24 Feb 2023 - Global Credit Wrap

2yr UST @ 4.8%, 10 and 30 yr near 4%, 3rd largest HY outflow on record, "other" funding markets seeing more activity, more distress in RE/Used car related issuers

*SUMMARY*

Inflation continues to be a major issue as demonstrated by the hot PCE reading on Friday. Besides this, we are seeing certain large corporates move to preserve margin by keeping prices high (e.g. Nestle this week) and hike prices (e.g. VirginMedia). These actions are what could keep inflation stickier for longer even if basic commodity prices are in decline.

This higher for longer for inflation theme is altering the market’s expectations of terminal rates in the major DM economies, which is what is behind the surge in yields beyond just short dated bonds. The 10 and 30 year UST are again on the cusp of breaking 4.0% while the 2 year Treasury is not so far from hitting the 5% mark, which is almost unimaginable after the recent QE excess period.

This week’s bond issuance was less notable for the volume printed, rather the avenues in which debt was issued. Issuers across the credit asset class are utilising alternative avenues to traditional public credit markets to issue debt at the moment. Just this week we saw Porsche issue a €2.7bn of Schuldschein debt, Southern Co issue $1.5bn in the Convertible bond market, Uber opting to refinance in the loan market, Carvana issue prime auto loan ABS, Cruiseliner Hurtigruten’s 5 year term loan commitment with one investor, UK’s Secure Trust Bank issue a T2 bond in a club deal* format and Egypt issue a $1.5bn Sukuk. Meanwhile, private credit is behind some very large, recent (£1bn+) deals in UK/Europe for non benchmark issuers as discussed later on.

US HY markets are weakening as government bond yields surge. This has been reflected in the 3rd largest weekly outflow on record out of the US HY sector ($6bn). More signs of stress are emerging for certain highly indebted issuers in the Real Estate and Used car sector including a $1.7bn default from a US based commercial real estate Mortgage bond

*Not confirmed, but just my hunch.

*TLDR*

MACRO

Fedspeak hawkish, Bullard & co under-estimated strength of US econ.

Yields on 12-month T-bills have risen to their highest since 2001

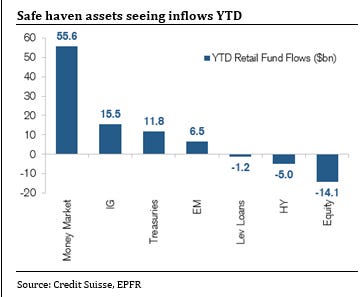

Allocators moving money in size into money markets

Mgmt Consultants start to cut jobs in classic sign global economy is slowing

The US construction industry is short of workers

UK Labour leader Keir Starmer promises to 'give Britain its future back'

BoE’s Mann: 'Too soon to stop interest rate increases"

Eurozone growth accelerates to nine-month high in February

January car sales in Europe rose 11% for 6th consecutive monthly gain

South Korea holds rates for first time in 12 months

INFLATION

US PCE Inflation for January came in hot

3mth annualised rate revised up to 4.8% from 2.9%

New academic paper suggests “immaculate disinflation” would be unprecedented

Sovereign (dis)inflation snippets

Canada's inflation rate slowed to 5.9% in Jan, but food costs continue to rise

Brazil inflation beats forecasts in mid-February, rate cuts still unlikely

Core Inflation may prompt more rate hikes in Asia

Singapore's January core inflation rises 5.5%, fastest in 14 years

Hong Kong Inflation Rises To 2.4%, Highest In 4 Months

South Korea's PPI slows to near 2-year low

Corporate (dis)inflation snippets

Watchfinder has cut prices of its second-hand products by 15%

World’s largest food company warns prices will continue to rise

Danone Sales Rise at Fastest Rate in Decade on Higher Price

Kraft “continues to anticipate high single-digit inflation” for 2023

Virgin Media to hike broadband and Mobile prices by double digits in April

IG

BHP, Tesco, Astrazeneca just some of the new issuers in the week

Porsche decides to issue €2.7bn in the Schuldschein market

Moody’s upgrades Kraft Heinz to Baa2 from Baa3, outlook is stable

FINANCIALS

Issuance: T2s from UK Banks including a 13% coupon issue, some SGD T2/AT1 from French Banks

Yet another AT1 called (Ibercaja)

UK’s Nationwide BS announced a repurchase facility for its CCDS instrument

Two UK building societies are set to merge

HSBC 4Q - Adjusted pretax ahead, capital solid, outlook underwhelms a bit..

