3 March 2023 Global Credit Wrap

Credit markets functioning ok despite rising rates and problems in certain areas of the market (EM Sovs, Real Estate, Subprime Auto Loans, Brazilian Credit...)

*KEY THEMES*

Fed speakers toned down hawkishness from prior week

US 10 and 30 yr hit 4% before rallying at end of week

US consumer reducing large discretionary spending

Several companies looking to improve balance sheets by reducing debt (e.g AT&T, American Airlines, Occidental).

IG - Record issuance week in $ (YTD), more subdued in €. Aercap double upgrade.

Banks continue to issue AT1 with healthy order books, HSBC raised $7bn of TLAC.

HY/Lev Fin market functioning reasonably well for better borrowers - Large issuance for Teva, Cruiseliners agree on new credit facilities. But, HY issuers being cut by agencies at a rate..

EM -Sri Lanka closing in on on IMF deal while Pakistan risk of default surges

Distressed -Corporate distress rising in Brazil but Adani rallies on new investor disclosure. A Blackstone Nordic RE CMBS defaults.

ESG - Pemex to increase disclosure to improve ESG ratings and unlock financing

Private Credit - Record deal in the making for Cotiviti ($5.5bn) indicating more biz being taken away from Banks

Trading - M&A in outsourced trading arena..

*TLDR*

MOVES / KEY LEVELS

UST: 10yr and 30yr hit 4% before rallying at the end of the week

UK/European Govvies - 30yr gilt closed at 4.2%, German benchmarks hitting new post GFC highs

Inflation breakevens continue to rise in major DM bond markets

Credit spreads closed the week tighter in CDS

MACRO

Traders are now pricing in a 5.5% Fed Funds rate

Traders push back peak ECB rate bets into 2024 for first time

Fedspeak this week more measured

Rates higher but financial conditions loose in the US

Target, Macy’s, Costco, Best Buy see consumers cut back, search for discounts

US Home Prices Post First Annual Drop Since 2012

Higher mortgage rates is resulting in more cash buyers of US homes

Low-income households are falling behind on car bills in the US

ECB’s QT program began on March 1st, Schnabel explains rationale

COMMODITIES

European Power Producers Switch to Gas From Coal as Prices Fall

Aramco CEO says oil demand for their products is strong…

Russia Halts Flows to Poland

Credit highlights from Occidental/Kosmos Energy figs

INFLATION

US unit labour costs came out at 3.25%, much higher than 1.6% estimate

US Rents went up 0.3% in Feb, breaking 5 month down streak

UK shop price inflation hits fresh high + UK Food inflation remains high

Largest fare hike in more than a decade on London Transport

Surprise Jumps in French, Spanish inflation turn up pressure on ECB

German Supply Chain Bottlenecks Continue to Ease

Eli Lilly Cuts Insulin Prices by 70%

FINANCIALS

Largest FIG deal YTD courtesy of from HSBC ($7bn TLAC)

New AT1s issued by HSBC/Barclays and Caixa Bank, very health demand

Stanchart 7.75% AT1 to be redeemed, Nationwide BS CCDS tender results

IG

Strongest week of issuance in $ IG market YTD

Insight from Q4 earning season, the latest from Factset

Innovative SLB from Pandora - terms tied to using 100% recycled silver and gold

Provisional agreement reached on European green bonds - EU Council

More US IG corp issuers are using call options to benefit from future change in refinancing environment

Real Estate firm Heimstaden Bostad to repurchase SEK8.5bn (~$812m) of debt

EDF could reduce debt by €960m

AT&T CFO says it Co. targeting Net Debt / EBITDA of 2.5x by 2025

HY

Teva upsized its HY deal to $2.49bn

BB issuers issuing in loan market, marking change from flood of single Bs

$ Lev loans posted positive returns in February led by riskier credits

Cruiseliners - Carnival gets $2.1bn facility, Norwegian gets $0.3bn facility.

