*TLDR*

MOVES

UST - Maturities all the way from 5s up to 30s have rallied ~30bps YTD

Bond ETFs - Broad rally across credit assets on Friday led by Prefs, EM, HY and IG

Credit spreads - Starting the year strong

MACRO

US eco data - Market leant more on the AHE in NFP and much weaker than expected ISM data to push bonds and risk assets higher to close the week, largely ignoring the very low unemployment rate.

Japan - The yield on 10-year Japanese govt bonds rose to 0.50% to hit BOJ's policy ceiling. JPY hit a new 6 month high vs USD this week

German PMI hit 5 month high and business confidence improved

Negative yielding debt down from $18tn in Nov’21 to zero this week - BofA

2022 fund flows - US Treasuries saw the most inflows, whereas Credit and EM saw outflows - BofA

INFLATION

US prices paid data showing the longest stretch of declines since 1974-75

German and French inflation and EZ PPI data came in lower than expected

UK food inflation climbs to record high, but overall inflation slowing - BRC data

EM - Polish inflation unexpectedly slowed to a 4 month low, Colombia inflation surprised to upside

CPI next week the big data point

HY

January is proving to be a strong month for HY, there is historic precedent…

2022 saw nearly $100bn of “Rising Stars” leave the HY index

HY default rate closed at 1.61% at end of 2022 (JPM Research)

Bankruptcy risk - Party City, Bed Bath and Beyond and a number of Crypto firms

New issues - Ford issued triple tranche, possible Air France SLB, Scorpio Tankers avoids bond market and instead taps up Banks for credit facility

Macy’s on Friday said holiday sales will be on the lower end of its expected range

Cineworld - Judge Isgur tells Cineworld to fast track theatre closings

One firm has been buying up discounted large loans according to BBG

FINANCIALS

3 new AT1 issues this week and high yielding senior £ paper from CS and Barclays

A low reset € T2 was called by Barclays

M&A - Stanchart approached by First Abu Dhabi Bank. SMFG to up stake in Jefferies (press report).

Financials services firms are taking up some of the office space being left by big Tech firms (e.g Meta Platforms).

IG

US IG posted worst total return year on record -16.6% according to CS

EUR IG new issuance has started the year with a bang..

EM + ASIA

Inflow to EM debt ($2bn) in Dec-22 was 1st monthly inflow since Aug’21 - BofA

EM new issuance starts 2023 strongly

Emerging-market currencies advanced for a third-straight week

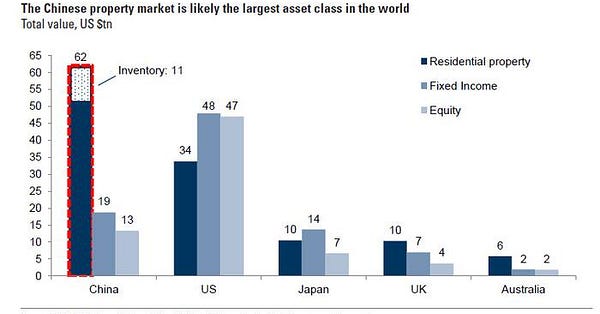

China HY $ bond spreads halved from 2900bp on 27th Oct to 1360bp this week - BofA

China said to ease “Three Red Lines” rule

Sri Lanka Sovereign - Tourist arrival numbers and spend per head improving

Venny/PDVSA - Chevron Sending Tanker To Venezuela To Load Oil (first time in almost 4 yrs)

Gol Airlines publishes preliminary 2023 outlook

*MOVES OVER 5D*

Treasuries

I don’t normally cover the moves in UST but the recent moves have been material.

Maturities all the way from 5s upto 30s have all tightened around 30bps vs where they closed in 2022. These are significant moves which mainly took place post the NFP and ISM prints. As we head towards earnings season starting next week, there is likely to be further volatility in Treasury yields.

