24 March 2023 - Global Credit Wrap

Financials heavy update this week including trading recap on AT1s...

*TLDR*

Short term asset allocation has been into safety trades (Gold went through $2k intra week, $5.1tn is sitting in money market assets now and 2 year UST rallied 7bps further from the prior week to culminate in a 130bps tightening from the 5% mark we saw on 8th March 2023.

There are a number of signs that the “market plumbing” is being tested to the max… Massive moves in Government bonds, volatility in Bank instruments (Stocks/CDS/Bonds), rising number of “stop-outs” for Macro HFs, and the surge in usage of Fed facilities. This has culminated in the return of coordinated Central Bank actions to improve Dollar liquidity led by the Fed…

Within AT1, trading data and updates from dealers suggests large amounts of “risk transfer” from original owners to new HF / special sits type buyers. There appears to be a clear divide on the future of the AT1 sector with “outsiders” (mainly Social media influencers & newsletter writers) calling for the end to the sector, while “insiders” such as Central Banks (ECB/BoE/Canada/MAS) and FMs active in the sector defending its long term future. The week ended with significant widening in the DB credit complex.

Looking forward, the latest focus is on the impact of Regional Banks curtailing their lending ambitions and the associated impact on the CRE sector. I have been writing for weeks/months on how the office sector particularly in the US is facing a lot of difficulties, but as with everything there will be regional variations which could see different fortunes for different businesses in this sector.

MOVES

Govt bonds:

Huge vol in front end Govt bonds with the 2yr UST seeing highest rate vol since 1982 according to MS

10 year UST broke below 200DMA

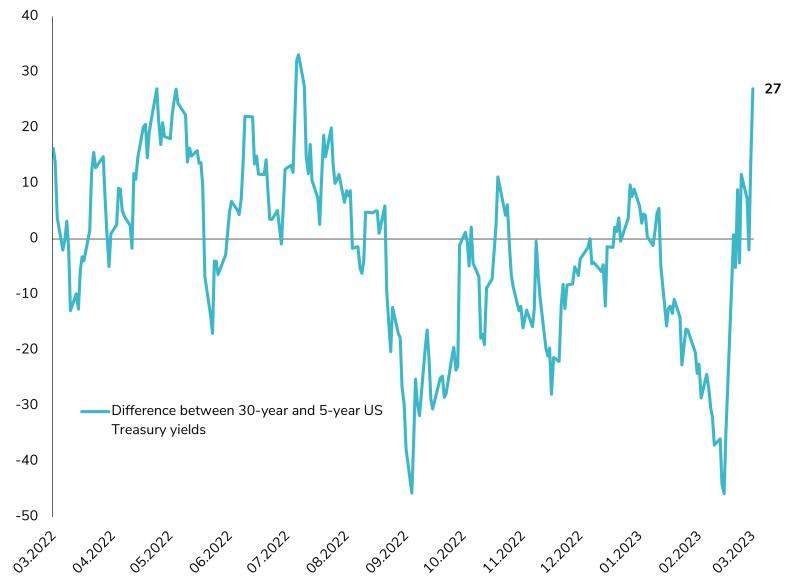

5s30s spread turned positive again on 21 March and spikes to 23bps

Australian bonds head for a third-straight weekly advance

Credit spreads - Main story in town is the move in European Bank CDS

Bond ETFs

Weakness in Bank AT1, Preference Shares, Asian HY and Long dated UST. Strength in EM Local, TIPS, Med dated IG Corp and IG more generally and EM HC.

MACRO

“Coordinated central bank action to enhance the provision of U.S. dollar liquidity” - Fed Reserve

A number of central banks hiked this week, despite Banking sector worries (remember inflation?).

Rates in US/UK/Norway at levels last seen during 2007-2009.

SNB raised rates, says Credit Suisse takeover prevented larger crisis

Money market AUM rises above $5.1tn according to BofA, two week increase in AUM is highest since Apr-2020

Doubleline’s Gundlach predicts Fed will be cutting rates this year, says 2yr UST is better indicator of near term rate trajectory

BofA FM Survey: Majority of FMs expecting Systemic Credit Event

Corporates announced some large layoffs this week (Amazon further 9k cuts, Accenture 19k of cuts)

Hong Kong Overnight Funding Costs Double in Sign of Cash Squeeze

Citi Credit card data showing tentative signs of slowdown of consumer spending suggesting some spillover of negative sentiment from Bank sector concerns

European Services PMI came in stronger than expected, manufacturing still weak

UK retail sales boosted by second-hand and discount stores

INFLATION

UK CPI surprises to upside, Asian nations seeing some lower than expected inflation prints (Japan/Singapore/HK)

Cement prices remain elevated

COMMODITIES

Gold posts a 4th straight weekly gain

Iron Ore Set for Worst Week Since October 2022

Investors liquidated positions in oil as banking crisis erupted

FINS

DB led Financials sector lower to close the week

Notable move wider in Banks CDS

Bank stocks are trading at levels last seen in major crises - Chart

Citi CEO Fraser says 'this is not a credit crisis'

Bond redemptions this week - DB T2, Lloyds Senior and UBS Bail-in Notes, PBBGR did not call its AT1

UniCredit leaning towards repaying AT1 bond in June - source via RTRS

NY’s Community Bank purchase of $39bn of assets from Signature Bank did not include CRE exposure

Europe’s Top Banks Won’t Face Credit Suisse’s Fate: Moody’s

European Banks exposure to US CRE - Chart

Global AT1 instruments suffered a record drop this week

Some Asia Bank AT1s Also Have Swiss Wipeout Clause: Creditsights

Algebris’ Serra on AT1 - AT1s are ‘Absolutely not dead’

CS AT1 - Round robin of stories including which firms made money on the recent volatility and a podcast discussing the potential legal challenge on CS AT1 write-down.

