5 May 2023 Global Credit wrap

Pref ETFs weak, US Jobs strong, US Homebuilders ATHs, RE financing, Travel & Leisure (esp. Cinemas) strength. Surprise hike in Malaysia, Apollo acquisitions, interesting ratings changes...

*TLDR*

NOTABLE MOVES

Govvies - The 1 month US T-bill yield widened out more than 100bps over the week

Credit - Preference share ETFs posting losses of more than 5% on Regional Bank weakness. Credit spreads across all major indices widened.

Equities & Vol - Vix Index went above 21 before closing with a 17 handle. Strength in some Luxury Autos (BMW 52w high) and some Housebuilders hitting ATHs (Pulte/DR Horton). Some cyclicals weaker (e.g. United Rentals oversold).

MACRO

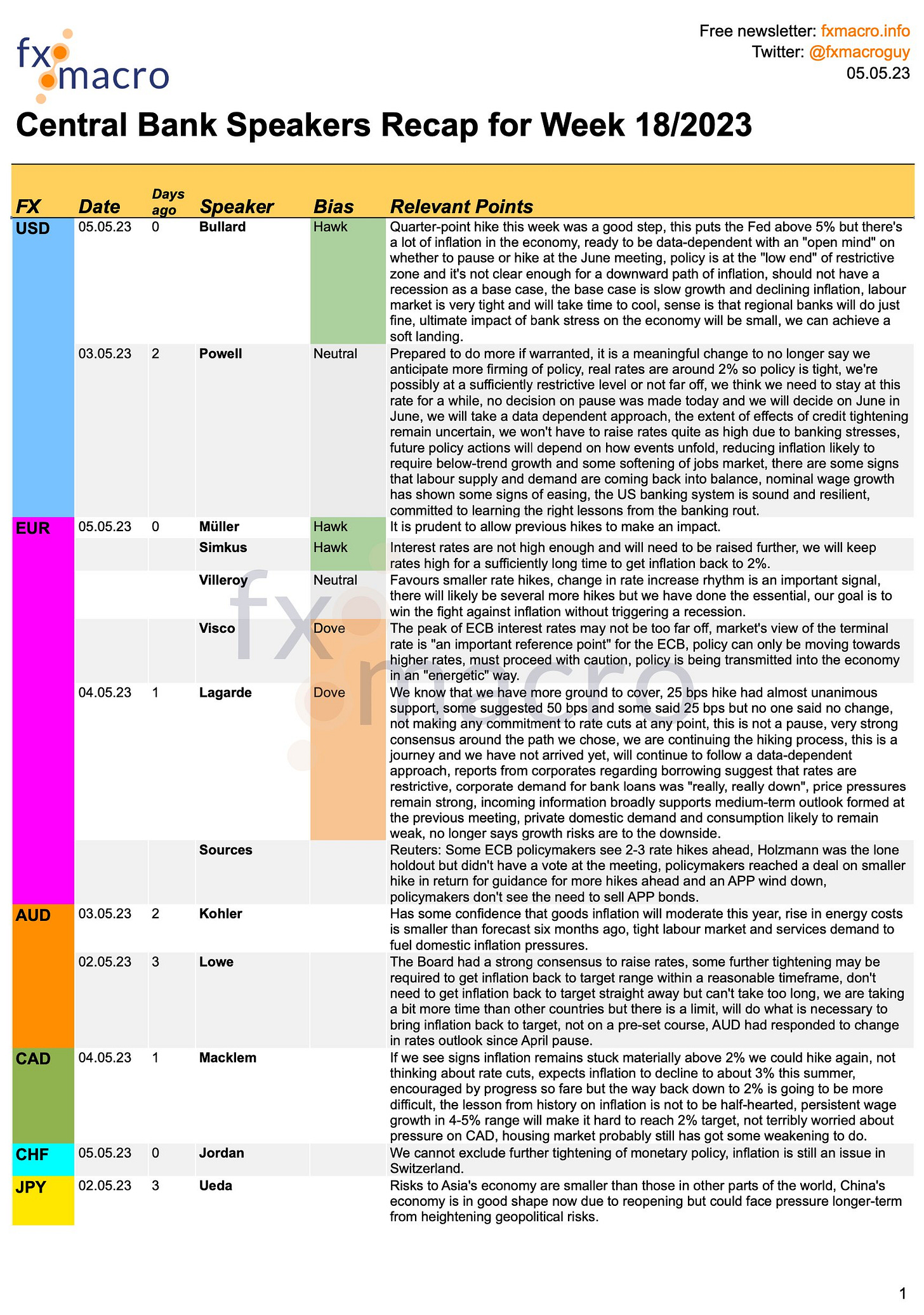

Central Banker speaker summary from FXMacro

Fed pushes interest rates above 5% for first time since 2007

ECB hikes rates by 25bp, to the highest level since 2008

Euro area banks tightened lending standards more than expected

RBA unexpectedly hikes rates by 25 bps, says inflation still too high

European PMIs slight miss but UK PMIs come in stronger

German Factory orders plunged most outside of the pandemic

US 4 & 8 week T-Bills issued at highest ever yields

US Jobs Data Recap - Data is still coming in too strong to justify cuts

Corporate Jobs - Hiring/firing highlights

US restaurants finally get labor relief with more workers seeking jobs

UK Tory party rumored to want to bring Housing “Help to Buy” scheme back

…Problem is that Tories lost a lot of seats in latest local election

INFLATION

Falling inflation:

Euro zone headline inflation picks up but core unexpectedly slows in April

Swiss April CPI and Core CPI came in light of expectations

UK Shop Price Inflation Cools for First Time in 2023, BRC

Indonesia’s Inflation Eases to 11-Month Low in April

Thai Core CPI comes in lighter than expected

Sri Lanka's key inflation rate eased to 35.3% in April from 50.3% in March

Turkish Inflation Is Back Under 50% for First Time in Over Year

Flat or rising inflation:

South Korea Apr CPI rises 0.2% in line with expectations

Taiwan April CPI rose 2.35% Y/y; Est. +2.2%

Weak Yen Pushes Japan Inflation Expectations to Four-Month High

Dallas Fed says Inflation stopped rising but it’s barely coming down

IG

IG Corporate Issuance - $30bn priced in $USD last week

Maersk signals weaker results for rest of 2023

Vodafone, CK Hutchison set to unveil UK mobile tie-up soon

Autos and Auto-parts firms report decent updates

Other IG snippets (Starbucks, Aercap)

HY & Lev Loans

US HY issuance in May 2023 to date exceeds whole of May 2022 issuance

Carl Icahn’s IEP 2029 Bonds trade down ~10pts on Hindenburg short, then stage recovery

Ford Q1 2023 Results

Cinemas Recap (Cinemark shares +90% YTD, IMAX hit new 52w high)

Travel & Leisure Sector strength in earnings from IAG, RCL, Marriott, IHG, Ryanair, Lufthansa.

Apollo potential bid for SAS Airlines

FINS

NAB and Lloyds Bank shares trade down on “peak margin” narrative

Strength in Italian and Greek names (Unicredit, Piraeus).

Lincoln Financial Announces $28 Bn Reinsurance Transaction With Fortitude Re

Regional Banks - *Ran out of time to write stuff on moves/news in this sector*

REAL ESTATE

Bond and Bank Debt deals for US and European Real Estate firms in Green Format

Vonovia sold five properties to CBRE Inv Mgmt for >$600m

Derwent: London property investment trust credits ‘busy’ West-End and return to the office for uptake in leases

Great Portland Estates acquires two properties in Central London

Defaults Roil L.A. Office Owner

EM

Weaker than expected China eco data in April…

…But China’s holiday spending exceeds pre-pandemic levels for the first time

S&P Global Thailand MFG PMI Rises to Record high of 60.4

India's Go First Airways files for bankruptcy

Suriname reaches debt restructuring deal with bondholders

Sri Lanka Sovereign: creditors to discuss debt restructuring on Tuesday & more

Positive IMF headlines for Kenya and Tunisia pushed up bond prices

BCB maintained the Selic rate at 13.75% for 6th straight meeting

Malaysia central bank may hit pause after surprise rate hike

Cemex - consolidated leverage ratio down to 2.62x at Q1 2023

Middle East’s Biggest Port Prompts Rare Private Debt Deal

RATINGS

Rising Stars: Verallia. Leonardo

Fallen Angels: SBB

Upgrades: Las Vegas, Mercedes Benz, Publicis, Bank of America, Bank of Georgia, TBC Bank (Georgia), Greene King, Bombardier, BG Energy, El Salvador

Downgrades: Egypt, Canadian National Railway, Casino

BUYSIDE / TRADING

Apollo’s been busy last few weeks (bidding for companies)

Blackrock Chart - “Yield is back”

MarketAxess Volume Statistics come in a bit light for April 2023

1Q2023 BNP FICC Trading was +9% YoY

LINKS

Torsten Slok, Apollo | What Is Back to Normal After Covid?

Milken Institute Credit Outlook Video featuring some big names in Credit

*MOVES*

GOVT BONDS

UST - Biggest moves here in T-Bills. The 1 month bill yield widened out more than 100bps over the week, and the 2 and 3 month bills widened around 20bps each. The 5%+ handle may attract buyers unfazed by the debt ceiling issues.

CREDIT

BOND ETF price moves between 28th Apr and 5th May: Laggards during the week were prefs, duration, IG Corps, HY, Fallen Angels, Index Linked Gilts. Pref ETFs were dragged down by Regional Bank Prefs performance. Highlighted moves: PFFD -5.6%, VCLT -2.0%, INXG-2.0%, TLT-1.5%, ANGL-1.2%.

Stronger performers over the week were: Interest rate Vol, Inverse longer dated UST, Asia, EM Local. Highlighted moves: IVOL+3.4%, TMV+3.2%, 2821 HK+1.0%, EMLC+0.8%.

Credit Spreads moves between 8th May and 1st May: In CDS, widening bias with Xover pushing to +450, EU Sub Fins +10bps wider to 197bps, CDX HY +18bps to +495bps. Similar widening bias occurred in cash credit spreads.

FX

EUR lowest vs GBP since December (Thanks davidbelle)

JPY lowest vs EUR in 15 years

EQUITIES + VOLATILTY

Vix Index went above 21 before closing with a 17 handle to end the week post NFP

Notable positive moves on stocks:

BMW Hits 52-Week High at 104.50 Euros

Inditex Hits 52-Week High at 31.60 Euros (owner of Zara stores)

Green Brick Surges to Highest Since 2010 on Best 1Q in History (stock was +23% on 4th May). Follows Beazer Homes ($BZH) which was up 24% on last day of April.