Bond ETFs

Top Gainers - PGX +6.6% [Prefs], EDV+6.1% [Long dated UST], AHYG+5.0% [Asian HY], TLT +4.5% [20+ yr UST], LTPZ+4.0% [Long dated TIPS], PCY+2.9% [EM HC Sov Bonds], JNK+2.8% [US HY], LQD+2.4% [IG CORP]

Underperformers - TTT -12.6% [Inverse Long US Treasury 3x], IVOL -1.3% [Quadratic Interest rate Volatility & Inflation hedge]

Credit spreads

CDS - Big move tighter in the first trading week of 2023…Xover nearly 50bps tighter to 426bps, CDX NA. HY 34bps tighter to 450bps, EUR Sub Fins -12bps to 160bps. CDX NA IG at 75bps and ITRX EUR at 82bps.

Cash credit - US HY 20bps tighter, EM HY 14bps tighter, Pan Euro HY & USD CoCo both 7bps tighter each. US IG Cash now at 133bps vs a high of 165bps seen in October 2022. GBP IG cash now below 200bps at 187bps.

*MACRO*

US Jobs Data Recap for the week

Overview –JC/JOLTS/NFP data overall still indicating a strong labour market. The doves pointed to lower than expected avg hourly earnings and the steady drop in monthly job adds from Feb-22 to justify the rally in stocks and bonds to end the week. Meanwhile, unemployment hit the lowest since 1969.

NFP - “Something here for everyone.” This was the narrative coined by Jeanna Smialek of the NYT.

US Initial Claims - showed lowest reading in Q4 22 [Src: Datatrek] - 204,000 new claims for the week ending December 31st, down 19,000 from the prior week. Prior Q4 low: 212,000 (week ending December 10th) Reading at the start of Q4: 219,000.

JOLTS - Still representing a very tight labour market despite some softening.

USM ISM Services PMI for December was much weaker than expected

This is what provided the turbo rally in bonds on Friday more so than the NFP.

The worrying thing is that other surveys/data seem to be pointing to a similar slowdown…

Leading economic index (LEI)

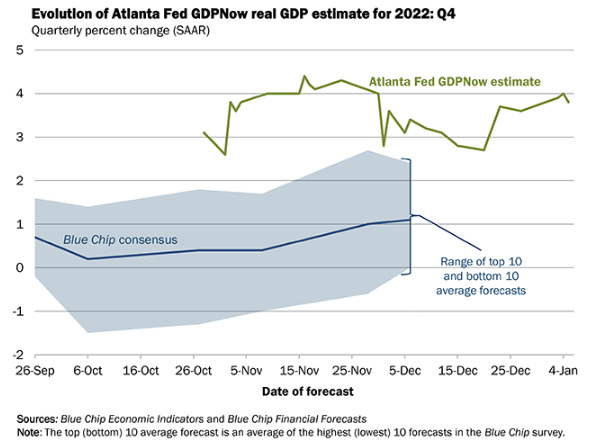

However, the Atlanta Fed GDPNow is showing a completely different picture to the above data

GDP 4Q 2022 estimated to be 3.8% as at 5 January.

Japanese news / moves round up

Sidenote: Why look at Japan? It is one of the last markets to (possibly) tighten monetary policy and has already been shown to have an impact on other Global bond markets as seen last month.

-The yield on 10-year Japanese govt bonds rises to 0.50% to hit BOJ's policy ceiling

-BOJ likely to raise fiscal 2022 and 2023 forecasts for Core CPI in new projections

-JPY strengthened to a fresh 6 month high vs USD this week but bounced off the 130 mark to close the week nearer to 132.0.

The strength in JPY currency has seen Japanese exporters like Nissan and Toyota’s share prices trade down (both hit 52 week lows this week).

Sources used:

, @HarksterHQ,German PMI hit 5 month high and business confidence improved

Extract from S&P Global/Markit: This morning's data showed that services activity dropped at a slower rate in Germany during December, with the PMI picking up to a 5-month high of 49.2 (Nov: 46.1). Business confidence also rose as price pressures eased further from their peak. Full report

This data point hints at a better macro backdrop than the expectation 3-6 months ago due to the worries around the Energy crisis in Europe.

Canada added a record 431,000 new permanent residents in 2022 - Cimmigration

The justification for the record immigration is to ease the labour shortages in the country and marks a different approach to the UK and US whereby immigration appears to be a more sensitive topic than in Canada.

