of free cash flow for the full year, which was also a record and more than triple the prior year

$570m of cash at the end of the quarter and $4.1bn of net corporate debt

$1.4bn of available liquidity at the end of the quarter

Company had reduced its debt by $1.9bn since the peak of the pandemic and had improved its leverage ratio to 3.4x, which was the lowest level since 2014

Company had paid down $100m of its revolving credit facility in the quarter, which was part of its $1.5bn revolving credit facility

Danaos Q4 - Cash and debt highlights

Listed container ship name Danaos updated the market with its Q4, key highlights:

Reduced its net debt by $1.1bn in 2022, from $2.4bn at the end of 2021 to $1.3bn at the end of 2022

The company’s net debt to EBITDA ratio was 0.29x

42 of its vessels are debt-free currently.

Generated $1.1bn of net cash from operating activities in 2022 vs $375.6m in 2021.

Company generated $1.1bn of FCF in 2022, compared to $284.7m in 2021.

Danaos’ CFO said in the earnings call that the company had $1.4bn of available liquidity at the end of the quarter and that the company had no significant debt maturities until 2025.

REIT / Real Estate news roundup

Not all the names mentioned in this round up are HY but this was the most relevant section I could stick these comments in.

Castellum Corporate Hybrids trade up on debt plan - Nordic Real Estate firm Castellum AB announced that it intends to carry out a fully underwritten rights issue of approximately SEK 10 bn (~ $1.1bn) to strengthen its balance sheet and provide capital for future investment opportunities. The rights issue is expected to be carried out during the second quarter of 2023. The rights issue would enable the company to maintain a strong financial position and flexibility after the acquisition of Kungsleden AB. It would also reduce its leverage and improve key financial ratios. Moreover, Castellum’s loan-to-value (LTV) ratio would decrease from 42.3% to 36.7% and the net debt to EBITDA ratio from 13.6x to 11.9x (excluding any potential further positive impact deriving from the assets disposal already announced and not yet closed). CASTSS 3.125% Corporate Hybrids traded up around 7pts following the news.

Nordic Property firm Balder issued convertible bond to protect its credit rating - Balder sold €500m of convertible bonds in order to manage its liabilities and “further prolong the company’s debt maturity structure.” Balder is trying to improve its credit metrics as it faces the prospect of a downgrade to a junk credit rating at Moody’s. The converts were priced with a 32.5% premium and 3.5% coupon. As is what usually happens with converts issuance, Balder shares dropped after the announcement.

Brookfield Defaults on Two Los Angeles Office Towers (BBG)

I’m no expert on Downtown LA property but this story was interesting and seems to have resulted from the dwindling demand for large office space in parts of the US.

Extracts: Brookfield Corp., parent of the largest office landlord in downtown Los Angeles, is defaulting on loans tied to two buildings rather than refinancing the debt as demand for space weakens in the center of the second-largest US city. The two properties in default, part of a portfolio called Brookfield DTLA Fund Office Trust Investor, are the Gas Company Tower, with $465 million in loans, and the 777 Tower, with about $290 million in debt, according to a filing. The fund manager had warned in November that it may face foreclosure on properties. The company had the option to extend the maturity on the loans tied to the Gas Company Tower, but elected not to, according to its latest filing. It also elected not to get interest-rate protection that was required for loans for the 777 Tower property, which amounts to an event of default, the filing said.

BBG Distressed team highlighted distress in other loans linked to the Malls sector:

Amazon.com Inc. will ask workers to come into the office at least three days a week starting in May according to Amazon’s corporate blog.

Segro ($12.5bn market cap) - Warehouse specialist Segros’s (Ticker: SGRO) shares' ended the week stronger despite seeing its adjusted NAV per share down 15% in 2022 due mainly to the impact of higher interest rates. Liquidity and the balance sheet looked very strong: £2.2 billion of available liquidity and a modest level of gearing reflected in LTV of 32% at 31 December 2022. Statement.

Regional REIT (UK) - UK Regional Office REIT specialist (Ticker: RGL) had a trading update and said that 99% of the Company's tenants had returned to the office in some form compared to March 2022 when only 30% had returned. It went onto say that: “There are a variety of ways in which the Company's offices are being utilised, with hybrid working being the most popular. The vast majority of tenants are in full attendance three days per week, Tuesday, Wednesday, Thursday, and for many this is four or even five days per week.”

