31 March 2023 Global Credit Wrap

Fins bounce back, China consumption returning, Inflation measures falling, credit ratings upgrades, private credit loans to start trading?

*TLDR*

**There will be no weekly substack for the next 2 weeks due to Easter holidays.**

In the meantime please feel free to like, comment, share and re-tweet this Substack!

“SUPER-SKINNY” SUMMARY:

Jobs - Corporate earnings calls focusing more on job cuts than labour shortages

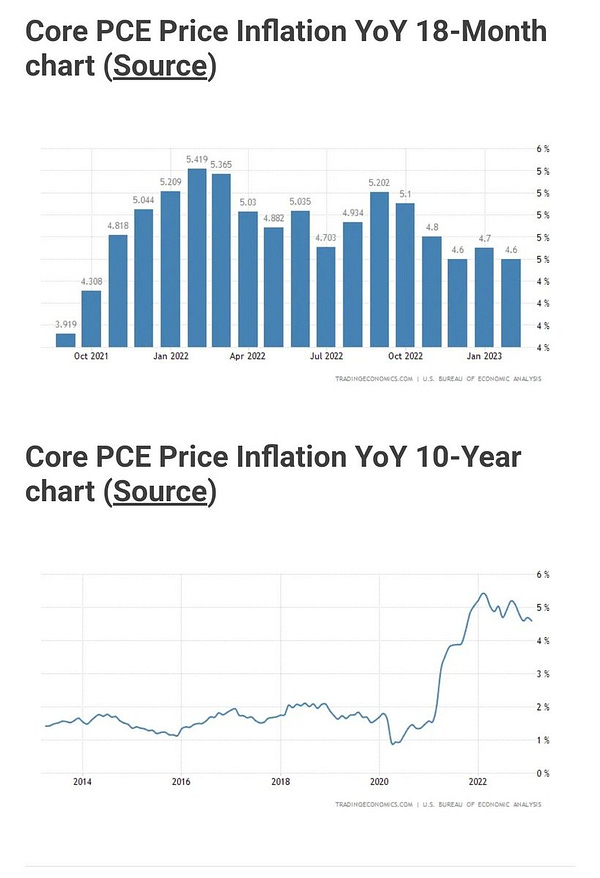

US Core PCE came in light, European inflation falling but UK remains sticky

Key funding markets resumed activity post CS/SVB i.e. IG, HY and FIG and ABS markets saw deals print with ABS deals from Ford and Avis actually being upsized.

AT1 Bond ETF +6.98% over 5 days as AT1 sector recovers, DB AT1 +10pts in last 2 days of week generically, brushing off some of the CDS-led concerns in prior week

EM local debt had an impressive Q1 posting a ~5% return. Note USD Index posted negative return in the quarter.

China non-manufacturing PMI hit 12 year high, suggests consumption is rebounding

Real Estate and Offices - lot of content this week in this substack.

Big banks looking at secondary trading of Private Credit loans

Credit Ratings - Some positivity here with 3 HY issuers being upgraded to IG and some blue-chip issuers like GM and United Airlines being upgraded

MACRO

Fed Reverse Repo facility use jumps to 2023 high

Credit tightening at US regional banks would limit Fed's historic rate push: S&P

BBG Chief Economist observes that there are now more talks of job cuts than labour shortages from S&P 500 earnings calls

More job cut announcements this week from likes of Disney, Vodafone, Warner Music, EA, Netflix and Roku

