25 November 2022 Global Credit Wrap

Duration and credit rally continues, keep an eye on events in China...

*TLDR*

MACRO

US Dollar weakened further after poor US eco data and Fed Minutes

10 year UST heading for biggest monthly fall since 2020

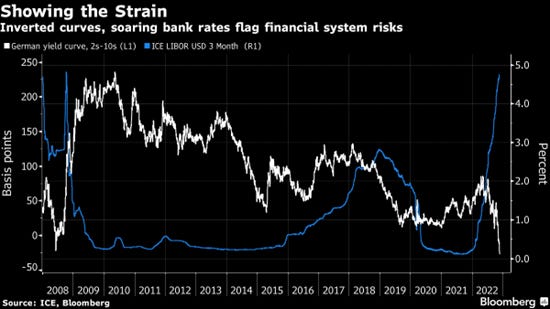

German yield curve inverted by most in 30 years

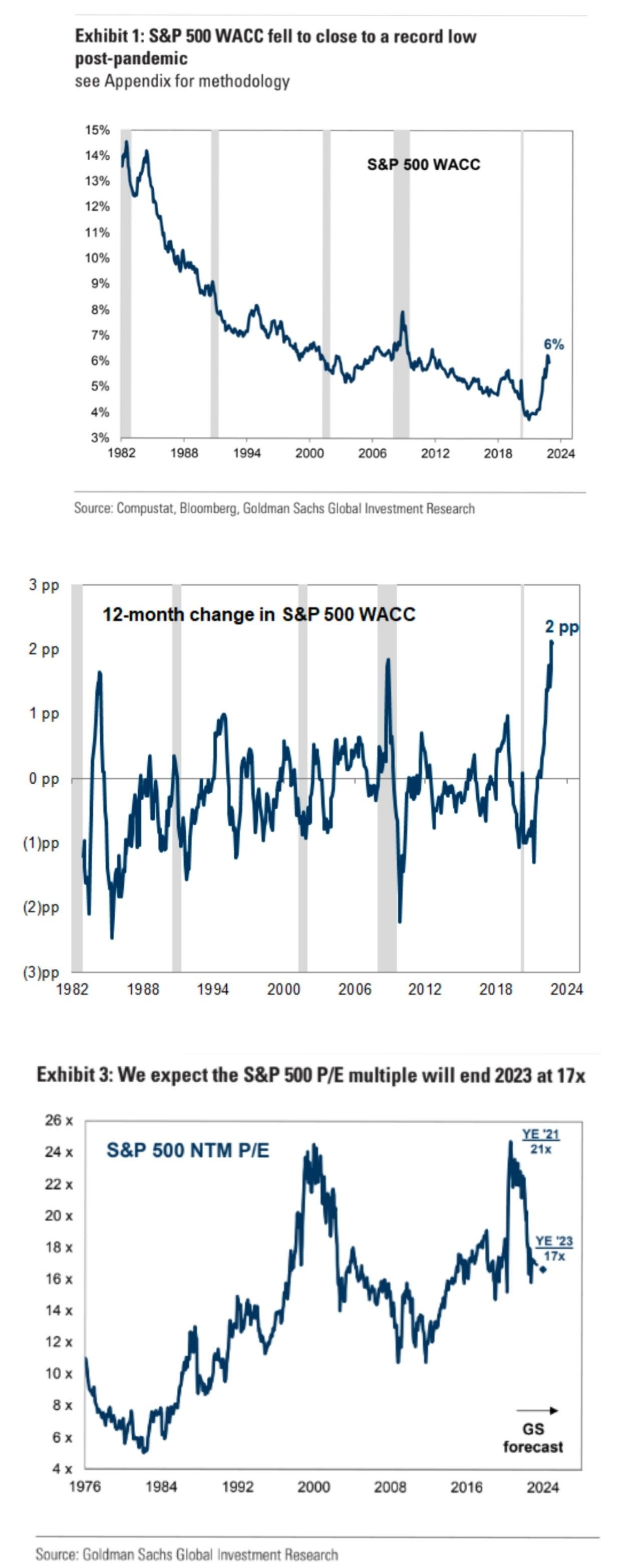

Highest jump in WACC in 40 years

European Xover broke below August '22 levels (now at 453bps)

