Global Credit Wrap 9 December 2022

Banks reducing hung loans, more A&Es in HY/EM, that low reset AT1 call, UK mid-size Banks...

*TLDR*

MACRO

US Treasuries / Fed:

Timiraos hints at 50bps at upcoming Fed meeting, Feb meeting less clear

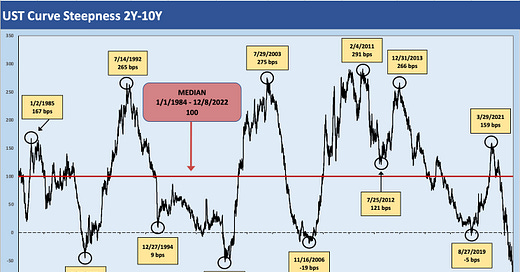

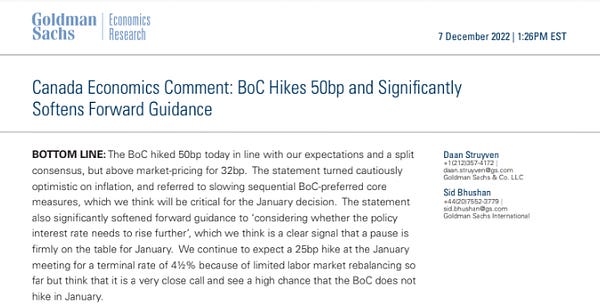

Extreme curve inversion in 2s10s, Gundlach / Creditsights Founder comments

Wells Fargo strategist reckons 10 yr goes to 4.25% - 4.75% in early 2023

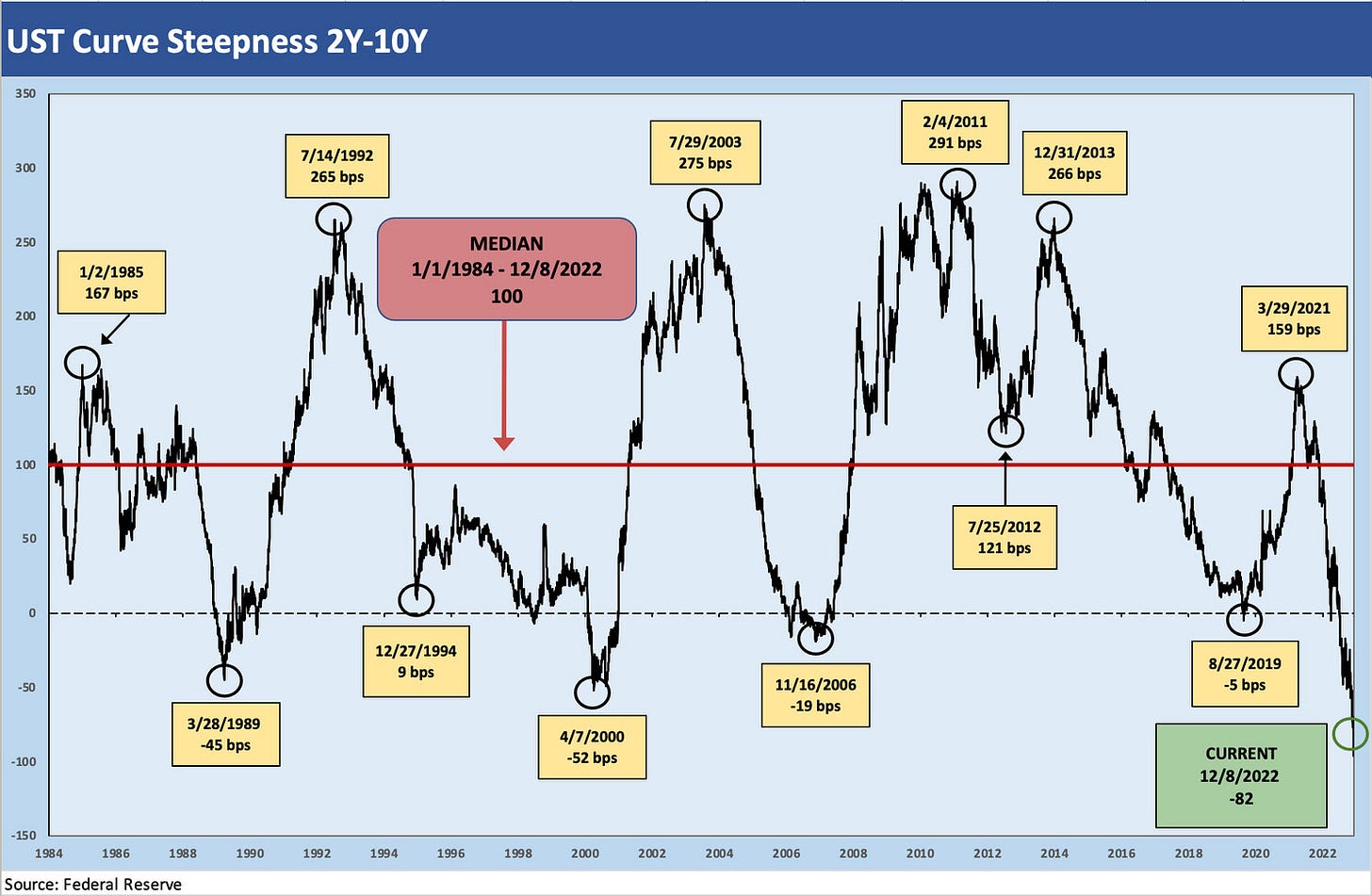

Canada - BoC hikes 50bps, GS thinks pause coming as soon as next meeting

BIS highlights cross currency swaps as a key global risk

Consumer to see bit of relief from Gas Prices/Mortgage costs

US Gas prices could go below $3 bucks after hitting $5

US 30-year mortgage rate has moved from 7.08% to 6.33% over the last 4 weeks

Australian consumers to see caps on coal and gas prices to limit energy bills

However, data shows the US Consumer is spending more by saving less, borrowing more

INFLATION

CPI preview for next week from BofA

Wage inflation continues surge higher, other indicators showing disinflation:

Delta Airlines - Agrees 34% pay increase over 3 years with Pilots

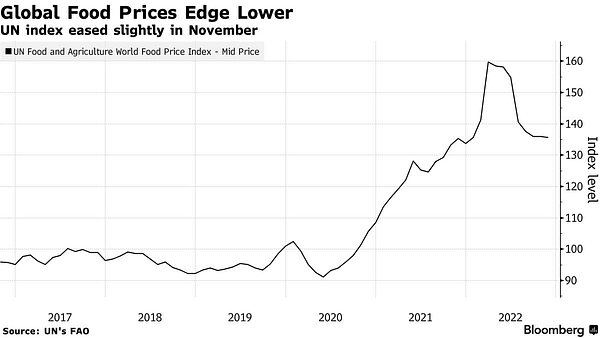

UN Food price index and Cotton prices keep coming down

US Manheim used vehicle value index last month was down 14.2% YoY

Apartment lease rents are decelerating: WSJ’s Timiraos

UK RICS house price index fell to -25% in November

COMMODITIES

Iron Ore at 4-month high on China RE / re-opening hopes

Brent Crude oil traded back to end of 2021 levels

Trafigura post an impressive set of figures for FY 2022, secures €3bn loan guaranteed by German Government

Russia to sell discounted crude to Pakistan

NEW ISSUES/TENDERS

Quietest November in US IG for 15 years

EUR HY quietly got issuance done, and in the process reducing hung loans on bank balance sheets..

Apollo structures bond backed by back Music Catalogues

Golar LNG Contemplates buyback of bonds

CHINA