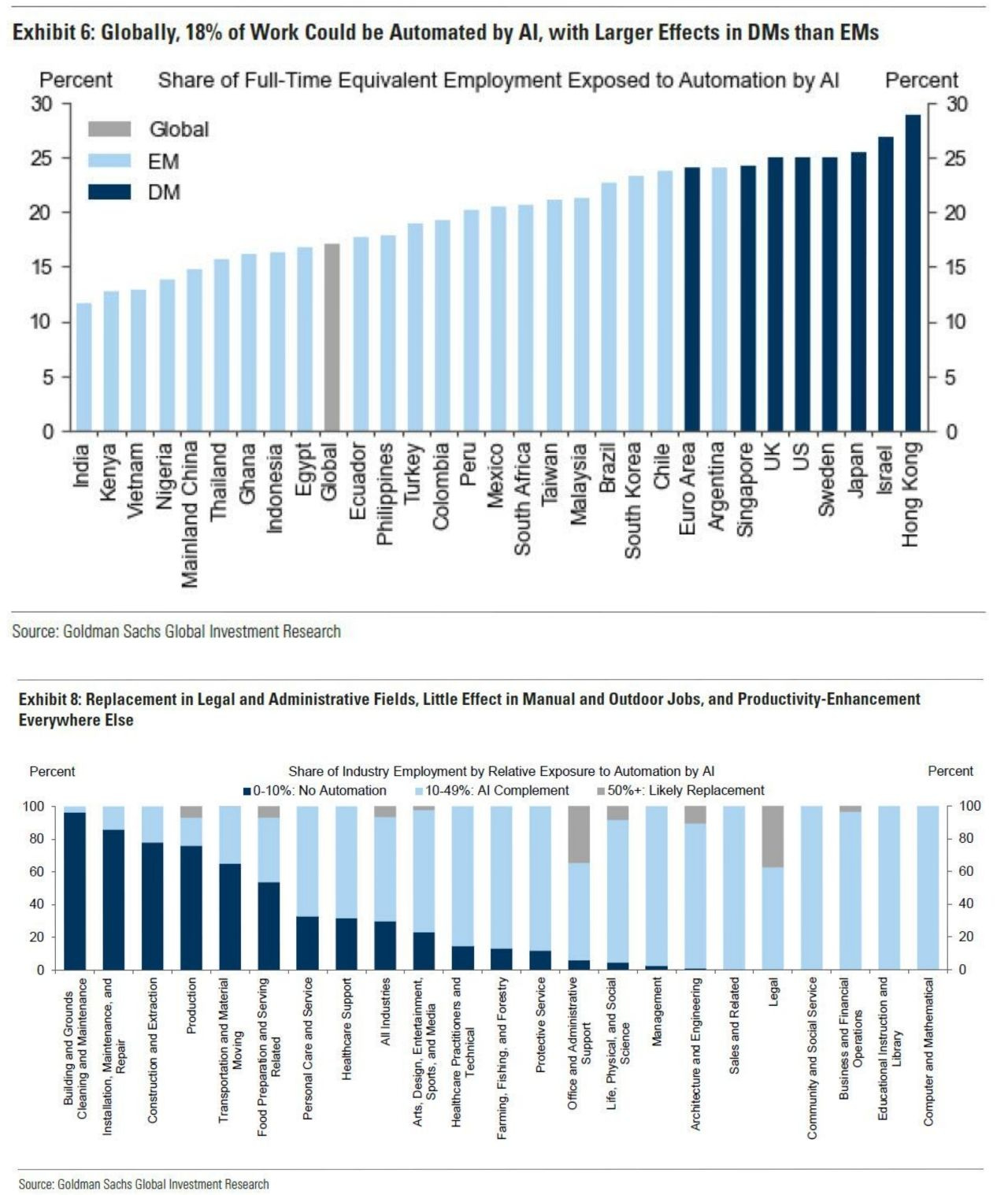

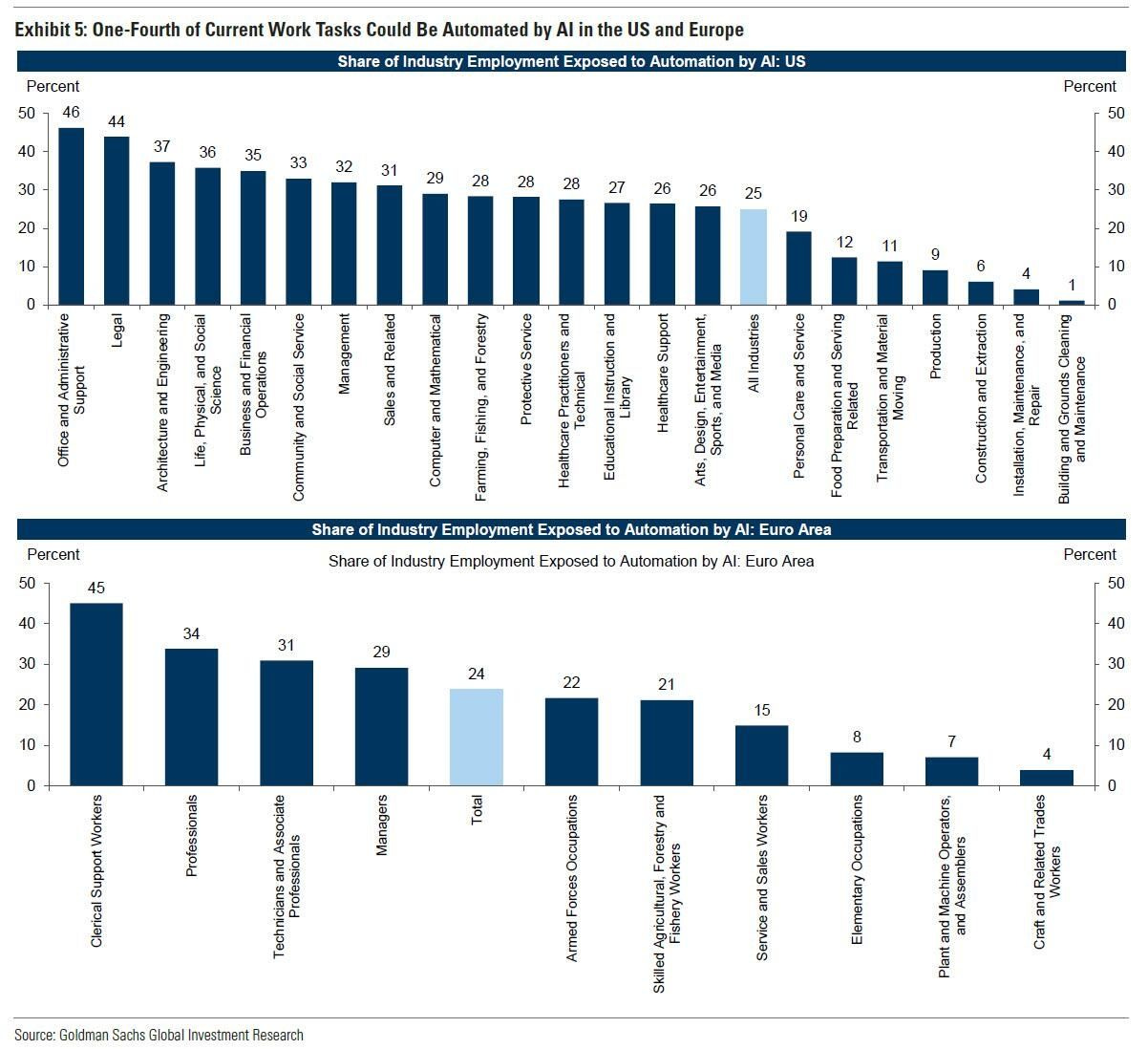

GS - Some interesting charts on impact of AI on the workforce

INFLATION

US Core PCE data came in lower than expected

Fed Funds rate is above the latest Core PCE reading

YoY % increase in US Monthly Rent prices has moved down to 2.7%, lowest since April 2021, this should filter into Shelter CPI eventually which could see sharp declines in overall US CPI - Charlie Billelo

Slowing US M2 Money supply for Feb-23, suggests deflation is coming

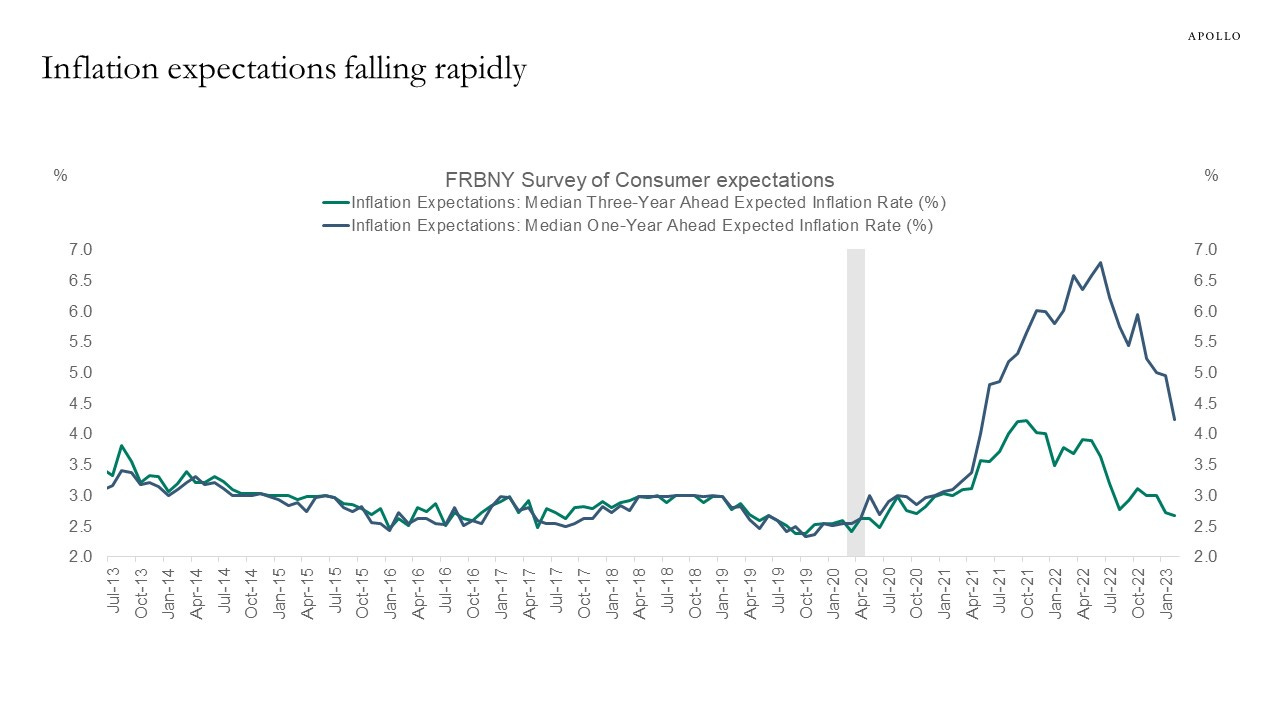

Apollo Chart: US Inflation Expectations are falling rapidly

Inflation in Europe is coming down but a a slower rate than economists predicted:

French inflation slid in March to a six-month low - though by slightly less than forecast

