14 April 2023 Global Credit Wrap

Better risk tone despite narratives/positioning. Sub Fins deals coming back, RE Credit seeing bit more two way, big Financials knock it out of the park (JPM/C/BLK)

*SUPER SKINNY SUMMARY*

Risk tone better despite positioning by investors (high cash levels, low yields on ultra short dated T-Bills) and rolling recessionary calls…:

USD Index DXY hit 12m low

US HY Spreads @ 5 week low

Two bank sub-debt deals priced, showing improved risk appetite post CS

$1bn lev loan for Qualtrics priced

MSCI Inc.’s World Equity Index hit 10 week high

Speculative assets Ether and BTC hit 52w highs

M&A activity in Commodity space suggests corporate confidence

Large Fund raises by Blackstone and HPS in Real Estate & Credit strategies respectively.

Cautiously optimistic data released:

US and China inflation gauges came in lower than expected

China exports rose for 1st time in 6 months

However there is still plenty of hawkish data which kept short end yields firm:

Higher U-MIch inflation expectations and better than expected US Retail Sales Control Group data

Better than expected jobs data in Australia

Mixed inflation data in Europe and EM

Next week should see more market participants return from Easter and Ramadan (but note Eid at the end of this upcoming week). Busy reporting calendar for earnings which should reveal more about US Regional Bank health and Corporates generally.

*TLDR*

MOVES

$ Index DXY fell to 12m low in the week before strengthening to close the week

Credit: All major 5 year CDS indices trading tighter led by Xover. Senior Fins CDS back at early March levels (pre-CS event)

MSCI Inc.’s World Equity Index hit 10 week high

Crypto flying - BTC & Ether hit 52w highs

MACRO

US Treasury yields ended the week firmer after US Retail Sales & U-Mich data

Positioning suggests risk aversion still high:

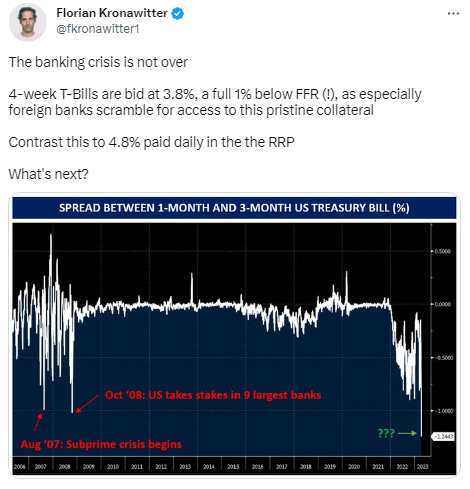

There is a 100bps spread between 4 week T Bills & FFR

BofA Clients’ proportion in cash & cash equivalents remain high vs LT avg.

5% FDIC-Insured savings account is back for 1st time since 2007

Australian jobs data was better than expected

More countries holding key rate with Singapore MAS surprising with a hold

The Telegraph said R. Sunak plans to hold a general election in autumn 2024

Busy corporate earnings calendar coming up next week

Avg. interest rate on 48-month US Auto loans hits highest since 2007…

UK mortgages - 56k 2yr fixed deals to be refinanced in Sep-23 at higher rates

INFLATION

US - March CPI, and PPI indicators came in lower than expected

US CPI has moved down from a peak of 9.1% in June to 5.0% in March

Supercore CPI also slowing but less so that headline

However, U-Mich inflation expectations remained high

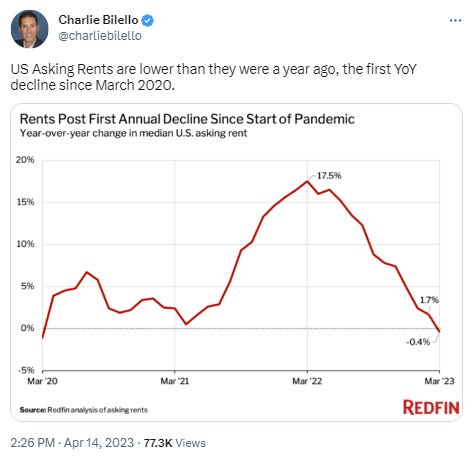

US Asking rents are lower than a yr ago, first time YoY decline since Mar-2020

Sovereigns ex US:

China continues to see slowing inflation in March

But inflation still surprising to upside in countries like Norway and Romania.

Small reprieve for Sweden where inflation came in lighter than expected

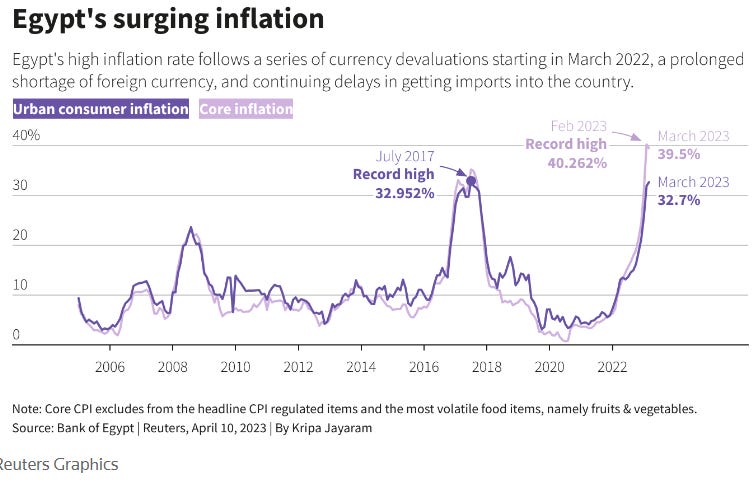

Egypt's headline inflation rate increased to 32.7% in Mar vs 31.9% in Feb

COMMODITIES

WTI Oil px posted its fourth week of gains

Energy Speculators had boosted net long in oil - CFTC Report from prior week

Commodities M&A across Coal, Copper and Oil sector Cos

Commodities issuers raised over $1.4bn in US HY Market this week

Sibanye refinances, increases $ denominated facility to $1bn

A number of resource based firms saw positive credit rating actions

IG

T-Mobile has two notch upgrade at Fitch to BBB+, Sprint upgraded to IG

Hybrids - Ibedrola calls low reset bond, Softbank new Yen issuance

FINS

Fed’s Emergency Loans to Banks Fall for Fourth Straight Week

US Bank Deposits are down 5% YoY but still above levels from mid 2021

Two sub debt deals priced this week showing improved risk sentiment post CS

AT1s - Recap

JPM stock closed up 7.6% on Friday after reporting Q1 2023

Julius Baer stock outperforming wider European Banks, hit 52 week high

Danske Raises Full-Year Guidance on Trading, Interest Income - RTRS

NatWest Group PLC Upgraded To 'BBB+' Outlook Stable - S&P

HY & Lev Loans

US HY - Tightest spreads in 5 weeks

The US lev loan market reopened Monday with a deal roadshow for Qualtrics

US CLOs See Mild Cushion Erosion with 1Q23 Default Uptick - Fitch

Notable Single name news:

