Weekly Global Credit Wrap w/e 29 Jan 2021

I couldn't go without making a bond comment on the Reddit/WSB thingy...

**CONTENTS

**Rates**

Nothing to write home about here in US Rates this week…

Dollar Libor Falls to Record Low as Cash Glut Weighs on Rates – BBG

**Credit**

Bofa strategists’ suggests Global investors are piling into US Credit…

7-Eleven issued blockbuster $10.95bn debt deal this week

Could Netflix become an Investment Grade issuer?

UK Pubs - Interesting deal activity (Marston’s)

**Financials**

BNP $600m 6.5% legacy Tier 1 call notice issued

European Bank earnings been good so far, capital returns making a comeback?

**HY**

Bigly US HY issuance despite HY outflows

How did the Reddit / WSB action impact HY credit - AMC example

WeWork bonds catch a bid

**Sustainable credit investing**

ANZ Bank issued an SDG Tier 2 with a very low coupon

Oil majors' credit ratings under threat from growing climate risks: S&P Ratings Agency

*EMERGING MARKETS / ASIA*

Kenya’s economy slumped into recession after 18 years in September

IMF staff lay ground for $1.8 bn loan to Costa Rica -Centralbanking.com

Indian firm gets stake in the Port of Colombo, Sri Lanka - Nikkei

Cathay Pacific sold convertible bonds this week (2.75% coupon for 2026 maturity in HKD)

**Rates**

Nothing to write home about here in US Rates this week:

10yr US Treasuries – Rallied from 1.1% to 0.996% intraweek but closed in a steepening fashion at 1.085%.

30yr US Treasuries – Range traded between circa 1.75% and 1.86% and closed the week at 1.84%.

The main take-away is that there wasn’t as pronounced risk-off move in US Treasuries as in the US equity market.

Dollar Libor Falls to Record Low as Cash Glut Weighs on Rates – BBG

BBG reports that “The three-month London interbank offered rate for dollars was set at 0.20188%, below the previous nadir of 0.20488% reached on Nov. 20. The benchmark has fallen in all but one of the past nine trading days, weighed down as rates on Treasury bills and repurchase agreements have been pressed lower amid a glut of cash in short-term markets.” Full article: BBG/Yahoo Finance

This just lends further to the difficulty of holding cash in the low rate environment that has persisted for so long.

**Credit**

Bofa strategists’ suggests that Global investors are piling into US Credit due to lower fx swap costs and higher yields

Extract: “ASIAN and European investors are pouring money into US dollar corporate bonds, which have grown more enticing as longer-term US yields have risen and hedging costs have fallen. A European investor can earn about 1.03% on an average US highgrade corporate bond after hedging, or around 0.8 percentage point above euro-denominated counterparts, according to data compiled by Bloomberg. That’s one of the biggest advantages for US notes since early 2017. A month ago, that gain would have been just 0.56 percentage point.”

Read full article here: Link

7-Eleven issued blockbuster $10.95bn debt deal this week

7-Eleven Inc, a subsidiary of Japan-based retail group Seven & i Holdings Co. Ltd., completed a $10.95 bn issuance of an eight-part offering at pricing levels that were on the firm end of early pricing talk. This could be seen as a good result for the company and shows that public debt markets are hungry for issuance. The proceeds will be used to finance the parent company’s acquisition of U.S.-based convenience store and gas station chain Speedway LLC from Marathon Petroleum. It’s longest tranche (2051 maturity) priced at T+105bps to yield 2.819%. See S&P Global’s good write up on the deal: S&P Global

Marriott Vacations Worldwide issued 2026 Convertbile with zero coupon

Marriott Vacations Worldwide completed an offering of $500M principal convertible senior notes due 2026 in a private offering

Proceeds from the offering will be used to finance and complete the Welk Resorts acquisition, repay certain outstanding Welk Resorts debt

I don’t know the issuer well, and I am not a convertible bond person, but this seems like a pretty good deal for the issuer in a not so straightforward sector due to the pandemic. Please submit comments on any thoughts you may have about the issuer/pricing. Link to the issuer website:

Could Netflix become an Investment Grade issuer?

