10 February 2023 Global Credit Wrap

2 year UST now at 4.5%, more sticky inflation for nations and corporations, US HY bonds coming with 6s and 7s coupon handles, EM bond rally stalling, earnings snippets from Apollo, CS calls

Summary:

The Fed's other voters were wheeled out this week to subtly walk back some of J Powell's dovish tones from the last Fed meeting. They succeeded for now and have pushed up the terminal rate as well as the yield on the 2 year Treasury to 4.5% compared to a February low of 4.03%. In Germany the 2 year yield hit the highest since 2008.

Inflation prints from nations and corporates paint a picture of stickier inflation. There are bright spots such as Germany where inflation is falling but it seems to be a rarity in terms of data. The US Labor Dept revised up the consumer prices data for December.

Earnings season is highlighting the shift of consumer demand from goods to services. Shipping liner Maersk warned of lower profits in 2023 after bumper years in 2021/22. Meanwhile, travel and leisure firms are reporting robust demand and profits, e.g. Royal Caribbean, Hilton and Hertz.

There are a number of signs of increased corporate confidence - heightened M&A activity, return of dividend recaps in EUR HY, US HY bond deals coming at yields of 6/7%. Looser financing conditions may make it easier for certain companies to come out of bankruptcy as might be the case with Cineworld Ch11, where there seems to be some visibility around constructive solutions.

EM bond rally is stalling somewhat due to the rise in US yields, strengthening Dollar, idiosyncratic factors at single B sovereigns and distressed exchanges. Some China property HY bonds are weakening after a face-ripping rally since back end of 2022. Meanwhile, Bankers are trying to get China Property companies to return to the bond market…

*TLDR*

NORTH AMERICA MACRO

US 2 yr yield hit 4.5% which is 50bps off the Feb '23 low.

German 2yr yield rose to 2.77%, highest since 2008

More evidence of shift from goods (e.g. Maersk) to services (e.g. RCL/HTZ/HLT) this week from corporate reporting

Goldman Sachs cuts U.S. recession odds to 25%

OTHER DM MACRO

UK GDP - GDP print showed no technical recession. House prices stabilised (in January) according to Halifax data.

Lloyds Bank CEO says mortgage arrears are still very stable

The UK Gilt market might be made more accessible to retail investors

INFLATION

Revisions show U.S. consumer prices a bit firmer than previously reported by Labor Dept

Economist Steno sees US CPI coming in light next week

Breakeven rates in UK/Germany/Canada/Italy ticking up

Some big inflation prints in DM and EM Sovereign space

However, German Inflation Slows to Five-Month Low

China core CPI rises as China reopens, PPI remains in deflation

Scottish National Party (SNP) calls for 20% cut to energy bills

UK Housebuilders, Ralph Lauren, Unilever, Carlsberg talk about inflation..

Food inflation continues to be a big culprit of sticky inflation

Redfin data: US rents showed smallest increase since May 2021

UK’s Ofcom to review inflation-linked, mid-contract price rises

COMMODITIES

First Australian Coal Shipment to China in 2 years set to dock

Oil price got a much needed boost after Russia said it will cut production in March

Tanker / oil services stocks to the moon YTD

Positive credit ratings trajectories on mega cap oil firms

IG

Credit positioning in the US market is no longer short - BNP Chart

IG new issues - Intel printed $11bn across 7 tranches despite prior week's downgrades

Big week for M&A announcements with over $60b of potential transactions

UK Telcos tendering for debt this week, BT issued new bonds

Nokia upgraded to IG by S&P

Maersk warns lower container volumes to hit 2023 profits

Industrials - Siemens raises FY guidance after strong Q1

Other earnings updates from BP, VW and Unibail Rodamco

FINANCIALS

3 AT1s issued - ING, Julius Baer and BankInter

Monte Paschi CFO says no new AT1/T2 this yr

Credit Suisse earnings / capital highlights

Brookfield Reinsurance $1.1bn acquisition of Specialty Insurer and Reinsurer Argo

Blackstone to Become No. 1 in CLOs With AIG’s $3.6 Billion Deal

Hannover RE achieves significantly better prices and conditions in 1 Jan 2023 renewals season

HY

10 US HY bonds sold totaling nearly $7bn in the week to COB Thursday

Travel/Leisure companies are issuing (AAL/RCL/WYNN)

AAL also completes $1bn TLB refinancing

Yields on HY bonds are coming tighter than in prior months, e.g. latest tranche of Nielsen HY bond sold at 9.7% vs 11% in Nov-22

Banks continue to offload “hung loans”

EUR HY - Seeing signs of froth returning with 1st dividend recap done for an issuer in a long while

Hilton stock climbs toward 9-month high as leisure and business RevPAR exceed pre-pandemic levels

AMC - Has bought back total of $365m of debt since start of 2022

Cineworld - Possible roadmap to coming of out Chapter 11 emerging

Healthcare sector debt distress - articles from BBG and Pitchbook

Some positive noises in UK Housebuilders’ trading updates

Royal Caribbean shares move higher post strong guide on bookings, CEO sees robust demand from financially healthy customers

EM

Mexico’s Banxico Stuns Markets With Big Hike to Tackle Inflation Woes

Adani recap for the week ended 10 Feb

China Property issuer Wanda comes back second time, talk of China Property bond market re-opening

Some Single B EM Sov bonds lot weaker this week - E.g. Ecuador/Egypt and China HY rally taking a pause

Brazilian Airline announces complex financing transaction

Sri Lankan Airlines bond - Event of default

BUYSIDE

Apollo earnings call snippets

Aurelius Distressed Debt Funds Gain 44.8% on Cineworld, Ukrainian Telecom

Third Point publishes Investor letter, affirms allocation to asset backed and corporate credit

Pershing square investor presentation - shows how much they made on Interest rate swaption trade..

TRADING

EU Consolidated Tape - One firm collaborating with the big bond trading platforms on a solution

Earnings highlights from Tradeweb, Flow Traders, and FICC desks at Soc Gen/BNP/CS

RATINGS

A number of updates from Sovereigns and Corporates this week

*MOVES*

Govt bonds

2 year Treasury hit 4.5%. 2yr bottomed at around 4.03% on 2nd of Feb this year. Recent cycle high has been 4.8%. With short dated “risk free” assets yielding this much, bound to put pressure on other more riskier assets

US 2s10s Weekly curve inverted to new low and the lowest since the early 1980s. Curve inversion was helped on by the new 10y bond issued in the week.

German 2yr yield rose to 2.77%, highest since 2008

Market Inflation expectations as judged by breakeven rates are rising in a number of markets during the week:

UK 10yr breakeven rate rose to 5 week high

German 10 yr breakeven inflation rate hit 5 week high

Canada 10 yr breakeven inflation rate hit 3 month high

Italy 10 year breakeven inflation rate hit 9 week high

Credit - Moves over 5 days

CDS - General widening trend across all major credit indices. Xover+31bps, CDX HY +23bps, CDX EM+17bps. Xover back up over 400bps.

Cash bonds - Widening trend here too besides European HY which was 8bps tighter on the week. Widening led by US HY (+29bps) and EM HY (+26bps). EM HY USD spreads at 666bps(!). US IG started to widen out too (only 3bps).