German inflation eased significantly in March on the back of lower energy prices but still came in above forecast

Inflation in UK shops hits record high of 8.9%

Ghana Hikes Rate More Than Expected to Rein In 53% Inflation

COMMODITIES

2 Apr 2023: Kurdistan Says Reaches Deal With Iraq to Resume Oil Exports according to Arab News

Commodity Trader Vitol made close to $15bn in 2022

Cargill & other big Western Grain Traders are being shown the door by Putin

Lundin Copper Deal Is Bet on Declining Political Risk in Chile

IG

US and EUR IG markets returned to life post CS/SVB

Call notice for Total Corporate Hybrid and tender offers in Aroundtown senior

HY

HY new issue markets thawing too post banking problems

2 notable Auto ABS deals (not HY rated) issued by Ford and Avis were upsized

Spreads between IG and Junk hit 5 month high

3 HY issuers were upgraded to IG

Petrofac 2026 Bond rose 20pts on contract award announcement

SES, Intelsat Near Deal to Form $10 Billion Satellite Giant

MSTR bought 6,455 More Bitcoin for approx $150m at avg px of $23.2k

PE firm Cinven Skips Debt Market and Will Buy MBCC Unit With Equity

Real Estate news

Good chart from GS on European RE Debt

Manhattan Office Vacancy hits record high at 16%

Cash flow from a $217m Blackstone RE portfolio no longer covers debt payments: Moody’s

Lloyds Bank said to be looking to sell loan exposure secured against Canary Wharf office block

UK Mall operator Hammerson placed one of its JVs into receivership in Feb 2023, a mall investment in Leicester, in the Midlands UK

UK “Build to Rent” sector holding up better than most areas of Real Estate

Vanguard Plans to Open Manchester Office in the UK Regions

FINS

Issuance / tenders:

EU Fins new issuance resumed post SVB/CS

Japanese Bank SMFG may sell yen denominated AT1 bond in April

Natwest tendered for T2, Virgin Money call notice on € senior

AT1:

DB AT1 posted strong gains to close the week ~10 pts in 2 days

Unicredit 6.625% callable in early June 2023 is back to trading near par

Apollo assures investors deposit flight won't spill over to Athene

EM

EM new $ issuance from recently upgraded Costa Rica, and Poland.

China Central Government Is Borrowing at Fastest Pace on Record

China PMI data:

China non-manufacturing PMI hit 12 year high, suggests consumption is rebounding

but China's manufacturing PMI declined to 51.9 in March versus 52.6 in February

Sunac China unveils sweetened restructuring offer for US$9.1bn in offshore debt

South Korea extends eased lending ratio rule amid global banking woes

Sri Lanka carries out Investor Presentation, debate remains over DDR

Bahrain economy grows at fastest pace since 2013

Ukraine’s MHP said to pay next coupons according to spokesman

Burford Capital’s US shares rose 53% in a day after YPF/Argentina ruling

RATINGS

Notable actions:

S&P Global lowered its outlooks for Bank of America, JPMorgan Chase, PNC and Truist to stable from positive

Moody's affirms ratings of Australia's four major banks; outlooks stable

AB InBev Upgraded to A3 by Moody's

General Motors Upgraded to Baa2 by Moody's

United Airlines Upgraded to BB- by S&P

S&P Upgrades Dufry AG To 'BB-'; On CreditWatch Positive

WeWork Downgraded to C by Fitch

Gap Downgraded to Ba3 by Moody's

S&P revised Oman’s outlook to positive and affirmed its ratings at BB

S&P Lowers Outlook for Turkey’s Debt Rating to Negative

Argentina Downgraded to CCC- by S&P

X-S&PGR Takes Various Rating Actions On Eight U.S. Office REITs

BUYSIDE / TRADING

Weekly Lipper Bond Fund flows saw more outflows across the board

EM Local Bond ETF attracts biggest weekly inflows since Jan 2022 | BBG

UBS Research quantifies lack of liquidity in European Credit Markets

Goldman head of FICC and equities to relocate to Paris…:(

JPMorgan, Goldman Plan to Start Trading Private Credit Loans

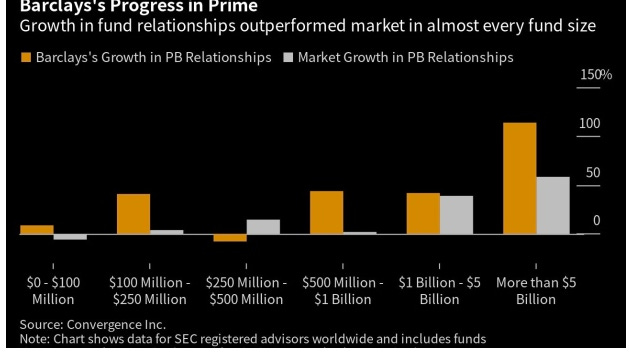

Barclays’ financing business up more than 50% in 4 years

LINKS

Fed always breaks something - DB Chart

Bridgewater Podcast - “Our Takeaways from the Banking Crisis”

Gramercy - Decoding the Global Macro Environment | 2Q23 Strategy Outlook

BBG Intelligence Credit Edge Podcast on Distressed Debt / Bankruptcy

*MOVES*

Govt bonds & currencies

USD Index posted a 1.31% decline in Q1 2023

Bitcoin was set to end its best quarter since March 2021 with ~ 70% gain.

Norwegian Krone is the worst performing G10 currency this year

Treasury volatility is coming down

Commodities

Oil traded near a two-week high as disruptions on the Ceyhan pipeline in Turkey keep a bid under the oil price. Brent closed at $80 and WTI at $76.

However note that weekend news suggests that Iraq and Kurdistan may have come to an agreement re Oil exports out of Kurdistan (scroll to Commodities section below).

Credit

Fins: AT1 Bond ETF +6.98% over 5 days. Broad rally in AT1 with DB paper up ~10 points in last two days of the week but still down on the month.

XOVER tightened 59bps to 436 suggesting some resumption of animal spirits

CDX HY exhibited similar move to Xover to close at 463 (54 bps tighter on week)

In cash spreads - US HY spreads went further below symbolic +500bps level to close at +472bps.

But bigger picture; all indices besides CDS EM and CDS NA IG went wider in March.

Equities

Nadsaq rose 20% from its recent lows

S&P 500 rose 3.5% for the best week since Nov-2022

Interesting single name / sector movers:

Carnival Cruise rose 15% from the recent low on Monday 27th March

Burford Capital US shares +53% on Friday after Peterson ruling

Notable New 52w highs: GE, Oracle, H&M, Games Workshop, Sainsburys, Marks & Spencer, Carlsberg, Heineken, Ab Inbev, Hermes, NVR

Equity volatility down significantly with VIX Index closing at 18.7 vs 1yr high of 34.75 in May 2022.

*MACRO*

Fed Reverse Repo facility use jumps to 2023 high…

Can’t disagree with Open Outcrier here…

SNB Sight Deposits Up Most Since 2011 as Banks Tap Crisis Funds | RTRS

Extract - Sight deposits held by the Swiss National Bank (SNB) jumped last week, data showed on Monday, suggesting that both Credit Suisse and UBS may have taken big chunks of emergency liquidity to secure their merger. Sight deposits - cash held by the SNB for commercial banks overnight - jumped to 567bn Swiss francs ($619bn) from 515bn francs a week earlier. The 52bn franc increase was the second-highest on record, just behind a 52.4bn franc leap in August 2011 when the SNB was selling huge amounts of francs to relieve pressure on the safe-haven currency.

