12 May 2023 Global Credit Wrap

$10bn US HY issuance in May alone, EUR HY issuance also notable. Inflation falling in most countries. Iraq said to resume Kurdish oil exports. More European RE Hybrids trading in the 20s..

*TLDR*

MACRO

Why April Inflation Report Reinforces the Fed’s Plans to Pause - Timiraos/WSJ

S&P 500 Q1 Earnings update as at 12 May 2023 - Factset

BofA's Hartnett compares current market to post Bear Stearns period in 2008…

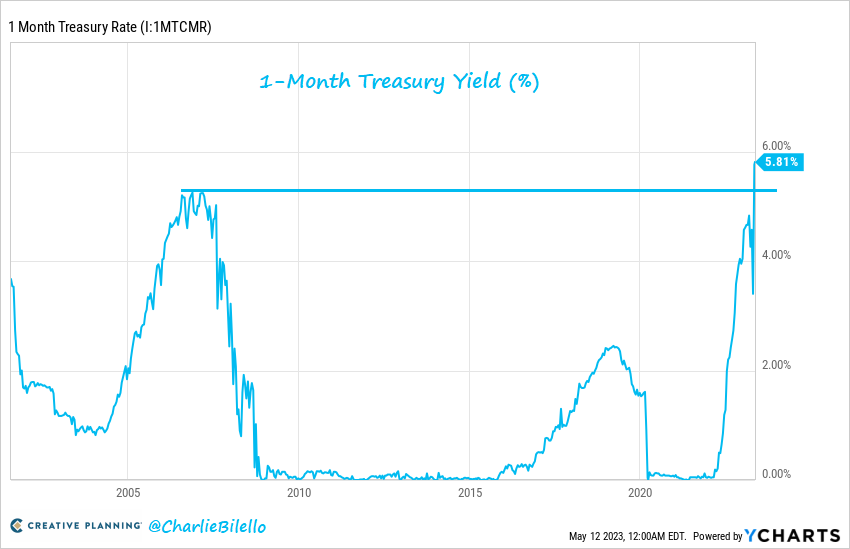

1M T-bill yield has moved up to 5.81%, the highest level since July 2001

Bill Gross Advises Buying T-Bills to Bet Debt-Ceiling Issues Will Be Resolved

US Default Swaps Are Now More Expensive Than Brazil, Mexico

Interest Expense on US Public Debt rose to $828bn over past year, a record

US Small Business optimism comes in at 89 lowest since March 2013

German industrial production fell more than expected in March

China Export data was strong, imports not so much

Unemployment up in American states with large exposure to Banks & Tech

INFLATION

Inflation falling in most nations that posted inflation stats, excluding Norway

AirBNB seeing increasing signs of price sensitivity from consumers

Tyson Foods seeing signs of consumers buying less meat due to expense

COMMODITIES

Copper price at six month low on weak China inflation data

Lithium: Allkem and Livent have announced a $10bn merger

Pakistan Wants To Pay In Chinese Yuan For Russia’s Crude Oil

IG

IG new issuance remains healthy, lots of reverse yankees in EUR IG

Top HF PM Boaz Weinstein warns on tightness of IG spreads, referencing SLOOS

IG news snippets:

Ryanair places its biggest order ever for Boeing aircraft ($40bn)

Ryanair ordered 300 new Boeing 737-MAX-10 aircraft (150 firm and 150 options) for delivery between 2027 to 2033.

Nissan FY earnings tops estimates

Emirates Telecom CEO to Join Vodafone as Non-Exec Director

Telefonica Q1 net profit falls 58% on higher debt costs

BP Capital Markets Announces Debt Tender Offer for EUR notes

Utilities Engie and EON report strong results

HY

HY new issue colour:

EUR HY active included Auto Parts issuers, Green £ Hybrid and Nordic $ Drilling deal @ 9.25%

New convertible bonds for Wayfair and Bloom Energy

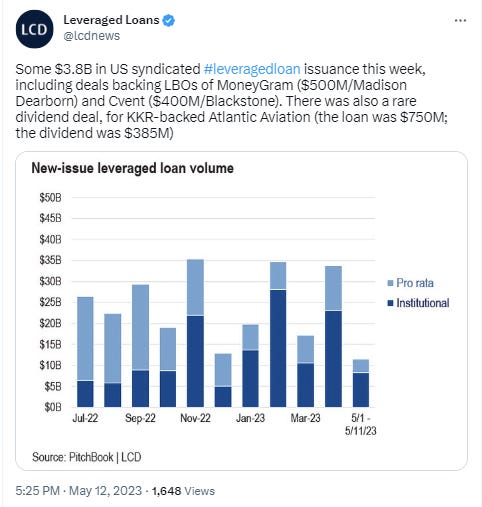

Lev loans saw $3.8bn of issuance

Creditsights maps out how debt ceiling could impact on HY spreads

EUR HY Single B spreads at tightest to BB in last 6 years

HY Snippets:

