13 January 2022 Global Credit Wrap

Risk-on credit rally giving a boost to HY & EM, bond fund flows gather momentum, Fomo building, Bank FICC divisions post blowout figs

*TLDR*

Macro

More dovish Fed speak including Harker hinting at 25bps at next meet

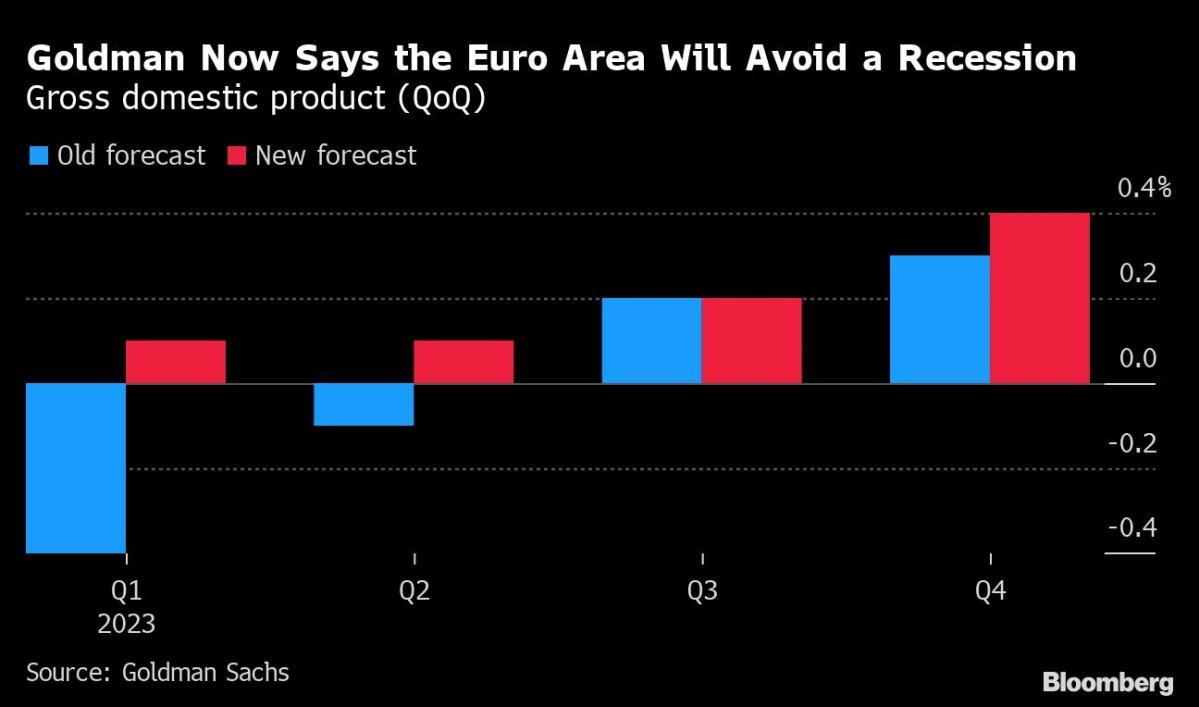

Goldman no longer forecasts Euro area recession

Bond fund flows are gathering momentum, even in EM debt - Bofa charts

Behaviourally, FoMo levels are hitting fever pitch, especially as some accounts try to play catch up with bond ETFs some of which are up 7-10% YTD e.g. PGX (Prefs) +9%, VCLT (Vanguard Long Term Corporate Bond ) +7.2%.

Travel - Several Airlines and Cruiselines report robust booking figures providing hints about consumer spending priorities…

German House Prices Drop for First Time in More Than a Decade

Japanese life insurers sold record amount of foreign bonds in December

Upcoming BoJ meeting is a key risk event, see preview from CityIndex below.

Inflation

Japan's sharp wholesale price rise heaps pressure on BOJ's ultra-easy policy

US December CPI Inflation - Recap

TSMC says chip shortage nearing its end, Tesla cuts prices as much as 30%

Inflation in EMs is mixed, Argentina seeing record inflation, meanwhile in CEE and Turkey inflation appears to be decelerating

Commodities

Copper hits $9,000 per ton for the first time since June 21, 2022

Very cheap Russian oil continues to be on offer to those who can buy it

Financials

Savvy banks flood market with bond issuance to reduce reliance on TLTRO funding, breaking issuance records in the process.