Bond ETF Moves - Duration, Asian HY, IG and EM Sov leading rally in week

HY Bond Funds see 5th weekly inflow while IG sees 14th consecutive outflow

One narrative for current rally is that bears are locking in gains for 2022 and not looking to position aggressively ahead of year end, therefore allowing bulls to take control for now…

Week ahead includes: EU CPI, US Core PCE, US NFP

CHINA

Major protests to COVID-zero gathering steam as case count goes out of control

Chinese Banks said to provide upto $91bn in credit lines to some China developers

Market indicators show faith in China re-opening/stimulus - E.g some China Property $ bonds are up 40pts over 1 month and Iron Ore price is +25% in November

COMMODITIES

Windfall taxes - Germany and Italy joins in the Windfall Tax party..

Europe may not suffer nat gas shortage this winter: Trafigura

LNG: Asian LNG prices surge, Qatar/China sign 27 year LNG deal

INFLATION

Tokyo inflation hits fastest pace since 1982, fueled by weak Yen

Unionised UK workers likely to see more pay hikes to avert strike risk

UK Egg prices rise by up to 20% in two weeks

TENDERS/NEW ISSUES

Lots of bond tenders going on across Corps, Fins and EM.

GE said more than $10bn equiv of its debt was tendered

New issues - Some rare beasts (Mercedes in $, Greek Bank in £, 12% Japanese $ HY issue)

IG

Travel- Qantas upgrades profit forecast, Thanksgiving travel in US is busier than pre-pandemic. Meanwhile Trivago says European travelers more cost conscious.

HY

Rising yield spread between CCCs and single Bs

DB sees U.S. leveraged loan defaults near record highs in 2024

Theatre names rally on $1.5bn Amazon Theatrical Movie releases headline

FINS

CS bonds not participating in broad rally in sub financials

Virgin Money results impressed, provides useful read on UK macro

Portugal's BCP "does a Shawbrook"

EM

Chile set to enter recession

Ukraine - EBRD preparing financial package to Ukrainian Railways to help establish better connectivity with other European countries

Ghana proposes debt restructure

Helios Towers / Oman Towers deal set to complete in December

*MOVES OVER 5D*

CDS - CDX EM leading the pack tightening 23bps followed by CDX HY (-20bps) and XOVER (-18bps). Month to date, biggest mover appears to be Xover which has tightened 100bps MTD. Lots of indices are below key levels:

Xover below 500 (453bps)

CDX HY below 500 (461bps)

EUR Sub Fins below 200bps (175bps)

EUR IG Main below 100 (89bps)

US CDX NA IG below 100 (78bps)

Move in Xover has seen it go below the August 2022 lows, there have been similar moves in other credit indices vs August.

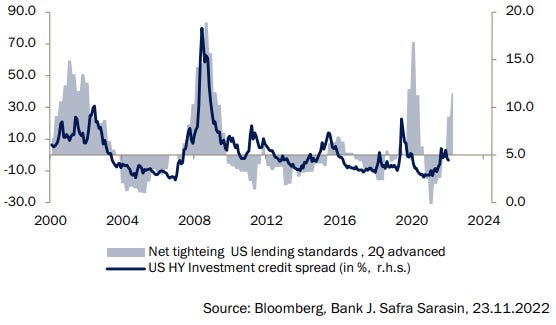

CASH CREDIT SPREADS - Pan European HY led tightening last week (-31bps) followed by CoCos (-25bps), US HY (-15bps) and EM HY (-13bps). Meanwhile, US lending standards are tightening…

BOND ETFs - Leading movers set out below:

SRC: BBG

Looking at the above list, the winners this week were duration (govvie and corps), Asian HY bonds, and EM hard currency sovereign bonds. Note the total return figures look a bit off but directionally seem correct. The main losers are inverse ETFs betting against long duration bond strategies, e.g. TTT, TMV, TBT, TBF which were down anywhere between 3 and 9%.

*MACRO*

Key macro happenings/levels this week

Dollar sold off further, DXY index now around 7% off the YTD highs as market digests a possible moderation of hikes from the Federal Reserve

Weak US data increased downward pressure on the Dollar and on US Treasury Yields. Initial Jobless claims rose more than expected to 240k from 223k and above expectations of 225k. The rise in claims could indicate a slowing of the labour market.