HY + LEV FIN

HY outflows picked up with this week led by ETFs

Notable issuance:

$1bn+ Uber Term loan

$1.5bn Convertible bond for Southern Co

Carvana issued $363m of Prime Auto ABS

American Car Centre did not proceed with bond issue, company looks to fold

Cruiseliner Hurtigruten secures refinancing of term loans

Several benchmark HY issuers reported earnings across a range of sectors; Rolls Royce, Transocean, Virgin Media, Cinemark and IAG

DISTRESSED

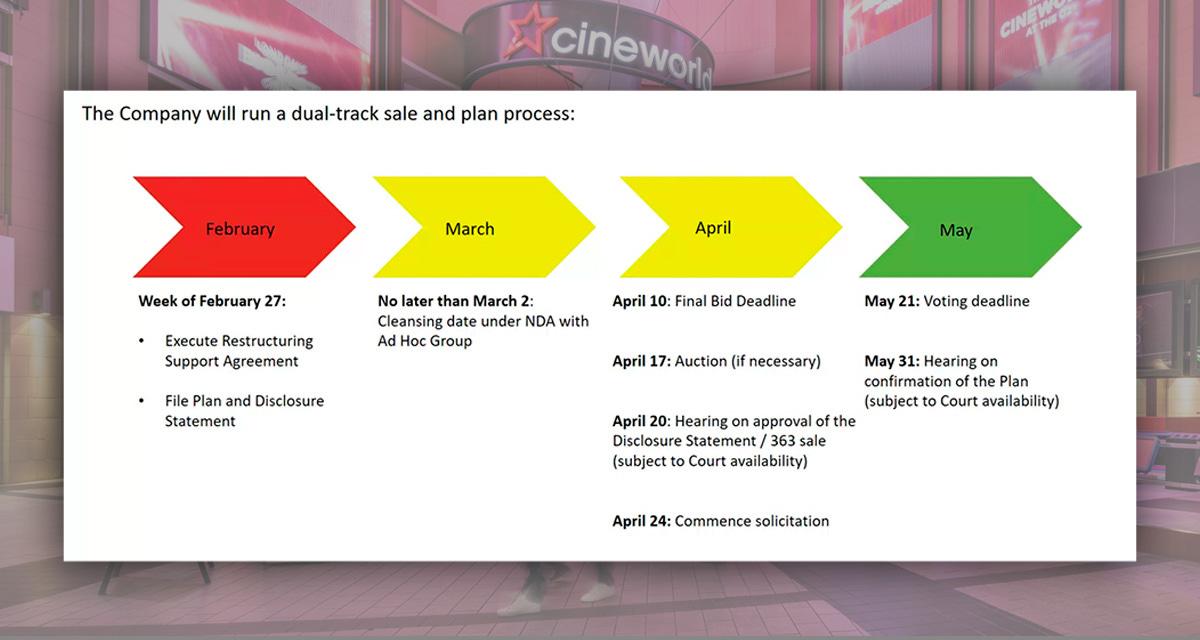

Cineworld - Some colour from the latest hearing around buyer interest

Pimco-Owned Office Landlord Defaults on $1.7 Billion Mortgage

A UK council has £2bn debts after Commercial Real Estate splurge

Subprime Auto Lender American Car Center Closes for Business

EM

Egypt raised $1.5bn in a 3 year Sukuk to yield 11%

Morocco looks to issue for 1st time since 2020

Adani back to BAU? - Group to Hold Asia Fixed-Income Roadshow Next Week

Sri Lanka Sovereign recap

China’s Central Bank Vows to Balance Growth and Inflation

Chinese cities cut mortgage rates for first-time buyers to lowest since 2019

BUYSIDE/PRIVATE CREDIT

Comment on Fairfax Insurance’s short duration bond portfolio

Euronext Makes €5.5 Billion Takeover Offer for Allfunds

Private Credit lenders are writing big cheques…

*MOVES*

Bonds

2yr closes at 4.8%. 3s, 5s, 7s all above 4%. 10s and 30s at 3.9%.

Inflation

U.S. 10-Year Breakeven Inflation Rate Rises to 11-Week High

Germany 10-Year Breakeven Inflation Rate Rises to 14-Week High

Italy 10-Year Breakeven Inflation Rate Rises to 6-Month High

Credit spreads

CDS Indices: Widening led by CDX HY (+21bps) and Xover (+14bps) over the week. Cash credit: Moves were relatively muted although I’m not sure that tells the whole story. GBP IG (+6bps), EUR HY (+5bps) were the main laggards. Meanwhile US HY and EM HY were tighter by 7bps and 6 bps respectively.

Bond ETF performance over 5 days

Weakest performers were Inflation linked, Treasuries, EM Bonds, Convertible bonds, UK Corps/Gilts : IVOL (-2.7%), IGOV (-2.2%), INXG (-2.0%), EBND (-1.8%), CWB (-1.7%), LTPZ (-1.7%), SLXX (-1.4%), IGLT (-1.4%). Looking at month end performances there are several Bond ETFs posting greater than 5% declines month to date, e.g: EDV, VCLT, TLT, IVOL.

Strongest: Inverse treasury bond ETFs, floating rate. TTT (+4.3%), FLTR (+0.2%).

*MACRO*

Fedspeak in the week

Bullard (non voter) - Marketwatch

Markets may be over pricing US recession risk, US economy is stronger than they had thought

Thinks Fed has a good shot at beating inflation 2023.