Looking at single names, there have been some big moves in the long end during the week with some EM single Bs seeing some big shifts down. E.g. Ecuador longer bonds have lost between 8 and 10 points and Egypt long dated bonds (2030 onwards) have lost around 5pts on the weeks. Both have been impacted by separate idiosyncratic news flow (Lasso referendum loss and Egypt downgrade) into a weakening market (due to sell off in US Treasuries). Also notable that some China HY names have run into some resistance after a face-ripping rally from late 2022, e.g. some Country Garden $ bonds down around 5pts on the week.

Bond ETFs

Winners - Less winners than losers this week in the Bond ETF space. Winners largely limited to inverse long dated Treasury strategies, Japanese Bond ETFs and Short term TIPs Funds. TTT+7.7%, TMV+7.7%, TBT+5.1%, XJSE+2.6%, JT13+1.5%, TIP5+0.3%, VTIP+0.3%

Losers - Longer dated strategies sold off the most this week led by long dated Treasuries, EM, Inflation linked and Investment Grade Credit. Highlighted moves: EDV -3.5%, VCLT -2.8%, IGLB -2.5%, BLV -2.4%, TLT -2.4%. EMBE -2.1%, XGIN -1.9%, LQD -1.8%, PCY -1.6%, INXG -1.6%, JNK -1.5%

Equities over 5 days

Major Indices - Spain’s Ibex touched Feb. 2020 Closing High as Banks, Travel pushed higher. Meanwhile FTSE100 hit a new record and could look at making a push at 8000!

Airlines weakened after a sustained period of strength while energy stocks rallied on mix of positive sentiment from BP results and talk of Russia cutting production. Examples; JETS ETF -5.3%, IAG (Int’l Consolidated Airlines Group -6.7%, Wizz Air -8.25%. Meanwhile BP+15% in the week.

Some China re-opening friendly sectors were softer, e.g. Metals and Mining. E.g. Anglo American -5.5%, First Quantum -7%, Glencore -7.6%. Note that Gold names held up better due to bid for Newcrest (which was up 10% on the week). Even insurers exposed to China weakened (Prudential Plc -5.6%)

YOLO and Cinema names softer, e.g. AMC -19% on the week, Coinbase -23% on the week.

REITs and US Home Construction weaker - Big losing streaks for likes of Home Depot/Lowe’s stocks. Some big US Homebuilders down generically 3-5%. European REITs Vonovia and Aroundtown down between 4.5% and 7%.

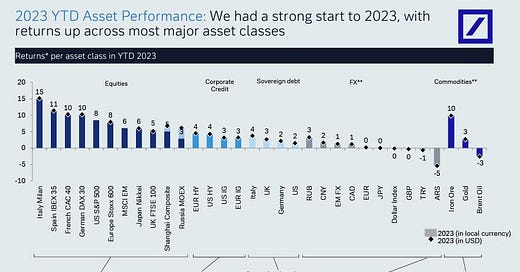

DB posted a nice YTD asset performance chart up to 7 Feb 2023

Performance led by equities in peripheral Europe - Italy, Spain then followed by France and Germany. In the bond space, there are gains across IG and HY credit. Iron ore price ripping on China re-opening.

Source: James Wong on Linkedin

*NORTH AMERICA MACRO*

Fedspeak tone this week - hawkish

The tone from pretty much all the Fed members this week (Bostic, Kashkari, Waller, Williams was all hawkish). The message seems to be that more work needs to be done on getting inflation down towards target. Were they tasked with walking back Fed Chair J-Powell’s dovish tones last week? Maybe. Read FXMacro’s weekly outlook to get a deep dive of key fed commentary.

Fed: yesterday, Richmond Fed's Barkin continued the hawkish tone of recent FOMC speeches, as he emphasized that Fed has its 'foot unequivocally on the brake'. In addition, Atlanta Fed's Wage Growth Tracker remained unchanged at 6.1% in January, supporting the view that labour market conditions still remain too tight. Markets' focus is already turning towards the key January CPI print next week, where we are looking for an uptick in both headline (0.5% m/m) and core (0.4% m/m) terms.

Curve inversion hits new extreme

The US 2-year yield exceeded the 10-year yield by the widest margin since the early 1980s on Thursday, surpassing its December 2022 extremes. As has been well documented by economists, fintwits and the financial press this has been a strong indicator of an upcoming recession.

Big rise in short term yields

The hawkish narrative and the presence of sticky inflation across many parts of the globe saw 2 year UST hit as high as 4.5% and the 3 year get above 4.0% again. Charlie Bilello summed up something similar regarding the one year Treasury:

Credit spreads vs senior Loan Officer Survey

This time it’s different? Unlikely.

Goldman Sachs cuts U.S. recession odds to 25% on strong labor market - RTRS

GS were early to upgrade Europe’s economic forecasts and have been right so far, could they be right about the US too?

Extract - Goldman Sachs said on Monday it now sees a 25% probability of the United States entering a recession in the next 12 months, down from a previous 35% forecast. "Continued strength in the labor market and early signs of improvement in the business surveys suggest that the risk of a near-term slump has diminished notably," the bank said in a research note. The updated forecast follows an employment report on Friday that showed U.S. job growth accelerated sharply in January while the unemployment rate hit more than a 53-1/2-year low of 3.4%, pointing to a stubbornly tight labor market.

BOC: Tiff Macklem bolstered his case for holding Canadian interest rates | BBG

Extract - In his first speech since declaring a conditional pause on rate increases, Macklem said it can take 18 to 24 months to see the full effects of higher borrowing costs. Policymakers, he added, want to avoid overtightening. The central bank’s benchmark rate has risen from 0.25% to 4.5% since March.

Layoffs ticking up but not as much as January 2023.

Other non-tech jobs related headlines I noticed this week:

EY Cuts Hiring Target by 60,000 (from 220k) for the twelve months to July 2023

Disney Cuts 7,000 Jobs in $5.5 Billion Restructuring

Credit Suisse intend to cut the total headcount from around 52,000 and 2022 to 43,000 over the next three years

JPMorgan Cuts Hundreds More Mortgage Workers

Travel / leisure company earnings confirming trend in economic data (goods into services)

This week saw a number of T&L companies report: Uber, Hertz, Hilton, Royal Caribbean to name a few. Each of them posted better than expected earnings, here are some key themes to come out of their earnings:

Hertz Earnings call - Looking back on Q4, the quality of our earnings was driven by solid execution and a strong market. Demand exceeded seasonal expectation across our leisure business, and corporate activity proved strong which was beneficial to midweek utilization.

…the inbound business, which is a very profitable business for us, okay, has been up quite considerably. In fact, the momentum we're seeing carrying into this first quarter, if you just look at the month of January, international inbound was up 56% year-over-year, so comparing January as against January. And that business continues to sort of play very strong. In fact, it played strong even through year-end when, in fact, foreign exchange would have suggested otherwise. So it just suggests to you the strength of demand of travel by non-U.S. customers who are coming to the United States. So very strong, and the momentum is carrying forward into January kind of as an early indicator on where we are on the year.

One last point on corporate I would raise with you and that is, if you look at the pattern of corporate demand, it too is changing for the better for us. Meaning, over the course of 2022, we saw an increase by about 20% for about 1.5 days to the duration of a corporate rental. That means that people are keeping that car longer.

It wasn’t all rosy for travel names with Lyft falling by 36% in one day after reporting earnings.

