17 March 2023 Global Credit Wrap

CS, all USTs below 4.0%, credit spread widening led by fins, lev loan defaults rising, illiquid markets causing pain.

*SUMMARY*

A hugely crucial weekend and week ahead for markets as it awaits the outcome of the Credit Suisse situation which will dictate short term moves in not only Bank Capital and Credit Markets, but the wider UK/European Markets which have a greater exposure to Financials. This is reflected at the equity indices whereby the tech-heavy NASDAQ posted its best week since November (on lower UST yields) but the FTSE 100 became technically oversold.

Besides CS, there are some other potentially major market moving events this week with the Fed FOMC, UK CPI and SNB policy decision.

*WEEKLY SHOUTOUT*

This week I would like to shout out to “Heard on the Trading Floor” who writes on Equity and Credit in a succint, and straight to the point manner with a keen emphasis on how to make P&L and learning from prior trading experiences. Besides their Substack, I am a big fan of the daily “What did I miss” tweets which they send out from the account @HeardFloor on Twitter which recaps the major moves large sector ETFs.

*TLDR*

MOVES

Govvies:

All major UST benchmarks now trade below 4% after huge rally

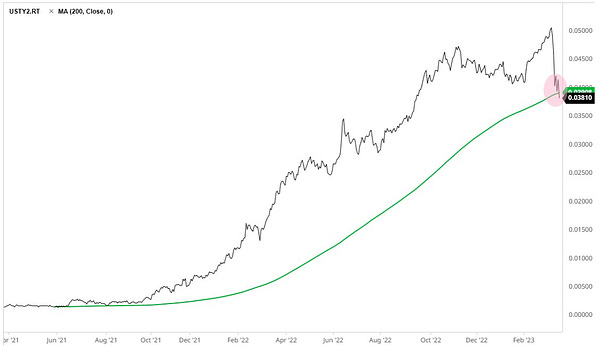

2yr UST has rallied nearly 100bps mtd and fell below 200DMA for 1st time since 2021

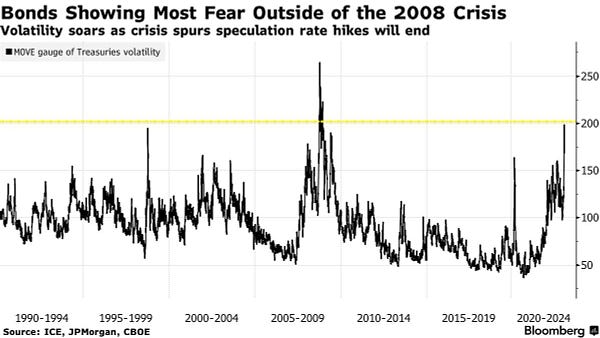

Treasury volatility is huge and market is experiencing patches of illiquidity

Credit spreads

Greatest widening seen in Sub Financials driven by US Regional Banks/CS

Itrx Main through 100bps

Xover widened but closed below 500bps, but CDX NA HY above 500bps

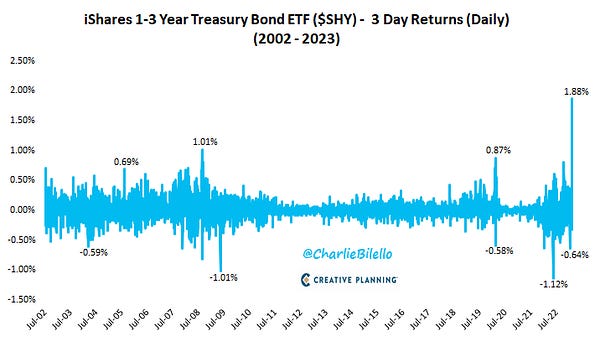

Bond ETFs - Weakening led by Bank CoCo ETFs. Treasury 1-3yr bond ETF experienced a 12-sigma event move! Rate sensitive bond sector ETFs rallied, e.g. long duration Treasuries/IG Corp/MBS

Equities - Nadsaq 100 +5.8% for week, biggest weekly gain since Nov,

KBW Bank Index closes 5.3% lower, capping two week loss of 28%. FTSE 100 in oversold territory.

MACRO

Money Market Funds Get Biggest Cash Inflow Since Early 2020

US Mortgage Rates decline for 1st time in 5 weeks, Homebuilder sentiment higher

Financial conditions are tightening - BBG Chart

Pimco’s Ivascyn Says Fed Will Take Notice, May Pause Rate Hikes

NZ Q4 GDP fell a more-than-expected, heightening recession risk

UK Labor Market Shows Signs of Easing With Weaker Pay Growth

UK Gilts - Some interesting snippets from DMO this week

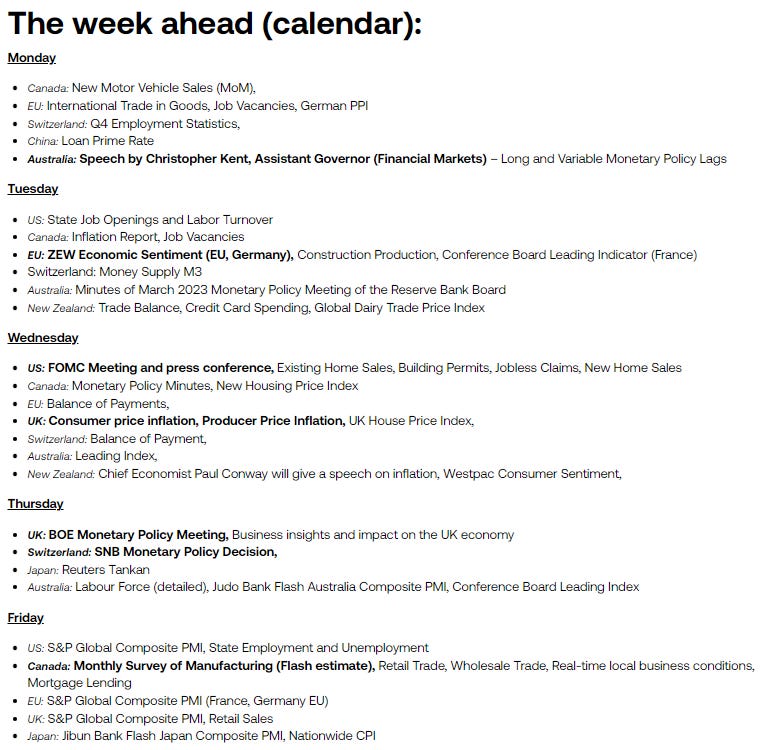

Week-ahead highlights are the FOMC (Wednesday), UK CPI(Wed), BoE and SNB Monpol decisions (Thur)

INFLATION

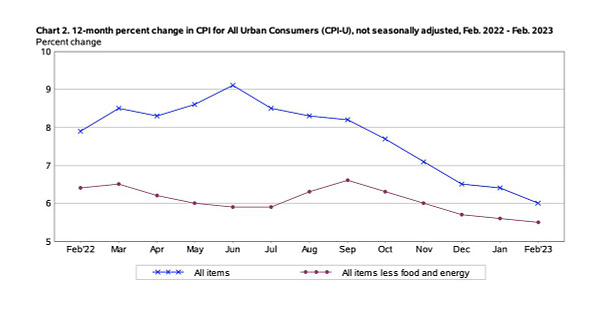

Nice chart showing downtrend in CPI over past year - H/T The Transcript

US Inflation Expectations Drop Sharply, NY Fed Survey Finds

US PPI unexpectedly fell in February to 4.4% (est. 5.2%, prev. 5.4%).