Home REIT (UK) - The UK social housing landlord is weighing options including a possible sale to Bluestar Group after a collapse in rent collection and a campaign by a short seller, according to BBG. The article states that the company has collected just 23% of the rent due for the quarter ending November 2022.

Sticking with small caps, UK Housebuilder and Regeneration specialist Inland Homes successfully re-negotiated its covenants with its bank lenders which sent the stock higher by 70% in a day.

UK’s Morrison Supermarkets debt sold at 85 cents on Euro - BBG

Apollo is amongst the group of investors that bought €500m of discounted loans that backed the acquisition of Morrisons Supermarkets. BNP led the sales process.

The price of 85.0 is lower than the level at which it was sold in July 2022 (87.25) which is slightly unusual as HY markets have rallied strongly since then. Moody’s did downgrade Morrison’s CFR to B2 from B1, outlook negative. While there were a range of factors for the downgrade, it seems the level of leverage is not commensurate with what Moody’s normally sees on a B1 rated credit, see extract from 14th Feb statement below:

Leverage, measured in terms of Moody's adjusted gross debt to EBITDA, stood at 9.1x at 30 October 2022. Moody's also anticipates that over the next 12-18 months, although improving from recent levels, leverage will remain significantly above the agency's expectation of leverage below 6.5x for the B1 rating previously assigned.

Boaz Weinstein of Saba Capital highlighting asymmetry of HY spreads

*DISTRESSED*

Debt advisors are seeing huge uptick in companies looking to do LMEs - BBG

Extract - High-profile financial advisers including Houlihan Lokey Inc., Lazard Ltd. and Evercore Inc. say they’re experiencing a surge in enquiries for so-called liability management as corporates bloated with debt find themselves searching for solutions to the end of a decade of almost free money.

The full article is well worth a read as it also refers to the chart below on bankruptcies.

Large bankruptcies in US have biggest January total since 2010 - BBG

EU bankruptcy filings reach highest level since start of data collection - Eurostat

Extract - In the fourth quarter of 2022, the bankruptcies declarations rose substantially in the EU, by 26.8 %, compared with the third quarter of 2022, and reached the highest levels since the start of the data collection in 2015.

S&P LCD: US HY default rate at end of 2023 expected to double vs 2022

Cos. that filed for bankruptcy in the week - Avaya, Tuesday Morning, Stanadyne

Stanadyne LLC - A maker of fuel pumps for engines, filed for bankruptcy after the pandemic hurt revenues and rising rates made its debt load unsustainable according to BBG.

Trailing 12-mth US HY default rate of 1.5% is highest since June 2020 - Fitch

Extract - The trailing 12-months (TTM) U.S. high yield default rate stands at 1.5%, the highest level since June 2020, according to Fitch Ratings. Defaults rates are still relatively low but are poised to rise toward the 3.6% historical 2001-2022 average by the end of 2023, likely at an uneven pace over the year.

Vue International lines up backing from shareholders for a bid for Cineworld - Sky

The fact that Vue International wants to expand suggests they and their backers see a future for the Cinema industry. As most buyers of distressed assets, they also are opportunistic in looking to buy assets cheaply as Cineworld attempts to come out of bankruptcy.

Extracts of Sky Article:

Europe's biggest privately owned cinema operator has lined up financial backing from its new shareholders to help assemble a takeover tilt at Cineworld, its stricken rival. Sky News has learnt that funds managed by Barings and Farallon Capital Management have agreed to provide capital to Vue International to support strategic acquisitions. City sources said that Vue, with support from the two funds, would be among the bidders for Cineworld ahead of a deadline set by the latter's advisers later this week.

Vue is thought likely to be keenest to own Cineworld assets in a selected number of countries, meaning it may have to line up buyers for those it does not want.

Vue is thought likely to be keenest to own Cineworld assets in a selected number of countries, meaning it may have to line up buyers for those it does not want.

In the UK, Vue ranks behind only Cineworld and Odeon by number of sites.

After a £470m debt-for-equity swap, the company's balance sheet is now in robust shape, with founder Tim Richards stating publicly that he wants to exploit opportunities to consolidate the sector.

On the topic of Cineworld, Petition’s substack had some further things to say on last week’s events from the Bankruptcy court.