Meanwhile, US S&P Flash PMIs for November disappointed, as manufacturing printed 47.6 (exp. 50.0, prior 50.4) and services fell to 46.1 (exp. 47.9, exp. 47.8), while the composite dropped to 46.3 (prior 48.2). Overall, business conditions worsened with the report noting output and demand is falling at increased rates with companies reporting increasing headwinds from the rising cost of living, tightening financial conditions, higher borrowing costs, and weakened demand across both home and export markets.

Fed minutes revealed that the central bank should soon moderate the pace of interest-rate increases to mitigate risks of overtightening - BBG

10 year Treasury heading for biggest monthly fall since 2020

ECB’s Schnabel said it maybe too premature to scale back increases in interest rates in the Eurozone (BBG)

Germany’s yield curve inverted by the most in 30 years (BBG)

2 different major financial institutions warned on financial stability (German Bundesbank and Singapore’s MAS).

Geopolitics - Europe does not seem to go down the same path as the US with respect to its China relationship, as demonstrated by the German leader Scholz’ recent visit to the nation and also a Senior Dutch official stating “it will defend its economic interests when it comes to the sales of chip equipment to China.” (BBG)

HY Bond Funds see 5th weekly inflow while IG sees 14th consecutive withdrawal

US HY Funds took in $2.2bn for the week ended 23 November according to Refinitiv/Lipper, thereby totaling $13.5bn for the 5 week stretch of inflow. US IG Funds saw its 14th consecutive outflow to total $40.7bn in that period.

Pimco, TCW and DoubleLine Bet on Mortgage Bonds as Rates Rise - BBG

Extract - “Mortgage bonds are close to the cheapest they’ve been since the GFC by some measures, and the likes of PIMCO are betting that prices have fallen far enough to make the securities a great buy now. “

*COMMODITIES*

Asian LNG prices hit 7 week high on winter-supply concern - BBG

Extract: “The Japan-Korea Marker, North Asia’s LNG benchmark, jumped 20% in the week to Wednesday to $34.24 per million British thermal units, according to traders citing an assessment from S&P Global. An ongoing outage at a key US export plant and forecasts for frigid weather in Europe are seen boosting global competition for the fuel this winter and potentially curbing shipments to Asia, the traders said.” Sidenote: a top importer (Japan) says “Global LNG supplies are sold out for years.”

Qatar seals 27-year LNG deal with China as competition heats up -RTRS

QatarEnergy has signed a 27-year deal to supply China's Sinopec with liquefied natural gas in the longest such LNG agreement to date as volatility drives buyers to seek long-term supplies…The pricing of the Sinopec deal will be similar to others in the past that were linked to crude oil. "The way we're pricing our deals with Asia is crude linked. We've done it this way in the past and that's the mechanism we're using going forward."

Europe could be set to avoid a nat gas shortage this Winter: Trafigura (RTRS)

Extract - “A 25%-30% reduction in industrial demand, plus solid inventories and strong flow of liquefied natural gas (LNG) will likely help Europe get through winter, but the next cold seasons will need huge volumes of gas to fill storage in light of the massive reduction and the potential halt of Russian gas flows to the continent.”

A good result for Europe, at least for this Winter…

Could Venezuelan oil hit the market again?

Extract from RTRS story - “Chevron Corp could soon win U.S. approval to expand operations in Venezuela and resume trading its oil once the Venezuelan government and its opposition resume political talks, four people familiar with the matter said on Wednesday.”

Germany plans 33% windfall tax on gas, coal and oil firms - sources | RTRS

Extract - “The German government plans to introduce a special levy to skim off 33% of windfall profits made by oil, coal and gas companies, which could generate revenue of between one and three billion euros, finance ministry sources told Reuters. The levy, called "EU energy crisis contribution", would affect a low double-digit number of companies, targeting their 2022 and 2023 profits, and would be implemented by the end of 2022, the sources added.