This week S&P Credit Rating Agency upgraded the rating on Netflix to BB+/positive. This is an extract of comments from S&P via Marketwatch

S&P raised its Netflix ratings to BB+, which is the highest speculative-grade, or "junk" rating, from BB, citing the company's "significantly improved" free operating cash flow (FOCF) trajectory, "and the likelihood that the company will generate sustained positive FOCF beginning as soon as 2021. The rating has a "positive outlook," which S&P said reflects the potential the rating could be raised if the rating agency can be convinced that Netflix will remain disciplined on its cash content spending. S&P's upgrade comes about a week after Netflix reported blowout fourth-quarter subscriber numbers. "While we expect Netflix to aggressively spend on content production in 2021, the company should not get back to pre-2020 spending trajectory in 2021," S&P said.

It is still a junk rated issuer, but is now only one notch away from being an split rated issuer (Investment Grade from one Agency and HY from other Agencies). I find this to be quite an achievement, considering the area that it operates in (streaming) and its reputation for being a high spender on content creation. I have not done the credit work on the name but clearly S&P have done theirs and they seem to like what they see. If they were to achieve investment grade status, that could see a further drop in its funding costs which would help in their battle vs other larger investment grade competitors such as Disney, Amazon and AT&T. From a technical perspective, investment grade benchmark funds normally require two agencies to rate a bond investment grade before it can enter the bond indices.

UK Pubs - Deal Activity (Marston’s)

This week UK Pub company Marston’s was bid for by a US PE Firm; Platinum Equity Advisors (BBC).

This is interesting for several reasons. Firstly, it is one of a number of pub chains that have been bid for/acquired in the past few years:

a) In 2019, Greene King was acquired by CK Noble (UK) Limited, part of the CK Hutch empire owned by Hong Kong Billionaire Li Ka-shing

b) In 2020, Stonegate plc finalised its acquisition of Ei Group (formerly known as “Enterprise Inns”).

The deal rationale for those issuers was basically the same, that the public equity markets did not fully reflect the value of the estate and the cashflow generation capabilities of these businesses.

This is not a phenomenon restricted to pubs, the recent confirmation that roadside assistance / insurance firm AA Plc* will be acquired by a consortium of PE firms is yet another example of UK firms being sold on the cheap, in my opinion. I believe the common factor in all the examples above is a poor understanding by the shareholder base of a company’s capital structure, debt position and access to debt markets.

From a markets perspective, and this week in particular with all the Reddit/GME/AMC stuff going on, the Marston’s bid approach highlights how it is dangerous to be short the equity of out-of-favour sectors, particularly those affected by the pandemic. Those with longer time horizons (PE firms for example) can often be prepared to pay up to acquire businesses at a modest premium now as they believe they might generate much larger returns over the longer term.

* Declaration: Holder of AA Plc shares.

**Financials**

BNP $600m 6.5% legacy Tier 1 call notice issued

Not unexpected, but continued retirement of legacy tier 1 bank paper in UK/Europe.

European Bank earnings been good so far, capital returns making a comeback?

It appears that banks that reported this week beat analysts’ earning expectations, namely the big ones – Bankia, UBS, BBVA, SEB to name a few.

BBVA (RTRS), UBS (Yahoo Finance) and Jyske Bank (S&P Global) were just some of the banks that announced re-commencement of buybacks for shareholders, demonstrating some cushion in their respective capital bases but also showing intent to please shareholders. Zerohedge also touched on the topic of buybacks in the US, citing BoFA (Zerohedge).

**HY**

Bigly US HY issuance despite HY outflows

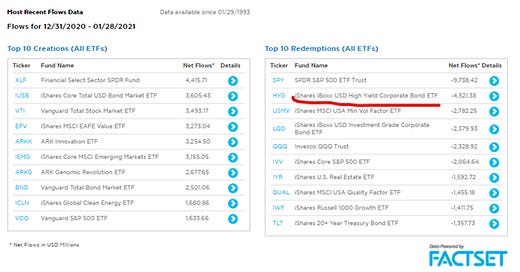

January 2021’s HY issuance came in at around $52 bn, making it the third busiest month on record and the highest for any January, according to data compiled by Bloomberg. Average US HY issuance for Januaries over the last six years has been c. $20bn. The issuance stats are more impressive since the last few weeks have seen outflows out of HY bond etfs. ETF.com’s flows data seemed to show the 2nd largest ETF to see redemptions is the well known HYG Fund, which is just one of a number of HY Bond ETFs out there.