EUR HY: Good news for Lottomatica holders following announcement of IPO

Jaguar Land Rover bonds advance on good FCF and orderbook updates

DISH network CDS widens, stock hits 24 yr low, bonds lower

Carnival has enough cash to address 2023 and 2024 maturities: CFO

Delta Airlines raises Q2 EPS but Q1 came in softer than expected

Container Owner Triton to Go Private in $4.7 Billion Buyout

Another clothing retailer gets taken over by bondholders - Takko

REAL ESTATE **NEW SECTION**

European Real Estate Credit seeing tiny bit more positivity

Adler Wins Debt Restructuring Approval

Neinor Homes bonds redeemed at ~8pt premium to market prices

UK’s LXI REIT finalises debt refinancing

M&A in Office sector:

Office Properties Income Trust & Diversified Healthcare Trust Announce Agreement to Merge in All-Share Transaction

ARA Asset Management acquires Regional REIT’s asset manager

DoubleLine Says It Is ‘Perfect Time’ for New Real Estate ETF

WeWork and Rhone default on office tower in SF’s Financial District

Dublin Office Space Take-Up Drops 42% in Sign of Further Stress

EM

China exports rose for the 1st time in 6 months

Emerging Currencies Soar as Investors Eye Fed’s Next Moves

U.S. hails Erbil-Baghdad Oil Accord; Calls for Resumption of Oil Exports ‘As Quickly as Possible’

ADB mulling cheaper funds for Sri Lanka, support for green bonds

Pakistan bonds off the lows on talk of of UAE/IMF support

Egypt bonds took a leg lower following high inflation print

RATINGS

Still seeing good level of upgrades in HY and EM amongst downgrades

Asda CFR downgraded to B2 from B1, outlook stable – Moody's

S&P Puts Lottomatica On CreditWatch Positive On Planned IPO

Moody's upgrades Europcar Mobility Group S.A.'s CFR to B2; outlook stable

Fitch Upgrades Chesapeake's IDR to 'BB+'; Outlook Positive

Fitch Revises Outlook on Oman to Positive; Affirms at 'BB'

Fitch upgrades Saudi Aramco to 'A+'; outlook stable

S&P upgraded Guatemala from BB- to BB

Fitch Upgrades Pegasus to ‘BB-’; Outlook Negative

Barclays strategists warn on risk of European RE Bonds being cut to junk

BUYSIDE / TRADING

Some credit and Real estate funds are raising huge amounts

Blackstone Eyes Junk Debt to Replace Emerson Private Credit Loan

Largest ever private credit deal not going ahead due to deal cancellation

Blackrock saw $34 bn of bond ETF net inflows in Q123

Blackrock accounted for over 60% of total F.I ETF trading volume in Q123

BlackRock Sells Asset-Backed Bonds From Credit Suisse’s Books

JPM’s Q123 F.I Trading Highlights

Citigroup Q123 - 3rd best quarter for F.I this decade.

LINKS

Apollo Credit Market Outlook April 2023 slides

60:40 portfolio has bounced back after a tough 2022 - WSJ

“Yet Another Value Blogger” Podcast re latest Burford Capital ruling

*MOVES*

FX / Crypto

DXY fell to 12 month low in the week before strengthening to close the week

GBP closes a touch below 1.25 after rising from 1.18 in early March 2023

Brazilian Real has strengthened below 5.0 and closed the week at 4.9

Ether & Bitcoin hit 52w highs this week. Ether rose above 2k after software upgrade, Bitcoin remains above $30k

Credit moves over 5 days

CDS - All major 5year indices trading tighter led by Xover (-29bps tighter to 430). Senior Fins CDS now back down to 95bps (lowest since Early March 2023 around start of banking crisis). Sub Fins CDS experienced a 17bps rally during the week but is the only major CDS index to be wider YTD

Cash Credit - US and EUR HY spreads trading below 500bps with US HY in particularly tight at +439bps. Bank CoCo spreads still above 500bps but tightened 21bps this week.

Bond ETFs:

Underperformers included long dated UST (EDV-4.3%, TLT-3.2%), Gilts + Inflation (INXG-3.5%, IGLT -1.9%), JGBs (JT13 -2.4%, XJSE -2.3%).

Outperformers were Inverse long dated TSY ETFs (TMV+10.5%, TTT+10.3%), AT1 (AT1+2.4%), HY (HYLD+1.3%, WING+1.0%), Preferreds (PGX+1.1%), Corporate Hybrids (EHYB+0.8%)

Commodities

WTI Oil posted its fourth week of gains

Equities:

MSCI Inc.’s World Index hit 10 week high

European Stocks Eye Longest Weekly Winning Streak Since December

Asia Pacific stock gauge is on course for its highest close since February

Interesting single name moves:

Notable 52w highs: BMW, Visa, Julius Baer, Merck Moncler, L’Oreal, Hiscox, Heidelberg Cement.

Notable 52 lows: Mainly US Regional Banks which did not experience a lift from JPM’s +7.6% move on Friday; e.g Bank of California, Home Bancorp, First Community Bankshares (list goes on). Other firms hitting 52w lows include Real estate and mortgage REITs (e.g. JLL, Blackstone Mortgage REIT)

*MACRO*

US Treasury yields ended the week firmer

A stronger than expected Retail Sales Control Group figure and an unexpected jump in University of Michigan sentiment and a marked rise in 1-year ahead inflation resulted in yields closing higher after dipping mid week.

The 2 year UST for example widened 13bps on Friday alone.

100bps spread between 4 week T-Bills and Fed Funds Rate - Chart

Rush to safe havens has seen yields come down on US T-Bills.

Link to original Tweet.

BofA Clients - Proportion in cash & cash equivalents remain high vs LT average

This chart seems to corroborate the low yields in the ultra short dated T-Bill space.

https://twitter.com/bnschwartz/status/1646956149990891521

5% FDIC-Insured savings account is back for 1st time since 2007

Smaller Banks trying to attract deposits.

ttps://twitter.com/charliebilello/status/1646869432050778112

Australian jobs data was better than expected - PSL

Extract - Australia's employment grew by 53K jobs in March according to the latest Labour Force survey, surpassing market expectations of 20K. The unemployment rate remained steady at 3.5%, defying expectations of a slight increase to 3.6%.