US Homebuilders DR Horton and Pulte hit ATH on Fed Pause chatter - BBG

Notable negative moves on stocks:

United Rentals RSI Oversold

Hilton Grand Vacations Shares Down Most in About Six Months

*MACRO*

Central Banker speaker summary from FXMacro

Click here for the original post: https://twitter.com/fxmacroguy/status/1654569365780705280

Fed pushes interest rates above 5% for first time since 2007 - Yahoo Finance

ECB hikes rates by 25bp, to the highest level since 2008

Extract from Fredrik Ducrozet: Meanwhile the ECB expects to discontinue the reinvestments under the APP as of July 2023 (up from €15bn monthly QT in Q2). APP redemptions will average €27bn per month between July-23 and Apr-24. This rate hike cycle is the fastest in the history of the ECB, second only to Bundesbank tightening cycles in the 70s and the 80s.

Euro area banks tightened lending standards more than expected

Source: https://twitter.com/fkronawitter1/status/1653311190477488129

RBA unexpectedly hikes rates by 25 bps, says inflation still too high - Yahoo Finance

Extract - The Reserve Bank of Australia unexpectedly hiked interest rates on Tuesday and said that more monetary policy tightening may still be in order as the bank moves to curb stubborn inflation in the country. The RBA hiked its cash target rate by 25 basis points to 3.85%, ducking market expectations that it would keep the rate at 3.6% after pausing in April.

European PMIs slight miss but UK PMIs come in stronger

EZ roundup by Sharecast- Economic activity in the single currency bloc accelerated by less than previously thought, the results of a closely followed survey revealed.

The S&P Global HCOB Composite Purchasing Managers' Index rose from a reading of 53.7 for March to 54.1 in April - an 11-month high.

That was less than a preliminary reading of 54.4 published in mid-April.

On the positive side of things, employment growth in the euro area hit a nearly one-year high, even as price pressures continued to moderate.

Input price inflation, while "historically sharp", slowed to a 26-month low, the survey compiler said.

However, the expansion of the economy was solely down to activity in services, as factory output shrank for the first time since January alongside falls in manufacturing order books.

UK via BBG - The final estimate of the UK composite purchasing managers’ index pointed to the UK private sector growing at its fastest pace in a year. It rose further into growth territory to a reading of 54.9 in April, up sharply from the first estimate of 53.9.

Side note: UK mortgage approvals bouncing back to a five-month high, which is discussed in the BBG article on the UK.

German Factory orders plunged most outside of the pandemic - Oliver Rakau

Oxford Economics explains why in the thread.

4 & 8 week T-Bills issued at highest ever yields - BBG

Thursday’s Treasury bill auctions provide the latest example. As documented by Bloomberg’s Alex Harris, the Treasury Department sold $50 billion of four-week bills at 5.84% and $45 billion for eight-week bills at 5.4% — the highest yields ever for both benchmarks.

US Jobs Data Recap - Data is still coming in too high to justify cuts

The week ended on a hawkish tone due to a very strong print on NFP after what was a dovish start to the week with US JOLTS data.

—> JOLTS Job openings fell to 9.59 million in March, less than the 9.7 million economists expected. This data was considered dovish due to a near record decline in job openings YoY.

→ US April ADP showed jobs increased by 296k vs which is above the expected 148k and March's addition of 142k.

→ US NFP for April 2023 showed:

The unemployment rate has fallen again to 3.4% - the lowest rate since 1969

Wage growth picked up to 0.5% on a month-on-month basis, the fastest pace since last summer

13th consecutive months of beats on NFP data expectations

28 consecutive months of jobs growth in the US

Prime-age labor force participation rate and employment-to-population ratio rose in April. The last time the prime-age LFPR was this high was March 2008

Employment rates for women and African Americans at record highs

However, last month's NFP number got revised down from 236k to 165k

Sources: @nick_bunker, @NickTimiraos , @KathyJones

Corporate Jobs - Hiring/firing highlights:

Morgan Stanley Plans 3,000 More Job Cuts (BBG)

Broadcaster Sky is reportedly lining up hundreds of job cuts as it grapples with a shift to streaming (Daily Mail)

Shopify to reduce workforce by 20%, sells logistics business to Flexport for 13% equity (2320 people)

Qualcomm plans to lay off 5% of its workforce amidst economic uncertainty (2550 people)

Cognizant says revenue will decline in 2023, to lay off 3500 employees

Unity Conducts Its Third and Largest Round of Layoffs in a Year (600 people)

SAS to close some international offices, making selective hires in prepping for stock offering (250 people)

Temasek-backed healthtech startup PharmEasy latest to lay off employees (1200 people)

Volvo Cars to axe 1,300 jobs across Sweden to cut costs

Sources: https://www.trueup.io/layoffs / BBG

AI related impacts on Job Market

IBM plans to use artificial intelligence to replace 7,800 jobs over the next five years, CEO Arvind Krishna said in an interview.

Chegg shares fell ~ 50% in a day because its customers are said to be using ChatGPT instead of paying for its study products

US restaurants finally get labor relief with more workers seeking jobs | RTRS

A welcome development here as Restaurants were able to hire workers and hold on to them in the US, extract:

More job seekers are filling out applications to sling Big Macs at McDonald's, and Starbucks baristas are staying in their jobs longer, as a cooling economy sends workers back to low-wage restaurant gigs and keeps them there.