IG

IG New issue markets subdued but Thursday saw a flurry of issuance mainly from the states from blue-chip issuers like Marriot and Prologis

HY

Deals getting postponed due to Bank sector vol, Ford is in the market trying to raise a prime ABS. Tender offer from EUR HY name Casino.

Apple Plans $1B Theatrical Movie Push, Cinema stocks rose

Liberty Global Agrees to Buy Rest of Belgian Carrier Telenet for $1 Bn

Avis - Moody’s upgraded rating of Avis Budget Car Rental to Ba3 from B1

Rackspace Lenders Tap Legal Counsel as a Preventive Measure

DISTRESSED

Carvana Plans $1 Bn Debt Exchange in Restructuring Bid

Short Sellers Step Up Bets Against Office Owners on Bank Turmoil

Commercial property risks rise up bank investors’ worry list - FT

EM

China Evergrande offers bond and equity swaps in debt restructuring

S&P Warns of Default Wave Ahead for Latin America as Rates Rise

Bolivia Pays Dollar Bond Coupon as Currency Crisis Mounts

IMF approves $3Bn Under the new EFF Arrangement for Sri Lanka

Sri Lanka Bondholders Said to Eye GDP-Linked Debt Restructuring

World Bank and Egypt agree on $7bn framework

Kurdish oil revenue to be moved under federal government supervision

RATINGS

Tesla bonds exit junk-rated status after Moody's upgrade

Airlines: Delta & American to positive outlook, IAG raised to BB+ by S&P

Fitch downgrades First Republic's IDR to 'B'; maintains rating watch negative

Ally Financial Affirmed at BBB- by Fitch

S&P Raises Commerzbank AG Rtg To A- From BBB+; Outlk Stable

Main Aussie Major Banks get ratings updates from Fitch

Casino Downgraded to Caa1 by Moody's

S&P Downgrades Carvana Co. To 'CC' On Proposed Debt Exchange

Argentina Downgraded to C by Fitch

Bolivia Downgraded to Caa1 by Moody's, May Be Cut Further

Fitch upgrades Ghana's long-term local-currency issuer default rating to 'CCC'

Aramco Outlook to Positive by Moody's; L-T Rating Affirmed

BUYSIDE / TRADING

Analysing trading activity in CoCos from TRACE/Mifid-II sources

Could Var shock explain some of the large moves in Govt Bonds?

Fund Industry Faces Mass Downgrades as MSCI Reviews ESG Ratings

Top Macro HF said to have to reduce risk after large losses this month

Private Credit firms KKR and Pimco (PC division) say that they are able to lend at more attractive terms as Regional Banks pull back on lending

*MOVES*

Govt bonds

Significant rates volatility in the front end as quoted by Morgan Stanley: “Over the last 8D the German 2Y yield has moved on average by 25bp a day, easily the biggest ever period of realised volatility. US 2Y yields have moved on average by 30bp in the last 9 days, the biggest period of rates volatility since October 1982.”

10 year US Treasuries broke below 200DMA (3.482%)

5s30s spread turned positive again on 21 March and spikes to 23bps

Chart from Syz Group via BBG

Australian bonds head for a third-straight weekly advance

Credit spreads

Strangely benign end to the week in CDS with Xover closing below 500bps at 496bps and was the only major index to widen (3bps) over the week.

The above does not tell the whole story, since there was some significant intra-week tightening in EU HY CDS. From the wides on Monday to Tuesday’s close, iTraxx Xover tightened in 103bps, a 2-day move only exceeded by the 160bps tightening in the series seen in March 2020 according to MS.

In cash credit, CoCos were the major underperformer. Both US and European HY cash credit spreads are above 500bps. IG cash spreads in USD, EUR and GBP all tightened on the week.

The real action was in European Bank CDS which saw widening in the whole sector led by DB, CMZB, Barclays, Soc Gen and ING

Source: BBG

Bond ETFs - Px changes over 5 days

Underperformers - Bank AT1 (AT1 LN -8.3%, Preference shares (FPE -4.1%), Asian HY (AHYG -1.1%, CMBS (-0.9%), long dated UST (EDV-0.6%).

Outperformers - EM Local Debt (IEML+2.0%, EMDD+1.5%), TIPS (LTPZ+1.9%), Medium dated IG Corps (IGIB+1.5%), EM HC (EMB+1.4%), IG Corps (LQD+1.4%)

Commodities

Gold posts a 4th straight weekly gain, topped $2k during the week (first time since March 2022)

Iron Ore Set for Worst Week Since October 2022

*MACRO*

“Coordinated central bank action to enhance the provision of U.S. dollar liquidity” - Fed Reserve

Extract - The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank are today announcing a coordinated action to enhance the provision of liquidity via the standing U.S. dollar liquidity swap line arrangements.

A number of central banks hiked this week…

The Fed, BoE, Norges Bank, Taiwanese Central Bank and the Philippines are just some of the countries that hiked rates this week. The hikes in the US / UK and Norway were the highest since the 2007-2009 period. Taiwan hiked more than expected (1.875% actual vs 1.75% expected).

SNB raised rates, says Credit Suisse takeover prevented larger crisis | RTRS

Extract - The Swiss National Bank raised its benchmark interest rate by 50 basis points on Thursday and said UBS's takeover of Credit Suisse had averted a financial disaster, adding it was now critical the merger took place in a smooth and fast way.

The multi-billion Swiss francs rescue package brokered by the SNB, government and regulator on Sunday prevented a systemic crisis, SNB Chairman Thomas Jordan said.

"If this solution hadn't worked, Credit Suisse would have failed, with extreme consequences for Switzerland but also the global economy," he told a press conference.

"In the last few weeks there was a real erosion in confidence in the banking world and in order to halt it - we needed another solution besides liquidity," Jordan said.