Thinks that rates need to be north of 5%

Please refer to FXMacro’s excellent and unrivalled round up of Fedspeak and a wrap up of all the key macro data in the past week and the week ahead.

Yields on 12-month T-bills have risen to their highest since 2001

With T-Bills yielding 5%, There Is An Alternative (TIAA instead of TINA!).

Allocators allocating money in size into money markets

Interesting chart and an accurate depiction of the better alternatives on offer vs regular bank deposits.

Mgmt Consultants start to cut jobs as boom time ends - FT

A classic signal of an economic slowdown down the road; reduction of consultancy fees, advertising and then typically corporate travel budgets are items that get cut when firms want to address their bottom lines in the face of macro-economic headwinds.

Some interesting extracts from this FT article:

KPMG is cutting nearly 700 jobs in its US advisory business and about 200 in Australia — about 2 per cent of its total workforce in each country. Meanwhile McKinsey will make up to 2,000 of its 45,000 people redundant as part of a global restructuring following years of rapid expansion.

In two years as head of Italian lender UniCredit, Andrea Orcel has cut the bank’s €150mn annual spend on consultants by more than half.

Credit Suisse aimed to halve its spending on consultants last year, compared to 2021 when it spent SFr2bn on professional services hiring 16,430 consultants, contractors and outsourced workers. It reduced its external consultant headcount by a fifth in the final quarter of 2022.

The US construction industry is short of workers! - SCBA

This speaks to the need for workers in more manual roles vs office type roles, many of which can be automated out by Artificial Intelligence. These same office jobs are likely to be more at risk of job cuts as companies adjust their workforces for lower margins to prepare for an inevitable recession down the road.

Extract - The construction industry’s outlook for labor is bleak. In order to meet demand, contractors will need to hire an estimated 546,000 workers in 2023, and that’s in addition to the industry’s normal pace of hiring, according to a new analysis by Associated Builders and Contractors. In 2022, the industry averaged more than 390,000 job openings per month, the highest level on record. Construction’s unemployment rate of 4.6% for 2022 was the second lowest ever, indicating there are few construction workers seeking jobs, and therefore the pool to fill demand is shallow. ABC predicts demand for labor to increase by 3,620 new jobs for every $1 billion in new construction spending, on top of the current, above-average job openings.

UK Labour leader Keir Starmer promises to 'give Britain its future back' - Sky news

The Labour leader has a big job to do as the UK’s various public services crumble in the runway to a 2024 general election. If executed correctly, this could have implications for wage inflation, gilt markets, construction sector, housebuilders, healthcare sector and sustainable energy to name a few sectors…

Sir Keir Starmer has promised to "give Britain its future back" with a "mission-driven government" as he set out his priorities if he wins power at the next election. The Labour leader set out five goals which will be at the core of his manifesto. They are: Secure the highest sustained growth in the G7 Build an NHS fit for the future Make Britain's streets safe Break down the barriers to opportunity at every stage Make Britain a clean energy superpower In a speech in Manchester, Sir Keir said: "These missions will form the backbone of the Labour manifesto. The pillars of the next Labour government.

BoE’s Mann: 'Too soon to stop interest rate increases - Yahoo Finance

Extract - Bank of England (BoE) interest rate-setter Catherine Mann has warned that more interest-rate rises are necessary to bring down inflation as the BoE has been "insufficiently" aggressive in dealing with it. "I believe that more tightening is needed, and caution that a pivot is not imminent," Mann said in a speech delivered to the Resolution Foundation think-tank in London. "In my view, a preponderance of turning points is not yet in the data."

Eurozone growth accelerates to nine-month high in February -S&P GLOBAL

EZ PMIs this week increased the case for the ECB to keep tightening financial conditions.

Flash Eurozone PMI Composite Output Index at 52.3 (Jan: 50.3). 9-month high.

Extract - Eurozone business activity growth accelerated to a nine month high in February, reflecting an improved performance of the service sector and a return to growth of manufacturing output. Rising demand, healing supply chains, order book backlog reduction and improved confidence underpinned the upturn. The data are consistent with the economy expanding in the first quarter so far, with employment also continuing to rise.

January car sales in Europe rose 11% for 6th consecutive monthly gain - Autovista24

Extract - The EU new-car market started 2023 with its sixth consecutive month of year-on-year growth but the 11.3% gain in January was weaker than the 12.8% rise recorded in December…The major European markets all expanded last month, with double-digit gains in Italy, Spain, and the UK. However, Germany contracted by 2.6% after a 38.1% surge in December, breaking the five months of consecutive growth seen in the second half of 2022.

South Korea holds rates for first time in 12 months - Central Banker

Extract - South Korea’s central bank kept its benchmark interest rate steady today (February 23), the first time it had done so in a year. The Bank of Korea’s monetary policy board kept the base rate at 3.5%, after raising it in seven consecutive meetings. The last time the board kept its policy rate unchanged was on February 24 last year. The governor said the decision did not mean the bank had ended its tightening cycle. “I don’t want today’s decision to be seen as the end of the rate hikes,” Rhee.