American is planning a $15bn debt-cutting plan to get back to BB rating

AMC credit highlights

Nordic bond issuer activity round up

Ratings agencies cutting Junk issuers at a fast clip…

HY Dividend recaps total $5.8bn YTD

EM

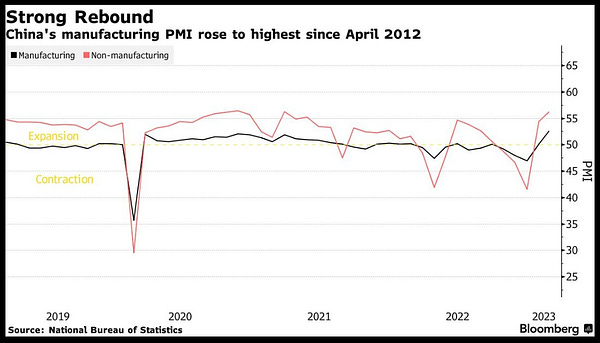

China's latest PMI greatly outperformed the US ISM

New issues - Morocco $2.5bn follows Egypt Sukuk, and Wynn Macau convertible

Sri Lanka closing in on IMF deal, while Pakistan seems to be nearing default

India's Adani group gets $1.9bn investment from U.S. firm GQG

Pemex to overhaul ESG credentials to lure investors

Iraq - KRG Oil Talks Resume

DISTRESSED

US bankruptcy Filings Arrive at Fastest Pace Since 2009

Distress in Brazil's credit market increases post Americanas, Oi files again

Gol Airlines announces Closing of US$1.4 billion Financing

Digicel set to be taken over by bondholders

PRIVATE CREDIT

Trafigura raises new USPP

Cotiviti buyout set to become largest ever Private Credit financing to date

Oaktree Capital is seeking to raise US$ 10bn for a new fund

RATINGS

AerCap upgraded by Fitch and Moody’s

BHP - Moody's Upgrades to A1

Moody's changes BP's outlook to positive; affirms A2 rating

Mercedes Upgraded to A2 by Moody's, Outlook Stable

TRADING

State Street rumoured to acquire outsourced trading firm CF Global

MarketAxess Announces Record Total Credit ADV for February 2023

*MOVES / KEY LEVELS*

Gov Bonds

US - Traders are now pricing in a 5.5% Fed Funds rate

Europe - Traders push back peak ECB rate bets into 2024 for first time

Key gov bond benchmarks went through 4.0% during week: US 10 yr hit 4.08% before rallying, US 30 yr hit 4.03% before rallying, UK 30 yr gilt closed week at 4.206%.

Germany:

2 yr yield rises past 3% for 1st time since 2008

10yr closed week at 2.707%

30yr yield hit the highest Since 2014

Inflation Breakevens:

U.S. 10-Year Breakeven Inflation Rate Rises to 16-Week High

U.K. 10-Year Breakeven Inflation Rate Rises to 2-Month High

Germany 10-Year Breakeven Inflation Rate Rises to 6-Month High

Italy 10-Year Breakeven Inflation Rate Rises to 9-Month High

Credit Spreads

CDS: CDX HY -33bps tighter, Xover -23bps tighter, CDX EM -18bps tighter, ITRX EUR Sub Fin -11bps tighter.

Cash Credit: US HY -22bps tighter to +397bps. Pan European HY -8bps tighter to +429bps.

Bond ETFs

The week ended on a different tone to the most of the week (rising bond yields) such that the winners were long dated strategies, convertible bonds, Inflation linkers, Asian HY. Losers were inverse long dated strategies, European govvies and credit.

Highlighted winners over 5d: LTPZ (+2.7%), EDV (+1.5%), IBCI(+1.2%), ICVT (+1.2%), ITPS (+1.2%), IGLB (+1.1%) CGBI (+0.9%), AHYG (+0.7%).

Highlighted Losers over 5d: TMV (-2.9%), TTT (-2.7%), MTD (-1.2%), CLIM (-0.9%), SYBC (-0.8%), PGX(-0.7%)

Source: BBG

*NORTH AMERICA MACRO*

4% is the magic number for US Treasuries

This is not how it finished at the end of the week, but all the benchmarks were at 4.0% or higher on Thursday at least.

Fedspeak this week more measured

Fed officials who gave speeches this week maintained a confident tone about raising interest rates, but more of them seemed to be more cautious on the quantum (25 or 50bps) and said they would base their decisions on incoming economic data.

Bostic, Waller, Collins and Jefferson were some of the Fed speakers this week. Highlights:

Bostic (non voter) - said his base case for March is 25 bps, but "there is a case to be made that we need to go higher." Said the Fed may be able to pause by summer and that he would adjust his rate outlook if data comes in stronger.

Waller (Voter) - If wage and inflation figures cool, a peak rate between 5.1% and 5.4% makes sense.

Collins (Non Voter) - Says More Rate Hikes Needed to Cool Inflation

Jefferson (voter) - Rejects arguments for Raising Fed’s 2% Inflation Goal

For a more comprehensive round up of Fed speak please refer to FXMacro’s excellent outlook for the week.

Rates have gone up but financial conditions remain loose - chart

Target, Macy’s, Costco, Best Buy see consumers cut back, search for discounts - CNN

Good article from CNN highlighting colour from earnings call from large US Retailers this week.

Target (TGT), Best Buy (BBY), Macy’s (M) and other chains say shoppers have pulled back on discretionary goods like clothing, electronics and home improvement. They have shifted their spending to paying for groceries and household basics.

Costco’s results highlighted slowing down of purchases of big ticket discretionary items and more purchases of Kirkland (Costco own brand) goods which matches up with what other food retailers were saying re “trading down”. Extracts of earnings call:

We've seen some weakness in what I'll call big ticket discretionary items

We're seeing decent sales in units of televisions, while the average selling price points have come down

people certainly are spending their dollars where they feel they should be spending them

…Shipping costs coming dramatically down on a 25- and 50-pound bags of jasmine rice

US Home Prices Post First Annual Drop Since 2012: Redfin

Extract - The median U.S. home-sale price declined 0.6% year over year in February, marking the first annual drop since 2012–but high rates mean homes aren’t more affordable. The milestone comes as daily average mortgage rates hit 7.1%, dampening homebuying demand.

Higher cost of debt → More cash buyers of US Homes

Low-income households are falling behind on car bills in the US - Axios

The share of payments on so-called "subprime" auto loans that were at least 60 days late rose to more than 6% in December. The December delinquency rate is a record, eking past prior peaks just before the pandemic, according to data from S&P Global.