China takes nationwide steps away from Covid Zero, e.g Beijing drops COVID testing burden

Chinese leaders including President Xi meet Dec. 15 to discuss next year's economic outlook. Leaders said to target 5% growth

China's exports fell ~9% in Nov, most since early months of lockdown

China debt ratio hits record high at 3x GDP

PPI and Consumer inflation fell in China giving central bank plenty of room to ramp up stimulus or cut interest rates.

Some China Property names are talking to select Creditors about restructuring plans

IG

US IG Funds saw first inflow in fifteen weeks

Luxury US Builder; Toll Brothers numbers come in better than expected

EM

Peru leader Castillo ousted

Brazil’s Copom maintains the Selic rate at 13.75% for third consecutive meeting

EM Corp bond extensions - Ukraine Rail (confirmed), Gol Airlines (local news story - not confirmed)

S&P says Ghana's local debt in default, cuts foreign bonds

Sri Lanka Headlines:

Paris Club proposes 10-year moratorium in 15-year Sri Lanka debt re-structure

WB Approves Sri Lanka’s Eligibility to Access Concessional Financing to Help Stabilize the Economy and Protect Livelihoods

HY

Leveraged loan downgrades outpace upgrades by fastest pace since covid default peak - Pitchbook

Carvana facing debt distress, seeks to engage with creditors early

Morrison Supermarket disposal of frozen distribution centres

Norwegian Cruise A&E of operating credit facility

Some AMC lenders said to be talking with restructuring advisors according to Re-Org

Some of the best performing US HY bonds are US Casino names with operations in China

FINANCIALS

UBS calls low reset AT1, sends whole Bank AT1 sector higher

Credit Suisse announced the completion of HoldCo and AT1 issuances for 2022

Conservative government set to de-regulate UK Banks…

Blackstone Private Credit hits quarterly 5% redemption limit

UK BTL Lender Paragon reports solid results, increases expected impairments due to changes in economic, political and inflation assumptions