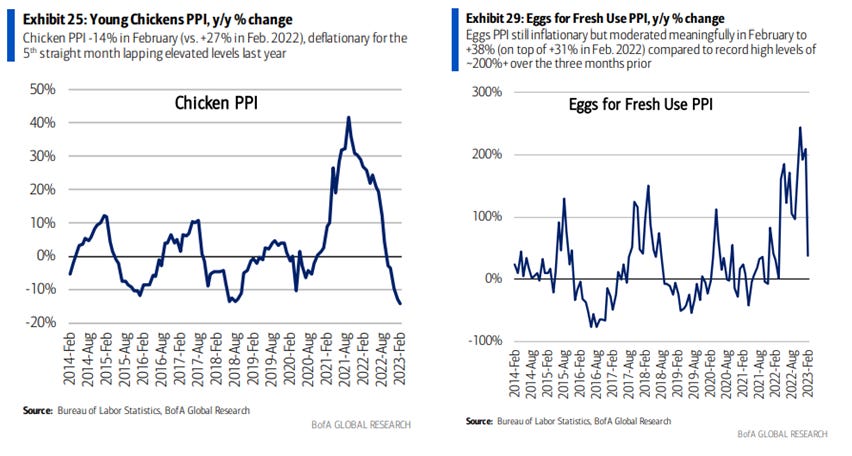

Chicken and Egg PPI coming down fast - BofA via Mike Z

BMW pausing increases on price of luxury cars

Sweden’s Feb-23 inflation numbers came in higher than expected

Argentina hikes interest rate 300 bp after inflation breaks 100% barrier

COMMODITIES

UK Chancellor Considered A Windfall Tax "Price Floor" For Oil And Gas Companies

FINS

Credit Suisse news and bond recap

AT1 Recap / Interesting moves besides CS

ECB Central Bankers came out in support of European Bank strength

Scope Research and M&G opine on European Banks

Speculators had built $16 bn bearish bet on Europe's banks - RTRS

Too-Big-to-Fail Lenders Rake In Deposits After Three Banks Fail

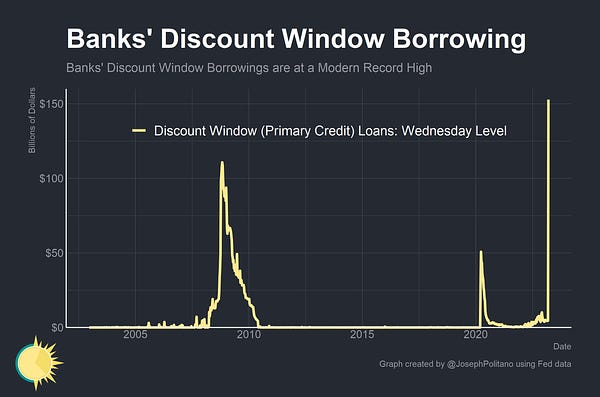

Banks borrowed nearly $153bn from the Fed’s discount window, more than in ‘08

SVB says Goldman Sachs was buyer of portfolio it booked losses on

A number of new bond issues were postponed during the week

UK listed Bank Earnings updates during the week - Investec/OneSavingsBank

IG

The US IG Credit market saw zero issuance for the first time since June 2022.

US Federal Home Loan Bank system sold $88.75bn of bonds on Monday

US approves $31B merger of two big railroads

HY

Average yields in the US HY sector rose above 9% (4 month high)

DISTRESSED

SVB creditors form group ahead of possible bankruptcy

SVB perps double in price from the lows, Tepper said to be involved (FT)

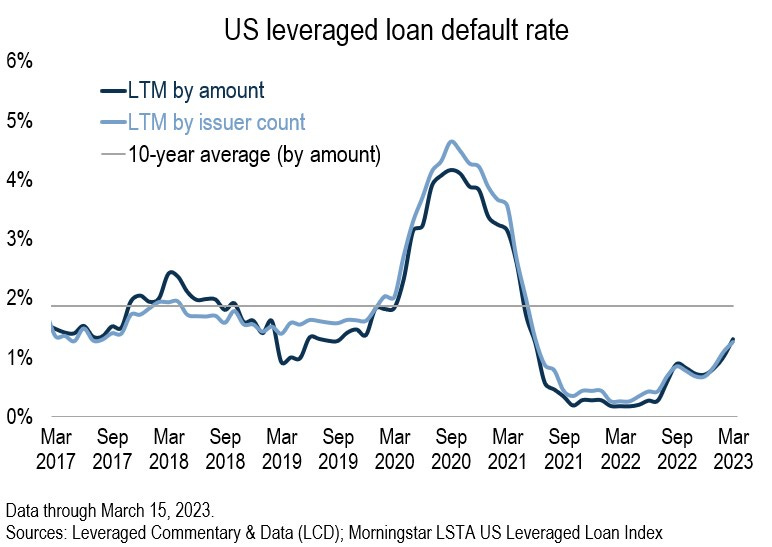

Diamond Sports Group bankruptcy prompts jump in leveraged loan default rate

Blackstone’s $325M Loan on Vegas Office Campus Hits Special Servicing

WeWork reaches deals to cut debt, extend maturities

A number of REIT and Real Estate related stocks hit new 52w lows

EM

China Home Prices Rise First Time in 18 Months

China’s Sinopec group to build oil refinery in Sri Lanka

Pakistan - KSA extends $1.2b deferred oil payment facility till Feb 2024

RATINGS

S&PGR Upgrades Saudi Arabia To 'A/A-1'; Outlook Stable

Expedia Upgraded to BBB by S&P

Moody's revised its outlook on the U.S. banking system to "negative" from "stable"

Moody's Places 6 US Banks Under Review For Downgrade

Moody's downgrades Ardagh Metal Packaging S.A.'s CFR to B2 from B1; stable outlook

Pemex Affirmed at BB- by Fitch

Argentina Upgraded to CCC- by S&P

Bolivia Downgraded to B- by Fitch, Outlook Negative

BUYSIDE / PRIVATE CREDIT

Ares Setting Up Business to Buy Secondhand Private Credit Funds |

TRADING

Goldman’s Rubner ‘Shocked’ by Big Market Moves, Blames Liquidity

Certain market participants are said to hit limits on huge market moves

*MOVES*

Govt bonds

UST - Massive rally here has seen all major benchmarks trade below 4.0%. The tightening has been led by the front end, e.g. the 2 year has narrowed nearly 100bps month to date!

Closing levels on major US benchmarks:

2y -3.83%

5y -3.50%

10y -3.43%

30y -3.62%

As an important aside, Treasury volatility is highly elevated right now, which is one of the reasons behind some macro funds getting stopped out recently, this is discussed in the trading section at the end.