The Fed seems to be watching this situation closely:

*OTHER DM MACRO*

ECB’s QT program began on March 1st - €15bn / month of reduction in APP

Will be interesting to see how this impacts the market dynamic in European Credit Markets. ECB board member Isabel Schanbel posted this useful looking speech this week: Quantitative tightening: rationale and market impact (europa.eu).

*COMMODITIES*

European Power Producers Switch to Gas From Coal as Prices Fall - BBG

Aramco CEO says oil demand for their products is strong…

Russia Halts Flows to Poland - Al Jazeera

Extract - Russia has halted oil supplies to Poland via the Druzhba pipeline, the chief executive of Polish refiner PKN Orlen says, adding that the company would tap alternative sources to plug the gap.

Key E&P company earnings + debt/cashflow highlights

Results from E&P companies this week demonstrated why the sector is outperforming:

Occidental - Repaid $10.5bn of gross debt last year, FY FCF of $14.1bn. Leverage declined from 2x in FY21 to 0.9x at end of FY22. The company is likely prepping to become investment grade again. Source: Oxy IR.

Kosmos Energy - Kosmos exited Q4 2022 with approximately $2.1 bn of net debt and available liquidity of greater than $1.0 bn, the highest level in five years. FY22 adjusted EBITDA more than doubled and net leverage halved to 1.4x. Kos generated ~$343m in FY22. It reduced its net debt by $400m, achieving its deleveraging target ahead of schedule. Expects to generate over $500m of FCF in 2023 at current oil prices, which will further strengthen its balance sheet and enable it to return capital to shareholders through dividends and share buybacks. Kos shares traded up +13.1% on the day of results but gave away some of its gains during the rest of the week. KOS IR.

*INFLATION*

Sovereign (dis)inflation data

US unit labour costs came out at 3.25, much higher than 1.6% estimate - RTRS

Tokyo Inflation Slows Sharply as Subsidies Mask Ongoing Strength

Surprise Jumps in French, Spanish Inflation Heap Pressure on ECB - BBG

UK shop price inflation hits fresh high - Sharecast

One quarter of British shoppers struggling as grocery price inflation goes above 17% for the first time - Kantar

German Supply Chain Bottlenecks Continue to Ease - Ifo Says

German Import prices in January 2023: +6.6% on January 2022, higher than estimated but rate of increase has slowed down. The YoY rate of change had been +12.6% in December 2022 and +14.5% in November 2022 - Data

Iceland’s Inflation Hits 14-Year High - IslandBanki

Turkish Inflation Slows More Than Forecast - Feb. Consumer Prices Rise 55.18% Y/y, Est. +55.70%

The IMF approved over US$ 1.7bn in funds for Jamaica to help towards higher inflation and climate change amongst other factors - RTRS

Corporate (dis)inflation snippets

Occidental expects 15% US cost inflation for 2023 vs 2022

Reckitt Benckiser (LON:RKT) Says Cost Inflation Has Peaked - BBG

Largest fare hike in more than a decade on London Transport - ES

UK’s Royal Mail to raise 1st and 2nd class stamp prices from April

UK’s Energy Price Guarantee set to stay at £2500 for next few months - BBC

Meta Platforms trims Quest Pro Headset 33% to $1,000

Eli Lilly Cuts Insulin Prices by 70% - Eli Lilly

US Rents went up 0.3% in Feb, breaking 5 month down streak:

*IG*

IG new issues - US sees busiest week of the year

Higher rates didn’t seem to deter issuers from coming to market in IG as $46bn was priced. Issuance in the EUR IG market seemed to slow due to the heightened rate volatility, BBG reported that it was the second lowest weekly total of the year at around €30bn. Interesting transactions from the week:

Simon Property: large US IG Real Estate issuer sold $1.3bn of notes, 10y at +165 to yield 5.644% and 30y at +195 to yield 5.914%. Issue rated A3/A-.

€500m Pandora SLB in EUR with terms tied to using 100% recycled silver and gold by 2025 as well as reducing emissions

McDonalds issued 7 and 12 year paper in Euros totaling €1bn

IFR said that more US IG Corps are adding features to their bonds that let them pay back the money early if they can get a better deal later. These options enable borrowers to redeem bonds if refinancing conditions become more favourable.

Insight from Q4 earning season, the latest from Factset

Comprehensive round up from Factset in the link above.

Coverage - 99% of S&P 500 companies have reported actual results

EPS growth - The fourth quarter will mark the first time the index has reported a year-over-year decline in earnings since Q3 2020 (-5.7%)

Guidance - For Q1 2023, 81 S&P 500 companies have issued negative EPS guidance and 24 S&P 500 companies have issued positive EPS guidance

Sector performance - Five of the eleven sectors are reporting (or have reported) year-over-year earnings growth, led by the Energy and Industrials sectors. On the other hand, six sectors are reporting (or have reported) a year-over-year decline in earnings, led by the Communication Services, Materials, and Consumer Discretionary sectors

Margins - blended net profit margin for the S&P 500 for Q4 2022 is 11.3%, which is below the 5-year average of 11.4% and will mark the lowest net profit margin reported by the index since Q4 2020 (10.9%).

UK Credit Markets Have Recovered From the Liz Truss Turmoil - BBG

European Tenders / Debt reduction stories

Real Estate firm Heimstaden Bostad to Repurchase SEK8.5 Billion ($812m) of Debt - Link. Sidenote: European real estate peer Balder got downgraded to junk by Moody’s.