The UK’s PRA sets out its priorities for 2023 for Banks and Insurers

IG

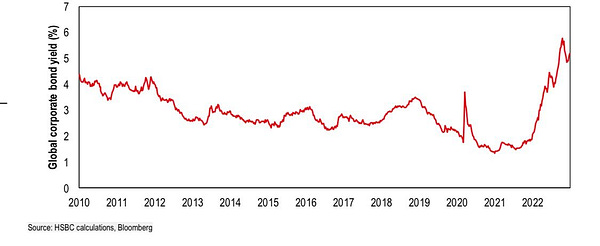

Global IG yields the highest since GFC

Kinks in the UST curve offering interesting opportunities at the short end

Enel re-opens Corporate Hybrid Market by issuing €1.75b of debt, tenders for EUR and USD Corporate Hybrids

European RE firm Aroundtown tender offer for senior bonds

Ryanair CEO sees high single digit air fare rise in 'very strong' summer

Christmas wasn’t too bad for most UK Food Retailers

HY

Risk-on rally and subsequent tight spreads have seen lower rated borrowers with good fundamental backdrops sell bonds/extend maturities with ease (e.g. Royal Caribbean, Transocean, WTI Offshore).

Correlation between Credit total returns & bankruptcies according to BBG Intel

US high-yield distressed ranks soar in 2022 - Pitchbook

Loan Downgrades Reach Pandemic Highs as Fed Hikes Hit Borrowers - BBG

Cruiseline bookings strength from Carnival and Hurtigruten, one Carnival bond is up 11pts YTD…!

American Airlines debt reduction ahead of internally set targets

Virgin Australia may IPO in return to market

Another European RE firm decides to tender for its bonds including Hybrids

EM

EM assets on a tear since end of October 2022 (coincides with China re-opening):

EM HC Bond ETFs returning between 10.5% and 13%

EM LC bond ETF returning more than 13%

EEM up more than 20% vs the low and past 200DMA

EM Govts have raised > $40bn on International Bond Market this year - FT

UAE pledges $3bn loan to help cash-strapped ally Pakistan

Sri Lanka - Worker remittances hit 18-month high in December

RATINGS

Coinbase Downgraded to BB- by S&P

Moody’s affirms Direct Line Insurance Group’s IFRS at A1 changes outlook to negative

S&P upgraded Stena on Thursday from B+ to BB- with a stable outlook

TRADING

Bofa, Citi and JPM report YoY growth in FICC revenues with Bofa posting nearly 50% growth YoY

*NOTABLE MOVES OVER 5D*

Total return to end of 16th January, but many US ETF performance will be 5 day performance to 13th January 2022

Bond ETFs

Main winners - INXG (Index linked Gilts) +4.6%, CWB (Convertibles) +2.5%, FPE (Preferreds) +2.1%, IGLT (UK Gilts) +2.1%, VCLT (Long term Corporate Bonds) +2.0%, EMLC (Local currency EM bonds) +2.0%, PCY (EM HC Bonds) +1.9%, AT1 (Bank AT1s) +1.9%.

Main losers - Magnitude of moves from losers were not as big as those seen in the winners. Main losers were Bond ETFs that are short long dated US Treasuries as well as TIPS ETFs.

Credit Spreads

Tightening in cash credit more evident in the past week suggesting real buying of cash bonds, which correlates with inflows into bond funds lately (particularly in EM).

Credit indices - CDX HY (-27bps tighter). The other major CDS credit benchmarks did not exhibit any large moves.

Cash spreads - Global CoCos (-31bps) and US HY (-30bps), Pan EUR HY (-24bps), EM HY (-18bps) leading the pack in terms of tightening. The large spread tightening in CoCos can be corroborated to the relative ease with which new AT1 issuance is being absorbed and then trading up in the secondary market, indicating meaningful participation in this rally.

*MACRO*

Goldman no longer forecasts Euro area recession via RTRS

Extract - Goldman Sachs said on Tuesday it expects the euro zone economy to grow by 0.6% this year, compared with its previous forecast of a contraction, thanks to a fall in natural gas prices and the reopening of China's borders. "We maintain our view that Euro area growth will be weak over the winter months given the energy crisis but no longer look for a technical recession," Goldman Sachs economists led by Sven Jari Stehn said in a note.

Markets seem to have moved ahead of the GS call as judged by the rally in European Stocks and confidence sensitive banks (e.g. SX7E up ~15% from December ECB meeting and more than 35% vs the late September 2022 lows).

Fed's Harker ready to downshift to 25bps interest rate hikes - RTRS

Extract - Federal Reserve Bank of Philadelphia leader Patrick Harker said Thursday that while the central bank needs to raise rates more to cool off inflation, it can probably do so at a much slower pace compared to the action of last year. “I expect that we will raise rates a few more times this year, though, to my mind, the days of us raising them 75 basis points at a time have surely passed,” Harker said in a speech to a local group in Malvern, Pa. “In my view, hikes of 25 basis points will be appropriate going forward.”