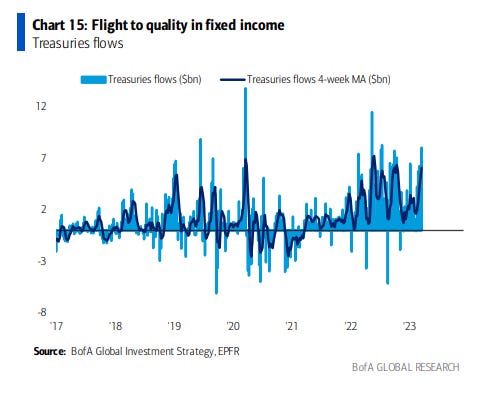

Massive inflows into UST are also putting significant downward pressure on yields:

Credit spreads

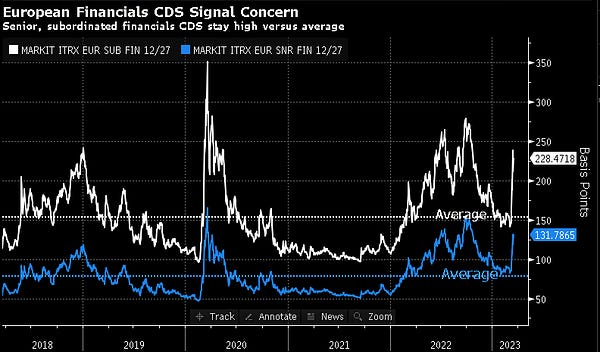

CDS - All major CDS benchmarks widened led by Xover and Sub Fins. Xover went through 500 during the week but closed the week at 493 (+67bps wider). SubFins CDS experienced 65bps widening to 229bps and Senior Fin CDS widened out 35bps to 129. The IG focused ITRX Main went through a 100 and closed at 101. CDX NA HY is trading at 530bps after widening 32bps.

Looking at where levels are vs recent history, SubFin CDS at 229bps is trading the nearest (out of the major benchmark indices) to the highs seen in 2022 of 280bps. Meanwhile going back further in history, SubFin CDS hit 531bps in November 2011 during the European Banks crisis.

ITRX Main has widened beyond the spike seen in December 2022 (+98bps) but are still off the huge wides noted in September 2022 of nearly 140bps. Similar trend in Xover and absolute level of 493bps is still well away from the wides of 670bps seen in September 2022.

Cash Credit - Again a widening bias seen here led by the Global CoCo Banking OAS which widened out a whopping 130bps driven by Credit Suisse’s AT1s (which more than halved in price) and the resultant impact on sentiment on the wider AT1 sector. Pan European HY was 84bps wider to 535, EM HY was 64bps wider to 769 and US HY widened 59bps to 509. US IG seemed to be the most contained with only a 22bps widening whereas EUR IG widened 37bps to 189.

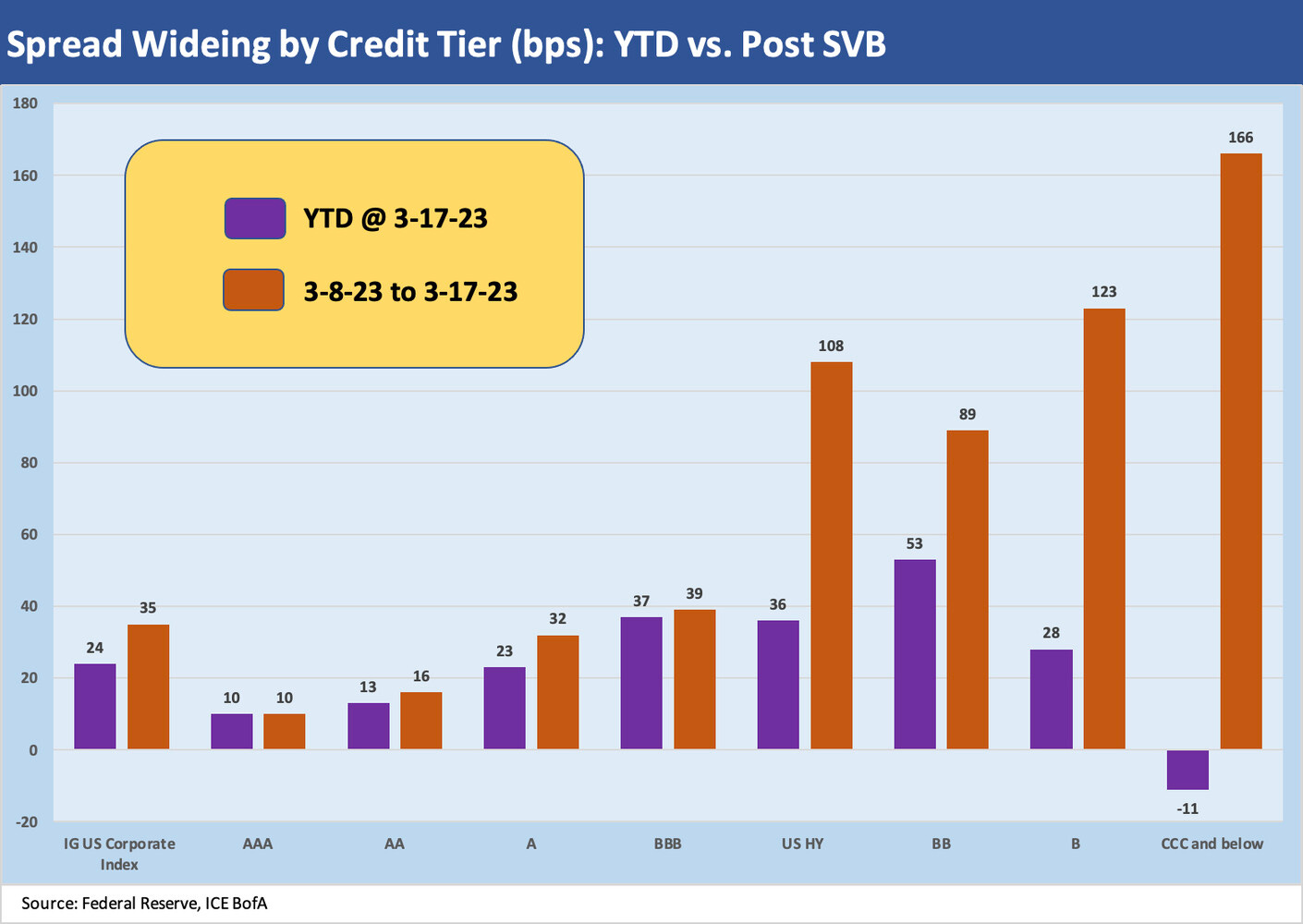

The chart below from Glenn Reynolds’ post on Credit spreads highlights how quick spreads have moved out since 8th March vs the YTD move:

Bond ETFs

Some really interesting moves this week. I can’t trust my feeds this week so moves set out below are only price moves and non total returns. The huge move in rates helped some rate sensitive sectors like mortgage backed, CMBS and to a lesser extent IG corporate credit. Bank CoCos suffered heavily due to the problems at CS and concerns about sentiment impact on the rest of the sector.

Outperformers - Interest rate vol (IVOL+8.6%), JGBs (XJSE+4.4%), Global Bond (DBZB+3.2%), UK Gilts (IGLT+2.8%), European Govvies (MTX+2.7%), MBS (VMBS+2.1%, MBB+2.0%), Intermediate bonds (VGIT+2.0%), Italian bonds (IS0M+1.9%), CMBS (CMBS+1.4%)

Underperformers -Bank CoCos (CCBO -9.1%, AT1 -8.6%), Preference shares (FPE-5.4%, FPEI-4.7%), European HY (IHYG - 3.9%), Global HY (HYLD-3.6%, Floating Rate (FLOT-1.6%), Inverse Treasury bonds (TMV-4.4%), Senior Loans (BKLN-1.9%, GBP Corporate 0-5 year (IS15 -1.8%).