Hilton stock climbs toward 9-month high as leisure and business RevPAR exceed pre-pandemic levels - Marketwatch

Extract - Shares of Hilton Worldwide Holdings Inc. hiked up toward a nine-month high Thursday, after the hotel operator reported fourth-quarter profit that more than doubled and beat expectations, amid continued strength in leisure and a steady recovery in business travel. “We’ve navigated through the most challenging times our industry has experienced and are deep into recovery throughout the world,” said Chief Executive Chris Nassetta on the post-earnings conference call with analysts, according to a FactSet transcript. He said revenue per available room, or RevPAR, for leisure, business transient and group guest segments all exceeded levels seen in 2019, as higher pricing helped offset occupancy that at 67% was just three percentage points below the below the pre-pandemic peak.

I discuss Royal Caribbean in more detail in the HY section later.

*OTHER DM MACRO*

Japan - PM expected to recommend surprise candidate

Extracts from Japan Times:

In a shocking twist just days before an official announcement, Prime Minister Fumio Kishida is expected to recommend economist Kazuo Ueda as the next Bank of Japan governor, media reports said Friday, four days after it was reported that Deputy Gov. Masayoshi Amamiya had been the government’s pick.

Krisjanis Krustins, director of sovereign ratings for the Asia-Pacific region at Fitch Ratings, said Monday the next governor “will likely have to balance the goal of achieving the BOJ’s inflation target against the negative spillovers of ultraeasy monetary policy, and potential risks around any policy tightening.”

The early reaction has been a strengthening of the Yen. Meanwhile, the BoJ said it would extend five-year loans against collateral to financial institutions for the third time since January in order to cap yields, according to press reports.

The Japanese market continues to be of interest to the wider financial markets due to their hugely contrasting monetary policies to the rest of the world and their impact on assets in US/Europe.

UK

UK GDP shrunk in December more than expected (-0.5% vs est of -0.3%) but was in line with expectation for QoQ and YoY.

Demand for workers accelerated in the UK in January for the first time in nine months according to REC and KPMG (BBG).

NIESR predicts that the UK will swerve a recession but real personal disposable income contraction over four consecutive quarters will make it feel like a recession for many. It goes on to predict that 1 in 4 households will be unable to pay their energy and food bills in 2023. .

In UK property news, Halifax house price data showed stabilisation in January after the drop in December. The UK RICS survey of house prices index worsened to -47 in January from -42 in December, falling to its lowest reading since 2009. Price expectations were negative for the next 12 months everywhere except Northern Ireland. UK mortgages were set for the slowest year since 2011, while Lloyds Bank CEO Nunn was in front of the Treasury Select Committee this week, where he told them that mortgage arrears are still very stable. UK banking CEO’s were also quizzed on why they were not passing on the benefit of higher interest rates to its savers. An extract from this moneyweek article summed it up quite well:

“variable-rate mortgage holders were paying over 4% interest at the end of 2022, up from 2% at the start of the year, according to Bank of England data. But the interest earned by savers with fixed-rate cash ISAs only rose from 0.5% to 1% in the same period.”

In a related topic, the UK Government seems to want to open up access to the UK Gilt market to Retail Investors. It is already open to retail investors but its not exactly a “click and deal” service like what they have in the US (Treasury Direct). A rates strategist at Natwest Markets suggested that the Treasury “could raise up to £70 billion from households and short-dated bills. The more likely outcome is more in the range of £40 billion to £50 billion.” Looking at where short dated Bills and Gilts trade, they appear to offer more than a regular UK Bank account / ISA:

Europe

German IP closed 2022 weaker than expected, declining 3.1% MoM which was mirrored in the weaker than expected initial GDP print for Germany. A lot of the weakness seemed to be driven by industries impacted by higher energy costs the most

Sweden’s house prices continued their fall in January. BBG states that prices have declined for 10 months due to higher rates.

OZ - Australia’s RBA hiked 25bps to a 10 year high of 3.35%, which is the highest since 2012 and the ninth consecutive hike. The RBA’s commentary was more hawkish as it said “it expects that further increases in interest rates will be needed over the months ahead to ensure that inflation returns to target and this period of high inflation is only temporary.”

*COMMODITIES*

First Australian Coal Shipment to China in 2 years set to dock | BBG

As part of the China re-opening, the nation appears to want to heal relations with other major nations like the US and Australia.

Extract - China’s trade relations with Australia showed concrete signs of thawing with coal shipments resuming after more than two years, and hopes of a return of lobster and wine sales. Bulk carrier Magic Eclipse was anchored off the southern port city of Zhanjiang on Thursday morning, according to Bloomberg shipping data. It’s carrying metallurgical coal mined in Australia that’s destined for the Chinese market. Zhanjiang is a center for steel production in China.

Oil price got a much needed boost after Russia said will cut production - RTRS

Extract: Russia will cut oil production by 500,000 barrels per day, or around 5% of output , in March, Deputy Prime Minister Alexander Novak said on Friday, after the West imposed price caps on Russian oil and oil products. The price of Brent crude rose on the news of the output cut from Russia, the world's second-largest oil exporter after Saudi Arabia, increasing by more than 2.5% on the day to $86.6 per barrel. "As of today, we are fully selling the entire volume of oil produced, however, as stated earlier, we will not sell oil to those who directly or indirectly adhere to the principles of the 'price cap'," Novak said in a statement. "In this regard, Russia will voluntarily reduce production by 500,000 barrels per day in March. This will contribute to the restoration of market relations."

Shipping guru, J Mintzmyer highlights his trade in Tanker stocks

Other parts of the oil services complex has seen similarly large gains YTD:

Valaris +15% YTD

TDW +21% YTD

Transocean +61% YTD

This compares to XLE (Energy Select Sector ETF) which is basically flat on the year. Note however that BP had a strong run following its results and is in fact +14.9% YTD.

Positive ratings trajectories on mega cap oil firms BP and Total Energies

BP’s outlook was raised to Positive by S&P; long term rating affirmed. Meanwhile, according to Bloomberg, Total Energies said it will focus on strengthening its balance sheet as it eyes the kind of credit rating enjoyed by US oil and gas titans Exxon Mobil Corp. and Chevron Corp. The French energy company is rated A+ by S&P Global Ratings, while its two American rivals are marked higher at AA-. Total hopes that by improving its rating, it will attract more investors and boost the value of its shares.

*INFLATION*

A number of European nations reported higher than expected inflation

Czech Jan. Consumer Prices Rise 6% M/m, Est. +5.8%

Norway Jan. Consumer prices +7.0% Y/Y; EST +6.5%

Hungary Jan. Consumer Prices +25.7% on Year; Est. +25.2%

Food inflation in Hungary hit 44.8% YoY in December - ING

Extracts of article:

…new reality that consumers had to adapt to higher food prices as food inflation in December accelerated to 44.8% YoY.

the biggest surprise came from the second-hand goods shops, where the monthly turnover increased by 31.1% in volume. In our view, this is another by-product of the extremely high inflationary pressure as consumers are shifting to buying second-hand goods with record haste.

Redfin data: US rents showed smallest increase since May 2021

Extracts - The median U.S. asking rent rose 2.4% year over year to $1,942 in January—the smallest increase since May 2021 and the lowest level in nearly a year…That’s roughly one-sixth the pace of January 2022, when rents were up 15.6% from a year earlier. Rent growth is cooling because of slowing demand and growing supply. Demand has slowed due to still-high costs (rents remain 22.5% higher than they were in January 2020), inflation, widespread economic uncertainty and slowing household formation.

German Inflation Slows to Five-Month Low on Energy Aid | BBG

Extract - German inflation slowed in January to the lowest level in five months thanks to further government aid to ease the burden on households from soaring energy costs. Consumer-price growth eased to 9.2% from 9.6% in December, Germany’s statistics agency said Thursday.