BBG Chief Economist observes now more talks of job cuts than labour shortages

Extract - Mike McDonough, the Chief Economist at Bloomberg Financial Products has been tracking the labor talk on S&P 500 earnings calls, and noted recently that there are now more mentions of job cuts than labor shortage on a three-month rolling basis. Source: BBG’s Joe Weisenthal’s daily newsletter.

Credit tightening at US regional banks would limit Fed's historic rate push: S&P

Extract - Those smaller [Regional] banks are key pillars of business and consumer credit, though their ability to lend will be limited by concerns around the prevalence of uninsured deposits and the possibility of further deposit flight, according to economists. This reduction in credit availability for households and businesses would tighten broader financial conditions and could be equivalent to one or more Fed rate hikes, according to Chris Varvares, co-head of US Economics at S&P Global Market Intelligence.

RBC Charts on tightening of Credit in Euro Area

Notable job cuts announced this week

More news job cuts this week but the only “very large” one seems to be Disney this week. Corporates are likely taking action to address their profit margins ahead of Q1 2023 reporting season.

Warner Music Group to Cut 4% of Workforce

Roku is cutting 6% of its staff

Vodafone cuts 1,300 staff in Germany

Netflix restructures film group as it scales back movie output, cuts jobs

EA will cut about 6% of its workers, it has ~ 12,900 employees

Virgin Orbit cuts 85% of workforce after failing to secure fresh funding

Disney Begins Job Cuts With Goal of Eliminating 7,000 Positions

Longer term impacts of AI on Job Market: GS via Linkedin

According to the research:

-DM countries more at risk of job losses due to A.I

-Legal & Administrative fields most impacted, less so in manual and outdoor jobs, productivity enhancements elsewhere

-25% of current work tasks could be automated by AI in US and Europe

Class of 2023 may have to face up to job market that is less eager to hire - WSJ

WSJ led with this story on how the upcoming Graduate intake season may be tougher than years past:

The Class of 2023 is getting ready to enter a job market that is suddenly less eager to hire new grads. Many employers are taking a go-slow approach to employing graduating seniors this year, college career offices say. The cautiousness marks a sharp reversal from the past two years, when companies often made offers barely weeks after school began and staged bidding wars over interns and graduating seniors.

Some of the companies that have laid off thousands of workers in recent months—including Alphabet Inc., Meta Platforms Inc. and McKinsey & Co.—are the same ones that went on hiring sprees when the Classes of 2021 and 2022 were graduating. Many of the companies announcing layoffs have been among the most-coveted and the best-paying large employers, and graduates are casting a wider net to make sure they find a job.

Amazon.com Inc. has postponed start dates for some 2023 graduates for up to six months as it cuts spending and trims staff. Wayfair Inc., the online furniture retailer that cut about 1,750 workers, or 10% of its workforce, says it will curb new hiring for full-time roles and internships. Both companies say they remain committed to early-career recruiting, and an Amazon spokesman said the affected students are receiving financial assistance.

For a more comprehensive run down of Macro events, please check out:

*COMMODITIES*

Kurdistan Says Reaches Deal With Iraq to Resume Oil Exports - Arab News

Extract - BAGHDAD: Iraq's autonomous Kurdistan region is to resume oil exports through Turkey Monday but in the future they will be supervised by the federal government in Baghdad, officials from both sides said.

The outcome, thrashed out in talks between federal and regional officials, spells the end of independent oil exports by the Kurdish regional government and marks a clear limit to its autonomy.

Ankara had stopped handling Iraqi Kurdish oil last month after an international tribunal ruled in a nine-year-old dispute that Baghdad was right to insist on overseeing all Iraqi oil exports.

"Sales of Kurdistan crude will be managed from now on by the State Oil Marketing Organization," a federal government official told AFP on Saturday.

Commodity Trading remains very lucrative as shown by Vitol

…However Cargill & other big Western Grain Traders are being shown the door by President Putin | Javier Blas (BBG)

Extract - Cargill and other big western grain traders are being shown the door by Vladimir Putin. The move will only increase Moscow's finances and influence (and make a few local grain oligarchs even richer).

Lundin Copper Deal Is Bet on Declining Political Risk in Chile - BBG

Lundin Mining Corp.’s $950M purchase of a majority stake in a Chilean copper mine is the strongest indication yet of declining political risk in the South American nation. The Caserones deal announced late Monday means Lundin will invest at least $2bn on in a mining district that spans the Chile-Argentine border, said Juan Carlos Guajardo, who heads consulting firm Plusmining. “This huge investment speaks for itself,” Guajardo said in a text message. “They have a tolerable risk perception for Chile and Argentina.”

*INFLATION*

US PCE & Core PCE came in lower than expectations and is now below FFR

Nicely summarized below.

Also the Fed Funds rate is above the Core PCE, which has not been the case for a while.

Slowing rent inflation in the US and eventually Shelter CPI will slow…

This whole thread from Charlie Bilello is great as it goes on to cover vacancies and how the supply of multi-family units increasing, here is a summary:

With vacancy rates rising to their highest level in two years, we should see further declines in YoY rent growth in the coming months.

And more supply coming with a record number of multi-family units currently under construction...

Shelter CPI is still moving higher (+8.1% YoY in Feb) & continues to lag real-time housing data by many months (Home Prices peaked in Jun 2022, Rents peaked in Aug 2022). When Shelter CPI stops moving higher, we should see sharp declines in overall CPI (Shelter is 34% of CPI).

Slowing US M2 Money supply for Feb-23, deflation coming?

Apollo Chart: US Inflation Expectations are falling rapidly

Extract - Both survey-based and market-based measures of inflation expectations are falling quickly, and the Fed will soon be talking about this as an important reason why they can allow themselves to be more dovish and ultimately start cutting rates.

French inflation eases to six-month low in March | RTRS

Extract - French inflation slid in March to a six-month low - though by slightly less than forecast - as a sharp drop in energy price inflation helped offset surging food prices, preliminary official data showed on Friday. Consumer prices rose 0.9% in March, bringing the 12-month inflation rate to 6.6%, down from 7.3% in February, according to EU-harmonised data from France's statistics agency INSEE.

German inflation eases less than expected in March | RTRS

Extract - German inflation eased significantly in March on the back of lower energy prices but still came in above forecast, adding to pressure on the European Central Bank to further tighten its monetary policy. German consumer prices, harmonised to compare with other European Union countries, rose by an annual 7.8% in March, preliminary data from the federal statistics office showed on Thursday. Compared to February, prices increased by 1.1%. Analysts had expected the harmonised figure to grow by 7.5% compared with March last year and increase by 0.8% from the previous month. A first reading of March inflation for the wider euro zone, of whose 20 economies Germany's is the biggest, is due on Friday. "There are still few if any signs of any disinflationary process outside of energy and commodity prices," ING's global head of macro Carsten Brzeski said.

Inflation in UK shops hits record high of 8.9% - Straights Times

Extract - The British Retail Consortium (BRC) said shop price inflation accelerated to 8.9 per cent, a fresh peak for an index that started in 2005, and an increase from 8.4 per cent in February. Food price increases hit 15 per cent, as fruit and vegetables fell into short supply.

