20 January 2023 Global Credit Wrap

Robust Single B rated HY issuance, signs of fatigue in HY rally, statistically significant UST moves, 25bps Fed hike locked in, Bank FICC trading boom, SL Sov debt - China speaks...

MOVES OVER 5D

Cash credit spreads outperformed credit indices this week

Tiny bit of fatigue setting into HY rally (Bond ETFs lower, and CDS wider). Asian HY and broader EM outperformed.

US MACRO

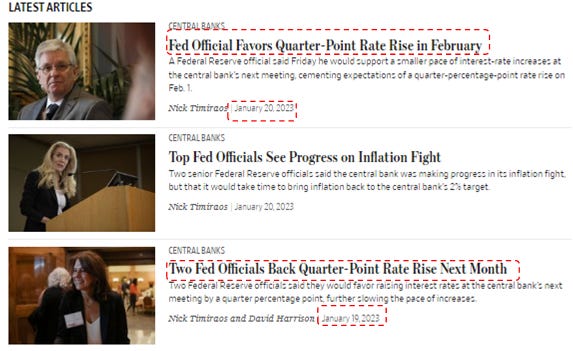

A number of fed voters push for 25bps, Timiraos flagging the same in WSJ

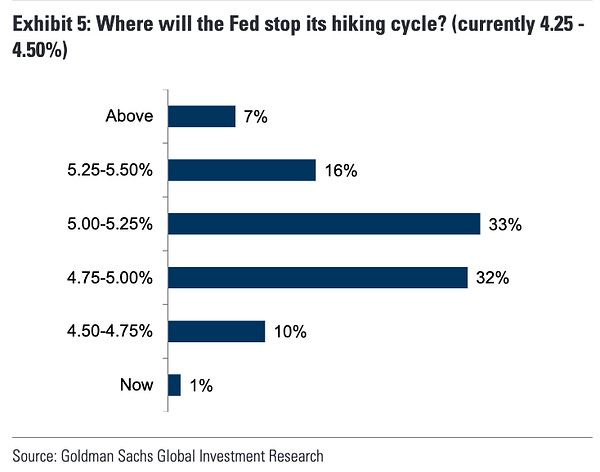

GS survey reveals most think Fed policy rate will be 5-5.25%

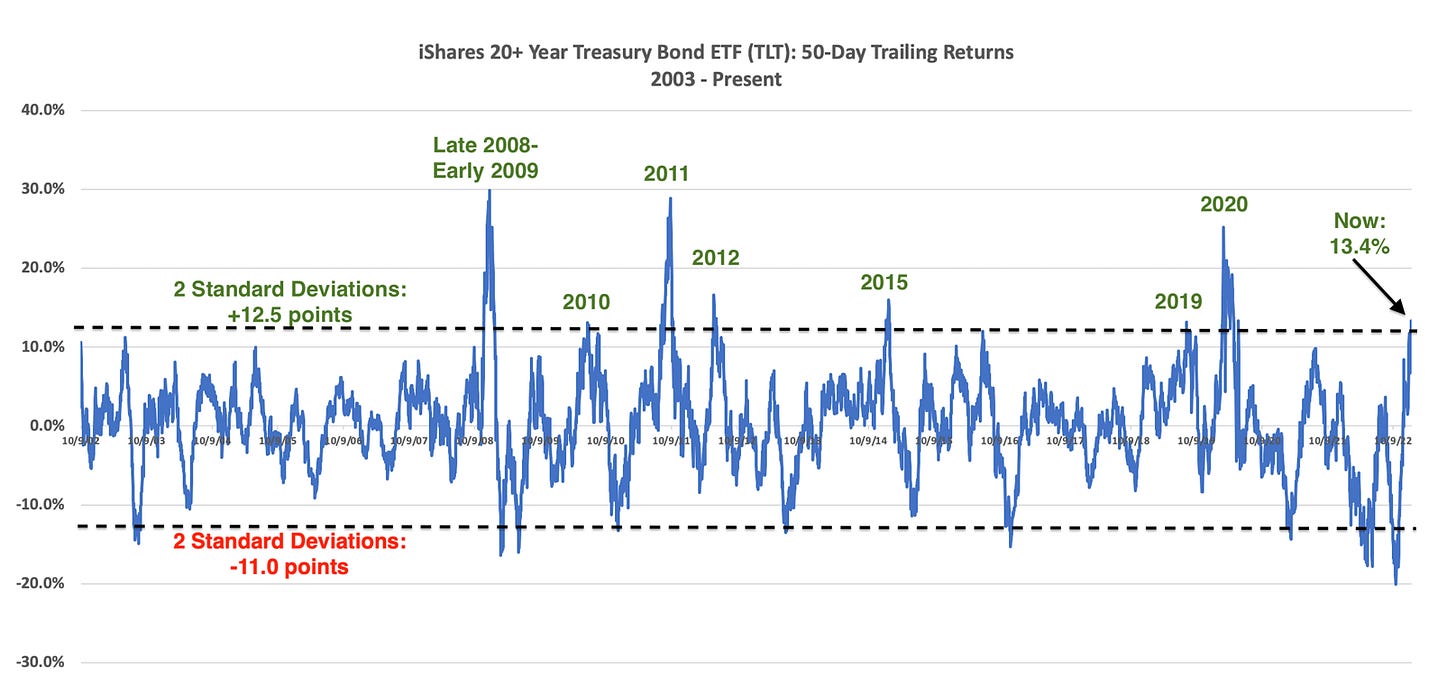

Statistically significant moves in long dated UST

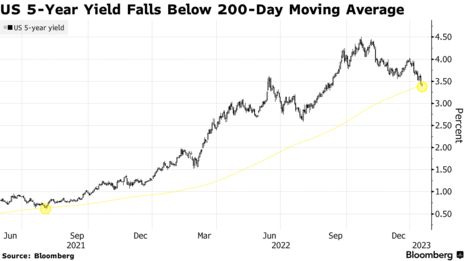

US 5yr yield fell below 200 DMA this week

Hedge Funds Extend US 10-Year Net Short to Most Since 2019: CFTC data

US Financial conditions the easiest in 11 months

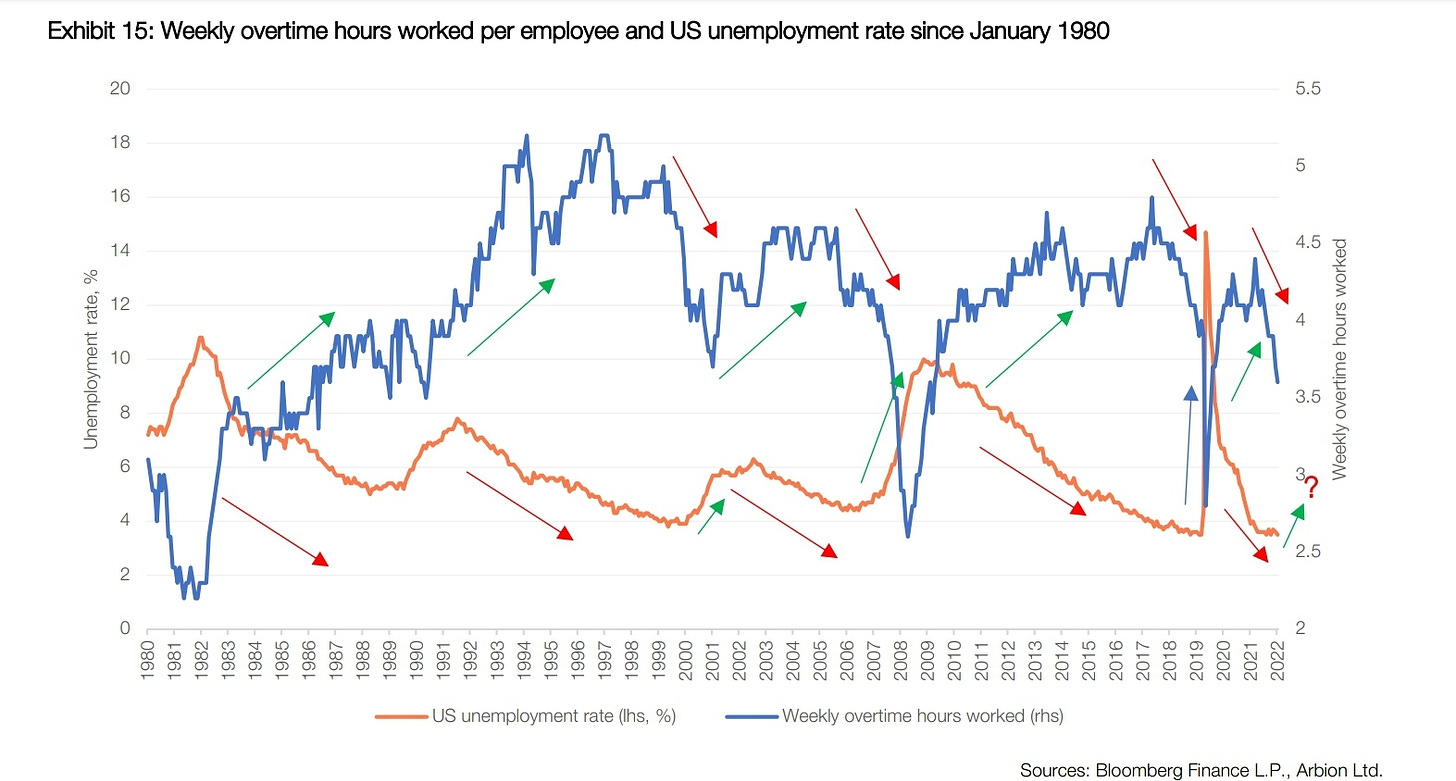

Weekly overtime hours worked suggests some weakness maybe ahead in US jobs

