3 Feb 2023 - Global Credit Wrap

More greed than fear in markets, pricing power back to IG Corp issuers, Xover at 379bps, CCCs/REIT bonds are rallying, US Homebuilder strength, distressed update, Adani bonds, AI in FICC Trading...

*SUMMARY*

The image below says a lot about the state of the current market including Fixed Income. Spreads on the lowest rungs of IG are nearest to the tights vs 3M T-Bills, IG credit is getting priced at negative concessions, Greek Bank AT1s are getting issued, single B rated HY issuers are terming out billions of debt with relative ease, share prices of CCC credits are posting triple digit percentage returns YTD, REITs are back to issuing bonds and some REIT Hybrids are posting double digit gains…

https://edition.cnn.com/markets/fear-and-greed

The recap below covers most of the main happenings in Fixed Income markets for the week gone, for the week ahead, please check out FXMacro’s outlook for the week ahead and the CityIndex week ahead for stocks that are reporting this week.

*TLDR*

MOVES

FX -Strength in non dollar currencies (e.g. AUD and EUR)

Brent Crude Oil back to $80 (Jan 2023 low)

Govt Bonds - US 10 year nearly touched 200DMA, UK Gilts 53s30s steepened to 65bps, BTPs saw largest drop in yield since Mar-2020 before widening on Friday

Credit -Xover tightened to 379bps (2022 high of 670bps), CDX HY at 407bps (2022 high: 626bps)

US HY - Aggregate yield falls to lowest in 5 months (7.7%), CCCs post biggest one day gain in > 2 years.

Equities - Bullish technical levels breached in Nasdaq 100 (through its 200DMA + entered technical bull mkt), S&P 500 approaching a “Golden Cross.”

NORTH AMERICA MACRO

US Mortgage rates dipped below 6.0% briefly

US Jobs market strong, ECI showed cooling off of wages

Number of companies noting high labour costs in their earnings calls, is this the signal for future job losses if same companies cannot pass on price rises

US ISM Services + Composite beat meaningfully, US ISM Manufacturing PMIs remain in the doldrums

Short dated UST yields end the week higher after very strong data on Friday (NFP+PMIs)

OTHER DM MACRO

EZ PMI & Q4 GDP came in better then expected

European QT begins March 2023, partial reinvestment will lean towards issuers with better climate performance

UK PMIs came in above expectations but remain below 50.0, mortgage approvals fell to GFC levels

INFLATION

Global inflation readings remain largely mixed

GS Chart - China reopening is an inflation risk

Euro area January consumer prices rose less than epxected, third consecutive decline. Food/Booze/Cigs climbed +14.1% (higher increase than prior month).

Inflation in UK stores rose at the highest rate since at least 2005 in January

Spanish inflation came in higher than expected due to core inflation rise

Lumber prices in the US are up around 30% YTD

South Korea January CPI comes in higher than expected

Sri Lanka’s inflation slowed for a 4th straight month in January

COMMODITIES

Is the oil price not rallying due shadow Russian fleet of oil tankers?

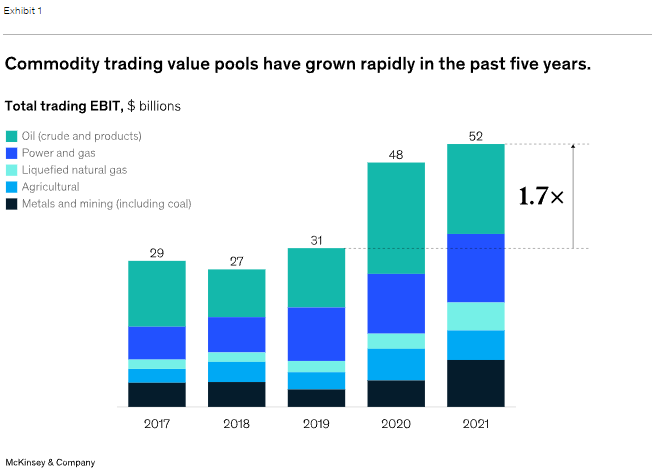

Some nice long reads from Mckinsey and BP on the oil market and commodity trading sector

FINS

AT1s called for HSBC and Barclays respectively, a mildly surprising call in T2

Issuance light, notable AT1 for Alpha Bank (Greek) at 11.875% in EUR, performs very well in secondary

Rising cost pressures push up price of motor insurance - UK's ABI

European Banks keep up positive earnings results

Media outlets focus on how much of high interest rates are being passed onto savers by banks

2 Credit Suisse bonds were the best performer in January in US

UK/European Insurers - 6 CEO changes just this year!

Moody’s Corporation - Interesting slides / take-aways from Q4 2022 earnings

IG

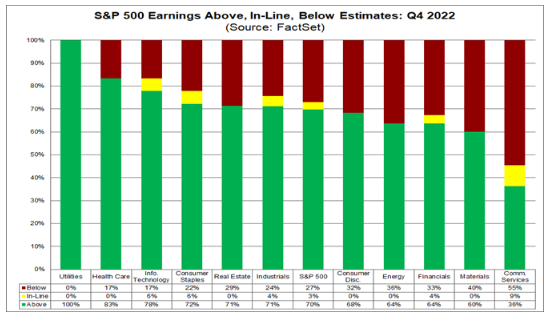

Corporate earnings update as at 3 Feb 2023 - Factset

Overall IG issuers paid no concessions / negative concessions in the US, Oracle with $40bn booksize on its multi tranche deal

Spread between US BBB corp bonds and 90 day T Bills is near zero according to BofA chart

Corporate Hybrids - Low new issuance, Repsol 10% buyback (S&P keeps equity content), some REIT hybrids see double digit percentage gains in a week

German Property Co Vonovia, is putting the brakes on the construction of new apartments

US Homebuilder Pulte earnings - bit of of a deep dive to understand what is driving the strength despite recessionary fears

HY

Reasonable issuance week for HY and Loans again across US and Europe

Easy financial conditions allows Altice France to extend maturities on $6bn+ of debt to 2028

Ford Q4 results disappointed equity investors, debt investors await S&P rating agencies’ next move

Coinbase stocks/bonds jump after class-action suit against the cryptocurrency exchange is dismissed

UK’s Stonegate Pubs Asset Sale rumours - BBG

S&P Ratings Report - European Issuer downgrades spike in Q422, key findings:

47% of all risky European credits are in the consumer products, media, entertainment and capital goods sectors

UK has the highest volume of risky debt

S&P expects the European speculative-grade default rate to rise toward 3.25% by September 2023, up from 1.6% in November 2022

US Distressed debt had a good month in January (+8% return)

2023 unlikely to see a boom in restructuring activity - FTI Consulting

More Than Half of Health-Care Providers Defaulted Last Year - BDO/BBG

EM

EM Central Banks - Rate hikes paused in a couple of nations

China - Consumption prioritised by Xi Ping, China / HK/ Macau border fully re-opened, PMIs improving

Adani update - Agencies comment, Banks comment, what is trading..