Extract - “Canada’s federal government has revealed it reached its historical target of 431,645 new immigrants in 2022. Without giving an exact figure, Immigration, Refugees and Citizenship Canada (IRCC) said on Tuesday that it reached the target laid out in the Immigration Levels Plan for last year. The number surpasses the record of more than 405,000 newcomers welcomed in 2021. IRCC also plans to break the record in each of the next three years, according to the 2023 to 2025 Immigration Levels Plan released in November.”

Flow recap for FY 22 (BofA):

US Treasuries +$170bn inflow

Credit -$235bn outflow

EM Debt -$80bn outflow (=17% of AUM)

2022 was the first year that saw annual IG retail outflows in over a decade, although ETFs saw inflows according to CS. For me, the outflows last year were really noticeable when trading in EM debt due to the smaller market size vs US IG and US HY credit markets.

*INFLATION*

US prices paid data showing the longest stretch of declines since 1974-75 - ING

Extract - prices paid component measure of inflation pressures fell sharply yet again and is deep in deflation territory. Moreover, this is the longest stretch of declines in the index since 1974-75, underscoring how significantly price pressures have swung from one extreme to another as supply chains ease and demand softens. The clear positive from this is that goods prices should continue to soften, helping to nudge inflation rates lower.

German and French inflation and EZ PPI data came in lower than expected

And a bit more on German headline inflation.

EZ PPI

UK Food Inflation Climbs to a Record High in British Shops…Straits Times

Food inflation climbed to record but overall inflation came down according to the BRC.

Extract - The British Retail Consortium said on Wednesday that food inflation “accelerated strongly” to 13.3 per cent in December, from 12.4 per cent the previous month, an all-time high for the index which started in 2005. The cost of fresh food rose 15% from a year earlier, also a record high, up from 14.3% in November. Still, overall inflation in UK stores dipped in December, marking the first decline in over a year. The BRC said shop price inflation decelerated to 7.3 per cent, down slightly from November’s record high of 7.4 per cent. The leveling off in prices overall was due to retailers heavily discounting stock in the run-up to Christmas to shift excess inventory.

Polish inflation unexpectedly slowed to a 4 month low - ING

Extract - CPI inflation fell to 16.6% year-on-year in December from 17.5% YoY in November on the back of cheaper coal (down by more than 20% vs. November). Core inflation continued to trend upwards and probably rose to 11.7% YoY from 11.4% YoY in the previous month. Persistently high core inflation will leave no room for rate cuts in 2023.

However inflation readings are not expected to decline in a straight line:

“The withdrawal of the Anti-Inflation Shield from 1 January and the low reference base associated with its introduction will boost annual CPI inflation readings in the first two months of this year.”

This is similar to other parts of Europe where energy caps have limited the increase of Energy cost.

Colombia’s December annual inflation of 13.1% came in higher than expected - RTRS

Extract - “The rise in consumer prices in December was led by a 2.66% increase in prices for food and non-alcoholic drinks and a 2.51% increase in hotels and restaurant pricing. Colombia's central bank board, like policymakers around the world, has lifted borrowing costs to combat inflationary pressures, taking the benchmark interest rate to a 23-year high of 12%.“

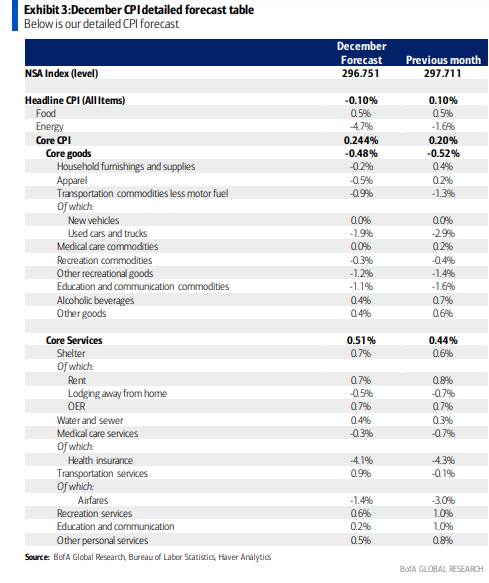

CPI Preview - BofA

In this data driven market, next week sees US CPI data released.