*FINANCIALS*

New issuance/tenders

Only really noteworthy issuer was Swedbank which came with an AT1 (Swedbank $500m PerpNC5.5 7.625%). Swedbank is one of the higher rated AT1 issuers so the new issue will have been bought by a broader base of investors. Swedbank’s shares hit a new 52w high during the week and were up 17.65% to the end of 17th Feb 2023.

Credit Suisse tapped its 5.5% 2026 bonds for a new €250m such that the total issue size is now €750m. The tap was said to have been sold to a single investor on the back of a reverse inquiry.

Round up of Bank earnings w/e 17 Feb 2023

More domestically focused UK Banks Natwest and Barclays disappointed equity investors with their earnings updates. The lack of material beats vs consensus saw them both trade down.

Bank Debt investors in the UK names seem more sanguine as capital remains strong and and asset quality remains ok at both Barclays and Natwest. The scope for more meaningful earnings upgrades at Commerzbank driven by lower costs and a more aggressive hiking trajectory by the ECB pushed Commerz shares higher.

Barclays - Improving credit rating is a "key strategic priority"

Extract from Barclays earnings call: “improving our credit ratings continues to be a key strategic priority and we maintain an active dialogue with all the agencies. Through this engagement, we were delighted the Moody's placed Barclays PLC on review for upgrade at the end of the year…Converting our positive outlook with S&P to an upgrade continues to be a priority too.“

Demand for short term CDs have jumped to highest since ‘08

This is an example of another higher yielding product which has tempted customers away from bank deposits.

Extract of WSJ:

Retail customers are clamoring for short-term certificates of deposits at a rate not seen since the 2008 financial crisis. Average monthly issuance for retail CDs maturing in less than a year has tipped above 950 in the past four months, CUSIP Global Services data show. If demand continues at that clip, it would be the first time annual issuance breaches 11,000 since topping 15,000 in 2008. Higher interest rates and a desire to hide out from stock- and bond-market pain has driven bank customers into the products, which are locked up for a set period. CD issuance surged in 2022 when stock market losses grew, said Gerard Faulkner, director of operations for CUSIP Global Services.

Lenders to PE owned Italian Life Insurer EuroVita write down $300m loan | BBG

A series of Bank lenders are in the process of writing down about $300m in loans to Life Insurer Eurovita after an Italian regulator suspended management and halted redemptions at the Life Insurer. The article from BBG basically questions whether PE investors have what it takes to be involved in the Life Insurance space.

Net interest income formed over 35% of Hargreaves’ Lansdown’s total revenue vs only 4% last year…

The UK’s number 1 stockbroker (by AUM) Hargreaves Lansdown (HL) reported interim results this week. While they do not have bonds out there, I found it interesting to see how much HL are making on clients cash balances due to the higher rate environment in the UK.

A combination of larger client cash balances and higher base rates has provided a significant tailwind to Hargreaves Lansdowns’ earnings. In the 6 months to 31 December 2022, Net interest income rose nearly a 1000%…(941% to be precise) or £112.9m. Net interest income formed 35.6% of HL’s Total Revenue compared to just 4% last year.

https://www.hl.co.uk/investor-relations/results-and-presentations

*IG*

IG New issue summary

Issuance topped $54bn this week.

Amgen raised the 9th largest ever US IG Corporate bond ($24bn) to help pay for its acquisition of Horizon Therapeutics. Amgen’s total order book topped out at $90bn.

Consumer issuance was popular with more than 72% of the issuance this week, other consumer names that issued included Pepsi, Philip Morris, Whirlpool.

There is a range of tenors being offered instead of just longer dated debt as was the case during the QE era including a 3 year AT&T (3NC1) which priced at +120bps over UST.

US Builder Toll Brothers enters into 5 yr $1.9bn sr unsec RCF | Filing

Extract - Toll Brothers, Inc. and its wholly-owned subsidiary, First Huntingdon Finance Corp, entered into a five-year, $1.905 billion senior unsecured revolving credit facility (the “Revolving Credit Agreement”) with the several lenders party thereto...

Glencore 2022 prelims - Cash & Cap structure highlights - IR

Glencore’s CEO said that the group had “significant surplus cash generation” and reduced its net debt to $0.1bn

Announced $7.1bn of shareholder returns

Liquidity of $14.8bn

Free cash flow generation of $10.9bn

“Committed” to maintaining an investment grade rating

Bond maturities capped at c.$3bn in any given year

EDF – Would like to retain S&P BBB rating: earnings call

EDF’s earnings call had an analyst question as follows: “I'd like to know whether you consider that your EUR64.5 billion debt is sustainable? Or do you feel you have to scale it back in the medium term?”