Italy to Raise Energy Windfall Tax in €35 Billion Budget - BBG

Extract - “The new budget, the first presented by Giorgia Meloni’s right-wing administration, plans to increase the tax rate on additional profits made by selling energy to 35% from the current 25% until mid 2023, according to a government statement released early on Tuesday. In 2023, the tax will be calculated on additional net income declared by companies selling energy at higher prices, and not on sales as it is done at the moment.”

UK - Recap of changes to the Energy Profits Levy (EPL)

The rate rises to 35% from 25% effective 1 January 2023.

The EPL sunset clause is extended to March 2028 from December 2025.

The Investment Allowance is reduced to 29% from 80% for all investment spending, except decarbonisation expenditure that will still qualify for the 80% rate

Sidenote: Shell said to be selling stakes in UK North Sea Oil Fields - BBG

*INFLATION*

Tokyo Inflation Hits Fastest Pace Since 1982, Fueled by Weak Yen - BBG

Extract - “Tokyo’s inflation outpaced forecasts to hit its fastest clip since 1982, an acceleration that suggests nationwide price growth will also quicken in November after months of yen weakness and elevated energy costs. Consumer prices excluding fresh food rose 3.6% in the capital in November, with the faster pace driven by further gains in processed food prices.”

Could surging inflation in Japan be the reason Japan is forced to change its highly simulative monetary policies?

UK union disputes suggests more wage inflation on the way

Nurses, Ambulance workers, Train Drivers and Postal workers are just some of the employee groups looking to strike ahead of the year end, planning on bringing the country to a standstill unless wage demands are met. ITV has more.

UK Egg prices rise by up to 20% in two weeks - TheGrocer

Shoppers facing growing egg shortages in the mults are also seeing hefty price rises, with Assosia data showing hikes of as much as 20% on some lines over the past fortnight alone. With Tesco, Morrisons and M&S becoming the latest retailers to introduce egg rationing this week, analysis of Assosia data by The Grocer shows there were 37 separate price increases across the the traditional big four, Waitrose, Lidl and Aldi since 12 November.

VW agreed a two-year wage deal of around 8.5% more pay over the next two years | RTRS

Extract - “Volkswagen agreed a two-year wage deal for workers at its western German factories, offering around 8.5% more pay, which was below inflation but above what other employers have yielded in recent weeks. The deal, affecting around 125,000 of the carmaker's employees, would have been considered exceptionally generous until recently but is now below inflation, which was 11.6% last month in Germany, Europe's largest economy.”

*TENDERS / NEW ISSUES*

Notable GBP Issuance

Commerzbank issued a £ Benchmark 10.25NC5.25 bond with an 8.625% coupon.

National Bank of Greece tapped into the demand for GBP credit by issuing a £200m 4.5NC3.5 senior preferred bond at 8.75%.

Severn Trent sold a £400m 4.625% 2034 deal - Book coverage was an impressive 8x. It priced at G+160bp and saw £3bn of demand which represents a huge turnaround for the Sterling Credit Market from the heady “Liz Truss / Kwarteng days!”

Notable USD issuance

Rare issuer Mercedes Benz got ~ $8.5bn in demand for its 3-part $2bn deal split between 2s, 3s and 5s. Given the current shape of the yield curve, the 2y bond yield was actually higher than the 3y which was higher the 5y.

ArcelorMittal priced $2.2bn repricing its curve wider and paying substantial concessions (65bps) in the process.

Ratuken (Japanese issuer) issued a BB+ (neg outlook) bond at a yield of 12%

Source: BBG

GE completes tender offer - early participation results - Biz Wire

Extract - “A total of approximately $9.3bn in principal amount of the Securities denominated in U.S. dollars, approximately £629m in principal amount of the Securities denominated in Pounds Sterling, and approximately €865m in principal amount of the Securities denominated in Euros, each listed in the table below were validly tendered and not validly withdrawn at or prior to the Early Participation Date”

Financials issuers that tendered for bonds

Ageas tender offer for FRESHES (see financials section)

Swiss Re Completes Debt Tender Offer

European issuers that tendered for bonds this week

Balder Plans to Buy Back Up to €500m of Notes (European Real Estate)

Bertelsmann Announces Tender Offer for BERTEL 3 04/23/2075 Corporate Hybrids

Orange - Tendering for callable £ 2023 Hybrids (Telcos)