Source: BBG

Significant Bond ETF move in 1-3 Year UST:

Equities

Nadsaq 100 ends up 5.8% for biggest weekly gain since Nov - BBG

KBW Bank Index closes 5.3% lower, capping two week loss of 28% - BBG

FTSE 100 RSI at 27.0 (technically oversold)

*MACRO*

Make sure to check out FXMacro’s weekly outlook for a comprehensive round up and look forward of Macro events this week.

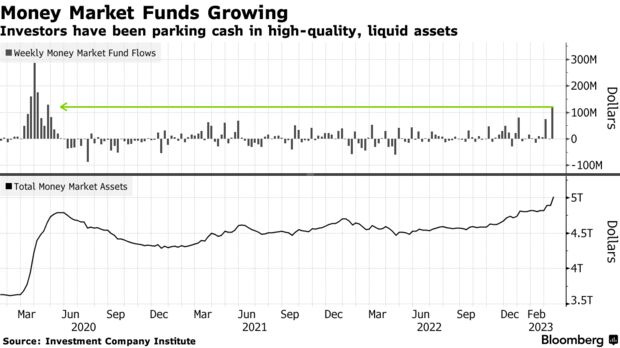

Money Market Funds Get Biggest Cash Inflow Since Early 2020 -BBG

Extract -About $120.93bn poured into US money-market funds in the week to March 15, the largest inflow since April 2020 based on data from the Investment Company Institute. Retail money accounted for $20.15bn of the total increase, while institutional cash climbed by $100.78bn.

US Homebuilder/Mortgages - Rates decline for 1st time in 5 weeks, Homebuilder sentiment higher

US mortgage rates declined for the first time in five weeks, helping propel a measure of home-purchase applications to the highest in a month - BBG

US homebuilder sentiment unexpectedly rose for the third consecutive month in March - Marketwatch

Financial conditions are tightening - BBG

Pimco’s Ivascyn Says Fed Will Take Notice, May Pause Rate Hikes - BBG

Extract - Financial stress among smaller US banks could prompt the Federal Reserve to pause its hiking cycle as soon as this month, according to Daniel Ivascyn, chief investment officer at Pacific Investment Management Co. “A lot has changed over the weekend,” said Ivascyn, the manager of the $116 billion Pimco Income Fund, the world’s largest actively managed bond fund. “There has been a meaningful tightening of financial conditions and significant risk aversion that we don’t think is over. This is likely a multi-month adjustment process” for the financial system.

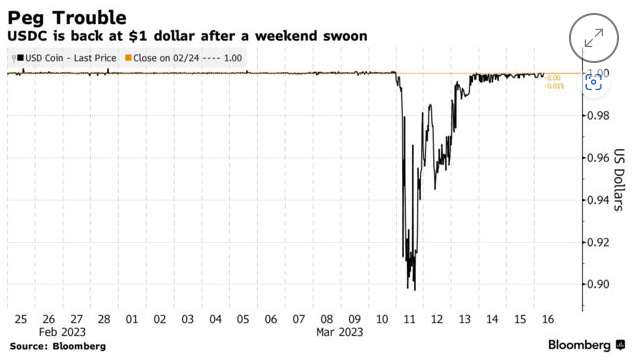

USDC is back at $1 dollar after SIVB issues | BBG

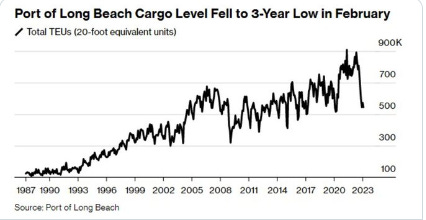

US Imports continue to decline from pandemic-era highs - BBG

NZ Q4 GDP fell a more-than-expected, heightening recession risk | RTRS

New Zealand's economy missed forecasts for growth in the fourth quarter and instead shrank 0.6%, official data showed on Thursday, raising the chances of a recession and making further interest rate hikes less likely.

UK Labor Market Shows Signs of Easing With Weaker Pay Growth | BBG

The UK labor market showed some signs of cooling as wage growth slowed for the first time in more than a year. Average earnings growth excluding bonuses fell to 6.5% from a year earlier, the Office for National Statistics said Tuesday. That’s down from a record outside the pandemic of 6.7% in the previous three-month period. Job vacancies fell 51,000 in the quarter through February...The apparent loss of momentum may encourage speculation that official borrowing costs are close to peaking.

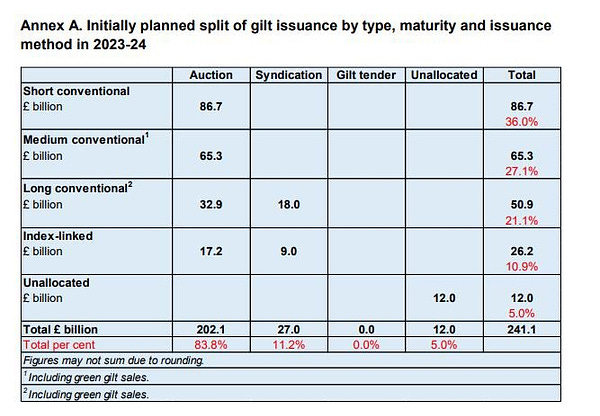

UK Gilts - Some interesting snippets from DMO this week:

DMO also seems less keen to issue Index Linked Gilts:

Week ahead by CityIndex

Highlights are the FOMC (Wednesday), UK CPI(Wed), BoE and SNB Monpol decisions (Thur)

*INFLATION*

Some long term perspective on US CPI via the Transcript

US Inflation Expectations Drop Sharply, NY Fed Survey Finds

Extract - The Federal Reserve Bank of New York’s Center for Microeconomic Data today released the February 2023 Survey of Consumer Expectations, which shows that inflation expectations decreased sharply at the short-term horizon, remained unchanged at the medium-term horizon, and slightly increased at the long-term horizon. Expectations about year-ahead price increases for gas, food, cost of rent, college education, and medical care all declined.

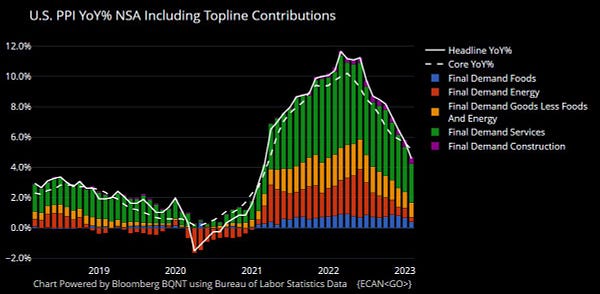

US producer prices (PPI) unexpectedly fell in February to 4.4% (est. 5.2%, prev. 5.4%).

Looks like a solidly declining trend in US PPI here.

Chicken and Egg PPI coming down fast - BofA via Mike Z

Extract - Chicken PPI -14% in February (vs. +27% in Feb. 2022), deflationary for the 5th straight month lapping elevated levels last year. Eggs PPI still inflationary but moderated meaningfully in February to +38% (on top of +31% in Feb. 2022) compared to record high levels of ~200%+ over the three months prior.