*UK/IRE*

Irish state (Exchequer) records surplus of € 5bn in 2022 - Gov.ie

Extract:

Tax revenue in 2022 was €83.1bn, an annual increase of €14.7bn (+22%)

Income tax receipts last year amounted to €30.7bn, up 15% on 2021

Corporation tax receipts amounted to €22.6bn last year, nearly 50% higher than a year earlier – for the first time ever, this is the second-largest source of tax revenue

VAT receipts were €18.6bn last year, up €3.2bn (over 20%) on 2021, reflecting the post-pandemic rebound in consumer spending

Citigroup signs deal for new European HQ in Dublin

As Tech companies such as Facebook retrench from the Irish office sector, sectors such as the Banking sector that are leasing office space in Dublin. The latest seems to be Citigroup according to the Irish Times.

“Citigroup has signed for a new headquarters in Dublin, in a boost for the office market in the capital. The US lender has agreed a €300 million deal for a new office campus in the city’s north docklands. Citi is understood to be paying about €100 million to acquire the site, with a further €200 million being set aside for the construction of its new base.”

Sidenote: Financial Services firm KKR is expanding into Meta Platforms’ old offices in NYC Hudson Yards - BBG

UK house prices drop for fourth month in a row - BBC

Extract - December prices fell by 1.5% compared to November, meaning the average house price is now £281,272, said Halifax. The bank said uncertainty about how the cost of living will affect household bills, as well as rising interest rates, is slowing the housing market. It expects buyers and sellers to "remain cautious" over the coming year. December's monthly fall was lower than the decline of 2.4% seen in November, even taking into account the expected seasonal slowdown, said Halifax mortgages director Kim Kinnaird.

*COMMODITIES*

Nat gas down to 2021 levels now

Same trend is true for European Nat Gas prices.

Chevron Sending Tanker To Venezuela To Load Oil (first time in almost 4 yrs) - Oilprice

Extract - U.S. oil company Chevron has a tanker on the way to sanctioned Venezuela, where it will pick up a load of crude oil destined for the United States. The crude cargo will be the first Venezuelan crude oil shipment to arrive in the United States in almost four years, according to a Reuters source. Chevron is also sending another tanker to Venezuela—this time set for delivery. The container is carrying much-needed diluents that will be mixed with Venezuela’s heavy crude. It will arrive in Venezuela in early January, the anonymous sources said. Chevron holds a six-month license, granted by the U.S. government in late November, to expand its role in its Venezuelan joint ventures. This license allows the U.S. oil company to bring some sanctioned Venezuelan crude oil to the United States for sale to U.S. refiners.

While the flows of oil coming out of Venezuela are not going to be huge to start with, it adds to the supply picture which could weigh on the oil price in the medium term if demand for oil products declines. Politically the US also no longer recognises Juan Guaido as Venezuela’s President, suggesting implicit backing for Maduro and his regime.

China considering end to Australian Coal Ban

Extract from ABC - China's state planner has reportedly allowed three central government-backed utilities and its top steelmaker to resume coal imports from Australia. The partial easing of the coal import ban is the first since Beijing imposed an unofficial ban on coal trade with Canberra in 2020. It comes after the Australian and Chinese foreign ministers met last month seeking to reset the frosty diplomatic relations between the two nations.

*HY*

January is proving to be a strong month for HY, there is historic precedent…

YTD to end of Thursday 5th January 2023, BBG HY index (LF98TRUU Index) posted a gain of 1.1% which represents the best week since November according to BBG. Yields have fallen 25bps week to date to 8.71%, the largest weekly drop in eight weeks. Strength at the beginning of a year is not something new for US HY according to Bloomberg Intelligence:

“January is the strongest month historically for the Bloomberg US Corporate High Yield Bond Index, averaging 1.4% in positive total return over the last two-plus decades. That includes the tumultuous starts of 2022, 2016 and 2008.”