German ZEW Index declined to 13.0 in March vs. 16.4 expected

Extract - The ZEW Indicator of Economic Sentiment is declining noticeably in the current survey from March 2023. At 13.0 points, they are 15.1 points below the previous month's figure. However, expectations are still in positive territory. The assessment of the economic situation for Germany is deteriorating minimally. It currently stands at minus 46.5 points, 1.4 points below the previous month's figure.

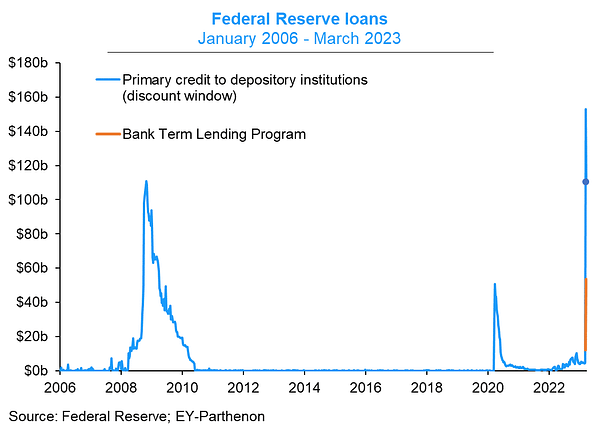

Fed lending update for w/e March 2022

Increased usage of Bank Term Funding program and Bridge Bank loans but there was a decline in the Discount Window.

Bull market in money market fund inflows

DoubleLine Gundlach saying he predicts the Fed will soon be cutting rates | BBG

He did a longer video on Youtube which explains his thinking a bit further and also talked about his views on Credit too.

BofA FM Survey: Majority expecting Systemic Credit Event

Corporates announced some large layoffs this week

Accenture - Cutting 19k workers (2.5% of workforce) - Sky News

Amazon - Cutting a further 9k workers - Personnel Today

Extract - Amazon has revealed plans to cut a further 9,000 jobs worldwide, just weeks after it announced the largest number of redundancies in the company’s history. The online giant said the job losses would mostly affect roles in Amazon Web Services (AWS), People Experience and Technology (PXT), advertising and its livestreaming service Twitch.

Could banking crisis be having an early impact on consumer confidence? Citi credit card data says so…

Citi via FXStreet “This was the first week of [Citi credit card] data following the disruption within the financial sector, and we were curious if it might have had an impact on the consumer. It sure did. .. biggest decline in total retail spending .. since the pandemic began (April 2020).”

Hong Kong Overnight Funding Costs Double in Sign of Cash Squeeze - BBG

Yet more signs of stress in global funding markets, this time in HK:

The cost to borrow overnight in Hong Kong jumped the most in at least 17 years, with market watchers pointing to stress in the global financial system as well as cash hoarding by banks ahead of the Federal Reserve rate decision and the quarter-end.

Euro Services PMI came in stronger than expected, manufacturing still weak | RTRS

Issue is that no-one seems to care about PMI data as the market is very much fixated on the developments with the banks and financial stability in general. Extract:

(Reuters) - Business activity across the euro zone unexpectedly accelerated this month as consumers splashed out on services, but weakening demand for manufactured goods deepened the downturn in the factory sector, surveys showed.

Friday's data add to evidence the bloc will dodge a recession and indicates the 20-nation region's economy is resilient in the near term at least, potentially giving the European Central Bank room to continue tightening policy.

S&P Global's flash Composite Purchasing Managers' Index (PMI), seen as a good gauge of overall economic health, bounced to a 10-month high of 54.1 in March from February's 52.0.

That was well above the 50 mark separating growth from contraction and above all forecasts in a Reuters poll which had predicted a dip to 51.9.

UK retail sales boosted by second-hand and discount stores - BBC

Extract - Shoppers facing cost-of-living pressures turned to discount and second-hand stores last month, giving retail sales a surprise boost. Sales volumes rose by 1.2% in February, official figures showed, the biggest monthly gain since October last year. Food sales also rose, but the Office for National Statistics said there were signs price pressures had cut spending in restaurants and on takeaway meals.

*INFLATION*

Sovereign inflation stories

UK inflation rate in surprise rise to 10.4% - Guardian

Japan's core consumer inflation slowed in February, but core still high - RTRS

Japan to spend $15bn on inflation aid ahead of local polls - Japan Times

Singapore Feb Core CPI came in lower than expected (+5.5% vs Exp 5.8%)

Hong Kong Feb CPI came in lower than expected (1.7% YoY vs Est of +2.4%)

South Africa Feb. Core CPI Rose 5.2% Y/y; Est. +5%

Germany Feb producer prices rise 15.8% YoY, Est 14.5%

Corporate inflation stories

Cement Shortages, Concrete Inflation Threaten Biden’s Building Boom - BBG

*COMMODITIES*

Striking action in France's refineries is poised to tighten European diesel markets | Oilprice.com

Striking action in France's refineries is poised to tighten European diesel markets, while crude oil markets are looking weaker, traders who spoke to Reuters said on Monday.

France has been battling strikes in its crude oil refineries as union members' pension system is due to be overhauled. The strikes have so far blocked shipments of refined products from France's Donges and La Mede refineries and have reduced the throughput at the Normandy and Feyzin refineries.

The curtailments have resulted in less feedstock demand—i.e., weaker crude oil demand, while threatening to tighten up the end product markets such as diesel. ICE low-sulfur diesel contracts rose on Monday to a premium of $35.25 a barrel—the highest level since November last year, with the profit margins for diesel in the EU climbing 40% over the last month.

French refineries process about a million barrels per day, or just over 8% of the EU's total throughput, IEA data shows, and the country's crude oil imports have sagged to 550,000 bpd in March, down 50% from February, Kpler data shows. This has created slack in the crude oil markets—specifically of North Sea and Nigerian crude oil grades.

"WTI cargoes for May delivery compared with April are down by $1.50-$2/bbl, because of that, North Sea is having to price lower to compete," a trader told Reuters.