Vonovia to Accept >EU1b of 2023, 2024 Notes for Repurchase

EM Issuers that tendered for bonds this week

Anton Oilfield (Asia listed oil services) - bought back $50.6m of Antoil 2022 Dec bonds

Republic of Panama offering to buy back over $837mm of bonds due in 2024

Ornex Offers to buy upto €20m of DTEK Renewables Notes at Discount

*HY*

Deutsche Bank sees U.S. leveraged loan defaults near record highs in 2024 | RTRS

Extract - “Default rates on U.S. leveraged loans will hit a near-record high of 11.3% in 2024, while defaults on euro leveraged loans will hit 7.1%, as the global economic outlook deteriorates, Deutsche Bank said on Monday. For 2023, however, Deutsche Bank expects default rates to be kept in check given the lack of near-term maturities. The bank said in a research note it expects a 5.6% default rate in the United States and 3.7% rate in the euro market respectively in 2023.”

Default rates update from Moody’s

Theatre names rally on $1.5bn Amazon Theatrical Movie releases headline..

Interesting twist for Cinema-goers and Theatre companies as Amazon hypes up its ambitions to launch more films in the Theatres going forward. The only issue is that most of the films that come out in the Cinemas frankly suck compared to shows available on the main streaming platforms…

CNBC Extract - “Cinemas stocks got a boost Wednesday after a report said Amazon plans to spend $1 billion a year on theatrical film releases. The tech company plans to make between 12 and 15 movies for movie theaters each year, Bloomberg reported, citing people familiar with the matter. A smaller number of films will be produced in 2023 as Amazon builds up its output, the report said…

Amazon founder and executive chairman Jeff Bezos has made no secret of his desire to expand the company’s media business, and he has long believed that it can help drive Prime subscriptions and additional purchases on its core e-commerce site. Amazon has released movies in theaters in the past. It premiered the first two episodes of its Lord of the Rings series in cinemas for a limited window, and its 2017 comedy “The Big Sick” was shown in theaters. But the company has primarily launched its original content directly on the Prime Video service. While a $1 billion annual investment for film development is on the lower end of what major Hollywood studios spend each year, its a positive sign for the movie theater business, which has struggled in the wake of the pandemic.”

CEO of AMC Adam Aron seemed to be especially pleased.

Separately, note that Netflix released a film starring Daniel Craig in the Cinemas:

Adam was also excited about the management change at Disney…

Who knows what all this could mean for the Theatre stocks, including Cineworld which is currently in a Chapter 11 process.

Oaktree Capital has injected additional funding into existing UK Pub Venture..

Oaktree Capital has injected additional funding into RedCat Pubs Company, founded by Rooney Anand, following talks with its lending banks, Sky News learns.

North Sea Oil firm EnQuest - Operations Update

EnQuest reported an operations update after the Autumn Budget. Key comments:

Net debt position of $750m as at Sep 30 vs $880m at June 30th

“Continue to progress towards our net debt to EBITDA target of 0.5x…”

RE EPL #1: "While the recently announced increase and extension of the duration of the Energy Profits Levy (“EPL”) is particularly disappointing and threatens the delivery of UK's twin objectives of long-term energy security and decarbonisation, we remain committed to the UK North Sea and delivery of value to our stakeholders."

Re EPL#2: “The increase in the Energy Profits Levy will impact free cash flow generation and the pace of deleveraging for the Group. However, the Group will continue to exercise strong cost discipline and optimise its capital programmes to mitigate the impact of the levy, with particular focus on the organic investment opportunities at Magnus and Kraken”

*FINANCIALS*

Credit Suisse roundup

Credit Suisse shareholders greenlight $4.2 bn capital raise (CNBC). Saudi National Bank take a 9.9% stake in Credit Suisse as a result and becomes the largest shareholder.

CS announced outflows of 84bn CHF ($89bn) in the first six weeks of 4Q and within its Wealth Management Unit, amounts totalling 10% of AUM went out the door. Rivals UBS and MS are said to be picking up most of the AUM in Asia according to BBG. The question many are likely to be pondering is what a smaller CS will look like in the future.

As a result of the poor news flow at CS, its bonds are not participating in the current rally in sub financials.