Activist investor Elliott pushes for changes at Goodyear, has 10% stake in biz

Norwegian Air eyes strong summer

Coinbase’s Ehrsam Reports $50mPurchase of Shares

Occidental Buys Back 6.5% of Warren Buffett’s Preferred Stock

AA Bond Co issued redemption notice for £105m of 4.875% 2024 bonds

Singapore Air: Partial Redemption Offer for S$6.2bn Convertibles

Dish Sees ‘Narrow Window’ to Address Its Growing Financing Needs

Adler announced a tender offer for its 2.125% 24 notes

Golar LNG: Summons for proposed amendment to the unsecured bonds

North Sea firm Harbour Energy Reports 1Q

DISTRESSED

Repeat Bankruptcies Are Piling Up at Fastest Rate Since 2009

KKR owned Envision Healthcare to Consider Bankruptcy Filing

Intercement hires firms to advise on Debt Refinancing

FINS

New issues: Yieldy Senior non-pref from Icelandic, Romanian and Spanish Banks

T2 new issuance:

Rothesay Life came with a T2 ££ deal which saw healthy demand

Klarna Holding SEK500m 10.25NC5.25 Tier 2

DB to accept €1bn of notes in tender offer

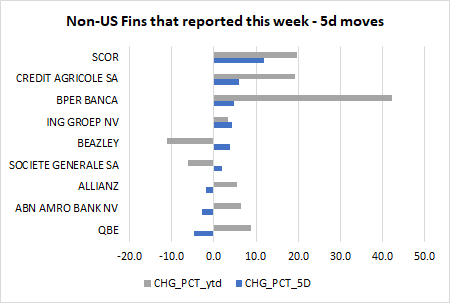

Q1 earnings season continued in European Fins with some big beats being posted

EM

Turkey moves:

Turkey Dollar bonds extend rally ahead of election

Borsa Istanbul Banks Index is up 27% this week

Iraq to resume Kurdish oil exports to Turkey Saturday

South African Rand hit 19.5 vs USD before rallying

Gabon Debt swap follows similar theme as per Ecuador

Kosmos Energy Q1 & Tullow debt principal amortisation

REAL ESTATE

European RE firm Akelius Hybrid bonds jump after call notice

SBB Corporate Hybrids Trade down into 20s on Rating downgrade, divi cut

Brookfield CEO Seeks to Reassure on Property After Defaults

RATINGS

Upgrades/positive outlook changes: Iceland Sovereign, Anglo American, Mondi, Amadeus, Cheniere Energy, WeWork, Las Vegas Sands, Wynn.

Downgrades / negative outlook changes: Alstria, Casino, Egypt, EnQuest

BUYSIDE / PRIVATE CREDIT

Pimco Clients Add €14bn, Ending a Year of Outflows

Many “high grade” borrowers are choosing private credit route according to BBG

TRADING

Trumid Reports April Performance including record HY mkt share

LINKS

Paul Goldschmid of top Credit HF King Street Capital Fireside Chat with BBG

*MOVES OVER 5D*

Credit

Bond ETFs - Advancers: ESG Corps, Aggregate bond funds, JGBs, TIPS, Convertible bonds, EUR HY and Preferreds. Highlighted tickers: SPPU +1.1%, JT13+1.0%, XJSE+0.8%, GAGG+0.7%, IBTS+0.5%, ITPS+0.5%, CWB+0.4%, IHYG+0.3%, EMES+0.2%, PGX+0.2%.

Decliners: Duration, IG Corps, Local EM Bond, China CNY Bonds, US HY. Highlighted tickers: IDTL-1.2%, EDV-0.9%, AGGG-0.7%, CORP-0.7%, EMLC-0.6%, CNYB-0.6%, TLT-0.6%, HYG-0.5%

Credit spreads - Hardly any movement here. Modest tightening (4bps) in Itrax Sub Fin index to 193bps. CDX NA HY widened 4bps to +497bps. In cash spreads, similarly dull movements but EM seemed to tighten ever so slightly (EM aggregate -4bps, EM HY-4bps).

Equities

Japan’s Nikkei making new YTD highs, nearing 30k level

Notable 52w lows/oversold names: Anglo American, BAT, Bally’s, Bumble, Northern Trust, Paramount Global, Southwest Airlines

Notable 52w highs / overbought names: Atlas Copco, Alphabet, Amazon (rose for 8 days straight), Greggs, Live Nation, Mastercard, Melrose Industries, Pulte, Royal Caribbean, Beazer Homes, Ryanair

Large cap cyclicals (e.g. CAT/DE/FCX) having tough time vs Tech YTD

*MACRO*

Why the April Inflation Report Reinforces the Fed’s Plans to Pause - Timiraos of WSJ

Extract - Federal Reserve officials were already leaning toward taking a summer vacation from interest rate increases to see if they have done enough to slow the economy and inflation. Wednesday’s inflation report makes that easier because it showed price pressures aren’t worsening and might soon be slowing as muted growth in rental-housing costs feed through to official inflation gauges.