EDF - French Govt asks for conversion of 87.8m of Oceanes into shares, which could reduce debt by €960m - Link

Provisional agreement reached on European green bonds - EU Council

Extract - Environmentally sustainable bonds are one of the main instruments for financing investments related to green technologies, energy efficiency and resource efficiency as well as sustainable transport infrastructure and research infrastructure. Under the provisional agreement, all proceeds of EuGBs will need to be invested in economic activities that are aligned with the EU taxonomy, provided the sectors concerned are already covered by it. For those sectors not yet covered by the EU taxonomy and for certain very specific activities there will be a flexibility pocket of 15%. This is to ensure the usability of the European green bond standard from the start of its existence. The use and the need for this flexibility pocket will be re-evaluated as Europe’s transition towards climate neutrality progresses and with the ever increasing number of attractive and green investment opportunities that are expected to become available in the coming years.

AT&T CFO says it Co. targeting Net Debt / EBITDA of 2.5x by 2025 - AT&T

AT&T CFO Pascal Desroches said “the company is maintaining a sharp focus on proactively reducing costs and deliberately allocating capital. The company is using free cash flow after dividends to help reduce debt as it seeks to achieve net debt-to-adjusted EBITDA in the 2.5x range by early 2025.”

Comments were made at the DB TMT conference during the week.

Aercap was upgraded by two agencies following its Q4 results

Both Fitch and Moody’s upgraded US listed Aircraft Lessor; Aercap to BBB flat, outlook stable. This is an extract of what Fitch had to say:

KEY RATING DRIVERS - The upgrade reflects AerCap's ability to reduce and maintain leverage, as calculated by Fitch, below 2.7x, in combination with the maintenance of a robust funding and liquidity profile, with revolver availability of over $9 billion at Dec. 31, 2022 and liquidity coverage of 1.4x. The ratings also continue to reflect AerCap's scale and franchise strength as the world's largest aircraft lessor; transition of the portfolio to its target of 75% new technology aircraft; access to multiple sources of capital; a predominately unsecured funding profile with an unencumbered asset base in excess of $54 billion as of 4Q22; relatively consistent operating cash flow generation; and a strong and experience management team.

*FINANCIALS*

Financials issuance / redemptions - Wide assortment of issuance

A wider variety of issuance this week and judging by the size and demand, a healthy functioning market here with yields still elevated vs long term averages.

HSBC printed the largest FIG deal YTD by issuing $7bn of TLAC multi-tranche with peak books hitting $24bn.

HSBC also issued $2bn of new PerpNC5.5 AT1 at 8.0%, books were said to hit $10bn (!), see RTRS story for more.

Caixa Bank issued a €750m PNC6.5 AT1 at 8.25%.

Barclays issued £1.5bn in PerpNC6 AT1 at 9.25% vs IPT of 9.625%. This is Barclays’ largest AT1 in GBP. New issue orders were said to top out at over £5bn. Some of the proceeds are likely to be earmarked from holders of the old ££ Barclays 7.25% AT1 which is set to redeem on 15 March.

Asian currency issuance - Barclays issued a SGD400m perp NC 2028 AT1 at a yield of 7.3%, while Intesa Sanpaolo raised 24.3bn Yen in a senior debt offering.

In the US, Citi issued $1.25bn of PerpNC5 to yield 7.375%, the securities have one IG rating.

In terms of redemptions, ABN Amro sent out a call notice for its $1.5bn T2 bond (XS1586330604) and Standard Chartered sent a call notice for its $1bn AT1 7.75% AT1, demonstrating a good run of calls for the AT1 market. Nationwide was oversubscribed on its buy-back for the Nationwide 10.25% CCDS. 775,608 units were bought back at 128.93 (7.95%)

Losing momentum on Solvency II reforms would be a missed opportunity: Phoenix

FTSE 100 Insurer Phoenix’s CEO Andy Briggs says that losing momentum on Solvency II would be a missed opportunity in the City AM.

UK Banks’ Net Interest Margins Are Close to Peaking: Fitch

Extract - Most UK banks’ net interest margins (NIMs) are close to peaking due to the approaching end of policy rate rises, higher pass-through rates to depositors, and lower yields and volumes in key lending segments, Fitch Ratings says. Net interest income increased materially in 2022, driven by rising interest rates, supporting the strong profits reported by the UK’s largest banks in their recent results announcements. But Fitch expects most of the banks’ NIMs to peak in 2023 as depositors become more selective in search of higher yields, mortgage margins fall, the slowing economy weighs on credit demand, and the policy rate peaks by mid-year.

Blackstone defaults on $562 mln Nordic property-backed CMBS - BBG via RTRS

Third high profile default in the sector in the last 3 weeks, and follows entities linked to Brookfield and Pimco separately. Real Estate seems to be right at the centre of troubles related to the second order impacts of rapidly rising interest rates:

Extract - Blackstone Inc has defaulted on a €531m bond backed by a portfolio of offices and stores owned by Finnish company Sponda Oy, according to BBG news as rising interest rates hit European property values.

The asset management giant and prolific real estate investor sought an extension from the bondholders to repay the debt, but they voted against it, the report said on Thursday, citing people familiar with the matter. "This debt relates to a small portion of the Sponda portfolio. We are disappointed that the Servicer has not advanced our proposal," Blackstone said in an emailed statement on Thursday. "We continue to have full confidence in the core Sponda portfolio and its management team," the company added.