EDF management responded as follows (extracts):

Regarding our debt. Needless to say, our debt level is something that we're taking very seriously. As Luc Remont rightly said, from the financial standpoint that's our legacy beyond 2022…A little bit of background information. S&P reaffirmed the BBB rating with a stable outlook. And we - it is really important for us that this rating is being maintained. It is consistent with the group's activity, consistent with a lot of industry players. And we seek to make sure that this rating will remain unchanged. And also the ratios that we introduced. Net financial debt to EBITDA ratio and economic debt to EBITDA, we seek to improve those ratios further relative to 2022.

Vodafone Said to Weigh Options for $15 Billion African Unit | BBG

Extracts:

Vodafone Group Plc is exploring options for its African business as investors ramp up pressure on the UK telecom company to boost performance, people familiar with the matter said.

The London-listed firm is working with advisers to study ways to extract more value from its 65% holding in Vodacom Group Ltd., the people said, asking not to be identified as the matter is private. The early-stage considerations range from merging the business with other operators or divesting some assets in certain markets, to selling a stake in the company, the people said.

While Vodafone has always seen the African unit as a core part of the group, the exercise shows that it’s willing to study a wide range of alternatives as it casts around for a way to stem a decline in its shares. Billionaire John Malone’s Liberty Global Plc disclosed a 4.9% stake in Vodafone on Monday, joining other strategic investors French billionaire Xavier Niel and state-backed Emirates Telecommunications Group Co., formerly known as Etisalat and now called e&.

Marriott beat Q4 EPS expectations, seeing early strength in China + APAC

*MARRIOTT INTL 4Q ADJ EPS $1.96, EST. $1.83

Marriott sees 2023 adj. EPS $7.23-$7.91; FactSet consensus $7.44

It seems corporate travel is picking up too, which corroborates reports from the US Car Rental Firms and US Airlines. Here are further extracts

The company saw business and cross-border travel improvements in the Q4, as well as increased demand for longer stays and luxury properties.

Marriott benefited from strong travel demand, especially in the U.S, where leisure demand remained robust and group demand more than fully recovered, leading to Q4 revenues 10% above pre-pandemic levels.

Marriott reported a 43.8% rise in fourth-quarter net income to $673 million, or $2.12 per share, and a 28.1% increase in fourth-quarter revenue per available room (RevPAR) to $97.62, compared to the same period a year earlier.

Group revenue for 2023 is already pacing up 20% year-over-year with room night and rate gains each quarter

Marriott saw a huge demand surge in January during the Chinese New Year holiday with RevPAR for the holiday period nearly in line with 2019. Other regions are also anticipated to benefit from an increase in outbound China travel, especially, APAC, where over 40% of room nights in 2019 came from Chinese travelers.

[2023] To-date, however, Marriott has not seen signs of demand softening….A month and a half into 2023, booking demand and pricing remains strong

Airbnb also reported strong figures, continuing the theme of strong reports from Travel & Leisure firms as consumers keep spending on experiences.

Kraft Heinz Upgraded to BBB by S&P, Outlook Stable

*CHINA*

China Bolsters Liquidity Support to Meet Loan Demand Surge | BBG

Extract - China’s central bank added more cash into the financial system to meet a rapid, post-Covid Zero rebound in loan demand, while keeping its key policy rate steady for now as the economic recovery takes shape. The People’s Bank of China injected a net 199 billion yuan ($29.15 billion) with its one-year medium-term lending facility (MLF) this month

China's dollar-bond default rate has dropped for five consecutive months - BBG Intelligence

According to the analyst’s research this is mainly due to the support measures introduced by the Chinese state following the reversal of its covid-zero stance.

*EM*

EMB Bond ETF saw $1bn outflow over past week | BBG

Extract - Over the past week, traders yanked $1.04 billion from the $16.4 billion iShares JPMorgan USD Emerging Markets Bond ETF (ticker EMB), according to data compiled by Bloomberg. On Tuesday alone, investors withdrew $514.6 million — the most one-day outflow since November 2022.

This compares to the past year’s inflow for EMB of $2.12 bn.