UK Mortgage Brokers react to rumour of “Help to Buy” Scheme coming back - FinReporter

Extract -Over the weekend it emerged that the government is considering restoring the Help To Buy scheme ahead of the next General Election. The Times reported that Sunak is drawing up plans to boost support for first-time home buyers by bringing back the Help to Buy Equity Loan scheme. Newspage asked property experts and brokers for their thoughts…

…Problem is that Tories lost a lot of seats in latest local election - Sky News

There were 8,000 seats up for grabs in the 2023 local elections that took place on Thursday.

Around 70% of the English electorate was eligible to cast a ballot, and it gave us a real indication of what we might see at the next general election.

Here are the performance benchmarks - and how each party actually did:

*Conservatives*

The Conservatives lost 1,064 seats - so it was worse than a "very bad night". The Conservatives lost over a third of the seats they were defending.

The government is trying to sell it as mid-term blues, and culture secretary Lucy Frazer claimed that Tories are "gaining the trust" of the British people, and that Rishi Sunak is "getting the country back on track."

But our political editor, Beth Rigby, discovered that 1,000 losses as worst case scenario was just their PR spin - 700 losses was internally viewed as the worst case.

So to spin these results as any other than catastrophic for the Conservatives would be a very difficult sell.

*Labour*

Labour gained 528 seats and are now the largest party in local government.

Sir Keir Starmer and his shadow cabinet members have claimed that this shows that they are "on course" to form a majority government after the next general election.

There is no doubt that it was a very good night for Labour, particularly considering how their support had cratered at the last general election.

That said, the Sky News projection by Professor Michael Thrasher shows that, based on these results, Labour would get 298 seats at a general election - its highest since the winning 2005 general election - but 28 short of a majority.

So it was certainly Labour's most successful night in a long time, but is it enough to get them into government?

*INFLATION*

Euro zone headline inflation picks up but core unexpectedly slows in April - IG

UK Shop Price Inflation Cools for First Time in 2023, BRC - BBG

Indonesia’s Inflation Eases to 11-Month Low in April: BPS

Sri Lanka's key inflation rate eased to 35.3% in April from 50.3% in March

Swiss April CPI and Core CPI came in light of expectations

South Korea Apr CPI rises 0.2% in line with expectations

Turkish Inflation Is Back Under 50% for First Time in Over Year

Thai Core CPI comes in lighter than expected

Taiwan April CPI rose 2.35% Y/y; Est. +2.2%

Weak Yen Pushes Japan Inflation Expectations to Four-Month High

Dallas Fed says Inflation stopped rising but it’s barely coming down - Authers

*IG*

IG Corporate Issuance - $30bn priced in $ last week

Massive day of issuance last Monday ($23bn) and then a flurry of issuance post NFP in the US IG market. Overall $30.5bn was priced across a range of issuers that included Glencore, Verizon (green), Meta Platforms, Comcast, Equifax, Boston Properties (Green). Meanwhile in Europe, issuance was more muted (~€6bn by end of Thursday) with issuers like Kraft Heinz in Euros. At the time of writing, a whole queue of issuers are looking to issue debt in the states post NFP led by Apple with a $5bn multi tranche.

Maersk signals weaker results for rest of 2023 - RTRS

Yet more evidence of the handover from the “goods economy” to the “services economy.”

Extracts - A.P. Moller-Maersk A/S, a bellwether for global trade, signaled weaker results for the rest of 2023 after reporting first-quarter operating profit that tumbled by more than half with transport volumes slowing and freight rates plunging.

Maersk, which transports close to one-fifth of the world’s containers, warned that the first three months of 2023 “will be best quarter of the financial year,” the Copenhagen-based company said in a statement on Thursday. It expects global economic growth to remain “weak” at around 2% this year.

Vodafone, CK Hutchison set to unveil UK mobile tie-up soon - RTRS

Interesting potential deal in the UK Telco space which has a high chance of being challenged by competition authorities:

Vodafone and CK Hutchison are close to agreeing a merger of their UK telecoms businesses, two sources said, in an expected 15 billion pounds ($19 billion) deal that would create the country's biggest mobile operator.

The deal would value the equity of the combined group at about 9 billion pounds, with roughly 6 billion pounds of debt, the Financial Times reported. The valuation is roughly in line with peers.

Negotiations, which have been protracted, are expected to be completed this month, one of the sources familiar with the matter said. The second source said an announcement could come "very soon".

Hutchison is scheduled to update on first quarter trading on May 9, while Vodafone publishes it full-year results on May 16.

The tie-up - with a planned ownership split of 51% Vodafone and 49% Hutchison, the Hong-Kong telecoms-to-ports conglomerate part-owned by billionaire Li Ka-shing - is likely to face intense regulatory scrutiny.

Autos and Autoparts firms report decent updates

BMW, VW and Infineon were just some of the firms which reported better than expected numbers this week for Q1.

BMW's cars business gets Q1 earnings boost from price hikes - AutoNews

VW makes solid start to the year - VW

“Infineon concludes a significantly better-than-expected quarter and again raises its outlook for the current fiscal year” - Infineon

Other IG snippets

Starbucks shares had a 9% drawdown during the week as company does not upgrade FY guidance despite strong Q1 beat - MarketWatch

Aercap Q1 2023 debt highlights

Adjusted leverage ratio of 2.56x as of March 31, 2023, below target of 2.7x

Secured debt-to-total assets ratio of ~14%

Next 12 months’ sources-to-uses coverage of 1.3x, with ~$18 billion sources of liquidity

Comment from earnings call (CFO): “So we did a fair amount of funding in the first quarter, all of that away from the bond market. And as I said, just given the funding that we’ve done and the performance to date and our outlook, we’re looking at around $4 billion to $5 billion for the remainder of the year. Most of that is going to be bonds and we would expect to do that kind of periodically throughout the year. But we’re still going to go to other markets as well, but I expect most of that will be in the bond market. And look, as you’ve seen issuance recently from some of the other aircraft lessors, so the market’s obviously open and we would expect to do that funding.”