The bond…was originally secured against 63 mostly office buildings in Finland. But Blackstone had sold off about 16 buildings to pay down nearly half of the note, which now has an outstanding balance of 297.1 million euros, according to Fitch Ratings.

Blackstone had acquired Sponda in 2017 for €1.8bn and interestingly the firm was founded by the Bank of Finland during the country’s banking crisis in 1991…

Furthermore, Blackstone’s Real Estate Investment Vehicle had to limit withdrawals once again in February as per this RTRS article:

BREIT said it fulfilled redemption requests of $1.4 billion in February, which represents only 35% of the approximately $3.9 billion in total withdrawal requests for the month, the firm said in a letter to investors.

CS also had to limit distributions on one of its Real Estate funds:

The onset of hybrid working continues to be a massive issue for Office firms. Just this week HSBC said it is looking to halve its office space in London.

*HY*

New issues/tenders in public markets

Despite volatile rates markets, some large bond issuances got completed for certain HY issuers like Teva (who raised in excess of 2bn) and Triumph Group which raised 1.2bn. Note though that both had issued large tender offer notices (e.g. $2.25bn tender in the case of Teva) for holders of its existing bonds, so there was likely to be roll-over of some existing holders.

Source: BBG

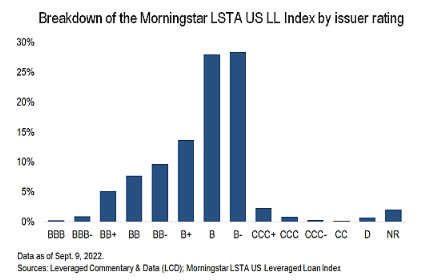

The loan market saw some BB issuers roadshow/price his week - Entegris, Terraform and Uber. This marks a change from the past few years of issuance which have seen the number of B rated issuers surge in the loan market. Pitchbook remarked in September 2022 that B rated issuers made up 57% of the $1.425tn US leveraged loan asset class which was up from 40% in the 5 years prior.

Source: Pitchbook

Interestingly lev loans posted positive returns in February led by riskier credits.

Cruiseliners - Carnival gets $2.1bn facility, Norwegian gets $0.3bn facility.

The size and unsecured nature of this facility read positively for Carnival.

"Our new facility enables us to retain the full benefit of our $2.9 billion revolver until August 2024, while building on our base $2.1 billion commitment over the next 18 months. The successful transaction is a direct reflection of our strong bank relationships and confidence in our continuing return to strong profitability, which we plan to utilize as a springboard to deleveraging and returning to investment grade," said David Bernstein, Chief Financial Officer. The New Revolver will be unsecured and guaranteed on an unsecured basis by Carnival Corporation, Carnival plc and the same subsidiaries of the Company that guarantee the Existing Revolver. In connection with entering into the New Revolver, the Company and its subsidiaries will contribute three unencumbered vessels to the Borrower, with each of these vessels continuing to be operated under one of the Company's brands.

Norwegian Cruise also entered into an unsecured facility in February as announced during the week:

In February 2023, the Company entered into a $300 million unsecured and undrawn backstop commitment with to further enhance its future liquidity profile. The facility will be available to draw beginning October 4, 2023 through January 2, 2024 and provides backstop committed financing to refinance up to $300 million of amounts outstanding under the Operating Credit Facility.

American Airlines is planning a US$ 15bn debt-cutting plan - BBG

Extract - The new chief financial officer of American Airlines Group Inc. has a message for skeptical voices in the credit community as the company seeks to secure a ratings upgrade: The $15 billion debt-cutting plan is on track.

After spending around $24 billion to upgrade its fleet in the run-up to the pandemic, following a bankruptcy and the merger with US Airways, the nation’s most-leveraged carrier is halfway through its biggest ever debt-reduction program.

Two months into the job, CFO Devon May is upbeat about the carrier’s ability to generate sufficient revenue through 2025 to raise its credit standing from B- to BB, in what would be the strongest rating since the merger about a decade ago.

AMC cash and debt highlights - Form 8k

Available liquidity at December 31, 2022 was $842.7m, including $211.2 m of undrawn capacity under the Company’s revolving credit facility.

Adjusted EBITDA was $14.5m compared to $159.2m for the fourth quarter of 2021

Reduced the aggregate principal balance of its debt by approximately $390m since the beginning of 2022

As at Dec 31 2022, total principal amount of debt was $4.9bn vs $5.2bn as at end of December 2021.

On the earnings call, CEO Adam Aron highlighted AMC’s competitive position vs peers:

…that as the world's largest theater chain, we are outrunning our competitors. Number two, Regal Cineworld, is in bankruptcy court….By contrast, AMC…ended 2022 with over $840 million of cash in the bank or undrawn revolving credit line. As for number 3 operator, Cinemark, we encourage you to look at the Q4 metrics where we overlap in the United States. Average ticket price; AMC $12.22; Cinemark, only $10 even; $12.22, $10; food and beverage per patron; AMC $7.76; Cinemark $7.43; total revenues per patron; AMC $21.85; Cinemark $19.35; film exhibition costs, and this is one where you want the number to be low and not high, AMC, our film exhibition costs were 51% of our admissions revenues, at Cinemark it was 58%.