For a more comprehensive coverage of Fed and other CB speak, please check

's weekly outlook.Sentiment check-up via latest BofA bull/bear indicator

The gauge is ticking up, and with it Fomo and exuberance levels from many market participants!

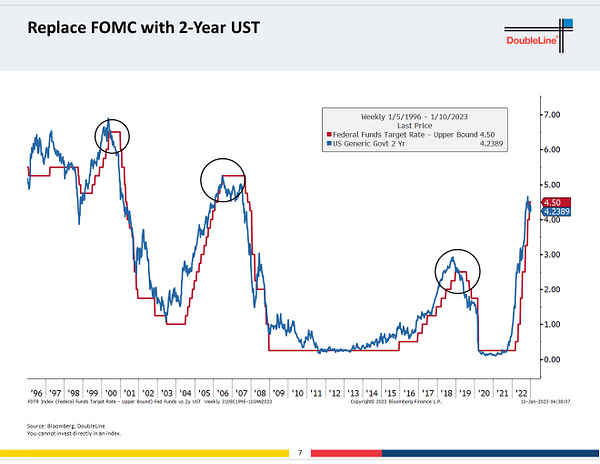

Gundlach: “Pretty obvious the Fed is not in control, the bond market is in control.”

Interesting chart taken from a thread by DoubleLine Capital.

Japanese life insurers sold record amount of foreign bonds in December

Japanese life insurers sold a record ¥2.25tr (US$ 17bn equivalent) of foreign bonds in December according to preliminary Japan MoF data. Sales totalled ¥11.5tr in 2022, an all-time annual high.

Foreign investors sold a net record 10.79tn yen of JGBs in 2022 - Nikkei

Meanwhile, Nikkei reported that: “Foreign investors sold a record 10.79 trillion yen ($82.9 billion) more in Japanese government bonds (JGBs) than they bought in 2022, Ministry of Finance data out Thursday shows, underscoring their role in driving the recent upward pressure on yields.”

BoJ preview for next week - CityIndex

The Bank of Japan meets on Wednesday this week (18th). Although expectations are for interest rates to remain unchanged, traders are speculating that there will be some form of Quantitative Tightening, as the BoJ is reportedly doing a complete review of its Monetary Policy at the meeting. Last month, the BoJ surprised markets by adjusting its Yield Curve Control (YCC). The Central Bank widened the band for the 10-year JGB from -/+0.25% to -/+0.50%. And although Bank of Japan Governor Kuroda insists that this is not QE and the Monetary Policy will remain accommodative, traders aren’t biting. Some have speculated that the BoJ may drop its YCC all together! As a result, traders have been buying Yen since Thursday to stay ahead of any surprises. USD/JPY has sold off nearly 440 pips this week to near 127.70 while GBP/JPY is down nearly 380 pips to 155.89. EUR/JPY is also down 230 pips on the week near 138.25. Recall that after the BoJ surprised markets at the December meeting, USD/JPY was down 520 pips on the day!

German House Prices Drop for First Time in More Than a Decade - BBG

Extract - Germany’s housing boom is over as prices for residential properties dropped for the first time in over a decade. A measure of home valuations fell in December by 0.8% from the same month a year ago, according to data released by the mortgage technology provider Europace AG on Thursday. That’s the first decline in the company’s EPX index for the month since 2009.

*(DIS)INFLATION*

Japan's sharp wholesale price rise heaps pressure on BOJ's ultra-easy policy - RTRS

Extract - The 10.2% year-on-year rise in the corporate goods price index (CGPI), which measures the price companies charge each other for their goods and services, exceeded a median market forecast for a 9.5% gain, Bank of Japan data showed. It followed a revised 9.7% increase in November.

US December CPI Inflation - Recap

CPI came in at -0.1% in December and Core CPI at +0.3%.

The overall inflation rate (YoY % change) moved down for the 6th consecutive month to 6.5%, the lowest level since October 2021.

Core inflation moved down to 5.7%, its lowest level since December 2021.

Core Goods CPI seeing rapid disinflation while core services is taking longer to come down (latter rose in December).

Overall good to see inflation measures coming down, albeit food inflation was higher MoM at +0.3%.