S&P 500 Q1 Earnings update as at 12 May 2023 - Factset

Extract - To date, 92% of the companies in the S&P 500 have reported earnings for the first quarter. Of these companies, 78% have reported actual EPS above the mean EPS estimate, which is above the 10-year average of 73%. It is also the highest percentage of S&P 500 companies reporting a positive EPS surprise since Q3 2021 (82%). In aggregate, earnings have exceeded estimates by 6.5%, which is above the 10-year average of 6.4%. It is also the highest surprise percentage reported by S&P 500 companies since Q4 2021 (8.1%).

BofA's Michael Hartnett compares current market to 2008 post Bear Stearns period..

“SPX up 11%, Nasdaq up 15% in 2 months after Bear Stearns Mar'08; SPX up 7%, Nasdaq up 10% in 2 months after SVB... recession to crack credit & tech as in '08 but a -ve payroll likely the "buy catalyst" for cyclicals in '23".

1M T-bill yield has moved up to 5.81%, the highest level since July 2001 - Bilello

Bill Gross Advises Buying T-Bills to Bet Debt-Ceiling Issues Will Be Resolved - BBG

Extract - “It’s ridiculous. It is always resolved, not that it is a 100% chance, but I think it gets resolved,” Gross said on Bloomberg Television’s ETF IQ Monday. “I would suggest for those who are less concerned, similar to myself, that they buy one-month, two-month Treasury bills at a much higher rate than they can get from longer-term Treasury bonds.” Rates on short-dated bills have soared ahead of the so-called ‘X-date’ early next month, after Treasury Secretary Janet Yellen warned last week that the government could run out of cash as soon as June 1. Anxiety that Congress will fail to lift the debt ceiling on time has manifested in the highest yields ever at last week’s four- and eight-week bill auctions, while Monday’s three-month sale offered the loftiest rate since 2001.

US Default Swaps Are Now More Expensive Than Brazil, Mexico - BBG

Interest Expense on US Public Debt rose to $828bn over past year, a record - Bilello

US Small Business optimism comes in at 89 lowest since March 2013 - BBG

The National Federation of Independent Business optimism index decreased by 1.1 points to 89, the group said Tuesday. A gauge of owners’ sentiment about future business conditions slipped to a four-month low, while a measure of sales expectations was the weakest since August.

That contributed to a pullback in business investment. Less than one in five firms said they’re planning capital outlays — such as spending on new equipment and expanded facilities — in the next few months, the smallest share since the onset of the pandemic.

US Small-Business Sentiment Stumbles to Decade Low | Flagging optimism prompts firms to reconsider capex plans

Only a net 3% of respondents said it was a good time to expand. While a touch better than the prior month, the share is still among the smallest on record.

German industrial production fell more than expected in March - RTRS

German industrial production fell more than expected in March, partly due to a weak performance by the automotive sector, spurring again recession fears in Europe's largest economy. Production decreased by 3.4% on the previous month following a slightly revised increase of 2.1% in February, the federal statistical office said on Monday. In a Reuters poll, analysts had pointed to a 1.3% fall.

China Export data was strong, imports not so much - RTRS

Inbound shipments to the world's second-largest economy fell 7.9% year on year in April, extending the 1.4% decline seen a month earlier, while exports grew 8.5%, easing from the 14.8% surge in March, customs data showed on Tuesday.

Unemployment up in states with Banks & Tech

Useful pictorial representation of a trend that most market participants are already aware of.

*INFLATION*

Sovereign inflation:

China’s inflation cools to 0.1%, its slowest pace in two years - CNN

German Inflation Softens but Energy Price Inflation Reignites - FXEmpire

UK Food Prices Replace Energy as Top Inflation Concern for BOE - BBG

Czech headline inflation lowest in a year - RTRS

Norway CPI comes in higher than expected

*NORWAY APRIL CONSUMER PRICES RISE 6.4% Y/Y; EST. +6.1%

*NORWAY APRIL UNDERLYING CPI RISES 6.3% Y/Y; EST. +6.1%

EU’s Fastest Inflation Slips as Hungary Eyes Rate-Cut Cycle - BBG

Danish Inflation Rate Drops Most in Decades as Wage Risks Remain - BBG

NETHERLANDS FINAL APRIL HARMONIZED CPI RISES 5.8% Y/Y; EST. +5.9%

Corporate inflation:

Airbnb earnings call: Call pointed towards elements of price sensitivity across consumers - RTRS

Tyson Foods shares plunged 16% to a 3 year low after earnings report showed signs that cash-strapped shoppers are cutting back on meat spending in a high-inflation environment - RTRS

Solar Silicon Prices Tumble in Longest Losing Streak Since 2012 - BBG

China’s Top Steelmaker Cuts Product Prices on Sagging Demand - BBG

Good chart here from BofA’s Hartnett in which he attributes poor approval ratings to high levels of inflation:

*COMMODITIES*

Copper price at six month low on weak China inflation data - Mining.com

Extract - The copper price hit the lowest since November on Thursday after inflation data from China added to concerns over the strength of the country’s economic recovery. China’s consumer prices rose at the slowest pace in more than two years in April. Producer deflation deepened last month, highlighting the broader economy’s struggles after the lifting of covid restrictions in December.