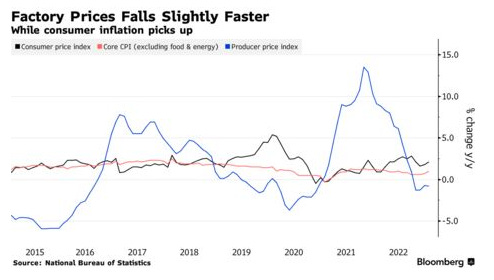

China’s Consumer Inflation Picks Up as Recovery Gathers Pace | BBG

Extracts:

Consumer inflation, core CPI picks up as China reopens

PPI remains in deflation, declining at more-than-expected 0.8%

The consumer price index rose 2.1% from a year earlier, the National Bureau of Statistics said Friday, up from 1.8% in December and matching the median estimate in a Bloomberg survey. Core inflation, which doesn’t include volatile food and energy prices, rose to 1% — the highest since June — a sign of stronger demand in the economy. Producer deflation deepened in January, with prices falling 0.8% from a year earlier, largely because of softer commodity costs. Economists surveyed by Bloomberg had expected a 0.5% decline.

Philippine inflation beats expectations, lifts chance of bigger rate hike | RTRS

Philippine annual inflation blew past expectations in January to reach a fresh 14-year high on surging food prices, raising the chance of the central bank delivering a larger interest rate hike to tame prices when it meets this month. The consumer price index (CPI) rose 8.7% in January, the statistics agency said on Tuesday, well above the 7.7% forecast in a Reuters poll and topping the 8.1% rate in December, when the central bank had expected prices to peak.

Reserve Bank of India (“RBI”) Sees FY24 India Inflation at 5.3%, Above 4% Target

RBI’s DAS went onto state that the stickiness of core inflation is a “matter of concern.” Note however that the RBI slowed its pace of increases of rate hikes for the second month in a row. ING had a more detailed write up on the RBI meeting and hike.

Other nations seeing higher than expected inflation readings - Egypt + Taiwan

Taiwan’s Jan. Consumer Prices Rise 3.04% Y/y; Est. +2.7%

Egypt Jan. Consumer Prices Rise 25.8% Y/y; Rise 4.7% M/m

UK’s Ofcom to review inflation-linked, mid-contract price rises - Commsupdate

Extract - UK telecoms regulator Ofcom has launched a review to examine whether inflation-linked, mid-contract price rises give subscribers of both fixed and mobile services ‘sufficient certainty and clarity about what they can expect to pay’. In a press release regarding the matter, Ofcom said it was concerned about the degree of uncertainty consumers face about future price rises specified in contracts on the basis of inflation.

Scottish National Party (SNP) calls for 20% cut to energy bills - Yahoo

Extract - The SNP has called on the UK Government to slash energy bills by at least 20% this year, claiming “households are being forced to pay through the roof for Westminster failures”. Ofgem, the independent regulator for the British energy market, confirmed the energy-price cap – which changes every three months – rose by 20% to £4,279 in January this year. UK households are, however, shielded by the UK Government’s Energy Price Guarantee (EPG), which limits how much the typical household pays for its wholesale energy, reducing the average annual bill to £2,500. In April this year, however, this limit is set to rise to £3,000. SNP Westminster leader Stephen Flynn has called on the UK Government to instead cut energy bills by 20% from April as the wholesale price of gas falls.

Barcelona, Madrid Propel Spanish Rental Rates to Record High - BBG

BBG comments that rents have increased for 11 straight months with supply tight. Further extracts: Rents in Spain have jumped to record levels, as gains in the country’s two largest cities help the country buck the downward trend across much of Europe’s real estate markets. January rents in Barcelona soared 25% from a year ago and jumped 12% in Madrid, according to data published Monday by Idealista.

Surprise Used-Car Price Jump Adds to Fed’s Inflation Worries | BBG

Exract - A surprise jump in used-vehicle prices last month is adding to US car buyers’ frustration and has the potential to dent hopes inflation is headed lower even as the Federal Reserve hikes interest rates. The 2.5% rise in average used-vehicle prices in January from December retraced some of last year’s 15% decline, according to data from Manheim. The prices at auctions tracked by the company often are a bellwether for the new-car market, so consumers have had reason to believe automakers and dealers will start discounting vehicles that have never been so expensive.

Carlsberg Warns Consumers May Drink Less Beer Amid Inflation - RTRS

Extract - "2023 will be another challenging year," Chief Executive Cees 't Hart said in a statement. "While beer historically has been a resilient consumer category, the higher prices in combination with generally high inflation may have a negative impact on beer consumption in some of our markets, particularly in Europe," he said. Brewers have raised beer prices in response to rising energy and raw material costs. Carlsberg said its revenue per litre of beer sold grew 9% last year, and that it would have to raise prices by a "high single-digit" percentage this year to cover rising costs.

Unilever - Snippets on Inflation from its Q4

ULVR lowered its forecast for cost inflation for the first half of 2023 from €2bn to €1.5bn and said rises in input costs would be “significantly lower” in the second half. It also stated that it pushed up prices to consumers by 13.3% in 4Q2022.

UK Housebuilders comment on persistent build cost inflation in the UK

Bellway: Build cost inflation persists across the sector, particularly where energy forms a large component of the cost base, although, Bellway’s strong commercial disciplines and renegotiation of terms with its supply chain partners have helped to offset some of these pressures.

Barratt Developments: underlying house price inflation, estimated at around 8.8% was largely offset by total build cost inflation at around 10%

Ralph Lauren Corp. will continue to raise its average retail prices | BBG

Extract …Although at a more moderate pace than during the past couple of years, the company’s chief executive officer said. The 10% average price increases at Ralph Lauren in the most recent quarter didn’t dissuade shoppers, Chief Executive Officer Patrice Louvet said in an interview Thursday.

Meanwhile competitor Capri doesn’t seem to be faring as well:

Aramark, US Food services company trades down 10% partly due to persistent food inflation

$10bn equity market cap Aramark saw its stock trade down double digits after citing persistent inflation issues, with food inflation being the main culprit. Food has been one of the items with the stickiest inflation in a number of regions in the most recent inflation data in Europe, Mexico, the UK as examples. Extracts Aramark’s earnings call re inflation:

we remain focused on managing our cost structure and maximizing unit efficiencies coupled with pricing to counter persistent inflation

we are encouraged by the continued signs of stabilization within the global supply chain that have allowed us to begin to gradually transition back to preferred sourcing programs where possible and appropriate. This has helped partially mitigate rising food costs due to persistent inflation that we continue to experience during the quarter.

I don't think that for the balance of the year, we really are going to be looking at much of a softening of the inflation, the food inflation.

Revisions show U.S. consumer prices a bit firmer than previously reported - RTRS

Extract - U.S. monthly consumer prices rose in December instead of falling as previously estimated and data for the prior two months was also revised up, which some economists said raised the risk of higher inflation readings in the months ahead. The consumer price index edged up 0.1% in December rather than dipping 0.1% as reported last month, the Labor Department's annual revisions of CPI data showed on Friday.