The issue seems to be that CPI food prices are still very high as highlighted by Glenn Reynolds (Co-Founder of Creditsights): CPI: Hungry for Inflation Outliers? | LinkedIn.

BMW pausing increases on price of luxury cars

Sweden’s Feb-23 inflation numbers came in higher than expected - SCB.SE

CPIF ex-energy reached a new high of 9.3% YoY, well above the Riksbank's forecast of 8.0%.

Argentina hikes interest rate 300 bp after inflation breaks 100% barrier - RTRS

*COMMODITIES*

Jeremy Hunt Considered A Windfall Tax "Price Floor" For Oil And Gas Companies - Politics Home

Extract - Changes to the Energy Profits Levy that would introduce a “price floor” for the windfall tax have been under consideration in the Treasury, following concerns investment in the North Sea is at risk, PoliticsHome understands.

The proposed mechanism for the EPL would aim to secure investment to bolster the UK’s domestic energy security following Vladimir Putin’s war in Ukraine.

A Whitehall source told PoliticsHome that plans were worked up ahead of the budget for a "price floor" that would mean the EPL would only kick in when the price of oil and gas reached a certain level. It is understood that the change will not be included in Wednesday's Budget, but has not been ruled out at a later date.

*FINS*

Credit Suisse recap

—Update at 10:25am London on 19th March:—

Based on press reports, talks are ongoing between the Swiss/US Financial Authorities, CS and UBS and other important stakeholders. At this present time, there is no public information about any other potential acquirors and it seems the “powers that be” want a deal to be struck before futures begin trading this evening. In the prior week, according to the FT sources, CS was seeing ~CHF 10bn of outflows a day and its senior (HoldCo) bonds are trading at large discounts to par, both which are not really sustainable for a GSIB Bank.

BBG’s article at 8am London time summarises the current situation well:

Talks to contain the crisis of confidence in Credit Suisse Group AG extended into Sunday, with Swiss officials and UBS Group AG racing to put together a deal to take over or break up the battered lender before markets open in Asia.

The parties are seeking to navigate thorny issues such as a government backstop and the fate of Credit Suisse’s investment bank, after UBS put aside its initial opposition to a deal with the smaller rival, people briefed on the discussions said. UBS is asking the Swiss government to take on certain legal costs and potential future losses in any takeover, said the people, with one report putting the figure at about $6 billion.

The complex discussions over what would be the first combination of two global systemically important banks since the financial crisis have seen Swiss and US authorities weigh in, some of the people said. Talks accelerated Saturday, with all sides pushing for a solution that can be executed quickly after a week that saw clients pull money and counterparties step back from some dealings with Credit Suisse. The goal is for an announcement by Sunday evening at the latest, the people said.

Another BBG reporter wrapped up the other weekend news on CS below in a thread which I’ve copied and pasted below in one digestible paragraph:

CS's investment banking and trading operations are a key sticking point in the government-brokered talks for rival UBS. UBS is worried about the balance sheet risk associated with the investment bank and businesses including leveraged finance.

UBS is asking the Swiss government for a backstop to cover future risks if it were to buy CS, looking at scenarios in which the government would take on certain legal costs and potential losses.

Deutsche Bank is monitoring the situation for a potential opening to acquire some businesses. Talks, which have touched on what parts of CS would be attractive and what valuation they’d put on them, are internal and no concrete proposals were made.

US authorities are working with their Swiss counterparts. A tie-up between the two banks would be of interest to Washington regulators because both lenders have operations in the US and are considered systemically important in Switzerland.

Who's sitting at the table? A politician, an economist, and a mathematician are among the select group of power players who will determine the future of what was once Switzerland’s pre-eminent financial institution.

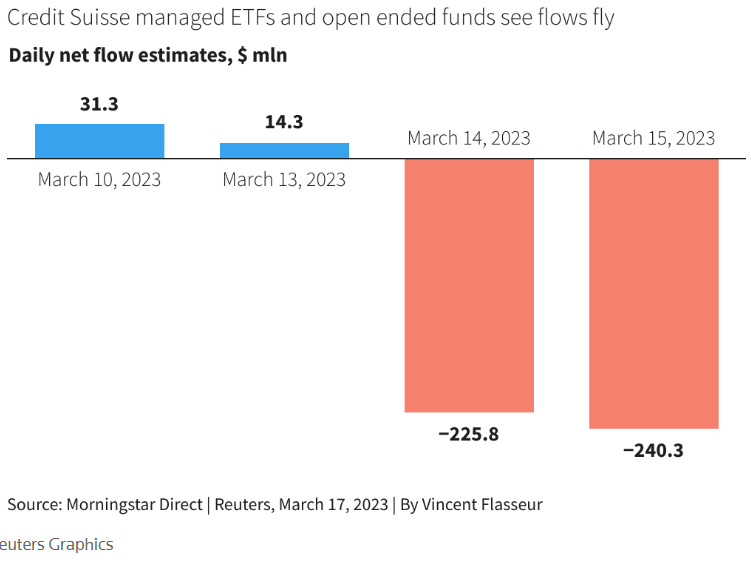

17 Mar | CS managed funds' net outflows top $450 mln -Morningstar | RTRS

17 March | CS to hold internal talks this weekend on scenarios for bank | RTRS

Credit Suisse AG will hold meetings over the weekend to assess scenarios for the bank as it struggles to regain the market's confidence, people with knowledge of the matter told Reuters on Friday. The meetings will involve teams reporting to Chief Financial Officer Dixit Joshi, the people said. Executives will run through the numbers and formulate scenarios that might reshape Credit Suisse's future, the sources added.

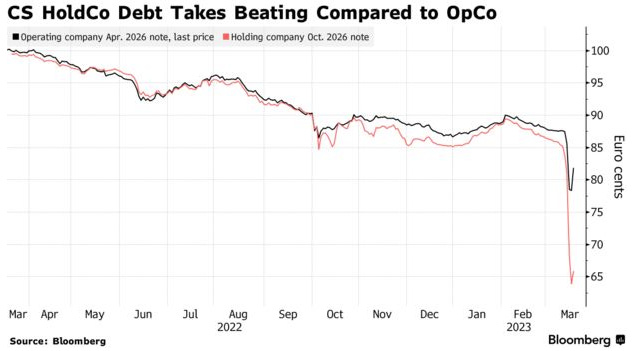

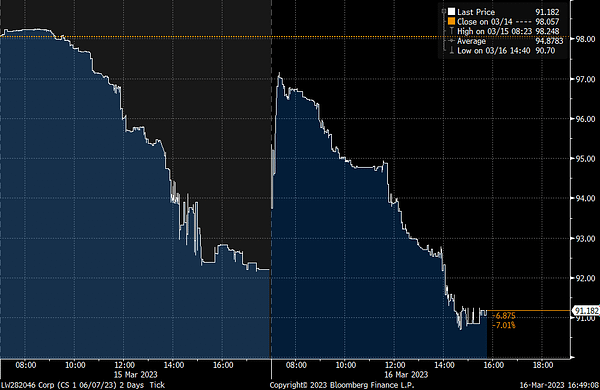

CS bonds Trading Recap

US FINRA TRACE system showed that ~8.75bn of CS paper traded across more than 20k trades during the week. This is not a complete list, but at least gives some idea of the volume traded in the USD denominated paper.