Investors dumped oil as banking crisis erupted: Kemp | RTRS

A common occurrence during periods of extreme market stress in that many participants liquidate positions which can result in gappy price action in a number of financial assets. Extract:

March 22 (Reuters) - Portfolio investors dumped petroleum futures and options at one of the fastest rates on record in the early stages of the banking crisis, as traders anticipated an increased probability of a recession hitting oil consumption. Hedge funds and other money managers sold the equivalent of 139 million barrels in the six most important futures and options contracts over the seven days ending March 14. The volume of sales was the 12th largest in the 522 weeks since ICE Futures Europe and the U.S. CFTC started to publish records in this form in 2013.

*FINANCIALS*

Financial bonds ended on a weaker tone led by DB AT1s and the DB complex as a whole. As a rough guide:

-$ DB seniors were generically indicated around +400bps over UST at cash prices between 74 and 100.

-DB $ LT2 were indicated around +600bs over UST with the exception of DB 4.875% 2032 trading more like +800bps

-DB $ AT1 were indicated at YTMs of 11-12% at cash prices in the high 60s

Please note these are very rough price ideas as of around 5pm London time on Friday and should not be relied upon.

The sentiment around DB weakened the whole AT1 and T2 sector with periphery Banks seeing the most cheapening, but Core (e.g. UK/French) less cheapening. This pattern is one that is common in most traditional sell-offs in financials, i.e. peripheries weakening more than Core European Banks.

It was a day when fundamental news really didn't seem to matter, since this week we saw Commerzbank's rating get upgraded and also DB sent out a call notice for its DB 4.296% 2028 (2023) callable LT2 bond.

My feeling is that in some cases, mutual fund cash outflows may had to have been met on Friday for instructions that were sent out earlier in the week (e.g. T+4 settlement from Monday or Tuesday) from allocators looking to trim in the sector.

If the European Banks sector is not going to collapse, there are areas that have become oversold, but my gut tells me that the negative developments and sentiments around the Banking sector are unlikely to disappear soon.

Non AT1 news

Notable move wider in Banks CDS spreads

I’m no CDS expert but the moves are hard to ignore. The issue is that equity markets and cash credit markets took a cue from the CDS market and Tweets from experienced practitioners in the sector.

Bank stocks are trading at levels last seen in major crises - BBG

Citi CEO Fraser says 'this is not a credit crisis' after U.S. bank failures | RTRS

"The banking system is pretty sound," and large and regional banks are well-capitalized, Fraser told the Economic Club of Washington D.C. on Wednesday. "This is not a credit crisis. This is a situation where it's a few banks that have some problems, and it's better to make sure that we nip that in the bud," she said.

Notable bond redemptions this week - DB T2, Lloyds Senior and UBS Bail-in Notes

DB is to redeem its $1.5bn 2028 T2 notes (US251525AM33) on May 24th 2023 at par (100). These bonds were trading a touch above 95 the day before its call notice (Thursday 23 March). Lloyds Banking Group is set to redeem its $1bn LLOYDS 0.695% 2024 senior bonds. UBS also announced a tender offer to buy back some bail-In notes.

NY’s Community Bank purchase of $39bn of assets from Signature Bank did not include CRE exposures - FT

Extract - New York Community Bank’s purchase this week of $39bn of assets from collapsed rival Signature did not include any of its real estate business, in a move NYCB said was part of its efforts to diversify away from CRE lending.

Europe’s Top Banks Won’t Face Credit Suisse’s Fate, Moody’s Says | BBG

Extracts - None of the region’s 11 remaining mega-banks, which include Deutsche Bank AG and BNP Paribas SA, show the “credit profile weaknesses that led to investor and depositor loss of confidence” in Credit Suisse which built up over almost two years, Moody’s said in a report on Wednesday. “Those banks that started deep and costly restructuring exercises have largely completed the process,” Moody’s analysts including Michael Rohr in Frankfurt wrote in the report, which focused on 12 banks which are big enough to be considered to be important to the global financial system.

European Banks exposure to US CRE - Chart

AT1s

Global AT1 instruments suffered a *record* drop

Deutsche Pfandbriefbank not calling AT1, largely expected, coupon increases

Deutsche Pfandbriefbank issued a notice stating that it will not call its AT1, extract of statement:

The decision not to refinance the AT1 Bond (ISIN:XS1808862657– “the Bond”) has been taken after careful evaluation of various factors, including market conditions and economic costs. The Bond will reset to a new fixed coupon being the equivalent of 5-year Euro Mid Swaps plus 5.383% from 28 April 2023 (as per the terms and conditions of the Bond).

The bond in question traded down a few points to close the week but it was already trading around 75 which suggested that the market was not expecting a call. However, only as recently as early March it was indicated closer to 90 suggesting the market changed its implied expectation of a call only recently. News outlets did the usual thing of then implying that no upcoming AT1 bonds for any issuer will be called, which experience over the last few years suggests is unlikely (absent a full blown European Banks crisis).

Unicredit 6.625% AT1 is next notable upcoming AT1 call…

The next notable AT1 maturity is the Unicredit 6 ⅝ Perp callable in 3rd June 2023 with a 30 day minimum call. A reuters story on Friday suggested that UniCredit put in request to regulators to repay the AT1 according to an unnamed source…the bond trades closer to par in the mid 90s.

Some Asia Bank AT1s Also Have Swiss Wipeout Clause: Creditsights

Extract - Asia-Pacific banks’ additional Tier 1 bonds contain the same clause used by the Swiss to write down the debt of Credit Suisse Group AG, roiling the global market. A report by research firm CreditSights said the existing terms and conditions of regional lenders’ AT1 notes “permit the regulators to impose losses on these instruments, similar to what FINMA imposed on the AT1s of Credit Suisse.” Still, Pramod Shenoi, co-head of Asia Pacific research, expects officials in the region only to invoke the clause if a lender lacks capital. Although both the Monetary Authority of Singapore and the Hong Kong Monetary Authority have said they’d respect creditor hierarchy, their statements pertained to the case of an institution being wound down, CreditSights said.