Virgin Money - FY results impressed. Stock up nearly 30% in a month (to 25 Nov 2022)

UK Challenger Bank Virgin Money issued a positive update. Key highlights from Fixed Income Presentation:

It also provided insight into the UK macro situation in terms of its own customers. The earnings call and slide decks are likely to be a good source of further info on that topic.

Ageas issues any and all tender for FRESH instruments…price rockets

Insurer Ageas issued a tender for its legacy FRESH instruments at a price of 82, they were trading about 75 prior to the announcement.

Portugal’s BCP “does a Shawbrook” on its T2 bond

BCP decided not to call its € 4.5% 2027 NC ‘22 T2 bond, which was broadly expected by the market. Instead it is launching an exchange offer for a new T2 instrument with a coupon of 8.75% (10.25NC5.25). This echoes similar moves by UK Challenger Bank Shawbrook which did something similar with its AT1 that was set to be called this December.

*IG*

Qantas Upgrades Profit Estimate with Continued Strong Demand |Aviationsourcenews

Extract - “Continued strength in travel demand has resulted in the Qantas Group upgrading its profit expectations for the first half of FY23. The Group now expects an Underlying Profit Before Tax of between $1.35 billion and $1.45 billion. This represents a $150 million increase to the profit range given in early October 2022. Consumers continue to put a high priority on travel ahead of other spending categories and there are signs that limits on international capacity are driving more domestic leisure demand, benefiting Australian tourism. Fuel costs remain significantly elevated compared with FY19 and are expected to reach approximately $5 billion for FY23, which would be a record high for the Group despite international capacity at around 30 per cent below pre-COVID levels.”

Thanksgiving Travel Is Now Busier Than It Was Before The Pandemic - BBG

Extract - “More people are traveling through US airports in the pre-holiday period than in 2019, according to the TSA. On Tuesday, 2,299,346 people were screened in security in American airports versus 1,968,137 passengers on the comparable day in 2019. Monday’s travel figures were higher as well, and the Sunday after Thanksgiving is expected to be even busier. United Airlines anticipates Sunday the 27th to be its biggest day since before the pandemic, with more than 460,000 passengers flying back from their Thanksgiving celebrations…”

Europeans Are Starting to Cut Back on Holiday Spending: Trivago (BBG)

Extract: “Data for the November-January period indicates an increased propensity for people to favor cheaper hotels and shorter trips, with more clicks for lower-priced options than at the equivalent time in 2019, Chief Financial Officer Matthias Tillmann said in an interview. At the same time, bookings this quarter via the Dusseldorf, Germany-based company’s website are currently around the level they were before the coronavirus crisis roiled global travel, Tillman said during Morgan Stanley’s TMT conference in Barcelona.”

VW says China sales will be roughly 14% lower than expected - BBG

Extract - “Volkswagen AG has lowered its sales target in China by roughly 14% for this year as the country reinstates its Covid-Zero policy that led to widespread supply-chain disruptions for the auto industry. The German carmaker plans to sell 3.3 million cars in China this year, on par with the previous year’s results and about a half million fewer than the 3.85 million previously estimated, the company’s China chief Ralf Brandstaetter said in an interview with Handelsblatt newspaper published Tuesday. “

Sidenote: VW is currently involved in a debate with ESG ratings agency MSCI regarding “allegations of forced labor in its own operations” in China to which VW issued a response, earlier in November, after MSCI ESG listed a “severe controversy” in its last ESG report on VW.

Enel to Sell Assets Worth €21 Billion in Bid to Reduce Debt - BBG

Extract - “Enel’s debt was €69.7 billion at the end of September. Assets that will be put up for sale will result in full exits from Argentina, Peru and Romania. It will now focus on six major markets from Italy to the US and Brazil. “

*EM*

Main EM / Asian Central Bank Activity

Turkey’s central bank slashed rates to 9% from 10.5% in line with analyst’ expectations (BBG)

South Africa hiked 75bps as expected taking the repo rate from 6.25% to 7.0%, it was the seventh consecutive hike in the repo rate.