*INFLATION*

US PCE Inflation for January came in hot - Axios

Extract - The core personal consumption expenditures price index, which excludes food and energy costs, rose 0.6% last month — the fastest since last June.

Since Fed officials last gathered for a policy meeting earlier this month, the inflation narrative has shifted some. Data they had in hand showed the core PCE index rose at a 2.9% three-month annualized rate. But since then, there's been an additional month of revisions; now, that figure is 4.8%.

Notably, the core services PCE index — a measure that strips out shelter costs and is watched closely by the Fed — rose at a 7.4% annualized pace in January. That's compared to a 5.2% pace in December, points out Diane Swonk, chief economist at KPMG US.

• "The move up we are seeing is the Federal Reserve's worst nightmare, as it suggests underlying inflation may be rebounding," Swonk wrote.

• "Those prices are more dependent on labor market shifts and are why the Fed is so focused on raising unemployment and cooling wage growth. The fear is a more persistent and corrosive bout of inflation taking root."

Academic paper suggests immaculate disinflation would be unprecedented - Axios

Extract - a paper presented this morning at a high-profile University of Chicago conference argues that, based on a study of past periods, "an immaculate disinflation would be unprecedented." The paper was presented at the Booth School of Business Monetary Policy Forum, with (by our count) seven out of 19 members of the Fed's policy-setting committee participating.

The details: The paper's five authors, including former Fed governor Frederic Mishkin, examined periods of disinflation in the post-World War II era in four countries. They calculated a "sacrifice ratio," i.e., how much economic pain, in the form of unemployment and other measures, it took to bring down inflation.

The results suggest that a mild recession will be necessary for inflation to come down to the Fed's 2% target. "Our historical analysis and modeling exercise lead us to conclude that the Federal Reserve and other key central banks will find it hard to achieve their disinflation goals without a significant sacrifice in economic activity," wrote Mishkin, along with Stephen G. Cecchetti, Michael Feroli, Peter Hooper and Kermit Schoenholtz.

Sovereign (dis) inflation news

Canada's inflation rate slowed to 5.9% in January, but food costs continue to rise -CBC

Brazil inflation beats forecasts in mid-February, rate cuts still unlikely - RTRS

Core Inflation may prompt more rate hikes in Asia - IMF

Singapore's January core inflation rises 5.5%, fastest in 14 years - Zaywa

Hong Kong Inflation Rises To 2.4%, Highest In 4 Months - BI

South Korea's PPI slows to near 2-year low RTRS

Corporate (dis) inflation trends

Jamaica Banks Required to Boost Cash Reserves to Fight Inflation Link

Watchfinder has cut prices of its second-hand products by 15% - TheNational

World’s largest food company warns prices will continue to rise - Axios

Danone Sales Rise at Fastest Rate in Decade on Higher Prices - BBG

Kraft “continues to anticipate high single-digit inflation” for 2023 -Form 8-K

Virgin Media to hike broadband by 13.8% on average and Virgin Mobile to hike by 17% on average in April - Moneysavingexpert

*IG*

IG new issuance

Some big names came to issue in the corporate IG market in Europe, e.g. Tesco, Astra Zeneca, however the market was dominated by SSAs. US IG volume went past $22bn and issuance included a rare issuer BHP which came out with a multi tranche following its results. It was interesting to see IG issuer Porsche issue a substantial €2.7bn in the Schuldschein market instead of the EUR IG markets.

Moody’s upgrades Kraft Heinz to Baa2 from Baa3, outlook is stable

Extract: The upgrades reflect the significant progress the company has made towards reducing financial leverage and improving its operating performance in recent years. …While margins have recently been pressured by inflation, and volumes as well because of pricing taken to cover inflation, improved supply chain performance and pricing that is catching up to cost inflation should begin to improve the EBITA margin modestly.

*FINANCIALS*

Financials issuance/tenders

Quieter week for financials issuance but there was still some activity of note:

T2 issuance for Lloyds in GBP (£750m 10.25NC5.25 T2 UKT+310bps) and Natwest in € (€700m 11NC6 T2 MS+260bps)

Couple of Singapore Dollar denominated deals for French Banks (BNP SGD600m perp NC5 AT1 notes to yield 5.9% and Credit Agricole SGD500m 10NC5 Sub T2 to yield 4.85%).

Small cap UK specialist lender Secure Trust Bank ($170m market cap) issued a £90m 13% T2 bond in a sole led deal. Secure Trust describes itself as a specialist lender. At its last half year results Secure Trust (STB) reported a CET1 of 14.0%, cost income ratio of 57% and RoAE of 12.5%. The largest area of lending is Real Estate finance (41% of loan book as at half year 2022). Secure Trust was also one of the lenders who recently waived some of the covenants on the debt of stressed UK small cap housebuilder Inland Homes.