Algebris’ Serra on AT1 - AT1s are ‘Absolutely not dead’

Round-robin of CS AT1 News

Some interesting stories in here including funds that bought senior debt ahead of the tender, funds that benefitted from trades across the cap stack (long and short) and even one that sold the day before the AT1 notes got zeroed. Reuters highlights how some firms are lawyering up in order to contest FINMA’s ruling. The Re-org podcast was informative on the legal challenge to the write-down of CS AT1.

Varde Partners makes over $50m from trades in CS Debt - BBG

Hedge Fund Marathon Made Quick $30m on Credit Suisse Bet - BBG

Hedge Funds Marathon, Redwood Scoop Up Credit Suisse Claims - BBG

BlueBay Bets on AT1s Even After Being Burned by Bank Upheaval - BBG

Spectrum Asset Management Inc ($20bn AUM manager) said it liquidated all its Credit Suisse positions on the Saturday prior to the CoCos being zeroed -RTRS

T. Rowe Price Group bought several hundred million dollars of investment-grade European bank bonds Monday as investors sought to dump their holdings - BBG

The CS AT1 Write-down and Implications for the European AT1 Market: Re-Org Podcast [I thought this was a really useful listen].

Explainer: Credit Suisse bondholders seek legal advice on AT1 wipe-out - RTRS

*IG*

IG New issue markets subdued

IG markets saw a handful of brand name issuers come to market in what was otherwise a lean week for issuance, due to bank volatility. Some of the “brand name” type issuers that came to market were Prologis, Marriott, AIG and VW (Green debt EUR offering). As an idea, Marriot priced $800m 6y paper at +170bps at a price discount which meant the bonds priced at 5.146% with a coupon of 4.9%. Issuers are looking to lock in low-ish coupons due to the strong rally in Treasuries despite what looks like wider spreads vs recent issuance.

*HY*

HY New issues / tenders

Not much to report other than HY issuer Ford attempting to issue an ABS deal. According to BBG; ”Ford began marketing $1.3bn in bonds backed by prime auto loans earlier this week and is expecting to price its deal on March 28.” The article goes on to say how Ford traditionally has been the first issuer to re-open markets after period of high volatility. This is true not only in structured markets but also in the HY market where Ford has often come in first and issued with large coupons.

Meanwhile BBG reported that deals in the lev loan space are being shelved due to volatility: “Bank underwriters across the US and Europe are pulling sales and pausing future ones amid tepid demand. Barclays Plc recently shelved a pair of loans for Ineos Enterprises and Russell Investments, while JPMorgan Chase & Co. yanked a deal for Agiliti Health.”

Topical EUR HY name Casino came out with a tender offer for €100m its 5.875% senior secured notes due 2024 issued by Quatrim, which helped the bonds move 1-2pts higher.

Cinema Stocks Jump Amid Report Apple Plans $1B Theatrical Movie Push - Hollywood Reporter

Interesting story and follows on from efforts by Amazon and Netflix to distribute more content via Cinemas. As a reminder, Amazon Studios which owns MGM recently released Creed III in Cinemas, giving some hope to the industry which has suffered due to poor film slates and over-leveraged structures.

Extract - The tech giant, whose movie slate includes Leonardo DiCaprio’s 'Killers of the Flower Moon,' looks set to follow Amazon and Netflix with its own play for box office.

Bloomberg, citing unnamed sources, reported that the tech giant plans to release a few movies in theaters this year, while ramping up its theatrical slate for a greater number of releases in future years. Apple could not be reached for direct comment on its push into theatrical releases, but it has been well telegraphed.

The tech giant recently hired former Disney marketing and content exec Ricky Strauss to join Apple TV+, which suggests Apple is serious about growing its streaming division and potentially its theatrical film efforts. And Apple, in recent discussions with major exhibitors, has indicated it wants to follow Amazon with its own $1 billion theatrical movie push.

Roundup of other HY News

Liberty Global Agrees to Buy Rest of Belgian Carrier Telenet for $1 Bn - BBG

TUI to Raise €1.8 Bn to Repay Debt, Strengthen Finances - Tui Group

Casino Downgraded to Caa1 by Moody's

Avis - Moody’s upgraded rating of Avis Budget Car Rental to Ba3 from B1

Rackspace Lenders Tap Legal Counsel as a Preventive Measure - Muckrack

Lovell to sell portfolio (will still service) to Hoist for net 1.2 bn SEK - EuroHY

*DISTRESSED*

Carvana Plans $1 Bn Debt Exchange in Restructuring Bid - BBG

Extract - Carvana Co. said it’s offering to exchange as much as $1 bn of bond principal at below-par prices as the struggling online car seller works to restructure its debt load. The company is offering to swap five series of bonds, including its 5.625% unsecured notes due 2025 and 10.25% unsecured notes due 2030 for new secured notes due 2028 that pay 9% in cash or 12% in-kind, according to a statement Wednesday. The debt will be secured by a second-priority claim on assets including vehicles.

Short Sellers Step Up Bets Against Office Owners on Bank Turmoil - BBG

Extract - Money managers have stepped up their bearish bets against office landlords, wagering that the US regional banking crisis will slash the availability of credit to property owners that were already suffering from the pandemic and rising interest rates.

Hedge funds are using credit derivatives and equities to bet against the companies and their debt. Almost 40% of shares in the iShares US Real Estate ETF are sold short, the highest proportion since June, according to data from analytics firm S3 Partners.

At Hudson Pacific Properties Inc., short interest reached a record 7.4% earlier this week before dropping to about 5% of shares outstanding, according to data compiled by IHS Markit Ltd. That’s almost double the level a month ago. For Vornado Realty LP, short interest is the highest since January.