Argentina ended 2022 with 94.8% inflation, highest rate in 32 years - Buenos Aires Times

”Latin America's third-largest economy has been suffering from runaway price hikes throughout the year, though December's monthly figure of 5.1 percent continued a general downward trend since a peak of 7.4 percent in July. In the preceding month, November, inflation totaled 4.9 percent. In a small victory for President Alberto Fernández’s government, the data means that Argentina managed to avoid registering a cumulative inflation rate for last year that ran into three digits. The economy also slightly undershot estimates from the experts – private analysts participating in the Central Bank’s most recent monthly survey of market expectations (REM) had forecast a rate of 5.5 percent for December and an annual rate of 95.5 percent.”

Sweden: inflation rate tops 10% for the first time since 1991 - BBG

Extract - Sweden’s inflation rate reached double digits for the first time in more than three decades in December, as price increases show little sign of abating despite the central bank’s efforts. The CPIF measure of inflation that’s tracked by the Riksbank rose by 10.2% from a year earlier, according to Statistics Sweden. That’s more than the 9.8% expected by economists, while the Riksbank had forecast a rate of 9.1%.

Inflation in Serbia appears to have peaked - BBG

Serbia will probably slow its monetary-policy tightening today as inflation appears to have peaked..note Romania slowed to a 25bps hike earlier this week

TSMC Chief Sees End to Chip Shortage That Hammered Auto Industry

Extract - Taiwan Semiconductor Manufacturing Co. expects a further easing to a chip crunch that’s restricted production in the global automotive industry, including for giants like Toyota Motor Corp. and General Motors Co. The shortage of crucial semiconductors for cars has persisted for over a year. In November, Ford Motor Co. Chief Executive Officer Jim Farley warned about supplies of legacy, or more mature, silicon. Vietnamese electric-vehicle maker VinFast said it was forced to delay rollouts of SUVs in Europe and Canada. “Automotive demand continued to increase and today we’re still probably not supplying 100% of the wafers they want, but it’s improving,” TSMC Chief Executive Officer C. C. Wei told analysts on a conference call. “We expect the shortage to be relaxed quickly. We expect auto shipments to grow again this year.”

Tesla Slashes Prices in bid to Boost Sales - The Verge

Extract - On Thursday night, Tesla revealed…steep price cuts on its lineup of cars, which in some cases amount to as much as 30 percent off when the latest EV tax credits are applied as well.

*COMMODITIES*

Copper hits $9,000 per ton for the first time since June 21, 2022

Negotiations between First Quantum and the Panama government appear to be back on track

First Quantum is a Toronto Listed Copper Miner with operations in Zambia and Panama.

Extract from First Quantum statement - Engagement between First Quantum, MPSA and the Government of Panamá (“the Government”) continues regarding the long-term future of the Cobre Panamá mine. The Company remains ready to reach an agreement that is fair and equitable to both parties.

First Quantum and MPSA are prepared to agree with, and in part exceed, the objectives that the Government outlined in January 2022 related to revenues, environmental protections and labour standards. This includes a minimum of US$375 million per year in Government income, comprised of corporate taxes and a profit-based mineral royalty of 12 to 16 percent, with downside protections aligned with the Government’s position. This minimum payment structure is a benefit to the Government that First Quantum believes is both unique and unprecedented in the mining industry. Under the newly proposed profit-based royalty, the government would receive revenue that is multiple times higher than under both the existing contract and the current Panamá Mining Code. The proposed royalty rates would be amongst the highest, if not the highest, paid by copper miners in the Americas.

Very cheap Russian oil continues to be on offer to those who can buy it

DNO Receives 11 Awards in Norway's APA Licensing Round - Globenewswire

Extract - DNO ASA, the Norwegian oil and gas operator, today announced that its wholly-owned subsidiary DNO Norge AS has been awarded participation in 11 exploration licenses, of which one is an operatorship, under Norway's Awards in Predefined Areas (APA) 2022 licensing round. Of the 11 new licenses, nine are in the North Sea and two in the Norwegian Sea. At yearend 2022, DNO held interests in 69 licenses offshore Norway, of which 16 were operated by the Company.

*FINANCIALS*

Savvy banks flood market with bond issuance to reduce reliance on TLTRO funding

BBG comments that European FIG sector raised the most weekly money ever in the European Bond market (€43bn) in the week closing 13 January 2022. Banco Santander raised €5bn of senior preferred bonds on Monday, the biggest individual bond deal by a bank in the region since GFC.

Notable issuance - Two AT1s from Lloyds Bank and Soc Gen this week

Lloyds Bank and Soc Gen issued AT1s in the week as issuers make use of the very friendly environment for borrowers in the space. A number of AT1s issued during more volatile periods in late 2022 are trading up at reasonable price premiums above par.