In terms of calls, Spain’s Ibercaja will be calling its €350 million AT1 bonds at the first opportunity, the lender announced Thursday. Redemption is scheduled for Apr. 6. As per the Jay-Z song lyric: “Numbers don’t lie, check the scoreboard” when it comes to market-wide AT1 calls in the past few years.

UK’s Nationwide BS announced a repurchase facility for its CCDS instrument- Announcement

Key highlights:

~Approx £100m of NWIDE CCDS to be purchased.

Purchase price of ~128.93 per CCDS plus accrued interest

Purchase facility took place during the period Feb 22nd to Feb 23rd

It will be interesting to see the take up for this tender since the purchase price is not much above current market prices. However, this instrument has risen 15pts since Nationwide BS’s earnings call when the prospect of a repurchase was announced.

UK Challenger Banks / Building Societies round up

Two UK building societies are set to merge - Newcastle and Manchester Building societies. Manchester BS has had a “trickier” financial situation that Newcastle BS in the past few years so is likely to help Manchester BS more. Both societies have legacy bonds out there. More in the Evening Standard.

HSBC 4Qs - Adjusted pre-tax ahead of estimates, capital solid

Key highlights:

HSBC 4Q ADJ PRETAX $6.83B, EST. $6.51B

CET ratio of 14.2% vs 3Q22: 13.4%

Asset Quality: Stage 3 loans of 2.08% vs 3Q22: 1.77%

2023 outlook: NII >$36bn (similar to 2022), Expected Credit Losses (“ECL”) of around 40bp and a RoTE of 12%+ from FY23.

*HY*

HY outflows picked up with this week led by ETFs

The above stats were a continuation of the trends tracked by Lipper for the w/e 21 Feb by by Refinitiv Lipper which showed that US HY funds had an outflow of $6.12bn. It represented the 3rd largest outflow on record.

New HY issuance recap

There was nothing remarkable about the issuance in the traditional US HY bond market with the only notable issuer to print being Transdigm which sold $1.1bn of 6.75% senior secured notes to yield 6.796%. Adjacent markets seem to perk up as judged by the convertible bond market which saw Southern Company price $.1.5bn of convertible bonds at 3.875%.

Southern Company intends to use the net proceeds to repay all or a portion of its outstanding commercial paper borrowings and GCP. Southern Company (NYSE: SO) is a leading energy provider serving 9 million residential and commercial customers across the Southeast in the USA.

In the lev loan space, Uber priced a $1.4bn lev loan to refinance debt in 2025. Uber’s corporate credit family rating also got upgraded by Moody’s to Ba3 from B1.

Seems the lev loan market is nicely humming along with several $1bn+ deals getting priced YTD with the other notable one being American Airlines TLB few weeks back.

In the asset backed market, Carvana, the online retailer of used cars issued $363m of Prime Auto ABS. However, it doesn’t seem the market is open to every issuer, with American Car Centre not proceeding with its asset backed issue this week,

In terms of notable calls, European Bakery goods firm Arytza announced its intention redeem the remaining € 200m of the Euro Hybrid bond, which has an interest rate of 6.82%. The call date of this transaction will be 28 March 2023. The transaction will be funded via cash from activities and other existing resources.

Hurtigruten secures refinancing and additional shareholder funding of EUR 80m - Company statement

Norway based cruiseliner Hurtigruten has successfully refinanced some of its near term loan and senior facilities. One non bank lender provided a commitment for a new EUR 200 million 5-year facility priced at E+600bps cash coupon, 600bps PIK coupon and will rank pari passu with the Group’s existing RCF and TLB.

The finalisation of the debt refinancing was a long time coming after Hurtigruten had appointed advisors way back in September 2022. The more favourable financial conditions and strength in cruise bookings helped get the financing deal across the line. Lenders/advisors to Hurtigruten would have had more pricing data to “comp” against since each of the large US Cruiseliners refinanced bonds in the HY bond market in the period between September and now (Carnival, RCL, Norwegian Cruiseline).

HY results round up - lots of benchmark names reported

A fair amount of benchmark HY names reported across a number of sectors with no major surprises by the results, i.e. Rolls Royce, Transocean, Virgin Media, Cinemark and IAG. Items of interest I noted in the results:

Rolls Royce shares popped 20% on the day of figures, mgmt look to want to get Rolls back into IG territory (currently BB rated).

Liberty Global - Virgin Media results looked decent. In its broadband segment, it saw strongest net adds of the year despite competitive market through Q4 speed increase for customers (now >300Mbps average) amongst other factors. Postpaid Mobile saw highest net adds of the year driven by strong black Friday and Christmas sales on O2 brand, particularly in upper end of the market. Virgin Media also saw a strong acceleration in Adj. EBITDA in Q4 supported by synergy delivery and continued benefit of price hikes. Note in the inflation section earlier, I commented that Virgin Media is about to hike its mobile and broadband prices in the UK.