The topic of the strength of HY vs IG in 2022 is an ongoing debate…

…It got me thinking whether there is anything more than just duration behind HY’s outperformance vs IG. This is when I came across a good chart from Credit Suisse showing the record number of rising stars that got upgraded to IG status in 2022.

Source: Credit Suisse

Who were the main Rising Stars in 2022? Freeport McMoran, Targa Resources, Kraft Heinz, HCA, T-Mobile, Centene, DCP Midstream, Deutsche Bank.

Defaults, another key input into risk premia within credit were very low at the end of 2022. JPM Global Economic Research (chart below) had the figure at 1.61% at end of 2022 compared to a long-run average of 3.57%. Therefore a better quality index (vs history), lower supply of bonds and shorter duration are key reasons the HY index outperformed IG in 2022 on a total return basis.

Looking forward, neither of these stats (# of Rising Stars, LTM default rate) are “perfect” leading indicators of the future state of HY credit. Fitch ratings agency forecasts cumulative 2022-2024 defaults to total 8.0% for HY and 7.5% for Lev loans, well below the respective 22% and 14% rates during 2007-2009.* HY credit spreads in December 2022 were lower than peaks during both recessionary and non recessionary periods. While we are not officially in recession, a number of indicators (yield curve inversion, LEIs and now ISM) suggest we could be nearing one, but HY credit spreads certainly do not appear to be reflecting that:

Bankruptcies update

Meanwhile, bankruptcies candidates are adding up. Bed Bath and Beyond and Party City are the most recent firms to raise concerns about their financial health.

Extract from BBG - (Bloomberg) -Bed Bath & Beyond Inc. has begun preparations for a bankruptcy filing that would likely come during its first operating quarter of the year, according to people with knowledge of the moves who asked not to be named discussing confidential plans. BBBY called off a proposed debt exchange and said that it might not be able to continue as a going concern.

Extract from BBG - Party City Holdco Inc. is laying the groundwork for a bankruptcy filing within weeks that may end with creditors taking ownership of the retailer, according to people with knowledge of the situation. The company will likely miss a coupon payment due in mid-February and could seek reprieve from its creditors to negotiate a restructuring, according to the people, who asked not to be identified because the matter is private. Known for selling balloons and other festive supplies, Party City has been hit hard by a helium shortage, costly shipping and softer demand amid an inflationary environment. Sales during the critical Halloween period disappointed investors.

The above two examples suggest to me that large amounts of debt should never have been introduced into these businesses. There are likely plenty of other businesses that raised debt during the good days but are now suffering to due to the more punitive cost of debt and constrained access to HY debt markets.

The crypto sector is another source of bankruptcies with the WSJ highlighting that all these firms have filed for chapter 11 so far: FTX, Celsius, Voyager Digital Ltd. and BlockFi Inc. This week there were worries around Silvergate, a so-called Crypto Bank, BBG summarised the story well:

Silvergate Capital Corp., a California lender that offers digital-asset ventures a place to park their cash, jolted shareholders Thursday with the revelation that it had recently survived an $8.1 billion drawdown on deposits. That’s roughly 70%, even more severe than runs seen in the Depression…Silvergate expressed confidence in its liquidity and ability to move on, a notion supported by several Wall Street analysts. But Silvergate’s disclosure — which included selling assets at a loss to raise cash — sent its stock tumbling, bringing its total slide to more than 90% since the end of 2021, the year Bitcoin reached a record high.

The article also highlighted that Silvergate has a preference share which now trades around 40 cents in the Dollar. Silvergate is laying off 200 staff (40% of its workforce) due to its recent problems.

Ford issued a three tranche deal, details:

US$ 1.3bn 3Y bond at a yield of 7.00%;

US$ 0.3bn 3Y FRN at SOFR+295bps and

US$ 1.15bn 7Y bond at a yield of 7.375%.

Ford Treasury team are one of the most pro-active teams out there and are always fast to print issuance when HY markets are open.

Air France-KLM is holding investor calls ahead of a possible SLB - BBG

Air France is said to be looking at raising a sustainability linked bond to repay senior bank loans granted by the French State in 2020. European Airlines have had a very good run of late due to falling oil prices and more recently a profit upgrade from Ryanair which lifted the whole sector.