Regional banks account for about 80% of bank lending to commercial properties, according to economists at Goldman Sachs Group Inc.

Office assets are the collateral for about $100bn of the $400bn of US commercial real estate debt maturing this year, according to MSCI Real Assets.

Workplaces worth nearly $40bn face a higher probability of distress, more than apartments, hotels, malls or any other type of commercial real estate, MSCI said on Wednesday. Almost $20bn of office loans that were bundled into commercial mortgage-backed securities and are due to mature by the end of next year are already potentially distressed, Moody’s Investors Service estimates.

Commercial property risks rise up bank investors’ worry list - FT

Extract - Commercial property loans are joining deposit flight and bond portfolios as the biggest perceived risk for US banks as rattled investors fret about lenders’ strength following the collapses of Silicon Valley Bank and Signature Bank.

Strains in the $5.6tn market for commercial real estate loans have deepened in recent months as the Federal Reserve’s year-long series of interest rate rises leads to sharply higher borrowing costs and weakening property valuations. Analysts fear any further reduction in lending — say, from businesses more keen on hoarding deposits following two shock bank runs in a week — could make a perilous situation worse.

The threat of a credit crunch rippling across the global financial system has overtaken inflation this month as investors’ biggest worry, according to a monthly global survey of fund managers by Bank of America.

Thousands of small and medium-sized banks that make up the bulk of US lenders account for about 70 per cent of so-called CRE loans, according to JPMorgan analysts.

Most of the products are not repackaged for the asset-backed securitisation markets so remain on banks’ books. CRE loans make up 43 per cent of small banks’ total lending, against just 13 per cent for the biggest banks.

“The collapse of SVB is putting a magnifying glass on regional banks, and their commercial real estate loan books remain an area of major concern,” said JPMorgan securitisation analyst Chong Sin. “Credit availability to CRE borrowers was already challenged coming into this year,” he added, warning in a note to investors that a retreat from lending among smaller banks risked creating “a credit crunch in secondary and tertiary CRE markets”.

Podcast on state of distressed - Dechert LLP

h/t @GrandTokamak for making me aware of this podcast.

Committed Capital | The Current Environment for Workouts and Restructurings

MARCH 22, 2023 - Today’s distressed market faces headwinds as a result of macro uncertainty, rising inflation and increasing financing costs. What are the opportunities and challenges for private equity investors and their investment strategies in the current environment? In this episode, Dechert’s Stephen Zide leads a discussion with Kevin O'Neill of KKR and Michael Schwartz of SVPGlobal on the latest developments and considerations relating to workouts and restructurings.

*EM*

China Evergrande offers bond and equity swaps in debt restructuring - RTRS

There was a tiny move up in the bonds on the news, but the wider risk off tone in markets meant that notes traded lower to end the week.

Extract - China Evergrande Group on Wednesday announced plans for the restructuring of its $22.7 billion in offshore debt, which could set a template for distressed rivals and shape investor sentiment on the country's embattled property sector.

S&P Warns of Default Wave Ahead for Latin America as Rates Rise - BBG

Extract - Rapidly rising borrowing costs pose more of a threat to companies in Latin America than anywhere else in emerging markets, raising concern that defaults in the region are about to rise, according to S&P Global Ratings.

Credit conditions are tightening more quickly now in Latin America than they were at the height of the 2008 financial crisis, analysts led by Gregoire Rycx wrote in a report. That is expected to put companies under pressure through the end of next year.

“Latin American countries are enduring the most severe tightening of financial conditions seen in recent history,” the analysts wrote.

Bolivia Pays Dollar Bond Coupon as Currency Crisis Mounts | BBG

Extract - Bolivia made a $22.5m coupon payment on its dollar bonds that was due on Monday, dipping into its rapidly vanishing supply of hard currency to stave off default. Investors in the securities due 2028 have received the money in their accounts, according to three people familiar with the matter who requested anonymity because the information isn’t public. The 2028 notes have fallen 22 cents to 59 cents on the dollar this year, pushing the yield near 17%, according to indicative pricing data collected by Bloomberg. Money managers have ditched the bonds as a shortage of dollars threatens the fixed exchange-rate system. Reserves have dropped below $3.5 billion from a peak of $15.5 billion in 2014 and most of those are locked up in gold holdings

IMF approves US$3 Bn Under the new EFF Arrangement for Sri Lanka - IMF

Extract:

The IMF Board approved a 48-month extended arrangement under the Extended Fund Facility (EFF) of SDR 2.286 billion (about US$3 billion) to support Sri Lanka’s economic policies and reforms.

The objectives of the EFF-supported program are to restore macroeconomic stability and debt sustainability, safeguarding financial stability, and stepping up structural reforms to unlock Sri Lanka’s growth potential. All program measures are mindful of the need to protect the most vulnerable and improving governance.

Close collaboration between Sri Lanka and all its creditors will be critical to expedite a debt treatment that will restore debt sustainability consistent with program parameters.

Sri Lanka Bondholders Said to Eye GDP-Linked Debt Restructuring | BBG

Extract - Sri Lanka’s private creditors are considering a proposal to swap defaulted bonds with new securities that would have cash flow linked to the nation’s future growth, according to people familiar with the matter. Under the plan, the security being mulled by Sri Lanka’s bondholders will pay less if growth falls to levels projected by the International Monetary Fund, the people said, asking not be identified as the discussions are private. Creditors view the multilateral fund’s economic forecast of about 3% for the next few years as pessimistic, the people said.

World Bank and Egypt agree on $7bn framework - The National News

Extract - The World Bank's board has approved a new Country Partnership Framework for Egypt that provides the country with $7 billion in funds over the 2023 to 2027 fiscal years.

The framework is in line with the Egyptian government's two-pronged 2030 and 2050 development and climate change plans, the Washington-based lender said on Wednesday.