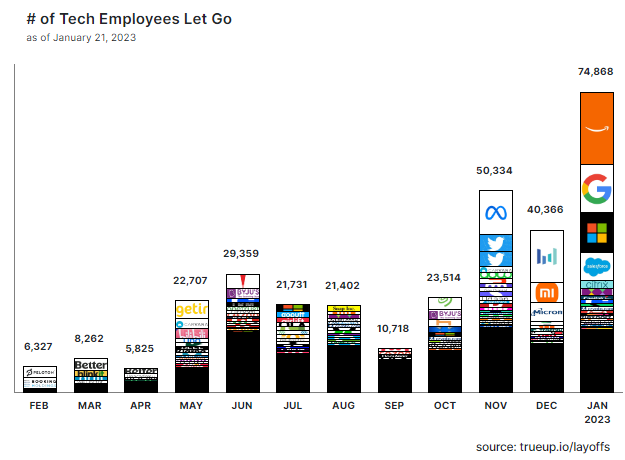

There have been nearly 75k layoffs in Tech alone in January so far

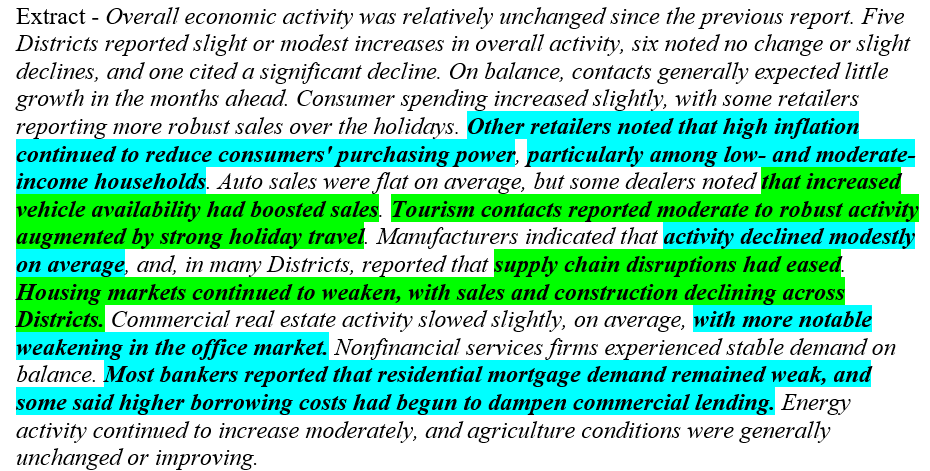

US Beige book saying high inflation reducing purchasing power for some consumers

RenMac question the weak US Retail Sales print

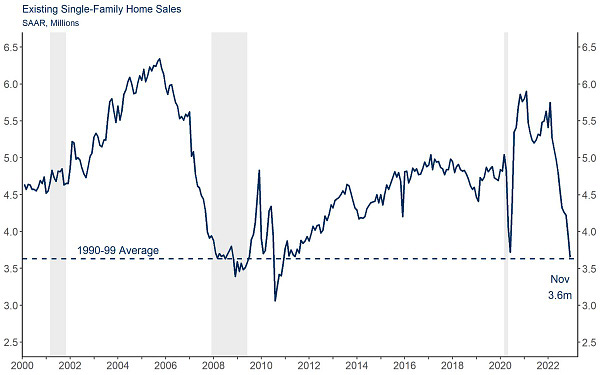

US Existing home sales collapsed below COVID lows, now normalising

US mortgage rates retreat to 6.23%, lowest in 4 months - XHB and ITB liking it..

US Household net worth still remains elevated

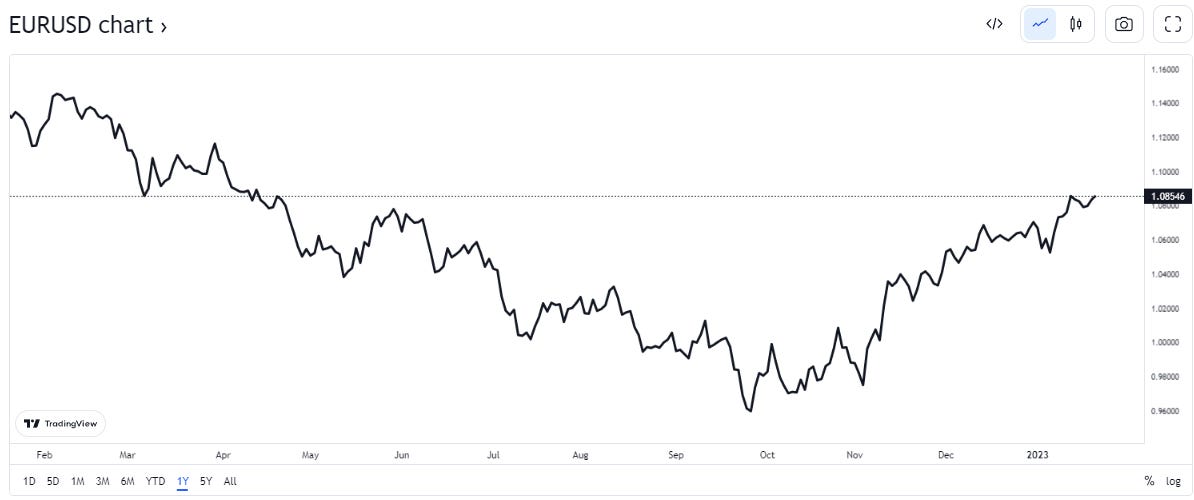

OTHER DM MACRO

German 10 yr bond tried to go below 2.0% but bounced higher after

Strong Euro will likely lower inflation in the region

One million protest against Macron's rise in retirement age in France

NZ House sales fall to lowest December level since 1995

UK Wage growth at fastest rate in 20 years, but failing to keep up with inflation

BoE’s Bailey says that Britain will experience a "long but shallow” recession..