South Korea hiked a more modest 25bps due to worries about its credit markets. BoK Governor Rhee Chang-yong signaled the end may be near for the country’s unprecedented streak of policy tightening to curb inflation, returning to a smaller interest-rate hike as concerns grow over economic growth and credit markets. (BBG)

Chile Set to Spearhead Global Rate Cuts as Boom Turns to Bust - BBG

Extract - “Chile is set to lead the world into a steep interest rate cutting cycle next year as inflation slows and its economy goes from boom to bust, according to swap markets.”

Ukraine: EBRD is investing € 300m in so-called solidarity lanes

Extract - “The European Bank for Reconstruction and Development (EBRD) is supporting efforts to safeguard global food security and aid Ukraine’s economy, by investing €300 million in Solidarity Lanes. The Solidarity Lanes, established by the European Commission and EU-bordering countries in May, are essential routes for facilitating the export and import of Ukraine's agricultural commodities as well as other goods.

As part of its commitment, the EBRD is prioritising investment in road, rail and other infrastructure. This includes investment and support for projects in Ukraine, Moldova, Poland and Romania.

In Ukraine, investment is needed to address border crossing bottlenecks and improve connectivity with the European Union. The EBRD is thus preparing a financial package for Ukrainian Railways which will be partly invested in resolving these problems. “

Ghana proposes debt restructure - BBG

Extract - “Ghana will ask holders of its international bonds to accept losses of as much as 30% on the principal and forgo some interest payments as it hammers out a debt-sustainability plan to qualify for a loan from the International Monetary Fund. “

Helios Towers expands to Oman on closing of Omantel acquisition terms

Extract from Shares Magazine: “Helios Towers PLC said that all closing conditions have been satisfied for its agreement with the largest mobile network operator in Oman, Omantel Telecommunications Co to buy its cell towers. Helios Towers is a London-based, Africa-focused telecommunications infrastructure company. It owns and operates telecommunication tower sites in Tanzania, the Democratic Republic of Congo, Congo Brazzaville, Ghana, South Africa, Senegal, Madagascar and Malawi. According to the deal, Helios will acquire the entirety of Omantel’s passive tower infrastructure portfolio. The purchase is unconditional, and expected to complete next month.”

*RATINGS*

X-S&PGR: Bertelsmann's Hybrids Now Have Minimal Equity Content

X-S&PGR Downgrades Akzo Nobel To 'BBB'; Outlook Stable

Fitch Upgrades Banca Monte dei Paschi di Siena to 'B+'; Outlook Stable

QBE. Ratings affirmed by Fitch with a stable outlook

Rolls Royce: S&P revised the company's outlook to Positive from Stable

Fitch Affirms South Africa At 'BB-'; Outlook Stable

Wizz Air Cut to Ba1 by Moody’s; Outlook to Stable From Negative

Fitch Downgrades Seplat to 'B-' following Sovereign Rating downgrade

Fitch Downgrades IHS Holding to 'B+'; Outlook Stable

*CHINA*

China roundup

The COVID-19 situation seems to be escalating based on press reports, so much so that some Twitter folks are questioning whether this is the intention of the Chinese State following the last Party Congress meeting:

Meanwhile, several China Property Bonds are off to the races due to top down loosening measures which are being transmitted via the Country’s largest Banks. For example, ICBC said it would provide 655 billion yuan ($91.4bn) in credit lines to 12 developers, including Country Garden Holdings…this reduces the potential risk of default for some of the largest developers which has sent their bonds soaring. The China State Council also authorised an RRR cut as a liquidity support measure.

Source: BBG

Oh yes, to add to the mix, this weekend there are multiple reports of huge protests in China against the zero COVID policy…

*LINKS*

JPMorgan Sees $1 Trillion Demand Boost for Global Bonds in 2023 - BBG

Extract - “After unprecedented deterioration this year, we expect the balance between bond demand and supply to improve,” the JPMorgan strategists wrote. “With analysts focusing on 2023 outlooks, there is an emerging consensus view that softening growth and declining inflation should contribute to declines in bond yields.”

S&P update on Corporate Hybrids - Summary

Rising yield spread between CCC rated bonds and B rated bonds…

WACC sees highest jump in 40 years - GS Research

Extract - “The cost of capital for US firms surged by the largest amount in 40 yrs. The WACC jumped 2% to 6%, the highest level in a decade.” Source: Linkedin

🙏🙏🙏