The UK’s PRA sets out its priorities for 2023 for Banks and Insurers

Banks - Key priorities are financial resilience, operational risk and resilience, data and financial risks arising from climate change.

Insurance - Key priorities are financial resilience, risk management, implementing financial reforms [particularly to solvency II], reinsurance risk, operational resilience, ease of exit for insurers.

Insurer Beazley launches first cat bond for Cyber threats - Insurtechinsights

Lloyd’s of London insurer Beazley has launched the first cyber catastrophe bond, opening up one of the fastest-growing areas of the underwriting industry to investors as companies and governments seek to shield themselves from ransomware strikes. lloyd's Follow us: Linkedin Twitter Facebook The $45mn private bond will pay out to Beazley if total claims from a cyber attack on its clients exceed $300mn — a structure intended to give some protection to the insurer’s balance sheet from “remote probability catastrophe and systemic events”.

*HY*

This week saw new bond issuance from Offshore and LNG firms

Both Transocean and Venture Global issued in the HY market. Transocean’s new secured bond ($525m notes with 8.375% coupon) was more than 9x oversubscribed according to Creditsights. The blowout success of the new secured RIG bond seemed to open the door to new issuance to other shipping sector names e.g. SFL which announced a new deal roadshow. RIG’s shares are up more than 130% since the lows in September 2022, which is remarkable vs the less pronounced move in the oil price. The rally seemingly has more to do with the beta rally, unwinding of short interest, high day rates, a tight market for offshore rigs and positivity from the recent refinancing.

Meanwhile W&T Offshore sold a $275m HY bond (Caa1/B) at 11.75% which are aimed at redeeming the second lien notes due later this year.

Venture Global LNG, a low-cost producer of North American liquified natural gas sold $1 bn of seven-year notes to yield 6.25%. Venture is rated BB+.

Meanwhile EUR HY markets warming up, taking its cue from the US HY market

This, according to BBG’s HY reporter. As I am writing this I see that Tereos has opened the European high yield market for 2023. Tereos is a cooperative conglomerate, primarily active in the processing of agricultural raw materials, in particular sugar, alcohol and starch markets according to Wikipedia.

Cruiselines - RCL extension of debt facilities + rally in CCL

RCL has extended the maturities of its borrowing facilities. Meanwhile Creditsights research notes that CCL 10.5% 2030s are up 11pts ytd. Carnival reported that P&O Cruises has seen its strongest booking day in its history during the ’wave period’. Carnival said four of its five biggest booking days ever fall in the wave period of 2023. The wave season is a three-month period from January 1 to March 31 when cruise lines historically book the largest number of cabins. Tight HY credit spreads are hugely supportive for frequent users of the debt market like Carnival and RCL.

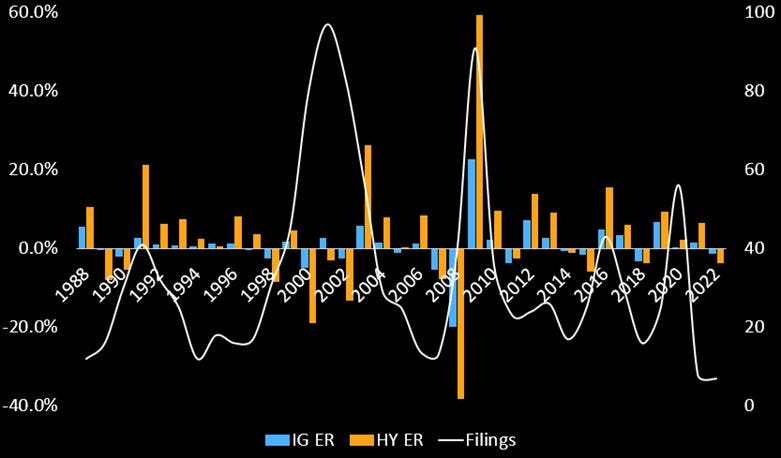

Correlation between Credit total returns and bankruptcy filings - BI Chart

BBG intelligence on correlation between credit total returns and bankruptcy filings:

A year of negative excess returns for each investment grade and high yield credit historically anticipates increased bankruptcy filings in the subsequent 12-24 months. The scale and persistence of the cycle are the primary unknowns, though the size of today's market and long period of relative quiet argue for a potentially higher number of filings and perhaps more elongated cycle than those of the post-financial-crisis era. Filings are large company filings as per the Florida-UCLA-LoPucki Bankruptcy Research Database.