UK Retail Sales Data / highlights:

UK shoppers cut back on spending as inflation takes its toll

More spending done on credit cards by UK consumer over Christmas

Ocado reported slowdown in food purchasing / switching to frozen items

INFLATION

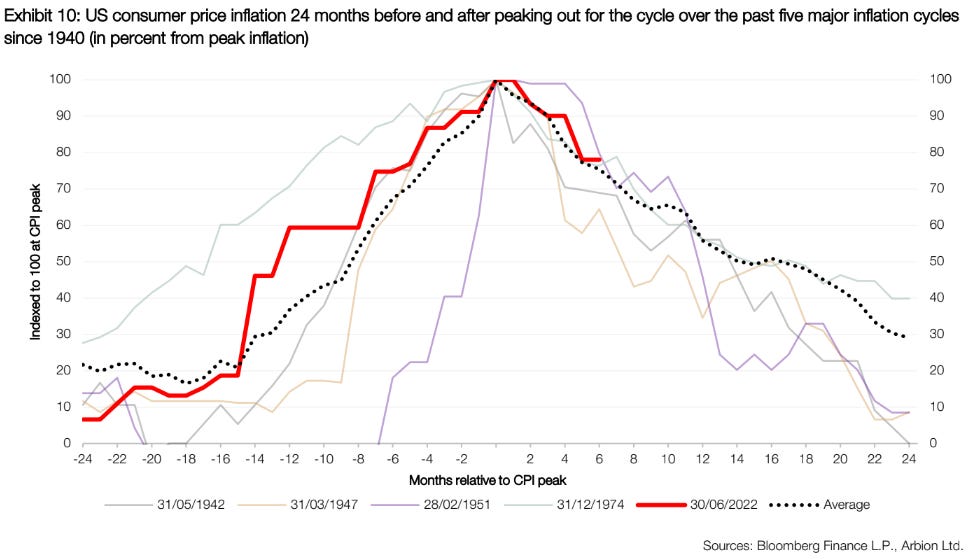

US CPI seems to be following a well trodden path

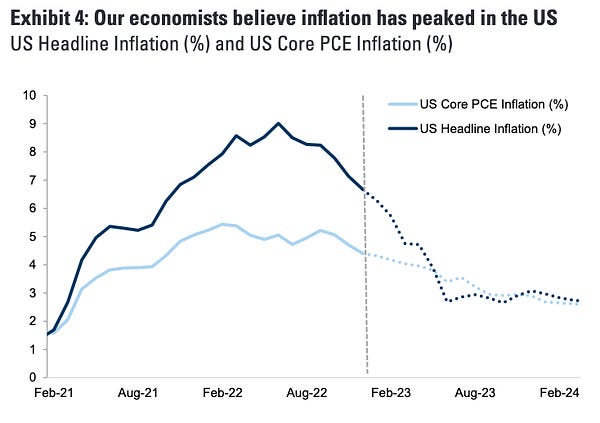

GS believes inflation has peaked in the US

Canadian CPI falls at fastest level since April 2020

UK inflation edges down to 10.5% in December, but food prices surge

Consumer pushback against higher prices? - Proctor & Gamble says shoppers pulled back in the face of relentlessly rising prices

COMMODITIES

UK’s Labour Party will end North Sea investment, says Sir Keir Starmer

Colombia Energy minister stands by decision not to award new oil and gas exploration contracts

EnQuest CEO interview with CNBC re North Sea

Indian Govt set to ban 25-year-old oil tankers, bulk carriers and other ships

FINANCIALS

Notable bond calls /redemptions: Sabadell AT1 & Quilter T2 (UK Wealth Mgr).

IG

Two new Corporate Hybrids this week (Ibedrola and Eurofins)

Enel looking to completely take out old € Hybrid, changes tender offer on $ Hybrid to uncapped offer.

Aroundtown new coupon fix on the former ARNDTN 3.75% EUR bond, announces results of tender offer for seniors

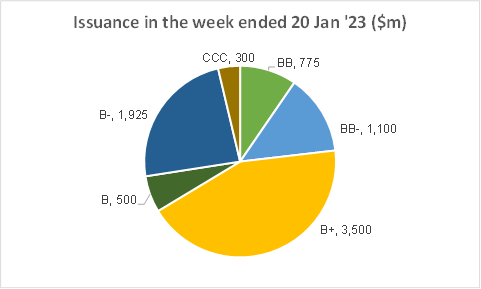

HY

$6.4bn raised was raised in the US HY market in the week with majority coming from single B rated issuers

Large HY capital structures terming out their debt stacks, e.g.:

Transocean

Bombardier

Altice France

US HY LTM Default rate unchanged for 4 months

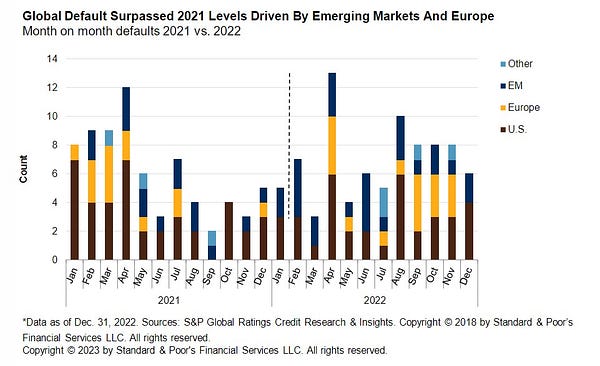

Global HY - There were 83 corporate defaults in 2022, a 15% increase YoY

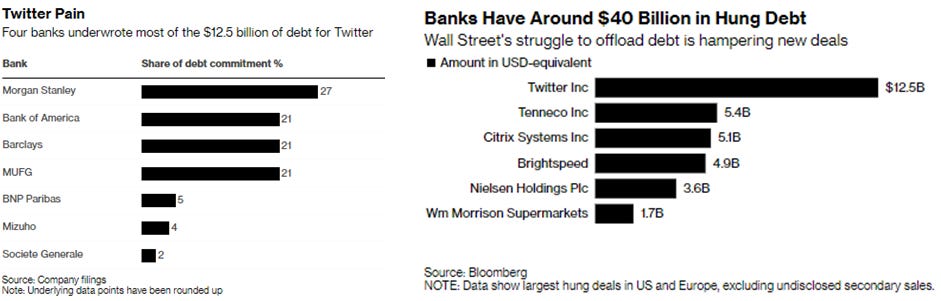

Morgan Stanley incurred $356m write-down on corporate loans in Q4

United Airlines expects to quadruple profit in 2023

Asda / EG Group Merger talks according to the UK’s Times

Jaguar Land Rover expects to generate positive cashflow in 2nd half of FY23

EM

BHP reckons China pro-growth policies will be supportive in H1’23 in an otherwise difficult economic environment

Goldman Sachs Lifts China’s Economic Growth Forecast to 5.5%

New issues - CEEs active with new Bulgaria € and Serbia $

Sri Lanka - India and China highlight their own individual support for debt plans

Argentina Bonds Jump as Government Stuns Market With $1 Bn Buyback - BBG

Turkey's President Erdogan brings election forward to May

Vedanta to sell Zinc International assets to Hindustan Zinc for $2.98bn

RATINGS

Moody's upgrades Uzbekistan's rating to Ba3, outlook stable

Coinbase Downgraded to B2 by Moody's, Outlook Stable

Fitch Takes Various Rating Actions on American Airlines' EETCs

TRADING

GS & MS - Strong performances in FICC divisions following likes of BofA and Citi last week. Extracts from earnings call / presentations give further detail.