RIG - Some quick highlights on debt/liquidity from the earnings call:

We ended the fourth quarter with total liquidity of approximately $1.8 billion, including unrestricted cash and cash equivalents of approximately $683 million, or approximately $275 million of restricted cash for debt service and $774 million from our undrawn revolving credit facility. We believe that the current strength of the offshore drilling market supports our ability to dramatically reduce our debt over time without the use of incremental equity. We will, however, continue to pursue the revenue actions as and when that makes sense.

Cinemark highlights:

Cinemark said fewer releases in 4Q and some an underperformance of films reduced its revenue by 10% to ~$600m. Cinemark swung to a net loss of $99m vs a profit of $5.7m the year earlier.

The recent film slate has had better momentum with customers - Over the past three months, we've seen Black Panther: Wakanda Forever deliver the biggest November domestic box office opening ever with a $181 million launch. Global phenomenon Avatar: The Way of Water crested $2.2 billion worldwide to become the third largest movie in history. Family film Puss in Boots: The Last Wish is well on its way to over $170 million of domestic box office, which is 14% higher than its first installment. Horror film M3GAN is quickly approaching $100 million of domestic box office. Sidenote: the new Puss in Boots scored 95% in Rotten Tomatoes…and I can personally vouch for that the film came in above expectations!

We generated 63 million of free cash flow in the quarter and 25 million for the full year. Turning to the balance sheet. We ended the year with 675 million of cash.

We continue to view our balance sheet as a strategic asset and a key differentiator. We executed upon our capital allocation priorities and strengthened our balance sheet during the year, paying down 21 million of international debt and repaying substantially all of our remaining deferred rent obligations incurred over the course of the pandemic.

Cinemark’s CEO is positive on the upcoming release of “Air”, which depicts the story of a rookie Michael Jordan and Nike’s fledgling basketball division and how Air Jordan was created. This feature is being created in Amazon Studios and is set to be released in Cinemas (unconfirmed as of yet) as well as streaming, and stars Matt Damon and Ben Affleck.

*DISTRESSSED*

Cineworld - Some colour from the latest hearing around buyer interest - Celluloid Junkie

Superb article from this website Celluloid Junkie. The key points of the article on the sale process and general status of the bankruptcy hearing seem to be that there is more demand from potential suitors for the RoW segment of Cineworld (CEE and Israel) which does not include the segments in the bankruptcy - UK & Ireland and the US. No bids came close to the $6bn in secured indebtedness on the company’s balance sheet today.

Pimco-Owned Office Landlord Defaults on $1.7 Billion Mortgage - BBG

Seems a few defaults have been announced lately in the US Commercial Real Estate sector, last week we heard of Brookfield owned properties defaulting and now these…

Extract - The office properties owned by Pimco’s Columbia Property Trust range from New York to San Francisco. An office landlord controlled by PIMCO has defaulted on about $1.7 billion of mortgage notes on seven buildings, a sign of widening pain for the industry as property values fall and rising interest rates squeeze borrowers. The buildings — in San Francisco, New York, Boston and Jersey City, New Jersey — are owned by Columbia Property Trust, which was acquired in 2021 for $3.9 billion by funds managed by Pimco. The mortgages have floating-rate debt, which led to rising monthly payments as interest rates soared last year.

A UK council has £2bn debts after Commercial Real Estate splurge - BBC

This news story is astonishing and stinks of (unchecked) debt fueled expansion into commercial property when debt was cheap. Woking Council seems to have ventured into speculative building of high rises and other projects such as one linked to the local football stadium.

Extracts from BBC -

A deputy council leader has called for government support amid predictions his authority's near-£2bn debt will cost an unsustainable £62m a year to service.

According to budget papers, the council borrowed about £1.8bn for investment purposes but is only bringing in £38.5m, and that is expected to rise to £43.3m next year.

But the figure is far below the predicted £62m in annual interest payments.

The council's financial difficulties have prompted an investigation by the Department for Levelling up Housing and Communities (DLUHC).

Woking Borough Council deputy leader Will Forster described the forecast as "quite stark" as he called for government intervention.

Councils cannot go bankrupt but instead can be placed under a section 114 notice which prohibits new spending commitments.

Mr Forster expects the council to fall under a section 114 by the 2024/25 financial year.

The worrying thing is that Woking council is not alone in spending large amounts on commercial real estate. The Guardian wrote this in 2022:

The National Audit Office estimates that councils across England ploughed almost £7bn into commercial property in the three years to March 2019, almost 15 times what they had spent over the preceding three years. Across the UK, local authority debt levels have surged by almost 50% since 2014 to stand at £130bn at the end of last year.

Rising debt service costs, higher long term office vacancies (due to WFH trends), shoppers preference for mega-malls (e.g. Stratford Westfield instead of Lakeside Shopping Centre), soaring labour costs and a cost of living crisis are ingredients setting up for a perfect storm for Councils that have splurged on CRE investments.