Steno sees a lower than expected US inflation print this coming week

Fair play to Andreas Steno Larsen for making a call on the upcoming US inflation print. He sees readings coming in at 6.1% and 5.3% for headline and core, respectively vs BBG consensus expectations of 6.2% and 5.5%. Check out his thread below:

*IG*

Credit positioning in the US market is no longer short - BNPP

IG New issue market

Was a week dominated by TMT with offerings from T-Mobile, BT, Vodafone, Intel. Intel brushed aside multiple ratings agency downgrades to print $11bn across 7 tranches after receiving north of $40bn of orders. In a departure from the recent trend, Intel had to offer decent investor concession to issue bonds (~17bps).

Telcos Vodafone and BT tendered for existing debt and issued new debt. Vodafone issued in long dated Dollar bonds and BT (British Telecom). BT issued an 8yr EUR and an 18yr GBP bond providing further evidence of investor appetite for duration.

Meanwhile in Europe, recently rising star (upgraded to IG rating) Nokia is looking to raise an 8.5 year SLB in Euros.

Noticeable tick up in M&A activity (over $60bn this week)

That is before the inclusion of the deal (no-deal) by First Abu Dhabi Bank for Standard Chartered.

Maersk warns lower container volumes to hit 2023 profits - RTRS

Extracts:

Sees 2023 underlying EBITDA of $8-11 billion

Down from a record $36.8 billion in 2022

CEO concerned about new ships coming to market in H2'23

CEO see no signs of price war yet in ocean shipping

Siemens Raises Full-Year Guidance After Strong First Quarter - RTRS

Siemens is a large industrial bellwether and their positive update provides evidence for a stronger economy than what a lot of indicators are suggesting. Extracts:

Industrial business reports strongest ever quarter

Siemens boosted by record backlog of 102 billion euros

Raises full year sales growth outlook

CFO says company has built up stocks to meet demand

Unibail Rodamco - Reduced net debt by €1.9bn in the year

The debt reduction was driven mainly by disposals. No meaningful insight was provided regarding the call on its hybrid other than: “The Group will make a decision regarding its call option ahead of the first Reset date in October 2023 and we'll provide an update at the full year -- at the half year results.”

Volkswagen pre-released its Q4 numbers

Some key line items appeared to come in lower than expected

4Q22 operating profit of €5.0bn was c.20% below consensus of €6.3bn

Auto Net Cash flow for the FY came in at around €5.0bn, below the company's target of ~€8.6bn.

The news seemed to be a bit of a non-event for its stocks and bonds.

BP earnings - cashflow / debt highlights

At the end of the Q4, net debt was $21.4 billion, compared with $22.0 billion at the end of the 3Q22 and $30.6 billion at the end of the 4Q21.

Reduced debt for the 11th quarter in a row

Operating cash flow in the quarter was $13.6 billion including a working capital release

BP announced with 4Q earnings it was "leaning-in" to its legacy businesses, increasing the long-term capex, production, and earnings guidance for oil and gas.

CFO:“If you go back to 2020, our balance sheet wasn't as strong as it is now. So we've got a much stronger balance sheet. We've improved our position with the ratings agencies. It gives us the capacity to invest more, to drive more returns for shareholders”

CFO: “40% of surplus to debt reduction and continued focus on growing EBITDA so that we can get that cash flow from operations over expanded debt down.”

BP came with a new issue this week ($2.25bn of 10yr bonds at +112bps) and its stock had its best week in 2 years.

*FINANCIALS*

New issue markets in financials

This week saw mild issuance again. Notable issues included AT1s from Julius Baer, ING and Bankinter. In senior, Investec tapped its 1.875% 2028 GBP bond (£200m Tap at UKT+330) and Virgin Money issued 500m Euros of 5.75NC4.75 paper (VMUK 4.625% 2028). Separately Monte Paschi’s CFO accounted it has no plans to issue AT1/T2 notes this year. No further AT1 calls this week, but this recap from CreditSights was useful:

Bank Earnings this week

A largely positive week for Banks again in terms of reporting. Bank credit seemed to be more supported than stocks which showed some dispersion in performance. Equity investors appeared to be disappointed in CS (big outflows) and SocGen (lower than expected distribution). Whereas ABN’s figures were received very well (big beats on NII, PBT and CET1 ratios vs consensus).

Standard Chartered’s shares were volatile due to the “will they/won’t they” situation with First Abu Dhabi Bank.

CS highlights:

P&L appeared to be largely in line with consensus estimates.

Capital: CET1 of 14.1% and leverage ratio of 5.4% which were both reasonable.

Nice comment below re capital coupon payments:

The AUM outflow was where the market was less impressed as there were CHF110.5bn ($119 bn) of outflows in the quarter which represented 8% of 3Q2022 AUM, CS stated that 2/3 of these outflows were in October 2022 (precisely the time the market bottomed!).

In terms of headcount, CS commented on the earnings call:

We intend to cut the total headcount from around 52,000 and 2022 to 43,000 over the next three years. We have already achieved a 4% reduction in the fourth quarter 2022 and we intend to continue to reduce third-party costs, including spending on contractors and consultants in a targeted and decisive manner.

Insurance / Re-insurance news snippets

Brookfield Reinsurance’s expansion continues with $1.1bn acquisition of Specialty Insurer and Reinsurer Argo - Reinsurance News

“Hannover RE achieves significantly better prices and conditions in 1 Jan 2023 renewals and further increases profitability of the business “- Earnings release

UK Specialty Insurer Lancashire updated the market - Lancashire reported strong premium growth and strong capital position but surprised the market somewhat with larger amount set aside for direct claims resulting from the war in Ukraine - Insurancebusinessmag.com

Blackstone to Become No. 1 in CLOs With AIG’s $3.6 Billion Deal - BBG

*HY*

US HY / Lev Loan New issue market

According to BBG there were 10 US HY bonds sold totaling nearly $7bn (by end of day Thursday). February is shaping up to be a good month with just under $10bn printing, which is higher vs Feb 2022 at the same point. Issuance in the US had a leisure theme with WYNN, RCL, AAL all issuing paper with the latter two issuing secured. Yields on HY bonds were mostly coming at high 6s / 7s yields across a range of credits. One of the other higher yielding deals that got issued was a HY bond add-on for Nielsen. The NLSN 9.29% 2029 bond issue was tapped at 98.00 to yield 9.725% for a bond rated B2/B. This compares to the original bond which was sold in November 2022 (a much more volatile period) at an all in yield of 11%, cash px at the time of 92. This second tranche of Nielsen debt represents the latest endeavours by Banks to sell down buyout debt which got stuck on their balance sheets as HY/Loan markets remained largely frozen throughout 2022.

Lev loans also keep printing, with $9bn of issuance dominated by refinancings:

In the loan space, American Airlines issued a $1bn TLB at S+275 at a price of 98.0 maturing in 2028. The loan was secured on all of AAL’s international slots/routes and gates linked to its South American route network. I make a related comment on Brazilian Airline Gol later in the EM section.

The tweet below nicely captured some of the recent outperformance of HY deals issued in the past few months:

European HY New issue market

In Europe, there was less deal activity than in the US HY market, deals of note were Ford Motor Credit, Luxury Retailer Isabel Marant (IMGRP 8% 03/01/28) and Iliad Telecom (ILDFP 5 ⅝% 02/15/30). Ford came ~30bps wide to existing curve in order to print. Part of the use of proceeds for the Isabel Marant group was to pay for a dividend to its shareholders, otherwise known as a dividend recap.

The Nordic market saw roadshows for North Sea issuer Waldorf Energy which is looking to issue $150m short dated senior secured bonds. It already has a 2024 bond.