LINKS

Howard Marks’ latest interview

Private debt funds ration withdrawals to individual investors

Pimco to return to issuing CLOs in Europe again

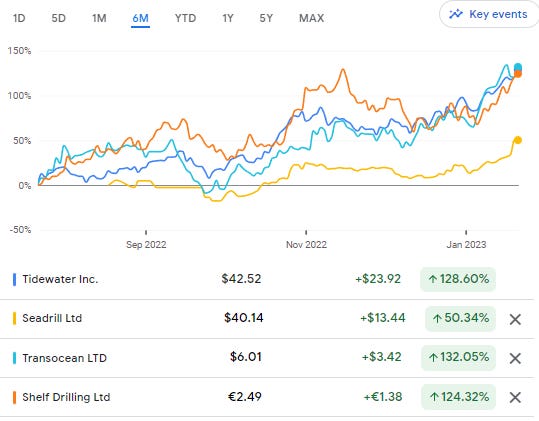

Oil services cos share prices have been ripping in the last 6 months

*MOVES OVER 5D*

Bond ETFs - Strength in: Preferreds (PGF/PGX 2%+ higher), Asian HY (AHYG +2.2%), Munis (BAB+1.4%) EM Sovs (PCY+1.6%, EMBE+1.0%, IEMB+1.0%).

Weakness in: GBP denominated bond ETFs (e.g IBTS, IBCI, IBGS, SE15 which are all down around 1-1.5%), long dated UST (EDV-1%), China Govt bonds (CNYB-0.9%) HY (IHYU -1%, HYG -0.6%).

Credit spreads

Cash - Big moves tighter in EM (EMHY -15bps, EM Agg -12bps), CoCos (-6bps), EUR IG (-5bps), Pan European HY (-5bps). Meanwhile, there was a widening bias in US HY (+17bps), indicative of a breather for spreads after an extended rally.

Credit indices - Generally a widening bias here, with none of the major indices I track tightening on the week highlighting a difference to cash. Widening bias most evident in CDX HY (+22bps,), Xover (+14bps), Sub Fins (+7bps).

*US MACRO*

Notable fed speak during the week

Fed voters Logan and Harker laid out case for 25bps on Wednesday

Fed’s Collins felt that it was appropriate to slow the pace of rate hike

Brainard made the case for keeping interest rates elevated for a sustained period

Please refer to FXMacro’s substack for more detailed Central Banker commentary from the week.

Nick Timiraos of the WSJ, who acts like an (unofficial) extended voice of the Fed is pointing towards a 25bps hike in several of his articles this week, which probably means 25bps is a done deal:

GS survey reveals most think Fed policy rate will be 5-5.25%

Datatrek on outsized long dated UST moves demonstrated by TLT

Datatrek commented that the moves we are seeing currently are more than 2 standard deviations higher than the average return over the period shown. Historically these sort of outsized moves are only seen when either a recession is close or recession fears are high, as shown by the spikes on the chart. The full analysis by Datatrek is worth reading.

US 5yr yield fell below 200 DMA this week | BBG

Extract - The five-year Treasury yield, seen as particularly sensitive to the path of monetary policy, fell below its closely watched 200-day moving average for the first time since 2021.

Hedge Funds Extend US 10-Year Net Short to Most Since 2019: CFTC via BBG

Financial conditions the easiest in 11 months - BBG

Weekly overtime hours worked suggests some weakness maybe ahead in US jobs - Arbion

Extract - The number of weekly overtime hours per employee in the US is falling. This tends to be a good indicator of incoming weakness for payrolls and hourly wages.

Layoffs continue to pile up in Tech…

Big ones this week were Amazon (18k), Microsoft (10k) and Alphabet (12k jobs globally).

Source: https://www.trueup.io/layoffs

The Fed Beige Book highlights

US Mortgage Rates Retreat to 6.23%, Lowest in Four Months | BBG

Extract - US mortgage rates fell to a four-month low last week, supporting more home purchases and refinancing. The contract rate on a 30-year fixed mortgage decreased 19 basis points to 6.23% in the week ended Jan. 13, according to Mortgage Bankers Association data released Wednesday. That helped boost total applications by nearly 28% in the week, though the data can be volatile around major holidays. MBA’s purchasing and refinancing indexes each rose to the highest since September.

ITB and XHB ETFs have made a significant recovery in sympathy with the lower yields on long bonds.

Existing home sales collapsed below COVID lows, now normalising

US Household net worth still remains elevated

RenMac question the weak US Retail Sales print

*OTHER DM MACRO*

German 10 yr bond tried to go below 2.0% but quickly bounced higher

Long term trend (higher yields) seems to be in tact.

Source: BBG

Strong Euro will likely lower inflation in the region further

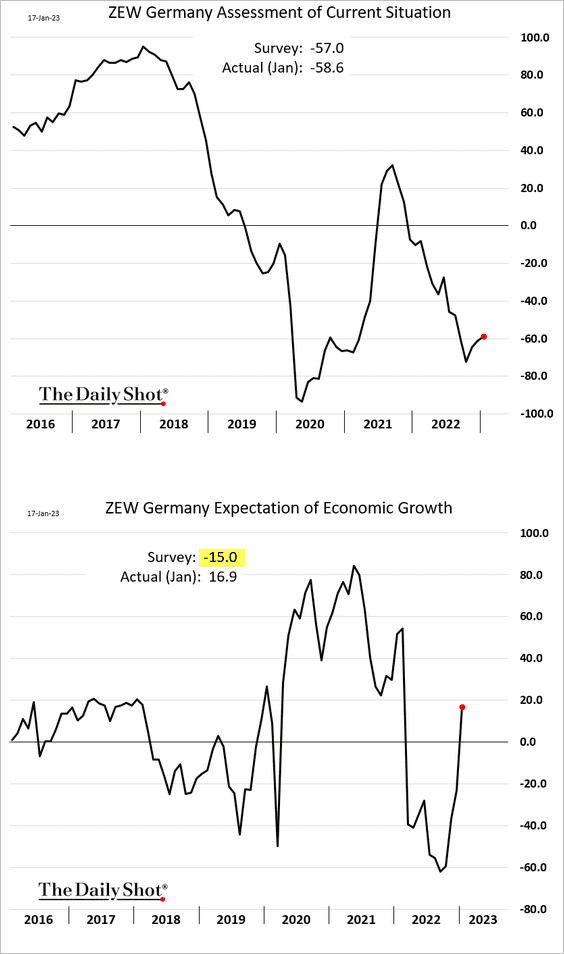

German ZEW Survey shows nice rebound in sentiment

France: One million protest against Macron's rise in retirement age | BBC

Extract - More than a million people have joined a day of protests and strikes, according to France's interior ministry, against plans to push back the age of retirement from 62 to 64. Some 80,000 protesters took to the streets of Paris, with demonstrations in 200 more French cities. President Emmanuel Macron called the reforms "just and responsible" - but they are facing a make-or-break moment. The strikes severely disrupted public transport and many schools were closed