MAS keeps policy rate unch in surprise move - Straits Times

Extract– In a surprise move, Singapore’s central bank hit the pause button in its monetary tightening policy, shifting its focus from ramping up the fight against inflation to defending the economy, which it said is facing the risk of a deeper slowdown. MAS’ pause is a surprise given that most private economists in recent private polls expected the central bank to go for a sixth round of policy tightening in the current cycle that started in October 2021.

Note that Singapore Q1 GDP came in light at +0.1% vs +0.6% expectation.

Other Central Banks which did not hike this week:

Peru kept rate at 7.75% (expected).

Bank of Canada holds interest rates unchanged at 4.5% (expected).

Bank of Korea held interest rates at 3.5% (expected).

UK - Chancellor hints at Spring 2024 election - Yahoo Finance

Extract - UK Chancellor of the Exchequer Jeremy Hunt signaled an election may be held as early as spring 2024 by which point he expects the economy to have “turned the corner.

Asked on Bloomberg TV at the International Monetary Fund’s meetings in Washington whether the poll will be held in the spring or autumn, before the deadline of January 2025, Hunt said it was “too soon to answer.”

But he added that all official forecasters, including the IMF, expect the UK to have moved on from the current difficult patch and to be growing “in a year’s time,” and for inflation to be under control at around 3%.

This is earlier than the current mainstream expectation of an election in late 2024.

Earnings season looks lit for next week

Monday will be especially interesting due to Schwab and a handful of Regional Banks reporting.

https://twitter.com/eWhispers/status/164695310041706496

US Auto loans - Problem building

https://twitter.com/MarketRebels/status/1646171313843699713

However high payments did not deter a large amount of consumers who financed a new vehicle in Q1 2023:

UK mortgages - 56,000 two-year fixed-rate loans set to end in September | BBG

Most of these loans are those that were taken before the end of the Stamp duty holiday.

It will be interesting to see how mortgage holders who have refinancing due this year adjust their household budgets for much higher mortgage payments. At the middle of 2021, the UK Base rate was only 0.1% compared to 4.25% now!

For a more concentrated dose of Macro, check out FX Macro’s Substack, it’s a regular read for me to set me up for the week ahead:

*INFLATION*

US CPI - Fintwit takes

https://twitter.com/charliebilello/status/1646135609319120897

US Supercore CPI inflation coming down but remains high

https://twitter.com/M_McDonough/status/1646130152122753024

“Accelerating disinflation, despite some latent core inflation stickiness” - Gregory Daco

CPI YoY…trend is your friend

https://twitter.com/SavvyTrader/status/1646129867627298820

Food at home prices fell in March for first time since 2020!

https://twitter.com/SaraEisen/status/1646144061365972993

US PPI - U.S. producer prices unexpectedly fell in March

Extracts from RTRS: U.S. producer prices unexpectedly fell in March as the cost of gasoline declined, and there were signs that underlying producer inflation was subsiding. In the 12 months through March, the PPI increased 2.7%. That was the smallest year-on-year rise since January 2021 and followed a 4.9% advance in February. The annual PPI rate is subsiding as last year's large increases drop out of the calculation.

Extracts from Gregory Daco: Goods PPI disinflation coming mostly from gas, diesel, natural gas, jet fuel, electric power, & veggies. Services PPI disinflation encouraging; Wholesalers and retailers margins declining sharply, & transportation/warehousing prices dropping. Conversely, prices for guestroom rental rose. The indexes for food retailing and for transportation of passengers advanced.

Trend seems to be lower looking over the past few months.

U-Mich one-year inflation expectations rose to 4.6% from 3.6% in March - RTRS

Extract - U.S. consumer sentiment inched up in April, but households expected inflation to rise over the next 12 months.

The University of Michigan's preliminary April reading on the overall index of consumer sentiment came in at 63.5, up from 62.0 in the prior month. Economists polled by Reuters had forecast a preliminary reading of 62.0.

"Rising sentiment for lower-income consumers was offset by declines among those with higher incomes," said Surveys of Consumers Director Joanne Hsu. "While consumers have noted the easing of inflation among durable goods and cars, they still expect high inflation to persist, at least in the short run."

The survey's reading of one-year inflation expectations rose to 4.6% from 3.6% in March. Its five-year inflation outlook was unchanged at 2.9% for the fifth straight month and has stayed within the narrow 2.9-3.1% range for 20 of the last 21 months.

Sovereign inflation snippets:

China CPI comes in at +0.7% vs +1.0% expectation

Chinese PPI set a new cycle low in March

BoE - will not be diverted from its fight against inflation by risks to financial stability from higher interest rates: Governor Bailey | BBG

Germany final March CPI came in at +0.8% vs est of 0.8%

Hungary CPI came in higher than expected but falls for second month in a row

Romania March CPI came in at +1.01% vs est of +0.70%

Norway March CPI came in at +6.5%, higher than +6.1% estimate

Egypt's headline inflation rate increased to 32.7% in March - RTRS

Singapore’s MAS: “Core inflation expected to ease materially by end of 2023”

Sweden Inflation Retreats, Bringing Some Relief for Riksbank - BBG

Australia 10-Year Breakeven Inflation Rate Rises to 4-Week High

Strong chart from former ECB VP Constâncio on wholesale German price inflation

https://twitter.com/VMRConstancio/status/1646834112722763776

Corporate inflation snippets:

Delta Airlines Q123 - The amount passengers paid to fly each mile on Delta was up 17% compared to both a year earlier and the same period in 2019 (CNN)

BlackRock Inc. increased its overweight call on inflation-linked debt (prior to the week’s US CPI readings).

Manhattan rents reach record high - CNN

US Asking rents are lower than they were a year ago, first time YoY decline since March 2020

https://twitter.com/charliebilello/status/1646867406306922497

*COMMODITIES*

Commodities M&A activity ticked up this week

https://twitter.com/IlliquidTrader/status/1646501781910814720

Acquirers seem to be interested in Coal, Copper and Oil.

Neptune’s Energy’s operations appear to be in North Sea, Europe, Africa and Asia.

The Glencore/Teck approach is more complex, it was summarised well by Mining Weekly:

Glencore wants to buy Teck and then spin off the combined companies’ coal assets, but Teck says the deal is a “non starter” and is instead pressing ahead with an earlier plan to hive off its coal mines and focus on metals. Teck investors will decide on the Canadian miner’s split plan on April 26, in a high-stakes vote that is being framed by Glencore’s camp as a referendum on its takeover proposal.

The Hudbay Minerals/Copper mountain deal appears to be focused on consolidating Copper operations.