Tourism in Caribbean rebounding, with Cancun, Dominican Republica in lead

Vedanta Taps Oaktree, PSBs To Refinance Debt + issues 1st ever sustainability linked loan separately

Sri Lanka has obtained the backing of the Paris Club - BBG

BUYSIDE / PRIVATE CREDIT

Blackrock’s main Credit ETFs get biggest ever January inflows

Pension Investments in Private Credit Hit Eight-Year High - WSJ

Japan’s Norinchukin Bank is planning to re-enter CLO market

TRADING

UBS earnings call highlights re FICC trading

DB misses on FICC for 1st time in a while, but it is still the main source of profits

Barclays Sees Credit Derivative Volumes Extending Boom Into 2023 - BBG

JPM survey sees increased role for Artificial Intelligence in Fixed Income

Octaura Completes First Fully Electronic Syndicated Loan Trades - Octaura

*MOVES OVER 5D*

In addition to moves in Credit, I’ve highlighted below some other noticeable moves in the Global Markets:

Currencies:

This week EUR/USD hit the highest since April last year

AUD/USD hit an 8 month high before trading down after US NFP/ISM.

Equities / crypto:

FTSE 100 closed at a new record

S&P 500 was poised to lift above its 200DMA and set off a golden cross buying signal. Golden cross = 50DMA lifting above 200DMA.

Nasdaq 100 spiked well above 200DMA and entered a bull market after rising 20% vs December low.

The European Stoxx 600 Tech Index hit nearly one-year highs

European Banks continued their rally but consolidated at end of week after better than expected results for the likes of Unicredit, Nordea and Santander. Relative disappointments from DB and UBS didn’t do enough to dull sentiment.

Bitcoin topped $24k at one point to hit the highest since Aug-22

Govt Bonds

US Treasuries: 10 year nearly touched the 200DMA but didn’t get there.

UK Gilts: Spread on 5s30s steepened to 65bps vs a one year average of 37bps. Note during the Liz Truss flash crash this spread went negative

BTPs - 10 year BTPs fell as much as 39bps to 4.0% on Thursday (largest drop since March 2020) before going back above 4.0% after strong US data on Friday

Credit:

Massive tightening in credit indices. Xover went below 400bps to close at 379bps (2022 wides of 670bps), CDX HY tightened 25bps to 407bps (2022 wides of 626bps). Subfin CDS tightened 10bps to 143bps (2022 high 280bps); CDX IG tightened to 67bps (2022 wide: of 111bps).

Cash credit spreads tightened meaningfully led by HY and CoCos. US HY tightened 28bps to 386bps (2022 high: 583bps), CoCos tightened 16bps to 386bps (2022 high: 580bps), EUR HY tightened 15bps to 449bps (2022 high: 675bps).

US HY yields/spreads - This week saw yields fall to lowest in more than 5 months of 7.73% which included a large one day drop in yields of 30bps.

The gains spanned across all high yield ratings, including CCCs which posted their biggest one day gain in > 2 years and saw yields fall to 12.9%. Src: BBG

Commodities

Brent crude back to $80, first time since mid January 2023

*NORTH AMERICAN MACRO*

Mortgage rates dipped below 6.0% briefly after going above 7% in 2022 helping US Homebuilder stocks. See later for some colour on US Builder Pulte where customers are resorting to “rate buy downs” to reduce long term mortgage costs.

The week started with US Employment Cost Index (“ECI”) coming in lower than expected which follows the broader declining inflation trend, ahead of the Fed meeting on Wednesday. Axios covered the ECI topic well saying that its a long term trend rather than a one off, there seems to be a debate on this particular topic.

Fed Chair J Powell did not acknowledge that financial conditions had loosened compared to the last meeting, and so the markets took that as a dovish read, resulting in a massive rally in risk assets with the most speculative securities seeing the biggest moves (e.g. Crypto / near bankrupt firms, Meta Platforms +25% in a day). The rally seemed to really take off on the Thursday during the ECB presser as the market probably felt it was safe to go higher after getting past the Fed/BoE and ECB meetings without any major hawkish speedbumps.

JOLTS and jobless claims came in strong mid week and the week ended strongly with blowout NFP, US ISM Services and US Composite PMI data that were all statistically significant in terms of their beats vs expectations. UST yields ended Friday wider (in particular the short end), reversing some of the gains on UST leading up to Friday afternoon. Note however that US ISM manufacturing PMIs came in weaker than expected, see John Kemp’s article on this topic.

*OTHER DM MACRO*

Eurozone January PMIs and Q4 GDP came in better than expected

Euro zone business activity returned to expansion mode as judged by this week’s PMIs. S&P Global's Composite Purchasing Managers' Index (PMI), seen as a good gauge of overall economic health, climbed to a seven-month high of 50.3 last month from 49.3 in December, just ahead of a 50.2 preliminary reading. To add to this, the Q4 GDP reading for the Eurozone came in at +0.1% outperforming expectations of a 0.1% drop. Within the data, Germany’s GDP contracted in Q4 whereas France’s expanded.

European QT from March 2023, partial reinvestment will lean towards issuers with better climate performance

The ECB stated in a separate news release that the APP portfolio will shrink starting in March 2023 at an average rate of €15 bn per month through the end of June 2023 (with partial reinvestment of portfolio maturities), and that the pace beyond that will be determined over time. During partial reinvestment, the ECB also indicated a stronger preference for issuers with better climate performance when purchasing corporate bonds.

UK Data recap

Despite all its PMI’s being below 50, the three PMI datapoints all came in above expectations (services, manufacturing and composite). However, reading into the survey detail there are concerns around labour shortages, industrial disputes and the lagged impact of higher interest rates on overall activity.

UK house prices fell for the fifth month in January, which is the longest string of declines since the GFC according to Nationwide Building Society data. Linked to that, mortgage approvals in Britain slumped in December to levels seen during the GFC, BoE data showed.

The combination of lower seasonal homebuying activity in December, low consumer confidence dented by higher rates/higher energy bills/higher food bills, overpriced properties and January 31st Tax bill payments could have abnormally subdued demand for mortgages in the UK.

*INFLATION*

China reopening - an inflation risk (?)