The data comes as broader British inflation rose unexpectedly in February for the first time in four months, led by food and drink prices. Shoppers are visiting discount grocers Aldi and Lidl to try to make their money go further, as well as putting fewer items in their baskets.

Swedish Grocers Pledge Price Cuts After Soaring Food Inflation - BBG

Extract - Three Swedish grocery chains announced they will cut prices as consumers in the Nordic country are reeling under the most rapid food-price inflation since the 1950s. Sweden’s grocers have faced increased scrutiny after data released earlier this month showed that rapidly rising food prices pushed an underlying measure of inflation to its highest level in more than 30 years. That prompted calls for price caps, and the three largest food retailers were summoned by the country’s finance minister. The price war started last week when Lidl flagged reduced prices on more than 100 goods, in a bid by the discount retailer to increase its share in the highly concentrated Swedish groceries market, which is dominated by ICA AB, Coop Sverige AB and Axfood AB. On Monday, ICA announced price cuts on 300 items, and Coop said it will cut prices on fruit and vegetables by 12%.

Ghana Hikes Rate More Than Expected to Rein In 53% Inflation - BBG

Extract - The monetary policy committee raised the key rate by 150 basis points to 29.5%, Governor Ernest Addison told reporters in Accra, the capital, on Monday. None of the nine economists in a Bloomberg survey forecast an increase of that size.

*IG*

IG New issues/redemptions

The US IG market functioned well with around $24bn of issuance being printed. Issuers that came to market included Lowes, Hyundai Motor and Mercedes Benz. Meanwhile in Europe €33.5bn of issuance printed as IG corporate investors largely got over concerns regarding SVB and CS for now. Issuers in Europe included the European Union, Harley Davidson, Siemens Energy, Schneider Electric. FIG issuance returned too with Metlife, Swedbank Mortgage, ANZ, Westpac, CIBC just some of the issuers that came to market. Source: BBG.

Notable IG redemptions:

Energy major Total Energies sent out a call notice on its TTEFP 2.708% Corporate Hybrid (XS1501167164) which has a call date of 5 May 2023. S&P commented that the redemption (without replacement) will not have any impact on its intermediate equity content since it formed less than 10% of its hybrid stack.

European REIT Aroundtown announced a tender on its senior 2025/26 paper':

€700,000,000 1.000% Notes due 2025 (ISIN: XS1715306012)

€800,000,000 0.625% Notes due 2025 (ISIN: XS2023872174)

€500,000,000 1.875% Notes due 2026 (ISIN: XS1649193403)

€600,000,000 1.500% Notes due 2026 (ISIN: XS1843435501)

€1,000,000,000 0.000% Notes due 2026 (ISIN: XS2273810510)

€500,000,000 2.00% Notes due 2026 (ISIN: XS1815135352)

Tender offers are set to expire at 5:00 p.m. CEST on April 4; Expected settlement date is April 6. Aroundtown seems to be sticking to its guns on not tendering for any of its Hybrid paper despite being allowed to tender up to 10% without any changes to its intermediate equity content from S&P. Source for the tender: BBG.

*HY*

HY new issue market

The US HY new issue market woke up from its slumber by posting around ~$1.5bn of issuance. In the US, PE owned Multi-Color Corp issued $300m of 5.5 year notes, which represented the first deal in more than 3 weeks. Demand was said to be around $1bn and pricing tightened to 9.5% from 10.0%. There was also a deal for EnLink Midstream which is rated BB.

In European HY, French cable manufacturer Nexans increased the size of its offering to €400m from €325m in senior unsecured sustainability-linked notes (“SLB”). Separately IHO Verwaltungs issued €200m of 8.75% 2028 tap in EUR, according to its website: “IHO Holding is a strategic holding company, combining the holding and management activities of the IHO Group. IHO Group’s operating business is conducted by Schaeffler, Continental, Vitesco and Atesteo. IHO Group holds 100% of the voting rights in Schaeffler AG, a 36% stake in Continental AG and approx. 39.9% of the shares of Vitesco Technologies AG.”

Meanwhile, BBG highlighted that there are likely to be more “hung loan” sales from Banks as HY market conditions improve.

HY issuers also raised money in the ABS market, which again points to slightly easing financing conditions. Ford raised $1.57bn of Prime Auto Loan ABS which was upsized from $1.31bn. Avis Budget Rental Car raised $1B in Auto ABS, which was also an upsized deal from $500m to $1bn.

Spreads between IG and Junk hit 5 month high - BBG Chart

HY News Roundup

A few HY issuers were upgraded to IG:

Netflix upgraded to Baa3, Bonds to Move to High-Grade Index

Wienerberger Raised to Investment Grade by Moody's

Schaeffler Raised to Investment Grade by Moody's

Profit at UK supermarket Asda slumps on inflation hit | RTRS

MSTR bought 6,455 More Bitcoin for approx $150m at avg px of $23.2k | Link

Copper Mountain shares pop 11% on day of results - Mining.com

Petrofac 2026 Bond rose 20pts, stock +70% on the day on $14.1bn WindPower Contract (RTRS)

SES, Intelsat Near Deal to Form $10 Billion Satellite Giant - BBG

Liberty Global Plc wrote down the value of its Virgin Media O2 joint venture by £3.1bn because of what the cable and wireless company called a challenging macroeconomic environment -10k via BBG

PE firm Cinven Skips Debt Market and Will Buy MBCC Unit With Equity - BBG

We saw this happen in a few instances in 2022 when credit markets were largely closed.

Extract - UK buyout firm Cinven has decided against using borrowed money to purchase a building-materials business, according to people familiar with the matter. It’s an unusual move in the private equity world that in part reflects the turmoil in the banking industry and leveraged-finance markets.

Cinven will use its own money to buy the chemical admixtures operations from Germany’s MBCC Group, said the people, who asked not to be identified because the talks are private. Buyout firms typically use high-yield financing for a significant portion of the purchase price when doing deals, saddling the target with debt but also providing much bigger returns than acquisitions that are financed with equity.

The UK private equity firm had financing offers from direct lenders but opted against them, said one of the people. It plans to refinance with debt in the future when the MBCC unit needs funding and markets are more stable, they said.

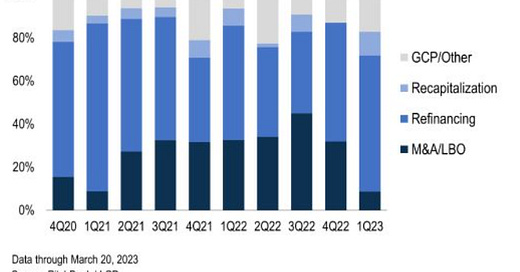

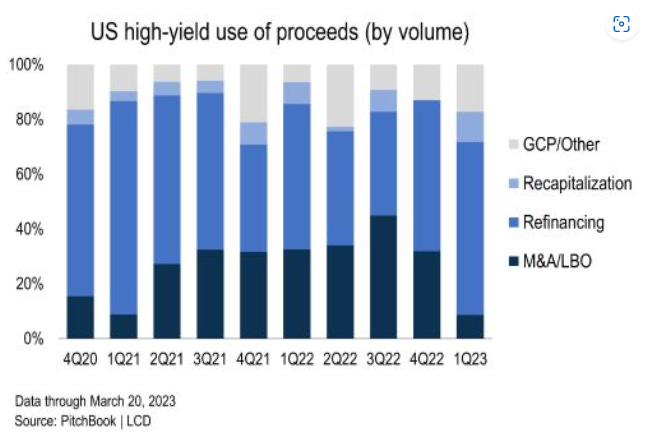

Pitchbook highlights how LBO volume is down compared to recent history

REITs/Real Estate Corner

/// Good chart from GS on European RE Debt

///GS on Delinquency Rates

///Manhattan Office Vacancy hits record high at 16%

/// Cash flow from $271m Blackstone portfolio no longer covers debt payments: Moody’s -TheRealDeal

Extract - Two months after a $271 million Blackstone loan secured by 11 Manhattan multifamily buildings went to special servicing, Moody’s downgraded the CMBS debt, citing cash flow that wouldn’t cover the debt service. The loan is still current, but the portfolio’s “declining performance” has driven up the loan-to-value ratio, putting the CMBS bondholders at risk. The Moody’s report found that the debt is now far greater than the apartment buildings are worth. As of March, the mortgage’s loan-to-value ratio hit 147 percent, which a Blackstone spokesperson said was calculated at 127 percent using the same methodology when the loan was issued.