Nordic bond issuer updates

Seaspan: Atlas Corp shareholders approve take-private deal

American Shipping - Profitable in Q4 2022. Company closed on the acquisition of the Normand Maximus and commenced long term bareboat charter. Also bareboat charter for six vessels were extended by three years. AMSC owns a bunch of Jones Act authorised Oil Tankers.

Brooge Petroleum (Fujaira based Oil/product Storage) - SEC Unaudited filing - Revenue $79.2m, net income: $26.2m. 100% of terminal capacity currently contracted at higher storage & handling rates than 2022. 2023 adjusted EBITDA forecast to increase significantly.

Mime Petroleum (Norwegian North Sea E&P) - Summons for written resolution. Ad hoc committee has provided a proposal for alternative financing through the issuance of super senior bonds to meet the near-term liquidity shortfall.

Golar LNG (LNG) - Debt free balance sheet and strong cash reserves of more than $1bn. GLNG has significantly de-levered its balance sheet from approximately $2 bn of net debt just two years ago, at the end of 2020, to a debt free position today. Company. Co. exploring alternatives to start to return value to shareholders through dividends or stock repurchases. However unsecured bonds have restrictions on paying dividends which company are exploring options on.

Altera Shuttle Tankers (Shuttle Tankers) - Reported earnings and announced a deal with French energy major TotalEnergies for the charter of its 2013-built suezmax Samba Spirit.

HY Dividend recaps total $5.8bn YTD - BBG

Increasing signs of frothy behaviour in HY..

Extract - Private equity firms are using some of their companies as automated teller machines again. The firms are piling more debt onto companies they own to fund payouts to themselves, in a telltale sign that investors are increasingly willing to take risk. So far this year in the US, there have been eight leveraged loan sales whose proceeds in part went to companies’ owners, mainly private equity firms, according to data compiled by Bloomberg. That compares with two for the entire fourth quarter of 2022. In Europe, companies have raised $2 billion in dividend recapitalizations, accounting for 12% of all leveraged loans sold this year, compared with just 4% for all 2022. Investors are willing to buy this debt in part because there have been so few loans sold in recent months, as new acquisition activity has been depressed.

Ratings agencies cutting Junk issuers at a fast clip..

*EM*

EM Issuance

Not a huge week for EM issuance again due to outflows and weakness resulting from higher US Treasury yields. However, this week did bring two notable issues; a $2.5bn of sovereign bonds for Morocco (BB+ rated) and a convertible bond for Wynn Macau. Morocco priced $1.25b 5Y (2028) at +195 and $1.25b 10.5Y at +260 (2033) at yields of of 6.22% and 6.602% respectively. Wynn Macau’s $600mn 4.5% CB due 2029s helped lift the rest of the Wynn Macau curve.

China round up - China's latest PMI greatly outperformed the US ISM

Numbers out of China looked good ahead of its National Party Congress that is set to take start this weekend. Reuters were alluding to China possibly targeting a growth rate as high as 6% for 2023. The UK’s Guardian has written that Xi Jingping will look to overhaul China’s government and party institutions at this meeting.

The transmission mechanisms into the China Property firms appear to be working too

Sri Lanka Sovereign recap

The noises being made by the IMF, the CBSL and the Government seem to suggest that a deal is nearby. In advance of a deal, Sri Lanka hiked rates and relaxed the currency band which saw a mild strengthening in the LKR. Key headlines:

IMF chief seeks timely resolution of Sri Lanka’s debt restructuring - Colombo Gazette

World Bank starts working on new Sri Lanka lending framework | EconomyNext

Sri Lanka raises rates, relaxes currency band to secure IMF funds - Al Jazeera

Extract - Sri Lanka’s central bank has raised interest rates to tackle inflation and said it would relax its currency band to move towards a market-determined exchange rate as it seeks to secure a bailout from the International Monetary Fund. On Friday, the bank raised its standing deposit facility rate and standing lending facility rate by 100 basis points each to 15.5 percent and 16.5 percent, respectively, it said in a statement.

Meanwhile, Pakistan bonds are indicating a very high risk of default - BBG

Pakistan 8.25% 2024 bonds were indicated at 50 cents in the Dollar. Pakistan’s external financing needs are around $11 bn for the fiscal year ending June, including $7bn in external debt payments, Moody’s said in a note Wednesday after it downgraded Pakistan to Caa3, outlook stable.

It will be interesting to see how Pakistan do in this situation since public EM funding markets are not really open to them. This then increases the reliance on other bi-lateral or multi-lateral lenders. Once again, as is the case with Sri Lanka, China is a material creditor to Pakistan which could complicate the debt restructuring process. A potential default could result in more risk aversion in EM among low single Bs/CCC credits. It is interesting that Pakistan’s FM said the country has never defaulted, but Moody’s thinks it has defaulted at least once since 1983 (since their records began).

Iraq-KRG Oil Talks Resume But Wide Differences Remain - MEES

Something to monitor in the region.

