*OVERVIEW*

Firstly, my thoughts and prayers are with the Ukrainian people at this current time.

Secondly, what a week, and what a start to the year so far in markets…

A lot is happening in the Fixed Income Market in a short time, back end of last year saw the drift lower in Emerging Market bond prices, then it was the sharp rates sell-off in US followed by UK and Europe and now the Russian invasion. I’m not even counting the number of idiosyncratic situations playing out in Global Credit (e.g. EDF downgrades, Saipem debt problems, Adler, Turkey Inflation, ongoing China property situations etc). The number of negative yielding bonds is coming down, increasing the average yield of bonds and the number of bonds trading at a discount to par (100). This should be attractive to new buyers of fixed income, and provides re-investment opportunities for long term buy and hold investors, but maybe less than ideal for those who bought tightly priced bonds at the new issue stage. All this with the caveat of a very high inflationary backdrop in many parts of the globe. Trading conditions remain tricky with greater dispersion in indicative quotes from brokers/dealers and an even bigger difference between trading indications and “actual” bids/offer prices returned.

Credit spreads - Some interesting trends playing out

Credit indices - Looking across MTD moves, Xover has moved out more (+46bps) compared to Sub Financials CDS (+16bps). The widening in Investment Grade CDS Indices appeared to have slowed down for now. Note that Xover ended tighter on the week despite the Russian invasion…

Cash Bonds (BBG Barc Agg credit spreads) - EUR HY is undeforming US HY (+78bps in the former vs +30bps in the latter MTD). The all in yields (unadjusted for FX) of US HY are higher due to the bigger move in US Treasury yields. EM spreads have widened out +43bps MTD too driven mainly by Ukraine / Russsia moves. In the Investment Grade space, EUR IG is underperforming US IG (+38bps wider compared to +18bps for US IG MTD). This trend in IG could be reflective of the earlier widening in US IG credit. Global CoCos spreads are +60bps wider in the month to +388bps.

Lev Loans - YTD returns turned negative (S&P/LSTA Lev Loan Price Index down 1.02% YTD to 24 Feb)

US HY posted 6th consecutive weekly loss, yields rose to new 16-month high of 5.85%

Bond issuance stalling - 2nd consecutive week of no new deals in EUR HY and only one notable deal in US HY (Twitter sold $1bn 8 yr bonds). A few deals were postponed in HY (e.g. BellRing) EM (e.g. Mumbai Airport) and High grade (e.g. SSA Land NRW). BBG reporting that it was first time since Mar-2020 that an SSA deal has been postponed. Interestingly though, Peabody the Coal producer managed to price a $275mm convertible bond on 25 February, which is impressive to have achieved during a period of elevated volatility.

*MACRO*

21 Feb - Fed Governor Brainard said Fed is ready to raise interest rates next month and begin shrinking its balance sheet in coming meetings

24 Feb - The Fed should hike by 100 bps by midyear - Fed’s Waller

22 Feb - ECB: Villeroy favours ending net asset purchases around Q3

Eurozone economic activity rose more than expected and at the fastest pace in five months in February

French inflation rate at 4.1%, country vows to keep gas tariffs in place

Germany Tipped Into Second Recession by Virus, Bundesbank Says - BBG

Mortgage rates in the US are getting closer to 4%

Weekly flows (BBG/Lipper):

U.S. Loan Funds See $913m Inflow in Week to Feb. 23

U.S. Junk-Bond Funds See Seventh Straight Week of outflows, this week posting $995.5m outflow, YTD outflow over $14bn

US Investment Grade Funds see outflows of $754.7m

*COMMODITIES / INFLATION*

Total compensation for finance, information and professional employees rose 4.4% in January YoY - WSJ

-Outpacing 4% wage growth for all workers, according to the Atlanta Fed's wage tracker.

HSBC Boosts Bonuses 31% in ‘Extraordinarily Competitive’ Market

Italy's govt approved ~ €8bn in aid to shield consumers and companies from soaring energy prices - BBG

Oil SPR release coming from US says Biden, and possibly Japan

LNG supply-demand gap is forecast to emerge in the mid-2020 - Shell LNG Outlook

Pentagon to boost rare earths and lithium stockpiles -sources: RTRS

What are commodities focused shares telling us?