Lithium: Allkem and Livent have announced a $10bn merger - Jack Farchy

…to create what could one day be the world's 3rd largest producer.

Pakistan Wants To Pay In Chinese Yuan For Russia’s Crude Oil - Oilprice.com/BBG

If Pakistan were to pay for Russian Barrels without using Dollars in the future it could further change the historical correlation between the US Dollar and the Oil price…

Extract - Cash-strapped Pakistan hopes it can pay for future Russian crude oil deliveries in Chinese yuan, Pakistani Minister of Power, Khurram Dastgir Khan, told Bloomberg in an interview published on Wednesday.

Pakistan has so far ordered just one crude oil cargo from Russia, expected to arrive this month.

Pakistan expects to receive in May its first cargo loaded with discounted Russian crude after placing its first order for oil from Moscow under a new bilateral deal, Pakistan’s Petroleum Minister Musadik Malik told Reuters at the end of April.

The payment for the first cargo of Russian oil was made in U.S. dollars.

Pakistan is desperate to import energy at low costs after it was outspent on the market last year when oil and gas prices surged while its foreign exchange reserves dwindled. The country has a currency swap with China, which would make it easier to pay for crude than using the little U.S. dollar reserves it has.

“We hope that if this becomes a long-term arrangement, it’ll become a rupee and Chinese currency transaction,” the Pakistani minister Khan told Bloomberg, commenting on the imports of Russian crude oil.

*IG*

IG new issuance

EUR IG printed ~40bn of issuance in the week consisting of a lot of “reverse yankee” issuance (US companies issuing in EUR). Issuers that came to market included L’Oreal, AT&T, Honeywell. Part of the reason for issuing in Euros could be the strong technical as highlighted by analysts at BBG Intelligence who pointed out a huge net negative supply of IG bonds (particularly BBBs) in April in EUR IG.

Top HF PM Boaz Weinstein warns on tightness of IG spreads, referencing SLOOS

He later goes onto subtweet that he is positioned for wider credit spreads.

IG News / Earnings Recaps:

**Ryanair places its biggest order ever for Boeing aircraft - CNN**

Ryanair has agreed to buy 150 new Boeing 737-10 aircraft, and taken options on 150 more, inking the largest order ever placed by an Irish company for US manufactured goods.

The deal is worth $40 billion at list prices, Ryanair (RYAAY) said in a statement Tuesday, which contained none of the sharp criticism that CEO Michael O’Leary has previously leveled at Boeing because of delays in delivering aircraft the airline had ordered.

The planes, the largest of Boeing’s (BA) 737 Max aircraft, will be delivered between 2027 and 2033. Europe’s biggest budget carrier said the purchase will help it grow passenger numbers from 168 million in the year to March 2023 to 300 million by March 2034.

Sidenote: Ryanair hit a new 52w high this week.

**Nissan tops estimates - RTRS/Nissan**

Full year operating profit of 377.1 billion yen, up 52% year on year

Positive free cash flow and operating profit in the automotive business for the full year

Forecast 38% increase in operating profit for fiscal year 2023 compared to fiscal year 2022

Nissan expects 38% full-year profit rise on stronger sales outlook, based on expectations of almost 30% sales growth in both North America and Europe. However, in the key Chinese market the forecast was far less upbeat, at just 8%.

A positive contribution to the upbeat forecast also comes from a better outlook for materials prices.

**Emirates Telecom CEO to Join Vodafone as Non-Exec Director**

**Telefonica Q1 net profit falls 58% on higher debt costs - RTRS / BBG**

Company raised prices in Spain an average of 6.8% in January

Churn rate in Spain was lowest in eight years despite hikes

Spanish telecoms firm Telefonica disappointed the market on Thursday with a 58% drop in first-quarter net profit from the same period a year ago as the company was unable to raise prices in line with costs.

The company said its net profit fell to 298m euros, while overall revenues rose 6.7% to 10.05bn euros. Core earnings fell 2.4% to 3.12bn euros.

The company managed to raise prices in most Latin American countries and Britain where fees are tied to inflation and raise prices on some products elsewhere, but costs such as labour and IT equipment often rose faster than prices, Chief Operating Officer Angel Vila said in an interview.