/// JPM estimate 21% of Office CMBS loans to default eventually

/// £300m spent on Biggest ever UK Build-to-Rent outside of London - BBG

Really good and insightful article from BBG. Interesting that there are not many Build to Rent pure play firms in the bond market besides UK listed Grainger.

Extract - Harrison Street Real Estate Capital, a Chicago-based firm with $55 billion in assets under management — will team up with Apache Capital and NFU Mutual to finance 722 apartments overlooking Birmingham’s trendy Jewellery Quarter district. The Birmingham deal comes as London’s renters leave the city in droves, as pricey monthly payments squeeze budgets to the limit.

In the same week, specialist lender and asset manager Intermediate Capital Group (ICP) announced funding for a Built-to-Rent deal in Brent Cross, in North West London.

/// Lloyds Bank looking to sell loan exposure secured against Canary Wharf office block

As BBG highlights: Lloyds Banking Group Plc is attempting to sell a loan secured against a Canary Wharf office block owned by Chen Hongtian’s Cheung Kei ahead of an imminent maturity. A unit of Cheung Kei has already defaulted on another nearby office block financed by Lloyds and a broker has been appointed to sell that property, according to people with knowledge of the process. The valuations of both properties have fallen sharply, risking credit losses, the people said, asking not to be identified as the process is private. The lender is attempting to offload a £175 million ($214 million) senior loan secured against 5 Churchill Place, the former London headquarters of Bear Stearns Cos, which is due to mature next month, the people said. Cheung Kei has also failed to repay a £265.5 million loan from Lloyds secured against 20 Canada Square which came due in October and is now attempting to sell the building. Cheung Kei has appointed Jones Lang LaSalle Inc. to find a buyer and the broker has set an initial guide price of £250 million, they added. Cheung Kei bought the property for £410 million in 2014.

The number of lenders looking to walk away from upcoming refinancings in the UK is not as high as what has been seen in the US but I did read this week that UK listed Mall owner / operator Hammerson put a 50% JV Investment in Highcross shopping Centre into receivership in February 2023. This is because at 31 December 2021, certain covenants on the secured loan at the Highcross joint venture were in breach and an impairment of the full equity value was recognised at that time in Hammerson’s accounts.

/// Some positive news on the office sector - Vanguard Plans to Open Manchester Office in European Expansion | BBG

Vanguard Group Inc. is planning to open an office in Manchester as the $7.5 trillion asset management giant presses ahead with its European expansion. The new 14,000-square-feet facility, proposed at St. Peter’s Square in the northwestern English city, is meant to accommodate more UK staff as the US company’s London base has reached capacity, a spokesman said. The number of local hirings isn’t yet known, he added, without saying when the premises will be operational.

For more colour on the state of UK Regional Offices, people may find this week’s update from UK small cap Regional REIT (RGL) useful. Note, RGL did not let out the building to Vanguard.

/// Moody's downgrades DEMIRE's CFR to B3; negative outlook | Moody’s

Downgrade of DEMIRE (Deutsche Mittelstand Real Estate AG), a listed German real estate company.

Extract - The downgrade reflects liquidity concerns resulting from large bond and loan maturities in 2024. Higher interest rates as well as geopolitical and financial market volatility provide for a weak property environment. In this context, DEMIRE's task to refinance the remaining €550 million of bonds and €169 million of secured loans in 2024 is more challenging considering the short timeframe and the limited unencumbered asset base. Property lending as such is still intact, but the current discussions and capital market volatility with respect to some of Europe's largest large banks come with the risk of tighter lending criteria for the entire sector. Moreover, disposals are an important part of funding for the repayment of the bonds, and targeted disposals are more uncertain as investor appetite is reduced and uncertainty around property values persists.

*FINS*

FINS new issues/tenders

There was a subtly better tone in FIG this week as issuance returned and even talk of a resumption in AT1 issuance. BBG reported that Japanese Banking Giant SMFG might look to issue a Yen denominated AT1 in the first major deal after the Credit Suisse “zero-ing.” According to BBG:

SMFG Tests AT1 Appetite in First Major Deal After Credit Suisse.

MUFG also has plans to sell AT1 debt possibly in April.

Sumitomo Mitsui Financial Group Inc. has started sounding out investors on pricing levels for a planned Additional Tier 1 bond sale, in what may be the first such deal by a major global bank since writedowns at Credit Suisse Group AG. The riskier bank notes from the Japanese lender may carry a coupon as high as about 2.2%, based on preliminary guidance provided to investors, according to people familiar with the matter, who asked not to be identified because the matter is private. Financial authorities regard SMFG as a global systemically important bank…

As stated in last week’s blog post, the next callable AT1 of note is the Unicredit 6.625% with first call date of June 3rd 2023. Should this get called, it would prove to be a small positive that can help restore more confidence in the sector. This bond closed with indications of ~98/99 suggesting a high expectation of a call from market participants.

NatWest Group launched a tender offer to purchase for cash any and all of its outstanding 5.125% Subordinated Tier 2 Notes due 2024. In a small way this would have helped to tighten up spreads in the broader T2 space. Virgin Money sent a call notice for its €500m senior unsecured 0.375% 2024 notes, it had a reset spread of 1 year EUR swap + 0.85%.

Apollo assures investors deposit flight won't spill over to Athene - RTRS

Super interesting article that is worth reading in full. Reuters did a great job explaining Apollo’s annuity business here.

Extract - Apollo Global Management Inc has been telling investors and analysts in the last few days that its reinsurance business Athene does not face the risk of a run on its annuities akin to how deposits fled some U.S. regional banks.

*EM*

EM New issues

Issuance this week from Poland, Korea National Oil Corp, Korea Housing Finance Corp (EUR) and Costa Rica.

Most notable issuance was Poland, who raised $5bn of debt in 2 parts in USD:

$2.5b Long 10Y Fixed (Oct. 4, 2033) at +140, reoffer price 99.246 to yield 4.968%

$2.5b 30Y Fixed (April 4, 2053) at +180, reoffer price 98.77 to yield 5.585%

Source: BBG

On Costa Rica, newspaper Latin Finance highlighted it was the country’s first new bond issue in 3 years, and the issuance followed IG issuer Panama from the prior week. Costa Rica issued $1.5b 11Y at Par to Yield 6.55% for a BB- rated issuer from Fitch, B+ rated by S&P. Fitch had recently upgraded its ratings on Costa Rica by two notches to BB-, citing in part an improvement of its fiscal position.