Coinbase stock/bonds under pressure following Kraken Staking news

Extract - On Thursday, the SEC announced a settlement with crypto-trading platform Kraken regarding a product it offered that helped investors lock up or “stake” their crypto on various blockchain protocols in exchange for yield. The SEC said Kraken’s offering amounted to the sale of unregistered securities. Without admitting or denying the charges, Kraken agreed to pay $30 million in disgorgement and other penalties and to stop offering staking to U.S. investors.

Coinbase shares and bonds traded down on the fear that it too would have to stop staking activities to US investors, with shares down 23% on the week ended 10 Feb. Coinbase 2028 bonds traded down circa 4 points.

AMC - Has bought back total of $365m of debt since start of 2022 - Form 8k

AMC has bought $85.m of debt since December 19 2022 at an average discount of ~49% across the company’s 10%/12% Cash/Pik Toggle Second Lien Notes due 2026 and $4.1m of the 5.875% 2026 notes. This is in addition to the $100m of 10%/12% Cash/PIK it exchanged for APEs with Antara Capital LLP. Total debt purchased since the beginning of 2022 stands at $365m.

Cineworld Ch11 update - possible rights offering / sale of assets

According to news sources, Cineworld debt restructuring seems to be progressing as there are positive noises from the company and a large amount of its creditors. Possible avenues are said to include a rights offering from its lenders (BBG) or a sale process (Hollywood Reporter). The full articles are definitely worth a read for anyone interested in the Cineworld bankruptcy or the Cinema sector more broadly.

Key extracts from these articles:

Some creditors have recently discussed a share sale that could raise $800m — open only to existing lenders — for Cineworld as part of a restructuring plan…The final size of any issuance depends on creditor appetite and how much debt the restructured company is deemed able to carry following its bankruptcy, the people said. Discussions are ongoing and no final decisions have been reached, they added. The restructured business could be valued at about $4 billion including debt, one person said.

Cineworld has recently received “a lot of interest” in its assets from potential buyers, Cineworld’s lawyer, Josh Sussberg, said.

Arnold & Porter Kaye’s representative acting for an ad hoc group of term lenders “also told the court that while one option to resolve the Chapter 11 process included “ownership of this enterprise” via a debt-for-equity transaction, a possible sales process for Cineworld was also moving ahead on parallel tracks.”

Sussberg had pointed to strong box office from Avatar: The Way of Water helping sustain Cineworld through the bankruptcy process

Healthcare Debt Gets Harder Look as Distress Builds, Prices Drop | BBG

A sector that I am less familiar with (Healthcare) which has seen broad deterioration in credit metrics, good article from Bloomberg. Extracts below:

Some hospital operators have provided pessimistic outlooks

Raft of recent downgrades create headaches for CLO managers

(Bloomberg) -- Healthcare companies used to be some of the safest to lend to during economic downturns, until private equity firms bought them out and larded them with debt. Now they’re some of the riskiest borrowers in the world of leveraged loans.

Five companies in the healthcare space defaulted last year, compared with a historical average of roughly one default a year for an industry that often has stable demand, according to S&P Global Ratings. And 33 healthcare companies saw their credit grades cut by S&P in 2022, while bond graders were generally increasing ratings a year earlier as the economy emerged from the pandemic.

The outlook for healthcare companies, especially service providers, looks bleak. They face labor shortages as medical professionals retire en masse, and regulatory changes are weighing on how much they can charge government payers and insurers.

Pitchbook also did a deepdive on the Healthcare sector for those interested.

Better than expected updates from UK Housebuilder updates this week:

Barratt, Bellway and Redrow all reported this week and showed mildly positive signs coming out of the UK Housebuilding sector vs a difficult macro-economic backdrop in the UK. UK builders with bonds out there are Berkeley Homes (IG) and Miller Homes (HY).

UK Housebuilder equity index has had a decent rally after the LizTrussMageddon event in early Q3 2022…

Barratt Developments, the $5.6bn market cap FTSE 100 UK Housebuilder sees early signs of improved trading in its half year statement.

Higher revenue + completions YoY

Lower margins YoY - The benefit of underlying house price inflation, estimated at around 8.8% was largely offset by total build cost inflation at around 10% which, when combined with an adverse mix effect on gross margin from a greater proportion of completions in London.

Still sitting on net cash position

Growth in PBT YoY

Outlook + current trading: The current trading outlook remains uncertain with only four weeks’ trading since the start of 2023. Reservations have shown a modest uplift since the start of January, helped by the tempering in both future interest rate and energy cost expectations, as well as the introduction of more competitive mortgage rates. The sustainability of this recovery however remains uncertain, notably with respect to the challenges still faced by first time buyers. Net private reservations per active outlet per average week from 1 January 2023 through to 29 January 2023 were 0.49, 45.6% below the 0.90 in the equivalent period in 2022, reflecting the more tentative demand seen in the calendar year to date, but an uplift on the level of activity seen from our AGM announcement through to 31 December 2022. Forward sales as at 29 January 2023 were 10,854 homes (30 January 2022: 15,736) at a value of £2,665.0m (30 January 2022: £4,109.7m) with 8,719 homes of these total forward sales either exchanged or contracted (30 January 2022: 11,362 exchanged or contracted).

Bellway Plc ($3.3bn mkt cap UK Housebuilder) trading update for the six months ended 31 January 2023 - Statement

Record completions of 5,695 homes (2022 – 5,694 homes) and a 1.6% increase in the average selling price to £316,900 (2022 – £311,849).

The overall reservation rate reduced by 31.7% to 138 per week (2022 – 202), with weaker private demand partially offset by the Group’s programme of accelerating the construction of social homes.

Elevated mortgage rates and the end of Help‐to‐Buy have contributed to a 43.8% decrease in the private reservation rate to 91 per week (2022 – 162).

The combination of strong volume output and the decrease in reservation rates has resulted in a lower, yet still sizeable forward order book, which comprises 5,108 homes (2022 – 6,628 homes), with a value of £1,386.8 million (2022 – £1,940.9 million).

Visitor numbers and reservation rates in January have improved from the levels in the fourth quarter of calendar year 2022 and, if sustained through the spring, the Group is on track to deliver full year volume output of around 11,000 homes (31 July 2022 – 11,198 homes).

Reflecting the strength of our land bank and a more cautious approach towards land investment, 2,428 plots (2022 – 8,660 plots) were contracted in the period.

The balance sheet is resilient, with net cash of £292 million4 (2022 – £195.8 million) and low adjusted gearing, inclusive of land creditors, of only 2%5 (2022 – 4.5%).

Royal Caribbean shares move higher post strong guide on bookings - Statement

RCL reported very strong booking figures in its guidance for 2023 which sent its shares 7% higher and more than 50% higher YTD. Meanwhile for Q4 2022 and Y/E 2022 it returned to positive adjusted EBITDA and operating cash flow. On the net income line RCL was loss making due to high interest costs, marketing & selling costs and D&A. The strong bookings suggests that the type of consumer which goes on Royal Caribbean Cruises is still in good health. Funnily enough I was watching the UK’s Apprentice episode about where they have to sell experiences to tourists on the island of Antigua, and it was clear to see that the North Americans were not shy on spending, compared to the one British customer in the show who managed to haggle the price down!

Highlights:

Jason Liberty, CEO: There has been a lot of talk about the state of the consumer, so I want to share what we are seeing from daily interactions with consumers who are either booking their dream vacations or who are currently sailing on one of our amazing ships. Overall, we continue to see robust demand from financially healthy, highly engaged consumers that are excited to sail on our brands.