Source: ETF.com

Meanwhile, it seems loan funds are seeing inflows in a continuing trend since the start of this year (S&P Global ).

How did the Reddit / WSB action impact HY credit - AMC example

What a week in the Equity market for stocks like Gamestop and AMC. But was there any read-across to the bonds of these issuers? In AMC’s case; yes.

AMC’s shares closed up a phenomenal 278% this week, after closing up around 50% last week.

Equity raises this month and a conversion of a $600m convertible bond by Silverlake Group reduced AMC’s 1st lien debt, which led S&P to raise AMC’s credit rating on its 1st Lien date from CCC- to CCC.

This has of course had a beneficial impact on its debt, with AMC 1st lien bonds up around 30 points YTD (~38%) and its 2nd liens up around 50pts YTD (230%). So both bonds have so far generated equity style returns from bonds this year alone.

WeWork bonds catch a bid

Something I tweeted about this week, WeWork bonds rallied hard in January on a press report it could combine with a SPAC or raise money elsewhere.

**Sustainable credit investing**

ANZ Bank issued an SDG Tier 2 with a very low coupon

ANZ issued 750mm of 10.25 NC 5.25 T2 SDG at Euro Mid Swaps +112bps.

At the reoffer price that means a yield of 0.669% in EUR which looks like extremely competitive pricing for a well rated, medium dated subordinated bond. No doubt, this sort of transaction could see other banks looking to jump on the bandwagon to issue similarly low coupon sustainability bonds.

It seems that regular T2 Bank bond issuance has been light in UK/Europe anyway YTD, so this could be a catalyst to get issuers issuing, of course there needs to be “enough on the table” for good investor sponsorship. This is especially true as a lot of low coupon issuance is sensitive to rising government bond yields.

Oil majors' credit ratings under threat from growing climate risks: S&P Ratings Agency

Extract: S&P Global Ratings said Jan. 26 it is considering downgrading its credit ratings on a number of major oil and gas producers, including ExxonMobil, Shell and Total, to reflect a growing risk to their businesses from the energy transition, price volatility, and future profitability. S&P Global

Medium to longer term, the cost of capital seems to be rising for less environmentally friendly energy companies whereas it remains very low for any firm pursuing green energy ambitions. I note that some of the new energy firms such as Hydrogen Firm Ballard are looking to enter the debt market (Yahoo). Of course emerging energy players bring their own risks in the form of immature revenue streams/profitability and a lack of track record in the debt markets.

*EMERGING MARKETS / ASIA*

Kenya’s economy slumped into recession after 18 years in September

Extract: “The Kenyan economy sunk to its first recession after exactly 18 years in September 2020 with gross domestic product (GDP) falling by 1.1 per cent in the third quarter.

The contraction in growth was preceded by the first GDP contraction since September 2008 with GDP slumping by 5.5 per cent (revised from -5.7 per cent) between April and June.

While the government had moved to lessen restrictions on enterprise following the initial COVID-19, the retention of tough measures including a night time curfew alongside the closure of schools continued to inhibit economic activity.” Read more: Citizentv.co.ke

IMF staff lay ground for $1.8 bn loan to Costa Rica -Centralbanking.com

Extract: “International Monetary Fund staff have agreed the terms of a support package for Costa Rica, as the country struggles with high debts and the effects of the Covid-19 crisis. The IMF and Costa Rican authorities announced on January 22 that they had reached a “staff-level agreement” on the terms of a $1.75-billion, three-year loan to the Central American nation. “ Read more here: Link

Indian firm gets stake in the Port of Colombo, Sri Lanka - Nikkei

Extract: “President Gotabaya Rajapaksa has caved in to Indian pressure for a stake in the Port of Colombo, the busiest harbor in the strategically located South Asian island where China already has a foothold.” Continues here: Nikkei

Cathay Pacific sold convertible bonds this week (2.75% coupon for 2026 maturity in HKD)

Extract: “Cathay Pacific Airways is planning one of its biggest bond sales to buttress its finances as Hong Kong’s hometown airline struggles to ride out the travel slump forced by the global coronavirus pandemic.

The HK$6.74 billion (US$869 million) five-year convertible bonds maturing in February 2026 will be offered at par with a coupon of 2.75 per cent. “Read more: SCMP

Disclaimer: Not investment advice. I may have positions in securities mentioned in the above blogpost. These are my own views, not my employer’s.