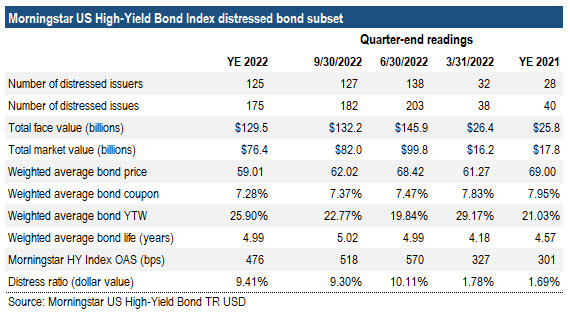

US high-yield distressed ranks soar in 2022 - Pitchbook

Extract - In 2022, the tally of distressed bonds in the Morningstar US High-Yield Bond Index expanded from a mere 40 issues at the start of the year to 175 at year-end, using the measure of distress as bonds marked 1,000 bps or more above Treasuries. Reflecting the underlying economy, energy-sector bonds dominated the list in January, but healthcare bonds led in December…

US CLOs Structurally Resilient Amid Corporate Rating Pressures - Fitch Ratings

Extract - Broadly syndicated loan CLOs under Fitch Ratings’ surveillance showed structural resiliency amid downward rating pressures to issuers in portfolios…Fitch expects net downgrade activity on U.S. leveraged loan issuers to continue amid a tough macroeconomic climate, resulting in deteriorating asset performance outlook for CLOs in 2023.

The fourth quarter was the third in a row to register net downward rating activity in CLO portfolios as measured by Fitch’s Issuer Default Rating (IDR) Equivalency Ratings. There were 58 upward actions outweighed by 145 downward movements, netting 87 negative actions. This has contributed to an increase in exposure to ‘CCC+’ to ‘CCC’ rated issuers in CLO portfolios, though few reinvesting CLOs were tripping excess ‘CCC’ covenants at YE, with exposures largely below the typical 7.5% limit.

Loan Downgrades Reach Pandemic Highs as Fed Hikes Hit Borrowers - BBG Law

Extract - Bond graders are getting increasingly alarmed about US leveraged loan borrowers, signaling that even though the loans have rallied this year there are storm clouds gathering in the market. Loans to junk-rated companies have been getting downgraded at one of the fastest paces in recent months since at least 2011, Citigroup Inc. strategists Michael Anderson and Steph Choe wrote in a note this week.

According to the article, the pace of trailing three month downgrades jumped to the highest since 2020.

Bain Capital explores Virgin Australia IPO as aviation market improves - Euronews

Bain Capital said on Monday it is looking to relist airline Virgin Australia, in a move that would come as the domestic aviation market bounces back strongly from pandemic lows. A listing of Australia’s second-biggest carrier would likely be one of the country’s largest initial public offerings (IPOs) in 2023 after capital markets activity plunged last year amid global financial market uncertainty. “In the coming months we will consider how to best position Virgin Australia for continued growth and long term prosperity,” Mike Murphy, a Sydney-based partner at the U.S. private equity firm, said in a statement. “It is Bain Capital’s current intention to retain a significant shareholding in a future IPO of Virgin Australia.”

Sidenote: Qantas’ share price hit a new 52 week high to begin the week commencing 16 January.

American Airlines debt reduction ahead of internal target, liquidity $12bn at 4Q

Extracts from the Form 8-K:

The Company has achieved more than half of its goal to reduce total debt by $15 billion by the end of 2025, with total debt down more than $7.5 billion in the first 18 months of the program.

Liquidity: The Company expects to end the fourth quarter with approximately $12 billion in total available liquidity, comprised of cash and short-term investments plus undrawn capacity under revolving and other credit facilities

Besides the balance sheet, AAL upgraded its revenue, EPS and net income estimates as per below:

Revenue: The Company expects its fourth quarter total revenue to be up 16% to 17% versus the fourth quarter of 2019, which is higher than its prior guidance of up 11% to 13%.

Adjusted operating margin : The Company expects to report an adjusted operating margin of between 10.25% to 10.5% in the fourth quarter, higher than its previous guidance of 5.5% to 7.5%.

Adjusted EPS : The Company expects to report fourth quarter adjusted earnings per diluted share of between $1.12 and $1.17, compared to its prior guidance of between $0.50 and $0.70

The upgrade to EPS estimates goes counter to the broader thesis of EPS cuts for companies in 2023.

Iceland supermarket bonds trade up 8 points YTD on risk rally/ prospect of lower energy costs

UK Frozen Foods specialist Iceland sees its 2028 bonds trade much higher due to the prospect of cheaper business energy costs in the UK and the risk on-rally in EUR HY.