RCL returned to positive Adjusted EBITDA and Operating Cash Flow

RCL is experiencing a record-breaking WAVE season, resulting in a booked position approaching previous record highs and at higher prices

Load Factors were in line with guidance at 95%, with Caribbean sailings reaching 100%, and holiday sailings close to 110%.

Total revenues per passenger cruise day were up 3.5% as-reported and 4.5% in Constant Currency, compared to the fourth quarter of 2019.

Total revenues were $2.6 billion, Net Loss was $(500.2) million or $(1.96) per share, Adjusted Net Loss was $(284.9) million or $(1.12) per share, and Adjusted EBITDA was $409.3 million

The company is experiencing a record-breaking WAVE season, driven by strong demand. The seven biggest booking weeks in the company's history have occurred since the last earnings call in November 2022.

As of December 31, 2022, the Group's liquidity position was $2.9 billion, which includes cash and cash equivalents, undrawn revolving credit facility capacity, and a $700 million commitment for a 364-day term loan facility.

As of December 31, 2022, and taking into effect the extension of the credit facilities, the scheduled debt maturities for 2023, 2024, 2025 and 2026 were $2.1 billion, $2.6 billion, $5.7 billion and $2.8 billion, respectively. Approximately 75% of the company's debt is tied to fixed interest rates.

US Bankruptcies have risen for two straight months

Defaults in the month included Bed Bath and Beyond, Party City and Serta Simmons.

*EM*

Banxico Stuns Markets With Big Hike to Tackle Inflation Woes | BBG

Extract - Banxico, as the central bank led by Governor Victoria Rodriguez is known, raised its key rate 50 basis points to a record 11%, matching its half-point hike in December. The board also said in a statement that it could deliver a smaller hike at its next meeting.

Adani recap for the week ended 10 Feb

Adani says it will pre pay $500m bridge loan due 9 March - BBG

Barclays considering selling around $750mm of its Adani Group exposure - HBL

Adani Group said to be in talks with Farallon Capital for capital injection - HBL

Sidenote: never knew that former Presidential Candidate Tom Steyer heads up Farallon Capital..

Oaktree and DK named as buyers of Adani debt - BBG

Moody's cuts rating outlook on 4 Adani companies

Looking generically across the bond complex, some have appeared to have bounced around 5pts off the lows seen earlier this month.

EM New issuance:

More China Property issuers are looking to re-enter the bond market - In what would be a hugely positive step for the sector. So far this year, property company Dalian Wanda has issued two bonds, marking the start of the re-opening of issuance for that sector. Extract from mingtiandi.com “Dalian Wanda’s second dollar bond sale in less than a month was quickly oversubscribed on Monday, pointing to a renewed hunger from global finance after years of concern about the financial health of China’s highly indebted real estate groups.

The sale of a three-year dollar bond by Wanda received orders worth around $500 million, according to two people familiar with the deal, who said the developer had planned to raise as much as $300 million from the offering.

The second $ bond came at 12.375% for a 2026 maturity at 96.639.

Elsewhere, Braskem and Saudi PIF priced bonds this weeks. Sharjah hires banks for investor calls and Egypt is expected to bring a new $ deal before month end.

Other notable EM headlines:

RBI Hikes 25bps as expected - Slows pace of hikes for second straight meeting

China Junk USD Bonds Set for First Losing Streak in Two Months

Pakistan Bonds Extend Slide as IMF Talks End Without Deal

South Africa is nearing 100 consecutive days of rolling blackouts, the longest stretch yet, with more to come as its electricity crisis deepens.

Iraq pockets $7 billion in January oil revenue - Rudaw

Gol Airlines announces financing commitment from Abra in a complex transaction

The announcement from Gol will really separate the “Premier League” footballers from the “Sunday League” players in the credit world. Abra Group Limited, the new holding company established to control the operations of GOL and Avianca Group is instrumental in this transaction. The complex financing exercise appeared to be arranged between the company and the Ad Hoc bondholder group. This is a basic summary as per the release: Abra has agreed to (i) invest cash in GOL, (ii) contribute GOL bonds acquired from the Ad-Hoc Group and other GOL bondholders to GOL, and (iii) receive as consideration the issuance of the GOL SSNs due 2028 and GOL ESSNs due 2028. How has the market taken it so far?

GOLLBZ 2024 converts -5/7pts

GOLLBZ 2025 unsecureds -4/5pts

GOLLBZ 2026 secureds -10/12pts

GOLLBZ Perps -4/5pts

A lot of these moves are likely due to a lack of proper understanding of the transaction, a potential lack of appetite to participate in the support group or provide new money and accounts scared off by the recent ratings downgrades.

Sri Lankan Airlines bond - Event of default (SGX)

Extract of statement - The board of directors of the Company ("the Board") makes reference to the trust deed dated 25 June 2019 in relation to the 2024 Bonds ("the Trust Deed") and the coupon payment which fell due on 25 December 2022. Terms used in this notice and otherwise not defined shall have the meaning given to such terms in the Trust Deed. The Board hereby gives notice of an Event of Default pursuant to Condition 8(a)(i) of the 2024 Bonds as a result of the failure to pay the coupon due on 25 December 2022. The Board intends to communicate further with holders of the 2024 Bonds in due course.

*BUYSIDE *

Apollo Global Management earnings call snippets

Many investors are reaching out to us as they expand their private credit exposure from direct lending into a broad base of asset-based finance capabilities.

We think this is the largely untapped part of the $40 trillion IG fixed income replacement market and simply put, we believe the opportunity to source resilient yield and asset-based finance is where sponsor finance was and private credit was 10 years ago.

In response to a question on how the credit portfolios are holding up in this backdrop:

“In terms of Credit, there's just nothing going on in the portfolio. I mean impairments were like in the 2 to 3 basis points. There's just nothing we see, Glenn, that gives us cause for concern across the portfolio. And again, it gets back to this notion. We speak a lot about the words private credit. And I say as you've heard me say, there are two words that are both English words that actually don't mean anything. Private credit can be AA and private credit can be below investment grade, both have their place in portfolio. On a regulated balance sheet, it is investment grade private credit, excess spread over publicly traded corporates but without excess risk.”

Jim Zelter - Co President:

Yes. And if I could just highlight, Craig, there's -- I know there's lots of questions about credit cycle and a concern. From our perspective -- and we're not the economist. We'll let Torsten (Slok) do that, and we're just following our discipline in purchase price matters. I mean the reality is there are certain sectors that are doing very well post-COVID. There are certain that are having a bit of a challenge. Hotels, entertainment, lodging, airlines, doing very well. Hard industrials or the auto sectors having a tough time. Our IG book, a lot of financials have the big banks. Big IG book, CLO book, really strong AA, AAA book. So we really feel like we have a very well thought-out strategic asset allocation, and how we put it together is showing the robust nature of the portfolio.

Marc Rowan, CEO:

We're just not seeing it [credit stress] in the portfolio, absolutely -- absolute normalcy in terms of credit. And we're getting paid for structure and for illiquidity and for origination. We're not getting paid for credit.

One has to be stepping back and saying that, if I look at the relative attractiveness of asset class today, credit is simply more attractive than equity.

Ashmore Profits Slump 54% As Clients Pull Billions in Assets - BBG

Extract - Ashmore Plc’s profits slumped in the second half of last year as the asset manager saw clients pull billions from its funds. Pre-tax profit at the London-based firm plunged 54% year on year to £53.8 million ($65.1 million) in the six months through December, according to a statement Wednesday. Net management fees dropped to £98 million in the period from £131 million a year earlier.