NZ House sales fall to lowest December level since 1995

Extract - House sales nationwide have plummeted to new year-end lows, but price falls are stabilising, the Real Estate Institute says. There were just 4336 sales around the country in December, a 39% drop on the 6755 sales in the same month in 2021, according to the institute’s latest figures. It was the lowest sales count for a December since 1995, and stood in stark contrast to the record high of 8935 in December 2020. Nationally, sales also fell by 23.6% from November. Sales were down annually, and from November, in every region, and Auckland and Wellington sales counts at 1327 and 448 were the lowest since December 2008 and June 2008 respectively.

SNB’s Jordan claimed that some tightening was on the cards and it was not time to discuss loosening.

Norges Bank held rates steady in a unanimous vote

Extract of associated statement: Policy rate kept unchanged at 2.75 percent

Norges Bank’s Monetary Policy and Financial Stability Committee has unanimously decided to keep the policy rate unchanged at 2.75 percent.

Consumer prices have risen sharply, and inflation is markedly above the target. Activity in the Norwegian economy is high, and the labour market is tight. High inflation and higher interest rates are weakening household purchasing power, and many firms expect a fall in activity ahead.

Based on the Committee’s current assessment of the outlook, the policy rate will need to be increased somewhat further to bring inflation down towards the target. Since Monetary Policy Report 4/22, the labour market appears to have been a little tighter than projected. Continued pressures in the Norwegian economy may contribute to keeping inflation elevated. These developments could suggest raising the policy rate at this meeting. On the other hand, there are prospects that energy prices will be lower than expected earlier, and global inflationary pressures appear to be easing. The policy rate has been raised considerably over a short period of time, and monetary policy has started to have a tightening effect on the economy. This may suggest a more gradual approach to policy rate setting. The outlook for the Norwegian economy is more uncertain than normal. “The future policy rate path will depend on economic developments. The policy rate will most likely be raised in March”, says Governor Ida Wolden Bache.

UK Wage growth at fastest rate in 20 years, but failing to keep up with inflation - Sky

Extract - Wages rose 6.4% from the same period a year earlier, in the highest increase since records began in 2001. But despite increased wages, workers are earning less. Real wages fell 3.8% as pay failed to keep up with the increasing cost of goods.

BoE’s Bailey says that Britain will experience a "long but shallow” recession..

Extract from Teletrader - Bank of England (BoE) Andrew Bailey projected that Britain will experience "a long, but shallow" recession during his visit to South Wales on Thursday, underlining that the country's economy has indicated a pattern of "weak activity over quite a prolonged period."

The rate of inflation is expected to decline "rapidly" in the first half of the year, the central bank's governor explained, but warned that the United Kingdom's tight labor market could pull the strings on the inflationary pressures, pushing the policymakers to raise interest rates. "The level of activity we have in the economy is below where it was pre-Covid (GDP) and remains about 0.3% below," Bailey stressed.

UK shoppers cut back on spending as inflation takes its toll - RTRS

Extracts -

Retail sales -1.0% m/m in Dec vs Reuters poll +0.5%

Annual fall of 5.8% is biggest on record for any December

ONS says cost-of-living squeeze behind the drop

Online sales hit by postal strike

UK Retailer earnings boosted by credit cards - BBG

UK’s Ocado Drops as Online Consumers Cut Grocery Spending - Grocery Gazette

Extract - Ocado Retail CEO Hannah Gibson has said that she remains “confident” in the company’s value offering, despite consumers cutting back on online grocery spending in response to the cost-of-living crisis. The online supermarket reported a retail revenue of £549.4m and delivered its “biggest ever” Christmas last year, despite shoppers buying less and shopping less frequently as they respond to the cost-of-living crisis. “We’re seeing customers trade more into chilled and frozen items – and our ready meals have seen growth as more people are staying at home. Over Christmas, we saw party food up 35% and English sparkling wine up 70%.”

*INFLATION*

US CPI seems to be following a well trodden path - Arbion

GS believes inflation has peaked in the US

Canadian CPI falls at fastest level since April 2020 - Forex.com

Extract - Will this be enough for the BoC to hold on rates when it meets next week? Share: Canada Expectations are for the Bank of Canada to hike 25bps when the central bank meets next week to discuss monetary policy. The December CPI showed inflation at 6.3% YoY, much higher than the BoC’s 2% target. However, the YoY print dropped from 6.8% YoY in November vs an expectation of 6.4% YoY. In addition, as with the US CPI, it’s the MoM rate that people are talking about. The December CPI MoM dropped -0.6% vs a prior reading of 0.1% and an expectation of -0.5%. This was the largest drop in the month-over-month series since April 2020.

UK inflation edges down to 10.5% in December, food prices surge - RTRS

UK CPI drops to 10.5% in Dec from 10.7% in Nov

Food and drink prices rise at fastest since 1977

Services prices rise at fastest rate since 1992

Markets see BoE raising rates to 4% in Feb

Finance minister says high inflation is a "nightmare"

Proctor & Gamble says shoppers pulled back in the face of relentlessly rising prices - NY Times

Extract - Procter & Gamble’s sales fell for the first time in more than five years last quarter, the company reported on Thursday, as shoppers pulled back in the face of relentlessly rising prices. The maker of household staples like Tide detergent, Head & Shoulders shampoo and Charmin toilet paper saw sales fall 1 percent in the three months through December, versus a year earlier, the first annual decline since mid-2017. Profit also fell for a second consecutive quarter, sliding 7 percent. Both sales and earnings were hurt by changes in foreign exchange rates, the company said.

*COMMODITIES*

Colombia Energy minister stands by decision not to award new oil and gas exploration contracts - BBG

Extract - Colombia’s Energy and Mines Minister Irene Velez said that the government’s decision not to award new oil and gas exploration contracts was “absolutely urgent” and needs “immediate action.” Speaking in a panel on energy transition from the World Economic Forum at Davos, Velez doubled down on President Gustavo Petro’s campaign promise to transition the country away from fossil fuels. Her remarks signal a stark difference to comments by Finance Minister Jose Antonio Ocampo, who has said Colombia is open to the possibility of new contracts given its high fiscal revenue dependence from fossil fuels.

Labour will end North Sea investment, says Sir Keir Starmer | Telegraph

Extract - "Sir Keir Starmer has vowed to stop investing in new British oil and gas fields if Labour wins the next election. In a major departure from current government policy, the Labour leader ruled out new investment in North Sea fossil fuels as he outlined the party's mission to go green. Addressing business leaders and policymakers at the World Economic Forum in Davos, Sir Keir called on countries to form a “clean power alliance” to rival the Opec group of oil exporting countries. Sir Keir claimed an alliance would help bring down energy bills and stressed that Labour's energy plan did not involve fossil fuels. “What we've said about oil and gas is that there does need to be a transition,” he said. “Obviously it will play its part during that transition but not new investment, not new fields up in the North Sea, because we need to go towards net zero, we need to ensure that renewable energy is where we go next.”