Extract - Kurdish and federal Iraqi officials have finally begun talks to draft a key law needed to legalize Iraqi Kurdistan’s independent oil sector. While Baghdad appears willing to compromise in some key areas, in others it has retrenched its position. Officials from Iraq’s semi-autonomous Kurdistan Regional Government (KRG) have been in Baghdad for the past two weeks conducting meetings with their federal peers in an effort to revive talks to draft a mutually acceptable federal oil and gas law. If successful, the meetings could help resolve some of the differences on key articles of the law which Iraqi PM Mohammed al-Sudani promised to enact within six months of taking office last October.

Pemex to overhaul ESG credentials to lure investors - BBG

This could be a big deal for Pemex if executed correctly. Pemex currently has “severe controversies” listed against it in at least one of the big ESG rating firms. Should it address these matters appropriately, it could see wider participation in its bonds.

Extract - Petroleos Mexicanos is revamping its environment and safety procedures to ensure it can attract financing from banks and investors demanding tougher standards from fossil fuel companies, according to people familiar with the matter.

India's Adani group gets $1.87bn investment from U.S. firm GQG - RTRS

The Adani saga took a turn for the better with a significant endorsement from an $88bn AUM firm - GQG. Extracts from Reuters article:

GQG took a 3.4% stake in Adani Enterprises for about $662 million, 4.1% in Adani Ports for $640 million, 2.5% in Adani Transmission for $230 million, and a 3.5% stake in Adani Green Energy for $340 million, according to the filing.

"We believe that the long-term growth prospects for these companies are substantial," said Rajiv Jain, GQG's chairman and chief investment officer, adding the firm's investments take into account a five-year horizon. Before founding GQG, Jain spent 22 years at Vontobel Asset Management.

Jain said that as an investor in infrastructure companies, he has been following Adani for six years. "Our view was that these assets would not be low forever," he told Reuters.

Before investing, Jain said GQG did a "deep dive on our own" as part of due diligence, including conversations with the group's vendors, bankers and partners. "We actually disagree with (Hindenburg's) report," he said, adding that infrastructure companies are subject to tight regulation and therefore the risk of fraud is low.

Meanwhile, Adani Group will hold fixed-income investor meetings with investors starting next week in cities including London, Dubai and across US, according to a person familiar with the matter (SRC: BBG).

Separately, ET reported that Adani Group has received firm commitment for $800m debt facility, which will be used to refinance the Adani Green Energy's $750 million 4.375% bond due in September 2024.

Vedanta in talks for loan upto $1bn with Banks - Moneycontrol

Vedanta is in initial talks with at least three banks including Barclays, JP Morgan and Standard Chartered for loan up to $1b, according to people familiar with the matter

Ukraine secures USD2.5bn additional grant financing from World Bank - WB

*DISTRESSED*

US bankruptcy Filings Arrive at Fastest Pace Since 2009 - BBG via ActivistPost

As of the end of February, 39 large companies had filed for bankruptcy in the US YTD, this total represents the fastest pace of companies filing since the immediate aftermath of the GFC in 2009. US bankruptcy courts had seen 63 large filings at this point in 2009. Last week’s seven large filings included generic drugmaker Akorn and Covid-19 testmaker Lucira Health.

EM Credit Distressed round robin

Brazil’s Oi Seeks Creditor Protection Ahead of Debt Payments - BBG

Extract: Oi SA, the distressed Brazilian telecom operator, asked a court to shield it from creditors ahead of a major debt payment, in what may lead to a second bankruptcy protection process in seven years. The company, which underwent one of the largest corporate restructurings in Brazil’s history — that began in 2016 and ended just last year — said it needs urgent help to fend off creditors, according to a filing to a Rio de Janeiro court seen by Bloomberg News.

What’s more interesting is the wider stress ongoing in the Brazilian Credit markets, extract of BBG article via GlobalInsolvency.com:

Brazilian corporate bonds got hammered in February after the implosion of Americanas SA, further weakening the outlook for firms already wrestling with high borrowing costs, Bloomberg News reported. Six of the 10 worst-performing issuers in Latin America this month are Brazilian companies, data compiled by Bloomberg show. Dollar-denominated notes from Gol, Atento and Light lost at least a quarter of their value, while Azul, Stone and BRF bonds delivered losses of between 10% and 15%. The pile of Brazil corporate debt trading at distressed levels — which yield an average of at least 10 percentage points more than US Treasuries — climbed to $11.9 billion, according to data compiled by Bloomberg. That compares to $9.6 billion at the end of last year. The default of retailer Americanas temporarily halted the sales of local bonds and led to widening spreads, with banks striking a more cautious tone on the pace of credit origination. The Rio de Janeiro-based company filed for bankruptcy protection on more than 42 billion reais of debt in late January.

However, note that Brazil’s Gol airlines announced the closing of US$1.4 bn Financing - Gol

Irish Billionaire set to lose control of Digicel in $1.8bn debt-cut plan - Irish Times

Businessman Denis O’Brien is on track to cede control of Digicel under a plan agreed with a group of bond creditors to swap $1.8 billion (€1.7 billion) of the heavily-indebted group’s borrowings for an equity stake in the business.

Digicel said in a statement issued in the early hours of Wednesday that Mr O’Brien has “endorsed” the proposed comprehensive restructuring, which will see him “remain actively involved in the business as a director and retain an equity interest”.

Market sources say that bondholders behind the debt being written off will end up with a majority stake in Digicel, the jewel in Mr O’Brien business empire that he set it up in Jamaica in 2001 after netting about €200 million from his sale of Esat Telecom to BT Group the previous year.