Metro Bank unlikely to call T2 bond in 2023

CREDIT TRADING

Tier 1 US Banks see overall trading revenues at least 10% higher vs Q421: GS Fins Conference

Tradeweb Announces Partnership with BlackRock to Further Electronify Corporate Bond Market

RATINGS

CEMEX was upgraded to BB+ from BB by S&P

Ratings updates on Tullow/Kosmos following Ghana rating changes

LINKS

Boaz Weinstein Interview with Barry Ritholz (from late November)

Blackstone Global Co-Head of Real Estate speakt with Barry Ritholz (topical due to Blackstone REIT investor withdrawals news)

A UK asset manager comments on recent events at Aroundtown with respect to ESG

*MOVERS OVER 5D*

Credit spreads - CDS all widened a touch with CDX HY (+16bps to 479) and Xover (+15bps to 459) leading the widening. In cash, Global USD CoCo spreads tightened in 12bps, driven by the positive sentiment around the call of the UBS low reset 5% AT1. Pan European HY widened +12bps to 535bps.

Bond ETFs - Duration won out this week led by Government bonds with US Municipals and IG Corps following shortly behind. Weakness in Inverse Treasury ETFs, Inflation Linked, Gilts and Preferreds. The latter is interesting since Preferreds are a long duration credit like asset like IG Corps but the underperforming suggests a preference for higher quality exposure going into 2023. In terms of total return:

Main Winners: IDTL+1.7%, DBZB+1.3%, US10+1.2%, EDV+1.1%, BAB+1.0%, LQDE+0.9%.

Main Losers: TTT-3.0%, INXG-2.5%, PGX-1.7%, IBCI -1.3%, XGIN -1.3%, ITPS -1.2%, IGLT -1.0%.

*MACRO*

US Treasuries Comment - Levels/Inversion getting extreme

US 5s, 7s, 10s, 30s all yielding 3% handle compared to 4%+ in October.

The current inversion in 2s10s is deepest since early 1980s. Co-founder of Creditsights Glenn Reynolds made this point:

“The 2Y-10Y makes a statement on inversion with the most inverted curve since the wild period of Volcker inflation fighting way back during the double dip recession period. As an example, the 2Y-10Y had hit -241 bps in 1980. The above chart covers the period from 1984, when the market had returned to some remote level of normalcy, through Dec 8, 2022 (end of day UST quotes). The -82 bps inversion this week stands out across the cycles covered. What could it all mean? Maybe recession is closer than we think.”

Meanwhile Jeff Gundlach of Doubleline thinks we are only a few months away from a recession based on the inversion:

Based on historical precedent, looks like tougher times ahead for the US economy, but with the amount of QE that was pumped into the system and now QT, anything is possible.

Timiraos hinting Fed go +50bps at upcoming Fed meeting, February meeting less clear

Meanwhile, Elon gives his two cents on the Fed next week…

There is one bear amongst a sea of bond bulls - BBG

Extract from @kgreifeld’s “Weekly Fix” Publication (excellent btw):

“Everyone is bullish on bonds. KKR is bullish, Morgan Stanley is bullish, Pimco is bullish — the list goes on. And then there’s Wells Fargo…

Yields on 10-year Treasuries should soar to between 4.25% and 4.75% through early 2023, in the eyes of Wells Fargo macro strategist Erik Nelson. The logic is that for the Federal Reserve to successfully drag inflation lower, so-called real yields need to rise — meaning nominal rates need to move dramatically higher as well.”

Bank of Canada hikes 50bps, GS thinks pause coming

BIS highlights cross currency swaps as a key global risk - BIS

Exec summary - “Embedded in the foreign exchange (FX) market is huge, unseen dollar borrowing. In an FX swap, for instance, a Dutch pension fund or Japanese insurer borrows dollars and lends euro or yen in the "spot leg", and later repays the dollars and receives euro or yen in the "forward leg". Thus, an FX swap, along with its close cousin, a currency swap, resembles a repurchase agreement, or repo, with a currency rather than a security as "collateral".2 Unlike repo, the payment obligations from these instruments are recorded off-balance sheet, in a blind spot. The $80 trillion-plus in outstanding obligations to pay US dollars in FX swaps/forwards and currency swaps, mostly very short-term, exceeds the stocks of dollar Treasury bills, repo and commercial paper combined. The churn of deals approached $5 trillion per day in April 2022, two thirds of daily global FX turnover.

FX swap markets are vulnerable to funding squeezes. This was evident during the Great Financial Crisis (GFC) and again in March 2020 when the Covid-19 pandemic wrought havoc. For all the differences between 2008 and 2020, swaps emerged in both episodes as flash points, with dollar borrowers forced to pay high rates if they could borrow at all. To restore market functioning, central bank swap lines funnelled dollars to non-US banks offshore, which on-lent to those scrambling for dollar.”