Commodity focused issuers raised over $1.4bn in US HY Market this week

Issuers that came to market included Baytex Energy, Conuma Resources and Nickel Industries. The first two companies are both Canadian and in fact Baytex had a ratings upgrade prior to the deal announcement. Nickel Industries is an Australia based firm which came with $400m of 5.5yr bonds yielding 11.25% for a B rated credit.

Sibanye refinances, increases dollar-denominated facility to $1bn - Mining Weekly

Interesting that Sibanye didn’t look to issue in the EM bond market, without knowing the credit in detail its likely to have been more expensive due to current market conditions.

Extract - Multinational mining and metals processing group Sibanye-Stillwater has successfully refinanced and increased its dollar-denominated revolving credit facility from $600-million to $1-billion, providing enhanced liquidity for the diversified miner.

CEO Neal Froneman says the increase in the size of the facility, especially considering the uncertain macro-environment, is a “strong vote of confidence” in the group and further confirmation of the appropriateness and success of Sibanye’s strategic growth and diversification over the past decade.

The facility agreement concluded with a syndicate of ten international banks, led by Citi and Royal Bank of Canada, includes an option for Sibanye to increase the facility size by a further $200-million to $1.2-billion, through the inclusion of additional lenders and a margin of between 1.6% and 2%, dependent on leverage.

The new facility maturity is three years, with lenders having the option to extend the facility tenor through two further one-year extensions on request from Sibanye.

A number of resource based firms saw positive credit rating actions:

Fitch upgrades Saudi Aramco to 'A+'; outlook stable

Preem upgraded to BB- from B+; outlook stable - S&P

S&P Raises MEG Energy Corp. Rtg To BB- From B+; Outlk Stable

Fitch Upgrades Chesapeake's IDR to 'BB+'; Outlook Positive

Baytex Energy Upgraded to Ba3 by Moody's, Outlook Stable

S&P revised outlook on Freeport-McMoRan to positive and affirmed at "BB+"

Albemarle Outlook to Positive by Moody's

Energy Speculators boosted net long in oil - CFTC Report

Source: Saxo Market Call

ING covered this topic earler in the week.

*IG*

IG new issuance

Pretty quiet here, but issuance getting done without much of a problem. Walmart issued a 5 part $5bn deal and Sydney Airport and Telstra are roadshowing with a view to issuing in Euros.

T-Mobile has two notch upgrade at Fitch to BBB+, Sprint upgraded to IG- Fitch

The ratings upgrade has positive implications for T-Mobile and Sprint paper, please refer to the full statement for details.

Extract of statement - Fitch Ratings has upgraded the ratings for T-Mobile US Inc. (T-Mobile) and its subsidiaries including the Long-Term Issuer Default Ratings (IDR) to 'BBB+' from 'BBB-'. The Rating Outlook is Stable. The rating upgrade reflects the greater scale and continued improvement in T-Mobile's business and financial profiles due to strong execution on Sprint network integration that has resulted in a leading 5G network position, good operating momentum and substantial synergy realization with increasing cash generation and lower leverage. Fitch believes the company is well-positioned to drive multiple top-line opportunities that supports a significant increase in FCF that approaches $13 billion based on Fitch adjustments in 2023 from $6.9 billion in 2022 reflecting EBITDA growth, lower capital investments and reduced cash merger costs. Fitch also expects T-Mobile will demonstrate a consistent capital allocation policy that balances the potential for large shareholder returns and other investments with the maintenance of maintaining EBITDA leverage in the mid-2x area.

Corporate Hybrids - Ibedrola call low reset bond, Softbank new Yen issuance

Iberdrola called its IBESM 1 ⅞ PERP (XS1721244371). Despite having a very low reset of only EUSA5+1.592%.

Softbank issued $1.7bn of Yen hybrids to retail investors in Japan. The bonds priced at 4.75% for a 35 year yen hybrid callable in 5 years. Softbank is having to pay up for issuing Corporate Hybrids; they last paid 2.75% coupon for its previous Yen hybrid bond issued in 2021.

*FINANCIALS*

Fed’s Emergency Loans to Banks Fall for Fourth Straight Week - BBG

Deposits are down 5% YoY but still above levels from mid 2021 - Nick T

Two sub debt deals priced this week showing improved risk sentiment post CS

Interesting to see two large issuers come and issue in subordinated format.

Canadian Bank CIBC issued $750m of subordinated debentures in a 10NC5 format at +232bps in CAD, there was healthy book coverage of 2.7x.

Generali raised €500m of 10Y Green T2 @ MS +240bps

Note that Generali tendered for debt, so there may be some holders who decide to switch into the new issue from the old. Other tenders during the week included Vienna insurance. There was other senior loss absorbing issuance from KBC and ABN.

JPM stock closed up 7.6% on Friday after reporting Q1 2023

JPM seemed to be doing just fine based on its Q1 report. The big move in the shares could have been due to the high level of short interest going into earnings as evidenced by the tweet below from the 12th of April 2023:

Jack Farley of Blockworks shared some great charts from JPM’s Q1 highlighting some of the ways JPM benefitted in Q1 2023:

For more highlights on JPM’s earnings check out Librarian Capital’s detailed review of the results:

Next week we hear from some more banks to gauge the health of the US Banks system:

18th: BofA, GS

19th: MS, US Bancorp, Citizens Zions

20th: EW Bancorp, Comerica, KeyCorp, Truist Financial, Fifth Third

21st: W. Alliance

SRC: BBG

Julius Baer stock outperforming wider European Banks

I don’t follow JB that closely but my guess is that it is set to benefit from the acquisition of CS by UBS.

Danske Raises Full-Year Guidance on Trading, Interest Income - RTRS

NatWest Group PLC Upgraded To 'BBB+' On Resilient Franchise And Strong Forecast Earnings; Outlook Stable - S&P

Extract -

NatWest Group PLC (NWG)'s deep U.K. franchise has performed well through a period of turbulence in the domestic economy and global banking markets.

- The group's resilient universal banking business leaves it well positioned to generate solid organic growth and strong earnings over the next 12-24 months.

- A granular and stable deposit base, cautious liquidity management, and broad wholesale funding sources bolster NWG's ratings stability.

- We raised our long-term ratings on NWG to 'BBB+' from 'BBB' and affirmed our 'A-2' short-term issuer credit ratings. We took corresponding actions on all our other issuer credit and issue ratings on group entities and debt.

- The stable outlook indicates that we expect NWG's credit profile to remain robust over our two-year horizon, with continued strong earnings and solid funding and liquidity profiles builton its robust strategic positioning.