Euro area January consumer prices rose 8.5%, lower than expected (8.9%) - MarketWatch

Extract - Eurozone inflation eased more than expected in January, reaching an eight-month low, but price pressures persisted beyond energy as the European Central Bank gets ready for further interest-rate increases. Consumer prices rose 8.5% in January compared with the same month a year earlier, down from a 9.2% increase in December, according to preliminary data from the European Union’s statistics agency Eurostat released Wednesday. This marks the lowest inflation rate since May, after three consecutive declines following a record high of 10.6% in October. Economists polled by The Wall Street Journal expected inflation to fall to 9.1%. The decline in inflation was driven by moderating energy prices, which increased by 17.2% compared with a 25.5% rise in December. However, food, alcohol and tobacco prices climbed 14.1% on year, accelerating from the 13.8% increase recorded the previous month.

Inflation in UK stores rose at the highest rate since at least 2005 in January | BBG

The British Retail Consortium said shop price inflation accelerated to 8%, a record for an index that started in 2005, and an increase from 7.3% in December. Food price increases hit 13.8%, with sugar, alcohol and fruit and vegetables all particularly affected.

Spanish inflation came in higher than expected due to core inflation rise - ING

Spain continuing the recent trend of several countries reporting higher than anticipated inflation statistics:

Extract - Spanish inflation rose again to 5.8% in January, from 5.7% in December. The further cooling in gas and electricity prices was completely offset by a further rise in core inflation to a new record of 7.5% from 7% last month.

The increase in headline inflation was mainly because fuel prices rose more strongly, and clothing and footwear prices fell less than in January last year.

Food inflation also remains stubbornly high. The number of food producers planning to raise their prices further has barely fallen from its peak levels. Another factor is that the Spanish government has launched several support packages to help families in this energy crisis. One drawback of these measures is that they may prolong inflationary pressures.

Lumber prices are up around 30% YTD

Business Insider attributed the rise in Lumber prices to declining mortgage rates, improving homebuilder sentiment data and a recent jump in pending home sales.

South Korea January CPI comes in higher than expected

+0.8% m/m (expected +0.5%, prior +0.2%). Reuters extracts:

South Korean consumer inflation ticked up in January to a three-month high but, driven mostly by temporary effects. Temporary effects that had pushed up inflation included a lift in electricity charges, unfavourable weather for vegetables and a strong round of regular annual price rises, the Finance Ministry said in a statement.

Sri Lanka’s Inflation Cools to 8-Month Low as Supply Snarls Ease | BBG

…as the supply situation improves and the country’s monetary authority kept financial conditions tight.

*COMMODITIES*

TotalEnergies, Iraq see further delays to $27 bln energy deal | RTRS

Iraqi government seem to be playing hardball on a number of fronts including the matter and with the Kurdish Government on their share of payments from International oil companies in the region.

Extract - TotalEnergies and Iraq are taking further time to hammer out key sticking points in a long-delayed $27 billion energy deal which Baghdad hopes will revive foreign investment in the country. The deal was signed in 2021 for TotalEnergies to build four oil, gas and renewables projects with an initial investment of $10 billion in southern Iraq over 25 years. It has seen several setbacks amid disputes between Iraqi politicians over its terms, sources told Reuters early last year. TotalEnergies has now asked its foreign staff to leave the country and local employees to work from home, according to four Iraqi sources, as it struggles to resolve differences with Baghdad. Iraq's demand for a 40% share in the project is a key sticking point, while TotalEnergies wants a majority stake, three sources said.

Couple of good long reports out this week from Mckinsey and BP on Oil/Commodity Traders

The future of Commodity Trading - McKinsey Report

BP Energy outlook - Report

China re-opening could boost Brent prices by over 20% - GS

Goldman are not alone on the sell side in making similar bullish calls on oil, I wonder how much of the weakness is to do with the mass availability of cheap Russian oil, Trafigura commented that Russia’s shadow fleet of tankers has grown to 600 ships.

*FINANCIALS*

New issues/tenders/calls

Issuance was reasonably light this week, but a number of bonds issued a call notice / matured this week.

AT1s:

Barclays - called its £ 7.25% AT1

HSBC called its $ HSBC 6.25% AT1

UBS’s 5% AT1 (2023 call) was redeemed on 31 January 2023.

T2:

There was also an interesting call from Westpac for its AUD $ 250m 2028 T2 bonds (ISIN: AU3FN0040754) at its first call date, the reset is BBSW+140bp. This was despite the Australian Regulator (APRA) specifically sending out a comment about making economic calls on subordinated financials. In the prior week, Soc Gen called a low reset T2 bond.

The slowdown in large UK / Pan European Bank sub financials issuance and the above redemptions may support the sector in the short term although with short dated government bonds offering better yields than recent history, there are plenty of options for investors currently.

Alpha Bank issued 11.875% coupon AT1 in EUR

We did see Greek Bank Alpha Bank come with an inaugural €300m NC 5.5 AT1 (rated Caa1) priced at 11.875% vs IPT of 12.25 - 12.5%. Alpha Bank’s credit rating benefitted from the Greek Sovereign ratings upgrade in the prior week. It traded up in the secondary market and closed the week 103.75/104.25 after being issued at 100.0. BBG reported that the AT1 is a “stepping stone towards a resumption in dividend payments, a feat no major Greek lender has achieved since the GFC.”

This high coupon AT1 joins a number of other very high coupon AT1 from issuers such as Permanent TSB (IPMID) and Yapi Credit (YKBNK). History shows that very highly priced coupon bonds tend to perform very well (for businesses that are a going concern).

IPMID 13.25% AT1 (2027 call) - 113.5/114 cash (issued at 100 in October 2023)

YKBNK 13 ⅞ PERP (2024 call) - 104/105 cash (issued at 100 in Jan 2019)

Rising cost pressures push up the price of motor insurance - UK’s ABI

Motor insurers have been an area of focus for markets lately due to volatility in Direct Line Insurance shares and also concerns highlighted by Travelers in the US about motor claims inflation.

Extract of article - The average price paid for motor insurance rose by 8% in the fourth quarter of last year according to the ABI’s latest Motor Insurance Premium Tracker. The unwelcome, albeit below inflation, rise for motorists reflects the sustained cost pressures faced by motor insurers. The average premium paid for private motor was £470 up 8% on the previous quarter. The current average premium is 7% higher compared to Q4 2021,

Examples of increasing cost pressures cited by some ABI members include:

Energy inflation adding £71.75 to each repair.

Average paint and material costs have increased by nearly 16%.

Comparing 2022-Q3 with 2021-Q3 the average paint cost on repair has increased by 20%.

An estimated 40% of all work is now being affected in some way by parts delays.

Courtesy car costs to repairers are increasing at around 30%.

In addition, the average price of second-hand cars increased by 19% in the year ending July 2022, (source: Auto Trader)

It is clear to me that a number of issuers are still facing the hangover effects of the pandemic (supply chain issues, high inflation, higher labour costs). Just in this week’s blogpost, Ford, Lear, Motor Insurers and Pubs have all mentioned the similar issues.