Clearly something to monitor closely…

US Consumer spending more by saving less, borrowing more

*INFLATION*

CPI preview for next week from BofA

Delta Airlines - Agrees 34% pay increase over 3 years with Pilots: Forbes

Extract - In yet another sign of the leverage that unions wield during an industry-wide labor shortage, Delta Air Lines has offered its pilots a 34% pay increase over three years in a new contract, Reuters reported over the weekend. In October, the Air Line Pilots Association (ALPA), which represents nearly 15,000 pilots at the Atlanta-based carrier, said 99% of those who cast their ballots backed a strike if negotiators could not reach agreement on a new employment contract.

UN Food index eased off, will stores pass on the benefit to the consumer?

Cotton price - WSJ comments on price fall

Extract - Cotton prices, which surged through 2021 and reached an 11-year high in May of this year, have been on a steady decline and are now 47% below that peak.

Used-Car Prices in the US Extend Free Fall as Rising Supply Hurts Dealers | BBG

The impact of higher rates continues to reverberate across different markets, first housing now used cars.

“The widely watched Manheim Used Vehicle Value Index last month was down 14.2% from a year ago, while unadjusted used-car prices tumbled 12.4% in that span, the automotive auctioneer said Wednesday. The index fell to the lowest level since August 2021 as used-car sales declined 10% in November.”

Apartment lease rents are decelerating: WSJ’s Timiraos

UK RICS house price index fell to -25% in November, worse than the -10% estimate | RICS

The November 2022 RICS UK Residential Survey results show overall activity continues to weaken across the sales market, with higher interest rates and a difficult macroeconomic outlook both taking their toll on buyer sentiment. Meanwhile, rising demand and falling supply send rental prices upwards.

ECB’s Lane thinks we are near Peak Inflation | RTRS

*COMMODITIES*

Iron Ore at four month high mainly on China Property / Re-opening hopes - BBG

Brent Crude on a mad losing streak lately

This despite SPR needing to be refilled and China re-opening. Market prices could be declining due to recession worries, light positioning ahead of year end and the prohibitive cost of hedging oil positions after this year’s volatility. Ole Hansen of Saxo is a top read on commodities in his preview for the upcoming week.

Australia to cap prices of coal, gas to drive down energy bills | RTRS

Extract - Australia will cap coal and gas prices for a year in a bid to shave utility bills for households and businesses hit by soaring costs because of the Ukraine conflict, Prime Minister Anthony Albanese said on Friday. Gas prices will be capped at A$12 per gigajoule (GJ), while the limit for coal will be A$125 per tonne for 12 months, with the government supporting coal producers whose costs exceed that figure, he said.

Trafigura post an impressive set of figures for FY 2022

Trafigura had $14.8bn of cash and $39bn of debt as at end of September 30th 2022.

Trafigura talked about its excellent access to financing through an extremely volatile year including the post balance sheet date deal for a 4 year loan agreement guaranteed by German Govt for $3bn.

The full set of results will be a good read for anyone interested in Trafigura or Commodity Trading more generally.

*NEW ISSUES / TENDERS*

New issue markets remain quiet

BBG commented that this December is set to be the quietest December in 15 years for US IG at least, but that is reflected in other markets too. There was some modest activity in the loan and European HY space this week though.

EUR HY Issuance roundup

Bond issues were priced for Iliad (Telco), 888 (Gaming) and Intrum (Debt collector) in a subtly busy week for European HY. The 888 debt was one of those stuck on banks balance sheets as the syndication market froze over in 2022. Credit Sights European conference which took place this week had a good chart showing how the Banks have been working those loans off their balance sheet from earlier on this year. If you have this chart, feel free to subtweet.

IPF completes exchange offer, new issue IPF 12% 2027 sized at £50m

Following on from other specialist lender NewDay, IPF successfully completed its exchange offer. The new bond was formed from £37.6m of the existing notes due Dec 14 2023, additional £12.4m of new notes issued of which £9.8m will be retained by Treasury for possible sale in the future.

American Axle raises new TLB, deal upsized

TLB upsized from $650m to $675m

7 year TLB with final terms of SOFR+CSA+350, 0.50%, 97.0.

Issuer rated B1/BB-; Ba1/BB+ (facility).

Interesting to see AXL choose the loan market over the HY bond market to carry out this transaction.

European RE Firm Heimstaden bond tender was upsized to SEK580m

Heimstaden’s tender offer for holders of its SEK1.75b outstanding senior unsecured floating rate bonds 2019/2023 was upsized by SEK80m to SEK580m, due to “strong interest” according to BBG. In USD terms that equates to around $56m.

Golar LNG - Contemplates buyback of bonds | Statement

Golar LNG Limited (equity ticker G 0.00%↑ LNG) announced an offer to buy-back parts of its $300m senior unsecured bonds maturing 20 October 2025 for cash in a Reverse Dutch Auction format.