Cyclone Ilsa 'a litmus test' for reinsurance pool, WA broker says

Extract - Severe Tropical Cyclone Ilsa, which is set to cross the Pilbara coast near Port Hedland as a category 4 system tonight, will act as a litmus test for the Federal Government’s new cyclone reinsurance pool and expose any fundamental issues, Broome Insurance Brokers Director David Keys says. The Australian Reinsurance Pool Corporation (ARPC) has declared Ilsa a cyclone event under the pool, which is run by ARPC and backed by a $10 billion government guarantee.

AT1s - Roundup of newsflow / viewpoints

After Switzerland, Brazil is the largest issuer of CoCos with permanent write-down rules, according to data compiled by BBG.

MUFG Clients Lost $700 Million in Credit Suisse AT1 Wipeout - BBG

*HY + LEV LOANS*

US HY - Tightest spreads in 5 weeks

According to BBG on Friday 14th Apr 2023, the sector has advanced for 6 consecutive sessions which represented longest winning streak in more than 3 months. Yields hit a 2 month low of 8.38% and spreads are the tightest in 5 weeks (cash USHY spreads at +458 at time of writing on Friday). Spreads rallied partly on the lower than expected inflation prints coming out of PPI and CPI data during the week. Positive ratings actions for a number of HY issuers is likely helping sentiment too.

The US lev loan market reopened Monday with a deal roadshow for Qualtrics

The loan is being raised to support the buyout of software firm Qualtrics. At Friday afternoon in London, it looks as if the deal is being upsized by $200m to make it a 7yr TLB with pricing of SOFR+350bps priced at 99.0. Risk appetite is definitely better if $1bn lev loans are being executed.

US CLOs See Mild Cushion Erosion with 1Q23 Default Uptick - Fitch

Default rates remained low in CLOs as at end of 1Q23 but ticked up vs end of 2022. Within the ratings downgrades many appear to be downgrades down to CCC+ and below which could result in higher defaults down the line.

Extract - U.S. broadly syndicated loan CLOs under Fitch Ratings’ surveillance maintained ample rating cushions in 1Q2023, although some experienced mild deterioration as default exposure picked up, says Fitch in its latest Monthly U.S. CLO Index.

Increased defaults during the quarter pressured rating cushions overall. There were 12 newly defaulted issuers during 1Q23 and three issuers that exited the status during 1Q23. This brought the total defaulted issuers to 19 at the end of March, up from 10 in December. The average default exposure in CLOs increased to 0.7% from 0.4% at year-end.

Rating actions continued to trend negative with 36 positive actions and 43 negative actions in March by Fitch’s Issuer Default Rating Equivalency Ratings. Over half of the negative actions were downgrades, mostly to ‘CCC+’ and below.

EUR HY: good news for Lottomatica Bondholders following announcement of IPO

GTKIM 8.125% 2026 Corp bonds look like they are up 6pts. BBG story here.

https://twitter.com/CavaggioniMario/status/1646410829191847940

Jaguar Land Rover - Good figs see bonds advance (Statement)

Extract of statement:

Wholesales in Q4 were 94,649 units, up 24% vs Q4 FY22; and for the full year 321,362, up 9% compared to a year ago (wholesales exclude China JV)

Retail sales in Q4 were 102,889, up 30% vs Q4 FY22; and for the full year 354,662 units, down 6% compared to a year ago

Order book remains strong at 200,000 units as sales increased, reflecting strong client demand, particularly for Range Rover, Range Rover Sport and Defender

Free cash flow expected to be over £800 million positive in the fourth quarter and over £500 million positive for the full year

E.g bonds such as TTMTIN 4 ½ 10/01/2027 are +1-2pts higher than March 2023 lows.

DISH network CDS widens, stock hits 24 yr low - BBG

DISH, who was one of the issuers to “re-open” markets during the dark days of Q3 2022 with a 11.75% 2027 deal is seeing its CDS widen and its bonds sell off. The 2027 bond which traded up as high as 106.0 has fallen to 93.0.

Extract - Traders in the credit default swaps market are growing increasingly concerned about Dish Network, Michael Tobin reports.

The cost of protecting Dish debt against a default has surged this year to 41 points upfront, meaning it cost around $4.1 million to insure $10 million of debt. The company’s equity isn’t in good shape either, hitting a 24-year low this week after Barclays slashed its price target on the stock amid concerns about the company’s subscriber base.

There are about $44 billion of high-yield bonds in the communications sector that trade below 70 cents, according to a Bloomberg Intelligence report Wednesday. That includes Dish’s 3.375% convertible note due 2026 and its zero coupon convertible due 2025, which are both around 51 cents.

Carnival has enough cash to address 2023 and 2024 maturities: CFO - BBG

Extract - Carnival Corp.’s chief financial officer, David Bernstein, isn’t worried about rising interest rates — unlike other finance executives — as the cruiseline operator looks to pay down its debt rather than refinance it.

The Miami-based business had about $8 billion of liquidity, including cash and borrowings available under its revolver as of late March, up from $7.2 billion a year earlier. That’s enough to pay off the roughly $4.5 billion in debt coming due later this year and in 2024, Bernstein said in a phone interview.

“We expect to keep paying down debt,” Bernstein said. “We should be well positioned and not have the need to refinance in the next two to three years.”

Delta Airlines raises Q2 EPS but Q1 came in softer than expected - CNN

Extract - The second quarter revenue and earnings were slightly below Wall Street forecasts, which the company attributed to flights canceled due to bad weather. But shares of Delta (DAL) were higher in pre-market trading due to its strong forecast going forward.

The company said the record second-quarter bookings will allow it to post earnings per share of between $2 and $2.25, well above the current forecast of $1.66. For the full year, the company expects earnings per share of between $5 and $6, which could put it well above the $5.40 forecast from analysts.

Container Owner Triton to Go Private in $4.7 Billion Buyout - Gcaptain

After Seaspan, another container sector company goes private.

Extract - Brookfield Infrastructure Partners LP agreed to buy Triton International Ltd., the world’s largest owner of intermodal shipping containers, for $4.7 billion to expand in transportation logistics supporting the global supply chain. Toronto-based Brookfield will pay $85 a share, including $68.50 in cash, the companies said early Wednesday, which is a 35% premium to Triton’s closing price Tuesday. The acquisition, which needs the approval of Triton shareholders and regulators, is expected to be completed in the fourth quarter.

Another clothing retailer gets taken over by bondholders - BBG

Follows events at Matalan which was also taken over by key creditors.

Extract - German retailer announced it will be taken over by creditors. Restructuring deal does not include new money for the company. The creditor takeover of a German retailer despite recent solid operational performance signals the risks faced by some European junk-rated issuers, amid a looming wall of maturing debt.