Source: Google Finance as at 6 January 2023

Scorpio Tankers gets new credit facility at SOFR+1.975% - Statement

Extract - The Company has received a commitment from a group of European financial institutions for a credit facility of up to $225.0 million. The credit facility will be used to finance 11 MR product tankers and two LR2 product tankers. The credit facility has a final maturity of five years from the signing date and bears interest at SOFR plus a margin of 1.975% per annum.

SOFR closed at 4.31% on Friday, it is unclear whether the facility is secured or unsecured (my guess its secured…at those rates).

Scorpio Tankers had a convertible bond which traded all the way up to 160 from par before being taken out last year. It is telling that STNG decided to raise money from banks instead of the US HY market (which would likely require two sets of ratings etc).

Macy’s warns holiday-quarter sales will come in light, citing squeeze on shoppers’ wallets - CNBC

Extract - Macy’s on Friday said holiday sales will be on the lower end of its expected range. It said consumers’ budgets are under pressure and that it expects the squeeze to continue into this year.

The weak report runs contrary to reports this week from Costco (record 1 day move in share price on Friday) Next Plc (UK) and B&M Stores (UK discount store).

Cineworld - Judge Isgur tells Cineworld to fast track theatre closings | Deadline

Extracts -

Judge Marvin Isgur on Wednesday told parties to the Cineworld bankruptcy that they need to speed things up as debtors and creditors hash out a restructuring plan for the giant movie chain, including closing theaters, wrapping up lease negotiations with landlords, and advancing an overall sale process.

Cineworld has closed 23 theaters since filing and reached new lease agreements with 25% of landlords — a percentage that clearly failed to impress Isgur.

Cineworld on Tuesday said it would run a sale process focused on proposals for the group and talks with interested parties this month.

Meanwhile, Avatar 2 has surpassed Top Gun Maverick at the Global Box office posting $1.5bn in ticket sales.

Copper Mountain launches bond buyback @ 103.0

Following the sale of its EVA project, Canadian listed Miner Copper Mountain has announced a buyback of $87m of its HY bonds. These are trading in the 90s but the buyback offer is at 103.0. It is the second debt buyback in the “Nordic” USD HY market a month after Golar LNG carried out a Dutch auction to buy back $140m of its bonds.

Elliott bought the dip in buyout loans according to BBG

Elliot Investment Management have been buying buyout loans at a discount according to BBG. The latest one they are said to have purchased is CVC’s €1.5 Billion Debt for Unilever Tea at 82 cents in the Dollar.

*FINANCIALS*

AT1 Recap

Three new AT1s were issued for Credit Agricole, Sabadell and BNP all in Euros.

Of most interest was the Sabadell which came with an IPT of 10% but ended up pricing at 9.375% coupon. Pricing has generically improved for issuers slightly from the back end of last year when some European AT1 was being issued at coupons of 10%+ (e.g. DB and Permanent TSB).

Barclays low reset T2 called, new senior bond issued at 6.5%

There was a call for a Barclays 2% 2028-23 € bond which had a reset of 5 year Eur Swaps +1.9%. Barclays also issued a £1bn new senior bond at 6.369% in GBP.

Credit Suisse issued £500m of 3 year GBP bonds at 7.75%

Credit Suisse issued an A3/A-/BBB+ senior bond at Gilts +425bps. CS has quietly been tapping debt markets over the past 6 months despite all its problems…

Banks M&A talk/rumours

There were two press reports of note, firstly that First Abu Dhabi Bank had supposedly looked at Standard Chartered as a takeover candidate but subsequently dropped its pursuit. Secondly, Jefferies share price spiked on a press report that Sumitomo Mitsui Financial Group is considering raising its stake in Jefferies. Intraday both shares rallied ~20% when M&A reports were announce but both shares pared gains following the news. The attractiveness of the banking sector does not appear to be just limited to acquirers but to stock market participants, as the European Banks index has climbed its way up to where it was a year ago prior to the Russia/Ukraine conflict.