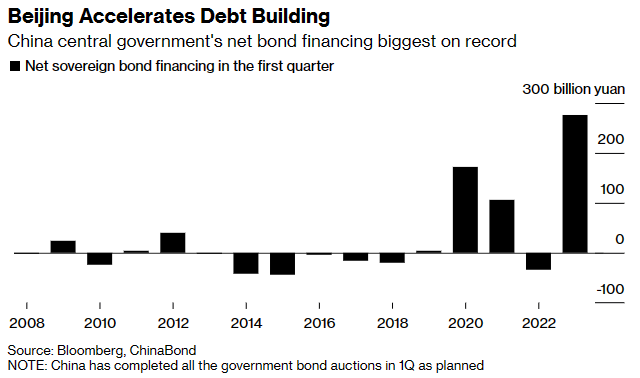

China Central Government Is Borrowing at Fastest Pace on Record - BBG

The amount of sovereign bonds sold this quarter, excluding those maturing, reached 277 bn yuan ($40 bn), the highest level for the same period since 1997, when the official ChinaBond website started releasing the data, Bloomberg calculations show.

China non-manufacturing PMI hit 12 year high, Manufacturing came in weak..

RTRS - China's manufacturing activity expanded at a slower pace in March, official data showed on Friday, raising doubts about the strength of a post-COVID factory recovery amid weaker global demand and a property market downturn. The services sector was stronger, with activity expanding at the fastest pace in nearly 12 years after the end of China's zero-COVID policy in December boosted transportation, accommodation and construction.

Sunac China unveils sweetened restructuring offer for US$9.1bn in offshore debt - SCMP

Extract - The company has reached an agreement with a group of offshore creditors representing over 30% of its outstanding offshore debt. The move follows a US$19.15bn debt restructuring plan unveiled last week by China Evergrande Group.

South Korea extends eased lending ratio rule amid global banking woes | RTRS

Extract - South Korea extended by two months the relaxed loan-to-deposit ratio requirement for lenders, citing lingering concerns on the global financial markets about the banking sector’s health, the top financial regulator said on Monday.

Sri Lanka and Bondholders wrestle over whether DDR* will take place - BBG

*DDR = Domestic Debt Restructuring.

Extract - Overseas investors such as BlackRock Inc. and Pacific Investment Management Co. are demanding that domestic debt holders share billions of dollars of losses as the government prepares to outline its plans on Thursday. But authorities haven’t committed either way, with officials mindful that piling losses on local banks may endanger financial stability. The government will give more clarity by April, Treasury Secretary Mahinda Siriwardena said at a forum in Colombo Thursday, when asked if local debt will be restructured.

Meanwhile, CBSL Governor Nandalal Weerasinghe said: “Sri Lanka will not re-structure Treasury bills outside of central bank holdings and will engage with major T-bond holders for voluntary ‘optimization’“. - Economynext

Sri Lanka carried out an Investor Presentation

Link to official presentation is here: Ministry of Finance - Sri lanka (treasury.gov.lk)

Link to local broker (NDB) interpretation of the presentation:

More strength in ME - Bahrain economy grows at fastest pace since 2013: BBG

Extract -Bahrain’s economy grew at the fastest pace since 2013 last year, fueled by an acceleration in non-oil growth, according to preliminary government data.

Overall economic output grew nearly 5%, driven by 6.2% growth in the non-oil sector, higher than anticipated by the government’s recovery plan launched in 2021 in response to the coronavirus pandemic. Hotels and restaurants led growth in the non-oil sector, followed by government services and then real estate.

Ukraine’s MHP said to pay next coupons according to spokesman

Still amazed at how MHP keeps servicing its coupons despite the war in Ukraine.

Haven’t seen an official release from the company but saw the same update from the sell-side:

Burford Capital’s US shares rose 53% after Argentina found liable - BBG

Extract - A US judge ruled against Argentina and in favor of entities funded by Burford Capital on claims the South American nation failed to pay fair value to shareholders when it nationalized the gas and oil company YPF SA in 2012. US District Judge Loretta Preska Friday ruled in favor of the Spanish companies Petersen Energia Inversora S.A.U. and Petersen Energia S.A.U., which sued YPF and Argentina in 2015. While she granted a request by YPF to dismiss the claims, she determined that the Argentine government itself was liable, with damages to be resolved at trial. While the judge didn’t set a figure for the compensation, Argentina would have to pay $7 billion to $19.8 billion, newspaper La Nacion said on Friday, citing estimates provided by the funds. The country has been trying to rein in expenses to reduce its fiscal deficit under a $44 billion deal with the International Monetary Fund. Burford’s New York-listed shares soared as much as 59%, an intra-day record, after the news. The London-listed shares were up 30% prior to being suspended. YPF’s US-listed shares dropped 1.8%.

Potentially large win for Burford, since now the quantum of damages need to be resolved at a trial with estimates coming in at $7bn to $19.8bn of which Burford is set to take a cut if successful. Bonds strengthened a tad on the news but nowhere near as much as the move in the US listed shares of +53%.

*RATINGS*

SOV

Germany Affirmed at AAA by Fitch

IG

AB InBev Upgraded to A3 by Moody's

EDP Affirmed at BBB by S&P

General Motors Upgraded to Baa2 by Moody's

EnBW Outlook to Stable by S&P; L-T Rating Affirmed

Financials

S&P Global lowered its outlooks for Bank of America, JPMorgan Chase, PNC and Truist to stable from positive: ZH

Fitch Affirms Legal & General's IFS at 'AA-', Outlook Stable

Moody's affirms ratings of Australia's four major banks; outlooks stable:

ANZ Bank Affirmed at Aa3 by Moody's

CBA Affirmed at Aa3 by Moody's

NAB Affirmed at Aa3 by Moody's

Westpac Affirmed at Aa3 by Moody's

HY

Fitch Affirms Intelsat Jackson Holding's IDR at 'B+'; Outlook Positive

Schaeffler Raised to Investment Grade by Moody's

Wienerberger Raised to Investment Grade by Moody's

Air Canada Outlook to Positive by Fitch; L-T IDR Rating Affirmed

United Airlines Upgraded to BB- by S&P

Moody's affirms Miller Homes' ratings; outlook is changed to negative from stable

Moody's downgraded senior unsec. of DEMIRE to Caa1 from B2

S&P Upgrades Dufry AG To 'BB-'; On CreditWatch Positive

WeWork Downgraded to C by Fitch

Gap Downgraded to Ba3 by Moody's

EM

S&P revised Oman’s outlook to positive and affirmed its ratings at BB

S&P Lowers Outlook for Turkey’s Debt Rating to Negative

Morocco Affirmed at BB+ by S&P

Qatar Outlook to Positive by Fitch; L-T IDR Rating Affirmed

Azerbaijan Affirmed at BB+ by Fitch

Argentina Downgraded to CCC- by S&P

S&P Raises Ukrainian Railways FC Rtg To 'CCC+'; Outlook Neg

Fitch Downgrades Light's IDRs to 'CC

Fitch Downgrades Sino-Ocean to 'B+'; Maintains Rating Watch Negative

Also, X-S&PGR Takes Various Rating Actions On Eight U.S. Office REITs

Extract - Fundamentals in the office real estate market are deteriorating, pressured by longer-term secular headwinds from remote working and near-term cyclical risks from a slowing economy and weaker job growth. Following a portfolio review of the rated office REITs, S&P Global Ratings took several rating actions.