Takko Fashion GmbH, which runs almost 2,000 clothing stores across Europe, announced it will be taken over by its bondholders, led by Silver Point Capital LP as part of a debt restructuring. Unlike other companies falling prey to creditors earlier this year, Takko’s troubles weren’t due to a cash shortfall from operational difficulties.

BBG’s Credit Edge Podcast discussed the Takko situation in more detail:

*REAL ESTATES/REITS*

European Real Estate Credit seeing tiny bit more positivity

A constructive backdrop (Neinor Home debt redemption/Adler debt restructuring approval) may have been behind a more constructive two way activity in European Real Estate Credit. However the interest appears to be more in senior credit as hybrids remain largely in the doldrums. Names like Senior Aroundtown in Euros generically advanced around a point off the lows set in March. However note that there are still some paying RE Corporates hybrids that are trading in the 20s and 30 cents range.

Adler Wins Debt Restructuring Approval - BBG

Extract - Adler Group SA won approval to restructure €6 billion euros ($6.6 billion) of debts by a London judge, despite opposition from some of its creditors including DWS Group and Strategic Value Partners. The verdict allows Adler to extend maturities of bonds due next year, borrow around €900 million and temporarily suspend interest payments. The only alternative was a default on debt later this month that would lead to an insolvency filing, Adler’s lawyers had said during a hearing earlier this month.

Neinor Homes bonds redeemed at ~8pt premium to market prices

Looks like a good outcome for holders of Neinor Homes bonds. Neinor Homes is a listed company focused on the residential development market in Spain with a market cap of around $800m USD. Based on an article in Property-Magazine.EU, Neinor raised a €140m 3 year green loan from its Banks which was likely used to buyback these bonds. In this instance it looks as if the Treasury team were very pro-active in managing its debt maturities.

https://twitter.com/KillinGswitCH98/status/1646417547497971713

What is also interesting is is that a company CC’d on the tweet shown above replied back to the poster with a response, check the thread for exact comments.

UK’s LXI REIT finalises debt refinancing - Statement

Not an issuer with debt outstanding in the public markets, but since there is so much concern re CRE and upcoming maturity walls in general I wanted to highlight some of the details of the transaction. The full statement goes into lot more detail about which debts were refinanced and other new debt facilities.

A quick look at the company website highlights these key metrics, LXI REIT:

has a long weighted average unexpired lease term to first break of 26 years, with 98% of its rental income index-linked or containing fixed uplifts;

is 100% let or pre-let to over 80 institutional-grade tenants across a range of robust sectors; and

is leveraged at a pro-forma Loan to Value ratio ("LTV") of 33%

Therefore low LTV, long leases and very well let out...

Extract of refi statement - The Board of LXi REIT plc (ticker: LXI), the specialist inflation-protected very long income REIT, is pleased to announce the signing of a £565 million loan facility, being the final step of the refinancing of its near-term debt maturities, and allows the Company to increase its annual dividend target.

"We are delighted to have signed this facility, which represents the final step of our comprehensive refinancing programme. The combination of the medium-term and revolving bank facilities, along with the long-term institutional facilities announced on 6 March, provides the Company with operational flexibility, including an ability to migrate further to unsecured/debt capital markets funding in due course. It will also underpin our long-term progressive dividend policy."

Bank Facility

The Company has signed a new, £565 million secured, interest-only debt facility with a syndicate of banks comprising a number of the Company's existing lenders ("Bank Facility"). The Bank Facility comprises a £200 million five-year revolving credit facility, a £115 million five-year term loan and a £250 million three-year term loan.

The blended margin on the Bank Facility is 2.23% per annum over SONIA. The Company has purchased interest rate caps representing £400 million of notional to cap the SONIA cost of the Bank Facility at a rate of 2.0% per annum, resulting in an all-in rate of 4.23% per annum for the first 3-years of the facility.

The cost of the £400 million of SONIA caps was fully covered by the value of the derivatives owned by the Company. The Company expects to hedge the remaining £165 million shortly through a 5-year swap with no initial cost.

The Bank Facility provides the Company with substantial covenant headroom together with appropriate remedial cure rights ahead of any potential breach trigger. Drawing the Bank Facility is conditional on finalising market-standard property due diligence and the redemption of certain of the Company's existing financing arrangements and release of the associated security.

The Company was advised on the Bank Facility by Rothschild & Co.

Office Properties Income Trust and Diversified Healthcare Trust Announce Agreement to Merge in All-Share Transaction - Bizwire

Extract - Office Properties Income Trust (Nasdaq: OPI) today announced that it has entered into a definitive merger agreement with Diversified Healthcare Trust (Nasdaq: DHC), pursuant to which OPI will acquire all of the outstanding common shares of DHC in an all-share transaction. OPI will be the surviving entity in the merger and expects to change its name to “Diversified Properties Trust” upon the closing of the transaction and to continue to trade on The Nasdaq Stock Market LLC.

McKnight’s Senior Living website summarised the situation well:

“OPI will be the surviving entity and will change its name to Diversified Properties Trust upon closing of the transaction. The combined company will be led by members of the OPI executive management team, among them President and Chief Operating Officer Christopher Bilotto and Chief Financial Officer and Treasurer Matthew Brown. At 40%, senior living will represent the largest property type in the combined portfolio, with office properties representing 35%. Medical office buildings will represent 12%, and life science properties will represent 9%.”

From a generalist’s perspective this transaction looks like an Office REIT merging with a Healthcare REIT to reduce the proportion of office sector exposure in the overall new enlarged business. With the rationale (imo) likely to improve the perception by equity/credit investors as it becomes a more diversified real estate play. This might be too simple a take from me, so feel free to comment in the comments section if you understand the transaction better or have a different view.

ARA Asset Management acquires UK listed Regional REIT’s asset manager - Link

Extract - Regional REIT (RGL)- Confirms that ARA Asset Management has acquired majority shareholding in London & Scottish Property Investment Management, with CEO Stephen Inglis retaining a significant minority interest. Expects no change to day-to-day management of REIT.

According to its website ARA Asset Management is part of the ESR Group, APAC’s largest real asset manager powered by the New Economy and the third largest listed real estate investment manager globally. With US$140 billion in gross assets under management (AUM).

DoubleLine Says It Is ‘Perfect Time’ for New Real Estate ETF - BBG

DoubleLine Capital LP sees opportunity in the commercial real estate market despite mounting fears over the industry.

“It’s a perfect time, because with all this negative sentiment, you’re seeing a lot of unique opportunities,” DoubleLine portfolio manager Chen said in a phone interview. “By no means are we ignoring it, but there’s a lot of devil in the details as to what’s going on with specific properties. As an active manager, we’re able to pick and choose where we want, do what we like, what we don’t like.”