"We managed to pass on almost all (cost increases), but we had a profit margin erosion of about one percentage point," he said. The company also recorded a 19% increase in interest payments during the first quarter to 667m euros and booked a 200m euro capital gain in the first quarter of 2022 on the sale of telecom infrastructure in Colombia.

**BP Capital Markets Announces Debt Tender Offer**

BP tendering for 10 of its Euro denominated senior bonds.

**Utilities Engie and EON report strong results**

High power prices boost Engie earnings in first quarter - RTRS

Energy giant now assumes it will end up towards the upper end of the guidance ranges for adjusted group EBITDA, adjusted net income, and EPS -DPA

EON hit a 52w high during the week.

**Grainger Plc reports H1 - Grainger**

Extract - Grainger plc, the UK’s largest listed residential landlord and leader in the build-to-rent sector, today announces a continuing strong performance for the six months ended 31 March 2023. Grainger’s £3.1bn operational portfolio totals c.10,000 homes with a further c.6,000 homes in our £1.6bn build to rent investment pipeline.

Highlights:

Consistent strong performance and excellent outlook: planned doubling of EPRA earnings over next 4 years

▪ Net rental income +12%

▪ Dividend per share +10%

▪ Like-for-like rental growth +6.8%

▪ EPRA NTA robust at 310pps

▪ Occupancy 98.5%

▪ Low cost of debt fixed for c.6 years.

*HY*

New HY issuance

US HY issuance running at around $10bn so far in May.

Euro HY - Some interesting issuance with Eramet (Mining & Mettalurgy), Dana Inc (Auto Parts) and Adler Pelzer (Auto parts) came to market. In the GBP market, Utility : Vattenfall raised £250m of 60.25NC5.25 Green Hybrids at 6.875%. The Nordic market saw HY bond issuance for Odjfell Drilling which raised $390m in a 1st lien bond issue with a coupon of 9.25%.

Some further observations from Luke Millar of LCD here in his tweet:

Bumper wk of HY supply. Swathe of reverse yankees & deals testing risk appetite. What caught the eye is spread over govvies. Crown, Ford, Eramet pay v little extra spread than 2018-2020. Others like Dana are. But for quality BBs, rise in cost of debt is purely interest rate move. And while interest costs are rising, making refinancing until need to unappealing, the stampede of BBs in recent months is because more CFOs have come to terms with the fact they are not having to pay up hugely in spread terms and are accepting the new IR environment.

Banco Santander priced a subprime auto loan deal of $1.033bn, having previously pushed back the transaction following the collapse of Silicon Valley Bank according to Global Capital.

In the convertibles space, online furniture store Wayfair issued $600m convertible senior notes due in 2028, and will bear interest at a rate of 3.5% per year. Separately Bloom Energy raised $550.0m (upsized) of 3.00% green convertible senior notes due 2028.

Lev loans saw $3.8bn of issuance - LCD

How debt-ceiling worries could play out in HY Market: CreditSights |Marketwatch

Good article, from top Credit Research firm Creditsights:

Extract -“While the U.S. has gone through many rounds of debt-ceiling roulette in the past decade, 2011 marked a particularly contentious battle in which Congress allowed extraordinary measures to be used right up until the day Treasury thought it could run out of cash leaving it unable to pay its obligations,” the analysts said.

High-yield bond spreads are “the most susceptible” to debt-ceiling-related pressure, they said, estimating that spreads on junk bonds rated CCC are at risk of widening toward 1,500 basis points, as they did in September 2011. Bonds rated below BBB by S&P are below investment-grade.

Investment-grade spreads may fare “somewhat better,” particularly for bonds that are higher up the credit-rating spectrum, the CreditSights analysts said.

EUR HY Single B spreads at tightest to BB in last 6 years

Activist investor Elliott pushes for changes at Goodyear, shares jump - RTRS

Extract - Activist investor Elliott Investment Management L.P. disclosed a large investment in Goodyear Tire & Rubber Co on Thursday and said it wants the company to strengthen its financial position by refreshing the board, selling its stores and conducting an operational review. Elliott holds a 10% stake in the 125-year-old company, making it one of Goodyear's biggest investors. The investment firm, which manages $55 billion in assets, is proposing that five new directors join the 12-member board. Advertisement · Scroll to continue

Goodyear can use proceeds from selling the store network to pay down debt, improve its balance sheet and financial flexibility, Elliott said in a letter to the board, which it made public. All of Elliott's proposed changes could boost Goodyear's stock price about $21 to the low-$30 range, it said. On Thursday afternoon, the stock jumped 19% to $14.05. Over the last five years the stock has fallen 47%, with a 50% loss in 2022.