North Sea Firm’s EnQuest CEO made some interesting comments this week at Davos regarding the less favourable environment from the current UK Government.

Indian Govt set to ban 25-year-old oil tankers, bulk carriers and other ships - E.T

Extract - “The government is set to ban 25- year old oil tankers , bulk carriers, and general cargo vessels, both Indian registered and foreign flagged, from calling Indian ports to load and unload cargo as it looks to encourage a younger fleet to improve safety, meet global rules on ship emissions and protect the marine environment from pollution during mishaps.”

Should be supportive for firms with newer tanker fleets.

Golar LNG locks in $140m in EBITDA from unwinding majority of its TTF hedges for 2023/4 - Globenewswire

Extract -”Golar LNG Limited announces today that it has unwound the majority of its swap arrangements for its Dutch Title Transfer Facility (“TTF”) linked production on the FLNG Hilli

March-December 2023, securing approximately $76 million of Distributable adj. EBITDA:

Full year 2024, securing approximately $49 million of Distributable adj. EBITDA”

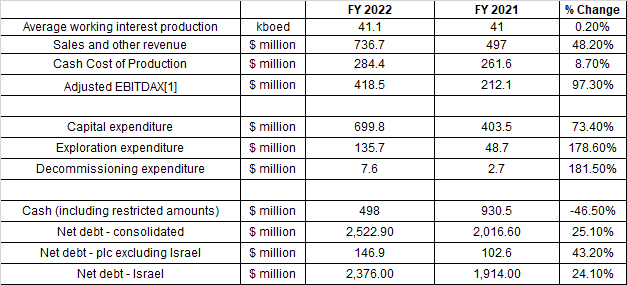

Energean trading update - IR

Energean, London listed Israeli Gas play reported strong set of numbers in its trading update to 31 December 2022:

Revenues were $736.7m, a 48% increase versus 2021 comparable period

EBITDAX of $418.5m, an increase of 97% versus 2021 comparable period

On track to deliver mid-term annualised targets of $2.5bn of revenues and $1.75bn of EBITDAX

Group cash as of 31 December 2022 was $498.0m (including restricted amounts of $75 million) and total liquidity was $719.0m

Key Karish field set to come online next month (Feb 2023).

Regarding capital structure Energean said this:

On track to reduce net debt / EBITDAX < 1.5x (mid-term target)

Interest rates fixed as part of 2021 refinancing

Reviewing options for 2024 EISL bond maturity to maintain efficient capital structure

*FINANCIALS*

Notable bond calls /redemptions:

Banco Sabadell to Early Redeem €400 AT1

UK Wealth Manager Quilter called its QLTLN 4.478 02/28/28

Both issuers have issued subordinated debt recently which has enabled them to retire these bonds. Although very subtle, this indicates to me that funding markets particularly in financials are humming along ok.

*HY*

Weekly HY new issue comment

$6.4bn raised was raised in the US HY market and $11.4bn raised YTD according to Bloomberg. Of that total, Transocean raised $1.8bn secured debt and all that was just in seven days. The Nordic Dollar bond market also is pumping out new issuance including a $150m SLB for SFL ($1.4bn market cap vessel owner and lessor) which yielded 9%.

The US HY market saw most issuance from lower rated issuers led by the B rated segment demonstrating the strong risk on tone pervading markets right now.

Src: BBG

The issuers that hit the market this week (Transocean, Bombardier, Dish) are those with reasonably large debt stacks with ratings in the single B ratings area. RIG’s second bond issue is said fund the redemption of 2024 and 2025 maturities such that it reduces ~$1bn of debt between now and 2025. This is notable for a business where a lot of the previous bear case has been around debt loads and access to debt markets. Meanwhile, Norwegian Cruise upsized its new issue from $500m to $600m.

Recent experience (2018 Fed tightening, 2020 pandemic and now 2022 Ukraine/Russia war & high inflationary period) has seen a similar trends in the new issue markets. Firstly, it is senior corporates that re-open new issue markets with widely priced issuance, then senior financials, then sub financials then slowly HY and last is usually EM and HY single Bs / CCCs.

US HY LTM Default rate unchanged for 4 months, and other stats from Credit Suisse

A note from Credit Suisse’s HY desk highlighted the following:

In 2022, US HY had 14 defaults whereas EUR HY saw only 3 defaults

Current distress ratio in Europe is higher (10%) than in the US (7%)

US HY LTM default rate has been unchanged for four straight months at 1.4%

In EUR HY the issuer default rate remains historically muted at 0.5%, and it has not been above 1% since October 2021.

I might have mentioned this last week but LTM default rates are not a great indicator of future defaults, but do paint a picture of relative calm with respect to current credit market conditions.

S&P LCD on Global Corporate defaults

Altice kicks off process to extend maturing loans, increase pricing - memo (RTRS)

Extract - Telco firm Altice France on Thursday launched a process to extend its existing loans maturing between 2025 and 2026 to August 2028, according to a memo seen by Reuters. The move is a sign that big companies are trying to take advantage of improved market sentiment and investor appetite to refinance debt well before existing loans mature. Altice France's outstanding loans consist of a total of $6.070 billion and 2.145 billion euros ($2.32 billion).

Secured Altice France paper is rated B2/B and assuming they get the extensions done points to more increased risk appetite from buyside participants compared to most of last year.

MS incurred $356m write-down on corporate loans stock on B/S - BBG

Extract - Morgan Stanley incurred a $356 million write-down on corporate loans stuck on its balance sheet in the fourth quarter as the market for leveraged buyout debt, including Twitter Inc., remained weak.

European Telco Iliad signs €300m loan with EIB to finance 4G and 5G - Link

Extract - The Iliad Group and the European Investment Bank (EIB) have set up a new €300 million loan to help finance its mobile network rollouts in France. The sum will go some way in helping to densify Iliad’s 4G network and to deploy its 5G network in the country. EIB has helped to finance Iliad’s fixed network rollouts for over 10 years and this new loan brings Iliad’s total amount of EIB financing to over €1.1 billion since 2009.

Imagine how many HY issuers wish they had access to financing like this!

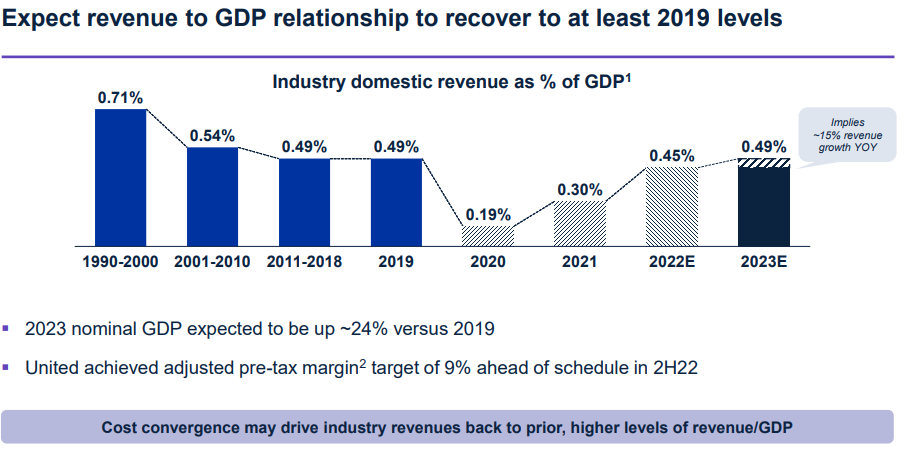

United Airlines expects to quadruple profit in 2023 - Yahoo Finance

United Airlines Holdings on Tuesday forecast at least a four-fold jump in full-year profit for this year and reported fourth-quarter earnings that topped Wall Street estimates on robust travel demand.