At the time of writing (10:02 am London Sunday 19th) the very rough indicated trading range of CS paper appear to be as follows:

CS Opco: - 90-100

CS Holdco: 70-88

AT1: Mostly concentrated around 25-33

Cross referencing TRACE’s data vs the weekend indications, it looks as if there has been a small bounce in AT1 paper but clearly the situation is very fluid and illiquid. The links below provide some further background on the goings on in CS bonds this week:

—Credit Suisse Bail-In Bonds in Distress - BBG—

—CS looking to tender for $2.5bn of bonds, bond prices not fully believing it—

“JohannesBorgen” the highly knowledgeable Bank capital FinTwit posted the Tweet below demonstrating how the market is skeptical of whether CS do actually tender for these bonds.

AT1 Recap / Interesting Moves besides CS

AT1 Invesco Bond ETF is down 8.6% this week, while Wisdomtree Coco Bond etf is down 10.3%. A lot of this is down to the exposure to CS AT1s which in many cases more than halved.

Certain Deutsche Bank AT1 have traded down 10pt in the week

Recent new issue Lloyds $ AT1 (Lloyds 8%) traded down 8.5pts in the week

Large well capitalised Nordic Banks (Nordea/SEB/Svenska) seem to be seeing the most buying cares so far in this sell off.

ECB Central Bankers came out in support of European Banks

Extracts of Reuters article:

"French and European banks are very solid" - Villeroy.

While the ECB had "the tools to ensure the liquidity of banks", Villeroy said it was unlikely it would have to use them as "European banks are not in the same situation as U.S. banks".

"I think we sent a signal of confidence that is strong and dual. It reflects both confidence in our anti-inflation strategy and confidence in the solidity of European and French banks," Villeroy said.

Extract from FXStreet:

European Central Bank (ECB) Governing Council member Madis Muller is making some comments on the global banking crisis, in his appearance on Friday.

Key quotes

“SVB created a backdrop of uncertainty.”

“Credit Suisse has had problems for years.”

“SNB’s intervention in Credit Suisse has made decision-making easier.”

“There are not many euro area banks that took risks like SVB did.”

“There is no sign yet of persistent inflation pressure easing.”

“Banking uncertainty complicates communication.”

“The latest inflation forecasts assume more rate hikes.”

M&G likes bank bonds ex CS paper | BBG

The debt of Europe’s national banking champions is an attractive play despite the financial sector turmoil of recent days, according to M&G Investments fixed income director Pierre Chartres. That’s because these large institutions are well capitalized, have a diversified deposit base and are subject to stringent regulation, Chartres said in an interview in Singapore. M&G oversees about $412 billion in assets. “This could be an opportunity to add some European banking risk,” he said. “We’re still relatively constructive on European banks” that are dominant in their jurisdiction, he said.

M&G did a more detailed post on its BondVigilantes blog re bank capital earlier in the week.

Scope Research opines that Europe’s large Banks are not in crisis | Scope

Extract - The Wide Angle – When a banking crisis is not a banking crisis

The market panic that took hold yesterday does not reflect reality. There is no rational basis to the view that Europe’s large banks are in crisis. The opposite is true.

You could be forgiven for ignoring this when professional prophets of doom and talking heads remote from the realities on the ground scream from the rooftops that European large banks are close to insolvency and riddled with liquidity problems (very much not the case), that they are poorly regulated (the opposite is true), or that Credit Suisse is “too big to fail but also too big to be saved” (catchy but nonsensical).

No serious banking expert knowledgeable about the European landscape is saying anything remotely like the system is in crisis. On balance the European banking sector is with few exceptions in its best shape in decades. Liquidity and funding stability remain reassuring, with LCR and NSFR ratios well above regulatory floors.

Credit Suisse has been an outlier in the European banking landscape for years now. After yesterday’s SNB and FINMA statements, Credit Suisse’s restructuring will be sped up and, if history is a good indicator, it is not far-fetched to assume that parts of the group could be merged into UBS. Fixed-income investors fear that the Credit Suisse restructuring could lead to regulators preventing the group from paying AT1 coupons. Doubtful this will be the case.

Speculators had built $16 bn bearish bet on Europe's banks - RTRS

March 15 (Reuters) - Short sellers had amassed bearish positions worth more than $15.7 billion against European banks by Tuesday, after the collapse of Silicon Valley Bank sparked contagion fears and sent shares plunging, according to S&P Global Market Intelligence.

The 113 lenders tracked by the researchers saw an average increase of 5% of shares out on loan between March 10 and 14.

The data did not cover the drop in Credit Suisse shares on Wednesday, which fell by as much as 30% at one point after its top shareholder said for regulatory reasons it could not inject more capital into the bank.

Traders with short positions on Credit Suisse could, according to market prices, potentially have made month-to-date profits of up to $238.6 million and year-to-date profits of up to $192.4 million, research from S3 Partners showed.

US Regional Bank Weekend Headlines:

US Regional Banks are not an area I follow as closely, but these were some of the more recent interesting headlines over the weekend

*FIRST CITIZENS SAID TO WEIGH TAKEOVER OF SILICON VALLEY BANK

*SENIOR BIDEN OFFICIALS IN TOUCH WITH BUFFETT ON BANKS

*MIDSIZE US BANKS ASK FDIC TO INSURE ALL DEPOSITS FOR 2 YEARS

Too-Big-to-Fail Lenders Rake In Deposits After Three Banks Fail | BBG

Extract from 14th March:

JPMorgan Chase & Co., the largest US bank, alone received billions of dollars in recent days, and Bank of America Corp., Citigroup Inc. and Wells Fargo & Co. are also seeing higher-than-usual volume. Citizens Financial Group Inc. announced Monday that it “has seen higher than normal interest from prospective new customers over the past few days,” and that it would temporarily extend branch hours to accommodate BofA was the only one to quantify the rough estimate of deposits received - BofA Gets More Than $15 Billion in Deposits After SVB Fails - BBG.

Banks borrowed nearly $153bn from the Fed’s discount window, more than in ‘08

SVB says Goldman Sachs was buyer of portfolio it booked losses on | RTRS

Extract - SVB Financial Group said on Tuesday that Goldman Sachs Group Inc (GS.N) was the acquirer of a bond portfolio on which it booked a $1.8 bn loss, a transaction that set in motion the failure of SVB.

The portfolio SVB sold to Goldman Sachs on March 8 consisted mostly of U.S. Treasuries and had a book value of $23.97bn, SVB said. The transaction was carried out "at negotiated prices" and netted the bank $21.45 bn in proceeds, SVB added.

Goldman Sachs' purchase of the bond portfolio was handled by a division that was separate from the unit that handled SVB's stock sale, according to a source familiar with the matter.

A number of new issues were postponed during the week | BBG

Santander Consumer USA on Wednesday delayed the sale of $942m of bonds backed by subprime auto loans

On Monday, car leasing firm Automotive Rentals Inc. paused an almost $900m auto lease ABS offering

Government-backed home loan company Fannie Mae halted a mortgage-linked bond

International Petroleum Corp decided not to proceed with its previously announced tap issue

All of this was of the back of volatility arising from the fallout of SVB, the other regional US Banks with problems and the problems at Credit Suisse. Postponement of new bond issues indicate higher financial stability risk and less than ideal borrowing conditions. Firms that had limited access to funding prior to this market-wide stress will have the most difficult time as a result, and we could see the default rate rise further (see the Distressed section later for charts on default stats).