EM New issuance

Quiet week for EM new issuance with main highlight being Sharjah’s $1bn November 2023 sustainable bond (SHJGOV 6.5% 2032). The bond is expected to have split ratings of Ba1/BBB-. In the EM HY space Egypt is set to issue a $1.5bn new 3 year Sukuk according to BBG. They better be quick while conditions in EM remain supportive, the time to have come to market was probably earlier in February when markets were in a goldilocks mood.

Adani bonds rally strongly to end the week, moving out of distress - BBG

The Adani Fixed Income investor call that took place on Thursday made some market participants more comfortable with Adani’s bonds. Key points seem to be that it will look to cut its ND/EBITDA ratio below 3x next year (currently 3.2x) and also it said it faced no material refinancing risk/near term liquidity requirements. Following the call, some bonds (e.g. 2024 Adani Ports & Special and Adani Green Energy) are trading in the low 90s. These had traded as low as the low 70s cents in the dollar.

*RATINGS*

SOV/QSOV/MUNI

NYC Upgraded to AA by Fitch on Strong Recovery From Pandemic

IG / XOVER

Kraft Heinz Upgraded to BBB by S&P, Outlook Stable

S&P Revises Outlook on Infineon to Positive From Stable

Moody’s Downgrades Akzo Nobel Ratings; Outlook Changed to Stable

Moody's downgrades adidas to A3 from A2; Outlook remains negative

X-S&PGR Revises Renault Outlook To Stable; Affirms 'BB+/B' Rtgs

HY

X-S&PGR Dwngrds AMC Entertainment To 'SD' On Distressed Exchange

Moody's downgrades Morrisons' CFR to B2 from B1; outlook negative

Moody's downgrades Silvergate Bank's deposit ratings to Ba3 from Ba1; outlook remains negative

Monte Paschi got a rating upgrade to B1 by Moody’s

X-S&PGR Puts Vantage Drilling Int'l Rtgs On CreditWatch Positive

Peabody Energy Upgraded to B by S&P, Outlook Positive

Talos Energy Upgraded to B by S&P

S&PGR Upgrades W&T Offshore To 'B-' from 'CCC+'; Otlk Stable

EM SOV

Fitch Downgrades Pakistan to 'CCC-'

Suriname Outlook to Stable by Moody's

Guatemala Upgraded to BB by Fitch on Strong Fiscal, Eco Recovery

EM CORP

Azul Downgraded to CCC- From CCC+ at S&P

X-S&PGR Affirms Car Inc. 'B-' Rating; Outlook Remains Negative

Fitch Downgrades Lippo Malls Indonesia Retail Trust to 'CCC+'

YPF Affirmed at CCC- by Fitch

*BUYSIDE / PRIVATE CREDIT*

Fixed income ETFs see record inflows in January (etfstream.com)

Extract - Fixed income ETFs in Europe saw record inflows last month amid predictions central banks are set to slow the pace of rate hikes over the rest of the year. According to data from Bloomberg Intelligence, investors piled €9.5bn into European-listed fixed income ETFs in January alone.

Steve Eisman (of big short fame) is buying bonds after 15 years..BBG Video

Extract - Neuberger Berman Eisman Group Senior Portfolio Manager Steve Eisman says the group is buying bonds and US Treasuries due to the rise in real yields. "One thing that I've been doing lately, which I haven't done in 15 years -- our groups are actually buying bonds, at least some bonds," he says on "Bloomberg Surveillance."

Soros Fund Mgmt bought LQD in Q4 2022 according to 13F Filing | BBG

Nice trade for Soros’ Investment firm:

George Soros’s investment firm piled into US corporate bonds as yields on fixed-income securities hit multi-year highs in late 2022. Soros Fund Management purchased about $255m worth of the iShares iBoxx $ Investment Grade Corporate Bond exchange-traded fund, according to a regulatory filing Monday. The ETF now comprises 4.4% of its $5.7 bn US equities portfolio, its third-largest position.

Apollo, Goldman Plan Private Credit Funds for Rich Europeans - BBG

Extract of BBG article- Apollo Global Management and Goldman Sachs Asset Management LP are preparing to launch private credit funds aimed at wealthy European investors, trying to capitalize on a burgeoning corner of the credit market. The firms are developing strategies to target affluent individual investors interested in private lending for leveraged buyouts in the region, according to people with direct knowledge of the matter, who asked not to be identified as the information is private... The moves would follow a similar fund started by Blackstone Inc. last year.