The agreement will be enforced jointly by the World Bank, the International Finance Corporation and the Multilateral Investment Guarantee Agency (Miga), building on the three institutions’ current portfolios and adopting a flexible approach to lending, the World Bank said.

The framework will be supported through $7 billion in lending — with the IBRD extending $1 billion a year for the entire period while about $2 billion will come from the IFC — in addition to guarantees from Miga.

The agreement will be carried out in co-ordination with Egypt's Ministry of International Co-operation, headed by Rania Al-Mashat, who is also the World Bank Group’s governor in the country.

The framework deal “supports Egypt’s efforts to build back better by creating conditions for green, resilient and inclusive development,” said Marina Wes, World Bank country director for Egypt, Yemen and Djibouti.

Iraq's Kurdistan oil revenues to be moved to account under federal government supervision - Reuters

Extract - March 16 (Reuters) - Oil revenues from Iraq's semi-autonomous Kurdistan region will be transferred to a bank account under federal government supervision for the first time since 2002, state news agency INA reported on Thursday, citing the prime minister's media adviser Hisham al Rekaby.

*RATINGS*

SOVEREIGN

Germany Affirmed at AAA by S&P

IG

Tesla bonds exit junk-rated status after Moody's upgrade

Moody's upgrades Grainger's senior unsecured rating to A2; outlook stable

Moody's affirms Merck & Co.'s A1 rating; revises outlook to stable from negative

Valvoline Outlook to Stable by Moody's; L-T CFR Rating Affirmed

Fitch Affirms Hawaii Airport Revenue Bonds at 'A+'/'A'; Outlook Positive

S&P Affirms 'BBB-' Rtgs On Diamondback Energy, Otlk Positive

FINANCIALS

Fitch downgrades First Republic's IDR to 'B'; maintains rating watch negative

Fitch Downgrades First Republic Bank's U.S. RMBS Servicer Ratings

Moody's downgrades First Republic Bank's originator assessment and places the assessment on review for downgrade

Ally Financial Affirmed at BBB- by Fitch

S&P Raises Commerzbank AG Rtg To A- From BBB+; Outlk Stable

Swedbank Outlook to Stable by Moody's; Issuer Rating Affirmed

S&P Placed Credit Suisse Group AG On Credit Watch 'Positive' From 'Stable'; Rating 'BBB-'

UBS Group Outlook to Negative by S&P; Ratings Affirmed

NAB Affirmed at A+ by Fitch

CBA Affirmed at A+ by Fitch

ANZ Bank Affirmed at A+ by Fitch

Westpac Affirmed at A+ by Fitch

HY

Casino Downgraded to Caa1 by Moody's

Avis - Moodys upgraded rating of Avis Budget Car Rental to Ba3 from B1

Globalworth Real Estate Cut to Junk by S&P

S&PG Downgrades WeWork To 'CC'; Outlook Negative

PGS Upgraded to B3 by Moody's, Outlook Stable

Delta Air Lines Outlook to Positive by S&P; BB Rating Affirmed

S&P Downgrades Oriflame To 'B-'; Outlook Stable

American Air Outlook to Positive by S&P; B- Rating Affirmed

S&P raises IAG ratings to BB+; Outlook Stable

NCL Corp Outlook to Stable by S&P; L-T Rating Affirmed

New Fortress Energy Affirmed at BB- by Fitch

S&P Upgrades SGL Carbon SE To 'B'; Outlook Stable

Fitch Affirms Trafford Centre Limited; Outlook Negative

Newell Brands Cut to Junk by S&P

S&P Downgrades Carvana Co. To 'CC' On Proposed Debt Exchange

S&P Upgrades Mallinckrodt PLC To 'CCC' From 'SD'; Outlk Neg

EM SOV/QSOV

Argentina Downgraded to C by Fitch

Bolivia Downgraded to Caa1 by Moody's, May Be Cut Further

Benin Affirmed at B+ by Fitch

Fitch Downgrades DTEK Energy to 'C' on Tender Offer

Fitch Revises Romania's Outlook to Stable; Affirms at 'BBB-'

Fitch upgrades Ghana's long-term local-currency issuer default rating to 'CCC'

Aramco Outlook to Positive by Moody's; L-T Rating Affirmed

United Arab Emirates Affirmed at Aa2 by Moody's

Abu Dhabi Affirmed at Aa2 by Moody's

EM Corp

Adani Ports Affirmed at BBB- by Fitch

Adani’s S&P Rating Upgrade Hinges on Governance, Access to Funds

Fitch Downgrades GOL to 'RD'; Upgrades to 'CCC+'

Arcelik Downgraded to BB by S&P

Fitch Affirms Ziraat at 'B-'; Outlook Negative

*BUYSIDE*

Fund Industry Faces Mass Downgrades as MSCI Reviews ESG Ratings - BBG LAW

Extract - MSCI Inc. is planning a sweeping overhaul of how it applies ESG ratings to the fund industry, in a move that’s likely to lead to mass downgrades and fuel debate around the value of such scores. The changed methodology will affect up to 73% of the entire public fund universe, including exchange-traded funds, mutual funds, index funds and actively-managed funds, MSCI ESG Research told Bloomberg on Friday. The firm, which provides ESG ratings for tens of thousands of equity and fixed-income funds, said it will in the future only take the scores of underlying holdings into account.

*TRADING*

Analysing trading activity in CoCos from TRACE/Mifid-II sources

2.7bn of CoCos traded during the week according to Mifid-II post-trade sources.

Highest volume of trades seen in HSBC, Credit Agricole, DB, ING, Soc Gen

Volume bias seems to be towards more recent issues (and therefore longer duration paper) suggesting older vintages of AT1 didn't trade as much.

Highest number of tickets appeared to be in DB, Credit Agricole, ING, HSBC and BNP.

Looking across at US TRACE data, I had to look at trading over last 10 days since the "5 days" option may not include the first two days of the trading week.