*HY*

US HY issuance in May 2023 to date exceeds whole of May 2022 issuance

$5.3bn priced in the first week of May. BBG reported that this amount already exceeds $4.2 bn in all of May 2022. Issuers that came to market included Equipmentshare.com (yield of 10.5% for B3/B- rated credit) and Emerson Climate which priced at 6.625% for $2.275bn of debt, where UoP was LBO. There was also a Euro portion to the Emerson deal. Interesting that Emerson ended up issuing in the public HY market instead of the private credit market. Other interesting issuers included a $1bn issue from Private Jet Operator Vistajet.

Carl Icahns IEP 2029 Bonds trade down ~10pts on Hindenburg, then stage recovery

Bonds recovered around 2pts of the losses after falling~10pts. Stock closed up 27% higher on 5th May after dividend announcement.

Ford Q1 2023 Results - Investor Presentation

Summary of Q1, no comments were made re credit ratings in the presentation or on the conference call. Note that Fitch and S&P have Ford on positive outlook which could send it back into IG index if it is upgraded, there is no guarantee of an upgrade despite the positive outlook.

Cash and Debt highlights:

Commentary from Just Auto:

Ford has announced first quarter revenues up 20% on last year at $41.5bn. The company also posted $1.8bn net income for the quarter which compares with a net loss of $3.1bn for the same quarter last year.

Ford broke out its results by major operating unit and its staple ‘Ford Blue’ unit (where its high volume ICE passenger vehicles sit) posted first quarter revenue of $25.1bn, EBIT of $2.6bn and an EBIT margin of 10.4%, all up sharply from a year ago. Strong demand for high margin trucks in North America continues to benefit Ford’s bottom line.

Ford ‘Model e’ which is where the EV business sits and – according to Ford – operates like a startup, posted Q1 revenues down 27% alongside an EBIT loss of $722m.

Ford is maintaining the full-year 2023 performance expectations that the company first articulated in early February: for adjusted EBIT of $9bn to $11bn and adjusted free cash flow of about $6bn.

Additionally, the company reaffirmed 2023 segment-level EBIT expectations: about $7 billion for Ford Blue, up modestly from last year; a full-year loss of about $3 billion for Ford Model e; and EBIT approaching $6 billion for Ford Pro, which would be nearly twice its 2022 earnings.

Ford said its operating targets were subject to:

Headwinds including economic uncertainty around the globe; higher industrywide customer incentives, as vehicle supply-and-demand rebalances; a lower profit from Ford Credit; lower past service pension income; exchange rates; and growth-related investments, e.g., in customer experience, connected services and capital expenditures, and

Tailwinds such as supply chain improvements and higher industry volumes; launch of the all-new Super Duty truck; and lower costs of goods sold, including for materials and commodities.

Cinemas Recap

Pretty amazing turnaround in some of the firms in this sector, i.e.

Cineworld set to exit bankruptcy

Cinemark shares +90% YTD

IMAX shares hit a new 52 week high on 28th April

Torsten Slok commented in his slide deck (see “LINKS” section below) that Theatres and Broadway shows are “back to normal.”

—> Cineworld gets US court approval to raise $2.26bn after bankruptcy - RTRS

Extract - Cineworld is aiming to emerge from Chapter 11 bankruptcy in the first half of 2023, with a proposal to cut $4.53 billion in debt, wipe out existing shareholders and transfer ownership of the company to its lenders. U.S. Bankruptcy Judge Marvin Isgur at a hearing in Houston approved Cineworld's plan to fund its post-bankruptcy operations with a new $1.46 billion loan and the sale of $800 million in new equity shares. Cineworld is scheduled to seek final court approval of its bankruptcy restructuring on June 12.

—> Cinemark 1Q beats on Revenue and Earnings | MarketWatch

—> AMC Saw Q1 Sales Jump, Losses Narrow; CEO Says Ability To Raise Capital Will Be “Crucial Component” Of Success | Deadline

Travel & Leisure Recap - Still strength here

Airline IAG raised its FY earnings outlook and reported a surprise Q1 profit

Cruiseliner RCL Q1 consensus estimates ahead of expectations

IHG saw "Excellent rebound in demand ... since the lifting of travel restrictions" - Librarian Capital

Marriot beat on the top and bottom line and raised its FY23 guidance -Yahoo

Ryanair Holdings April Passenger Traffic Grew 13% vs Apr 2022

Lufthansa saw strong passenger revenue growth (+73% YoY) but cargo revenue saw 30% drop YoY, at end of March 2023, the company had liquidity of €10.5 bn

Apollo seeking approval to take majority stake in distressed Airline SAS - RTRS

*FINANCIALS*

Financials stock moves for those that reported

Quick observations:

Greek Bank Piraeus outperforming on good figures ahead of election on 21 May

Unicredit outperforming on beat & raise

HSBC re-instated quarterly dividend

Lloyds and NAB shares traded down on “peak” margin narrative following figs.