European Banks keep up positive earnings results

Overall this week European Banks reported strong trading updates. Looking at share prices over 5 days and YTD, material outperformers were Unicredit, Santander, BBVA. A lot of this outperformance is likely down to analyst consensus being too cautious for these banks ahead of the earnings.

Bloomberg did a nice summary of European Bank earnings so far here.

Some governments are asking Banks how much interest is being passed onto savers

Governments and savers have taken notice of the large profits that banks are making and there are already questions about how much is being passed onto savers in terms of better rates. In the UK, Natwest’s CEO will face a grilling by British lawmakers next Tuesday over whether lenders are passing on enough of central bank interest rate rises to consumers, after initially saying she was too busy to attend a meeting with the Treasury Committee. Meanwhile in Spain, dedicated Pensioners and Savers are finding other ways of earning an attractive return by turning to instruments called Letras. I discussed the same phenomenon last week in the US where depositors appear to be moving money into money market accounts to earn a better return that at the banks.

It’s not all bad news, UK savers who have a JPM Chase account (like me) can earn 3% interest on their cash now…

Credit Suisse bonds were best performer in January in US - BBG

According to Bloomberg and TRACE data, Credit Suisse’s bonds were the best performing US IG bonds in January with its 7.95% 2025 bonds tightening 130bps and its 7.5% 2028 bonds tightening 104bps in the month.

European Insurance CEOs Played Musical Chairs in January, Says Berenberg

Extract - Six European insurers in Berenberg's coverage have announced a change of chief executive officer so far this year. "Six in one month is a lot, given that in 2020-22 there were just eight changes, an average of just under three per year," they say. Looking at their track record, Berenberg concludes that change has generally been positive for relative stock performance and particularly good when the appointee was an outside.

Notable announcements include retirement of Legal & General’s CEO Nigel Wilson, change of CEO at SCOR and departure of CEO at Direct Line in January.

Moody’s Corporation - Interesting slides / take-aways from Q4 2022

Moody’s Macro-economic outlook - Interesting that Moody’s see credit spreads going near 600bps by end of Q123…which is ~200bps from where we are right now. Also Moody’s sees global HY default rate rise to 5% by year end from very low levels currently.

Four year US and EMEA Corporate Refinancing Walls

Source: Moody's IR

*IG*

Corporate Earnings season update w/e 3 Feb 2023 - Factset

Not a cheery update from Factset…

Extract - At the midpoint of the Q4 earnings season, the performance of S&P 500 companies continues to be subpar. While the percentage of S&P 500 companies reporting positive earnings surprises remained flat over the past week, the magnitude of these earnings surprises decreased during this time, mainly due to negative EPS surprises reported by a number of large technology companies. Both metrics are below their 5-year and 10-year averages. As a result, the earnings decline for the fourth quarter is larger today compared to the end of last week and compared to the end of the quarter. If the index reports an actual decline in earnings for Q4 2022, it will mark the first year-over-year decline in earnings reported by the index since Q3 2020.

IG Issuance trends this week

In the US market, now there appears to be negative concessions being paid for IG investors (this week) which is a world away from the situation seen in 2022 (avg concession of 13bps). Of note was a mammoth Oracle multi-tranche IG deal which saw $40bn of demand. Pricing power has very much returned to IG corporations as investors look to make a return on cash that has come to them via fund inflows and bond maturities.

In the European market there was nothing remarkable of note. I note that European IG issuance is running ahead of the US at this point (€295bn in Europe vs $154bn in the US).

Great chart from BofA’s Hartnett on the RV between BBBs and 90 day US T-Bills!

Corporate Hybrid Corner

New issuance calmed down in this area which helped the sector drift higher along with other risk assets. This week’s biggest positive movers were in the REIT space led by the Aroundtown complex including its subsidiary Grand City Properties (week to date px changes below).

There didn’t appear to be any specific news on the name but there was a series of positive developments in the sector.

Property sector peer Balder exercised a call to redeem one of its hybrids following an equity raise. This Hybrid traded as low as 75 in the middle of 2022 and will be taken out at par.

German real estate peer Vonovia stated it will not start any new construction projects in 2023, instead choosing just to complete those that have already been started. This should be net beneficial to creditors over the near term as property companies priorise liquidity and debt reduction over capex for new projects:

Germany's largest landlord, Vonovia, is putting the brakes on the construction of new apartments more consistently than previously announced. "We will not have any new construction projects started this year. Inflation and interest rates have risen enormously and we cannot close our eyes to it, "said Vonovia board member Daniel Riedl in an interview with the Westdeutsche Allgemeine Zeitung ( WAZ, Tuesday edition ). Planning in Berlin and Dresden are particularly affected.

In November, Vonovia boss Rolf Buch announced that the Bochum-based Dax group would cut its investments in new buildings and energy-efficient refurbishment by 40 percent in 2023 to just 850 million euros. Vonovia now only wants to complete ongoing new construction projects and not start any new ones for the time being. "We would have had a significant number of construction starts this year, for example in Berlin or Dresden, and moved them backwards - as most property developers are currently doing", said Riedl to the WAZ. "We need stable framework conditions."

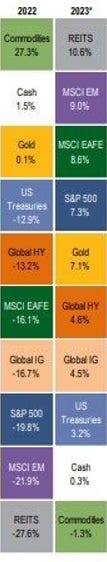

The REIT sector generally is experiencing good momentum, with REITs issuing senior paper in both the EUR IG and US HY markets in the past two weeks and REIT equities are the best performing sector in Global markets YTD according to BofA’s returns quilt. They were the worst performing sector in 2022…

Repsol - Offered to buyback 10% (~€235m of hybrids) via a tender offer without replacement in mid January. S&P commented that it would not affect the equity content on its hybrid. These sort of actions have been the key differentiator between “good citizens” in the Corporate Hybrid world and the “bad citizens,” the latter whose hybrids have been smoked in the process…

US Homebuilder Pulte reports Q4 earnings, stock spikes after massive run up

I decided to dig deeper in to Pulte’s ($13bn market cap US Homebuilder) earnings to understand the incredible strength in its share price. Pulte’s stock had run up around 40% from the November lows ahead of numbers this week then spiked a further 10% post the earnings. Strength in US Homebuilders sector does not seem to stack up with the recessionary concerns many parts of the market have. So what gives?

-Better than expected margins and guidance. Home sales gross margin was up 200bps YoY to 28.8% for the reported quarter. Adjusted operating margin increased by 250bps year over year to 20.6%. Drivers of the improvement in margin include sales in higher margin geographies like Florida, the relative strength of “spec sales” and some lower materials costs. It expects to reap some benefit in Q1 2023 from some of the same factors

-Low leverage, decent cash flow and reduced spend on land acquisition / development spending in light of market conditions

- Declining US mortgage rates helped by the YTD rally in the long bond

-Still a chronically low level of property inventory available in the USA with homebuyers becoming more active as mortgage rates go down and house prices cool off into the key Spring buying season.