Norwegian Air eyes strong summer - RTRS

Consistent message from European Airlines re strong demand for air travel, repeated at Norwegian Air. Extract - Norwegian Air (NAS.OL) is expecting one of its strongest summer seasons ever, but is concerned a shortage of Danish air traffic controllers could lead to problems, the budget airline said on Friday. The comments, which came as the company reported a loss for its seasonally weaker first quarter, chime with those of rivals as airlines see a surge in demand in the wake of the pandemic but fret about a repeat of last year's disruption at airports.

Other HY news snippets

Coinbase’s Ehrsam Reports $50 Million Purchase of Shares - Blockworks

Occidental Buys Back 6.5% of Warren Buffett’s Preferred Stock - BBG

AA Bond Co issued redemption notice for £105m of its 4.875% 2024 bonds, leaving £127m.

Singapore Air: Partial Redemption Offer for S$6.2b Convertibles

Dish Sees ‘Narrow Window’ to Address Its Growing Financing Needs - BBG

Extract - Dish Network Corp.’s Chairman Charlie Ergen sees a “narrow window” to address the company’s capital structure, which includes $14.7 billion of distressed debt that has been sliding further into troubled territory for the past few months.

Adler announced a tender offer for its 2.125% 24 notes

Golar LNG: Summons to written resolution – Proposed amendment to the unsecured bonds, supported by the majority of bond holders

Harbour Energy Reports 1Q, highlights:

Net debt reduced from $0.8 bn at year end to c.$0.2 bn at the end of March.

The potential to be net debt free in 2024 is unchanged.

Significant liquidity of $3.1 bn, as at quarter end, although its debt capacity is expected to be impacted by the EPL at the upcoming annual re-determination of our borrowing base.

*DISTRESSED*

Repeat Bankruptcies Are Piling Up at Fastest Rate Since 2009 - BBG

Extract - Akorn is one of 12 firms this year to seek bankruptcy protection for a second or even third time after initial attempts at court-supervised rehabilitation failed. So-called Chapter 22 filings — industry slang for repeat bankruptcies — are piling up at the fastest rate since the Great Recession, according to BankruptcyData.

Envision Healthcare to Consider Bankruptcy Filing - BBG

More distressed debt activity in the healthcare space..

Medical staffing firm hires restructuring lawyers, bankers

Company squeezed after pandemic halts elective procedures

Envision Healthcare Corp. has hired restructuring advisers and is contemplating a bankruptcy filing after the Covid-19 pandemic halted elective surgeries and left the company struggling to manage the $7 billion of debt from its 2018 leveraged buyout, according to people with knowledge of the matter.

The KKR & Co.-backed company, one of the largest physician staffing firms in the U.S., has already been holding back pay for doctors, and it has struggled to convince its bondholders to take a haircut in exchange for a new loan that would pare its debt load.

Sidenote, Fierce Healthcare reported that: “Babylon Health, a digital primary care provider, plans to be taken private as it continues to be saddled with mounting losses. The company entered into a funding agreement with AlbaCore Capital LLP that will provide up to $34.5 million in interim funding to provide liquidity to support Babylon’s ongoing operations. As part of a longer-term plan, which includes restructuring the company's debt, the agreement will support Babylon's plans to be taken private. “

Intercement hires E. Munhoz Advogados & Houlihan to advise on Debt Refinancing

Extract of statement -São Paulo, May 10, 2023 – InterCement Participações S.A. (“InterCement” or the “Company”) announces the engagement of advisors to support it in the assessment of alternatives for its capital structure.

Despite the excellent operating performance in recent years, allowing InterCement to reduce its leverage substantially and to be among the highest EBITDA margins for cement companies worldwide, the need for adjustments in the Company’s capital structure remains.

Also weighing on this decision is the adverse macroeconomic scenario that persists in Brazil and Argentina, the Company’s main markets. These markets have been suffering from a combination of high interest rates and inflation, as well as restrictive foreign exchange regulations in Argentina and low GDP growth in Brazil. Therefore, the Company has not been able to complete its refinancing plan, despite continuous efforts since June 2022.

InterCement has retained E. Munhoz Advogados and Houlihan Lokey as its advisors, in order to support the Company in advancing an overall constructive solution to address its capital structure.

*FINS*

Fins New issuance & Tenders

There were three new senior issuances for smaller European Banks this weekend:

Abanca Corp Bancaria raised EUR 500m of 3NC2 Sr prefs MS+22 to yield 5.63%, rated Baa3/BBB-/

Islandbanki issued 300m of 3 year senior prefs at 7.375%, rated BBB.

Banca Comerciala Romana EU 700m 4NC3 Senior Non Pref at a reoffer price of 7.625% in Euros for an IG rated issuer Baa2/BBB+

Pension Insurance specialist Rothesay Life came to market with a £500m issue: ROTHLF 7.734% 2033 T2 sub bond (G+375). Books were above £1.45bn. Issue is rated BBB+ (Fitch). Sticking with the T2 theme, Klarna Holding raised SEK500m 10.25NC5.25 in a Tier 2 FRN at Par.