Both firms are masters of selling financial products, so one can never doubt their ability to sell this type of product, but in my opinion its not the easiest sell in an ageing credit cycle and at a time when 6 month bills are yielding 5%.

The timing of these private credit fund launches coincides with rising defaults in private credit market as outlined by a fellow fintwit below. Note that this tweet was in response to Boaz Weinstein’s tweet about tight HY spreads.

*TRADING*

JPMorgan Trading Head Troy Rohrbaugh Says ‘Fixed Income Is In’ | BBG

Extracts - Good news for Wall Street’s fixed-income trading shops: “Fixed income is in,” according to Troy Rohrbaugh, JPMorgan Chase & Co.’s global head of markets.

“It’s actually a trade-able, invest-able asset class now and we’re seeing a lot of interest,” Rohrbaugh said Wednesday at a Bank of America Corp. conference. JPMorgan, which boasts Wall Street’s biggest FICC-trading business, is seeing ongoing strength in macro products as well as a pickup in credit, a weak spot last year.

Rohrbaugh said first-quarter trading results are trending “slightly down” from last year’s $8.8 billion haul, echoing guidance from Chief Financial Officer Jeremy Barnum Tuesday.

Rohrbaugh predicted the industrywide trading wallet will probably shrink after recent banner years, but “with the direction of the market, much higher rates, much higher levels of volatility, there’s a lot more opportunity.”

Natwest Markets Macro Traders got paid - EfinancialCareers

Extract - It's an open secret that some of the best macro traders in London are sitting on the NatWest Markets trading floor on London's Bishopsgate. And given that 2022 was an exceptional year for macro traders, it's hardly surprising that today's NatWest results reveal a generous increase in top performers' pay.

Citi pulling out of Australian Credit Trading

Surprising in my opinion…seemed like a good franchise. But guess Citi concentrating on “core regions” for Credit of which Australia doesn’t seem to be one. Interested to hear from people in the region if there is a different explanation.

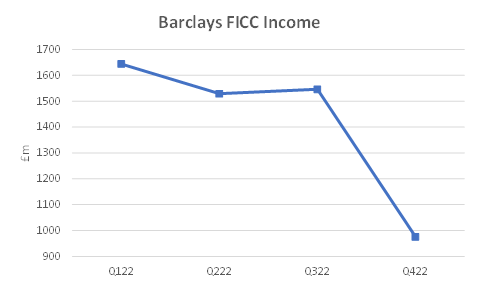

Barclays FICC Trading insights

Extracts from presentation/earnings call:

Corporate and Investment Bank (CIB) income increased by 8%; the best full year for both Global Markets and FICC.

CIB income increased 8% to £13,368m – Global Markets income increased 38% to £8,844m representing the best full year for both Global Markets and FICC on a comparable basis . FICC income increased 65% to £5,695m, mainly in macro, reflecting higher levels of activity as we supported our clients through a period of market volatility.

A key part of our strategy has been to grow this financing business. As a result, whilst we have long been top-ranked in fixed-income financing, we are now also top five in prime services.

Consequently, an increasing amount of our markets' income now comes from financing across FICC and equities, and this has grown at a 16% CAGR over the last three years.

Looking at Barclays quarterly trend, FICC revenues dropped off compared to prior quarters which may have some seasonality element to it due to the lower amount of trading days around Christmas/New Year.

Source for data: Barclays Q4 Release

CS is exiting distressed debt + special sits trading | BBG

CS Trading is exiting the distressed debt market at the wrong time as debt distress is on the up. However the decision appears to be more motivated by capital allocation from the new CS management rather than a market timing issue. Yet another example of reasons why bonds can change hands in the credit markets besides just relative value reasons.

Extract - The [CS Distressed] portfolio, which has as many as 30 trading positions, includes a revolving credit facility of struggling auto-parts maker Standard Profil Automotive GmbH, which has an interest rate of 14%. Other positions include claims on Thomas Cook, which collapsed in 2019.

A new academic paper about Bond ETFs & bond Liquidity published

*LINKS / CHARTS*

A more detailed week ahead from Rahul:

Bloomberg’s Brink Newsletter

Bloomberg Intelligence podcast on Structured Credit / Healthcare Debt:

Regular reminder on impact of tightening cycles from BofA