European RE firm Citycon Oyj announces tender offers for senior and hybrid bonds

Citycon, an owner and developer of urban hubs in the Nordics and Baltics offered to repurchase EUR1.2 bn of bonds. The bonds being targeted are the notes due 2024, and the hybrid capital securities (4.496% perps and 3.625% perps) totaling €1.19b. The deal is intended to deleverage the Finnish real estate group's balance sheet and optimize its debt maturity profile. Source: MT newswires/Citycon. The tender offer follows a trend of Real Estate firms tendering for its debt, in particular Hybrids.

*EM & ASIA*

A strong period for EM Assets

A number of EM indicators are rallying on the back of the re-opening in China and a weak Dollar:

MSCI EM Currency Index +7.9% since end of October, and has closed up every day since December 26th to the 13th of January 2022

EMLC - EM LC bond ETF +13.4% since end of October

EMB - EM HC Bond ETF is +12.7% since end of October

CEMB - EM Corporate Bond ETF is +10.9% since end of October

Not to forget equities, EEM ETF entered a bull market and broke past its 200DMA in January.

EM Govts have raised more than $40bn on International Bond Market this year - FT

Extract - Emerging market governments have raised more than US$ 40bn on international bond markets so far this year, as an easing of global inflationary pressures and hopes of an economic rebound in China clear the way for the fastest January borrowing spree on record. Fourteen emerging market sovereign borrowers raised a total of US$ 41bn from the start of January up until Thursday [12 Jan] , according to data from Dealogic. That far outpaces the early days of any previous January, typically a busy month for debt sales, according to Bank of America strategists — the only year with a larger amount raised across the entire month was 2021 with US$ 48.7bn.

The week saw a number of issuers come to market; Saudi Arabia, Mongolia, Latvia, Philippines and Turkey.

The splurge in issuance seems to be making its way to EM Corporates too with a number of Quasi Sovereigns and Corporates issuing recently too; Ecopetrol, Bank Leumi, Export Import Banks of India and Korea, ICBC, Liberty Costa Rica, Posco and YPF…

Egypt Is Closer to Ending Devaluation of Volatile Currency - BBG

Extract - Egypt’s third major currency devaluation in less than a year appeared closer to achieving its aim, with signs that the foreign-exchange market may be stabilizing despite a whipsawing pound. The North African nation has allowed its currency to weaken in phases and the latest devaluation, which started last week, is finally helping to narrow the gap with prices quoted in the black market.

UAE pledges $3bn loan to help cash-strapped ally Pakistan - Al Jazeera

Extract - The existing loan of $2bn will be topped with an additional loan of $1bn, a statement by the Pakistani prime minister’s office says.

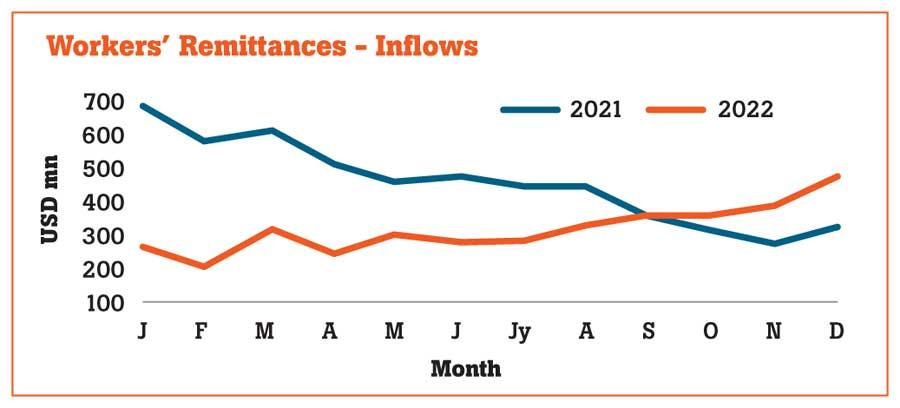

Sri Lanka - Worker remittances hit 18-month high in December | DailyMirror.lk

Extract - Worker remittance income received the typical seasonal pop in December to reach the highest level in eighteen months, continuing the months-long growth streak in Sri Lanka’s key foreign exchange income, but what the country could muster for the year was still sharply down from its previous year’s levels. The data showed that Sri Lanka’s migrant workers had sent US$ 475.6 million as remittances in December, up from US$ 384.4 million received in November.