Buyer behaviour is also adapting to higher rates and trying tactics like “rate buy downs.” This is a similar concept to product fees in the UK mortgage market where homebuyers can pay a higher product fee to secure a lower long term rate, which eventually works out better over the long term. See here for a super simple explanation of “rate buy downs”:

It wasn’t all great news for Pulte as new orders declined 41% YoY for the quarter and cancellation rose to 32% roughly in line with its peer group.

In summary, I think PHM has been helped by lower mortgage rates, cooling house prices and homebuyers that are still keen to move. However it is clear that management actions had a large part to do with its success, e.g. navigating to higher margin areas, actively reducing costs, keeping leverage low. The nearest example I can think of to PHM’s management is that of Next Plc in the UK who manage to defy consensus most quarters due to superior management skills despite operating in a very tough and cyclical sector - clothing and homeware.

*HY*

Issuance /tender activity

US HY - $2.6bn priced in first few days of February after a blowout January 2023 which saw just short of $20bn printed. The January issuance total was larger than the issuance in any single month since the start of the Russian invasion. This week’s transactions included:

Uniti Group - a $1.5bn market cap US REIT price up $2.6b 5-year secured notes at par to yield 10.5%. The deal was upsized by $850m and pricing tightened after initial whisper of around 11%. Demand was said to be more than $5bn. Last week we saw REIT issuance in the EUR IG space from Prologis (a mega cap US property co) which may have encouraged much smaller firms like Uniti to brave the funding markets

Mauser Packaging - Got more than $7bn for its junk bond sale. Mauser Packaging Solutions sold $3.55 billion of junk bonds and leveraged loans to refinance debt after capturing strong demand for the deal.

Charter Communications - Issued $1.1b 8NC3 at Par to Yield 7.375%, deal was rated B1/BB-.

Martin Midstream sold $400m 5NC2.5 2 lien notes at 11.5% Coupon at $97.00, deal was rated Caa1/B/B.

Also, it looks like another good week for US $ lev loans:

EUR HY - European HY issuance came just short of €3bn. Two less well known issuers came to market (FONFP and STENA). Foncia is a PE owned property management services company in France and Stena is a Swedish shipping line company and one of the largest ferry operators in the world. The Stena deal appeared to trade up in the secondary market whereas the Foncia deal traded below reoffer closing the week. Looking at recent deals in EUR HY/Xover space, notable outperformers have been the GBP AA 2028 bond and the EUR Italmatch bond that are up around 3pts each.

In terms of tenders, AA announced that it has accepted £307.5m from its tender of the 2024 bonds in cash. Anecdotally it has felt as is the Sterling market has had the most money come back to credit investors vs total bonds outstanding lately as there was a flurry of tenders at the back end of 2022 mainly in the IG space. Container name CMA CGM will early redeem its €525m 7.5% 2026 senior notes on February 9th. Norwegian announced it bought back NOK 72m of its September 2026 zero coupon bonds as it looks to clean up its capital structure.

Altice France has agreed a deal to extend maturities on $6.13bn of its loans to 2028

This is just yet more evidence of a very accommodative HY / lev loan market that will help borrowers reduce near term refinancing risk.

In a separate article, Billionaire owner Drahi stated that they would not use any proceeds from its French business to up its take in British Telecom where Drahi is currently a 17.99% shareholder. The Telco space seems to be an area where M&A activity is hotting up, this week it was revealed that $63bn market cap Emirates Telecom (Etisalat) upped its stake in IG issuer Vodafone to 13%.

Ford Q4 results disappointed equity investors, debt investors await S&P rating agencies next move

The equity market didn’t like Ford’s results much as its shares were sold off 7.6% on the day after earnings were announced. Reasons for the stock weakness appeared to be the miss on earnings expectations, poor execution and continued supply shortages.

Ford’s CEO acknowledged they could have done better, as he stated that “$2bn in profits were left on the table."

However debt investors cannot complain too much about Ford’s cash flow and debt metrics. It generated $2.4bn of adjusted FCF and had liquidity of $48bn at year end. Net Cash ex Ford Motor Credit was $12.3bn (vs. $16.1bn FY21)

S&P ratings currently have Ford on positive watch, following these results it will be interesting to see if they move that up into Investment grade. Funnily enough no mention was made about the goal of becoming investment grade again on the earnings call.

In a related announcement, Auto supplier Lear fell the most in 7 months on Thursday after missing guidance too. Lear pointed to an unstable production environment and historically high wage inflation.

Both stocks had a decent run up to their earnings announcements following GM’s blowout figures earlier on in the week which saw the stock +8% in one day.

Coinbase stocks/bonds jump after class-action suit against the cryptocurrency exchange is dismissed

Coinbase shares surged after a Manhattan federal judge dismissed a class-action suit against the crypto exchange.

The complaint claimed Coinbase engaged in the unregistered sale and offering of securities and had failed to register as a New York state broker-dealer.

The judge ruled that the plaintiffs had failed to establish their claims and that Coinbase’s marketing efforts did not constitute solicitation.

Total return on Coinbase 2028 bonds YTD: 29%

Total return on Coinbase stock: YTD 130%

Transocean (RIG) in $400 million-plus ultra-deepwater drillship deal

Following Transocean’s recent bond market issuance, it has won a large contract in Brazil.

Extract - ..Transocean has scored a contract worth upwards of $400 million for its ultra-deepwater drillship Dhirubhai Deepwater KG2 for operations offshore Brazil. Transocean on Tuesday confirmed the Dhirubhai Deepwater KG2 has been awarded a 910-day contract by a mystery national oil company for work offshore Brazil. The estimated $392 million order backlog, which equates to a dayrate of $430,769, excludes a mobilisation fee of 90 times the contract dayrate. This new contract is expected to start in the third quarter of 2023.

UK’s Stonegate Pubs Asset Sale rumours - BBG

Good article from BBG on the pubs sector and how B rated issuer Stonegate (the UK’s largest pub chain) might be disposing of some pubs to reduce debt. This stat from Alix Partners is grim reading but just might be symptomatic of changing habits and higher costs of running an average pub: More than 4,800 licensed premises closed last year, which amounted to 4.5% of the total number in the UK, which includes restaurants and other licensed venues. Closures accelerated in the final quarter.

Taking a simple look at stock performance over 5 years, pubs have underperformed the FTSE 250 and in particular budget choice JD Wetherspoon. Meanwhile, budget take-away outlet Greggs has outperformed. Note Stonegate is not listed.