United sees an adjusted profit of $10 to $12 per share for 2023, up from $2.52 per share last year. That is well above analysts' estimates of $6.54 a share, according to a Refinitiv survey.

U.S. carriers are enjoying the strongest travel demand since the start of the COVID pandemic, boosted by reopening of closed borders, a strong U.S. dollar and rising corporate travel.

While recession fears have sparked concerns about consumer spending, airlines say travel demand remains strong and exceeds the pace of flight capacity growth, keeping ticket prices high.

Key financials for the quarter:

In 2022 it early redeemed $400m of its debt

Ending available liquidity of $18.2 billion.

Forecasts Adjusted net debt to adjusted EBITDAR of < 3x in 2023

UAL also posted an interesting chart linking GDP to air travel revenues:

Asda / EG Group Merger talks according to the UK’s Times

JLR forecasts positive cash flow for 2nd half of FY 23 | RTRS

*IG*

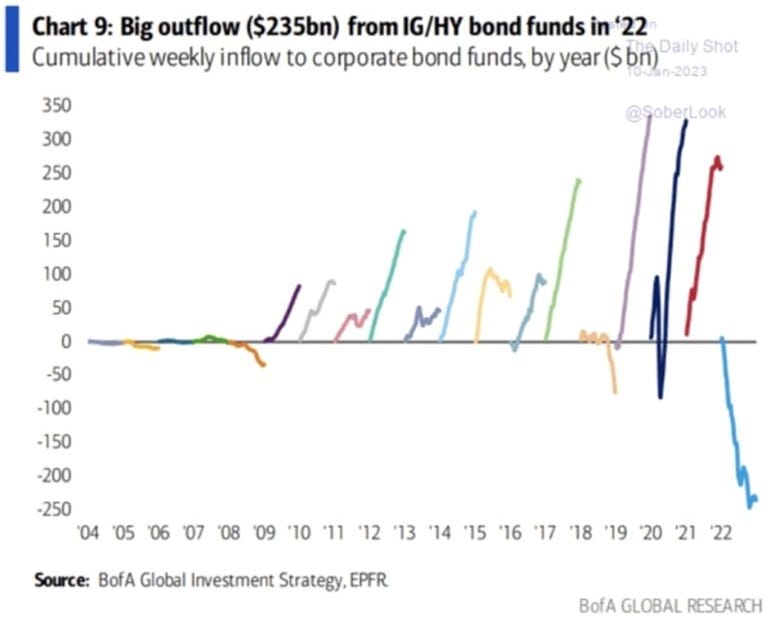

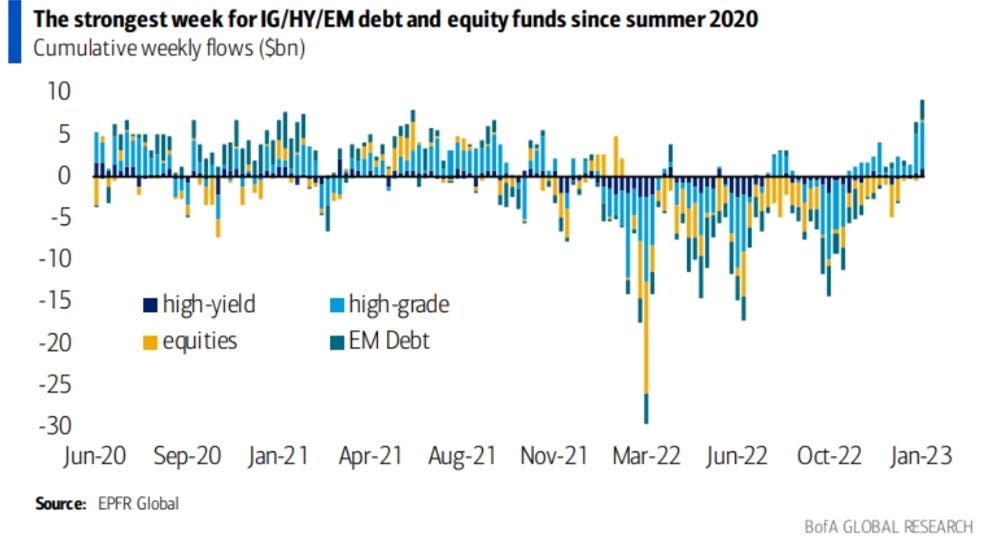

Credit Fund flows, comparing FY 22 to 2023 YTD…

2022:

2023 YTD:

Corporate Hybrid recap

→Two new Corporates this week:

Iberdrola €1b PNC5.5 Green Hybrid 4.875% Coupon

Eurofins Scientific EU600m PNC5.5 Hybrid at 6.875%

I’m not too familiar with the issuers above, however the Eurofins deal seems to have been issued to refinance upcoming maturities.

→ Aroundtown’s Jan 2023 callable Hybrid saw its bond fix to a new coupon. It is now the ARNDTN 7.0438 Perp. Note that Aroundtown tendered €110.5m of its senior bonds which is about one third of what it had been looking for.

→ Enel announced results of its tender offer on its existing European Corporate Hybrids. It said that approx €699.97m of €750m of its 5.5 yr non call securities were valid tendered according to a filing. Following this, a “substantial repurchase event” is expected to occur and the company intends to exercise its option to redeem all of its outstanding EUR Hybrid. Secondly, Enel said the capped maximum amount for the tender offer in relation to the $1.25b 8.750% Capital Securities due 2073 is removed.

The huge take up for the old Enel EUR hybrid suggests that many market participants are fine with extending duration and clipping the higher yield. The new bonds have seen good follow through in the secondary market as they have rose as high as 103.

*EM*

BHP reckons China pro-growth policies will be supportive in H12023 in an otherwise difficult economic environment

“China’s pro-growth policies, including in the property sector, and an easing of Covid-19 restrictions are expected to support progressive improvement from the difficult economic conditions of the first half,” BHP Chief Executive Officer Mike Henry said in a statement Thursday. The nation was expected to produce more than 1 billion tons of steel for the fifth straight year, he said. SRC: BBG

Goldman Sachs Lifts China’s Economic Growth Forecast to 5.5% - BBG

The bank’s economists are now projecting the economy will expand 5.5% this year, up from 5.2% previously, they said in a note late Tuesday. Official data published earlier in the day showed the economy grew 2.9% in the fourth quarter from a year earlier, well above economists’ forecasts for 1.6% expansion. Monthly indicators for retail sales, industrial production and unemployment for December were also better than analysts had expected. Goldman’s economists said it was “very surprising” the official data for December were not worse, given surging Covid infections and broadly-based labor shortages in the month.

New EM issuance/ tenders this week

Bit of a quieter week but we saw more CEE issuance come to market in the form of Bulgaria € and Serbia $. Elsewhere, Woori Bank, First Abu Dhabi and Israel Discount Bank all issued. Ecopetrol announced a $1bn tender for its 5.875% notes due 2023.