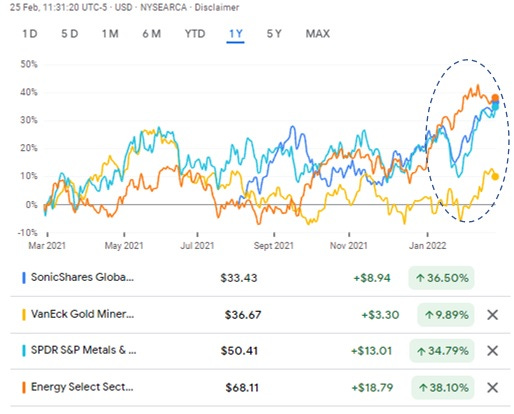

While many Tech and “High Growth” companies have had a tough start to the year, many commodity/shipping/gold focused shares are having a great time. The chart below shows 1 year performance of ETFs in these sectors, but the lines show a clear “lift-off” in both blue lines (Metals & Mining/Shipping ETF) and Gold Miners (GDX) while the rally in XLE (Energy Sector ETF) seems to be moderating a touch.

*Russia / Ukraine*

A lot happened here this week, some quick observations below:

Hard currency Russian and Ukrainian bonds both suffered big falls this week (~30-50pts). There was a bit of a bounce back in Certain Russian issuers like Gazprom that seemed to suffer less from specific sanctions.

BBG’s Javier Blas (and the co-author of the excellent book: “The World for Sale”) touched on this point re Gazprom in the below Tweet/Article:

In the case of both countries, the sell-off extended to the Sovereigns, Quasi Sovereigns, Corporates and Financial Institutions. Risk of sanctions (before they were announced), and alleged margin calls at certain places appeared to make the situation worse.

The price falls paid little attention to the to respective credit quality and bond maturities of different bonds and reflected more of an aversion towards anything linked to Russia or Ukraine. Price transparency is dreadful with bonds being quoted typically with 20-30 point bid/offer spreads but most points trading via appointment anyway.

In terms of trends:

Russia - Financials seem to underperform Corporates as there were more of them that were set out in sanctions lists

Ukraine - Seems to be a trend towards issuers that fared better during Crimea related volatility

Other “second order” bond impacts included that of Belarus whose sovereign 2023 $ bonds halved in price this week.

Companies with operations / revenues from Russia also encountered some price volatility, e.g. the likes of Wintershall DEA Hybrids and Raiffeisen Bank whos sub bonds went down to the 80s.

On a more positive note, Oil & Gas related bonds outside of Russia seemed to be more stable, although the chronic under-investment by the buy-side into oil and gas (due to ESG concerns/and possible PTSD from 2014-17 bankruptcy cycle) and the current highly illiquid conditions means that many Energy HY/EM QSovs/credits still trade at very high yields relative to their fundamentals.

Other news:

Major buyers of Russian oil struggle with bank guarantees -sources | RTRS

Russian oil importers cannot open letters of credit

Ship owners refuse to load in Russia

Shipping rates for Russia jump

Ukraine rail transport suspension following invasion hits steelmakers, miners - S&P Platts

Feb 25th IMF Statement on Ukraine - IMF

Extract from IMF MD Georgieva “I assured them that our staff will continue to work closely with the authorities to support Ukraine in every way we can. We will also continue to work hand in hand with the World Bank Group and other partners to coordinate our support and ensure the maximum benefit for Ukraine.”

*IG*

London public transport (TFL) bailout extended by four months - BBC

The Department for Transport (DfT) said the latest deal was worth about £200m, taking the total support given by the government close to £5bn.

Scentre (Australia/New Zealand) Shopping Centre Giant reported FY Figs

Highlights:

Available liquidity of $5.6 billion, sufficient to cover all debt maturities to early 2024.

Interest cover for the year was 4.0 times and balance sheet gearing at 31 December 2021 was 27.5%

*HY*

Saipem - Eni CEO Says Company to Support Saipem Along With Italy’s CDP

Heathrow airport COVID-19 losses reach $5.2 bln with travel on hold - Al Arabiya / BBG

Vista Global acquires Air Hamburg - Link (Private Jets)

Hertz profit rises on ongoing travel rebound, but restructuring costs weigh | RTRS

Golar LNG (“GLNG”) secured new $250 million 7-year bilateral corporate facility - Q4

Extract - “GLNG entered into a new $250.0mm undrawn corporate bilateral facility with Sequoia Investment Management to further increase financial flexibility and facilitate FLNG growth.”