DB said it is to accept to buy €1bn of notes in tender offer.

Q1 earnings season continued in EUR Fins, big beats keep coming

The week was characterized by better than expected results from the likes of Credit Agricole, Soc Gen, ING, Beazley and SCOR. I don’t know BPER Banca well but its stock is up 42% YTD.

*EM*

Turkey Dollar bonds extend rally ahead of election

Turkish $ bonds have rallied strongly ahead of the election on May 14th. Most of this has been down to falling inflation from the highs and was given a further bump when the withdrawal of Muharrem Ince which is said to boost the chances of Erdogan's presidential challenger, Kemal Kilicdaroglu.

Source: BBG

Iraq to resume Kurdish oil exports to Turkey Saturday - France24

Extracts - Baghdad (AFP) – Iraq's oil minister said Thursday that crude exports from the autonomous Kurdistan region to Turkey would resume on Saturday, hours after a deal was finalised following years of dispute.

On Thursday the Kurdish authorities said in a statement that "the Kurdistan regional government and the federal authorities have reached a (final) deal on the resumption of oil exports".

Hours later, Iraqi Oil Minister Hayan Abdel Ghani said crude exports would resume from Saturday.

Baghdad's State Oil Marketing Organization (SOMO) "informed the Turkish company Botas of the resumption of export operations... as of Saturday May 13", Abdel Ghani said in a statement.

South African Rand hit 19.5 vs USD before rallying - RTRS

The South African rand pared losses on Friday after officials said the country had not approved any arms shipment to Russia late last year, but the currency remained vulnerable to a fresh selloff after a turbulent week on domestic markets. The currency has been pummelled this week by investor concerns over the worst power cuts on record, and a U.S. allegation that a Russian ship had picked up weapons in South Africa in December.

Bank of America to Lead $500 Million Debt Swap for Gabon - BBG

These types of deal are becoming more popular, I believe there was something recently related to Ecuador and the Galapagos. Could be a good avenue for other single B and lower rated EM nations that are finding it difficult to fund themselves via the “regular” bond market.

Extract - Bank of America Corp. will arrange a $500 million debt swap for marine conservation in Gabon, as these types of deals gain in size and popularity, according to people familiar with the planned transaction.

The deal, due to be announced in July, will involve The Nature Conservancy, a US-based conservation nonprofit, said the people, who declined to be identified. Until now, Credit Suisse Group AG has dominated this market, having run similar debt conversions for Belize, Barbados and Ecuador.

African Oil Companies Recap - Tullow Oil and Kosmos Energy

Tullow Oil to prepay $100m of its 2026s 1st liens at $100 + accrued and unpaid interest. Prepayment date 15th May; Eligible holders as of 14th May. Those particular bonds are trading in the high 70s currently.

Kosmos Energy reported 1Qs, cash & debt highlights as follows:

Kosmos exited the first quarter of 2023 with approximately $2.3bn of total long-term debt and approximately $2.1bn of net debt and available liquidity of approximately $1.0bn.

The Company generated net cash provided by operating activities of approximately $204m and free cash flow of approximately $(20)m in the first quarter.

At the end of the quarter, the company completed its semi-annual re-determination of the RBL facility. As expected, the borrowing base decreased by ~$100m, effective April 1, due to the reduction in loan life.

Looking at the 5y stock performance of the two names, Tullow definitely seems to be the poorer cousin of the two..

*REAL ESTATE*

European RE firm Akelius Hybrid Bond Price Jumps after it Plans Early Repayment

Akelius Residential is a $6bn market cap firm listed in Stockholm. According to Wiki, Akelius Residential Property AB is an international residential real-estate company registered in Sweden. Akelius Residential Property owns nineteen thousand rental apartments in New York, Boston, Washington D.C., Austin, Toronto, Montreal, Ottawa, Quebec City, Paris, and London.

Its AKFAST 3.875% 2078 hybrid bonds callable July 2023 were called which sent these hybrids 4 pts higher

Based on an article in BBG, “Not calling would have gone against expectations at issue: CFO” and they “chose to repay a hybrid bond early because that was the honorable thing to do.”

Sweden’s SBB Corporate Hybrids Trade down into 20s on Rating downgrade, divi cut

SBB’s Corporate Hybrids joined the unfortunate list of Corporate Hybrids (that are still paying) yet trading at 20 cents in the Dollar or equivalent.

The new development included the company being downgraded to junk by S&P. That was subsequently followed by a dividend cut and then a halting of its rights issue. This saw its corporate hybrid trade down from the high 30s into the high 20s.

The week ended on a slightly more positive note after SBB said it would sell shares in property developer JM for the equivalent of $270m.