VMUK traded down on higher than expected provisions (although still very small)

Source: BBG

NAB closes the week down nearly 8% on peak margin narrative - RTRS

Extract: National Australia Bank Ltd, the country's No. 2 lender, fell short of analyst forecasts in half-year profit released on Thursday and took a hit to its share price after warning that the windfall from rising interest rates had peaked.

Profit at the bank, also Australia's biggest business lender, jumped 17% to A$4.07 billion ($2.72 billion) in the half year to March as higher rates allowed banks to widen their margins, but fell short of the A$4.15 billion average analyst forecast, according to Refinitiv.

The company's net interest margin, a closely watched measure that shows the amount banks take in interest payments minus operating costs, also grew from a year earlier but shrank in the March 2023 quarter from the prior quarter, hit by fierce competition for refinancing loans.

Lincoln Financial Announces $28 Bn Reinsurance Transaction With Fortitude Re - BizWire

Extract of statement: “Today’s transaction with Fortitude Re marks significant progress in our efforts to reduce our balance sheet risk, improve our capital position and increase ongoing free cash flow,” said Ellen Cooper, president and CEO of Lincoln Financial Group. “With our leadership team in place, we are rapidly executing on actions to fortify our balance sheet, and we remain committed to further enhancing the pace of capital generation and long-term profitable growth.”

*REAL ESTATE*

Bond and Bank Debt deals for US and European Real Estate firms in Green Format

a) Boston Properties (BXP) raised $750m 10Y Green Bonds at +320 bps ~ $6.5% yield.

BXP is an $8bn market cap US Office REIT rated Baa1/BBB+.

b) Citycon Signed Total EUR 650 Million Committed Syndicated Credit Facility

Extract of article: Citycon Oyj has signed total EUR 650 million new committed syndicated multicurrency credit facility, to replace and extend its existing EUR 500 million facilities maturing in May 2024. The new facility consists of EUR 400 million revolving credit facility and a EUR 250 million term loan, and is fully secured by Iso Omena and four Norwegian assets. The credit facilities can be used for general corporate purposes. The maturity of both new facilities is 3 years, with one year extension option (3+1 years). The margin of the facilities is determined based on Citycon’s credit rating. Additionally, the margin is linked to achieving Citycon’s key sustainability targets.

Vonovia sold five properties to CBRE Inv Mgmt for >$600m - Yahoo

This follows the deal with Apollo in the week earlier. Increasing transaction activity gives more “real” evidence for RE companies to base valuations on.

Extract - Vonovia sold five properties to CBRE Investment Management for about 560 million euros ($620.4 million) on Thursday, as high interest rates and the surging cost of construction and energy weigh on property values. Two of the five properties, with a total 1,350 residential units, are in the final stages of construction, with completion expected by the end of August.

Derwent: London property investment trust credits ‘busy’ West-End and return to the office for uptake in leases - CityAM / @PeterProperty

Derwent’s update shows how location and quality of assets can make a difference in the Real Estate sector.

@PeterProperty - Derwent London leased 190,000 sq ft of space in Q1 for annual rents of £17.1m an average of 6.6% over the estimated rent. Boss, Paul Williams: “the West End, is busy and people are back in the office. Occupier demand continues to favour amenity-rich…sustainable space.”

City AM - Derwent, the London property investment trust, has told investors that London and the West-End is “busy” as a return to offices and shopping signal better times for the capital.

In its first quarter trading update, the FTSE 250 real estate firm revealed a 6.6 per cent uptake in the number of leases secured which totalled £17.1m. The group was bolstered by a flagship letting to fashion brand Uniqlo on Oxford Street and a new office space for consultant company Buro Happold. As demand in the capital heated up, Derwent said vacancy rates on its properties shrunk to 4.9 per cent during the quarter compared to 6.4 per cent in December 2022.

“London, particularly the West End, is busy and people are back in the office,”“Paul Williams, chief executive of Derwent London, said. He continued: “Occupier demand continues to favour amenity-rich, well designed and sustainable space, evidenced by a strong Q1 with £17.1m of new lettings across our portfolio on average 6.6 per cent above ERV.”

Great Portland Estates announces two central London acquisitions for £53 m - Link

The two properties (one in Soho and one in Bermondsey) will be additions to GPE’s Flex Office Portfolio.

Defaults Roil L.A. Office Owner - WSJ

Extract - (Dow Jones) -- Troubles at the Brookfield-linked landlord show some bets are unraveling

A major Los Angeles office owner operated by Brookfield Asset Management is struggling to make mortgage payments as vacancies and rising interest rates disrupt the city's commercial real-estate market.

The company, known as Brookfield DTLA Fund Office Trust Investor Inc., owns six Los Angeles office buildings and a retail center.

Five of the office buildings face the risk of foreclosure, according to its public filings, and at least two of its mortgages are in default.

The company on April 21 filed to delist from the New York Stock Exchange after its market capitalization fell below $15 million. The company's shares are down 87% since the start of the year to less than one dollar.

*EM*

Weaker than expected China eco data in April

Manufacturing PMI 49.2 in April vs 51.9 in March

Non-manufacturing PMI 56.4 vs 58.2 in March

China April Caixin manufacturing PMI at 49.5 vs 50.0 Est

China’s holiday spending exceeds pre-pandemic levels for the first time - CNN

Extract - Holiday spending during China’s Golden Week has surged past pre-pandemic levels for the first time in three years, in a sign the country’s travelers have fully emerged from the depths of Covid-related restrictions and are eager to live large to make up for lost time.