Finally in a nod to Banks’ less talked about “financial cousins”, Reinsurance and Insurance names have also been on a tear lately. One reason for this is a hardening rate environment for reinsurance, which this week’s Net Interest blog touched on. To give an idea of the rate increases, check out this extract from the piece:

“According to reinsurance broker Howden, global property catastrophe prices rose by 37% on January 1st, 2023, their biggest annual increase since 1992. Some segments saw even higher price rises. According to broker Gallagher Re, rate increases in global aerospace rose by 150-200%.”

Source: Google Finance

*IG*

EUR IG new issuance has started the year with a bang…

Weekly sales added upto €77bn, which represents one of the strongest starts to a year on record according to BBG and 73% ahead vs the same period last year.

EDF 5.25% Hybrid called

During the Christmas period, EDF called its EDF 5.25% $2bn Dollar issue and is set to be redeemed on January 29th. This follows the new issuance of a new € EDF Corporate Hybrid in November. Issuance has been light in the corporate hybrid space recently but that may change if credit spreads remain in check and investor cash balances remain high.

*ASIA / EM*

EM new issuance starts 2023 strongly

New issues of note this week were Romania USD multi-tranche, Mexico and Indonesia Sovereign. Romania and Indonesia’s 30 year bonds traded up nearly 3 pts vs where they were issued helped by the rally in the long bond. Book stats were generally healthy as demonstrated by the $3bn Indonesia deal which was nearly 5x covered…maybe the good old day are back.

Emerging-market currencies advanced for a third-straight week

The MSCI Emerging Markets Currency Index is up ~ 6% since the lows in October 2022.

China recap

China Caixin services PMI unexpectedly rose, 12m outlook rising to 17 month high

China to ease “Three Red Lines” rule

China began uploading genome sequence data to WHO database as demanded by other countries | SCMP

Sri Lanka Sovereign - Tourist arrivals and spend per head improving

Hindustan Times reported that Sri Lanka saw over 700,000 tourists in 2022 compared to 195,000 in the pandemic hit year of 2021. December 2022 recorded 91,691 arrivals behind the year’s highest amount of arrivals - 96,000 in February and 106,000 in March. The December arrivals were dominated by over 19,000 from Russia and over 17,000 from India.

It also seems that spending levels from tourists are nearing 2018 levels…

According to local press, Sri Lanka is anticipating a deal with the IMF in Q1 of 2023.

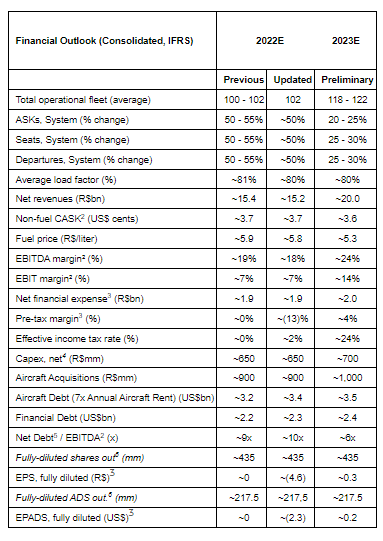

Gol Airlines publishes preliminary 2023 outlook - PRNewsWire

Extracts - The Company's revenue for 2023 is expected to increase around 32% compared to 2022. GOL estimates that its 2023 results will include savings of R$450 million from the re-incorporation of Smiles and R$400 million from the additional MAX aircraft in the fleet. In 2023, GOL expects to generate approximately R$4.5 billion of operating cash flow and neutral free cash flow after net capex and debt service. Total liquidity and available cash are expected to remain stable when compared to end of 2022.

LINKS / CHARTS*

Next week sees the main US Banks kick off earnings

Negative yielding debt vanishes - BofA chart

Fed’s Bullard delivered a presentation titled “The Prospect for Disinflation in 2023”

2023 European Private Credit Outlook: Direct lenders retain optimism | PitchBook

2023 US Private Credit Outlook: More market share, higher yield. But more defaults, too | PitchBook

Great podcast on EM Debt from the founder of Gramercy - Masters in Business