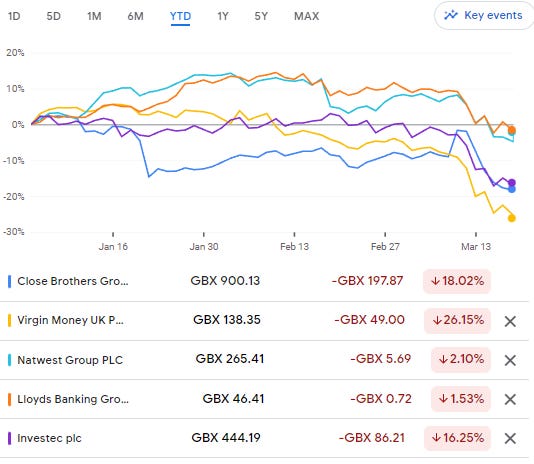

UK listed Bank Earnings updates during the week - Investec/OneSavingsBank

Investec and OneSavingsbank or “OSB” updated the market this week.

Investec’s numbers seemed to be largely neutral but OSB’s figures were received well with earnings ahead of expectations and the stock closing up 9.38% on Thursday.

Looking at UK Banks equity performance, on the whole, larger banks are outperforming their midsized peers YTD:

*IG*

US IG market recap

The US IG Credit market saw zero issuance for the first time since June 2022.

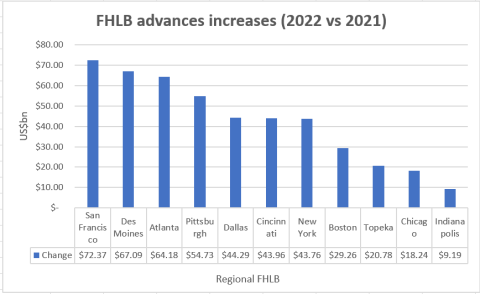

US Federal Home Loan Bank system sold $88.75bn of bonds on Monday - IFR

Extract - The US Federal Home Loan Bank system sold a US$88.75bn of bonds on Monday in a record day of issuance, amid worries that small regional lenders could be facing pressure from depositor outflows. A prolific issuer of debt, the FHLB serves as an important source of funding to regional banks. The system was originally designed to facilitate mortgage lending.

The liquidity move from the government-sponsored enterprise happened after the closure of three banks within the past week, which touched off concerns about the health of the US banking system. "We have continued to meet members’ heightened needs for liquidity, supported by a record day of debt issuance," Ryan Donovan, president and chief executive of the Council of Federal Home Loan Banks, said in a statement.

Also interesting to see which regions increased their borrowing in 2022:

h/t Richard Leong, Senior Reporter at IFR.

Couche-Tard to Acquire Europe Assets From TotalEnergies in EUR3.1 Bn Deal | RTRS

Canadian convenience-store operator Alimentation Couche-Tard Inc. agreed to buy almost 2,200 gasoline stations in Europe from TotalEnergies SE for €3.1 billion.

US approves $31B merger of two big railroads - AP

The first major railroad merger in more than two decades, one that would link the United States, Canada and Mexico, was approved by federal regulators Wednesday. Canadian Pacific’s $31 billion acquisition of Kansas City Southern will combine the two smallest of the nations seven major railroads after an arduous two-year review from the U.S. Surface Transportation Board.

*HY*

US HY Recap

BBG reported that average yields in the US HY sector rose above 9%, for the first time this year and also represented a 4 month high. Losses seemed to be driven by the lowest quality rungs of the HY market, i.e. CCCs and single Bs. New issuance was severely muted due to the high level of market volatility.

Trafigura Group Pte closes the refinancing and extension of its $5.4 bn European Syndicated RCF - Trafigura

*DISTRESSED*

SVB creditors form group ahead of possible bankruptcy - WSJ via RTRS

Extract - Creditors of Silicon Valley Bank's parent company have formed a group in anticipation of a potential bankruptcy filing, the Wall Street Journal reported on Tuesday, citing people familiar with the matter. Embattled lender SVB, which was shut down last week, on Monday said it was exploring strategic alternatives and had hired a restructuring veteran, but has not said it was planning to file for bankruptcy. The creditor group includes Centerbridge Partners, Davidson Kempner Capital Management and Pacific Investment Management Co, the report said, adding that they were being advised by PJT Partners Inc.

SIVB perp bonds have doubled in price vs the lows, Tepper said to be involved

Later in the week the news of David Tepper buying SIVB debt came out which could be one of the reason Silicon Valley Bank perps have doubled in value vs the lows to around 12 cents in the Dollar currently.

Diamond Sports Group bankruptcy prompts jump in leveraged loan default rate | Pitchbook

The RSA would eliminate “over $8 bn” of the company’s outstanding debt.

Real Estate Corner

--Blackstone’s $325M Loan on Vegas Office Campus Hits Special Servicing—

Extract from Commercial Observer:

The property’s equity value was written off three years ago as office headwinds intensified. The $325 m commercial mortgage-backed securities (CMBS) loan on Blackstone’s Hughes Center in Las Vegas has entered special servicing, Commercial Observer has learned. The nonrecourse loan is collateralized by the 1.5 m-square-foot campus, which comprises 10 office buildings and 110,000 square feet of retail across 68 acres. It was securitized in the COMM 2018-HCLV single-asset, single-borrower CMBS deal. Sources said the loan transferred — to special servicer KeyBank — after Blackstone provided a hardship letter stating its inability to fund future monthly payments.

“This 2013 investment was substantially written down beginning three years ago due to the headwinds facing U.S. traditional office,” a Blackstone spokesperson told CO. “Fortunately, U.S. traditional office represents only 2 percent of our global real estate portfolio today.”

—WeWork reaches deals to cut debt, extend maturities | RTRS —

WeWork Inc said on Friday it had struck deals to cut debt by about $1.5 bn and extend the date of some maturities, in a bid to preserve cash as the flexible-workspace provider feels the heat of mass layoffs on its business.

Last month, the company forecast weak current-quarter revenue, after having announced moves to cut 300 jobs and exit 40 underperforming U.S. locations in a move aimed at curbing its real-estate footprint.

Under the deals announced Friday, key investor SoftBank Group Corp’s $1.0bn unsecured notes would be converted to equity. The Japanese company held a stake of about 46% in WeWork before the restructuring was announced, as per Refinitiv data.

About $1.9bn of pro-forma debt will now mature in 2027, WeWork said, adding that it would have less than $2.0bn in net debt once the deal closes.

The agreements also cover an ad-hoc group which represent over 60% of the company's public bonds and a third-party investor, WeWork said. The group includes King Street Capital Management L.P. and BlackRock Inc.

-A number of REIT and Real Estate related stocks hit new 52w lows:-

This is not a complete list, but names that flashed up on my monitors this week:

Blackstone Mortgage Hits 52-Week Low at $17.28

Empire State Realty Hits 52-Week Low at $6.23

Vonovia Hits 52-Week Low at 18.58 Euros

Boston Properties Hits 52-Week Low at $51.53

*EM*

China Home Prices Rise First Time in 18 Months After Stimulus: Yahoo Finance

New home prices in 70 cities, excluding state-subsidized housing, gained 0.3% after being unchanged in January, the National Bureau of Statistics reported Thursday. Prices snapped an 18-month decline in the secondary market, rising 0.12%.