For many, this May Day period, spanning five days from April 29 to May 3, was the first chance to go on vacation in more than three years, without having to worry about catching Covid. During the Chinese New Year holiday in January, many people stayed home because of fears of infection during China’s “exit wave” when an unknown number of people caught the disease.

Travelers made 274 million trips within mainland China during the holiday, up 71% from a year ago and 19% higher than 2019, according to data from the Ministry of Culture and Tourism on Wednesday. Revenue from domestic tourism reached 148 billion yuan ($21 billion), up 129% from a year earlier and also slightly higher than 2019.

S&P Global Thailand MFG PMI Rises to Record high of 60.4 - S&P

Trevor Balchin, Economics Director at S&P Global Market Intelligence, said:

"The latest S&P Global Thailand Manufacturing PMI indicated that the manufacturing sector gained significant momentum in April, following a solid Q1.

The headline PMI surged to a new record high, as did the indices for output, new orders, purchasing and input stocks. The outlook brightened as well with firms

expecting a wider improvement in economic and political conditions in the coming months. "The latest data also signalled improving supply chains and an easing in price pressures, although the latter remain stronger than pre-pandemic trends."

India's Go First Airways files for bankruptcy - RTRS

Indian budget carrier Go Airlines (India) Ltd, which filed for bankruptcy on Tuesday, owes financial creditors 65.21 billion rupees ($798 million), its bankruptcy filing showed. The company, which operates the Go First airline, had not defaulted on any of these dues as of April 30, it said in the filing, which was seen by Reuters. "However, considering the present financial situation of the corporate applicant, defaults to financial creditors would be imminent," the filing said.

Suriname reaches debt restructuring deal with bondholders - RTRS

Extracts - Suriname reached an agreement in principle with its Eurobond creditor committee for the restructuring of its debt, the government said on Wednesday.

The deal to restructure Suriname's two outstanding dollar-denominated bonds includes a single, $650 million 10-year bond with a 7.95% interest rate, amounting to a 25% "haircut on the total recognized claims," the government said in a statement.

Reuters first reported that both parties had reached a deal on debt restructuring.

"Of the 7.95% interest rate, 4.95% is required to be paid off in 2024 and 2025, with the remainder added to the principal," the government said.

A value recovery instrument linked to future oil revenues and with an end date of Dec. 31, 2050, is part of the deal.

Sri Lanka Sovereign Headline Recap

SL Govt mulls US$ 6-7 bn assistance from multilaterals: FinMin Sabry (Sunday Obs.)

Sri Lanka's creditors to discuss debt restructuring on Tuesday - Zaywa

Japanese Finance Minister welcomes coordinated debt restructuring process on SL - FT.LK

Central Bank suspends issuance of Treasury Bonds - Sunday Times

Banks Association says relieved by CBSL assurance on domestic debt optimisation - FT.LK

Positive IMF headlines for Kenya and Tunisia pushed up bond prices

Bond prices of both countries advanced on the following headlines:

a) Kenya. Extract of RTRS- IMF’s Georgieva ruled out the risk of Kenya slipping into default…despite acute pressure on its finances by rising debt repayment obligations. "Kenya is definitely not among them," she said, citing a sustainable debt load and solid hard currency reserves.

b) Tunisia. IMF Says 'Almost' Done Lining Up Financing for Tunisian Deal (BBG)

Brazilian Central Bank maintained the Selic rate at 13.75% for 6th straight meeting

Malaysia central bank may hit pause after surprise rate hike - RTRS

Malaysia's central bank unexpectedly raised its benchmark interest rate on Wednesday, as it looks to manage persistent inflation amid strong domestic demand.

Bank Negara Malaysia (BNM) lifted its overnight policy rate by 25 basis points to 3%, confounding economists expectations for an extended pause.

Some economists now see the move marking the end of the current tightening cycle as price pressures ease along with slowing global growth that will likely hurt the export-driven economy.

BNM had kept rates unchanged at its two previous meetings this year, as it sought to assess the impact of four consecutive hikes totalling 100 basis points in 2022.

The Southeast Asian economy has bounced back strongly from a pandemic-induced slump, with growth hitting a 22-year high of 8.7% in 2022, but slowing global demand has clouded the outlook for the exporter of oil, commodities and high tech goods.

Cemex - consolidated leverage ratio down to 2.62x at Q1 2023 - IR

Middle East’s Biggest Port Prompts Rare Private Debt Deal - BBG

Extracts: Pension manager Caisse de Dépôt et Placement du Québec financed its stake in a Dubai port with $900 million in private debt.

The debt will be primarily used to refinance bridge loans put in place to finance CDPQ’s 21.9% stake in the entity controlling Jebel Ali Port — the biggest in the Middle East — and two industrial zones, the people said.

The deal’s geography is notable in a private debt market typically dominated by US, European and Australian businesses. The transaction garnered as much as $1.5 billion in demand from institutional investors, the people said, which typically include insurance companies, pension funds and asset managers.