-- We affirmed all ratings on the following issuers: Boston Properties Inc., Brandywine Realty Trust, Highwoods Properties Inc., Kilroy Realty Corp., Piedmont Office Realty Trust Inc., and Vornado Realty Trust.

-- We placed all ratings on Hudson Pacific Properties Inc., including our 'BBB-' issuer credit rating, on CreditWatch with negative implications.

-- We also lowered the issuer credit rating on Office Properties Income Trust to 'BB' from 'BBB-' and the issue-level rating to 'BB+' from 'BBB-'.

-- The rating outlook is negative on Boston Properties, Brandywine, Office Properties Income Trust, Piedmont Office Realty Trust Inc., and Vornado Realty Trust.

-- The rating outlook is stable on Highwoods Properties Inc. and Kilroy Realty Corp.

*BUYSIDE / PRIVATE CREDIT*

Weekly Lipper Bond Fund flows saw more outflows across the board

IG - $0.88bn outflow

HY - $2.13bn outflow

Lev loans - $0.71bn outflow, which represented 10th outflow in a row

Source: Refinitiv Lipper

EM Local Bond ETF attracts biggest weekly inflows since Jan 2022 | BBG

Interestingly though, in the week prior, the JPM EM Local Currency bond ETF received the largest inflow since Jan 2022. With BBG highlighting the possible rationale as a flow of money into large EMs that have hiked rates a lot already, now may look to cut going forward.

Performance of EM Local has been decent YTD as per this Reuters article:

Emerging market local currency debt enjoyed a solid three months, on track for quarterly returns of 4.8% -outstripping U.S. 10-year Treasuries. Top of the pack are Colombia, Hungary and Chile, with gains of nearly 10% or higher, and seen as broadly having finished their interest rate hiking cycles.

Blackrock had gone long EM Local Assets earlier in March too as referred to in the same piece:

BlackRock, the world's largest asset manager, turned overweight on the emerging market local currency debt earlier in March. "We prefer income in EM debt with central banks closer to turning to cuts than developed markets – even with potential currency risks," said Jean Boivin at the BlackRock Investment Institute.

Good note from UBS GWM on Private Markets - Linkedin

Some solid charts in this note on Private Credit, Private Equity and Private Real Estate. The only small snag is that the heading on the chart below should refer to lev loans instead as per the legend instead of “high yield corporate bonds.” Other key findings:

While direct lending funds have seen strong fundraising in dollar terms, the number of funds closed has declined. This suggest that investors remain positively inclined towards the asset class, but are being more selective in allocating to specific funds.

Rising rates and rising volatility have had more of an impact on lev loan syndicated markets than on private credit as seen from the chart below:

*TRADING*

UBS Research quantifies lack of liquidity in European Credit Markets

The authors from a UBS research note highlight some interesting stats re Trading liquidity in EU HY, see below for key findings and link to original piece re-shared on Linkedin.

Key findings:

EU IG Credit has seen secondary market liquidity decline by 40% since Q3 2022 - Surely this must be down to the lower involvement by the ECB..

EU HY market liquidity has been worse for longer than EUR IG

ETFs increasingly being used by market participants to express a quick view on Credit

However, recent experience shows that even a small flow (e.g. €24m) can move the largest EU HY ETF (€4.4bn in size) by 1% in TR terms.

Reckons we could see more cyclicality in ETF flows if we see increased credit spread volatility vs rates volatility

Lack of alternative liquidity providers to warehouse risk exacerbates risk during periods of market stress.

Time to liquidate an allocation to EU HY is ~ twice as long as what you can in “normal” market conditions.

Fed’s CMDI not capturing the recent vol in Sub Fins

Goldman Moves Senior Executive to Paris to Help Build EU Trading - Bloomberg

Extract - Goldman Sachs Group Inc. partner Lear Janiv will relocate from London to Paris to become head of FICC and equities trading at the bank’s main European Union unit. Janiv, a 16-year veteran of the firm, will coordinate the development of the bank’s European trading franchise, according to an internal memo. Goldman moved into a new, 9,000-square meter Paris headquarters last year, and has grown from around 170 staff in 2017 to 350 at the end of 2022 in the country, with further hires expected in 2024.

Barclays’ financing business up more than 50% in 4 years - BBG

Extract - In Barclays Plc’s bid to grow its global investment bank, its business of servicing hedge funds is an increasingly important calling card. While several of the firm’s rivals have exited prime brokerage after being felled by extreme risk-taking or a broader need to cut costs, Barclays has doubled down. The British bank has grown its prime business into a critical cog of its financing business, which generates £2.9 billion a year, up more than 50% from four years ago.

JPMorgan, Goldman Plan to Start Trading Private Credit Loans - Yahoo Finance

An inevitable development in the Private Credit space (in my opinion). I will be fascinated to see how this develops, since one of the “benefits” for owners of private credit loans is the lack of more regular price marks on their holdings, especially during periods of stress.

Extracts - Wall Street banks are looking to start trading private credit loans as they seek to make inroads into the lucrative world of direct lending, a potential first step that could ultimately reshape the largely buy-and-hold market.”

JPMorgan Chase & Co., Goldman Sachs Group Inc. and Barclays Plc are among the firms talking to private debt funds about facilitating secondary-market transactions, according to people with knowledge of the matter — with some banks reaching out directly to gauge manager interest. JPMorgan is using its own balance sheet to make markets amid an increase in client inquiries, said separate people familiar, who asked not to be identified because the details are confidential.

The foray is* the latest effort by Wall Street to capture a slice of the $1.4 trillion private credit industry, where shops from Apollo Global Management Inc. to Blackstone Inc. often team up to make loans directly to companies. Proponents say secondary trading would help direct lenders better manage their portfolio mix, as well as free up capital to make new deals. But others warn that regular price discovery could force shops to mark down the value of their debt during periods of financial stress, increasing volatility.

*LINKS*

Fed always breaks something - DB Chart via Isabelnet.com

Bridgewater Podcast - “Our Takeaways from the Banking Crisis”

Extract - Co-CIO Greg Jensen and Co-Head of Fixed Income Research Alex Schiller discuss our recent three-part series describing how the banking crisis is reshaping the financial system, and its impact on the economy and markets going forward. In this podcast, Daily Observations editor Jim Haskel sits down with Greg and Alex to delve deeper into the key takeaways from this series and how they connect to our economic outlook. The conversation covers the origins of the bank run, the mechanics of how it played out, the impact of the crisis on bank business models and profitability, and how all of this is flowing through to growth and assets. Greg and Alex also discuss the recent Fed meeting and how the banking strains — combined with an increasingly challenging macro environment — are creating a very difficult dilemma for policy makers.

BBG Intelligence Credit Edge Podcast on Distressed Debt / Bankruptcy

Gramercy - Decoding the Global Macro Environment | 2Q23 Strategy Outlook

Looks like a good read from top EM house Gramercy, where Mohammed El Erian is Chairperson.

Super helpful as usual!

Great write up as usual! I’m personally glad the ABS deals are going through especially the auto ones. Seems like a potential trade setup depending on Economic data that is released this quater. I’m curious if you have been keeping an eye on the Turkish Presidential election? It definitely seems like a big events for the EM bonds, especially Turkish bonds.