Apollo Sells $1.8 Billion Bond Backed by Concord Music Royalties - BBG

Extract - Apollo Global Management Inc. has priced $1.8 billion of bonds backed by music copyrights in Concord Music Royalties’ first securitization, having bought the largest debt of the securities it marketed. The Concord transaction is the largest music royalties asset-backed bond ever, according to Bret Leas, head of asset-backed finance at Apollo. It repackages royalty payments — both publishing and sound recording rights — from a catalog of more than one million music assets including those of Genesis, R.E.M. and Rodgers and Hammerstein.

*CHINA*

China round-up:

China takes nationwide steps away from Covid Zero, allowing for home isolation and reducing testing. SRC: @SofiaHCBBG

Chinese leaders including President Xi meet Dec. 15 to discuss next year's economic outlook. They're expected to declare a successful handling of the property bubble and signal the industry's normal operations can resume. SRC: @SofiaHCBBG

Defaulters Evergrande and Sunac are talking to select creditors about their restructuring plans, with Sunac the first to present a detailed offer. Country Garden sells new shares to raise funding for the third time since July. SRC: @SofiaHCBBG

China's exports fell ~9% in Nov, the steepest y/y contraction in dollar terms since the first lockdowns in early 2020. Local exporters across China are traveling abroad to meet clients in a bid to revive orders. SRC: @SofiaHCBBG

Around 5%. That's the number Chinese senior officials are considering for next year's GDP growth target. Premier Li Keqiang appears optimistic in meetings with heads of the WTO, IMF and OECD, saying economic growth will “keep picking up.” SRC: @SofiaHCBBG

Producer prices fell 1.3% in November and consumer inflation eased, giving China's central bank plenty of room to ramp up stimulus or cut interest rates. Core inflation, which excludes food and energy, was just +0.6%. SRC: @SofiaHCBBG

China debt ratio hits record high at 3x GDP - China's debt as a percentage of its economy hit a fresh high at the end of June, with local authorities borrowing heavily to underpin an economy weighed down by the central government's zero-COVID policy. Credit to the nonfinancial sector came to $51.87 trillion, or 295% of gross domestic product, to mark the highest debt-to-GDP ratio in data going back to 1995, in statistics released Monday by the Bank for International Settlements. Source: Nikkei

*IG*

US IG Funds saw $1.2bn inflow in w/e Dec 7th

Investment grade funds saw $1.2b inflow for week ending Wednesday December 7th, the first inflow in 15 weeks according to Refinitiv Lipper. Long dated bond end ETF saw near a $1bn in inflow last week whilst short dated funds look like they had an outflow. Source: US Bank

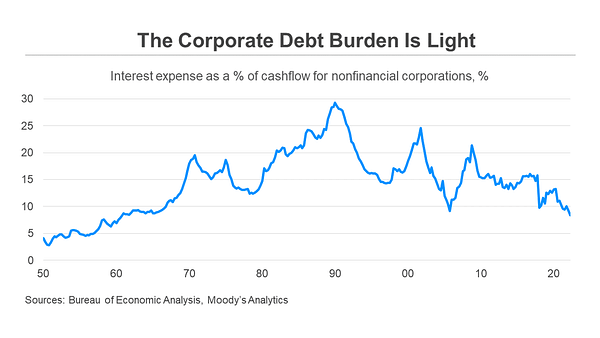

Corporate Interest Coverage looking healthy vs history

Luxury US Builder; Toll Brothers numbers come in better than expected

Great summary of earnings call here from BushwoodCap:

Affordability less of an issue for their buyers

20% of buyers pay all cash

Avg LTV of 71%

Cancellation rate as % backlog = 2.9% (avg. since 2010 = 2.3%)

Building cost coming down

TOL shares have been going up in line with the XHB ETF but popped on the results which were much better than expected. The rally in long dated govies (and therefore Mortgages) has also been a positive tailwind for share prices in the whole sector.

Toll Brothers Q4 Earnings:

Q4 EPS $5.63 Beats $4.01 Estimate

Q4 Sales $3.58B Beat $3.17B Estimate

More details here.

*EM*

Peru leader Castillo ousted - Guardian

Peru is onto its 6th President in 6 years, sounds like the UK, haha!

Brazil’s Copom maintains the Selic rate at 13.75% for third consecutive meeting

Gol Airlines - Estadao Newspaper says possible bond extension - Estado

Gol Airlines is said to be in talks with creditors to extend maturity of its $425m 2024 convertible bonds and or converting them into shares of Abra Group, the holding company that will aggregate shares of Gol and Colombian Airline Avianca. Following that, there is talk of extension of the 2025 straight bonds according to the article. Gol Airlines did not comment on the rumour, according to Coluna do Broad. Source: BBG

Ukrainian Railways Asks Bondholders to defer payments and extend maturities - BBG

Extract - Ukrainian Railways approached its debt holders with a request to defer payments on $895 million of its dollar bonds due 2024 and 2026. The state-owned company is seeking to hold coupon payments and extend the maturity on the 2024 notes by two years, citing “unprecedented economic and operating uncertainty” after Russia’s invasion of Ukraine. The request mirrors Ukraine’s successful effort to win bondholders’ consent for a similar request, as well as attempts from fellow Ukrainian companies, including poultry producer MHP and state oil and gas company Naftogaz.