Subprime Auto Lender American Car Center Closes for Business - BBG

Extract - American Car Center told employees the business was closing its doors, a day after it pulled a $222 million bond sale from the market, according to people familiar with the matter. The used car retailer, which tends to target consumers regardless of their credit history, said in an email to employees on Friday the firm was ceasing all operations, closing its headquarters in Memphis, Tennessee, and that all employees would be terminated by the end of the business day, the people said. The headquarters has about 288 people.

*EM*

New EM issuance

Egypt raised $1.5bn in a 3 year Sukuk to yield 11%. According to press reports, the deal was 4x oversubscribed, demonstrating good strength of demand for the issue. This could be the first of many sukuks for Egypt since Ministry of Finance established an international $5bn program for issuing sovereign sukuk for the next several years. The positivity around Egypt's new Sukuk has seen Morocco break cover on some fixed income investor calls to issue paper for the first time since 2020. Morocco is currently rated BB+ whereas previous issuance was executed when it was an IG credit.

Thai Airways debt restructuring earlier than scheduled - Straits Times

Extract - Thai Airways International Plc’s operating loss narrowed 84% last year after Thailand eased pandemic-related border restrictions and tourists started to come back to the popular Southeast Asia holiday destination.

The national carrier’s operating loss excluding one-time items came in at 4.6 billion baht (US$133 million) in 2022, down from a 29.2 billion baht deficit in 2021, THAI said in an exchange filing Friday.

The airline, which has posted net losses every year barring two since 2013, filed for bankruptcy protection in 2020 before most creditors agreed to extend terms and cut some payments as part of its $5.3 billion rehabilitation plan.

“The return of Chinese travellers will help support our strong growth in 2023,” Mr Chai said in a press briefing. “Demand is so high that we are scrambling to add flights and procure more aircraft.”

Thai Airways plans to exit from a court-supervised debt restructuring earlier than scheduled in late 2024 as a rebound in global air travel boosts its cash flow and reduces the need for new loans.

Adani Group to Hold Asia Fixed-Income Roadshow Next Week - Yahoo Finance

Extract - The Adani Group will hold a fixed-income investor roadshow in Asia next week as the embattled Indian conglomerate seeks to repair the damage caused by a shock short-seller report. The group will hold a roadshow in Singapore on Feb. 27, and Hong Kong on Feb. 28 and March 1, according to a person familiar with the matter. Among the executives in attendance will be group chief financial officer Jugeshinder Singh and corporate finance head Anupam Misra, said the person, who asked not to be identified because the matter is private.

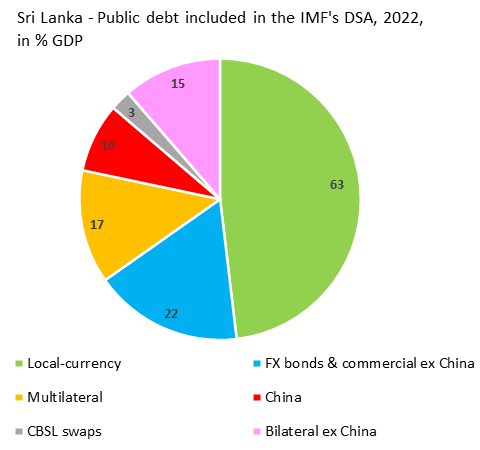

Sri Lanka Sovereign recap

Analysts at Research house IIF believe IMF approval program maybe near, and an interesting point is that the debt restructuring could take place regardless of the status of Chinese debt.

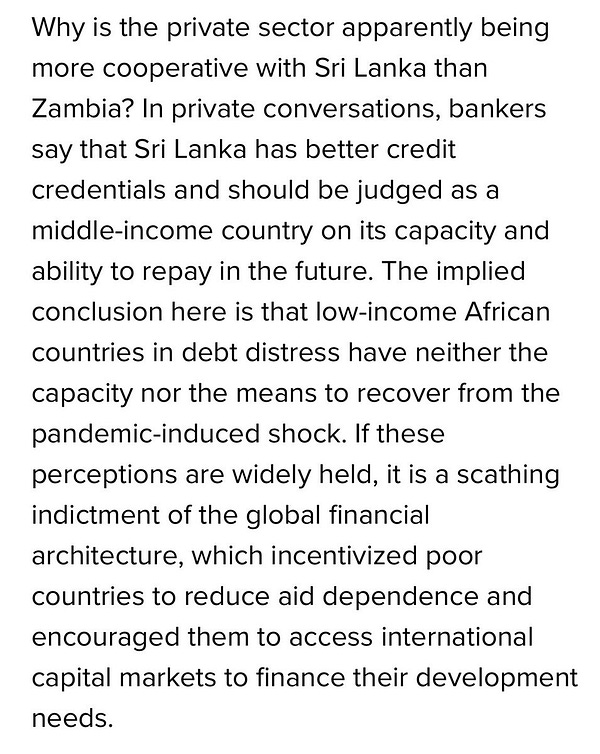

Similar thoughts re progress on a Sri Lankan Sovereign debt restructuring were shared in an article written by the Atlantic Council blog. The essence of the article was that private creditors to Sri Lanka have been more co-operative in the debt restructuring process than those in other distressed sovereign restructurings such as Zambia’s.