China’s Sinopec group to build oil refinery in Hambantota, Sri Lanka | LankanewsWeb

Extract - China’s Sinopec has offered to fully finance the construction of a refinery in Hambantota, the President’s Media Division said.

During a discussion with representatives of the Sinopec Group held at the Presidential Secretariat recently President Ranil Wickremesinghe said that the Government has taken a principled decision to expand the distribution of fuel which is expected to commence shortly.

The representatives from the Sinopec Group confirmed their readiness to invest in the import, storage, distribution, and marketing of fuel to cater to Sri Lanka’s energy requirements.

Pakistan - KSA extends $1.2b deferred oil payment facility till Feb 2024 | Pakistan Today

Saudi King Salman has approved the extension of a deferred oil payment facility worth $1.2 billion to Pakistan till February 2024. According to sources, the Saudi government has extended the facility through the Saudi Fund for Development (SFD).

*RATINGS*

-SOV-

United States Affirmed at AA+ by S&P

S&PGR Upgrades Saudi Arabia To 'A/A-1'; Outlook Stable

-IG-

Fitch Revises Pfizer's Outlook to Stable; Affirms IDR at 'A'

BHP Affirmed at A by Fitch

Expedia Upgraded to BBB by S&P

X-S&PGR Places Kansas City Ratings On CreditWatch Positive

S&P Cuts Eli Lilly & Co. Rtg To A-1 From A-1+; Outlk Stable

S&PGR Upgrades Invitation Homes To 'BBB'; Outlook Stable

Fitch Downgrades Philips to 'BBB+'; Outlook Stable

Fitch Ratings Cuts U.S. Housing Sector Forecasts on Higher Rates; Lower Confidence

-FINS-

DBRS Morningstar cuts Credit Suisse credit rating to ‘BBB’

S&PGR Upgrades Camelot UK Holdco To 'B+'; Outlook Positive

BCP Upgraded to BB+ by Fitch

Moody's revised its outlook on the U.S. banking system to "negative" from "stable" | RTRS

Moody's Places 6 US Banks Under Review For Downgrade:

First Republic Bank, Zions , Western Alliance, Comerica, UMB Financial and Intrust Financial

Aviva Affirmed at A+ by Fitch

Axa Affirmed at A+ by Fitch

NN Upgraded to A3 by Moody's, Outlook Stable

Fitch Rates Permanent TSB Group 'BB+'; Outlook Positive

Mediobanca Affirmed at BBB by Fitch

-HY-

Fitch Upgrades Banijay to 'B+'; Outlook Stable

Grifols Downgraded to B2 by Moody's

S&P Cuts National CineMedia Inc. Rtg To D From CCC-

X-S&PGR Downgrades Kleopatra Holdings 2 To 'B-'; Outlook Stable

Moody's downgrades Ardagh Metal Packaging S.A.'s CFR to B2 from B1; stable outlook

Fitch Revises Alaska Air's Outlook to Positive; Affirms IDR at 'BB+'

S&P UPGRADES CLEVELAND-CLIFF TO 'BB-' FROM 'B+'; OTLK STABLE

S&P UPGRADES NAVIOS MARITIME PARTNERS TO 'BB'; OUTLOOK STABLE

S&PGR Upgrades Vantage Drilling Int'l To 'CCC+'; Outlk Stable

Fitch Upgrades Eldorado's Ratings to 'BB'; Outlook Stable

Mallinckrodt PLC Downgraded to SD by S&P

-EM-

Argentina Upgraded to CCC- by S&P

Bolivia Downgraded to B- by Fitch, Outlook Negative

X-S&PGR Places Bolivia Long-Term Ratings On CreditWatch Negative

Aruba Upgraded to BB+ by Fitch

Turkey Affirmed at B by Fitch

Pemex Affirmed at BB- by Fitch

S&PGR Puts ESKOM 'CCC+' Rating On CreditWatch Positive

Vedanta: Downgraded 1 Notch to Caa2 by Moody’s

Moody's downgrades BRF S.A. ratings to Ba3; outlook is stable

X-S&PGR Upgrades Gol Linhas Aereas Intelig. To 'CCC+' From 'SD'

Fitch Revises TransJamaican Highway's Outlook to Positive; Affirms at 'BB-'

*PRIVATE CREDIT/BUYSIDE*

Ares Setting Up Business to Buy Secondhand Private Credit Funds | BBG

Extract -

Credit-secondaries market is booming as LPs look to rebalance

Ares follows similar moves from Apollo and JPMorgan Chase

Ares Management Corp.is setting up a business to snatch up stakes in private credit funds from other investors needing to cash out fast, according to people with knowledge of the matter. The $352 bn investment firm is finalizing plans for a credit secondaries strategy that will buy stakes from both limited partners and the fund managers themselves, said the people…

*TRADING*

Goldman’s Rubner ‘Shocked’ by Big Market Moves, Blames Liquidity | BBG

Interesting article which just talks about more liquid asset classes like Treasuries and stocks, although it does not touch on Credit which is a lot less liquid, especially in market conditions like these.

Scott Rubner sees big decline in ease of trading stocks, bonds

Goldman Sachs Group Inc.’s Scott Rubner, who has studied flow of funds for two decades, calculates the ease of trading S&P 500 futures has plunged 88% over the past two weeks. A similar gauge shows liquidity in Treasury futures dropped 83%. Both measures have reached the lowest since the March 2020 pandemic crisis, according to Rubner’s analysis.

Based on the current wide spread between bid and ask prices, it takes more than $2 million of buying or selling in US stock futures before a trader risks moving the market, compared to a $17 million order book at least around the start of March.

Trading is hard…certain market participants are said to hit limits on huge market moves

Brevan Howard has grounded some of its traders to stem losses - curtailed the betting of at least three money managers after they hit maximum loss levels….The traders all specialized in rates trading. Yahoo Finance

Rokos, which manages around $15.5bn, is down around 12.5 per cent this month - FT

At Goldman, a trading desk that handles interest-rate products lost around $200mn, according to people familiar with the matter. - FT

Graticule Macro Hedge Fund to Shutter After Losses…bets tied to front-end rates imploded and erased years of gains, the people said asking not to be identified because the details are private. As of last year, the firm managed about $3 billion. (BBG)

Macro hedge funds lost 2.15% on average on Monday alone, according to data group HFR, the biggest daily loss since the market turbulence of late 2018 - FT

Energy hedge fund Westbeck Capital Management has also cut the amount of risk it is taking after hitting the strategy’s maximum loss limit on Wednesday. according to an investor document seen by Bloomberg. The hedge fund has lost 8.9% this month and is down 9.9% this year, according to the letter. “The extraordinary volatility in the fixed income markets has triggered a severe oil market correction,” Westbeck told clients in the letter. “We understand the collapse in treasury yields over the recent days has translated into large losses for a number of macro players, creating a VAR shock, forcing widespread risk liquidation including large oil positions.”

Quant funds are down on average by around 6 per cent this month, according to a Société Générale index of these portfolios - FT

It’s not all bad since HF Argonaut Capital, profited by shorting SVB and has also been betting against Credit Suisse for several weeks, helping his fund to gain 4.5 per cent this month.