Sri Lanka Debt Headlines

Paris Club proposes 10-year moratorium in 15-year Sri Lanka debt re-structure: report | EconomyNext

Extract - The Paris Club group of creditor nations has proposed a 10-year debt moratorium on Sri Lankan debt and 15 years of debt restructuring as a formula to resolve the island nation’s prevailing currency crisis, India’s The Hindustan Times reported.

WB Approves Sri Lanka’s Eligibility to Access Concessional Financing to Help Stabilize the Economy and Protect Livelihoods | WB

Extract - The World Bank today approved Sri Lanka’s request to access concessional financing from the International Development Association (IDA). This type of financing, which is offered at low interest rates, will enable the country to implement its government-led reform program to stabilize the economy and protect the livelihood of millions of people facing poverty and hunger.

S&P says Ghana's local debt in default, cuts foreign bonds | RTRS

Extract - S&P Global downgraded Ghana’s long-term local currency bonds to “selective default” and cut the country’s foreign currency debt to “CC” from “CCC-plus,” with default a “virtual certainty,” the ratings agency said in a Tuesday statement.

S&P said Ghana’s proposed local debt swap is a “distressed exchange offer,” earning those bonds the “selective default” rating, while the foreign currency bonds downgrade responds to the government’s announced plans to restructure that debt.

Ghana’s parliament on Tuesday narrowly approved the proposed 2023 budget, overcoming resistance from opposition lawmakers over the inclusion of the debt exchange and a higher value-added tax.

Tullow Oil appointed new CFO - City AM

Extract - “Tullow Oil has appointed interim chief financial officer Richard Miller to the position permanently, and named him as an executive director. Miller is currently interim chief financial officer and group financial controller. Miller has been with Tullow for over 11 years, and has previously lead the Tullow Finance team, supporting a number of acquisitions, disposals and capital markets transactions. He also played a significant role in the continued turnaround of Tullow with the rebasing of its cost structure, the resetting of the balance sheet and the change to a more focussed capital allocation. Miller first joined Tullow from Ernst and Young LLP where he worked in the audit and assurance practice.”

*HY*

Leveraged loan downgrades outpace upgrades by fastest pace since covid default peak - Pitchbook

Single B rated leveraged loan companies are seeing the most amount of ratings downgrades, which chimes with the theory that recessionary trends and high rates affect the lower rated credits the worst.

Extract - “Driving the downgrade wave is the typically defensive Healthcare sector, while in the recently pummeled Technology sector, Software drove the highest number of downgrades. The rare upgrades are from sectors that were among the hardest hit during pandemic downgrade cycle…In the third quarter, the corporate credit rating of 74 facilities in the Morningstar LSTA US Leveraged Loan Index were downgraded, more than twice the number at the end of the first quarter. Given the 37 upgrades, the ratio of downgrades to upgrades in the third quarter was 2:1. This is double the ratio from the second quarter, when downgrades and upgrades were near parity. S&P Global’s ratings actions have been more punitive to single-B rated companies over any other ratings bracket…”

The Hottest US Junk Bond Trade Is All About China’s Reopening | BBG

Extract - “US casino bonds are up 9.7% in last five weeks on Macau bet, China’s reopening, extension of casino licenses sparks rally. Casino junk bonds, not the usual wager when a US recession may be coming, are enjoying a market-beating rally after Macau extended the companies’ gambling licenses just before China decided to reopen from the pandemic.”

Carvana Edges Toward Reworking Debt - BBG

Extract - “Carvana Co. is consulting with lawyers and investment bankers about options for managing its debt load as plunging used car prices and the company’s swift cash burn threaten its future solvency.”

According to BBG, Carvana has around $6bn of debt due with bond maturities ranging from 2025 to 2030. Like certain other HY issuers addressing maturities more than a year from now, Carvana appears to be following the same playbook albeit it is in a higher state of distress due to the deterioration in its end market (used vehicles) and high debt load. Glenn Reynolds, Co-Founder of Carvana also penned a note on Carvana this week highlighting its problems.

Also it seems large creditors are joining up to reduce instances of creditor on creditor violence.