Other key stats on the name (from BBG):

Current equity market cap of ~$1bn equivalent

SBB has an $8bn debt load

As at 10 May, 29% of SBB’s free float was out on loan (short interest)

Brookfield CEO Seeks to Reassure on Property After Defaults - BBG

Some interesting extracts below, but the full earnings call is really worth a listen if you want to hear some more reassuring comments re the RE sector from a key player in the sector, extracts below:

CEO Flatt says defaults not material to huge real estate business.

‘Our reputation in the capital markets sets us apart,’ he says.

Brookfield Corp. Chief Executive Officer Bruce Flatt sought to quell investor concerns about commercial real estate, saying its properties are soundly financed and that higher interest rates will have little adverse impact.

The alternative-asset manager defaulted on mortgages on office buildings in Los Angeles and around Washington, but Flatt said the problems are “discrete to those assets” and not material to the Toronto-based firm’s huge real estate business.

“When you own 7,000 properties, it is impossible not to make a few mistakes,” Flatt said in a letter to investors Thursday that accompanied first-quarter results. “But we have always prided ourselves on being an extremely responsible borrower, and our reputation in the capital markets sets us apart.”

The company has completed $12 bn of office financings since March 2020 and has minimal debt maturing this year, he said — and “the rates coming due on mortgages are in many cases similar to those that are expiring.”

The turmoil in US regional banks may create opportunities for Brookfield to buy real estate debt at attractive prices, Brian Kingston, head of the real estate business, told investors on a conference call. Such deals may result in Brookfield taking ownership of the asset or “it may just be acquiring debt and earning a good risk-adjusted return,” he said.

Interest rate hikes have driven unrealized losses on securities for US banks, and concern about the health of the commercial real estate sector has only added to the pain. But in many cases, the property loans are performing and there’s nothing wrong with the underlying collateral, Kingston said. “The distress is with the current owner of that loan and that’s what’s creating the pricing opportunity.”

*RATINGS*

SOV

Italy Affirmed at BBB by Fitch

Denmark Affirmed at AAA by Fitch

Bulgaria Affirmed at BBB by Fitch

Sweden Affirmed at AAA by Fitch

Israel Affirmed at AA- by S&P

Fitch Affirms Bulgaria at 'BBB'; Outlook Positive

S&P Raises Iceland Outlook to Positive From Stable on Strengthening Economy

IG

Anglo American Outlook to Positive by Moody's

X-S&PGR Upgrades Mondi PLC To 'A-'; Outlook Stable

S&PGR Upgrades Amadeus To 'BBB/A-2'; Outlook Stable

HY

Moody's assigns CFR and senior secured instrument ratings of B2 to Odfjell Drilling Ltd.

S&PGR Rates Odfjell Drilling Prelim 'B+'; Prpsd Bond Rted 'BB'

CHENIERE ENERGY MAY BE RAISED TO INVESTMENT GRADE BY MOODY'S

S&P Revises EnQuest PLC Outlook To Negative; 'B' Affirmed

Casino Downgraded to CCC- by S&P, May Be Cut Further

Alstria Office Outlook to Negative by S&P; L-T Rating Affirmed

WeWork Upgraded to CCC- by Fitch

Las Vegas Sands Outlook to Positive by S&P; L-T Rating Affirmed

Wynn Resorts Outlook to Positive by S&P

EM

Ecuador Affirmed at B- by S&P

Moody's places Egypt's B3 ratings on review for d/g

Egypt Downgraded to B by Fitch, Outlook Negative

Moody's Downgrades Kenya's Rating to B3 From B2

Jordan Affirmed at BB- by Fitch

*BUYSIDE / PRIVATE CREDIT*

Pimco Clients Add €14 Billion, Ending a Year of Outflows - BBG

Pacific Investment Management Co. saw outside clients add money in the first quarter, after a year of withdrawals fueled by a global bond market rout.

Many “high grade” borrowers are choosing private credit route according to BBG

I would debate whether Barca is an investment grade borrower, but someone can tell me otherwise in the comments section…!

Extract - Ferrero Group SpA, football club FC Barcelona and a Middle Eastern port have all used the US private placement market in recent weeks — a sign that this opaque way of raising money is becoming increasingly popular.

*CREDIT TRADING*

Trumid Reports April Performance including record HY mkt share - PRWEb

Trumid, the a challenger in the all-to-all credit trading arena reports April stats:

Extract - Trumid continued to be a trusted source of liquidity in April, with reported average daily volume (ADV) of $3.1B, up 54% year-over-year and record overall market share, up 63% versus April 2022.

Momentum from the first quarter continued in April with over 1,000 users trading on the platform for the fourth consecutive month. Healthy activity across Trumid’s Anonymous, Attributed Trading (AT), and Portfolio Trading protocols drove 37% growth in the daily number of users executing a trade last month.

Trumid had record high yield market share in April, up 57% year-over-year. Outperformance was driven by record user participation in high yield all-to-all trading.

*LINKS*

Paul Goldschmid of top Credit HF King Street Capital Fireside Chat with BBG

mate pls release a new version