*IG*

Global IG yields the highest since GFC

Kinks in UST curve see yield on Toyota 2yr bonds offering greater yield than the 5y tranche

-The 2yr fixed rates bonds were priced at 99.545 to yield 5.043% (G+85bps)

- The 5yr fixed rate bonds were priced at 99.934 to yield 4.64% (G+98bps)

Enel issued €1.75b Corporate Hybrid Debt Offering in 2 parts

Enel re-opened the Corporate Hybrid Market with a dual tranche Euro issue and a concurrent tender for some of its USD and EUR denominated Corporate Hybrids.

EUR 1b PerpNC5.5 Variable at MS+348.6, reoffer price par to yield 6.386%

EUR 750m PerpNC8.5 Variable at MS+377.4, reoffer price par to yield 6.633%

European Real Estate firm Aroundtown tender offer for senior bonds

Aroundtown is tendering for two of its senior bonds. According to BBG, Aroundtown invites holders of its 2025 maturity EU700m 1% notes and EU800m 0.625% notes for a cash tender offer. Minimum purchase price is 84.75% and 80.875%, respectively for a total of €300m. The risk on sentiment and the tender offer have seen credit spreads on Aroundtown senior bonds rally strongly, e.g. ARNDTN 1.45 07/09/28 had rallied more than 200bps from the wides seen in December 2022. Meanwhile, Aroundtown’s stock price has risen 62% vs the lows seen in October 2022.

Ryanair CEO sees high single digit air fare rise in 'very strong' summer | RTRS

Extract - Ryanair is expecting a very strong summer season with a reasonable prospect of average European short-haul air fares rising by a high single digit percentage, Chief Executive Michael O'Leary told Reuters on Thursday. Ryanair hiked its profit forecast for the year to end-March earlier in January after a strong Christmas season, meaning it is set to easily top the 1 billion euro ($1.08bn) annual profit it made before two years of COVID-19 losses. "The outlook for the summer at the moment is very strong, strong booking, strong pricing," the CEO of Europe's largest airline by passenger numbers said in an interview after announcing new routes from Italy. O'Leary said bookings over the first weeks of 2023 were strong as well as for the February mid-term and Easter holidays, although pricing for the first three months of the year will be a "little bit softer" than pre-COVID levels before picking up.

Christmas wasn’t too bad for most UK Food Retailers - Retail Gazette

Extract - With January now in full swing, retail giants such as Tesco, Sainsbury’s M&S and Next have unveiled their trading results for the crucial Christmas period. Despite inflation soaring and concerns about waning consumer demand, shoppers splashed out over the festive period. M&S CEO Stuart Machin says: “Customers wanted to celebrate the best they could over the Christmas period.” There were positive performance across the sector with a slew of profit upgrades as total sales across retail jumped 6.9% in December year on year, according to the BRC.

*RATINGS*

Coinbase Downgraded to BB- by S&P

Moody’s affirms Direct Line Insurance Group’s IFRS at A1 changes outlook to negative

S&P upgraded Stena on Thursday from B+ to BB- with a stable outlook

*CREDIT TRADING*

Snippets from Bank earnings call re 4Q Trading performance

JPM - Fixed income was up 12%, as elevated volatility drove strong client activity, particularly in rates and currencies and emerging markets, while securitized products continue to be challenged by the market environment

Bank of America - Sales and trading contributed $3.7 billion to revenue, and that improved 27%. That's a new fourth quarter record for this business.

At $16.5 billion in sales and trading for the year, it marked the best in more than a decade. FICC improved 49%, while equities was up 1% compared to the quarter a year ago. And the FICC improvement was primarily driven by growth in our macro products, while credit products also improved from a weaker Q4 '21 environment.

The continued themes of inflation, geopolitical tensions and central banks changing monetary policies around the globe continue to drive volatility in both bond and equity markets and repositioning from our clients. And as a result, it was another quarter that favored macro trading, while our credit trading businesses improved also spreads fared better than the prior year. Our fourth quarter net income of $650 million reflects a good quarter of sales and trading revenue, partially offset by lower shares of investment banking revenue.

Citi - In markets, we grew revenues 7%, mainly driven by strength in rates and FX, as we continue to serve our corporate and investor clients while optimizing capital. This was partially offset by the pressures in equity markets, primarily reflecting reduced client activity in equity derivatives. On the flip side, banking revenues excluding gains and losses on loan hedges were down 39% driven by investment banking as heightened macro uncertainty and volatility continued to impact client activity.

…Markets revenue up 18% on strength in fixed-income, partially offset by a decline in equity and investment banking revenues down 58%.

In markets, we strengthened our leadership position in fixed-income by gaining share, while making progress towards our revenue to RWA target.