Morrisons sells seven prime frozen distribution facilities to ICG - Real Assets

ICG Real Estate, the real estate division of ICG, has acquired a portfolio of ambient, chilled and frozen distribution facilities from supermarket chain Morrisons for £220m (€255m). Each of the seven properties are being leased to Morrisons on an index-linked and triple-net basis for a term of up to 25 years. ICG said its 12-strong sale-and-leaseback team focuses on core-plus and mission-critical assets in Europe with a view to generating long-term, inflation-protected income streams.

Walford Production Q3 2022 - Reports 0.23x ND/LTM EBITDA - Statement

Main highlights below.

Norwegian Cruise Line Holdings Announces Amendment and Extension of Operating Credit Facility - Statement

Extract - [Norwegian Cruise] has amended and extended the majority of its operating credit facility consisting of its senior secured revolving credit facility and senior secured term loan A facility on December 6, 2022. The amendment has resulted in the extension of maturities of approximately $1.4bn of the Operating Credit Facility by one year to January 2025. The Company is actively pursuing alternatives to address the remaining debt associated with the Operating Credit Facility that will otherwise mature in January 2024.

AMC Entertainment lenders again organized with restructuring advisors - Re-Org

As the movie theatre chain continues to burn a significant amount of cash as per sources that have spoken to Re-Org.

*FINANCIALS*

UBS calls low reset AT1, sends whole Bank AT1 sector higher

Why was this notable? Because the bond only had a reset of +243bps which I believe was close to or possibly was the cycle low in AT1 reset spreads. This matters since if the bond was not called the coupon would have reset to around 6.4% coupon which is lower than where UBS could price an AT1 today. Similar AT1s with low resets rallied in sympathy with the called UBS bond.

Conservative government set to de-regulate UK Banks | BBC

Extract - The government has announced what it describes as one of the biggest overhauls of financial regulation for more than three decades. It says the package of more than 30 reforms will "cut red tape" and "turbocharge growth". Rules that forced banks to legally separate retail banking from riskier investment operations will be reviewed. Those were introduced after the 2008 financial crisis when some banks faced collapse.

Britain urges banks to offer mortgage flexibility in cost-of-living crisis | RTRS

Extract - Finance minister Jeremy Hunt told banking bosses at a meeting on Wednesday he expected them to help borrowers, while the Financial Conduct Authority laid out options the regulator said lenders should adopt to ease the strain. "We expect every lender to live up to their responsibilities and support any mortgage borrowers who are finding it tough right now," said Hunt. The lenders agreed to offer support such as switching to cheaper fixed rates without a new affordability test, extending a loan or lowering monthly payments, the finance ministry said….However, the proposals stopped short of the forbearance package offered to borrowers in COVID-19 pandemic lockdowns, which included widespread payment holidays."

Nothing was mentioned about relief for UK Buy To Let Landlords who are already experiencing pain after the removal of mortgage interest relief.

Metro Bank does not expect to call T2 bond in 2023, makes amendment - Statement

Extract - Metro Bank (the "Company") today announces that upon implementation of a holding company, the Bank of England's Resolution Directorate has agreed to provide a temporary, time-limited, adjustment for the Company's existing £250 million 5.5% Tier 2 Notes (the "Notes") with respect to minimum requirement for own funds and eligible liabilities ("MREL") eligibility until 26 June 2025. The adjustment permits the Notes to remain eligible to count towards the holding company's MREL requirement until 26 June 2025, whilst remaining at the operating company. The holding company, required to be established by 26 June 2023, is progressing well and will become the new resolution entity post-implementation…The Notes have a one-time call date of 26 June 2023 and, given the adjustment, at present Metro Bank does not expect to exercise the call provision (unless it would be economically rational to do so at the time and subject to Prudential Regulation Authority approval). The Notes' eligibility for Tier 2 capital amortises from the call date over the remaining life of the instrument if not called. Metro Bank will continue to optimise its balance sheet and review capital management actions.

Paragon Group of Companies FY Results

UK Challenger Bank with large exposure to Professional buy to let landlords reported decent FY figs:

Operating profit of £226m +16.4% vs 2021

Pre-provision profit +26.6%

Underlying RoTE 16.0%

Net loan growth +6.0% YoY

Deposit balances +14.7% YoY

CET1 of 16.3%

3 months+ arrears on the portfolio were 15 bps compared to 21bps in prior year

A big reason for the jump in profits was a gain from pipeline hedging of £191m.

Paragon did downgrade its assumptions for the state of the UK Economy which resulted in a net impairment charge of £14m (net of Covid related releases)

Source: Paragon

Clearly the biggest assumption changes here were CPI and and House price changes. Either way, Paragon’s earnings report, slide deck and earnings call are all good sources to understand the UK economy and Buy to Let landscape from a set of experienced credit practitioners.

Credit Suisse Headlines

Credit Suisse Rises as Saudi Crown Prince Weighs Investment - Mohammed bin Salman is considering $500 million injection according to BBG.