AMC Theatres Sells Saudi Joint Venture Stake for $30M - Hollywood Reporter

Extract - The mega exhibitor will license its brand and other IP to local partner Saudi Entertainment Ventures…AMC which launched operations in the Middle Eastern country in 2018, said its stake in a joint venture has been bought out for $30 million, meaning a repayment of its original investment, by local partner Saudi Entertainment Ventures. AMC will now license its brand and IP to that company.

S&P - Risky Credits: European Issuer Downgrades Spike In Q4 22

Extracts - Downgrades of European risky credits increased by 13% to 54 in the fourth quarter of 2022, more than 1.5x higher than the pre-pandemic level, according to a report published by S&P Global Ratings.

Three sectors- consumer products, media and entertainment, and capital goods account for a material 47% of all risky credits by number, while the U.K. has the highest volume of risky debt, around 46% as of Dec. 31, 2022. Broadening input cost pressures, rising funding costs, and potential contractions in demand will weigh increasingly on earnings, particularly in more competitive sectors that lack pricing power. Retail, media and entertainment, capital goods, and consumer products have the most exposure in this regard.

"Operational challenges and inflationary headwinds remained the key factors in downgrades to the 'CCC' rating category in the fourth quarter of 2022," said S&P Global Ratings credit analyst Ekaterina Tolstova. "However, refinancing concerns and market liquidity risks rose materially, reflecting tightening financing conditions and investor risk aversion," Ms. Tolstova added.

S&P expects the European speculative-grade default rate to rise toward 3.25% by September 2023, up from 1.6% in November 2022

Distressed debt findings this week - BBG Intelligence

These items were sourced from Bloomberg Intelligence:

US Distressed-debt supply fell by $27bn in December to $107bn.

The level of distressed debt has ranged from $100bn to $150bn in the past 7 months.

US distressed credits returned 8% in January

The distressed cycle to date peaked at 10.7% which is well off the lowest peak of previous distressed cycles. (24.3%)

Health care continues to be the most distressed sector with a 24.3% distressed ratio, while utilities is the least, with none of its 55 issues in distress. In a complete reversal of fortunes over the past few years, Energy only has one distressed issuer (Petrofac).

Amongst US distressed debt, there is a greater proportion of loans over bonds.

Bed Bath and Beyond failed to make a Feb. 1 payment on $1bn of its notes, thereby defaulting and entering a 30-day grace period, during which time it can still make the interest payments. Meanwhile bonds of Carvana rallied as much as 27% from the lows, its stock performance has been even more impressive returning 204% ytd. The highly shorted name seems to be trading more on sentiment than on fundamentals and has become the latest YOLO play for Retail traders.

2023 unlikely to see a boom in restructuring activity - FTI Consulting

FTI which has a successful turnaround and restructuring practice sees elevated restructurings in 2023, but not a boom, according to an article published last week. The tone is similar in some respects to what the BBG Intelligence analysts wrote in their piece, where they expect a slow steady grind up of defaults and distressed bonds rather than a spike in distressed debt. This is unsurprising as it it hard to predict events like the pandemic or the Russian/Ukraine war which tipped a number of firms / sovereigns over the edge in a short space of time. Some extracts of the article below:

2022 was hardly a standout year restructuring activity, but it ended on a high note with 14 large filings in December, the largest monthly total of the year.

Filings in the second half of 2022 easily topped first-half filings

Large filings were down 15% YoY with only 103 in 2022

The bankruptcy leaderboard reshuffled in 2022, with the healthcare, financial services and real estate/lodging sectors accounting for nearly 40% of all filing

Many restructurings avoided the courthouse, with S&P reporting that 42% of default events in 2022 were distressed debt exchanges, with many other unrated names also engaging in aggressive liability-management transactions that probably averted a filing

Expect to see sponsors pull out all the stops to defend investments, especially recent ones, and engage in more debt exchanges, distressed debt buybacks, asset dropdown transactions with unrestricted subsidiaries, non-pro rata capital raises, equity cures and negotiated covenant waivers, with a Chapter 11 filing as a last resort. The ability of sponsors to execute such maneuvers will depend largely on the precise language of the credit documents and the willingness of creditors to take a haircut or commit more capital to a high-risk enterprise. There is nothing pro forma about any of this.

Markets may be underestimating the impact of high interest rates on many leveraged borrowers, which aren’t immediately draining on cash flow but take a cumulative toll over several quarters. Base rates for most leveraged loans jumped to 4.50%-4.75% in 2022 — an increase of at least 350 bps for borrowers with LIBOR floors and even more for borrowers without LIBOR floors. This represents a significant spike in borrowing costs, not only for new issuers but all issuers, with all-in yields for most leveraged loans now approaching 10%, in some cases nearly doubling from 2021.

the distressed debt ratio, a reliable harbinger of future default rates, implies an appreciable uptick in default activity by late 2023 from modest levels but nothing resembling a wave of defaults.

2023 is poised to see a steady uptrend in restructuring activity, but it may not be the blowout year that some professionals are expecting.

More Than Half of Health-Care Providers Defaulted Last Year - BDO/BBG

A survey carried out by BDO USA found that 60% of Healthcare CFOs report they defaulted on bond or loan covenants in 2022, up from 42% in 2021. The underlying issues behind the defaults have included: difficulties attracting patients after the pandemic, high labour costs, supply chain disruption and regulatory uncertainty. The FT also picked up on the distress in the Healthcare sector in the article (Debt woes mount for US healthcare sector as interest rates rise - FT), extract below:

The [US Healthcare] industry is under pressure from increasing wages after loading up on leveraged loans Despite pressures, much of America’s healthcare sector is in reasonable shape, according to Moody’s. US healthcare companies are sinking into debt distress as they struggle to contend with rising interest rates and labour costs after the sector borrowed heavily to fund a dealmaking boom. A fifth of America’s distressed bonds were issued by healthcare companies — spanning services, facilities, managed care and pharmaceuticals — according to an Ice Data Services index.

High debt levels and rising rates are a bad combo, as a number of over-leveraged sectors and issuers are finding out…

888 bonds (GAMHOL) drop after CEO departure and internal investigation…

into VIP accounts - Bonds were down ~7pts following the news. Some of 888 acquisitions bonds were issued in July 2022. As a gaming company, the last thing they need more of is potential ESG concerns.

GM bets on Lithium Americas with $650m investment and offtake

GM bets on Thacker Pass mine with offtake deal and $650m investment in Lithium Americas (LAC). LAC converts +6pts following the news.

*EM*

EM Central Banks - Pause activity…

Egypt’s CB held rates at 16.25% vs a consensus expectation of a hike to 17.25% after it said it was monitoring the effects of last year’s monetary tightening. Meanwhile Brazil paused hikes for the 4th meeting in a row and kept its rate at 13.75%.