*CHINA*

Headlines were mostly dovish coming from Chinese Authorities/Big Cities, also interesting that house prices rose first time since Sep 2021:

China's new home prices perk up as big city demand returns - RTRS

China CSRC Vows to Contain Bond Default Risks, Deepen Reforms - BBG

Two of China’s largest and most prosperous cities have cut interest rates for prospective home buyers - WSJ

-Joining an effort to prop up a housing sector whose weakness could threaten the broader economy. Cuts in Shanghai and Guangzhou, though modest, follow similar steps by dozens of smaller cities as home prices and sales weaken

China - Nanning Housing Authority to lower minimum down payment ratio to 30%

Regulators have asked Huarong and other so-called AMCs to buy property assets from troubled developers - Link

- and formulate plans for taking over or restructuring smaller lenders in recent weeks

Shimao Misses Payment as $948 Million Debt Talks Drag on - BBG/Youtube

HSBC bank took a $451mm impairment charge against its $21.3bn of China real estate exposure

*EM*

Brazil's Petrobras smashes all-time profit record amid Brent bonanza | RTRS

Nigeria Records $1.1 billion Foreign Trade Surplus in Last Quarter of 2021 - NIPC

Seplat Energy enters agreement to acquire the entire share capital of Mobil Producing Nigeria from Exxon

Egypt finalizing lead managers for debut USD-denominated sukuk after Turkey successfully issued

Egypt’s remittances climb to $28.9 bln during first 11 months of 2021

Specialist Mexican Lender -UNIFIN's CEO Sergio Camacho said the company plans to tap local debt markets this week

Sri Lankan Officials Met With Bankers in Bid to Solve Debt Crisis - WSJ

Sri Lanka reviewing proposals by investment banks to re-finance debt: Treasury Secretary - Economynext

Sidenote: Seems Central Banker Cabraal’s denial of talks with Debt restructuring Bankers is quietly being drowned out by official commentary by the Treasury in Sri Lanka…

*CREDIT TRADING*

BlackRock Sees Record Credit ETF Trading as ECB Saps Liquidity - BBG

Extract:

Average daily euro high-grade ETF volumes already at a record

“If we take anything from the month of February, we are on track to break any previous records when it comes to trading volumes,” Vasiliki Pachatouridi, head of EMEA iShares Fixed Income Strategy, said in an interview.

BlackRock’s IEAC ETF saw its first billion-euro day in almost two years after the European Central Bank’s hawkish turn earlier this month

COVID / RE-OPENING:

Japan may further ease restrictions - NHK

Poland to remove most COVID19 restrictions from March 1

Dubai Airport passenger numbers seen rising 90% in 2022 in boon to jet fuel demand - S&P Platts

*RATINGS*

Russia cut to Junk by S&P - Russia credit rating cut to BB+ by S&P, maybe cut further

Moody’s Places Russia, Ukraine Ratings on Review for Cut

Moodys withdrew ratings on VEB and Promsvyazbank (Russian Banks)

S&PGR Lowers Ukraine Long-Term Ratings To 'B-'; On Watch Neg

Ukraine Downgraded to CCC by Fitch

S&PGR Revises Georgia Outlook To Stable; Affirmed At 'BB/B'

Zambia: local-currency rating upgraded 2 notches to CCC+ by S&P.

Iraq Affirmed at B- by S&P

China Huarong was upgraded to BBB+ from BBB by Fitch

Macy’s Upgraded to IG by Fitch

Moody's upgrades Macy's CFR to Ba1 - Yahoo Finance

EDF downgraded to Baa1 from A3 by Moody's and to BBB from BBB+ by S&P

Fitch Places AXA SA on Rating Watch Positive

Moody’s places AXA’s debt ratings on review for upgrade

SoftBank Affirmed at BB+ by S&P

A number of Greek Banks got upgraded:

Fitch Upgrades NBG to 'B+'; Outlook Stable

Fitch Upgrades Piraeus Bank to 'B-'; Outlook Positive

Fitch Upgrades Alpha Bank to 'B'; Outlook Positive

First Quantum Minerals (Copper Miner) upgraded to B+ by S&P on reduced leverage

First Quantum Minerals Upgraded to B+ by Fitch, Outlook Positive