Here looks like ~3.1bn traded across the CoCos sector

Most traded tickers were HSBC, Lloyds ,CS, DB, UBS and Brazilian Banks Banco do Brasil and Itau

The most actively traded lines appeared to be recent new issues e.g. HSBC 8% and Lloyds 8%

SRC: BBG

The large moves in the front end Treasuries is thought to be due to a VAR shock

Rokos HF said to be down 15% YTD to March 17th, has had to reduce risk - BBG

Interesting story which demonstrates how even the some of the smartest Macro Traders have been temporarily wrong footed by the significant moves in the US Treasury market. It’s yet another piece of evidence showing how shocks are reverberating across financial markets but are so far being absorbed. Extract:

Chris Rokos has reduced risk in his macro hedge fund in response to double-digit losses this month.

“We have de-risked following this month’s market price action, and P&L volatility has declined substantially as a result,” Rokos’s London-based investment firm told clients in a letter on Saturday, a copy of which was seen by Bloomberg.

The firm sent the letter in response to a Financial Times story that said the US Securities & Exchange Commission raised concerns over Rokos Capital Management after an outsized bet on US government bonds backfired and forced the hedge fund to hand over large amounts of cash to its banks as collateral.

“However, we can confirm that throughout this period our unencumbered cash has been, and remains, at healthy levels. There have been no requests for additional initial margin from our counterparties,” the firm said.

Bloomberg reported last year that the investment firm, which already runs about $15.5 billion, was raising extra money because it’s required to post higher margin with counterparties due to the more volatile climate.

*LINKS/CHARTS*

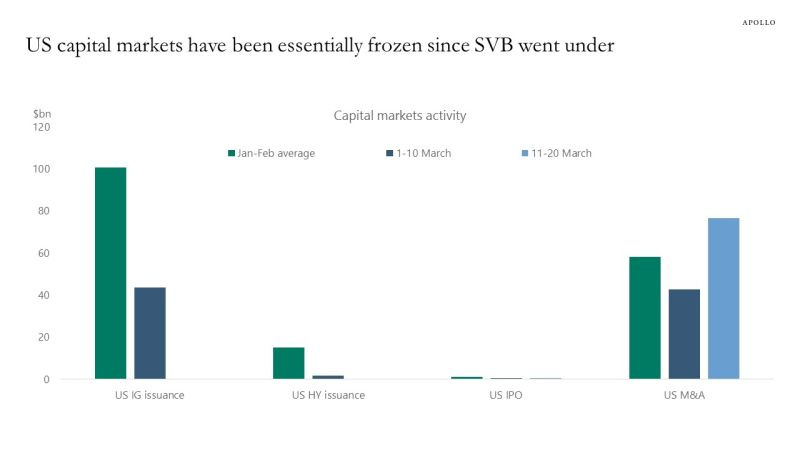

Torsten Slok - Apollo | Capital Markets Have Been Shut Since SVB

Since SVB went under, there has been basically no HY issuance, IG issuance, or IPO activity, see chart below. And completed M&A activity since Friday, March 10 reflects long-time planned M&A rather than new risk-taking. The longer capital markets are closed, and the longer funding spreads for banks remain elevated, the more negative the impact will be on the broader economy.

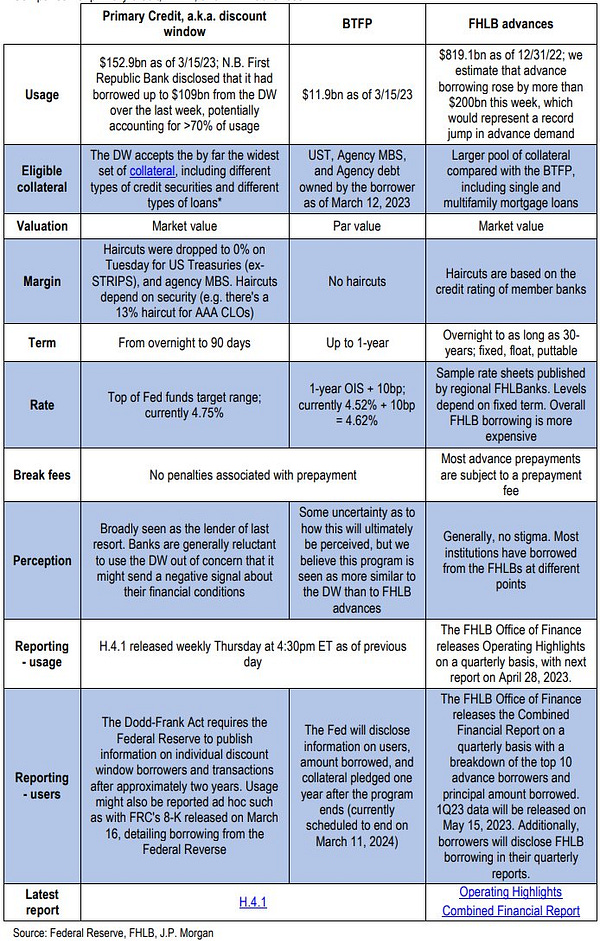

Useful crib sheet explaining various Fed facilities

US Banks’ Research on Deposit outflow from most vulnerable banks

Not all Regional Banks are the same it seems

Contrarian view (to current bearishness) on DB from the FinTwit Banks Guru

Small US Commercial Banks hold 70% of Total CRE loans

Credit Spreads Return From a Trip to Fantasyland - BBG Opinion Piece

Some interesting observations from a BBG opinion piece on equity risk premia and credit spreads.

“The Search for Capital Just Became an All-Out Hunt” - KKR

Pimco discuss Private Credit during the current banking crisis - Pimco

General theme of the discussion is that Banks are re-trenching from lending and Private Credit can step into fill those voids selectively at better risk adjusted yields than previously…

This summary is superb! thank you

Thanks for all the work you put into this, it’s incredibly helpful!