China recap - w/e 3 Feb 2023

Summary - China PMIs came in stronger than expected including Caixin PMI. Re-opening theme really gathering steam when it comes to travel / casinos with China fully re-opening border with Hong Kong and Macau with no requirement for COVID19 testing requirements. I think market has under-estimated this point this week due to the focus on DM Central Bank meetings + NFP, but it could be reflected in the strength in the FTSE 100 (new record high this week).

China Manufacturing PMI 50.1 [Est.49.8 Prev.47.0] Non-Manufacturing PMI 54.4 [Est.52.0 Prev.41.6] Composite PMI 52.9 [Prev.42.6] - CN wire

China Jan services activity expands for first time in five months - Caixin PMI (RTRS)

China: Caixin China Manufacturing PMI came in weaker than expected at 49.2 in January (vs consensus: 49.8; Dec: 49.0), the sixth month in the contraction territory. This is similar to the US where Manufacturing PMI remains in a funk..

Xi Urges Efforts to Spur Consumption to Drive Growth Rebound - BBG

British Airways and Virgin to fly daily from UK to China again - Guardian

China to reopen borders with Hong Kong, Macau after COVID closure - Al Jazeera

Extract - China has announced it will completely reopen its borders with the territories of Hong Kong and Macau, dropping COVID-19 testing requirements and daily quotas after nearly three years of closure.

DB produced a nice set of charts highlighting the re-opening in China: Linkedin.

Notable EM New issuance

Pemex $2b 10Y at 97.70 to Yield 10.375%

Dominican Republics DOP 62.282b 10Y Fixed (Feb. 3, 2033) at Par at 13.625%

Dominican Republic $700m 8Y Fixed (Feb. 3, 2031) at Par at 7.05%

Transnet $1b 5Y at Par to Yield 8.25% (South African state owned Logistics/Rail co)

See comment later on re tourism rebound in Dominican Republic which is a huge support for the country. There is likely good read-across for similar Caribbean / central American nations nearby.

Adani recap w/e 3 Feb 2023

Usual playbook of what happens in these sort of major idiosyncratic sell-offs in credit is happening again. I.e. overweight, real money accounts become forced sellers at distressed levels, whose bonds are scooped up by HFs and special situations investors. Quotes on the Adani bonds across the cap structure range from between 65 and 90, which is only moderately distressed (for now). A cursory search on the FINRA TRACE system across Adani family tickers shows ~650mm of reported trading volume (across 454 trades) with greatest volume in ADSEZ tickers in the past 5 days. Brokers are likely to be making decent p&l broking Adani paper “risk free” without the use of balance sheet.

News out this week:

-Fitch - No Immediate Impact on Rated Adani Entities’ Credit Profiles from ”Short-Seller Report”

-S&P cuts two Adani firms' rating to negative from stable - RTRS

- Moody's says Adani stock plunge can hurt group's ability to raise debt - ToI

-S&P Dow Jones is knocking Adani Enterprises off its sustainability index - CNBC

-GS/JPM say Adani debt offers value to trading clients - AFR Extracts: On a call with investors on Thursday, Goldman Sachs trading executives expressed the firm’s view that Adani debt had hit a floor in the short term and bonds of Adani Ports & Special Economic Zone Ltd have become interesting at the current price due to the value of that company’s assets, people with knowledge of the matter said. Goldman said it had traded about $US170 million ($240 million) of Adani bonds today before the call, attracting interest from global funds and distressed investors outside of Asia looking to scoop up the debt from an early stage, the people said.

-BBG reported that two the wealth management divisions of major Banks (one Swiss and one US Tier 1) have stopped accepting bonds of Gautam Adani’s securities as collateral for margin loans. I’m amazed that these securities were allowed as collateral in the first place…

Tourism in Caribbean rebounding, with Cancun, Dominican Republica in lead - La Prensa

Extract - Cancun, Mexico, Jan 30 (EFE).- Tourism in the Caribbean rebounded in 2022 after the end of coronavirus lockdowns with record-setting numbers of people flocking to the beaches in Cancun, Mexico, the Dominican Republic and Puerto Rico and with an almost complete recovery in Colombia, although with some lags in Cuba. In Mexico, which welcomes almost half of all international visitors to Latin America, according to the Statista and Latinometrics consulting firms, the southeastern state of Quintana Roo set a record last year with more than 30 million arrivals at the Cancun airport, according to the state government. Meanwhile, in the Dominican Republic, 7.1 million tourists arrived by air and 1.3 million on cruise ships last year, surpassing the prepandemic level and hitting record figures in 2022, the year in which the World Tourism Organization recognized the country for its “exemplary” tourism recovery. According to figures provided by the Tourism Ministry, tourists spent a record $8.671 billion last year, with 10 percent more tourists arriving by air and 20 percent more by cruise ship than in 2019.

Sri Lanka has obtained the backing of the Paris Club for debt restructuring - BBG

Extract - The Paris Club of creditors formally supports debt restructuring for Sri Lanka, bolstering the bankrupt nation’s efforts to unlock a $2.9 billion bailout from the International Monetary Fund, according to people familiar with the discussions. The IMF received the assurance from the informal group — comprising mostly rich, western bilateral creditors — in recent days, according to the people who asked not to be identified because they didn’t have permission to speak publicly. One of them said that the Paris Club drafted a communique last week.

Sri Lanka Sovereign Dollar bonds closed the week in the mid 30s.

Ethiopia signs financing agreement worth US$745mn with the World Bank - Tellimer

Extract - Ethiopia has signed two grant agreements with the World Bank totalling US$745mm, according to the Ministry of Finance. The first grant will be used to enhance its health-care system. The second grant will go into enhancing Ethiopia’s disaster risk management under the flood management project.

The Norwegian Govt Pension Fund’s Holding in DNO shares went above 5% - Link

US HF DK bought $1.1bn in bad debt from Abu Dhabi Commercial Bank | BBG

US hedge fund Davidson Kempner bought $1.1 billion in bad debt from Abu Dhabi Commercial Bank as the lender cleans up a balance sheet battered by a series of corporate defaults

Vedanta Taps Oaktree, PSBs To Refinance Debt + Issues 1st sustainability linked loan - Verve Times

Vedanta Resources is in talks with Oaktree Capital Management and government-owned banks to refinance its $2.5 billion debt maturing between January and June this year, senior company executives informed analysts last Friday evening.

Later in the week there was an announcement that Vedanta Aluminium had raised its first sustainability linked loan ($250m) from a series of mainly Middle Eastern and Asian Banks.