China’s Central Bank Vows to Balance Growth and Inflation - BBG

China’s central bank pledged to strike a balance between supporting growth and preventing inflation risks this year, as the economic rebound from three years of Covid damage gathers pace. The People’s Bank of China will provide “sustainable” support for the real economy and refrain from using “flood-style” stimulus, it said in its quarterly monetary policy report released late Friday. While inflation is expected to remain mild overall, it’s still necessary to look out for potential rising price pressures in the future, it said.

Chinese cities cut mortgage rates for first-time buyers to lowest since 2019 - SCMP

…in bid to revive property market. Extract- The average mortgage rate for a first home in 103 cities fell to 4.04 per cent in February, according to the Beike Research Institute The biggest drop came from second-tier cities, which on average cut their rate by 8 basis points to 3.99 per cent.

*BUYSIDE / PRIVATE CREDIT*

Fairfax Insurance’s short duration portfolio should do well going forward..

Fairfax Insurance’s earnings calls commented on its short dated bond portfolio and highlights why they are astute investors Fixed Income investors:

We have mentioned to you for many years now that we have not reached for yield. We benefited greatly by having such a low duration, 1.2 years coming into the year 2022 on our fixed income portfolio. Our low duration on our $38 billion fixed income portfolio reduced the impact of rising interest rates on our bonds to a decrease of only 2.8% on the fixed income portfolio much less than the 8% to 15% drop for many, many companies in our industry.

Notwithstanding our low duration, we had $1 billion of unrealized bond losses for the year, we expect much of this will reverse over the short term. In the meantime, we have been able to invest at higher interest rates, increasing our current normalized annual run rate for interest and dividend income to $1.5 billion, up from approximately $530 million at December 31, 2021 and $1.2 billion at September 30, 2022, a very significant almost 3 times what we had at the end of 2021.

Euronext Makes €5.5 Billion Takeover Offer for Allfunds - BBG

Extract - Platforms such as Allfunds offer investors access to a range of investment products in one place. They can require major technology investments to succeed, something that’s typically not a problem for exchange operators whose business is ensuring the smooth trading and settlement of financial products. Allfunds, which works with almost 3,000 fund groups and has more than €1.3 trillion of assets under administration, previously attracted takeover interest from German exchange group Deutsche Boerse AG, Bloomberg News reported in 2020.

Private Credit lenders are writing big cheques…

Some useful recent BBG articles demonstrating how Private Credit is providing large amounts of capital in private credit transactions:

Ares Management Corp. is in pole position to provide as much as £1 billion of private credit to finance a potential buyout of VetPartners amid interest from multiple possible bidders.

Private credit specialist HPS Investment Partners has provided a roughly £1.1 billion unitranche loan to Ambassador Theatre Group Ltd.

That follows on from the likes of Blackstone Inc. making the largest-ever European direct lending deal to UK software business The Access Group.

These large transactions put into question whether the “best” deals are going straight to private credit firms who provide better deal execution and more certainty for borrowers than syndicated markets which are unable to print large size for less well known issuers.

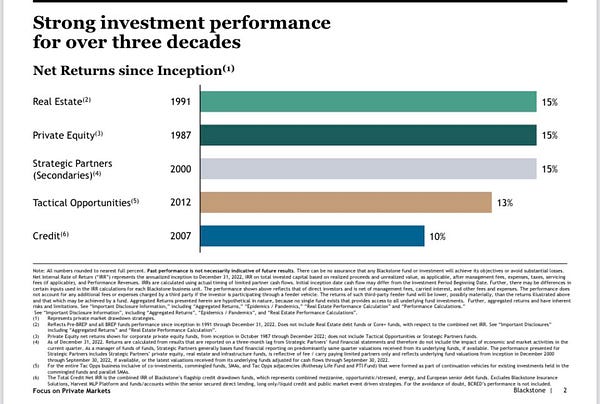

Interesting tweet on Blackstone’s long term track record across asset classes

*RATINGS*

X-S&PGR Raises Costa Rica Long-Term Ratings To 'B+'; Otlk Stable

Moody's upgrades Uber's CFR to Ba3; outlook positive

Fitch Upgrades Renault to 'BB+'; Outlook Stable

Fitch Downgrades Canary Wharf Finance II Plc

Boston Properties Outlook to Negative by Moody's

Fitch Upgrades Piraeus's Covered Bonds to 'BBB'; Outlook Stable

Morgan Stanley Affirmed at A1 by Moody's

X-S&PGR Affirms Aegon Group 'A+' Ratings; Outlook Negative

The best thing I read every weekend!

Great work and thank you for the shout-out!