Credit Suisse announced the completion of HoldCo and AT1 issuances for 2022 - Since Strategy Update on October 27, 2022, Credit Suisse successfully completed ~USD$5bn equivalent of HoldCo issuances. The 2023 funding plan is expected to be released on February 9, 2023, together with 4Q22 earnings.

Credit Suisse completed a CHF4bn equity raise - BBG

Extract - Credit Suisse Group AG completed a 4 billion-franc ($4.3 billion), two-pronged capital increase, giving Chief Executive Officer Ulrich Koerner the funds needed to embark on a comprehensive restructuring of the troubled lender. Investors agreed to buy 98.2% of the stock on sale in a rights offer to raise 2.24 billion francs, Credit Suisse said in a statement late Thursday. The remainder of the stock will be sold in the market at or above the offer price of 2.52 francs a share.

Blackstone Private Credit hits quarterly 5% redemption limit - BBG

Detailed article highlighting that HNW Investors from one particular region have been redeeming their holdings in BCRED ahead of year end.

*RATINGS*

Moody's upgrades The Co-operative Bank's long-term deposit ratings

Swiss Re Upgraded to A by Fitch

S&P Revises Ryanair Outlook To Positive; Affirms At 'BBB'

S&P Upgrades LVMH Moet Hennessy To 'AA-/A-1+'; Outlook Stbl

TotalEnergies Affirmed at AA- by Fitch

WeWork was downgraded to CCC from CCC+ and its unsecured notes to CC from CCC-

CEMEX was upgraded to BB+ from BB by S&P

Tullow / Kosmos updates following Ghana rating changes:

S&P leaves Kosmos Energy ratings Unchanged On Ghana Debt Restructuring

Kosmos Energy Downgraded to B3 by Moody's

S&P Affirms Tullow Oil 'B-' Rating; Outlook Negative

Moody's downgrades Tullow's ratings to Caa1; negative outlook

*CREDIT TRADING*

Citigroup & JPM see trading revenue rising 10% in Q4 | RTRS

Note this refers to all trading revenue and not just credit trading revenue.

Extract - Citigroup Inc expects revenue in its trading division to rise 10% in the current quarter from a year earlier, but investment banking fees will be down 60% in line with the industry, Chief Executive Jane Fraser said on Wednesday, "We're hoping 10% (increase) in markets based on what we have seen in October and November," she told the Goldman Sachs Financial Services conference.

Meanwhile, JPMorgan Co-CEO Of Consumer Division said trading revenue likely to be up about 10% in Q4 compared to last year. Bank of America’s CEO said trading will be up 10-15% in Q4; investment banking down 50-60%, in-line with the street.

Tradeweb Announces Partnership with BlackRock to Further Electronify Corporate Bond Market | RTRS

My read: More firms trying to sidestep Banks and Bloomberg Terminal (for trading and portfolio management).

Extract - “BlackRock Inc and trading platform Tradeweb Markets Inc are partnering to enhance electronic bond trading. Users of BlackRock's Aladdin system, widely utilized across the financial industry to manage investment portfolios and risk will gain greater access to Tradeweb's credit platform and data through the partnership.

The move will allow investors to tap wider liquidity in markets for corporate, municipal, and emerging market bonds, the companies said.

"To be able to improve your liquidity and capacity to trade in very volatile environments as well is definitely a key benefit of further deepening these integrations," Chris Bruner, chief product officer at Tradeweb, told Reuters.

The partnership will also give users access to all-to-all trading that allows buyers and sellers to deal directly with each other rather than relying on market makers such as banks. Tradeweb launched all-to-all corporate bond trading in 2017.”

*LINKS*

Boaz Weinstein interview with Barry Ritholtz - Master in Business

I skim read this and found it useful. Boaz Weinstein is an extremely experienced and successful credit (mainly derivatives) practitioner who has won big several times in the past, so its worth paying attention to what he has to say.

Masters in Business Podcast with Blackstone’s Global Head of Real Estate

Barry Ritholtz speaks with Kathleen McCarthy, the global co-head of Blackstone Real Estate. The largest owner of commercial real estate globally. Quite a topical area especially with the news flow around quarterly redemptions.

TwentyFourAM Blog post on Aroundtown non-call - TwentyFour AM

TwentyFour put out a detailed post outlining their view on the recent Aroundtown non-call which likely echoes the view of most ARNDTN Hybrid debt holders. It also brought a new angle to the debate, regarding its treatment of creditors:

“Stakeholders at every level of AroundTown’s capital structure will have taken note of the company’s treatment of its creditors, and we would expect this to be reflected in the firm’s ESG scores going forward. It seems property prices aren’t declining quite as fast as AroundTown’s corporate governance.”

A similar-ish situation occured at Aviva when it tried to do a call at par on its legacy preference shares which was subsequently reversed after significant investor backlash. Key difference is that the Aviva prefs had a large retail shareholding which Aroundtown’s Hybrids do not.