Main holders of Digicel bonds are said to include a number of US hedge funds and mutual funds, including GoldenTree Asset Management, PGIM Fixed Income Contrarian Capital Management.

Venezuela bonds gaining interest again according to BBG

*PRIVATE CREDIT / BUYSIDE*

Trafigura successfully prices USD225m of notes in the USPP market - Trafigura

Extract: The transaction is the Company’s seventh in this market following its first issuance in 2006, and is timed to refinance USD110.5 million of upcoming US Private Placement maturities, and has raised USD114.5 million of additional liquidity for the company. The transaction was increased from an initial USD100 million following strong investor demand, with almost two thirds of the total amount raised in the ten year tranche.

Securitas Doubles Schuldschein to €300m-Equivalent - Benzinga

IG rated issuer Securitas decides to issue in Schuldschein format. The issue was oversubscribed by more than triple the launch amount. The majority of the funding is for five years and consists of Euro and US dollar tranches.

Cotiviti buyout set to become largest ever Private Credit financing to date | BBG

Extract - Direct lenders were working on a $5.5 billion loan to finance the Cotiviti deal, which values the company at nearly $15 billion. If the transaction is successful Carlyle will acquire half of the company, while Veritas will continue to own the other half. The loan would be the largest buyout financing ever arranged by private credit firms. Apollo Global Management Inc., Blackstone Inc., HPS Investment Partners and Ares Management Corp. are among the firms that have offered to participate in the private loan for Cotiviti, Bloomberg previously reported. Oaktree Capital Management, Oak Hill Advisors LP, KKR & Co. and the asset management arm of Goldman Sachs Group Inc. are also part of the discussions, the people said.

It seems that in order to get the deal over the line there may be a PIK element to the proposed financing where the borrower pays part interest with more debt.

Oaktree Capital is seeking to raise US$ 10bn for a new fund - Bizwire

Oaktree seeking to raise $10bn in order to finance large LBOs as Banks retreat from this form of lending.

Extract - Oaktree Capital Management, L.P. has announced the launch of private credit-focused Oaktree Lending Partners and its related vehicles (OLP). OLP is targeting $10 billion in equity commitments from institutional investors. OLP will seek to originate senior secured loans of $500 million or more to private equity-owned U.S. companies, typically with over $100 million in EBITDA. Oaktree believes this market is especially attractive now, given the limited availability of debt capital to finance large leveraged buyouts (LBOs) and the record-high levels of committed private equity capital yet to be deployed, requiring financing. In Oaktree’s view, this imbalance has been driven by (a) the retreat of banks from this form of lending and (b) the constrained capacity of nonbank lenders that are fully invested and/or managing issues with prior investments.

*RATINGS*

AerCap Holdings Upgraded to Baa2 by Moody's, Outlook Stable

Fitch Upgrades AerCap Holdings N.V. to 'BBB'; Outlook Stable

BHP - Moody's Upgrades to A1

Moody's changes BP's outlook to positive; affirms A2 rating

Mercedes Upgraded to A2 by Moody's, Outlook Stable

Downgrades from S&P & outlook changes from Moodys, Fitch on Fresenius Medical

Moody's downgrades Balder's senior unsecured ratings to Ba1, stable outlook

Fitch Upgrades Renault's Rating on Improved Profitability

Fitch Affirms Investec Bank plc at 'BBB+'; Stable Outlook

Altice USA downgraded to B from B+ on earnings drop; outlook negative – S&P

Fitch Upgrades Costa Rica Two Notches on ‘Sharp’ Fiscal Progress

Moody's downgrades Pakistan's rating to Caa3; changes outlook to stable from negative

S&P revises outlook on Kenya’s B ratings to negative on weakening liquidity position

S&PGR Upgrades Kernel Holding To 'CC'; Outlook Negative

*TRADING*

State Street set to acquire outsourced trading firm CF Global - TheTradenews

Interesting developments on the outsourced trading sector. Seems to be a few firms trying to grow in this area as Asset Managers look to minimise fixed costs. Will be interesting to see how this plays out in Fixed Income where (good) Portfolio Managers are more in tune with bid/offer axes, market depth and pricing in their market.

Extract - Financial services giant State Street is set to acquire outsourced trading firm CF Global, multiple sources familiar with the matter have told The TRADE. The deal, if/when completed, will give State Street access to CF Global’s extensive relationships in the space as a segregated outsourced trading entity. The global custodian and asset management organisation recently saw its proposed acquisition of Brown Brothers Harriman’s Investor Services unit fall through; however, it did acquire Charles River Development for around $2.6 billion in 2018 and FX TCA startup Bestx in the same year.

In a related note, the closing of TD’s $1.3bn acquisition of Cowen Securities closed this week. Cowen are another firm with a presence in the outsourced trading area.

MarketAxess Announces Record Total Credit ADV for February 2023 | Business Wire

Chris Concannon, President and COO of MarketAxess commented:

“In February we delivered 25% growth in total credit average daily volume to a record $14.4 billion, driven by 30% growth in high-grade to a record $6.7 billion, and 43% growth in high-yield to a record $2.3 billion. These results were generated in part by strong estimated market share gains in high-yield, Eurobonds and municipals, with record Open Trading average daily trading volume of $4.7 billion.