*RATINGS*

Greece Sovereign upgraded to BB+ at Fitch, one notch below IG

Fitch Upgrades Alpha Bank to 'B+'; Outlook Stable

Fitch Upgrades Eurobank to 'BB-'; Outlook Stable

Fitch Upgrades National Bank of Greece to 'BB-'; Outlook Stable

Fitch upgrades Piraeus Bank's debt to B

Moody's Georgia affirmed at BB, Outlook to Positive by Fitch

Hungary Downgraded to BBB- by S&P, Outlook Stable

Nigeria downgraded to Caa1 from B3; outlook stable

Balder: Moody’s continues its review on a potential downgrade

Fitch Upgrades The Co-operative Bank to 'BB'; Outlook Stable

Moody's upgrades Atlas Copco's rating to A1 from A2 and changes its outlook to stable from positive

Petrobras Affirmed at BB- by Fitch

EnLink Midstream LLC Raised to Investment Grade by Fitch

S&PGR Upgrades easyJet To 'BBB'; Outlook Stable

S&PGR Downgrades National Grid Gas To 'BBB'; Withdraws Ratings

Intel rating downgrades:

Intel Downgraded to A2 by Moody's

Intel Downgraded to A- by Fitch

Moody’s takes rating action on 13 UK Housing Associations including 6 credit rating changes

While there are a number of reasons for the downgrades, Moody’s highlighted some macro economic conditions which were also behind the move: “The downgrades of the BCAs reflect the HAs' high exposure and lower resilience to weakening economic conditions, including prolonged high inflation, capped social rent increases, a housing market downturn and higher interest rates.”

*BUYSIDE/ PRIVATE CREDIT*

Recession remains #1 risk for credit investors – BofA Survey

This chart is even more interesting after the strong week of data we have had this week out of the US.

Japan’s Norinchukin Bank is planning to re-enter CLO market - BBG

Extracts - A Japanese agricultural bank is planning to resume its purchases of bundled leveraged loans in the US and Europe, after pausing last year when UK pension funds were dumping their holdings, according to people with knowledge of the matter… Growing demand has helped US CLO issuance reach $6.47 billion so far this year, according to data compiled by Bloomberg, up from the $4.9 billion priced at this time in 2022.

Some might say that being out of the market during Q4 2022 meant you missed out on some of the best possible returns from the CLO space. Either way, Norinchukin re-entering the CLO market is yet another bullish development in the wider HY space.

Blackrock’s main Credit ETFs get biggest ever January inflows

Pension Investments in Private Credit Hit Eight-Year High - WSJ

Extract - The average share of these retirement funds parked in the illiquid, typically unrated debt has crept up steadily to 3.8%, the highest on record, according to analytics company Preqin. Though a fraction of the overall portfolio, private credit now amounts to more than $100 billion in the retirement savings of U.S. and Canadian teachers, police and other public workers, according to a Wall Street Journal estimate based on Federal Reserve data and pension financial reports. And the pensions are planning to add more: Their average target allocation is 5.9%.

Interesting chart comparing private credit vs public loan pricing in Dec-2022

h/t @bnschwartz

*TRADING*

UBS earnings call highlights re trading

Seems UBS did well in Fixed Income as some of the US Banks did in Q4 too, highlights from earnings call:

In the investment bank, we had our best year on record for both revenue and profit before tax, supported by a record in global markets and outperformance in global banking as well.

Let's start with fourth quarter revenue on Slide 15. In addition to the usual seasonality, the macroeconomic environment led to depressed equity markets and low levels of client, M&A and capital market activity. However, we saw increased activity in fixed income and the benefit of higher rates.

We delivered the best 4Q on record in our FX rates and credit business

Deutsche Bank Misses as Debt Traders’ Winning Streak | BBG

Extract - Gains in fixed income trailed Wall Street for the first time in 10 quarters. Chief Financial Officer James von Moltke said despite the rare miss, the trading business that has driven much of Deutsche Bank’s rebound continues to do well this year. “A little bit of the froth” in trading went away at end of year, von Moltke said in an interview on Bloomberg TV. But “we don’t see that as any signal” for 2023 and are actually “very pleased” with performance.

Revenue from fixed-income trading, the biggest source of income for Germany’s largest bank, increased 27% from a year earlier, just shy of the average 28% at the five biggest US investment banks. That wasn’t enough to offset a 71% crash in the business of advising on deals, leaving the investment bank with 12% lower revenue.

JPM survey sees increased role for Artificial Intelligence in Fixed Income

Extracts -“This trend toward automation is something we’re seeing across the market now, and is expanding into the credit and rates side as well as commodities,” said Scott Wacker, head of FICC e-commerce sales at JPMorgan.

Quantitative hedge funds are “bringing systematic models optimized with machine learning to over-the-counter markets,” he said. “We’re also seeing asset managers using data in a more dynamic way using AI-enhanced technologies to assess and improve how they’re executing trades.”

There is so much data in the credit market (e.g. TRACE, APA data, Ratings, Bloomberg fields, historical prices/yields, customer trading data) that its no surprise A.I can be used to the benefit of the buy/sell-side. The penetration of algo prices on Bloomberg ALLQ could be labelled as basic A.I since they update quotes, generates prices based on different types of customers/sizes/liquidity of the bond. Systems like ChatGPT could be used to generate ideas (using natural language) for a trading desk to make money. E.g. quickly generate ideas on who would be a buyer/seller of a particular bond based on historic trading data. On the buyside it could be used to generate natural language queries to filter for particular bonds that meet a certain criteria.

As a sidenote, it seems Microsoft will be releasing GPT into the Bing search system within weeks.

Octaura Completes First Fully Electronic Syndicated Loan Trades - Octaura

The loan market is less liquid and less transparent than the corporate bond market, and that is saying something! Any technology that can reduce bid/offer, increase visibility is likely to be welcomed in a market that totals $1.45tn in size.

Extract - Octaura, the electronic trading platform for syndicated loans, announced the successful execution of their initial syndicated loan trades. Backed by eight of the world’s leading financial institutions, the company has built an open market electronic trading solution offering leveraged loan market participants access to data and analytics, trading execution and booking on a single platform. Upon the success of the initial syndicated loan trades, the company will move forward with releasing its beta version for loan trading sessions prior to official launch.

Barclays Sees Credit Derivative Volumes Extending Boom Into 2023 - BBG

Extract - Barclays says trading CDS index volume rose 50% in 2022. Levels elevated as investors looked to add and reduce risk.

Credit derivatives trading volume hit record levels last year, and could stay high in 2023, as investors look for quick ways to build and cut exposure to corporate debt markets as their views on the economic outlook shift.

Average weekly trading volume for the main North American investment-grade credit derivatives index jumped to $229bn in 2022, a 52% gain, according to Barclays Plc.

For the main high-yield index, volume rose 54% to $63bn, according to the bank’s analysis of DTCC data. Both volume levels represent all-time-highs for figures going back to 2011.

*LINKS*

DB Jan 2023 asset performance chart - Fixed income highlighted in Red

Pretty amazing how returns for subsectors in the asset class are so close together.

Source: DB/ Linkedin

No words on LIGTBZ?