Turkey's President Erdogan brings election forward to May - Tellimer

President Recep Tayyip Erdogan has said that Turkey’s general election will be held on 14 May, a month earlier than originally planned. In an address to lawmakers of his AKP party, Erdogan said parliamentary and presidential elections will take place on the same day. This is set to be his biggest electoral test after two decades in power. The Turkish investment landscape is still determined mainly by esoteric risks related to its unorthodox interest rate policy and Erdogan’s re-election bid.

Argentina Bonds Jump as Government Stuns Market With $1 Bn Buyback - BBG

Extract - Government looks to use funds from energy savings for plan Economy Minister Massa to focus on 2029, 2030 global bonds. Argentina’s international bonds leaped to their highest in more than a year after the government said it planned to repurchase about $1 billion of the debt, surprising investors in the cash-strapped country.

The South American nation’s $16.1 billion in overseas bonds due 2030 rose 2.5 cents to 35.5 cents on the dollar to the highest since October 2021, paring gains from earlier in the day. It is those bonds, plus ones maturing in 2029, that the government plans to buy back, Economy Minister Sergio Massa said Wednesday, without giving details. The central bank will lead the process.

Mexarrend Bonds Sink After Mexico Lender Says Will Miss Payments - BBG Law

Mexarrend following a similar trajectory to other troubled specialist lenders in Mexico, i.e Unifin and Credito Real:

Extract - Bonds of Mexican non-bank lender Mexarrend tumbled to an all-time low on Tuesday after the company said it will miss payments on local debt and dollar bonds after discovering errors in its accounting.

Sri Lanka - India and China highlight their own individual support for debt plans

China offers Sri Lanka support with 2 year moratorium on debts - SL Sunday Times

President gets Exim Bank’s letter supporting IMF’s loan programme. China yesterday responded to Sri Lanka’s long-standing request for a commitment on rescheduling its debts as a prelude to a bailout by the International Monetary Fund (IMF) with an offer for a two-year moratorium, the Sunday Times learns.

In a letter to President Ranil Wickremesinghe in his capacity as Finance Minister, the Exim Bank of China responsible for much of the loans given to Sri Lanka said the two-year moratorium would be a short-term suspension of the debts owed to China while asking all parties, i.e. Sri Lanka’s creditors to get together to work out medium-term and long-term commitments

[Reuters] - India has told the International Monetary Fund that it strongly supports Sri Lanka's debt restructuring plan as the island nation seeks a $2.9 billion loan from the global lender, according to a letter seen by Reuters. "We hereby confirm our strong support for Sri Lanka's prospective (loan) program and commit to supporting Sri Lanka with financing/debt relief consistent with restoring Sri Lanka's public debt sustainability," Indian finance ministry official Rajat Kumar Mishra told the IMF chief in a letter dated Jan. 16. Sri Lanka requires the backing of China and India - its biggest bilateral lenders - to reach a final agreement with the IMF on the $2.9 billion loan that is essential to help the country emerge from its worst financial crisis in seven decades. "The financing/debt relief provided by Export-Import Bank of India will be consistent with restoring debt sustainability under the IMF-supported program," the official said.

Vedanta to sell Zinc International assets to Hindustan Zinc for $2,98bn

Extract - The assets held THLZV through THL Zinc Ltd (Mauritius) comprising shares held in Black Mountain Mining Pty Ltd, South Africa (69.6 per cent) and THL Zinc Namibia Holdings (Pty) Ltd (100 per cent), Namibia, will be sold to the proposed wholly-owned subsidiary (SPV) of Hindustan Zinc Ltd (HZL) for a cash consideration not exceeding USD 2,981 million.

*RATINGS*

Coinbase Downgraded to B2 by Moody's, Outlook Stable

Fitch Takes Various Rating Actions on American Airlines' EETCs

Moody's upgrades Uzbekistan's rating to Ba3, outlook stable

*TRADING*

GS reports strong FICC division revenues

GS FICC sales & trading revenue came in at $2.69 billion, +44% y/y, estimate $2.37 billion according to BBG.

Extracts from GS presentation:

FICC net revenues were $2.7 billion in the quarter, up 44% year-on-year. In intermediation, we saw strength and rates and commodities amid elevated levels of client engagement, catalyzed by increased Central Bank activity and rate volatility and improve market-making conditions. In FICC financing, we saw increases in secured lending driven by higher balances. Full-year FICC revenues of $14.7 billion rose 38%

4Q22 FICC net revenues were significantly higher YoY — FICC intermediation net revenues reflected significantly higher net revenues in interest rate products and commodities and higher net revenues in credit products, partially offset by significantly lower net revenues in currencies and mortgages — FICC financing net revenues primarily reflected significantly higher net revenues from secured lending.

2022 FICC net revenues were significantly higher YoY — FICC intermediation net revenues reflected significantly higher net revenues in interest rate products, currencies and commodities, partially offset by significantly lower net revenues in mortgages and lower net revenues in credit products — FICC financing net revenues primarily reflected significantly higher net revenues from secured lending.

…Last year given what happened with rate normalization and energy markets around the world where particular tailwind to the interest rate products business, the commodities business. Meanwhile, we had softer performance in credit, mortgages and some of the equity intermediation activities.

So we continue to focus on market share, market share data lags but through the third quarter of last year, it shows that we continued to grow market share in our those businesses sales and trading

Certainly, if the new issue debt underwriting markets come back online as early indications on the investment grade side of things suggest and if the equity underwriting activities are to open up, there's a lot of activity that takes place with investors as they position in advance of an after new offerings that we should be able to capture given the investment that we've made in the client franchise.

We also ranked second in high-yield debt underwriting up from number three last year.

The year-over-year decline in intermediation revenues was driven by lower levels of client activity, particularly in derivatives, after strong engagement levels throughout the year. Financing revenues of $964 million were relatively resilient despite a decline in prime balances as clients took risks off throughout the quarter. Across FICC and equities, financing revenues were up 20% in 2022 consistent with our strategic priority to grow client financing activities.

Morgan Stanley Fixed Income net revenues +15% from a year ago

Extracts - 4Q: Fixed Income net revenues increased from a year ago reflecting stronger results in macro and credit products on higher client engagement, partially offset by significantly lower results in commodities.

In the full year comment, MS commented also that it had made “gains on inventory held for client facilitation in macro products driven by volatility in the markets.”

“Fixed income revenues of $9 billion for the full year were the highest in over a decade. The divergence between the Fed's guidance on financial tightening and conditions and the market expectations engaged clients and drove revenues in macro, while volatile energy markets benefited commodities.”

“…our share of fixed income is 10%;”

Debt volumes contracted following the first quarter. And while the market was receptive to higher quality issuance, activity was limited to constructive market periods.

James Gorman, CEO: The growth of our business is reflected in our higher average daily revenue, something I've been tracking for well over a decade. 2022, every trading day, saw revenues in excess of $80 million, and over one-third of those exceeded $100 million a day. Contrast that with only three years ago, when 95% of trading revenues were each below $80 million, and none exceeded $100 million.

*LINKS / CHARTS*

Howard Marks’ latest interview

Good quote in this video: “Prior to 1978, a bond rated below investment grade could not be issued. Moody's defined a B rated bond as follows: “Fails to possess the characteristics of a desired investment.”

Private debt funds ration withdrawals for individual investors - LPC

Pimco to return to issuing CLOs in Europe again | BBG

Oil services cos share prices have been ripping in the last 6 months

All eyes on earnings