Aurelius Funds Gain 44.8% on Cineworld, Ukrainian Telecom Bets | BBG

Extract - (Bloomberg) -- A set of Aurelius Capital Management drawdown funds gained 44.8% last year, helped by winning bets on Russian corporates and the debt of movie theater chain Cineworld Group Plc. The funds, which total about $132 million, also profited from trades on Ukrainian cellular provider Veon Ltd. and the sovereign debt of Belarus in the second half of the year, according to a person familiar with the results. Bets on drilling companies added to the gains, according to the person. Aurelius’ evergreen funds rose 6% for the year, the person said. Bonds guaranteed by Financial Guaranty Insurance Co. were among its successful positions. The funds’ high-yield benchmark fell more than 11%, while the S&P 500 finished the year down more than 18%.

Aurelius seems to be focused on distressed debt investing and has been in situations in the past such as Ukraine Sovereign and Argentina.

Third Point publishes Investor letter - Yahoo Finance

Good quote here from Third Point’s letter re Credit for everyone involved in some way in the Global Credit Markets.

Third Point Ltd’s January 2023 update showed its top gross credit longs which make for interesting reading:

Metlife buys $2.1bn private credit shop

Pershing Square Investor update - 9 Feb 2023 | Presentation

Bill Ackman generated 14.3% gross return from interest rate swaptions in 2022 which offset some of the fund’s equity losses in 2022. Click the link above to see the full presentation.

*TRADING*

FINBOURNE to provide European fixed income consolidated tape | Asset Servicing Times

Extract - Bloomberg, MarketAxess and Tradeweb have partnered with FINBOURNE Technology (FINBOURNE) to produce a consolidated tape (CT) for fixed income in European markets. FINBOURNE has worked with a number of capital markets participants, including firms, regulators and industry bodies to gain a comprehensive understanding of the industry’s CT requirements. The company’s introduction of a CT for fixed income in European markets comes amid ongoing industry discussion to integrate CT for real-time pre-trade as well as post-trade.

Tradeweb 4Q Earnings -Statement

Haven’t had time to summaries these results but see here for the link to the earnings call earlier this month.

Flow Traders earnings call highlights

Flow Traders, which mainly makes markets in the ETF space and increasingly in the single bond space had its Q422 results. Earnings snippets below:

it is evident that the investment-grade and high-yield bond markets have remained reasonably robust from a volume perspective, although being slightly down from the volumes seen in the first half.

We can also see that credit spreads have widened in 2022 when compared to 2021. There has also been a corresponding widening of fixed income ETP spreads during the same period.

According to BlackRock, ETP AUM is expected to double by 2025, which underscores the strength and importance of the ecosystem we are a key part of.

Electronification of trading is critical for all of our activities, but specifically, it is within our credit business, where this is a key structural trend in corporate credit and emerging market sovereign bonds. Increasing adoption of electronic trading ties into our core technology-enabled competency set.

We have further expanded and diversified our fixed income trading during the course of 2022. There was a material increase in fixed income value traded versus 2021 and the single bond market-making proposition has grown globally in the past year as well.

2023 will see further growth globally in our single-bond market-making proposition. In line with this, we will also be onboarding additional fixed income institutional counterparties in the full year.

BNP beat on FICC

BNP Paribas’ 4Q FICC Sales & Trading revenue came in higher than expected (€1.09 bn vs €0.856bn). The beat seems to have been driven by rates, FM, EM and commodity derivatives but less so from credit. The below are some highlights from the earnings call / presentation:

…Secondly, as reported by a very robust client activity and a reinforced setup with strong positions in FICC and equity business, global markets saw a very strong increase in revenues. Very strong in the sense up 27% year-on-year with a very good performance of FICC, up 32%, and a strong increase in revenues, up 19% in equity and prime services.

Soc Gen also beat on FICC - Extracts

On fixed income, this is also the best results on record with a EUR2.6 billion contribution, up by nearly 40% versus last year. In Q4, revenues are up 56% versus last year. The fixed income platform continued to benefit from a favorable environment, notably thanks to rate volatility.

Again, as we discussed earlier, we are going to see -- in normalized markets, we are going to see the global markets revenues decrease towards the guidance that we gave earlier last year.

Credit Suisse - Extracts from conf call re trading

Our sales and trading businesses were impacted both by our restructuring and lower client activity, resulting in an 89% year-on-year decline in revenues. We estimate that the impact of the accelerated deleveraging including that linked to our strategic actions accounted for around 40% of the year-on-year decline.

Challenging market conditions and lower client activity had a significant impact on our capital markets and advisory businesses, while the strategic actions to de-risk and exit certain business lines resulted in lower sales and trading revenues.

…with our macro and our markets businesses, we have rightsized those businesses, we've refocused them and of course align them towards our wealth management and our Swiss Bank franchise, which is a key pillar of our strategy at the outset.

Chris, if I could just answer the second question that you mentioned around the markets business, I would say, look, not to look really at the fourth quarter given that was an exceptional quarter for the company with all of the challenges that were there together with the intentional repositioning and restructuring related actions that we undertook in the fourth quarter. The markets business has an important alignment to our wealth management franchise. As a management team, we're moving pretty quickly to take the actions that were necessary to restore that -- the bottom line in that business, and we're confident in the actions that we've been taking in that franchise.

*RATINGS*

DM Sovereigns

Germany Affirmed at Aaa by Moody's

IG

BP Outlook to Positive by S&P; L-T Rating of A- Affirmed

X-S&PGR Downgrades Kennedy-Wilson To 'BB'; Outlook Negative

Nokia Raised to Investment Grade by S&P

Fitch Upgrades Deere to 'A+'; Outlook Stable

Stanley Black & Decker Downgraded to BBB+ by Fitch

HY

Moody's: Moody's downgrades PizzaExpress' corporate family rating to B3 from B2; outlook remains stable. 10 Feb 2023

MOODY'S AFFIRMS AMC'S Caa2 CFR AND APPENDS LIMITED DEFAULT (LD)

Fitch Revises Outlook on American Airlines to Positive; Ratings Affirmed at 'B-'

S&PGR REVISES ROYAL CARIBBEAN OUTLOOK TO STABLE FROM NEG

EM Sov

Ukraine Downgraded to Ca by Moody's, Outlook Stable

Moody's downgrades Egypt's ratings to B3, changes outlook to stable

Gabon Affirmed at B- by Fitch

Fitch Revises Armenia's Outlook to Positive; Affirms at 'B+'

Iraq Affirmed at B- by S&P

EM Corp

Moody’s downgrades 4 Adani company's outlook

MHPSA upgraded to CC from C by Fitch

Fitch Upgrades Turkish Airlines to B+; Outlook Negative

S&PGR Upgrades Embraer S.A. To 'BB+' From 'BB', Outlk Stable

Fitch Downgrades Azul to ‘CCC-’ from ‘CCC+’

Gol Downgraded to ‘CC’ From ‘CCC+’ at S&P

*LINKS / CHARTS*

Nice short analysis by Moody’s of Deposit trends at the big US Banks - Linkedin

Getting Sovereign Debt Restructurings out of the Rut in 2023: Three Concrete Proposals - Lazard

Credit research provider Acuity KP’s piece on Distressed Debt market - Link

Excellent summary as always!

I love it! Helps me immensely with catching up on credit info that I don't always track in my day to day operations. Keep it up!

thanks!