“I’m most concerned about loans done in 2021. That’s largely because those borrowers borrowed at ultra-low rates,” he said. “If you borrowed in 2013 or 2014 or some of the vintages or years that have already had some seasoning and underlying performance growth over the years, there I think there’s a little bit less pressure.”

Others have come out saying that parts of real estate debt look interesting, e.g.:

Full articles are well worth a read.

WeWork and Rhone default on office tower in SF’s Financial District - TRD

Extract - A joint venture between WeWork and Rhone Group has defaulted for not paying its mortgage on an office tower in San Francisco’s Financial District.

The venture launched by the coworking and private equity firms, both based in New York, defaulted on a $240 million loan for the 20-story building at 600 California Street, Bloomberg reported.

The same article mention issues with another building in the area: Late last month, Vornado Realty Trust and The Trump Organization asked for an extension on their loan for a 52-story office tower at 555 California Street, after it was put on a service watchlist. Their mortgage debt is $1.2 billion.

Dublin Office Space Take-Up Drops 42% in Sign of Further Stress - BBG

More tech related weakness in CRE, but this time in Europe:

Extract - The take-up of office space in Dublin in the first quarter dropped by 42% from a year earlier, a report by CBRE showed, compounding signs of a slowdown in Ireland’s commercial real estate.

Vacancies rose to 13%, up from about 8% in the same period last year, following the delivery of newly constructed space. Meanwhile, assignment and sub-lease deals accounted for just over 40% of all take-up in the first three months, the largest quarterly proportion on record, CBRE said.

The data add to growing evidence of stress in commercial real estate after office-space deals slumped 83% at the end of 2022 amid rising interest rates. Meanwhile high-profile technology firms such as Google and Twitter Inc. have been laying off staff, while Meta Platforms Inc. decided to sub-let part of its new European headquarters in Dublin late last year.

*EM + ASIA*

China exports rose for the 1st time in 6 months - Al Jazeera

Extract - China’s exports surged in March as the world’s second-largest economy continued to rebound from Beijing’s harsh “zero-COVID” pandemic policies. Total exports soared 14.8 percent year on year, customs data showed on Thursday, the first rise in six months and a sharp rise from March last year, when lockdowns crippled the economy. Imports fell a smaller-than-expected 1.4 percent. The trade figures soundly beat the expectations of economists, many of whom had predicted further declines in exports. Analysts polled by the Reuters news agency had expected exports to fall 7 percent, after falling 6.8 percent in the January-February period.

Emerging Currencies Soar as Investors Eye Fed’s Next Moves - BBG

The BBG article highlights that Brazil’s Real soared to the highest since June, the Colombian peso touched a seven-month peak and Mexico’s peso also jumped to an intraday high. The moves were off the back of the weaker Dollar, lower than expected inflation prints and an expectation of easier monetary policy by the US Fed. The latter point is the most up for debate due to inflation still being at high levels despite showing signs of falling this week.

U.S. hails Erbil-Baghdad Oil Accord; Calls for Resumption of Oil Exports ‘As Quickly as Possible’ - Kurdistan 24

Extract - Amb. Geoffrey Pyatt, Assistant Secretary of State for the Bureau of Energy Resources, addressing journalists on Tuesday, had high praise for the agreement recently concluded between the Kurdistan Regional Government (KRG) and the Iraqi federal government on the resumption of Kurdish oil exports, following their suspension after an adverse ruling, based on a Saddam-era regulation, by the International Chamber of Commerce’s International Court of Arbitration (ICC-ICA.)

The April 3 Erbil-Baghdad agreement overcomes the legal hurdles to Kurdish oil exports through the pipeline to Turkey’s port of Ceyhan, which the ICC-ICA cited in its ruling. Turkey has yet to resume them, however, and Pyatt called for doing so “as quickly as possible.”

Pyatt underscored the significance of the statement issued by National Security Council Advisor, Jake Sullivan, on Friday, as Sullivan became the most senior U.S. official to welcome the Erbil-Baghdad oil agreement.

“There are a variety of reasons” for that support, Pyatt explained. One is the “significant American investment in the upstream oil and gas sector in northern Iraq and the Kurdistan Region.”

“So we are keenly focused on finding a mechanism to see that the [oil] flows are restored as quickly as possible,” he added. “We remain engaged with our Turkish allies, as well, to facilitate this agreement and the resumption of flows through Ceyhan.”

ADB mulling cheaper funds for Sri Lanka, support for green bonds - Business Times

Extract - THE Asian Development Bank (ADB) is considering more concessionary funding for Sri Lanka and support for green bond issues as part of its assistance to help the South Asian nation recover from its worst economic crisis in decades.

The Manila-based lender’s immediate priority in 2023 is to continue work on overall economic stability and support the banking and energy sectors, ADB Sri Lanka country director Chen Chen said in an interview in Colombo.

“We are also actively working on mobilising more concessional resources and grant resources to the country,” Chen said. “This will hopefully be part of our assistance in the coming years.”

Through 2022, the ADB disbursed around US$334 million by re-purposing existing project loans. The lender already has about US$3.7 billion of previously approved loans in transport, energy, education, health, social protection, agriculture, and small and medium enterprises, among others, which will be disbursed as projects progress, Chen said.

Sri Lanka is now conducting an asset quality review of banks with ADB’s support, and is discussing reforms to improve governance and financial sustainability for the power sector, Chen said.

Pakistan bonds advance on IMF/UAE newsflow - Al Jazeera

For example, Pakistan 8.25% 2024 $ bonds are nearing 50 cents in the Dollar after hittng the low 40s in March 2023. Extract of Al Jazeera article below:

Pakistan’s finance minister says the United Arab Emirates (UAE) has informed the International Monetary Fund (IMF) that it will provide financial support of $1bn to the crisis-hit South Asian country.

Egypt bonds took a leg lower following high inflation print

Egypt's annual urban consumer inflation rate in March climbed to 32.7% year-on-year, just shy of an all-time record, from 31.9% in February.

Also it seems in the fx forwards market, Egypt’s currency has weakened a lot more than the official rate.

https://twitter.com/ZiadMDaoud/status/1647170748383993857

This has seen many of Egypt’s bonds trade at or near record lows with bonds like the Egypt 7.5% 2061s (which are still paying) trading just above 50.0.