*RATINGS*

*SOV/MUNI*

Switzerland Affirmed at AAA by Fitch

Fitch Upgrades Las Vegas, NV's IDR to 'AA'; Outlook Stable

*FINS*

JPMorgan Affirmed at A1 by Moody's

Bank of America Upgraded to A1 by Moody’s, Outlook Stable

PacWest Bancorp Placed on Rating Watch Negative by Fitch

Fitch Upgrades Bank of Georgia to 'BB'; Outlook Stable

Fitch Upgrades TBC Bank JSC to 'BB'; Outlook Stable

Fitch Affirms Lincoln National Corp.'s Ratings; Outlook Negative

*HY*

Callon Petroleum May Be Raised by Moody's

S&P upgrades Verallia's credit rating from BB+ to BBB- with a positive outlook 5 May 2023

X-S&PGR Revises Nobian Holding 2 Outlook To Stable; Afrms At ‘B’

JetBlue Affirmed at BB- by Fitch

S&P Raises Bombardier Inc. Rtg To B From B-; Outlk Stable

Fitch Affirms Seagate at 'BB+'; Outlook Negative

S&P Affirms First Quantum Minerals' Ratings; Removed From CreditWatch Negative

S&PGR WeWork Downgraded To 'SD' On Distressed Exchange

Fitch Changes Tele Columbus' Outlook to Negative; Affirms 'B-' IDR

Fitch Affirms Mattel's IDR at BB+; Outlook Positive Post Move to Unsecured Cap Structure

Fitch Downgrades Casino to 'CCC-'; Places on RWN

Moody's assigns B3 rating to Vista Global's new $500 million senior unsecured notes; outlook changed to positive

*IG*

Aker BP Affirmed at BBB by Fitch

Fitch Revises Pinewood's Outlook to Negative; Affirms IDR at 'BBB-'; Secured Bonds at 'BBB'

Fitch Upgrades Greene King's Notes to 'BBB+', 'BBB', 'BBB-'

Fitch Affirms Shell at 'AA-'/Stable; Upgrades BG Energy Bonds to 'AA-'

S&P Downgrades Canadian National Railway On Shift to 'More Aggressive' Financial Policy

Imperial Brands Affirmed at BBB by Fitch

Leonardo Raised to Investment Grade by Moody's

Digital Realty Outlook to Negative by S&P; L-T Rating Affirmed

X-S&PGR Upgrades Publicis To 'BBB+'; Outlook StableX-

S&PGR Upgrades Mercedes-Benz Group To 'A'; Outlook Stable

X-S&PGR Places Arconic Ratings On CreditWatch Negative

HP Inc Affirmed at BBB+ by Fitch

S&PGR Downgrades SBB To 'BB+'; Outlook Negative

Meta Platforms Affirmed at AA- by S&P

Meta Platforms Affirmed at A1 by Moody's

*EM*

Fitch Upgrades El Salvador to CCC+ After Debt Exchange

Fitch Affirms BOAD at 'BBB'; Outlook Stable

Benin Affirmed at B+ by S&P

Fitch downgrades Egypt to B, neg outlook | First Fitch Downgrade Since 2013

*BUYSIDE*

Apollo’s been busy last few weeks

Blackrock - “Yield is back” - Weekly Mkt commentary

Nice chart from Blackrock in their weekly note published May 1st 2023:

*CREDIT TRADING*

MarketAxess Volume Statistics come in a bit light for April 2023 : Link

1Q2023 BNP FICC Trading was +9% YoY - BBG

*LINKS*

Torsten Slok, Apollo | What Is Back to Normal After Covid? - Apollo

“Back to normal”:

- Container freight rates/supply chains

- Movie theatres and Broadway shows

- Immigration

“Below 2019 levels”:

- Working from office

- Activities in downtown

- Labor force participation

“Above 2019 levels”

- Consumer service spending: Streaming, flights, and hotels

- Inflation, labor market, and rents

- Commodity and gas prices

Source: Octavian Adrian Tanase on Linkedin

Milken Institute Credit Outlook Video featuring some big names in Credit - Link

Moderator Michael Milken

Speakers:

Victor Khosla, Founder and Chief Investment Officer, Strategic Value Partners

Lee Kruter, Partner and Head of Performing Credit, GoldenTree Asset Management

Michael Patterson, Governing Partner, HPS Investment Partners

Anastasia Titarchuk, Chief Investment Officer, Deputy Comptroller, New York State

Anne Walsh, Chief Investment Officer, Guggenheim Partners Investment Management

@the_red_deer shared more good stuff in terms of slide decks here.

Source: Red Deer

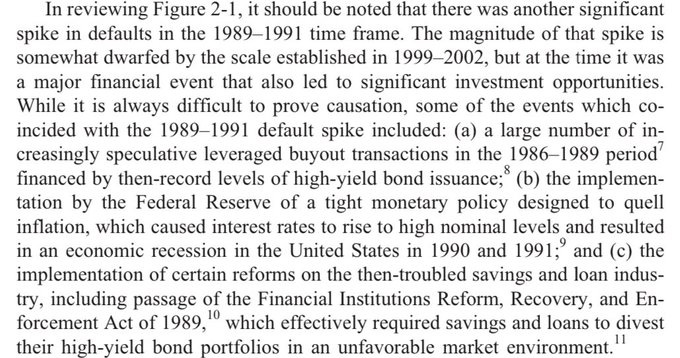

Could History Repeat?

Tweet from @8StringerBell8: “‘89-‘91 bankruptcy wave preceded by (i) three years of LBOs (ii) record bond issuance (iii) nominal tightening (iv) banking issues, and (v) mandated toxic asset book run-off.”

But this time is different.

https://twitter.com/8StringerBell8/status/1655001950352556035