*RATINGS*

IG:

S&P revised outlook on Freeport-McMoRan to positive and affirmed at "BB+"

Albemarle Outlook to Positive by Moody's

Fitch Upgrades T-Mobile to 'BBB+'; Outlook Stable

Moody's changes outlook on Sydney Airport to stable from negative, affirms Baa1 ratings

Moody's changes outlook on Melbourne Airport to stable from negative, affirms Baa1 ratings

Reckitt Outlook to Positive by Moody's; L-T Rating Affirmed

HY:

Asda CFR downgraded to B2 from B1 on decline in operating performance, increased leverage; outlook stable – Moody's

X-S&PGR Puts Lottomatica On CreditWatch Positive On Planned IPO

S&P Raises MEG Energy Corp. Rtg To BB- From B+; Outlk Stable

Preem upgraded to BB- from B+; outlook stable - S&P

Moody's upgrades Europcar Mobility Group S.A.'s CFR to B2; outlook changed to stable

Fitch Upgrades Chesapeake's IDR to 'BB+'; Outlook Positive

Baytex Energy Upgraded to Ba3 by Moody's, Outlook Stable

FINS:

None of note

EM:

Fitch Revises Outlook on Oman to Positive; Affirms at 'BB'

Fitch upgrades Saudi Aramco to 'A+'; outlook stable

Malaysia Affirmed at A3 by Moody’s; Outlook Remains Stable

S&P upgraded Guatemala from BB- to BB

Fitch Upgrades Pegasus to ‘BB-’; Outlook Negative

Barclays strategists warn on risk of European RE Bonds being cut to junk

https://twitter.com/danjmcnamara/status/1646088339257188354

*BUYSIDE / PRIVATE CREDIT*

Some credit and real estate funds are raising huge amounts casting aside market sentiment

Blackstone Announces $30.4 Bn Final Close for Largest Real Estate Drawdown Fund Ever - …In total, Blackstone’s three opportunistic strategies (Global, Asia, Europe) now have $50 billion of capital commitments. Blackstone has delivered a 16% net IRR on over $100 billion of committed capital in the BREP global funds over more than 30 years. Anticipating changing macrotrends, Blackstone Real Estate shifted its portfolio away from assets facing headwinds such as traditional office and malls and is approximately 80% concentrated in logistics, rental housing, hospitality, lab office and data centers. BREP X’s scale and discretionary capital positions it well to capitalize on opportunities in its highest conviction sectors across the globe.

HPS closes $17bn Strategic Investment Partners V Fund - The Fund is the fifth vintage of HPS's flagship junior capital solutions strategy which has invested over $36 billion since inception in 2008. As one of the largest dedicated providers of junior capital globally, the Fund will continue to focus on providing customized financing solutions for large, established businesses in North America and Western Europe. The Fund seeks to leverage HPS's global credit platform and relationships to source investments directly from private and public companies as well as private equity-backed businesses across a broad array of industries.

Blackstone Eyes Junk Debt to Replace Emerson Private Credit Loan - BBG Law

Extract -

Part of new debt to replace $2.6 bn private credit loan

RBC leads loan component, Barclays leads bond portion

Blackstone Inc. is looking to refinance $5.5 billion of debt for a unit of Emerson Electric Co., just months after the buyout titan turned to direct lenders to help fund the deal as banks pulled back from lending. The private equity firm has hired Royal Bank of Canada and Barclays Plc to raise debt from investors in the leveraged finance market, according to people familiar with the matter. The deal is currently being shown to investors to garner feedback and gauge interest, they added. Blackstone may significantly lower borrowing costs for the deal, and the loan component of the financing.

Largest ever private credit deal not going ahead due to deal cancellation - BBG

Extracts - Veritas Capital and Carlyle Group Inc. have ended their talks for the Washington-based alternative asset manager to take a stake in health-care technology firm Cotiviti Inc., according to people with knowledge of the matter. Bloomberg News previously reported Carlyle’s proposal, valuing Cotiviti at around $15 billion with debt, included what would have been the largest-ever private credit deal. Private credit firms including Apollo Global Management Inc., Blackstone Inc., HPS Investment Partners and Oak Hill Advisors had proposed a $5.5 billion financing package to back the transaction.

*TRADING*

Blackrock accounted for over 60% of total F.I ETF trading volume in Q123

Extract - BlackRock led the industry with $34 billion of bond ETF net inflows and accounted for over 60% of total fixed income ETF trading volume during the quarter.

JPM’s Q1 F.I Trading Highlights

Taken from 8k and earnings call:

Markets & Securities Services revenue was $9.4 billion, up 1%.

Markets revenue was $8.4 billion, down 4%. Fixed Income Markets revenue was $5.7 billion, flat, reflecting higher revenue in Rates and Credit and lower revenue in Currencies & Emerging Markets.

Equity Markets revenue was $2.7 billion, down 12%, against a strong first quarter in the prior year.

Securities Services revenue was $1.1 billion, up 7%, driven by higher rates, partially offset by lower deposit balances and market levels.

Rates was strong during the rally early in the quarter as well as through the elevated volatility in March. Credit was up on the back of higher client flows and Currencies & Emerging Markets was down relative to a very strong first quarter in the prior year. Equity Markets was down 12%, driven by lower revenues in derivatives relative to a strong first quarter in the prior year and lower client activity in cash.

Citigroup Q1 F.I Trading highlights

Taken from earnings call:

Within markets, our fixed income revenues were up 3% from a year ago, we benefited from excellent performance in rates and continued engagement from our corporate clients. The first quarter of 2022 is no slouch, as you may recall, but this quarter was our third best in a decade.

Fixed income business which was up about 4% year-over-year, driven largely by strength in rates and we saw rate volatility in the back end of the quarter and we were well-positioned to take advantage of that and serve clients and that aided getting us to the down for an aggregate across markets.

CEO Jane Fraser - we are the go-to-bank for corporates and that provides a highly attractive but pretty steady flow of activity, this is obviously and the volatile markets we've been seeing is from our perspective very good volatility because we're able to support our clients in rates, FX, commodity hedging.

BlackRock Sells Asset-Backed Bonds From Credit Suisse’s Books - BBG

Extracts - Credit Suisse Group AG has hired BlackRock Inc. to help sell a portfolio of structured bonds for the Swiss bank. BlackRock’s Financial Markets Advisory group has been selling off securities over the last two weeks, including pieces of collateralized loan obligations, commercial mortgage bonds and niche asset backed debt, according to people with knowledge of the matter. Bonds backed by auto, credit card, student and aircraft loans or leases were also included in the lists of securities put up for sale, which included at least $300 million of bonds, said the people, who asked not to be identified discussing private transactions.

*LINKS*

Apollo Credit Market Outlook - Link

Torsten Slok, Apollo - A Default Cycle Has Started

Lagged Fed hikes + elevated inflation + tighter lending standards = volatile markets

60:40 portfolio has bounced back after a tough 2022 - WSJ

YAV Podcast with Caro-Kann Capital LLC re Burford Capital’s Judgement Ruling